Investors in the mining sector are preparing for what should be another strong year for the industry by adding a total of $86.3 billion of market capital to the top mining companies in the Top 50 ranking in 2021.

The overall value of the Top 50 ended 2021 at just under $1.4 trillion after peaking a little above that. This amount represents an increase of about $100 billion since the beginning of the year and double the market capitalization they had during March and April 2020, i.e., the peak of the pandemic.

Coal Doesn’t Go Cold

With no exposure to iron ore other than trading, Glencore (OTC:GLNCY) and its investors bucked the trend by closing the year with $25 billion.

The Swiss multinational company, Glencore, a commodity trading and production company, has not abandoned coal mining. Like its peers, its coal, gas and oil trading arm is benefiting from rising energy prices.

The performance of coal miners in 2021, especially in China, is the clearest evidence of the volatility of commodity markets. Although only a short time ago, towards the end of the year coal miners and their coal divisions in the diversifieds were threatening to drop out of the ranking altogether.

The rest of the three remaining coal companies (the ranking excludes power companies that operate their own mines such as Shenhua Energy) rose and Coal India halted its decline. The world’s largest coal miner, Coal India was number 4 in the rankings four years ago.

Lithium on the Rise

The high demand for electric cars has caused lithium prices, used for the motors and battery technology, to remain high, and their rebound has been prolonged. At the moment, the top three lithium producers, listed in the Top 50 ranking, have a global value of more than $66 billion.

Tianqi Lithium briefly dropped its position in the rankings in 2019, due to its market value being below $5 billion. However, China’s Shenzhen-listed Lithium producer is now ranked in the top 20 of the majors, with a value of about $25 billion surpassing SQM.

For its part, Albemarle (NYSE:ALB), the world’s number one producer, has risen 59% since the year began which made its investors $10 billion richer. Charlotte, North Carolina-based Albemarle announced that it intends to buy, with the aim of expanding downstream, a Chinese lithium producer.

Ganfeng, the leading manufacturer of lithium chemicals (a company not ranked as mining is not a major part of its business) is striving to secure investment in that sector of production. For its part, copper producer Codelco is advancing work on its lithium project. However, concessions in Chile could become scarce or disappear altogether in the decades to come.

Pilbara Minerals is currently ranked 54th but Pilbara is expected to enter the top 50 mining rankings very soon, as the company continues to post record highs and operations at the Pilgangoora project are ramping up to supply the huge demand for spodumene for Chinese transformers.

Rio Tinto’s (ASX:RIO) Jadar project is not off to a good start in Serbia. The Anglo-Australian company’s lithium business is likely to start to look up in the rankings in the next few years as well as Sibanye’s entry into battery metal with an acquisition in Nevada.

Iron Ore, and More

Falling iron ore prices and the decline of copper in the market in the last months of 2021 affected the ranking position of the big three companies, BHP (NYSE:BHP), Rio Tinto (ASX:RIO) and Vale (NYSE:VALE). Over the course of last year, they lost a total of $56 billion.

Last year, BHP had a valuation of almost $200 billion being worth slightly more than oil company Royal Dutch Shell for some time. This made it the most valuable stock in the UK.

A sign of the belief investors have in the effect on mining for the green energy transition is the fact that BHP has lost almost $50 billion despite activating the search for nickel for battery manufacturing. Rio Tinto, for its part, has lost $43 billion since its peak. These losses are indicators that iron ore mining remains central to the sector.

The fall in iron ore caused South Africa’s Kumba Iron Ore to have its worst valuation of the year, plummeting 30%. Australia’s Fortescue Metals, the world’s fourth largest iron ore producer, plunged by $13 billion over the year. While its ranking fell six places as its trading arm, Fortescue Future Industries, got off to a slow start.

CSN Mineração, one of the biggest mining IPOs since Glencore’s in 2011, dropped out of the 50 ranking in its first quarter debut. But thanks to last year’s 87% rise, the Cleveland-Cliffs company is ranked in the top 50 after spending years in obscurity.

Uranium

For the first time after many years, the value of uranium producers is once again ranked in the top 50.

Kazakhstan’s Kazatomprom expanded its stock exchange listing beyond Almaty. As a result, the company has doubled in value this year. Kazakhstan, responsible for about 40% of uranium production, despite the turmoil in the country, has not affected the fortunes of the state-controlled company.

AngloGold Ashanti, Cameco’s main rival, has been overtaken by Cameco leaving Cameco out of the rankings at the end of the year. However, the stock’s performance since the Dec. 31 close would see the Saskatoon-based company move back up the rankings in the hope that it can take advantage of the revival of uranium mining and the problems in Kazakhstan.

A Banner Year

Overall, the mining industry had a banner year with record investor inflows. The bullishness of 2021 is likely to continue as the pandemic recedes and producers get back to normal with production targets as well as a more balanced and predictable supply chain.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Vale (NYSE:VALE), the international mining giant, may be looking to buy a 30-40% in Anglo American’s (LSE:AAL) Minas-Rio iron ore project in Minas Gerias, Brazil, according to some reports. If the deal happens, Vale could look to acquire an operatorship stake in the project as well.

Located in the states of Minas Gerais and Rio de Janeiro in the south-eastern region of Brazil, Minas-Rio is an iron ore project 100% owned by Anglo American. The project is estimated to produce more than 26.5 million tonnes of iron ore per year.

The area is also known for hosting the world’s largest iron ore mine by reserves, Carajas, which belong to the Brazilian mining company Companhia Vale do Rio Doce (CVRD). Minas-Rio and Carajás work together in areas such as logistics and rail transportation. It also consists of a 529 kilometre pipeline, filtering plants, and export terminal location in the Atlantic port of Acu in Rio de Janeiro state.

Anglo American (LSE:AAL) bought the rights from MMX back in 2008. While annual production for phase one of operations is expected to be below 30 million tonnes, probable reserves have been estimated at 1.45 billion run-of-mine (ROM) tonnes back in February 2013. This would leave plenty of production capacity for Vale if the miner decides to acquire a stake in the project. Considering the billion-plus tonnes in probable reserves, this project could bring Vale much closer to its production target. It would also solidify the company’s position as a dominant global supplier of premium iron ore.

Vale’s (NYSE:VALE) Dominant Position in Iron Ore

Vale (NYSE:VALE) is one of the biggest mining companies in the world, and one of the most dominant suppliers in the global iron ore market. The company is set to produce close to 350 million tonnes of iron ore this year, making it by far the biggest producer of all top mining companies. Vale produces more than twice as much raw material in comparison to number two, Rio Tinto.

If the deal goes through in Minas Gerais, Vale could have access to a significant portion of Anglo American’s production at the project, with no signs of slowing down their expansion plans anytime soon. However, there are some concerns over how this would affect Vale’s own stock prices if they were actually buying another project at a time when commodity demand has been declining due to slower economic growth in China, which is also reducing volumes sold through major iron ore suppliers into that market.

The deal has not been confirmed yet and is subject to some speculation, but it could help Vale with its key production targets in the short term if they do sign off on a deal.

Vale buying Minas-Rio would certainly be good news for both companies involved, as Minas-Rio has proven reserves and an existing infrastructure so it’s easier and faster for Vale to get the product to market than starting from scratch.

Take an Operatorship Stake

When a mining company takes an operatorship stake in a project, it means the company is taking the responsibility for mining and selling all of the product from that project. The owner of a project with an operatorship agreement usually gives its partners access to a set amount of raw material each year depending on agreed-upon rates, but a mine under operatorship has 100% control of production and sales going forward.

This can be very profitable for both parties because the operator can control production and sales without having to pay the owner any additional fees for taking on operatorship. It’s also beneficial to both parties because the mining company is now able to focus on making money from its own mine instead of renting out part of it.

Iron Ore Gaining Traction

Iron ore production is gaining traction again after the pandemic slowed production due to a demand dearth. The largest importer of iron ore is China, and there was a significant reduction in China’s imports of iron ore as the country started importing less coal and steel to cope with the pandemic.

China has recently increased its coal and steel production, which means it will likely increase raw material demand as well. This is good news for Vale because increased demand from China should help push prices up significantly even if it doesn’t acquire Minas-Rio.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining companies have become some of the biggest companies to make sweeping, rapid changes to their business models, operations, and social responsibility charters in the last five years. With net-zero emissions goals being set around the world for the developed world from anywhere from 2030 to 2050, companies will need to keep up.

The mining industry’s renewed commitment to ESG (environmental, social, governance) principles has meant that a new operational standard is in place. For many, that means reducing emissions to zero.

Canadian gold mining company IAMGOLD (TSX:IMG) is taking the pledge to achieve net negative greenhouse gas emissions (GHG) emissions by 2050 at the latest. This is a challenging task, but one that can be accomplished with the right amount of investment and commitment.

Gordon Stothart, President, and CEO of IAMGOLD (TSX:IMG) said on Monday, “In our view, reversing the effects of climate change does not mean stabilising emissions; it demands that we reduce the total volume of greenhouse gases going into the atmosphere and the world’s oceans year over year. We know that we are losing habitat at an unsustainable pace.”

The company’s strategy will be two-pronged, with the first target focused on GHG reduction from scope 1 and scope 2 emissions. This largely focused on heavy and light vehicle fleets and power generation and supply. This is the easiest to accomplish because the technology exists, and investment will only be needed for implementations.

The second prong of the strategy includes the second target of GHG removals. This is done by supporting the effects of climate change by supporting net positive biodiversity and protecting carbon sinks. To do this, IAMGOLD (TSX:IMG) will use nature-based solutions, creating habitat for flora and fauna at a faster rate than it disturbs. This net-zero approach will ultimately cancel out any of the effects of disturbance in local habitats from mining operations.

Stothart continued, “Absolute reductions form a critically important part of IAMGOLD’s strategy in actively combating climate change, with investments in nature-based carbon offset projects supporting greenhouse gas removals.”

Mining companies are held to a much higher standard these days, and reporting is necessary at every step of the process. In 2022, an external verification will be completed on its emissions reporting, the company will develop and announce medium-range time targets for reductions and removals for targets 1 and 2, and publish a solid roadmap and timelines for how the company will achieve its ultimate goal by 2050 of net negative emissions.

How the Industry is Adapting

The mining industry is adopting ambitious and ambitious sustainability targets to promote safer and more sustainable mining activities that will have a positive impact on society. It is cutting CO2 emissions as fast as possible for projects, with the aim of increasing their overall value to society.

Most companies have targets set for 2030, and 2050, that create a step-by-step process for achieving net-zero or net negative emissions by those dates. Many companies are reducing emissions and compensating for CO2 emissions that can’t be avoided to create a sustainable world for future generations. The best way to help the mining industry meet its emissions targets is to improve its operational efficiency in the short term and invest in renewable energy sources in long term.

The need for change is increasingly permeating the mining sector and technological advances offer miners opportunities to reduce their direct and indirect emissions. Looking to the future, feasibility studies of new and existing mine extensions will be assessed according to the impact on emissions and the way in which mines can achieve sustainability.

Electrification of the plant and other operations is a crucial way to reach zero in mining, processing, and transport. Many of the hardest-to-electrify heavy industries and mining processes have emissions that are difficult to eliminate and are part of the energy mix over which miners have no direct control. Consider the steel industry which over the next 20 years must eliminate 17 billion tonnes of direct and indirect CO2 emissions. This is a challenge, but one that the industry is taking on, head-on.

Removing 6.1 billion litres of diesel from copper mines per year – equivalent to 105,000 barrels per day – would reduce a quarter of all greenhouse gas emissions produced. The copper mining industry is pushing hard for net-zero emissions, as a metal that can be used for electric energy storage and transportation. This green technology metal is critical to the future of net-zero emissions, and so mining companies are committing to making the production process green as well.

Most diversified miners have set bold net-zero targets in oil and gas. The major benefit of all of these goals is that miners can provide the supply growth and demand for the energy transition they need to decarbonize their own sector. Mining is the key to the refinement of metals that can be used in wind, solar, electric vehicles, storage, and transmission, and will be essential if the world is to achieve the Paris target of net emissions by 2050.

For them, the route to eliminating their own operational greenhouse gas emissions by 2050 is feasible if not attractive. The world’s largest mining companies by market capitalisation, BHP Group (ASX:BHP), and Rio Tinto (ASX:RIO), have espoused ambitions for net-zero emissions, as has been noted in previous analyses of mining companies as serious and feasible targets.

As a result, many mining companies have set ambitious carbon emissions targets that are consistent with the Paris climate agreement from 2015 and strive to attain net emissions zero.

Net CO2 emissions occur when greenhouse gas emissions released by an organization are offset by an equivalent amount of carbon capture from the atmosphere. For many mining companies, this means determining a baseline level of GHG emissions and then looking for ways to reduce these emissions, commonly called decarbonization.

Although there are practical limits to how much GHG emissions can be reduced in mining, several innovative approaches that will be explored in the future are promising. New technologies, better use of data and smart automation are helping mining companies to become more energy efficient around the world.

Vale, one of the world’s largest mining companies, has been outlining its greenhouse gas reduction commitments for some time. Having the industry giants committing to this goal is a signal to the rest of the industry, no matter what size company, that it is a real and possible target.

The World Bank estimates that the transition to a net-zero emissions economy will require demand growth of up to 500%. On an individual raw material basis, demand for cobalt is estimated to increase by 20% by 2040. Copper, nickel, and other metals necessary for electric technologies for infrastructure and in particular EVs will share in that demand growth as well. If demand grows by many multiples as predicted, then this trend is one that will grow to be unstoppable in the near term, and perpetually inevitable in the long term.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

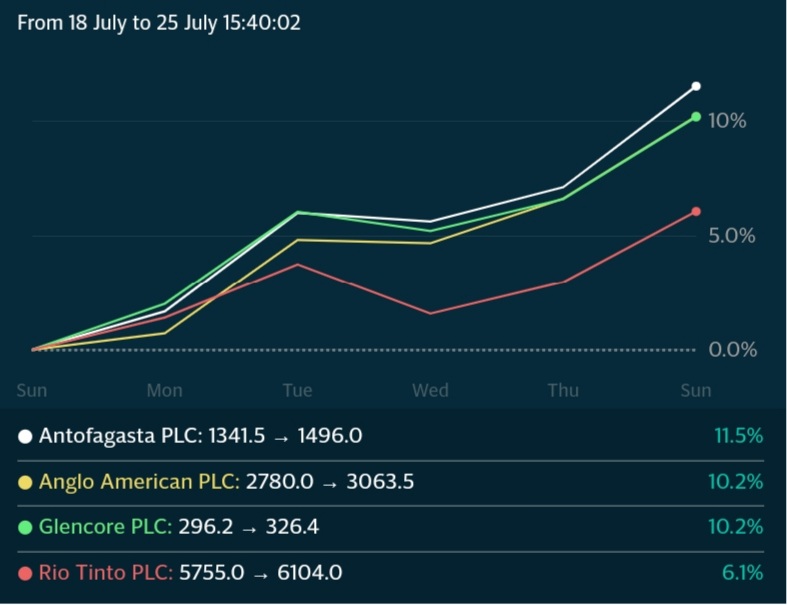

This is set to be a big week for mining earnings, as some of the world’s biggest mining companies will begin to show the market exactly how much this commodity boom is helping. This week will see the top five western diversified mining companies report earnings, and investors should be watching for record profits that could drive dividend payouts to match.

Analysts estimates show that the top five miners may have raked in a combined $85 billion in the first half of 2021, double the number from 2020. Of course, lockdowns and supply chain meltdowns had serious effects on earnings last year. As processes slowed to a halt and demand dropped off a cliff, mining companies mainly were sitting on their hands like the rest of the economy.

However, the latter part of 2020 saw engines start up and restrictions lifted in many mining-friendly jurisdictions, and 2021 has accelerated the commodity price gains from last year.

The first to report on Wednesday will be Rio Tinto Group and is expected to announce $22 billion in profits for the first half of the year, equalling the same amount as its total profits in 2020.

Other companies such as Glencore, Anglo American, and Vale SA were also expected to post massive profits for the first six months of 2021, and possibly their highest-ever numbers for the six months to June period, according to estimates from analysts compiled by Bloomberg.

The sector has seen a revival of its activities faster than most other sectors of the economy as the industry has been one of the primary beneficiaries of the recovery stimulus injected into the global economy. With trillions of dollars in recovery packages going out, demand for commodities has bounced off 2020 lows to skyrockets higher every single month. Demand for commodities like iron ore, aluminum, steel, and copper are driving prices higher every week while inflation pressures continue to spread through the economy.

This bull run for commodities has been a huge gift for mining companies who have the tailwind of demand and higher prices for their production to account for big profits.

Ben Davis, an analyst at Liberum Capital, said, “This should be a pretty much stellar set of results all round. We’re expecting record dividends from BHP and Rio, while Anglo and Glencore also have the potential to surprise.”

Stocks have been on a tear lately, up double digits in some cases in a single week, so there may be room to move higher on earnings news. Freeport-McMoRan already hinted at its blockbuster results when it announced it had wiped out $5 billion in debt over the last 12 months, blasting past a target month ahead of the planned schedule.

A record dividend was also paid out by Anglo American Platinum Ltd. (79% owned by Anglo American) on Monday of $3.1 billion, equal to 100% of first-half headline earnings. In a significant understatement, CEO Natascha Voljoes said the company was in a “strong financial position” and that the company was able to deliver “industry-leading returns.”

Everyone is set to benefit from higher profits from miners this year, beyond stakeholders and investors in the companies themselves. Government should also see higher tax receipts from miners, who contribute significantly to the global economy and often up to a third of any given domestic economy in many regions like South and Central America, and Africa.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

China’s iron ore imports have been on a tear in 2021 so far. March logged 102.1 million tonnes imported, and April dropped to 98.6 million tonnes. One of the most robust partnerships for this trade has been between China and Australia. Australia’s iron-rich reserves have been supplying China for years, and iron ore transactions account for a large part of the island’s GDP.

Most recently, though, iron ore prices are dropping, as China’s trade data for May showed shrinking profit margins for steelmakers, hitting enthusiasm with a wet blanket. China is responsible for more than half the world’s output, and any shift in their trade data always signals a shift in the market.

Steel Exports Hit Iron Ore Imports

May saw iron ore imports hit 89.8 million tonnes in May, significantly lower than March and April. Steel exports followed lower, down 34% from April to May to 5.3 million tonnes.

“The proportion of iron ore shipped to China from Australia fell a lot recently, and we can see the decline to continue in coming months,” said Wang Yingwu, an analyst with Huatai Futures in Beijing.

Iron ore and steel price dynamics are closely linked, with Chinese producers driving much of the demand. When exports slow or grow, overall demand can shrink by up to 15% from month to month. “The sharp drop in steel prices…has led to a sharp drop in the profits of steel mills,” according to a recent note from Sinosteel Future analysts.

That demand slowdown is also creating a lot of short-term volatility for iron ore as global supply remains tight, generally keeping prices high.

Global Iron Ore Production In a Delicate Balance

One producer feeling the squeeze is Vale (VALE). Last Friday, the company had to stop production at the Timbopeba mine in Brazil and a section of its Alegria mine. Prosecutors had ordered the evacuation of an area around the nearby Xingu dam in the state of Minas Gerais.

In an already tight market, these closures could account for up to 40,000 iron ore tonnes per day, according to Vale (VALE).

“It is unlikely the global balance will feel the full weight of this supply vacuum as Vale (VALE) fights to overturn this ruling as quickly as it was imposed,” managing director at Navigate Commodities in Singapore Atilla Widnell said.

Still, as iron ore prices continue to swing and ultimately climb, the squeeze is likely to continue for steel producers importing the valuable ore, even as steel exports continue to shrink in some parts of the world.

The most-traded September iron ore on China’s Dalian Commodity Exchange ended daytime trading 4.4% lower at 1,118 yuan ($174.70) a tonne.

Benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were down 2.4%, changing hands for $202.42 a tonne, according to Fastmarkets MB, on Monday afternoon.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Junior mining companies are the prime drivers of new IPOs for the mining industry. The rewards for investing in these companies often far outweighs the risks, as getting in on the ground floor of a junior mining company can mean triple digit percentage point gains or more. Still, there are many questions on investors’ minds before they invest in a mining company, including the company’s plan for exploration, and how to evaluate whether the junior miner has a good chance of success.

Due diligence and risk management are just as essential when investing in junior mining companies, but factors as wide ranging as the strength of the management team and technical advisors, as well as the company’s ability to finance its exploration with a strong balance sheet, to the viability and potential of its chosen drill sites. Paying attention to the financials, operations, and the drill plan and results are all required to make better decisions when investing in junior mining companies. To get a better understanding of this potentially highly lucrative investment strategy, we spoke with Lennin Munoz, a geo engineer and mining industry veteran.

Mr. Munoz was able to provide us with some of his insights into why it is important to take a broad overall look of the company, as well as a detailed assessment of its drilling results and management philosophy.

Taking a deep dive into a junior mining company means going beyond the headlines and getting in the financials, and using critical analyses like NAV, IRR, CAPEX, and more to make an informed decision.

What are the critical analysis points you use to determine the strength and viability of a project?

Desirability, Viability, Feasibility and Sustainability. Inside the desirability angle for example if I look for a tier 1 or 2 deposit, I’ll definitely start with geology, for me the ORE BODY IS ALL! So good tonnage and grade is a key factor (e.g 1 Bt 1%Cu or 200 Mt 2g/t Au), then I analyze the viability of the project, for example, potential to be developed, metal production profile, CAPEX intensity, All in Sustaining Cost position in the cash cost curve. Then, I incorporate the feasibility perspective for example, mining methods, high grading programs in first years (payback), Geotech & hydrogeology, metallurgy, processing, tailings and water management, etc. This review helps me to complete my SWOT analysis, so at the end I include the sustainability framework to have a clear map of risks and opportunities, so I can at least measure which is my main risk and what the company is doing about it.

All of this process is summarized in a model where I define the metrics to rank investment opportunities, for example, NAV, IRR, payback, CAPEX, others. I like to calculate NAV/share since this is a comparable metric with the market value and I could make decisions according to my risk/reward ratio.

How important is the environment, social, and governmental (ESG) aspect for a junior mining company? How important is it for you as an investor, and are the companies doing this right changing views on the mining industry?

ESG is here and these important three letters are a must in any project valuation, for example, I use to review assets using a mining economics framework split in desirability, viability, feasibility, and sustainability (I used the Hutton model), is in this last point that ESG plays a key role, a decisive point that can determine any GO or No GO; my experience in the industry tells me that you can have the best skarn deposit, with a tremendous mine plan, already approved by your company’s board and be in a BFS stage, but without an environmental view, a social acceptance, will not fly. Or it can, but is this sustainable in the long term?

It’s difficult, will not be easy, net zero emissions as an example will be a very expensive initiative, but is here, I’ll try to be in Minexpo this September, I’ve reading very interesting material about new technologies in different vendors, thinking in carbon emissions, green energy, or any other idea aligned with the ESG framework.

Last but not least, and by the way I think the most important part, the social aspect, is that the industry is turning mindsets and thinking about how you can work in the same environment for mutual benefit. Learning from other’s mistakes through history is a very powerful tool in this sector. I think most of the developers are changing the strategy to implement a real social, and sustainable model.

Which companies are proving out those ESG commitments and critical analysis points the best right now?

Particularly, I really like what Solaris Resources (SLS.TO) is doing in Warintza, Ecuador. This is not an easy task, a lot of effort on the ground is required, and of course you need a tier 1 team to do that, a very skillful one that can understand what is happening and what are the needs of all the stakeholders. This level of envelopment is so incredible that Lasso and Arauz mentioned the project in public interviews, so the relevance of the project is across the country.

Let’s continue with what Anglo American (AAL.L) is doing, for example they are clear about the feasibility of 100% renewable energy for the Quellaveco Project; this is a very important greenfield development for Peru, first autonomous project, 100% renewable!

Another example is Vale (VALE), after Brumadinho in 2018 and all the facts down the road, they are turning to dry stacking tailings facilities, we are at an inflection point about waste management. Going to dry stacking is not cheap but thinking in long term and safety for stakeholders as a crucial factor to put the project in the feasibility side, could be invaluable.

Which mining jurisdictions do you feel are providing the strongest advantage for junior mining companies right now?

I like stable jurisdictions like the USA or Canada, my gold positions for example are there but I think more work on the permitting front should be improved.

I like what Ecuador is doing now, when you listen to a president (Lasso) talking about mineral resources development plans for the long term? They want to be a main exporter of commodities, like Chile or Peru.

I like Chile too, but this situation about the mining tax program proposal should be solved ASAP. In the same line, Peru, I think we’ll be good, we need to work more on the ESG front and establish long term plans to develop greenfield projects, but without a social view, it will be difficult. I like these countries but for sure stability is needed.

With copper’s coming supercycle, should the industry be concerned about supply/demand dynamics?

No, we are in a middle of a stock/global consumption rate amber alerts, but this is driven as a consequence of lower production rates from previous periods, I think big players will join the party during 2021 and 2022 and the price will correct – I expect a pullback in base metals in the next quarters, I expect a support range of $3.5 – $4.0/lb in the long term as new consensus. However, if we consider the current stress scenario in LATAM I’d say that if in the short term the situation in Peru and Chile is not solved, copper prices can expect a lot of volatility without precedents.

How might this tailwind play out in the short/long-term?

In my experience this situation is split in 2 channels, short term, where operations are printing cash at these prices, and operations in the early stage can be more flexible to run high grading programs, at the end the ones sitted in the first quartile of the cost curve like Southern are having a good year.

In the long term, the increase in copper price assumption has a direct impact in the cutoff calculation, this item is used to define the mineral reserves or in practical terms, the profitable ore, the lower cutoff, the higher reserves inventory you have (if the modifying factors allows this upgrade), so, if you present an annual information format (AIF) with additional reserves, it’s very probable you submit in parallel an update technical report (e.g NI 43 101) and therefore your valuation will be different, you expect to see an extension of the life of mine, more metal production, potential upsides, etc.

So it sounds like a positive environment for junior copper mining companies exploring over the next decade?

Absolutely, let’s take the long term explanation bove, marginal projects at $3/lb can be considered now in the development pipeline at these prices, which will depend on metrics but yes, upside is at hand.

Which companies/metals are on your watchlist or your prime investment candidates?

I like asymmetrical investments, and I think junior companies can provide that. Right now, a junior copper company is my favorite one. I like the “cost opportunistic” view, so if one thing is good, why gamble on things you don’t know? I think speculation is part of the markets but in my portfolio or watchlist, at least I consider companies where I can understand what they are doing, but if I can calculate the NAV under my method, that is a place where I will wait patiently.

The Mining Stocks Lennin Muñoz is Watching

Solaris Resources: (SLS.TO)

This junior copper mining company has driven forward recently with positive assay results, the expansion of drill holes at its flagship Warintza Project in Ecuador, and stock growth generating massive investor value.

The stock’s uninterrupted climb has been pushed along since the company went public last year by strong results and the addition of drill holes. The company’s expansion to its Warintza East with the first drill hole is contributing to the optimism around the company, and Solaris (SLS.TO) is number one on Mr. Munoz’s mining stock picks.

Anglo American (AAL.L)

Anglo American’s (AAL.L) Quellavaco mine in Peru is a shining beacon of what a new copper mine can be, and the site is one of the largest undeveloped copper deposits in the world. It’s commitment to operating with ESG principles at the forefront of the project’s philosophy means that Quellavaco is, according to Mr. Munoz, a “very important greenfield development for Peru, first autonomous project, 100% renewable!

With one of the best mining jurisdictions in the world, Peru affords Anglo American the perfect opportunity to develop this massive project while keeping it cost and energy-efficient.

Vale (VALE)

Vale’s (VALE) commitment to improving the maintenance and safety of its dams gives it a unique advantage in the industry right now. The company’s plans to increase the share of dry processing in its production to 70% by 2023 will allow it to reduce the use of dams in its operations.

By investing in the implementation of dry stacking disposal technology, this initiative shows that we “are at an inflection point about waste management, “said Mr. Munoz. “Going to dry stacking is not cheap but thinking in long term and safety for stakeholders as a crucial factor to put the project in the feasibility side, could be invaluable.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

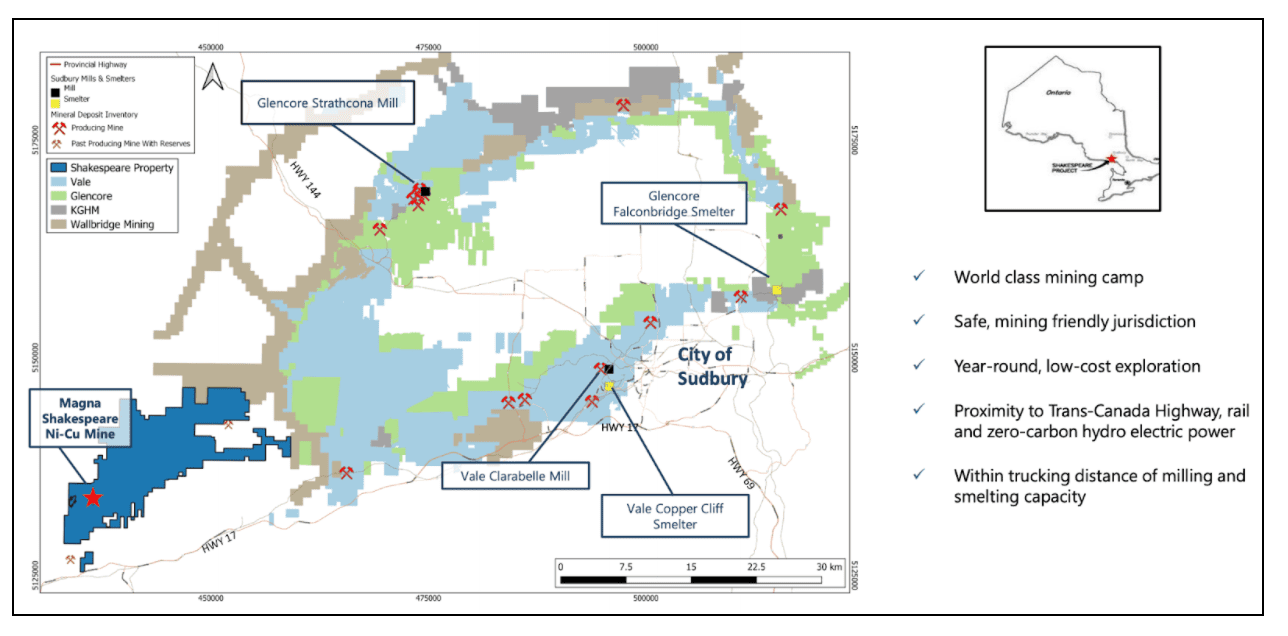

Sudbury, Canada, is a great place to mine nickel. The region has been home to some of the world’s largest nickel deposits, and the Sudbury Basin has eight producing mines. When production started over 125 years ago, it was little more than a frontier town in a country that was still finding its footing. Now, however, the area has produced over 11 million tonnes of nickel since that inaugural group of miners decided to put down roots and explore the land.

Companies like Vale (NYSE:VALE), KGHM, and Glencore (LON:GLEN), have control of most of the land packages in the region. These major players dominate the area and produce most of the nickel coming out of the Sudbury Basin. However, some junior miners are getting in on the action as well. Magna Mining (TSXV:NICU) has made its mark with a 100% stake in the Shakespeare mine, its flagship project. The mine could be a profitable one for the smaller miner with an indicated open pit resource of 14.4 million tonnes at 0.37% nickel, 0.37% copper, and 0.9g/t total precious metals. Today, Magna Mining begins trading on the TSX Venture Exchange, under the ticker NICU.

After going public, Magna Mining will have the capital to expand and advance its operations at the mine at a faster clip. The first area of focus will be expanding the exploration program to find more of the all-important nickel deposits sitting under the surface. Multiple drill targets have been set near the company’s existing deposit. This expansion of the project and the plan is really the first serious capital expenditure for the region in a long time. Additionally, the property package the company acquired includes more than 180km2 of prospective adjacent land, providing the opportunity for exploration in a section of the area that has seen little exploration in the past.

The company seems to be in the right place at the right time, with nickel fast becoming one of the critical metals for the green and digital transformations taking over the global economy. Elon Musk, CEO of Tesla, mentioned in an earnings call in 2020, “Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel.”

The Tesla boss’s call for more nickel mined in an environmentally conscious and socially responsible way was a wake-up call that the industry needs to step up to the plate and get more of the metals required for batteries, energy storage, and digital devices. Musk also later shared the company’s goal of implementing a battery supply model in North America to facilitate the production of zero high-cost cobalt and more low-cost nickel. It is rare that a company has a client wanting more than they can provide, but this is the state of play for the nickel miners out there right now.

As demand continues to pick up, projects in the Sudbury basin and beyond will also need to accelerate their timelines and invest more into existing nickel projects to keep up. New projects will also be necessary, both from major mining companies and the junior miners entering the field.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

What happens when one of the largest iron ore miners misses expectations despite booking a recovery through 2020? For Vale, missing analyst expectations meant becoming the singlehanded most important driver for the iron ore price rally, adding fuel to an already strong upward trend.

The company was able to squeeze out some growth from its operation YoY, which was attributed to the gradual resumption of its operations in Tembopeba, Fabrica, and Vargem Grande complexes in the Minas Gerais state in 2020. Strong production in Serra Norte in Para state, lower rainfall in January, as well as the restart of operation at Serra Leste in the Northern System had some effect on the output.

Disappointing Numbers

After Chinese steel output jumped in March, Vale has had an outsized impact on prices in what analysts are calling a tight market. The company’s ramp-up has been a boon for the company, and the missed expectations have propped up the price of iron ore.

1Q21 output was 68 million tonnes, 14.2% higher than the quarter from the year before, but still 5.5% less than the average analyst estimate of 72 million tonnes.

While the disappointment isn’t particularly drastic, Vale’s size and outsized influence in a market that seems to be squeezed by lower supply has had an outsized effect on the strength of the iron ore price rally.

Despite the weaker quarter with 6.3 million tonnes in pellet production for 1Q21, 9.2% YoY due to a lower pellet feed availability from the Itabira and Brucutu sites, Vale expects to gradually increase production in 2021. The company plans to do this using the higher availability of pellet feed from Timbopeba and Vargem Grande.

Tilting the Scales

According to BloombergNEF, Vale (NYSE:VALE) is expected to account for 83% of global supply growth this year. With a capacity of 327 million tonnes per year, this is certainly possible. Before the Brumadinho dam collapse, the company produced 385 million tonnes in 2018. Vale’s scale and operational stability mean a gradual increase in production during 2021, allowing the miner to maintain its full-year guidance between 315-335 million tonnes of iron ore.

The company is also the biggest producer of mined nickel and has a significant pull on production and prices for the metal. It produced 4.7% less of it YoY.

When it comes to copper production, the company took a bigger hit. Production was down 19% over the same period due to maintenance that slowed down by pandemic restriction on contractors. With contractor restrictions and mining restrictions lifted, Vale (NYSE:VALE) has nothing standing in its way on the path to expansion.

The company has also announced its intention to exit the coal business, and as such, has concluded a revamp of two processing plants in Mozambique. While the rumours have been swirling for some time that coal is on its way out the door and is losing favour among miners, the fact that an industry leader like Vale (NYSE:VALE) is moving away from it is a strong signal that the rumours are true. The resulting void waiting to be filled by other miners may not be filled, or if it is, will be filled much slower as the world moves away from coal mining and use during the electrification efforts of the global economy in the coming decades.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

CMC Metals Ltd. CMC Metals Ltd. |

CMB.V | +900.00% |

Cascadero Copper Corp. Cascadero Copper Corp. |

CCD.V | +100.00% |

Cullen Resources Ltd. Cullen Resources Ltd. |

CUL.AX | +66.67% |

Enterprise Metals Limited Enterprise Metals Limited |

ENT.AX | +50.00% |

Pacific Bay Minerals Ltd. Pacific Bay Minerals Ltd. |

PBM.V | +40.00% |

Coronado Resources Ltd. Coronado Resources Ltd. |

CRD.V | +33.33% |

Casa Minerals Inc. Casa Minerals Inc. |

CASA.V | +30.00% |

Azincourt Energy Corp. Azincourt Energy Corp. |

AAZ.V | +25.00% |

Dios Exploration Inc. Dios Exploration Inc. |

DOS.V | +25.00% |

Poseidon Nickel Limited Poseidon Nickel Limited |

POS.AX | +25.00% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan