Peru’s Ministry of Energy and Mines recently reported that mining investments increased through November 202 to an accumulated total of $4.6 billion, up from $4.4 billion in 2021. The country has focused on attracting more investments in the sector, which has been a major contributor to its economy.

The final month of the period, November, was the best performing month with the most inflows with a total of $467 million, 7.8% higher than October’s total of $434 million, as reported in the Mining Statistical Bulletin.

The biggest investor was Anglo American (LON:AAL) which invested $964 million in the country in 2022, bringing its share of mining investments to 20.9% for the year. The company’s share is the biggest in the sector in Peru. The runner-up was Minera Antamina, owned by BHP, Glencore, Mitsubishi, and Teck Resources, investing $394 million. Third place was given to Minera Yanacocha, owned by Newmont (NYSE:NEM), with $332 million invested, and fourth was Southern Peru, with $238 million invested. Those four mining companies comprised 42.7% of all mining investment in Peru for 2022.

The report is important to the country, which has long been dependent on the mining sector, as it demonstrates that the sector is still a major driver of Peru’s economy and that investors are confident in the industry’s future. The investments also represent a major source of revenue for the government, with the majority of investments going toward infrastructure and operations.

Exploration activities were also a highlight in 2022, where $383 million in investments flowed from January to November 2022, up 33.9% from the previous year. For existing projects and accumulated mine development investments, the total reaches $778 million, up 49.5% from the same period the previous year.

Peru’s copper production is second only to Chile, which is the world’s largest producer of the metal. The country is also a major producer of silver, zinc, lead, and gold. The mining sector has been a major contributor to the Peruvian economy for many years, and the recent investments show that this trend will likely continue for years to come. The further boost to the industry from the ongoing green energy transition accelerated by factors including the pandemic, rising demand for metals and minerals, and technological advancements should further support the sector’s growth in the years to come.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Australia-based mining explorer KGL Resources has signed a participation agreement with Glencore (OTC:GLNCY), the Anglo-Swiss commodity trader for copper concentrate produced at its Jervois copper project.

Under the agreement, which has a minimum term of five years from the commencement of commercial production from the project, Glencore to acquire 100% of copper concentrate produced at the Jervois copper project.

The contract with Glencore, is subject to securing project financing by the end of September 2025 or commencement of commercial production by December 2025 at the latest, among other terms and conditions.

KGL managing director Simon Finnis said: “This agreement is a key component of KGL’s plans to procure funding for the development of Jervois.

“Work is continuing on the feasibility study, which will incorporate the terms of this agreement, as well as the new resource data from the Bellbird, Reward and Rockface deposits. We expect this will result in favourable annual production and mine life outcomes.”

The Jervois project has a total copper resource of 20.97 million tonnes at 2.03% copper and 31.9 g/t silver.

KGL said in a statement: “The sale price for the copper concentrate is volume-based and calculated by reference to the LME cash settlement price for copper, with silver and gold credits (subject to minimum ‘payable’ limits) and adjustments for penalties, treatment and refining charges and a freight credit.”

Production will be delivered to Glencore’s Mount Isa copper smelter located in inland Queensland.

Glencore also recently announced that it reached an agreement with Metal Acquisition Corp for the sale and purchase of the CSA copper mine for which it will receive $1.05 billion in cash.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

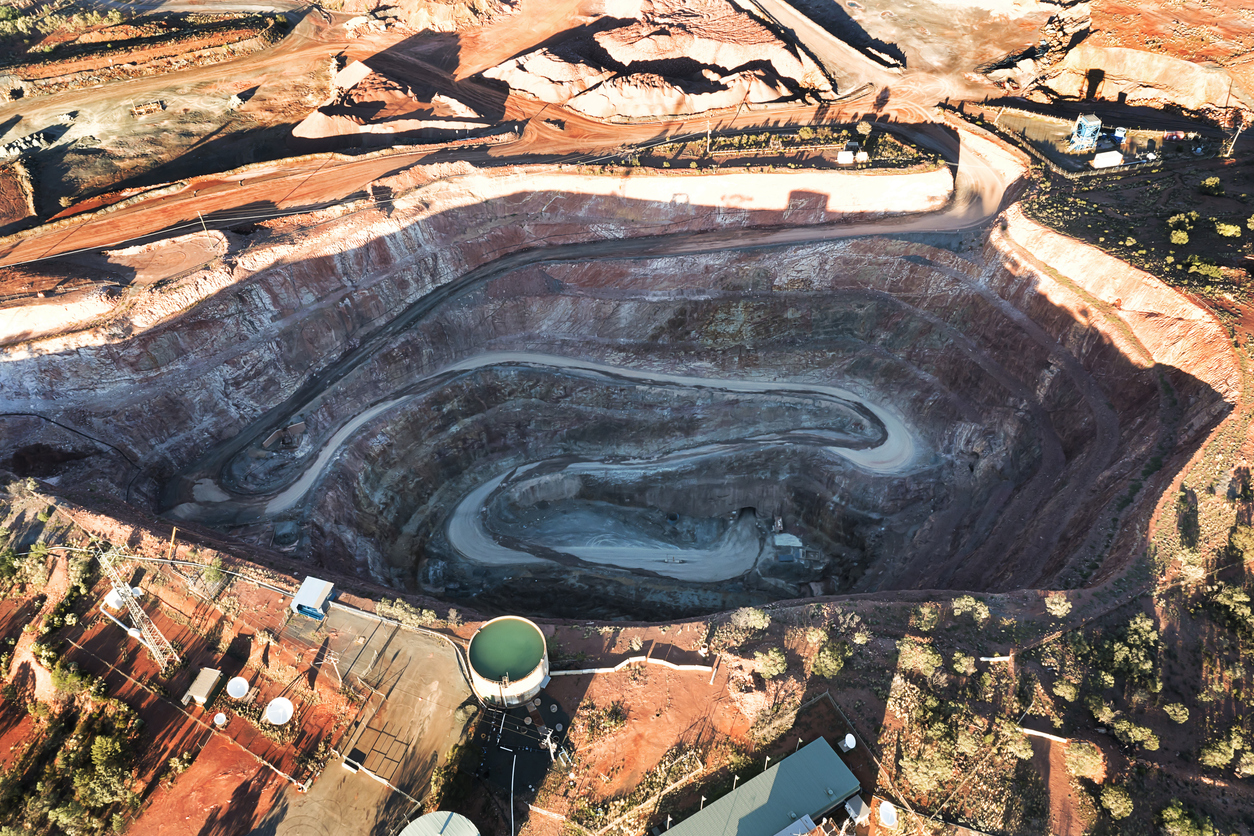

Metals Acquisition Corp., a blank check firm has signed a $1.1 billion deal to acquire Glencore’s (LON:GLEN) (OTC:GLNCY) CSA copper mine in Australia. After Perth-based IGO Ltd announced it would drop out of contention, Metal Acquisition became the leading contender to acquire the asset. After a year-long race, the deal is now a reality for the firm.

The purchase has given Metals Acquisition Corp 100% ownership and control of the mine’s operations, which will allow it to produce between 41,000 and 49,000 tons of copper per year. This gives the firm a good profit guarantee as copper is such an essential metal for the production of electric vehicles.

In addition, the high demand for copper and the lack of supply has caused copper prices to soar by more than 25% over the past year. According to experts, this trend will continue as more and more companies join the fight against climate change, making copper a more and more sought-after metal.

Metals Acquisition Chief Executive Mick McMullen said: “Copper is expected to play a key role in the global energy transition ‘megatrend,’.

Separately, Glencore announced that it has purchased 657,264 of its ordinary shares of USD 0.01 each on the London Stock Exchange and the Multilateral Trading Facilities of Morgan Stanley & Co. International Plc.

The purchase was completed on March 16, 2022. Glencore intends to hold the repurchased shares in treasury so the company now holds 1,408,178,868 of its ordinary shares in treasury and maintains 14,586,200,066 ordinary shares outstanding.

The purchase of the shares is part of the company’s share buyback program which is expected to be completed between February and August 2022.

Russian Review

Glencore recently announced that it will review business with Russia as the invasion of Ukraine has affected commodity markets.

Glencore has a 10.55% stake in En+Group, the Russian aluminum producer, as well as a 1% stake in Rosneft, the oil producer. This represents an investment value of $789 million and $485 million respectively by the end of 2021.

Increasingly, the list of companies cutting business ties and reviewing their operations with Russia is growing as foreign governments have lobbied for this to happen.

Glencore’s review is expected to bring further turmoil to the aluminum market as shipping companies have also suspended ship operations to and from Russia, causing supply chain issues for the global aluminum supply chain.

“Over time, global commodity trade flows will need to adapt to some or all of Russian/Ukrainian supply being unavailable, whether due to infrastructure damage, sanctions or ethical concerns,” Glencore said.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Glencore (OTC:GLNCY), the world’s largest commodity trader and miner, is reconsidering its business activities in Russia following the Russian invasion of Ukraine.

Among the activities under review is Glencore’s shareholding in the Russian hydroelectric and aluminum group En+Group, which has an annual production capacity of 3.9 million tons and is controlled by United Co. Rusal International PJSC, and about 0.5% of Rosneft.

This move by Glencore came after a variety of Western companies linked to Russian companies announced to cut ties with the country following Russia’s invasion of Ukraine. This due to pressure from governments and shareholders following the invasion.

The Swiss-based trader is also a major trader of aluminum maker Rusal’s metal and also trades some other Russian commodities including its oil. Glencore currently holds a 10.55% stake in En+Group, Rusal’s majority shareholder, and also owns a small 1% stake in oil major Rosneft.

In 2020 Rusal announced an agreement to sell aluminum to Glencore for US$16 billion which benefited the company by selling a third of its production to the trader. The deal was originally to run until 2024 with an option to extend it to 2025, Rusal stated at the time.

As already mentioned Glencore was also buying oil from Rosneft although the volume figure has not been disclosed.

Glencore at the end of 2021 announced in a press release the results of the value of these shares which were US$789 million and US$485 respectively.

Glencore in a press release stated, “We have no operating footprint in Russia and our trading exposure is not material to Glencore. “We are reviewing all our business activities in the country, including our shareholdings in En+ and Rosneft.”

Glencore also stated that it condemned the Russian government’s actions against the people of Ukraine and said, “The human impact of this conflict is devastating. Glencore is looking to see how we can best support humanitarian efforts for the people of Ukraine.”

The aluminum market has also been affected by Glencore’s decision as shipper AP Moller-Maersk A/S said it has halted ship bookings to and from Russia which increases supply turmoil for buyers already suffering the ravages of shortages.

Glencore’s business review also marks a radical shift in Glencore and Russia’s relationship as former Glencore CEO Ivan Glasenberg, received Russia’s Order of Friendship from President Vladimir Putin in 2017 in recognition of the company’s role in the privatization of Rosneft.

With the current destabilization of the Russian economy, mining companies are quickly rethinking their strategies, with many of them pulling out of the country entirely for the time being. Others will be able to operate for now, but may be weighing the risks of the unstable, unpredictable situation before making further decisions.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Nickel is an indispensable compound in steel production and is known as the “silent saviour” because it plays a role in the global transition to clean energy and is one of the key metals for battery assembly in electric vehicles for companies like Tesla, Volkswagen, Mercedes, and more. In 2020, despite the global pandemic, global nickel production totalled 22 million tonnes. Global nickel mining production is expected to rise again this year, with GlobalData estimating an increase of 6.8% to 25 million tonnes.

According to the US Geological Survey, total nickel reserves are estimated at 94 million tonnes. That total counts Australia and Indonesia as holding some of the largest reserves in the world, with big production numbers as well.

Production slowdowns were not a particular problem for the nickel mining industry, and the industry was more than able to make up for lockdowns and restrictions by keeping operations running in multiple countries using caution and the right safety measures. The total 22 million tonnes produced in 2020 is a testament to the resiliency of the industry and the fact that while demand may have shrunk temporarily in the period, production must continue to keep up with ongoing demand that continues to rise.

The Top 10 Nickel Producers

Russia Norilsk Nickel (OTC:NILSY)

Russia Norilsk Nickel (Nornickel) was the top nickel producer with approximately 178 kilotons (kt) of production, up from 172 kn in 2019. The Nornickels Kola Division, which includes five mines, is being reviewed for its environmental footprint and has pledged $5 billion over the next decade to clean up the pipelines on the Kola Peninsula.

Vale (NYSE:VALE), Glencore (OTC:GLNCY)

From its Brazilian proejcts, Vale (NYSE:VALE) is in second place with 167.6kt, down from about 171kt the year before. PT Vale Indonesia says it plans to begin construction of its Pomalaa nickel project next year. The mining giants in third, fourth and fifth place are Glencore (OTC:GLNCY), which has assets in Australia, Canada and Europe and collectively produced 101.6kt and 108kt in 2019 ; followed by BHP (ASX:BHP) with 74.8kt from its nickel west business in Australia, and Anglo American (LSE:AAL) with 43.6kt from its Brazilian business.

The Chinese company MCC JJJ Mining, whose production is based on its ownership of 85% of Ramu Mine in Papua New Guinea, rounds out the top ten and is one point behind Finnish Terrafame with 28.6 kts of nickel production in 2020. Perth-based IGO produced 29.5kts and Terrafames followed close behind with 28.7kTS.

A Metal for an Electric Future

Nickel is known as the “silent saviour” because it plays a role in the global transition to clean energy and is one of the key metals for battery assembly in electric vehicles. The nickel group is of extreme importance to the global economy and the mining industry in countries in every corner of the globe.

Metallic mineralization occurs in the hard nickel group, which includes nickel, cobalt, copper and chromium. The economic concentration of nickel is found in sulphide and laterite-rich deposits in Australia, Indonesia, South Africa, Russia and Canada which together account for more than 50% of the nickel resources in the world. Nickel mining has increased significantly over the last three decades, and known nickel reserves and resources are growing rapidly.

Due to the enormous use and demand for Canada’s nickel specifically, nickel-related products are exported to more than 100 countries. Nickel and its compounds are indispensable for the manufacture of countless products on which we depend.

Nickel, long used as a corrosion-resistant material in the steel industry, has exploded due to the mass production of cheap electronic equipment, most of which uses nickel in manufacturing. Demand for nickel has also increased in recent years and is becoming increasingly important in the electric vehicle industry. As demand for renewable energy increases, electric cars are increasingly dependent on copper, nickel, cobalt and other metals.

As the world moves away from fossil fuels, the demand for copper, nickel, cobalt and other metals will continue to rise. A 2017 World Bank report says that the industry will demand copper and nickel by 2050 at an increase of 250% if the world builds enough wind technology to keep global warming below 2 degrees – an increase over the Paris climate agreement benchmark. With the additional need from energy storage technologies, the demand for nickel will increase by 1,200 percent.

The same applies to cobalt, which is needed for lithium-ion batteries and can be degraded. According to a report by the World Bank on a low carbon future, there will be strong demand for a wide range of base and precious metals. In addition to the usual suspects such as cobalt and lithium-ion, the list includes aluminium, silver, steel, nickel, lead and zinc.

Cobalt is a silver-grey metal that was developed as a by-product of copper and nickel mining and is an important component of the cathode of lithium-ion batteries. Nickel is another ingredient needed in batteries and is expected to account for a large proportion of future batteries.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As copper prices began to rapidly rise earlier in the year, competition between the biggest mining companies has been extra intense this year. Between copper being a vital metal as we move forward with the green energy transition and the disruptions due to the Covid-19 pandemic, the demand for copper has only grown.

The top 10 copper mining companies were just released and produce over half of the world’s copper output, with most of the global copper supply produced by giant mining companies.

Despite the impact from the pandemic, worldwide copper production still surpassed the 20-million-tonne mark in 2020.

Let’s take a look at the top three companies and what they accomplished in 2020. Here are the top 10 copper mining companies:

Codelco

Chile’s Codelco was by far the biggest copper mining company in 2020, producing 1727.50 Kt, as they implemented a four step plan to help overcome operational challenges and continue copper production.

Codelco recently broke ground at their Salvador copper mine, which is the Rajo Inca project. This is a $1.4 billion dollar expansion of the copper mine, and is expected to increase the operating life of the mine by around 47 years and increase output by 50%. This salvador mine has been in operation since 1959 and the expansion will change it from an underground mine to an open pit. Full production at the new section is set to begin in the first half of 2023, and it is expected to yield 90,000 tonnes per year.

BHP Group (NYSE:BHP)

Australia’s BHP Group was the second largest copper producing company in 2020, producing 1188.50 Kt. According to the BHP group, this is enough copper to build over 420,000 wind turbines. The Company did experience a disruption in production due to the pandemic, resulting in a shutdown for a period of time.

In recent news, BHP Group just approved a multi billion dollar investment for Jansen Potash mine in Saskatchewan. According to the provincial government, $5 billion has already been spent on production and another 7.5 billion will be used to complete the new operation. This is said to be the largest investment in the history of the province of Saskatchewan.

Glencore (OTC:GLNCY)

The third largest copper mining company in 2020 was Switzerland’s company Glencore, producing 1182.30 Kt of copper in 2020. Glencore operates more than 180 sites and offices in 35 different countries, which means the impact of Covid-19 varied depending on the country. With all of their precautions in place, they managed to be in the top three copper mining companies in 2020.

Glencore recently signed a partnership with Britishvolt for a long term supply of cobalt. According to Glencore, “The deal highlights the need for strategic partnerships between raw material and battery producers on the roadmap to net-zero; with Environmental, Social and Governance a growing focus of investors.”

Overall, the price of copper has and is continuing to rise at a fast rate, especially due to the green energy movement. Investing in copper mining companies is a good way to benefit from that price, and helps stay on top of the most current copper trends.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

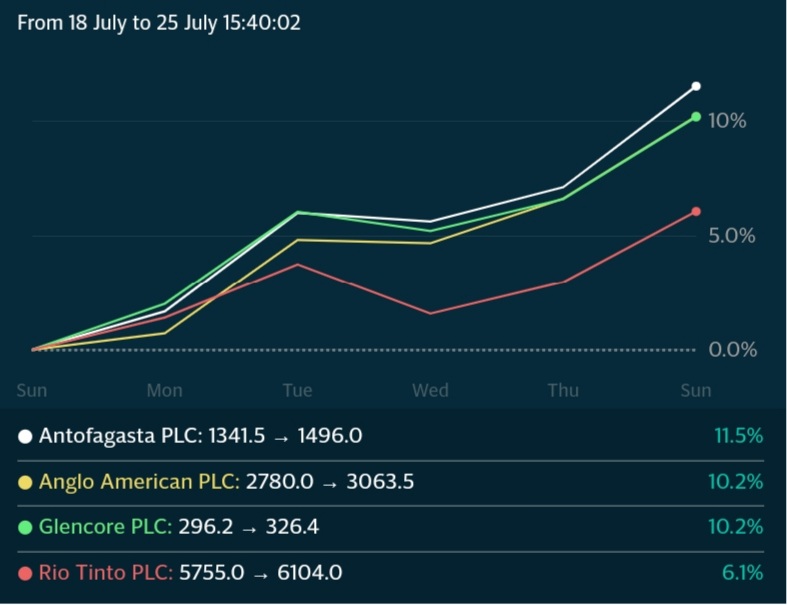

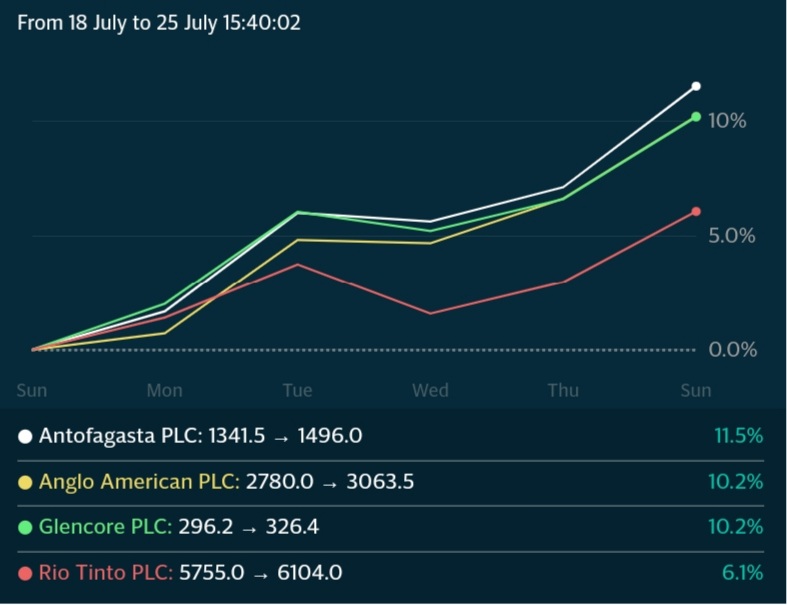

This is set to be a big week for mining earnings, as some of the world’s biggest mining companies will begin to show the market exactly how much this commodity boom is helping. This week will see the top five western diversified mining companies report earnings, and investors should be watching for record profits that could drive dividend payouts to match.

Analysts estimates show that the top five miners may have raked in a combined $85 billion in the first half of 2021, double the number from 2020. Of course, lockdowns and supply chain meltdowns had serious effects on earnings last year. As processes slowed to a halt and demand dropped off a cliff, mining companies mainly were sitting on their hands like the rest of the economy.

However, the latter part of 2020 saw engines start up and restrictions lifted in many mining-friendly jurisdictions, and 2021 has accelerated the commodity price gains from last year.

The first to report on Wednesday will be Rio Tinto Group and is expected to announce $22 billion in profits for the first half of the year, equalling the same amount as its total profits in 2020.

Other companies such as Glencore, Anglo American, and Vale SA were also expected to post massive profits for the first six months of 2021, and possibly their highest-ever numbers for the six months to June period, according to estimates from analysts compiled by Bloomberg.

The sector has seen a revival of its activities faster than most other sectors of the economy as the industry has been one of the primary beneficiaries of the recovery stimulus injected into the global economy. With trillions of dollars in recovery packages going out, demand for commodities has bounced off 2020 lows to skyrockets higher every single month. Demand for commodities like iron ore, aluminum, steel, and copper are driving prices higher every week while inflation pressures continue to spread through the economy.

This bull run for commodities has been a huge gift for mining companies who have the tailwind of demand and higher prices for their production to account for big profits.

Ben Davis, an analyst at Liberum Capital, said, “This should be a pretty much stellar set of results all round. We’re expecting record dividends from BHP and Rio, while Anglo and Glencore also have the potential to surprise.”

Stocks have been on a tear lately, up double digits in some cases in a single week, so there may be room to move higher on earnings news. Freeport-McMoRan already hinted at its blockbuster results when it announced it had wiped out $5 billion in debt over the last 12 months, blasting past a target month ahead of the planned schedule.

A record dividend was also paid out by Anglo American Platinum Ltd. (79% owned by Anglo American) on Monday of $3.1 billion, equal to 100% of first-half headline earnings. In a significant understatement, CEO Natascha Voljoes said the company was in a “strong financial position” and that the company was able to deliver “industry-leading returns.”

Everyone is set to benefit from higher profits from miners this year, beyond stakeholders and investors in the companies themselves. Government should also see higher tax receipts from miners, who contribute significantly to the global economy and often up to a third of any given domestic economy in many regions like South and Central America, and Africa.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

In 2013, the Democratic Republic of Congo (DRC) banned exports of concentrates to encourage miners to process and refine ore locally in the country. As the world’s biggest cobalt producer and Africa’s largest copper miner, this had a pretty significant impact on the industry and how companies operated in the region.

Now, the DRC has reinstated that export ban, threatening the global supply chain as the complications and bottlenecks that come along with refining in the country loom large. Mining companies that currently hold waivers to continue with shipments out of the country can continue, but most new projects and the expansion of existing mines will be held back by this ban.

A lack of smelting capacity often drove the Congolese government to issue a multitude of waivers during the previous export ban. It is likely the same process will be needed this time around as miners have had little time to prepare and the country’s smelting capacity and infrastructure still lies in a similar state as 8 years ago.

A Scramble to Protect Assets and Production Pipelines

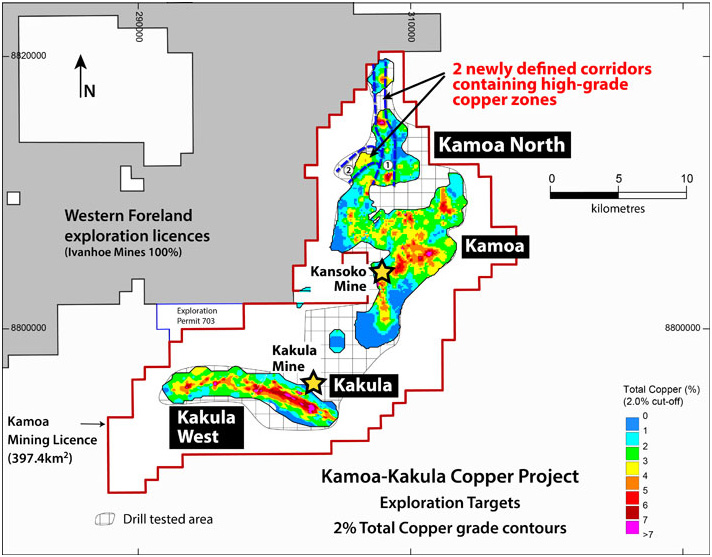

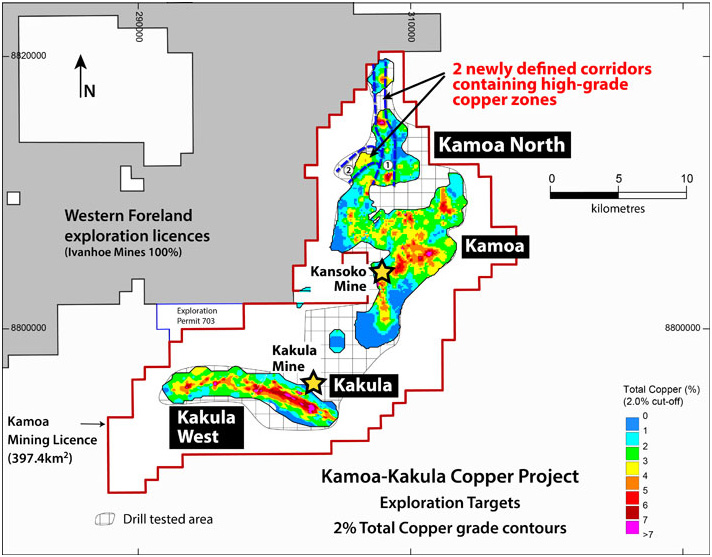

Companies are moving quickly to protect their assets in the DRC, with Ivanhoe Mines (TSX:IVN) filing an application quickly last Friday for a waiver while continuing talks with the mines minister. The company’s Kamoa-Kakula project has begun copper concentrate production this week, and will need the waiver to ensure the project remains viable and operating at an optimal level.

“The rules recognize that a derogation may be justified for a number of reasons,” president and CFO Marna Cloete said in a statement. “Kamoa Copper has filed the necessary application materials and we have had constructive discussions with the Minister of Mines on obtaining a derogation for Kamoa-Kakula given current limitations on smelting capacity in-country.”

Ivanhoe has said it will use local smelter capacity as much as possible and is looking at constructing its own complex at the project site to produce blister and anode copper. However, with severe power deficits still being dealt with in the DRC, mining companies have been prevented from building processing facilities. The gridlock has created a kind of stalemate for the process which is the prime driver for the high level of waivers issued.

One company less affected by the ban is Glencore (LON:GLEN), whose operations at its Mutanda cobalt mine (the largest in the world) are expected to resume operations in 2022. Since the company exports mainly cobalt in hydroxide and copper cathodes, the ban will not adversely affect the company’s production and they will not need the waiver as Glencore (LON:GLEN) remains unaffected.

Supply Threatened

Copper and cobalt are two critical minerals and metals that are required for all of the technology, batteries, and energy storage and production solutions currently being used around the world. The developed world’s appetite for copper and cobalt continues to grow, and demand is expected to oustrip supply by a critical amount. Estimates from CRU Group show a possible annual supply deficit of 4.7 million metric tonnes by 2030. To close that gap, the copper industry would need to spend more than $100 billion. If no new mines get built and bottlenecks like export bans in the DRC continue, the deficit could grow to 10 million tonnes, according to commodities trader Trafigura.

With demand growing rapidly and supply lagging, copper prices continue to rise, giving copper miners around the world a strong tailwind for production and investment. For the next few decades, the industry could see copper mining companies holding all the cards for the red metal, creating a strong and profitable business for everyone involved.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

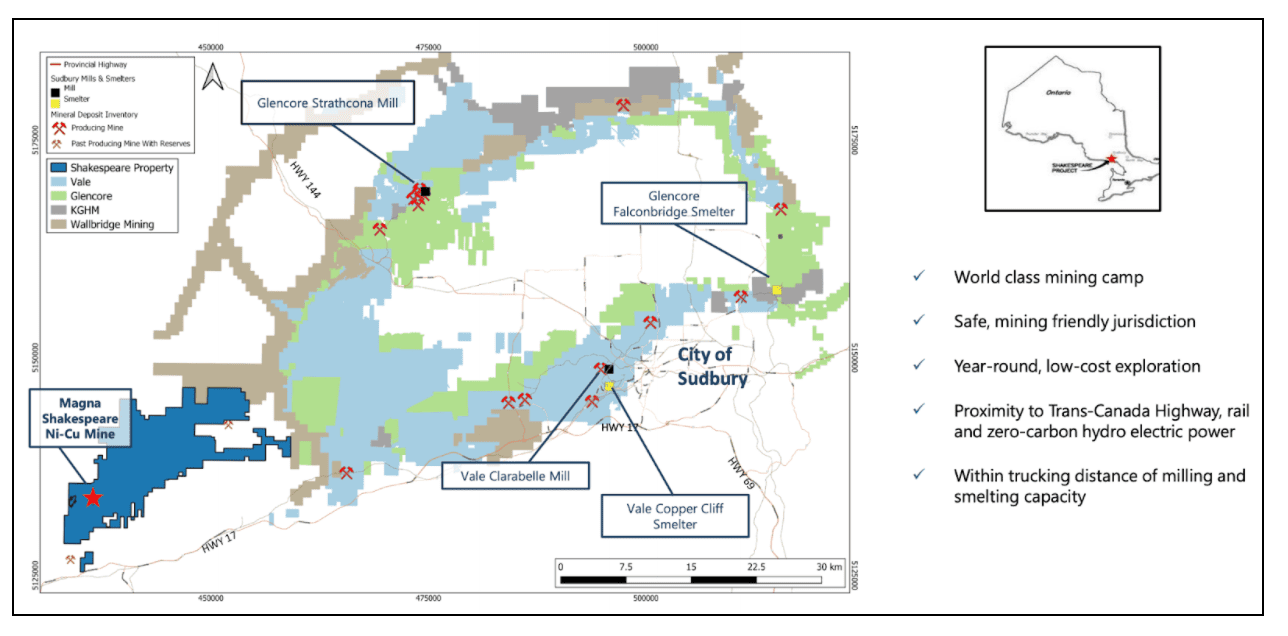

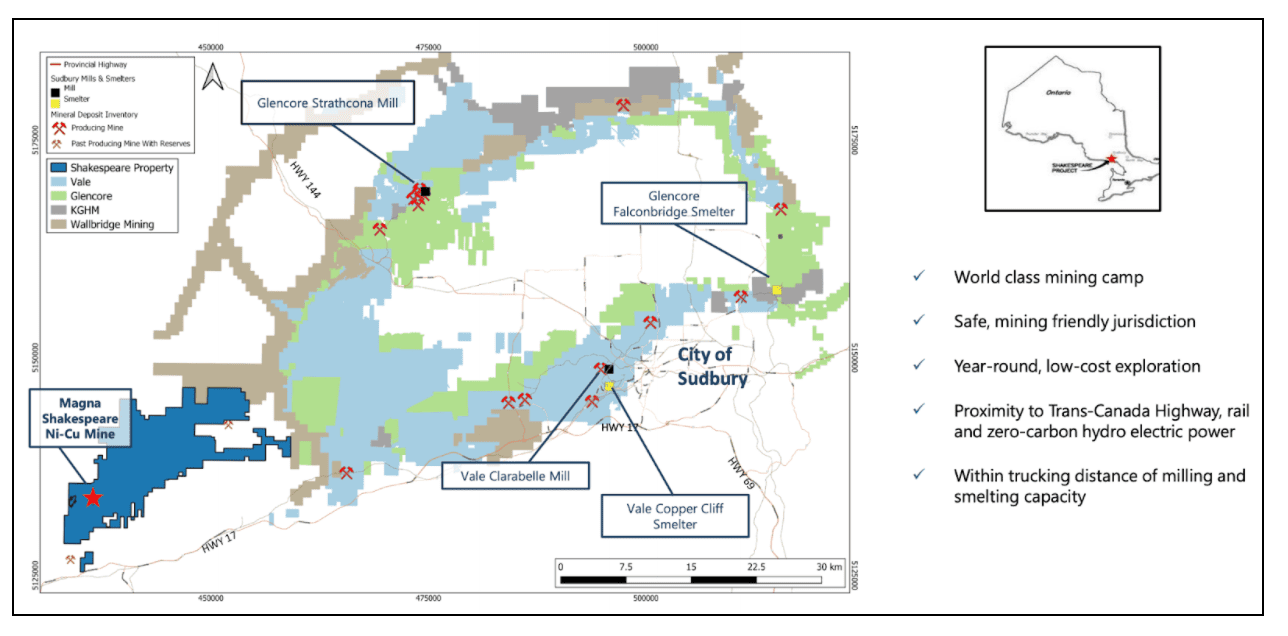

Sudbury, Canada, is a great place to mine nickel. The region has been home to some of the world’s largest nickel deposits, and the Sudbury Basin has eight producing mines. When production started over 125 years ago, it was little more than a frontier town in a country that was still finding its footing. Now, however, the area has produced over 11 million tonnes of nickel since that inaugural group of miners decided to put down roots and explore the land.

Companies like Vale (NYSE:VALE), KGHM, and Glencore (LON:GLEN), have control of most of the land packages in the region. These major players dominate the area and produce most of the nickel coming out of the Sudbury Basin. However, some junior miners are getting in on the action as well. Magna Mining (TSXV:NICU) has made its mark with a 100% stake in the Shakespeare mine, its flagship project. The mine could be a profitable one for the smaller miner with an indicated open pit resource of 14.4 million tonnes at 0.37% nickel, 0.37% copper, and 0.9g/t total precious metals. Today, Magna Mining begins trading on the TSX Venture Exchange, under the ticker NICU.

After going public, Magna Mining will have the capital to expand and advance its operations at the mine at a faster clip. The first area of focus will be expanding the exploration program to find more of the all-important nickel deposits sitting under the surface. Multiple drill targets have been set near the company’s existing deposit. This expansion of the project and the plan is really the first serious capital expenditure for the region in a long time. Additionally, the property package the company acquired includes more than 180km2 of prospective adjacent land, providing the opportunity for exploration in a section of the area that has seen little exploration in the past.

The company seems to be in the right place at the right time, with nickel fast becoming one of the critical metals for the green and digital transformations taking over the global economy. Elon Musk, CEO of Tesla, mentioned in an earnings call in 2020, “Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel.”

The Tesla boss’s call for more nickel mined in an environmentally conscious and socially responsible way was a wake-up call that the industry needs to step up to the plate and get more of the metals required for batteries, energy storage, and digital devices. Musk also later shared the company’s goal of implementing a battery supply model in North America to facilitate the production of zero high-cost cobalt and more low-cost nickel. It is rare that a company has a client wanting more than they can provide, but this is the state of play for the nickel miners out there right now.

As demand continues to pick up, projects in the Sudbury basin and beyond will also need to accelerate their timelines and invest more into existing nickel projects to keep up. New projects will also be necessary, both from major mining companies and the junior miners entering the field.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

For countries to reap the rewards of their natural resources, they need to make sure there is a favourable climate for miners and businesses operating within their borders. For Ecuador’s new president Guillermo Lasso, that means welcoming mining companies with open arms as they work to build a sector that is critical to Ecuador’s national economy. Chile hosts some of the biggest mining companies in the world, including BHP Group Ltd. (NYSE:BHP), Anglo American Plc (LSE:AAL.L), Glencore Plc (GLNCY), Antofagasta Miners (LSE:ANTO.L), and Freeport-McMoRan Inc. (NYSE:FCX).

Walking a Tightrope

Recent discussions by lawmakers in Chile could throw the country’s status as a mining hotspot into question. If investors or companies get spooked by the new tax, it could hamper efforts to invest in new projects or expand the ones currently operating in the region. Particularly for proposed royalty deals on copper and lithium sales, the ongoing discussions now could throw a wrench into the works of years of planning and investment.

Foreign investment in the country is an essential source of stimulus and job creation. The mining industry contributes massively to the national economy, and it has made Chile the biggest copper-producing nation in the world. With the new bill approved just last week imposing higher taxes on sales, and cash generated based on the current running price of copper, those contributions could begin to dry up.

A Painful Tax

Initially, lawmakers wanted to impose a 3% flat royalty for mining companies extracting copper and lithium. The valuable metals have seen steady price increases over the years, and with the coming electrification of the global economy, this trend shows no signs of abating.

A new version of the bill proposes a marginal rate of 15% on sales with copper prices between $2 and $2.50 per pound and up to 75% on any revenue generated from fees about 4%. This sliding scale has miners concerned about the future of their operations in the country, as copper’s price seems to have no slowdown in sight. If the bill were approved today, with current copper prices, the royalty rate would be 21.5%. Miners would be able to discount refining costs and some other tax write-offs for any copper sold as refined cathode, but the cut would be almost prohibitive for them.

“You can absolutely try and take more from the golden goose…”

This proposed tax would hit the biggest mining companies the hardest, with the bill affecting miners that produce more than 12,000 tonnes of copper and 50,000 tonnes of lithium per year. One of the companies that would be affected is speaking out against the proposed bill, as it would cut into the country’s status as a mining partner for some of the largest mining companies in the world. According to Ragnar Udd, President of BHP Minerals Americas, “You can absolutely try and take more from the golden goose but you just need to be very clear on what the implications are on that long term. The sort of reforms that are being put forward at the moment will be really quite damaging to the industry.”

“These are tax levels akin to expropriation…”

Even though the proposed tax has miners worried for the future of their operations, it is unlikely that the bill will be passed, especially in its current form. He believes the current system is fine, under which miners are charged a variable rate of up to 14% on operating profit. This rate only applies to large producers and does not affect the less competitive mines, giving them a shot at growth and keeping the country competitive for international investors.

For now, worry and outright opposition are the state of play, as one prominent mining group president has already touched on. Resistance is strong, and this is unlikely to let the bill pass as is. Sonami president Diego Hernandez issued a statement calling the project unconstitutional. He made it clear that the consequences of the proposed bill on the industry and the country would be severe and damaging. With this bill, Sonami (an organization representing copper miners in Chile) predicts that 12 of the 15 biggest miners operating in the country would end up operating at a loss.

Diego Hernandez himself has made it clear that the bill is unacceptable: “These are tax levels akin to expropriation and this is going to inhibit investment immediately.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The world continues to watch the mining industry for signs of a serious commitment to the decarbonisation efforts sweeping the global economy. Company after company continues to put their effort and money where their mouth is. The latest company to jump onto the net-zero train is Ivanhoe Mines (TSX:IVN), committing to net-zero greenhouse gas emissions at its Kamoa-Kakula Copper Mine.

The company’s CEO, Robert Friedland, will be speaking today at the 2021 Goldman Sachs Copper Day and made the announcement before his speech.

The mine is expected to be the world’s highest-grade major copper mine and should begin producing its first copper concentrates soon. The Phase 1 mining rate is expected to be 3.8 million tonnes per year, with an approximate feed grade of more than 6%. Phase 2 should see a ramp-up to 7.6 million tonnes per year, and with the proposed expansion to 19 million tonnes, Kamoa-Kakula could end up being the world’s second-largest copper mining complex.

The company’s ambitions don’t stop at production. The way Ivanhoe plans to mine is focused on support from a green electricity grid and a plan to reduce the use of fossil fuels until the net-zero emissions goal is reached. Electric, hybrid, and even hydrogen technologies are proposed for trucks and transportation. While the upfront investment will cut into the cash on Ivanhoe’s balance sheet, the costs down the road from reduced fuel costs, lower ventilation costs, and even lower health and safety costs as the healthier and cleaner technologies pose less of a risk to workers will more than make up for those initial investments.

The Canadian company is not just following but leading the way when it comes to large-scale net zero emissions projects. Its Kamoa-Kakula copper discoveries in the Democratic Republic of Congo (DRC) have opened the opportunity for the project to become one of the world’s largest and make the company one of the world’s largest copper producers.

Pushed along by the Paris climate agreement and the Canadian government’s initiatives in reducing emissions to zero by 2050, copper mining companies like Ivanhoe (TSX:IVN), Solaris Resources (SLS.TO), and Glencore (LON:GLEN) are pledging their efforts to the critical cause. This is not just because of the ethical and environmental benefits, but because investors also demand these commitments now. Without a plan for the environmental, social, and governmental (ESG) principles in the planning stages of projects, investors may be hesitant to commit capital.

Glencore (GLEN:LN), one of the world’s largest producers and marketers of copper, produced 1.26 million tonnes and sold 3.4 million tonnes through its marketing business in 2020. Their copper production is so large that the company is also a major producer of cobalt, a byproduct of copper. Most of their cobalt product comes from the Democratic Republic of Congo.

The Start of an Upward Trend

While 2020 was a good year for Glencore (GLEN: LN), 2021 began to set the trend for production increases. On Thursday, the company reported 301,200 tonnes produced in the first quarter of 2021, 3% higher YoY from Q1 2020. While the reopening of production and the lifts of restrictions for miners contributed to this bump, productivity improvements also lent a hand to the increase.

“The group’s overall production was broadly in line with our expectations for the first quarter. Production in Q1 2021 reflects that many of our operations continue to maintain thorough Covid-safe working practices, as appropriate for each specific country and region. Full-year production guidance has been maintained for our key commodities,” according to CEO Ivan Glasenberg.

Big Influence

Glencore’s business is one of the most diversified, comprising more than 60 commodities. The company has operations at approximately 150 mining and metallurgical sites in more than 35 countries. Employing 135,000 employees and contractors, where Glencore goes, significant employment number improvement often follows, and the company holds so much sway in many commodities that it is often responsible for price changes as a direct result of supply and demand.

Copper’s in-demand status continues to increase, and Glencore’s production increase is just a piece of what will be necessary over the coming years to meet the massive demand coming. As one of the largest producers and marketers of copper in the world, Glencore (GLEN: LN) will need to take a lead position in the market and help balance the supply issues facing the industry right now.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

GCX.V | +100.00% |

|

AAZ.V | +50.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

CRB.AX | +33.33% |

|

CASA.V | +30.00% |

|

GEM.V | +28.57% |

|

BTT.V | +25.00% |

|

PGC.V | +25.00% |

|

MTB.AX | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024