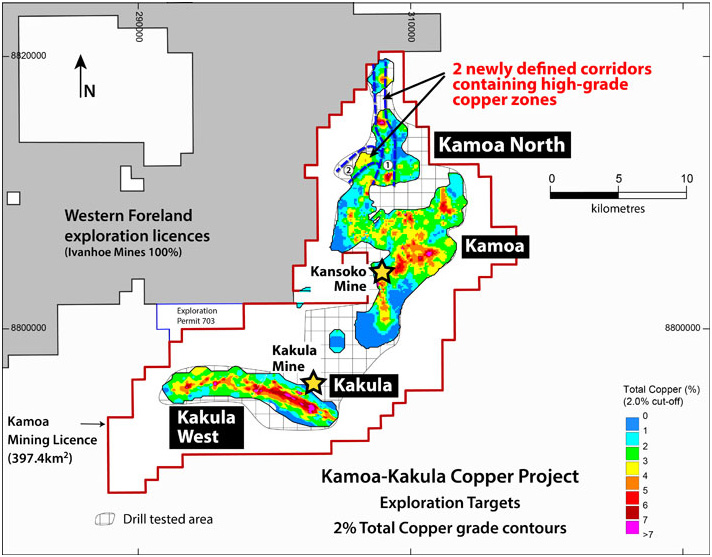

The world continues to watch the mining industry for signs of a serious commitment to the decarbonisation efforts sweeping the global economy. Company after company continues to put their effort and money where their mouth is. The latest company to jump onto the net-zero train is Ivanhoe Mines (TSX:IVN), committing to net-zero greenhouse gas emissions at its Kamoa-Kakula Copper Mine.

The company’s CEO, Robert Friedland, will be speaking today at the 2021 Goldman Sachs Copper Day and made the announcement before his speech.

The mine is expected to be the world’s highest-grade major copper mine and should begin producing its first copper concentrates soon. The Phase 1 mining rate is expected to be 3.8 million tonnes per year, with an approximate feed grade of more than 6%. Phase 2 should see a ramp-up to 7.6 million tonnes per year, and with the proposed expansion to 19 million tonnes, Kamoa-Kakula could end up being the world’s second-largest copper mining complex.

The company’s ambitions don’t stop at production. The way Ivanhoe plans to mine is focused on support from a green electricity grid and a plan to reduce the use of fossil fuels until the net-zero emissions goal is reached. Electric, hybrid, and even hydrogen technologies are proposed for trucks and transportation. While the upfront investment will cut into the cash on Ivanhoe’s balance sheet, the costs down the road from reduced fuel costs, lower ventilation costs, and even lower health and safety costs as the healthier and cleaner technologies pose less of a risk to workers will more than make up for those initial investments.

The Canadian company is not just following but leading the way when it comes to large-scale net zero emissions projects. Its Kamoa-Kakula copper discoveries in the Democratic Republic of Congo (DRC) have opened the opportunity for the project to become one of the world’s largest and make the company one of the world’s largest copper producers.

Pushed along by the Paris climate agreement and the Canadian government’s initiatives in reducing emissions to zero by 2050, copper mining companies like Ivanhoe (TSX:IVN), Solaris Resources (SLS.TO), and Glencore (LON:GLEN) are pledging their efforts to the critical cause. This is not just because of the ethical and environmental benefits, but because investors also demand these commitments now. Without a plan for the environmental, social, and governmental (ESG) principles in the planning stages of projects, investors may be hesitant to commit capital.

Copper miners are always looking for more. More ore, more mines, and more copper to refine and get to the market. The demand for copper is growing at such a fast clip that companies can’t keep up, so ‘more’ is the only word that matters now. For that, they need to go to the regions they are most likely to find the valuable red metal. One location is promising to deliver the copper necessary to meet the incredible demand over the coming decades.

The Andean Copper Belt

Northwestern South America, including Colombia, Ecuador, Peru, and Northern Chile is host to some of the richest copper deposits in the world. The area’s geology is among the earth’s most richly mineralized, making it an exciting area choice for the companies that are just testing the surface of hugely prospective sedimentary copper basins in those countries. This mineral-rich piece of prime mining real estate is referred to as the Andean Copper Belt.

The 2500-kilometre mineralized arc formed during the Lower Paleozoic eric around 300 million years ago. This mineral-rich multi-country zone has been sitting dormant for millions of years, and now copper miners are able to benefit from this region to help meet the current and coming copper boom.

Tip of the Iceberg

What’s impressive is that initial exploration of sedimentary basins in Colombia, Ecuador, and Peru might be the tip of giant icebergs of sediment-hosted copper-silver deposits sitting underneath. If the theory is proved, it would mean billions of pounds of copper and hundreds of millions of ounces of silver lay hidden just beneath the land in the Andean Copper Belt. Copper miners could be working on and extracting copper from the region for hundreds of years, and the work still wouldn’t be finished.

Exploration efforts are expanding quickly in countries like Ecuador at mines like Warintza, and while the pandemic may have slowed progress in 2020 a little, copper demand hasn’t. Mining companies in the area like Solaris Resources will be in a position to fill that demand as it increases over the next few years and into the coming decades.

Sedimentary Copper

Ocean basins composed of porous materials such as sandstone, limestone, and black shale area where copper deposits are formed. The copper and other minerals travel up and become trapped in the rock layers. This mineral deposition is different from a copper porphyry deposit, which is ultimately formed when a block of molten-rock magma cools. The magma might come from underground or aboveground volcanoes, or simply the earth’s crust as it is pushed upward over time.

The cooling then leads to a separation of dissolved metals into distinct zones of copper, molybdenum, gold, tin, zinc, and lead. By the time humans are ready to mine it, it has been sitting in the earth for millions of years, waiting for a capable miner prepared to put it to good use.

Copper porphyries are often visualized as a bag of flour, with millions of grains of rice (copper and other minerals). They are spread across a large area. Sedimentary copper deposits are much more concentrated, sitting underground on top of each other like a stack of books.

Ecuador First

For miners operating in the Andean Copper Belt, both types present a wealth of minerals. The exploration and production efforts of the companies in the region are exciting and lucrative. Anyone paying attention to the area and the metal that is fast becoming one of the most valuable should pay attention to any and all progress on this front.

Ecuador in particular is positioning itself as a mining-friendly partner to Western mining companies. According to government officials, the mining industry could represent up to 4% of the country’s GDP this year, up from 1.6% in 2018.

Who Are the Players?

To accomplish this, Ecuador has opened the market to more business-friendly regulations in order to attract foreign capital. This has brought strong development partners in the private sector from countries like Canada, China, and the United States.

Lundin Gold (LUG.TO)

Lundin Gold is in the basin but does not expect to encroach on copper miner’s territory as their work is focused on the Fruta Del Norte gold mine in Ecuador. The company sent off its first industrial-scale exports of gold from the mine in December 2019, and despite a slight slowdown in 2020, is still producing regularly. The project and the company also have the support of a mining-friendly government that is ensuring Ecuador is a substantial mining partner.

EcuaCorriente

EcuaCorriente owns the Mirador copper mine. The company is a subsidiary of Tongling Nonferrous Metals Group and China Railway Construction. The mine has estimated reserves of 3.2 million tons of copper, 3.4 million ounces of gold, and 27.1 million ounces of silver. The first copper exports from the company left the country in July 2019. EcuaCorriente has been a great test case for how profitable exploration and discovery efforts can be in the region.

Solaris Resources (SLS.TO)

Fulfilling the abundant promise of the Andean Copper Belt, Solaris Resources has made a significant new discovery at its Warintza copper project in southeast Ecuador. A geophysical study revealed a much more extensive porphyry system than anticipated, sparking a drill rig expansion that saw the rig count double from 6 to 12. Early results are promising, and the company will have its hands full in 2021, expanding the project and starting production soon after.

Solaris will have a grid for Warintza that includes clean, low-cost electric power and the ability to get supplies in and out of the site easily due to well-developed infrastructure. Ecuador’s abundant supply of freshwater eases the company’s work significantly as well. As a result, capital costs for the project will be much lower than average.

As drill results continue to come in and the company moves from discovery to production, their flagship Warintza project in this piece of prime copper real estate is set to be the launchpad for years and decades of significant results.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Peru is one of the prime copper mining destinations for miners from every corner of the globe. Some of the largest deposits of the red metal are sitting in the ground in this mining-friendly country. For Anglo American, the Quellaveco Mine presents an opportunity to add another world-class cost-efficient mining operation to their diversified portfolio.

A Hotbed

Anglo American is part of a group of miners that contributed 58% of mining investment in Peru in January. While mining investment in Peru slumped because of the pandemic and remains below pre-pandemic levels, investment in infrastructure and planning has restarted in earnest now. The Quellaveco Mine is a significant focus of capital expenditure for the company, and it’s pretty easy to see why.

A Hot Commodity

According to Bloomberg, “Within a decade, the world may face a massive shortfall of what’s arguably the most critical metal for global economies: copper.

The copper industry needs to spend upwards of $100 billion to close what could be an annual supply deficit of 4.7 million metric tons by 2030 as the clean power and transport sectors take off, according to estimates from CRU Group. The potential shortfall could reach 10 million tons if no mines get built, according to commodities trader Trafigura Group. Closing such a gap would require building the equivalent of eight projects the size of BHP Group’s giant Escondida in Chile, the world’s largest copper mine.”

Copper miners are scrambling to keep up with demand, and for the time being, prices continue to climb due to the supply shortfall. In the coming years, companies will need to manage their projects to avoid overproduction and a glut of the valuable metal, but for now, there are plenty of opportunities to ramp up production and get more copper into the market.

This is great news for companies that are developing and investing in new projects right now,

Quellaveco Mine

The mine is one of the largest copper deposits in the world and is located in Peru’s most established copper-producing region. Due to the skilled workers and established infrastructure, the project is likely to be a big winner for the company when it begins.

Anglo American expects the mine to be ready for 2022, at which time the first copper production will begin. This project seems to be coming at just the right time to take advantage of a confluence of events and circumstances in the global economy and the process of electrification worldwide. For now, investors will be watching for any sign of the Quellaveco Mine proceeding according to plan, and Anglo American will need to deliver on many of their promises to deliver this project on time and on budget.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining companies often have their hands full with multiple projects spanning locations in different regions, countries, and sometimes continents. This can create complications for operations, but if the company has the right management and operational experience, having a variety of projects on the go at the same time can be a serious benefit.

Typically driven by low commodity prices, large mining companies are beginning to shift away from project diversification to focus on their best projects to increase competitiveness. By doing this, many companies believe that it will allow them to compete more effectively in specific sectors and make the most of what they have. While this can be effective for some, having a range of projects complementing each other, while maintaining focus on one or two flagship projects has proven to be a successful format for others.

Having a portfolio of projects is also necessary so that holdings are sufficiently diversified and exploration does not have to stop when one project is not moving forward. While it is good to have many projects, focus is also necessary for the proper and effective execution of any mining strategy. For a company like Solaris Resources operating in the Americas, a diversification strategy has been beneficial for their exploration and production efforts, but they have been able to balance this with a particular focus on one mine.

Flagship Status

The Warintza Mine in Ecuador discovered by David Lowell has been the flagship project for Solaris since its inception, and exploration and development has been focused on there for some time now. With the news of the added drill holes and capacity coming, the company is preparing to double down on that success while bringing out the best in the work being done there with ESG principles and particular zero-carbon project planning.

Getting Everyone Involved

The emphasis on consultation, local employment, educational practices, and ESG principles has made Warintza not just the flagship of the Solaris portfolio, but an example in the industry of how things can be done the right way while ensuring stakeholder success at every level. Prior to beginning work on the site, thorough consultation was done with the Shuar Nations of Warints and Yawi, to establish trust and transparency from the outset. In any long-term effort, starting off on the right foot is essential. This consultation process ensured that the project would get off to a good start while maintaining open communication with the local community. Transparency was also ensured by acquiring full permitting, and no Administrative Silence was allowed.

Considering the diversity and robust mining infrastructure, Ecuador is perfectly placed to complement the company’s work and extensive employment opportunities have been extended in the local and surrounding communities. The project is bringing jobs to the area while making everyone feel good about the work they are doing. The result is a community that understands the impacts and benefits of the project, was involved with the planning, and is able to directly benefit from its success. This win-win approach is not just good messaging, but part of the operational ethos of the company for the project, and has helped the company deliver transparency, education, and inclusion from the start.

History

The mine itself was discovered by David Lowell in 2000 but was largely dormant since 2001. At the time, Ecuador was a frontier jurisdiction with no commercial mining industry. Things began to change in 2014 when the government shifted its policy in the wake of the collapse of the oil sector to encourage mineral development. The change was fuelled by Lundin Gold acquiring the Fruta del Norte project, 45 km south of Warintza, and developing it in a socially and environmentally responsible manner. This improved sentiment toward mining development and created conditions for Solaris to successfully restart a dialogue with the communities surrounding its Warintza Project in 2018. After extensive dialogue with local and surrounding communities, the root causes of conflict were resolved, and by mid-2019, an innovative CSR program was instituted. By the time 2020 rolled around, the company had signed an Impact and Benefits Agreement with community stakeholders after a government-sponsored prior consultation process, and Solaris Resources was able to restart exploration on the project in earnest.

Looking Back

When tracking the company’s progress, it might be helpful to do so by following the trajectory of the stock over the past 8 months. After listing as a spin-out of Equinox Gold, Solaris’ mission began to explore and develop the Warintza Project in Ecuador. Once results started to come in, a pattern began to emerge:

- July 18, 2020: Solaris lists at $1.50.

- August 10, 2020: SLS-01 returned 567m @ 1.0% Cu-Eq effectively extending mineralization to depth below historical drilling, averaging 200m and improved upon the estimated resource grade of 0.56% Cu. Price: $2.43.

- September 28, 2020: SLS-02 returned 660m @ 0.97% Cu-Eq which confirmed further extension of higher-grade mineralization relative to historical drilling. SLS-03 returned 1,010m @ 0.71% Cu-Eq and collared 426m east of the first two holes, and further improved upon depth-extent of known mineralization. Price: $4.30.

- November 23, 2020: Three drill assays (including the first campaign at Warintza West) included SLS-04 returning 1,004m @ 0.71% Cu-Eq, SLS-05 returning 918m @ 0.5% Cu-Eq, SLS-06 returning 884m of 0.50% Cu , further extended mineralization relative to historical depth. Price: $5.72.

- January 14, 2021: SLS-07 returned 1,067m @ 0.60% Cu-Eq, bottoming in mineralization beyond the 150m depth of the corresponding historical hole, and SLS08 returned 454m @ 0.62% Cu-Eq both effectively extending mineralization to the north and northeast. Price: $6.59.

- February 16, 2021: SLSW-01, the first hole drilled at Warintza West, returned 798m @ 0.31% CuEq (0.25% Cu, 0.02% Mo, and 0.02g/t Au), extending mineralization to Warintza West. Price: $6.90.

- February 22, 2021: SLS-10 returned 600m @1.00% Cu-Eq, SLS-11 returning 668m @ 0.57% Cu-Eq), SLS-12 returning 736m @ 0.74% Cu-Eq, and SLS-13 returning 462m @ 1.00% Cu-Eq. Price: $7.27.

- March 22, 2021: SLS-14 returned 922m @ 0.94% CuEq, SLS-15 returned 1,002m of 0.60% CuEq from near surface, SLS-16 returned 958m of 0.77% CuEq from near surface, extending mineralization between east & west. Price: $8.70.

Contrary to the common narrative of many miners that list and consistently lose value as their discovery efforts return less than expected or nothing, the company’s story appears to be the exact opposite based on the eight-month period they have been a public company.

Moving Forward

The project has turned out exceptionally well for the company, and last month Solaris made it clear that it wants to expand on the success it has had so far by doubling the rig count and beginning to drill new holes, all while maintaining that commitment to the community and the ESG principles the project was planned with. The company’s press release highlighted some of the recent impressive results from the 20,200 metres that have been drilled so far at the mine:

- Three additional holes at Warintza Central, as detailed below, have returned long intervals of high-grade mineralization, with the highest grades starting from the surface, and extending mineralization between the eastern and western drilling and stepping out to the southwest.

- SLS-14 was collared on the western side of Warintza Central and drilled into an open volume to the east, returning 922m of 0.94% CuEq¹ (0.79% Cu, 0.03% Mo, and 0.08 g/t Au) from the surface, including 850m of 0.98% CuEq¹ (0.82% Cu, 0.03% Mo, and 0.08 g/t Au), significantly extending the limits of mineralization.

- SLS-15 returned 1,002m of 0.60% CuEq¹ (0.52% Cu, 0.01% Mo, and 0.04 g/t Au) from surface, including 694m of 0.67% CuEq¹ (0.57% Cu, 0.02% Mo, and 0.05 g/t Au) within a broader interval of 1,229m of 0.56% CuEq¹ (0.48% Cu, 0.01% Mo, and 0.04 g/t Au), stepping out to the southeast and extending mineralization to depth.

- SLS-16 returned 958m of 0.77% CuEq¹ (0.63% Cu, 0.03% Mo, and 0.06 g/t Au) from near surface, including 486m of 0.84% CuEq¹ (0.70% Cu, 0.03% Mo, and 0.07 g/t Au), extending mineralization between the eastern and western drilling at Warintza Central.

- To date, 20,200 metres have been drilled at Warintza Central in 25 holes of which results have been reported for 16; drilling is ongoing with six rigs currently operating and increasing to 12 by mid-year

Source: Solaris Resources

Each project has built on the success of the last, and as they expand, each step continues to pour more fuel into a tank driving the company from one milestone to the next. Not only do they stand to benefit from the expansion of the project, but from all of the future compounded gains from the Warintza mine. Drilling thus far has generated significant value for the company and stakeholders involved at every level, and with more drilling to come, one has to assume that the compounded results of that work will reflect positively on the company and stock for the foreseeable future and beyond. Lately, the stock has been balancing between $8 and $10, but with this range being tested frequently with changes of 10% or more in a single daily session, it seems investors are ready for a price above $20 or $30 now.

With the recent insider-buying activity from Solaris Chairman Richard Warke and a management team that has invested over $100M in less than a year in both private placements and on the open market, the Solaris story is proving to be a powerful one. The company has seen its share price reflect its significant progress in a very short amount of time, and it seems that the potential for moving forward is also driving much of the vigour from investors.

Potential

The company’s current market cap sits at just below $1 billion, and any breakthrough could mark a psychological shift in how the company is perceived as a result of the value generated by the Warintza project in particular. Solaris has ongoing discovery drilling that is aimed at discovery potential in 2021, meaning big news for the company may lie ahead with any discoveries this year. The Warintza Project has proved that the company’s efforts are being well-spent in the past year and that work has taken the company further than ever before.

Although progress has been made, with the expansion of the project and the focus on expanding at the same time, the company may be looking at future valuations several times greater than current levels only taking into account current rates of return. If the new drill holes and discovery plans continue at this pace or better yet accelerate, the future of the project and the company will be very bright indeed.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As far as investment managers go, Cathie Wood is both an outlier and an insider. She runs a $60 billion dollar firm, Ark Investment Management, and while the fund has been a smaller player in past years, the firm has AUM of over $60 billion as of February 2021. Her rapid growth comes on the heels of a growing popularity and a willingness to ride trends that passive funds would not be willing to take advantage of.

As far as investment managers go, Cathie Wood is both an outlier and an insider. She runs a $60 billion dollar firm, Ark Investment Management, and while the fund has been a smaller player in past years, the firm has AUM of over $60 billion as of February 2021. Her rapid growth comes on the heels of a growing popularity and a willingness to ride trends that passive funds would not be willing to take advantage of.

Ark’s focus is ETFs, giving her the structure and reputation to manage the portfolio actively, and in full transparency. The firm, and Wood in particular is known for her bold and confident convictions, and she’s on the record as a contrarian on a number of investment opinions. ARK has gone from being an arguably middling player in 2020 to being the seventh largest exchange-traded fund issuer in the $5.9 trillion industry. This time last year, Ark was managing $3.6 billion in ETF assets.

Growth Is Not Over

With fresh inflows of cash, comes the need for fresh ideas, and at this unrelenting pace, Cathie Wood is moving to generate as many ideas as possible. Recently, she’s had some opinions about the red-hot markets and where there might be a bubble. While consensus in some circles seems to be that equities are overvalued and verging on or already sitting in bubble territory, Wood has some other ideas.

Two big takeaways from a recent interview were her view that it is fixed income that is in a bubble, not equities, as equity outflows have been quite consistent since 2008/2009 and that money has been flowing into the fixed income space for some time. The other was that contrary to there being a bubble, she sees healthy equity growth ahead. Her take? Massive stimulus, positive profit expectations, and copper will drive growth for 2021 and beyond.

The Insider

Cathie Wood knows a thing or two about mining, and tech metals in particular. She has a track record of picking innovative companies for her $28 billion ARK Innovation ETF that is up more than 24% YTD. The ARK Autonomous Technology and Robotics ETF is up 29% so far this year, proving her knowledge and skill in the tech sector is not just a fluke.

Bullish on Elon Musk

In a March 3rd Reuters article about her interview on Benzinga’s YouTube channel, Cathie is noted to be bullish on Tesla for the time being and seemingly far into the future. Her view is that the company founded and headed by Elon Musk is a leader for the autonomous vehicle space, and as such she’ll be keeping the company in her Ark Innovation fund’s portfolio. Tesla accounts for roughly 10% of the fund’s portfolio, proving her confidence in the electric-vehicle maker and its CEO Elon Musk.

Red Metal On Fire

Her overarching view on tech and innovation continues when it comes to metals, as she selects it as one of her top areas for growth this year. Wood’s focus on the tech industry and electric vehicle makers gives her the insights into what those companies and industries will demand over the coming years, including valuable metals like copper.

The red metal has been on a tear lately, benefitting miners around the world, and as demand increases for copper from tech companies, parts suppliers, and battery makers, copper miners will be increasing production while reaping the rewards of the higher prices.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CMB.V | +900.00% |

|

CCD.V | +100.00% |

|

CASA.V | +30.00% |

|

AAZ.V | +25.00% |

|

RMI.AX | +25.00% |

|

POS.AX | +25.00% |

|

KGC.V | +20.00% |

|

GDX.V | +20.00% |

|

LPK.V | +16.67% |

|

CCE.V | +16.67% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan