Canada’s Ivanhoe Mines (TSX:IVN) and Congo’s state mining company Gécamines have begun construction activities at the historic Kipushi underground zinc-copper mine, which they plan returning to production by late 2024. The two companies reached a key milestone this week with the commencement of development work on the project, located in the Democratic Republic of Congo (DRC).

Ivanhoe has also concluded an agreement (MOU) with the provincial government of Haut-Katanga to investigate possibilities for extending border trade at the DRC-Zambia crossing in Kipushi, which will allow commercial goods and people to flow freely.

The company’s plan is to construct a commercial border outpost specifically for the Kipushi mine and update the existing one in Kipushi. As of now, it only serves people travelling between DRC and Zambia.

The companies formed a joint venture called Kipushi Corporation which had a breaking-ground ceremony for the project. The company noted pre-production capital costs estimated at $382 million which include contingency. At the moment, they will use existing rehabilitated surface and underground infrastructure to keep costs low. This plan is aimed at reducing the time to production to two years. The project includes a feasibility study which should include a 800,000 tonne-per-annum concentrator and an underground mine. Production for the mine is expected to be an average fo 240,000 tonnes of zinc per year, with a mine life of 14 years.

Both companies have noted that once the mine is in production, it has the potential to be the world’s highest-grade major zinc mine. Kipushi would have an average head grade of 36.4% for the first five years of production, head and shoulders above the nearest competing mine. The after-tax NPV of a zinc price at $1.40 per pound, with an 8% real discount rate, is $1.4 billion. The after-tax real internal rate of return (IRR) wold be 54% at those levels.

The mine is world-renowned for its production of copper and zinc. Union Minière operated the site for 42 years. In 1924, they started mining an 18% copper deposit from a surface open pit—which was the richest copper deposit at the time.

Kipushi then evolved into Africa’s biggest underground copper, zinc, and germanium mine. Gécamines took control of the facility in 1967 and ran it until 1993, when it was put on care and maintenance due to a variety of economic and political reasons.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Ivanhoe Mines (TSX:IVN), a Canada-based mining company, reported from its Kamoa copper mine in the Democratic Republic of Congo (DRC) that it had achieved record production numbers in Q1 2022 at the Kamoa copper mine. The mine recorded production o f55,602 tonnes of copper, which the company attributed the increase in production to improved mining operations and higher grades.

Mark Farren, Kamoa Copper’s CEO, commented in a press release: “The Phase 2 concentrator has been successfully commissioned in record time. We can expect to see a doubling of copper output for the remainder of this year, as well as further increases into 2023 as the de-bottlenecking program is executed. It has been wonderful to see how quickly Phase 2 reached commercial production, as our team leveraged prior learnings and experience from Phase 1.”

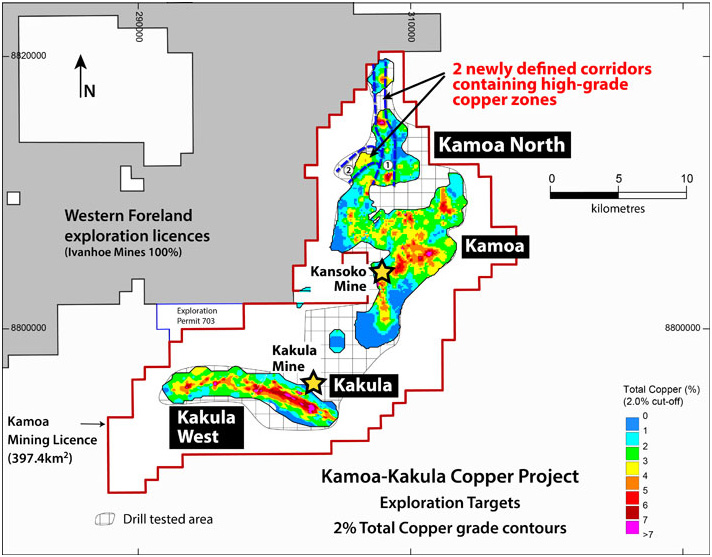

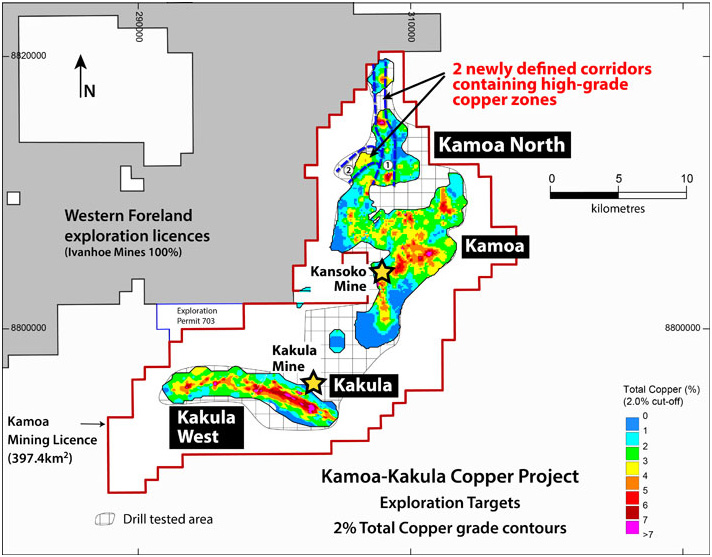

In May 2021, the Kamoa-Kakula project began producing copper concentrates, and commercial production began on July 1st, 2021. Kamoa-Kakula is well positioned to be one of the world’s major copper producers through planned phased expansions.

On April 7, 2022, the Kamoa-Kakula Phase 2, a 3.8 million tonne per day concentrator facility, achieved commercial production. Kamoa-Kakula also established a new daily production record on April 8 with 25,126 tonnes milled and 1,202 metric tons of copper produced.

Considering that copper is one of the battery metals playing a key role in the green energy transition, Ivanhoe’s goal of producing the industry’s “greenest” copper is key.

Ivanhoe is working to be the first net-zero carbon emitter in the world’s top copper producers’ ranks. Kamoa-Kakula will be powered by clean, renewable hydroelectric energy and is expected to have one of the lowest global greenhouse gas outputs per unit of metal produced.

Kamoa-Kakula

The Kamoa-Kakula copper deposit is a collaboration between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%), and the Government of the Democratic Republic of Congo (20%). According to international mining consultant Wood Mackenzie, it has been independently ranked as the world’s largest undiscovered high-grade copper discovery.

Higher Production

The higher production numbers come at a time when the industry is clamoring for more copper. The pandemic-fueled surge in demand for copper has caused a global shortage of the metal, leading to higher prices.

In 2021, the price of copper reached an all-time high of $10,000 per tonne on the London Metal Exchange. The rally was attributed to a combination of strong Chinese demand, constrained supply, and a weaker US dollar.

Copper is an essential metal for industries such as electric vehicles, renewable energy, and 5G technology. The global pandemic has caused a surge in demand for these products and has led to a shortage of copper. A shortage of new projects coming online on time to meet the demand has also pushed prices higher amid a general commodities supercycle.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

A new publication by Toronto-based research group Capitalight Research called Critical Metals for a Sustainable World is calling for an average copper price of $4.20 per pound in 2021. This comes on the heels of May 10th’s new record of $4.88 per pound, and multiple reports about supply issues set to hit copper supplies around the world.

The inaugural edition of the report notes that “trend copper prices must remain well above long-term ‘incentive levels’ to justify new mine development”. This would require a copper price of at least $3.50 per pound. The report’s name also hints at how important the metals used for the coming sustainable energy transitions will be. The company has dedicated an entire publication to these ‘critical’ metals that include copper, lithium, nickel, and even steel.

Mega Imbalance

Demand for copper is set to outstrip supply in the coming years, with the second half of the current decade accounting for most of that growth. The report mentions that global copper demand will grow by 3.8% in 2022 to about 25 million tonnes. This will need to be offset by new discoveries, higher production, and most importantly, new mines. Some companies are already racing to fill the gap.

Invanhoe’s (TSX:IVN) Kamoa-Kakula mine in the Democratic Republic of Congo (DRC) is coming online just at the right moment. After some delays at the project, the mine is moving forward with the DRC granting approvals and initial works beginning. Teck Resources (NYSE:TCK) also has a new project in the works, called Quebrada Blanca Phase 2. The company commented that it expects, “the current mine expansion wave will peak in 2024 and a large projected gap in required mine supply will open up in the second half of the decade.”

It’s Electrifying!

Much of the demand is to come from energy storage and electric vehicles. Many countries are pushing for full-scale reworkings of their infrastructure and rewriting laws to ensure that new cars sold after on or after 2035 or similar time targets are 100% electric. President Biden’s Bipartisan Infrastructure plan is calling for a brand new recharging network to be built across the country, with a massive amount of the critical metals mentioned in the Capitalight report required to build all of it.

The Critical Metals for a Sustainable World report also mentions that demand for copper “from renewable power projects, energy storage and electric vehicles could double by 2025 to 8.5 million tonnes and unlike recent years, prices will be driven less by short-term macroeconomic development in China and more by rising demand linked to global decarbonization.”

Current Plans Are Not Enough

It also goes on to say that although the supply concerns will be muted slightly by new copper mines coming on stream from companies like Teck Resources (NYSE:TCK) and Ivanhoe Mines (TSX:IVN), the research company expects that, “the current mine expansion wave will peak in 2024 and a large projected gap in the required mine supply will open up in the second half of the decade.”

Opportunities are waiting just around the corner, as an exciting decade gets fired up for copper miners around the world.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

While the Democratic Republic of Congo made things slightly more complicated for miners by reestablishing an export ban, some mining companies are moving forward with new permits and the ability to export their full output.

Ivanhoe Mines (TSX:IVN) (OTCQX:IVPAF) has signed a copper concentrate and blister copper off-take agreement on competitive arm’s length commercial terms for 100% of the company’s Kamoa-Kakula project’s Phase 1 copper output. This is a decisive step in the right direction, as the projected output for Kamoa-Kakula is expected to hit 200,000 tonnes of copper per year. In the midst of a supply shortage, Ivanhoe Mines (TSX:IVN) (OTCQX:IVPAF) is set to fill some of the gaps.

This year, Kamoa Copper made its first jump into production on May 25. It began producing copper concentrate and made the first delivery to the Lualaba Copper Smelter on June 1. The project includes a high-tech, high-grade milling, flotation, and recovery process to produce the ultra-high grade, clean copper concentrate.

Strong Agreements In Place

Off-take agreements have been signed between Kamoa Copper and CITIC Metal (HK) Limited, and Gold Mountains (H.K.) International Mining Company Limited, a subsidiary of Zijin, for half of the copper products from the Kamoa-Kaula Phase 1 production. This deal encompasses all of the copper concentrate and blister copper resulting from the processing of copper concentrates at the Lualaba Copper Smelter.

Ivanhoe Mines (TSX:IVN) (OTCQX:IVPAF) has a strong partnership with the Lualaba Copper Smelter, located near its Kamoa-Kakula project, just outside the town of Kolwezi. The smelter signed a 10-year agreement with Ivanhoe Mines (TSX:IVN) (OTCQX:IVPAF) on May 31 for the processing of a portion of Kamoa’s copper concentrate production. The terms of the agreement will secure copper concentrate processing for Ivanhoe Mines (TSX:IVN) (OTCQX:IVPAF) and allow the company to maintain steady exports with permission from the DRC. With the first copper concentrates already delivered to the smelter (June 1), the first blister copper ingots are now due to be delivered within 30 days of delivery to the Lualaba Smelter.

Lualaba Smelter

The Lualaba Smelter is one of the biggest in the region and is wholly owned by Chinese companies. 60% of the smelter is owned by China Nonferrous Metal Mining Group (CNMC) from Beijing, and 40% is owned by Yunnan Copper from Kunming.

The smelter is the first modern, large pyro-metallurgical copper smelter built in the DRC and is located only 40 kilometers from the Kamoa-Kaula site. The smelter can be accessed via a recently-constructed road that gives Ivanhoe Mines (TSX:IVN) (OTCQX:IVPAF) easy access to the smelting site. It began operations in 2020, with plans to treat up to 150,000 wet metric tonnes of copper concentrates from Kamoa-Kakula.

Its mandate is to produce blister copper containing approximately 99% copper to be returned to Kamoa Copper. Then it will be collected by CITIC Metal and Zijin from a storage area at the smelter. From there, the copper will be exported by CITIC through the port of Durban, South Africa, a process for which CITIC will be completely responsible for arranging freight and shipment to the final destination.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

In 2013, the Democratic Republic of Congo (DRC) banned exports of concentrates to encourage miners to process and refine ore locally in the country. As the world’s biggest cobalt producer and Africa’s largest copper miner, this had a pretty significant impact on the industry and how companies operated in the region.

Now, the DRC has reinstated that export ban, threatening the global supply chain as the complications and bottlenecks that come along with refining in the country loom large. Mining companies that currently hold waivers to continue with shipments out of the country can continue, but most new projects and the expansion of existing mines will be held back by this ban.

A lack of smelting capacity often drove the Congolese government to issue a multitude of waivers during the previous export ban. It is likely the same process will be needed this time around as miners have had little time to prepare and the country’s smelting capacity and infrastructure still lies in a similar state as 8 years ago.

A Scramble to Protect Assets and Production Pipelines

Companies are moving quickly to protect their assets in the DRC, with Ivanhoe Mines (TSX:IVN) filing an application quickly last Friday for a waiver while continuing talks with the mines minister. The company’s Kamoa-Kakula project has begun copper concentrate production this week, and will need the waiver to ensure the project remains viable and operating at an optimal level.

“The rules recognize that a derogation may be justified for a number of reasons,” president and CFO Marna Cloete said in a statement. “Kamoa Copper has filed the necessary application materials and we have had constructive discussions with the Minister of Mines on obtaining a derogation for Kamoa-Kakula given current limitations on smelting capacity in-country.”

Ivanhoe has said it will use local smelter capacity as much as possible and is looking at constructing its own complex at the project site to produce blister and anode copper. However, with severe power deficits still being dealt with in the DRC, mining companies have been prevented from building processing facilities. The gridlock has created a kind of stalemate for the process which is the prime driver for the high level of waivers issued.

One company less affected by the ban is Glencore (LON:GLEN), whose operations at its Mutanda cobalt mine (the largest in the world) are expected to resume operations in 2022. Since the company exports mainly cobalt in hydroxide and copper cathodes, the ban will not adversely affect the company’s production and they will not need the waiver as Glencore (LON:GLEN) remains unaffected.

Supply Threatened

Copper and cobalt are two critical minerals and metals that are required for all of the technology, batteries, and energy storage and production solutions currently being used around the world. The developed world’s appetite for copper and cobalt continues to grow, and demand is expected to oustrip supply by a critical amount. Estimates from CRU Group show a possible annual supply deficit of 4.7 million metric tonnes by 2030. To close that gap, the copper industry would need to spend more than $100 billion. If no new mines get built and bottlenecks like export bans in the DRC continue, the deficit could grow to 10 million tonnes, according to commodities trader Trafigura.

With demand growing rapidly and supply lagging, copper prices continue to rise, giving copper miners around the world a strong tailwind for production and investment. For the next few decades, the industry could see copper mining companies holding all the cards for the red metal, creating a strong and profitable business for everyone involved.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The world continues to watch the mining industry for signs of a serious commitment to the decarbonisation efforts sweeping the global economy. Company after company continues to put their effort and money where their mouth is. The latest company to jump onto the net-zero train is Ivanhoe Mines (TSX:IVN), committing to net-zero greenhouse gas emissions at its Kamoa-Kakula Copper Mine.

The company’s CEO, Robert Friedland, will be speaking today at the 2021 Goldman Sachs Copper Day and made the announcement before his speech.

The mine is expected to be the world’s highest-grade major copper mine and should begin producing its first copper concentrates soon. The Phase 1 mining rate is expected to be 3.8 million tonnes per year, with an approximate feed grade of more than 6%. Phase 2 should see a ramp-up to 7.6 million tonnes per year, and with the proposed expansion to 19 million tonnes, Kamoa-Kakula could end up being the world’s second-largest copper mining complex.

The company’s ambitions don’t stop at production. The way Ivanhoe plans to mine is focused on support from a green electricity grid and a plan to reduce the use of fossil fuels until the net-zero emissions goal is reached. Electric, hybrid, and even hydrogen technologies are proposed for trucks and transportation. While the upfront investment will cut into the cash on Ivanhoe’s balance sheet, the costs down the road from reduced fuel costs, lower ventilation costs, and even lower health and safety costs as the healthier and cleaner technologies pose less of a risk to workers will more than make up for those initial investments.

The Canadian company is not just following but leading the way when it comes to large-scale net zero emissions projects. Its Kamoa-Kakula copper discoveries in the Democratic Republic of Congo (DRC) have opened the opportunity for the project to become one of the world’s largest and make the company one of the world’s largest copper producers.

Pushed along by the Paris climate agreement and the Canadian government’s initiatives in reducing emissions to zero by 2050, copper mining companies like Ivanhoe (TSX:IVN), Solaris Resources (SLS.TO), and Glencore (LON:GLEN) are pledging their efforts to the critical cause. This is not just because of the ethical and environmental benefits, but because investors also demand these commitments now. Without a plan for the environmental, social, and governmental (ESG) principles in the planning stages of projects, investors may be hesitant to commit capital.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CMB.V | +900.00% |

|

CCD.V | +100.00% |

|

CASA.V | +30.00% |

|

AAZ.V | +25.00% |

|

RMI.AX | +25.00% |

|

POS.AX | +25.00% |

|

KGC.V | +20.00% |

|

GDX.V | +20.00% |

|

LPK.V | +16.67% |

|

CCE.V | +16.67% |