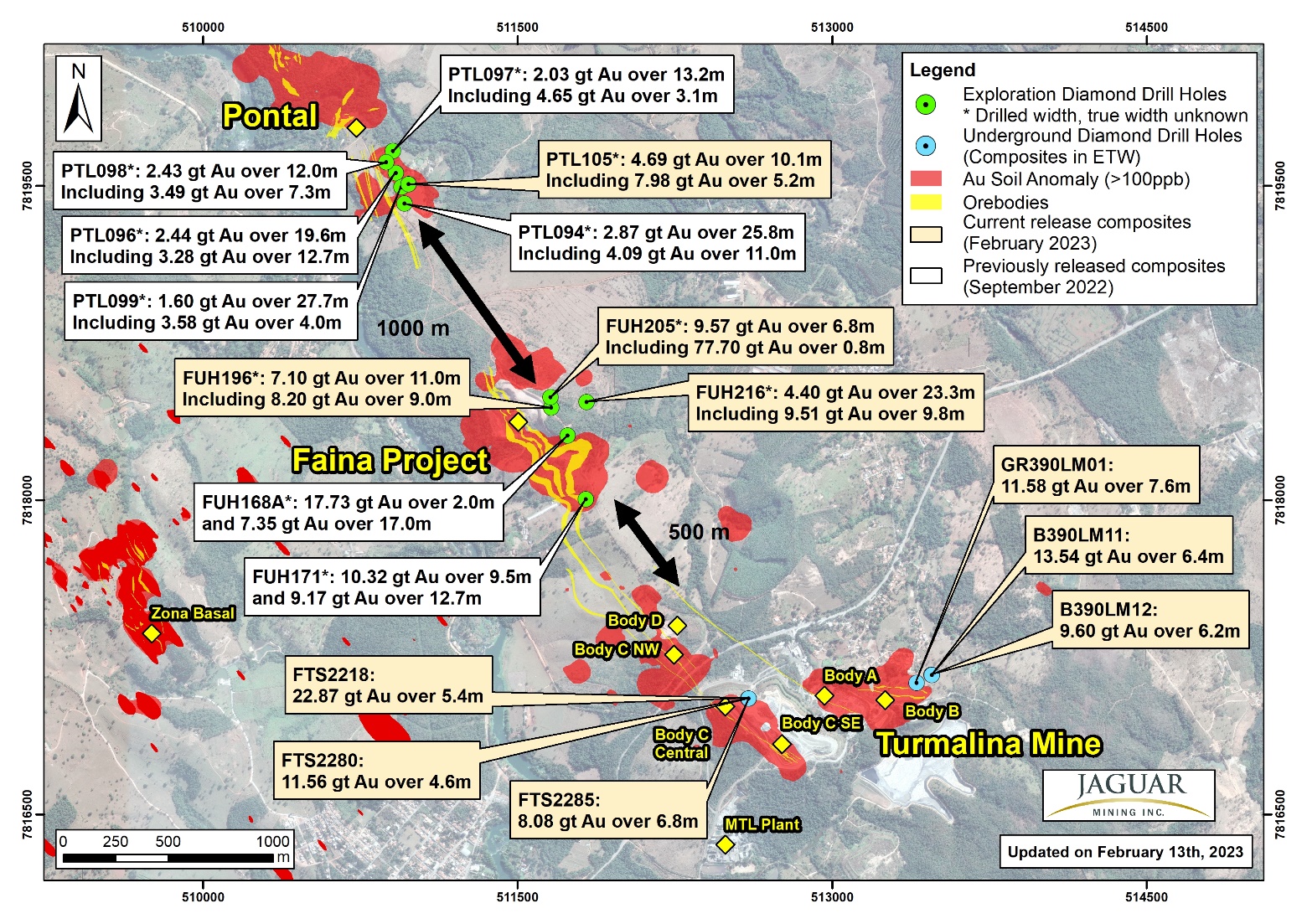

Jaguar Mining (TSX:JAG) has reported new results from exploration and growth activities at the Turmalina Complex in Minas Gerais, Brazil. The company has continued to expand on previous results at the project from several priority diamond drill campaigns begun in the fourth quarter of 2022. These campaigns focussed on high-grade extensions of mineralizations discovered earlier in 2022.

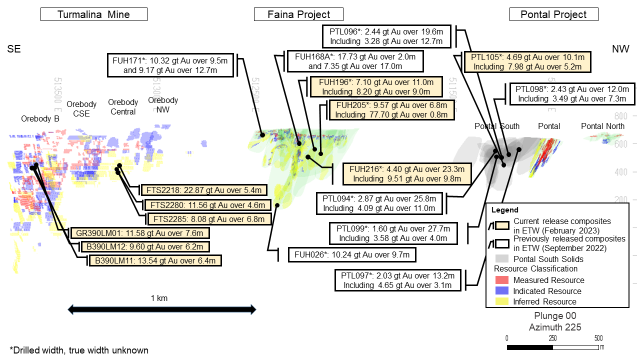

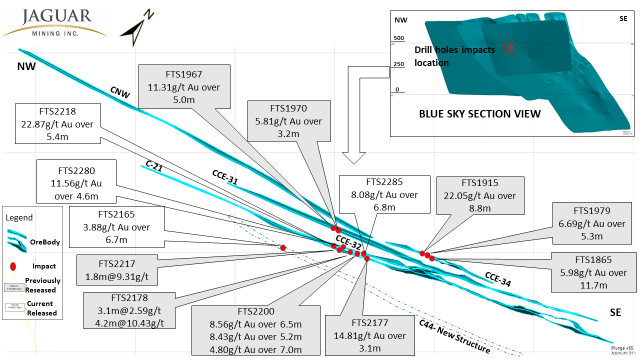

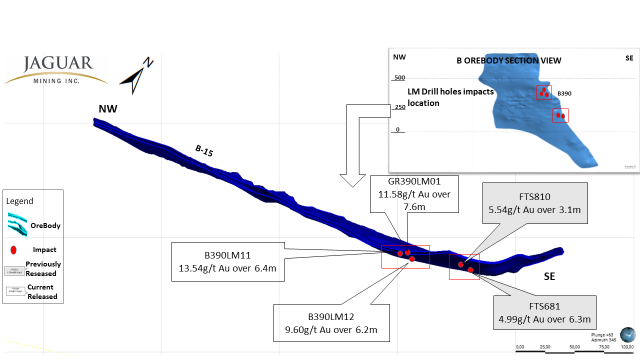

New exploration diamond drilling was focussed on high-grade mineralization in the C Structure at Turmalina, follow-up step-out drilling at the Pontal South Discovery, as well as high-grade targets within the B Structure, which were also at shallow levels in the mine.

Jaguar Mining sees the results so far as encouraging, with high grades over mineable widths reported from various areas within the C and B Mineralized Structures, including the identification of a new structure within the footwall of the C Structure.

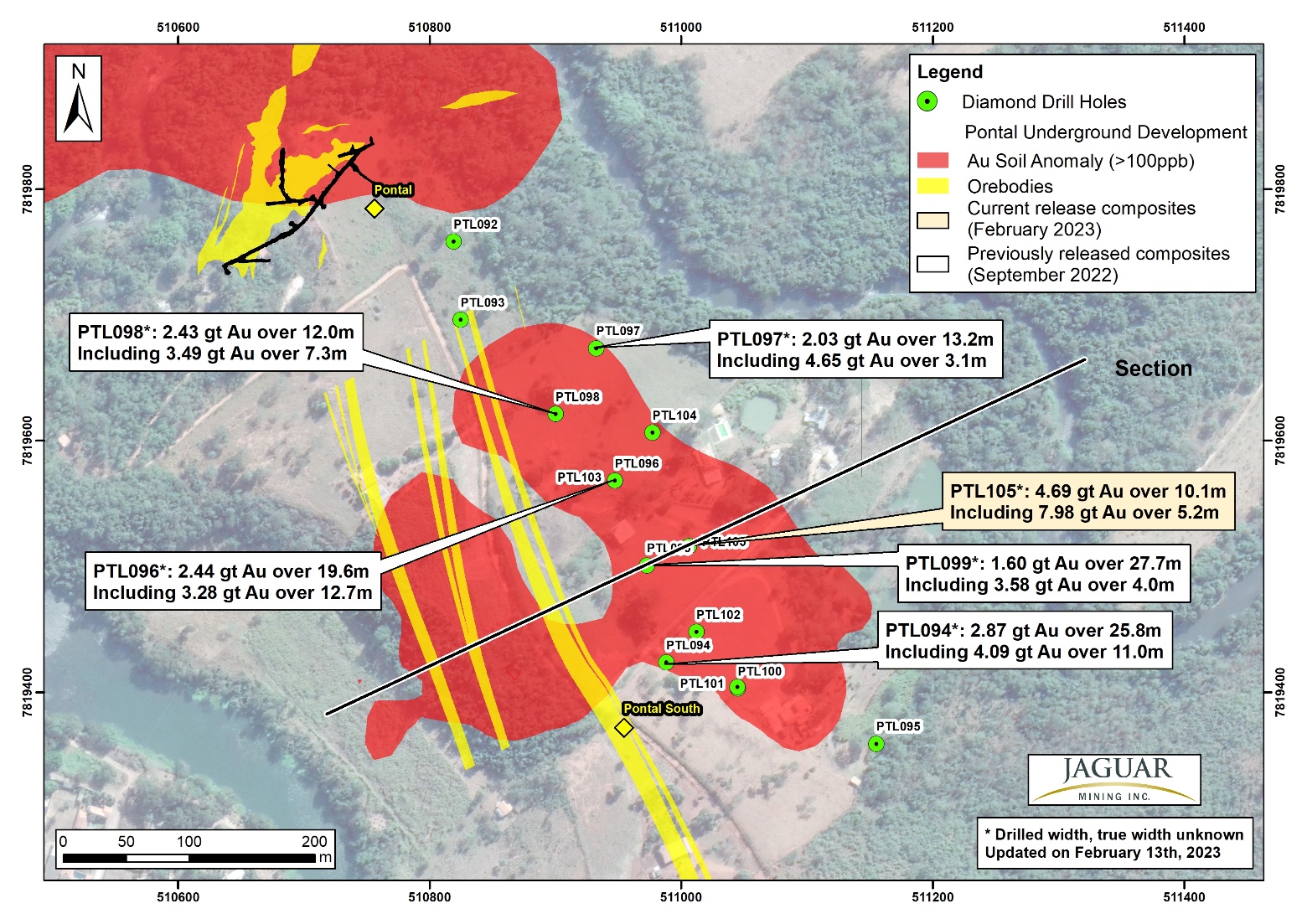

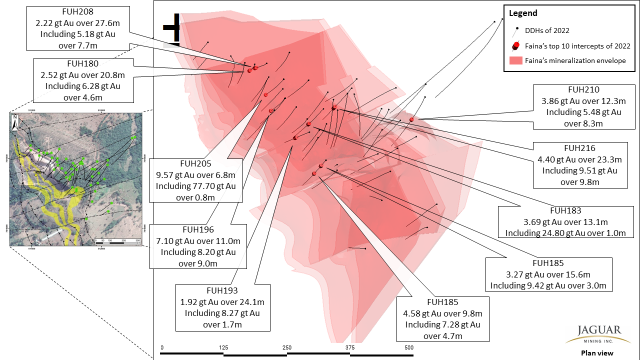

At the Pontal South Discovery, the company’s step-out drilling has demonstrated continuity of high-grade mineralization to depth down plunge. Jaguar Mining is also drilling at the Faina Growth Project, completing approximately 15,359 metres of infill resource conversion drilling across 46 holes with the goal of converting the published Inferred Mineral Resource to an Indicated Mineral Resource.

Drilling at the Faina Growth Project confirmed high-grade characteristics of this mineralization and continuity within the deposit. Drilling also underpins geological and grade models for the important project. Jaguar Mining expects to publish updated Mineral Reserves and Mineral Resources with the AIF sometime in March 2023.

Vern Baker CEO of Jaguar Mining, commented in a press release: “I am very excited about the positive drill results reported today as they support the Company’s organic growth plans and ultimately our future production profile. The high grades in the C and B Structures are at shallow levels and close to development in these sectors of the mine which justifies our plan to focus production in these areas and support ongoing underground access development towards the Faina Resource. The success of infill drilling at Faina and the continued definition of new mineralized areas along the main structural trend continue to demonstrate the upside potential of this trend.”

Highlights from the results are as follows:

- 22.87 g/t Au over an estimated true width of 5.4m in Orebody CNW

- 13.54 g/t Au over an estimated true width of 6.4m in Orebody B

- 7.98 g/t Au over 5.2m* in Pontal South

- 9.51 g/t Au over 9.8m*in Faina Resource Conversion Infill Drilling * (Drilled width – true width unknown)

C- Structure Mineralization

11.56 g/t Au over 4.6m

8.08 g/t Au over 6.8m

22.87 g/t Au over 5.4m

B- Structure Mineralization

11.58 g/t Au over 7.6m

9.60 g/t Au over 6.2m

13.54 g/t Au over 6.4m

Pontal South Exploration Target

2.44 g/t Au over 19.6 m* (including 3.28 g/t Au over 12.7m*)

4.69 g/t Au over 10.1 m* (including 7.98 g/t Au over 5.2m*)

* (Drilled widths -true width unknown)

Faina Project Infill Drilling Results

4.40 g/t Au over 23.3m* (including 9.51 g/t Au over 9.8 m*)

7.10 g/t Au over 11.0m* (including 8.20 g/t Au over 9.0m*)

9.57 g/t Au over 6.80 m* (including 77.7 g/t Au over 0.8 m*)

* (Drilled widths -true width unknown))

Table 1 – Best Drilling Intersections C-Structure with Grade x Thickness (GT) > 25 in the Turmalina Complex

| Summary of Diamond Drill Intersections

Orebody C Structure Turmalina Mine |

||||||

| Hole ID | From (m) | To (m) | DownHole Interval (m) | Estimated True Width (ETW) (m) | Gold Grade (g/t Au) | GT

(Grade x ETW) |

| FTS2165 | 60.4 | 70.3 | 9.82 | 6.6 | 3.88 | 26 |

| FTS2280 | 132.4 | 138.8 | 6.34 | 4.6 | 11.56 | 53 |

| FTS2285 | 147.1 | 155.8 | 8.67 | 6.80 | 8.08 | 55 |

| FTS2218 | 159.7 | 165.7 | 6.05 | 5.4 | 22.87 | 124 |

Table 2 – Best Drilling Intersections B-Structure

| Summary of Diamond Drill Intersections

Orebody B Structure Turmalina Mine |

||||||

| Hole ID | From (m) | To (m) | DownHole Interval (m) | Estimated

True Width (ETW) (m) |

Gold Grade (g/t Au) | GT

(Grade x ETW) |

| GR390LM01 | 65.3 | 84.4 | 19.1 | 7.6 | 11.58 | 88 |

| B390LM12 | 4.6 | 11.6 | 7.0 | 6.2 | 9.60 | 59 |

| B390LM11 | 2.3 | 9.8 | 7.5 | 6.4 | 13.54 | 86 |

Table 3 – Best Drilling Intersections Pontal South

| Summary of Diamond Drill Intersections

Orebody Pontal South Structure |

|||||

| Hole ID | From (m) | To (m) | DownHole Interval (m) | Gold Grade (g/t Au) | GT*

(Grade x Thickness) |

| PTL105 | 255.0 | 265.1 | 10.1 | 4.69 | 47 |

| Including | 258.0 | 263.2 | 5.2 | 7.98 | 41 |

GT*: (Drilled width – true width unknown)

Table 4 – Faina Resource Conversion Infill Drilling – Best Intersections

| Summary of Diamond Drill Intersections | |||||

| Faina Resource Conversion Infill Drilling – Best Intersections | |||||

| Hole ID | From (m) | To (m) | DownHole Interval (m) | Gold Grade (g/t Au) | GT*

(Grade x Thickness) |

| FUH180 | 216.2 | 236.9 | 20.8 | 2.52 | 52 |

| Including | 222.4 | 227.0 | 4.6 | 6.28 | 29 |

| FUH183 | 192.6 | 205.7 | 13.1 | 3.69 | 48 |

| Including | 204.7 | 205.7 | 1.0 | 24.80 | 25 |

| FUH185 | 61.9 | 77.5 | 15.6 | 3.27 | 51 |

| Including | 74.5 | 77.5 | 3.0 | 9.42 | 28 |

| FUH185 | 158.9 | 168.7 | 9.8 | 4.58 | 45 |

| Including | 164.0 | 168.7 | 4.7 | 7.28 | 34 |

| FUH193 | 146.8 | 170.9 | 24.1 | 1.92 | 46 |

| Including | 160.6 | 162.3 | 1.7 | 8.27 | 14 |

| FUH196 | 279.0 | 290.0 | 11.0 | 7.10 | 78 |

| Including | 280.0 | 289.0 | 9.0 | 8.20 | 74 |

| FUH205 | 289.2 | 296.0 | 6.8 | 9.57 | 65 |

| Including | 289.2 | 290.0 | 0.8 | 77.70 | 62 |

| FUH208 | 196.5 | 224.0 | 27.6 | 2.22 | 61 |

| Including | 201.5 | 209.2 | 7.7 | 5.18 | 40 |

GT*: (Drilled width – true width unknown)

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Companies engaged in exploration, mining, and trading often have good returns and revenues. The past year has seen the VanEck Vectors Gold Miners ETF (GDX) underperform the broad market in the last 12 months, but the 11.8% return was more than solid. It is only against the backdrop of a 46.2% gain for the iShares Russell 1000 ETF or the S&P 500 that comparisons lose steam.

Mining for Gold Value

Gold mining companies within gold indexes, however, have been generating asymmetric returns. Many of the winners have continued to scoop up the gains of a rising gold price and a favorable market. Today we’ll take a look at those stocks which may be undervalued according to it’s P/E for June 2021.

Stock picking is often thought of as the reserve of people who have a special talent or gift, however, value investing is as simple as figuring out whether a business’s stock is cheap compared to its intrinsic value as measured by its price-to-earnings ratio. Taking a look at the 12-month trailing P/E ratio, the best value gold stocks are Centerra Gold Inc. (TSX:CG) (NYSE:CGAU), Jaguar Mining Inc. (JAG.TO), Torex Gold Resources Inc. (TSX:TXG), Karora Resources Inc. (TSX:KRR)), and Kinross Gold Corp. (TSX:K)).

Centerra Gold (TSX:CG) (NYSE:CGAU)

The Canadian gold mining and exploration company operates three mines at the moment producing 824,059 ounces of gold and 82.8 million pounds of copper in 2020 alone. The company ran into a speed bump at its Kumtor Mine in the Kyrgyz Republic when the Kyrgyz Government took control of the mine in mid-May. The company lost control of the mine and suspended previously issued guidance for 2021 due to the uncertainty of the situation. However, with a 12-month trailing P/E ratio of 4.1, the company could be a value play for some portfolios.

Jaguar Mining Inc. (TSX:JAG) (OTC:JAGGF)

Our second Canuck on the list explores and develops gold properties in the Iron Quadrangle in Brazil, a profitable greenstone belt in Minas Gerais, Brazil. With a 12-month trailing P/E of 5.4, Jaguar (TSX:JAG) (OTC:JAGGF) is a technical value play for a company operating in an area of mineral exploration dating back to the 16th century.

Torex Gold Resources (TSX:TXG) (OTC:TORXF)

Torex’s 100% owned Morelos Gold Property comprising 29,000 hectares in the Guerrero Gold Belt in Mexico is the flagship project for the company, in a portfolio that includes two other major mines in Mexico. The company’s P/E of 6.7 may be an indicator of an undervalued company waiting for the right attention from investors.

Karora Resources Inc. (TSX:KRR) (OTC:KRRGF)

Both of the company’s primary gold-producing operations are located in Australia along the Norseman-Wiluna Greenstone Belt. Net earnings for Q1 2021 came in at more than ten times YoY as revenue grew 9.2%. The company’s P/E of 6.7 could be an indication of a value play waiting to be unlocked with the kind of financial results from the first quarter of this year.

Kinross Gold Corp. (TSX:K) (NYSE:KGC)

With a diverse portfolio spanning Brazil, Chile, Ghana, Mauritania, and Russia, and forward guidance of 2.4 million gold equivalent ounces for 2021, Kinross (TSX:K) (NYSE:KGC). Net earnings rose 21% as revenues grew 12.1%, possibly making the company’s P/E of 6.8 a value indicator for 2021.

Hunting for Deals

Undervalued companies can be opportunities to pick up shares at bargain prices before the rest of the market figures it out. Stocks like Centerra Gold (TSX:CG) (NYSE:CGAU), Jaguar Mining Inc. (TSX:JAG) (OTC:JAGGF), Torex Gold Resource (TSX:TXG) (OTC:TORXF), Karora Resources Inc. (TSX:KRR) (OTC:KRRGF), and Kinross Gold Corp. (TSX:K) (NYSE:KGC) could be the value buys for 2021 for investors looking to add some gold stocks to their portfolios.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan