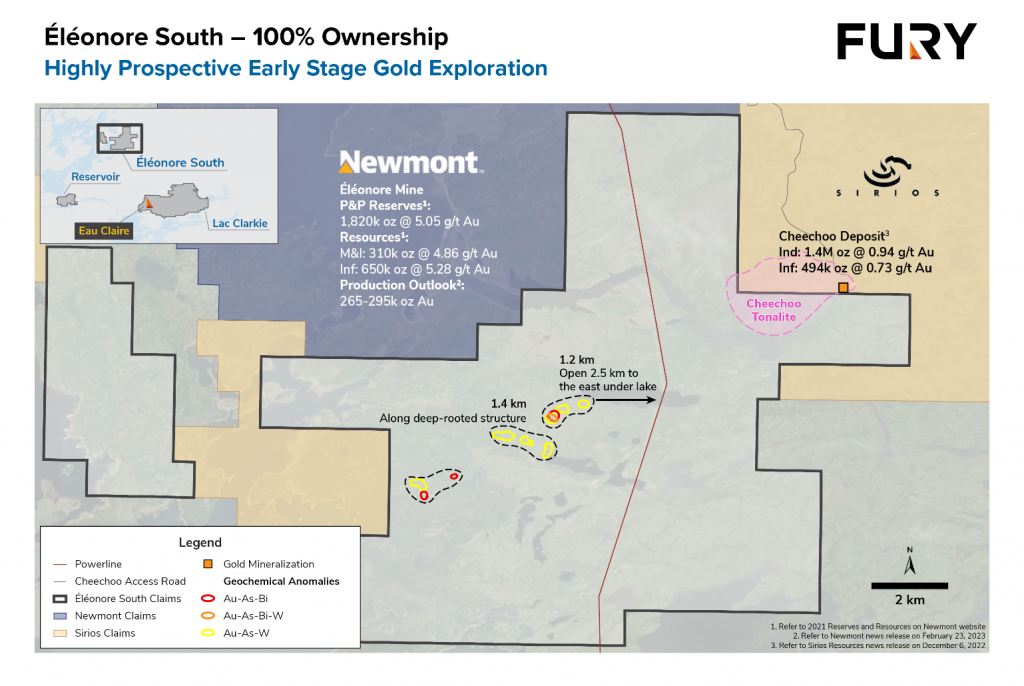

Canadian gold miner Fury Gold Mines (TSX:FURY) announced on Monday that it has reached an agreement with Newmont Corporation (TSX:NGT) to acquire Newmont’s 49.978% interest in the Éléonore South gold project in Quebec, Canada for CAD$3 million (approximately US$2.2 million).

As part of the deal, Fury Gold will also purchase around 30.4 million shares of Sirios Resources held by Newmont for investment purposes, spending CAD$1.3 million (nearly US$960,000) to do so.

Tim Clark, CEO of Fury Gold Mines, commented in a press release: “We value the strong relationship with Newmont and are confident that this transaction is a positive outcome for both companies. Our team has historically ranked the ESJV as one of our more prolific targets for discovery. As such, we are excited to now have 100% ownership as we expect this to provide a clearer pathway for more exploration and potential upside in returns for our investors from this project consolidation and investment in Sirios.

The Éléonore South project is located in a region with significant gold deposits. Newmont’s Éléonore gold mine lies to the north, while Sirios Resources’ Cheechoo deposit is positioned to the east.

Previous exploration at Éléonore South has identified two types of gold mineralization – high-grade structurally-controlled quartz veins hosted in sedimentary rocks, similar to Éléonore, and lower-grade disseminated intrusion-related gold mineralization akin to Cheechoo. Numerous untested gold anomalies remain throughout the property and will be a priority for Fury Gold.

At Cheechoo’s JT and Moni prospects, historical drilling has intercepted intervals including 53.3 meters of 4.22 g/t gold, 6.0 meters of 49.50 g/t gold and 23.8 meters of 3.08 g/t gold. Several of these holes require follow-up drilling and remain open.

The acquisition comes after Newmont announced plans last week to divest six non-core assets, including Éléonore, to pay down debt. The other assets are the Musselwhite and Porcupine mines in Ontario, the Coffee project in Yukon, and a 70% stake in the Havieron joint venture with Greatland Gold in Western Australia.

Newmont said it intends to focus on its portfolio of Tier 1 assets and emerging Tier 1 assets, sequencing development projects and enhancing capabilities to advance its pipeline of gold and copper projects. It has identified an additional $500 million in cost and productivity improvements.

By 2028, Newmont is targeting 6.7 million ounces of gold production and 8.3 million gold equivalent ounces. Average annual sustaining capital expenditure of $1.5 billion is expected over the next five years, along with average development capital of $1.3 billion per year.

Fury Gold Mines is a Canada-focused gold exploration company with projects in Quebec and British Columbia. It also holds a 59.5 million share position in Dolly Varden Silver Corp, representing 22% of issued shares.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Companies engaged in exploration, mining, and trading often have good returns and revenues. The past year has seen the VanEck Vectors Gold Miners ETF (GDX) underperform the broad market in the last 12 months, but the 11.8% return was more than solid. It is only against the backdrop of a 46.2% gain for the iShares Russell 1000 ETF or the S&P 500 that comparisons lose steam.

Mining for Gold Value

Gold mining companies within gold indexes, however, have been generating asymmetric returns. Many of the winners have continued to scoop up the gains of a rising gold price and a favorable market. Today we’ll take a look at those stocks which may be undervalued according to it’s P/E for June 2021.

Stock picking is often thought of as the reserve of people who have a special talent or gift, however, value investing is as simple as figuring out whether a business’s stock is cheap compared to its intrinsic value as measured by its price-to-earnings ratio. Taking a look at the 12-month trailing P/E ratio, the best value gold stocks are Centerra Gold Inc. (TSX:CG) (NYSE:CGAU), Jaguar Mining Inc. (JAG.TO), Torex Gold Resources Inc. (TSX:TXG), Karora Resources Inc. (TSX:KRR)), and Kinross Gold Corp. (TSX:K)).

Centerra Gold (TSX:CG) (NYSE:CGAU)

The Canadian gold mining and exploration company operates three mines at the moment producing 824,059 ounces of gold and 82.8 million pounds of copper in 2020 alone. The company ran into a speed bump at its Kumtor Mine in the Kyrgyz Republic when the Kyrgyz Government took control of the mine in mid-May. The company lost control of the mine and suspended previously issued guidance for 2021 due to the uncertainty of the situation. However, with a 12-month trailing P/E ratio of 4.1, the company could be a value play for some portfolios.

Jaguar Mining Inc. (TSX:JAG) (OTC:JAGGF)

Our second Canuck on the list explores and develops gold properties in the Iron Quadrangle in Brazil, a profitable greenstone belt in Minas Gerais, Brazil. With a 12-month trailing P/E of 5.4, Jaguar (TSX:JAG) (OTC:JAGGF) is a technical value play for a company operating in an area of mineral exploration dating back to the 16th century.

Torex Gold Resources (TSX:TXG) (OTC:TORXF)

Torex’s 100% owned Morelos Gold Property comprising 29,000 hectares in the Guerrero Gold Belt in Mexico is the flagship project for the company, in a portfolio that includes two other major mines in Mexico. The company’s P/E of 6.7 may be an indicator of an undervalued company waiting for the right attention from investors.

Karora Resources Inc. (TSX:KRR) (OTC:KRRGF)

Both of the company’s primary gold-producing operations are located in Australia along the Norseman-Wiluna Greenstone Belt. Net earnings for Q1 2021 came in at more than ten times YoY as revenue grew 9.2%. The company’s P/E of 6.7 could be an indication of a value play waiting to be unlocked with the kind of financial results from the first quarter of this year.

Kinross Gold Corp. (TSX:K) (NYSE:KGC)

With a diverse portfolio spanning Brazil, Chile, Ghana, Mauritania, and Russia, and forward guidance of 2.4 million gold equivalent ounces for 2021, Kinross (TSX:K) (NYSE:KGC). Net earnings rose 21% as revenues grew 12.1%, possibly making the company’s P/E of 6.8 a value indicator for 2021.

Hunting for Deals

Undervalued companies can be opportunities to pick up shares at bargain prices before the rest of the market figures it out. Stocks like Centerra Gold (TSX:CG) (NYSE:CGAU), Jaguar Mining Inc. (TSX:JAG) (OTC:JAGGF), Torex Gold Resource (TSX:TXG) (OTC:TORXF), Karora Resources Inc. (TSX:KRR) (OTC:KRRGF), and Kinross Gold Corp. (TSX:K) (NYSE:KGC) could be the value buys for 2021 for investors looking to add some gold stocks to their portfolios.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

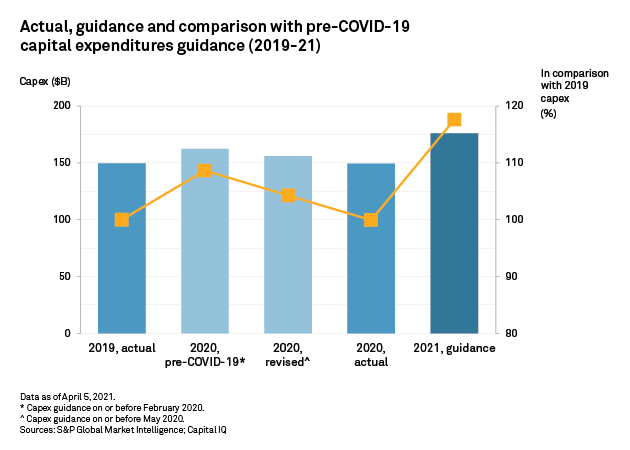

S&P Global Market Intelligence’s new report highlights the significant impact the pandemic has had on capital expenditure in 2020. The year was a complicated one, with projects shutting down temporarily, and licenses for new mines suspended until the lockdowns began to ease around the world.

Despite it all, the mining industry has fared well and continues to forge ahead with minimal disruption. However, the report found that among more than 400 mining companies examined, capital expenditures dropped 8% in 2020 when lockdown forced projects to stop work, and global supply chains began to crack under the dual pressures of shifting demands and lower production.

Feeling Better

The first quarter of 2020 held some optimism for the year. The miners’ group forecasted a capex YoY increase of 9% to $162 billion. By the beginning of the second quarter, expectations had been revised and the spending plans reduced 4% lower to reflect the coming changes. Still, this would represent an increase for the year before, as no one had anticipated the length of the lockdowns or the severity of the pandemic.

In the end, total capex for 2020 came in at $149.5 billion well below forecasts, but arguably strong considering the harsh mining environment of the year and the fact that global economic confidence was sucked out of the air faster than an airlock for a spaceflight.

A Realistic and Optimistic Outlook for 2021

S&P has set a positive tone for 2021, with a forecast of global gross domestic product growth of 5.5% in 2021, boosting capex and numbers across every. The company is forecasting a mining industry capex of $176 billion, up a substantial 18% fom 2020 and 2019.

As projects were put on hold last year and confidence dropped off a cliff, mining companies needed to revise their expectations. Now that the situation is improving rapidly, companies are ramping-up their activity. Positive outlooks are not hard to come by for miners as strong prices for metals and minerals continue to push commodity prices higher, boosting profits.

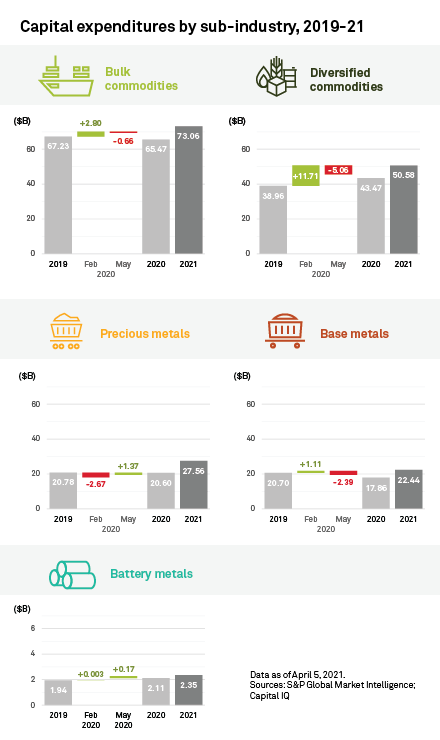

The Rich Get Richer

The Eastern Hemisphere is leading the recovery right now, particularly China and Australia. The influx of capital expenditures won’t be balanced across metals companies or metals either. Precious metals companies are expected to spend the most, and increase their capex by over a third compared to 2019. The biggest spenders will likely be the usual suspects including Newmont (NYSE: NEM) (TSX:NGT) and Gold Fields (JSE:GFI) (NYSE:GFI).

Large cap mining companies are always the first to jump into new projects with high capitalization levels and strong cash balances on hand. Most of these companies will recover stronger and faster, and S&P expects that companies with a $50 billion+ market cap will surpass their smaller peers for both forward guidance and spending. This would exacerbate the trend of the winners taking all, and the biggest players consolidating their gains and building on them. The largest market cap group is expected to spend 51% in 2021 compared to 2019, and the next three groups of companies expected to keep similar levels to 2019, averaging 12%, although they would be increasing their spending from 2020.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Monday, May 17 saw Newmont (NYSE:NEM) (TSX:NGT) complete its acquisition of GT Gold by scooping up the outstanding 85.1% of common shares of the Canadian exploration company in a C$393 million cash deal. Announced two months ago in March, the deal allows Newmont (NYSE:NEM) (TSX:NGT) to take control of the Tatogga gold-copper project in the Traditional Territory of the Tahltan Nation.

Tatogga sits about 14km west of Imperial Metal’s Red Chris copper-gold mine in British Columbia. For Newmont (NYSE:NEM) (TSX:NGT), the acquisition gives the US-based gold mining company a major advantage in the region, and further consolidates its position as the world’s number one gold producer.

Bigger and Better

By adding the copper-gold project to Newmont’s (NYSE:NEM) (TSX:NGT) portfolio, the company will add significant gold and copper annual production to its overall output. It also expands the company’s foothold in the area by adding to its existing interest through the company’s 50% ownership in the Galore Creek project; the acquisition includes the Saddle North asset. The company has also opened up opportunities for further exploration beyond the deposits at Saddle North with this acquisition.

Newmont (NYSE:NEM) (TSX:NGT) president and CEO Tom Palmer commented in a statement: “With the acquisition of GT Gold and the Tatogga project in the highly sought-after Golden Triangle district of British Columbia, Canada, Newmont continues to strengthen our world-class portfolio. We will partner with the Tahltan Nation at all levels, and with the Government of B.C to ensure a shared path forward as the company understands and acknowledges that Tahltan consent is necessary for advancing the Tatogga project.”

M&A Optimism Picks Up

M&A activity has picked up again after a sluggish rut in 2020 for the entire mining industry, but beautiful British Columbia’s volume has been higher than the average. Many of the deals in the last six months have involved deals with Vancouver-headquartered companies or companies with projects in the province.

In 2020, there was the sale of the New Gold (NYSE:NGD) (TSX:NGD) Blackwater property south of Prince George to Artemis Gold (TSX.V:ARTG) for a total of $190 million. The snowfield project operated by Pretium Resources (TSX:PVG) was bought by Seabridge Gold Inc. (TSX:SEA) in December 2020 for $100 million in cash, a 1.5% net smelter royalty on all production, and a future contingent payment of $20 million. Those deals began to foreshadow a pickup in M&A activity as miners’ optimism rose with the lifting of restrictions and business operations in some parts of the economy.

In early 2021, Eldorado Gold (NYSE:EGO) (TSX:ELD) made a neat and tidy acquisition of QMX Gold Corp. (TSX.V:QMX) for $132 million to kick off the new year.

More activity is likely with higher volume as well as bigger buyouts as a dearth of exploration projects or development projects makes anything operating or of a higher-quality worth even more. With everything scrambling to scoop up the same properties and projects, the competition is fierce, and it is driving bidding wars and competition not unlike the red-hot Canadian housing market.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan