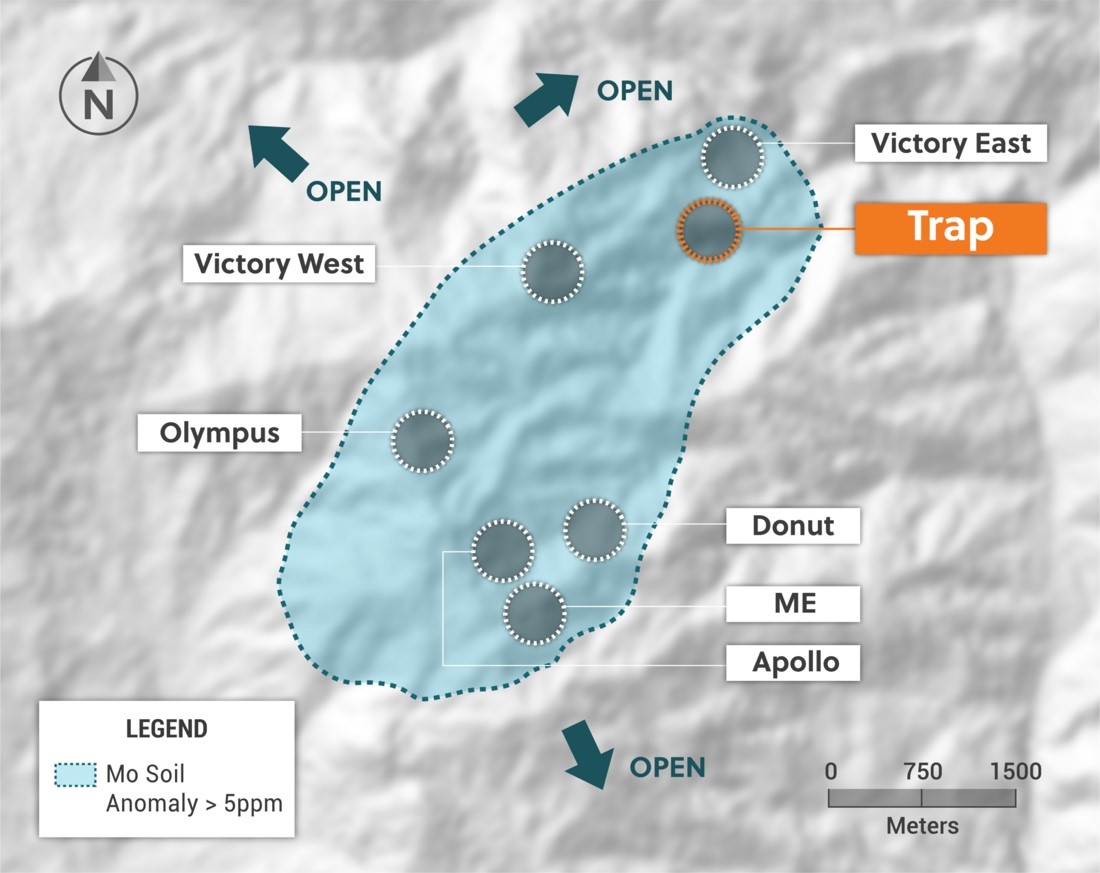

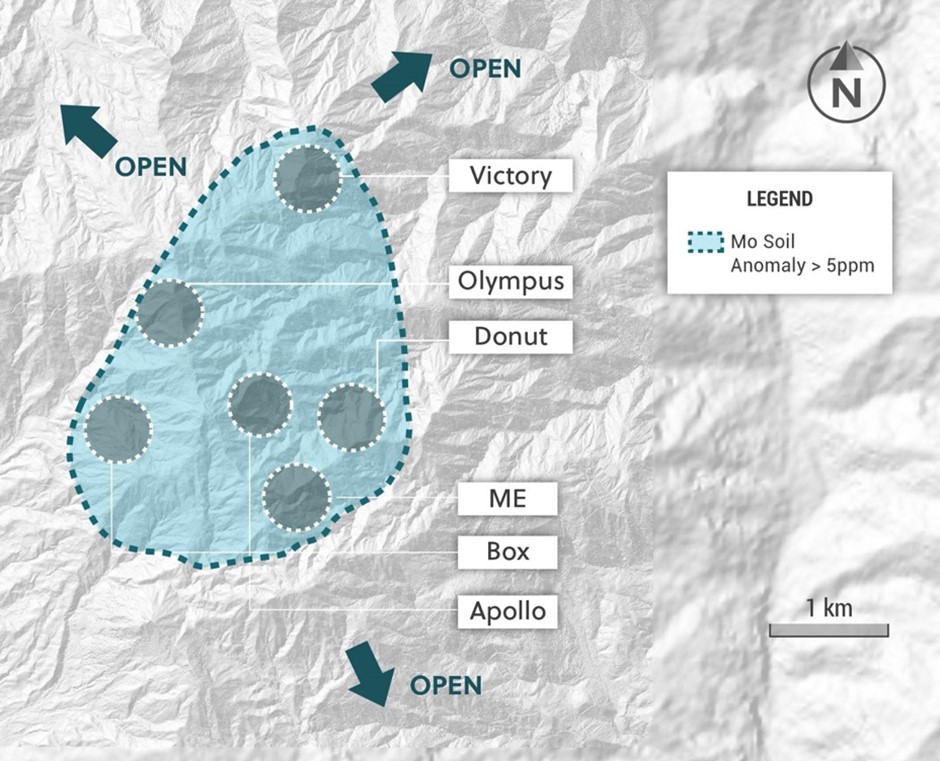

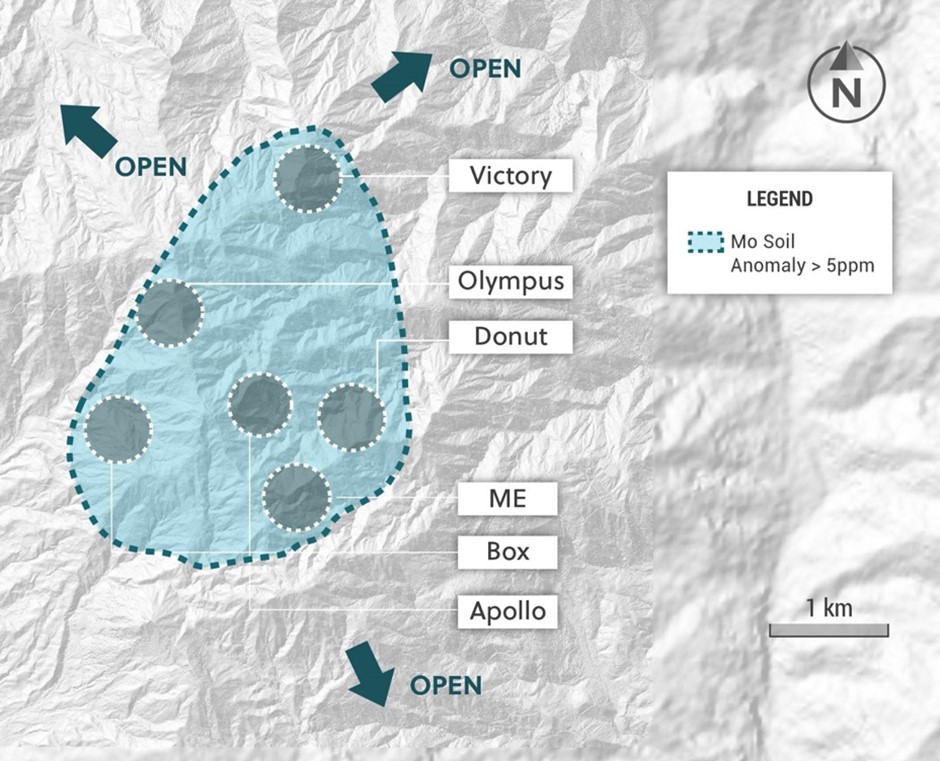

Collective Mining (TSXV:CNL) has announced today new high-grade gold and silver channel sample assay results from the Trap target at its Guayabales project in Colombia. The Trap target is in the northern portion of the 4 x 4 kilometre porphyry cluster where Collective has already generated eight drill targets through grassroots prospecting. The company has three diamond drill rigs running at Guayabales at the Trap and Apollo targets and expects a fourth rig to begin a phase II drill program for the Olympus target in late June 2022.

Drill testing has been completed for four of the targets, not including the Trap target, with three significant discoveries including the Olympus target. The company announced near-surface discovery holes of 302 metres @ 1.11 g/t gold equivalent and 216.7 metres @ 1.08 g/t gold equivalent from the Olympus target on March 15, 2022, and May 9, 2022..

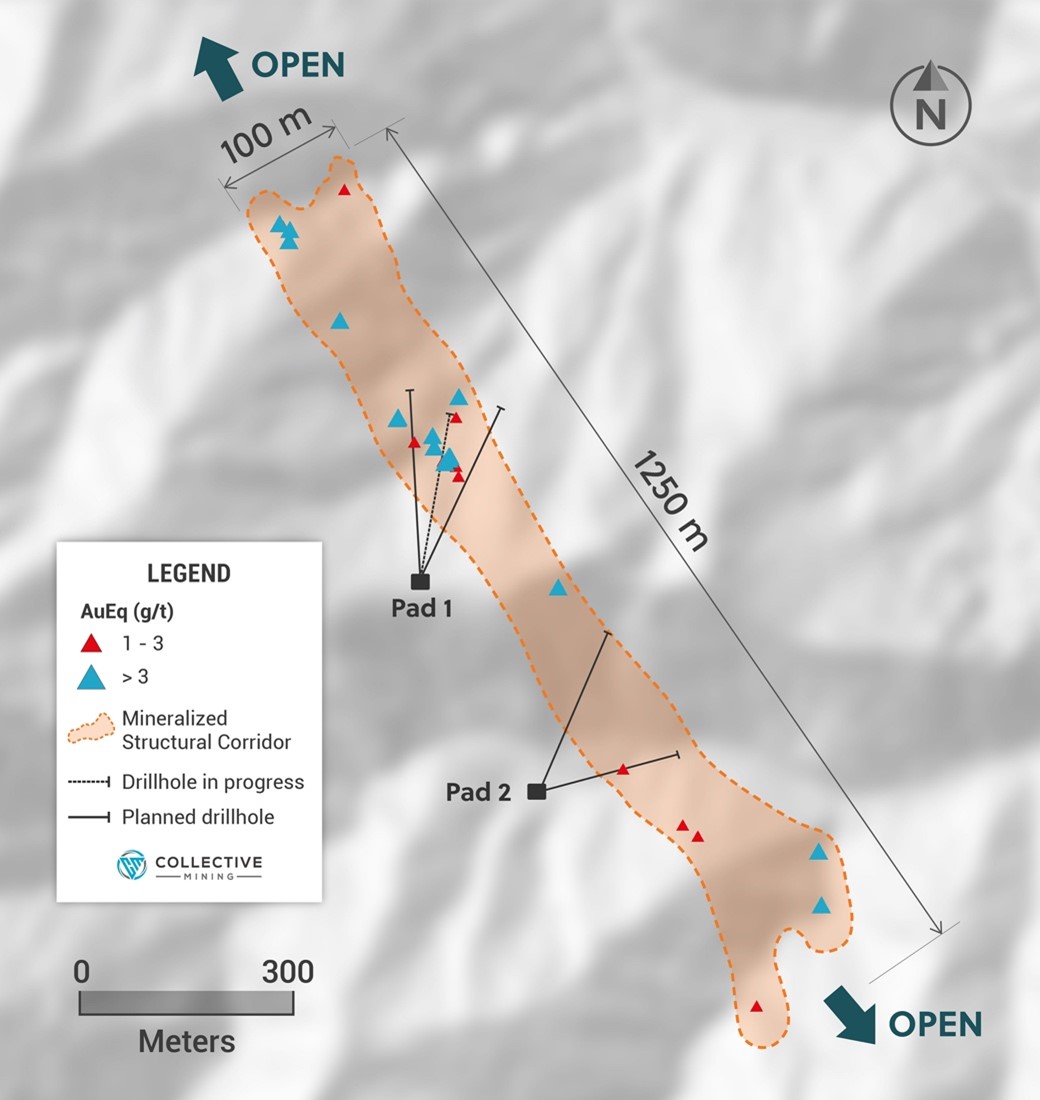

Ari Sussman, Executive Chairman, Collective Mining, commented in a press release: “The discovery of a new, high-grade vein system at Trap reconfirms just how prospective the Guayabales project is and to date we have outlined multiple styles of potentially economic mineralization within eight precious and base metal targets. Although exploration at the Trap target is in its infancy, we have already outlined a mineralized corridor consisting of multiple CBM vein systems with a strike length of at least 1.2 kilometres. First assay results from this program are expected in late Q3, 2022.”

Highlights of the results are as follows:

Highlights (Table 1 and Figures 1 and 2)

- Assay results of 33 reconnaissance chip channel samples taken from porphyry related, carbonate-base metal (“CBM”) veins within the Trap target confirm the presence of multiple, high grade, polymetallic veins. Channel sample assay highlights are as follows:

- 28.41 g/t AuEq over 0.30 metres

- 15.50 g/t AuEq over 0.25 metres

- 7.19 g/t AuEq over 2.2 metres

- 5.07 g/t AuEq over 1.7 metres

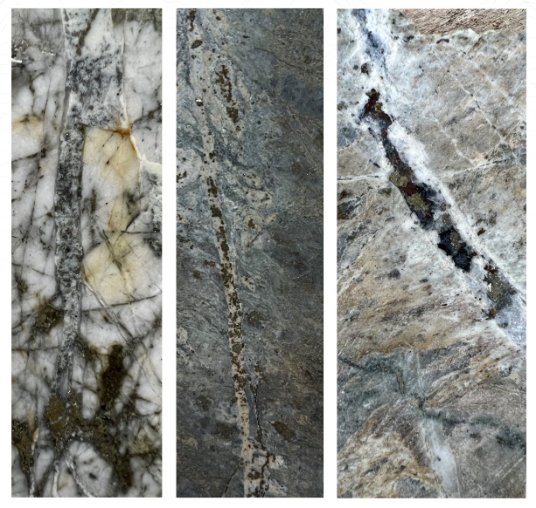

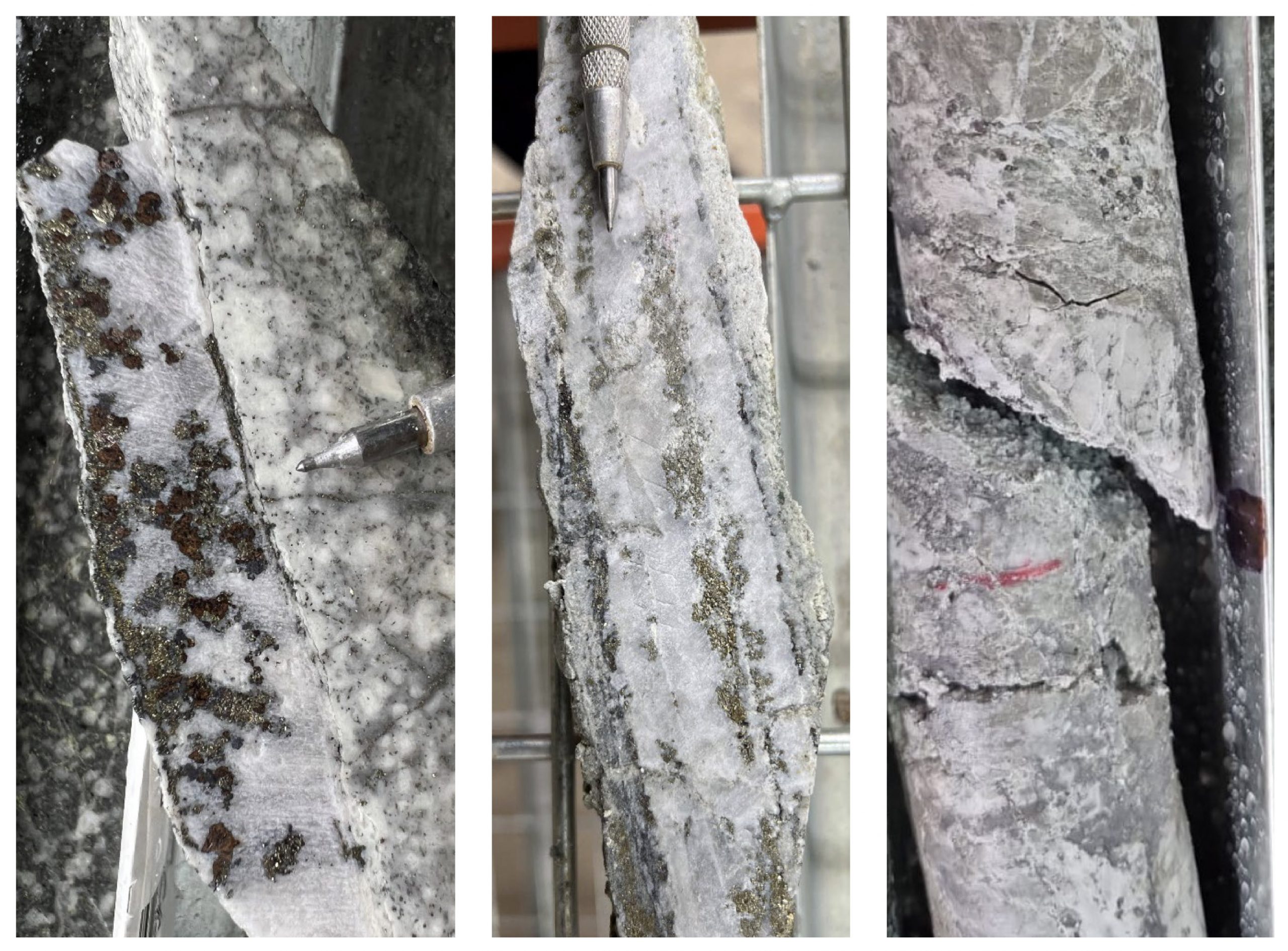

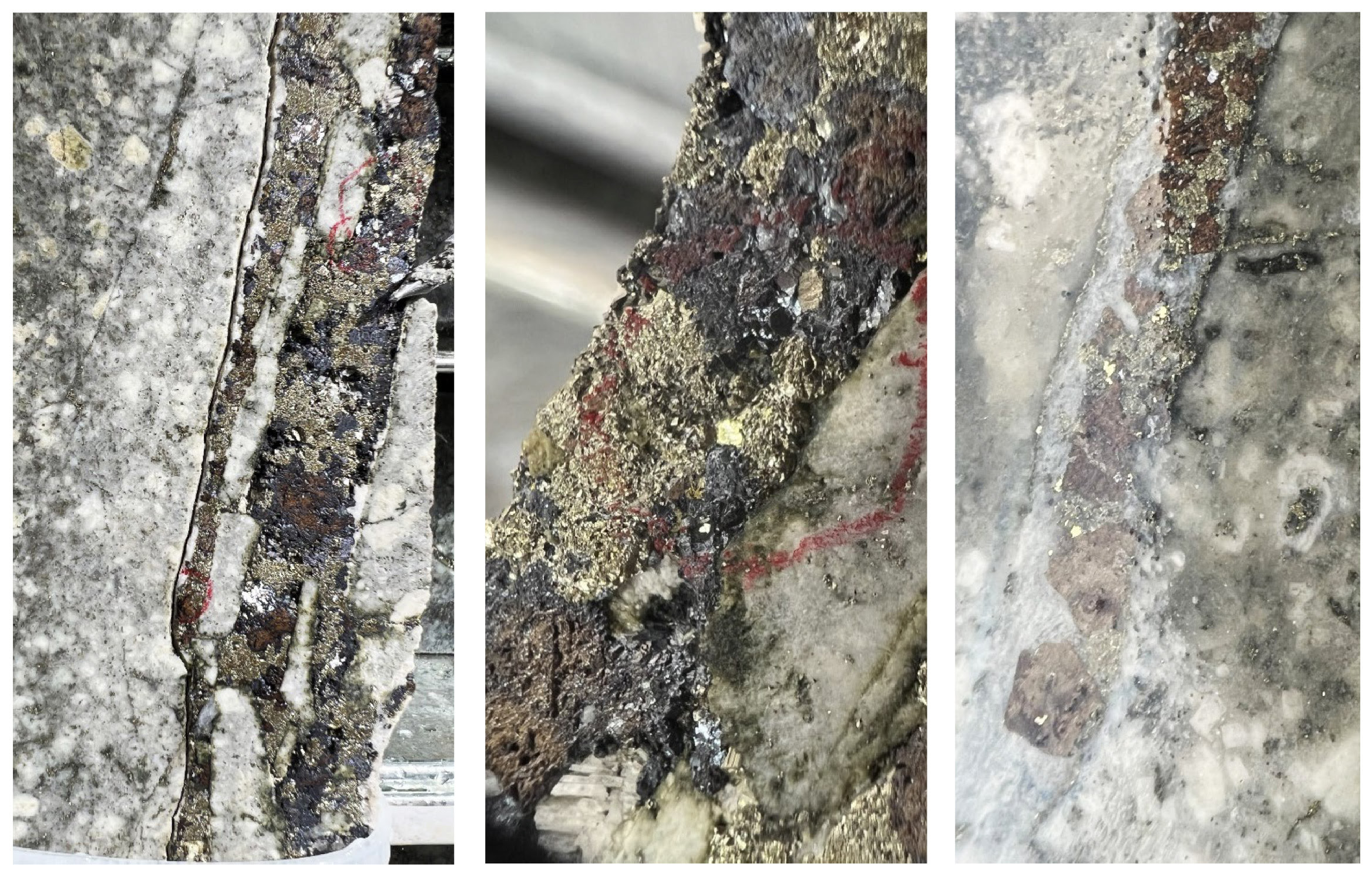

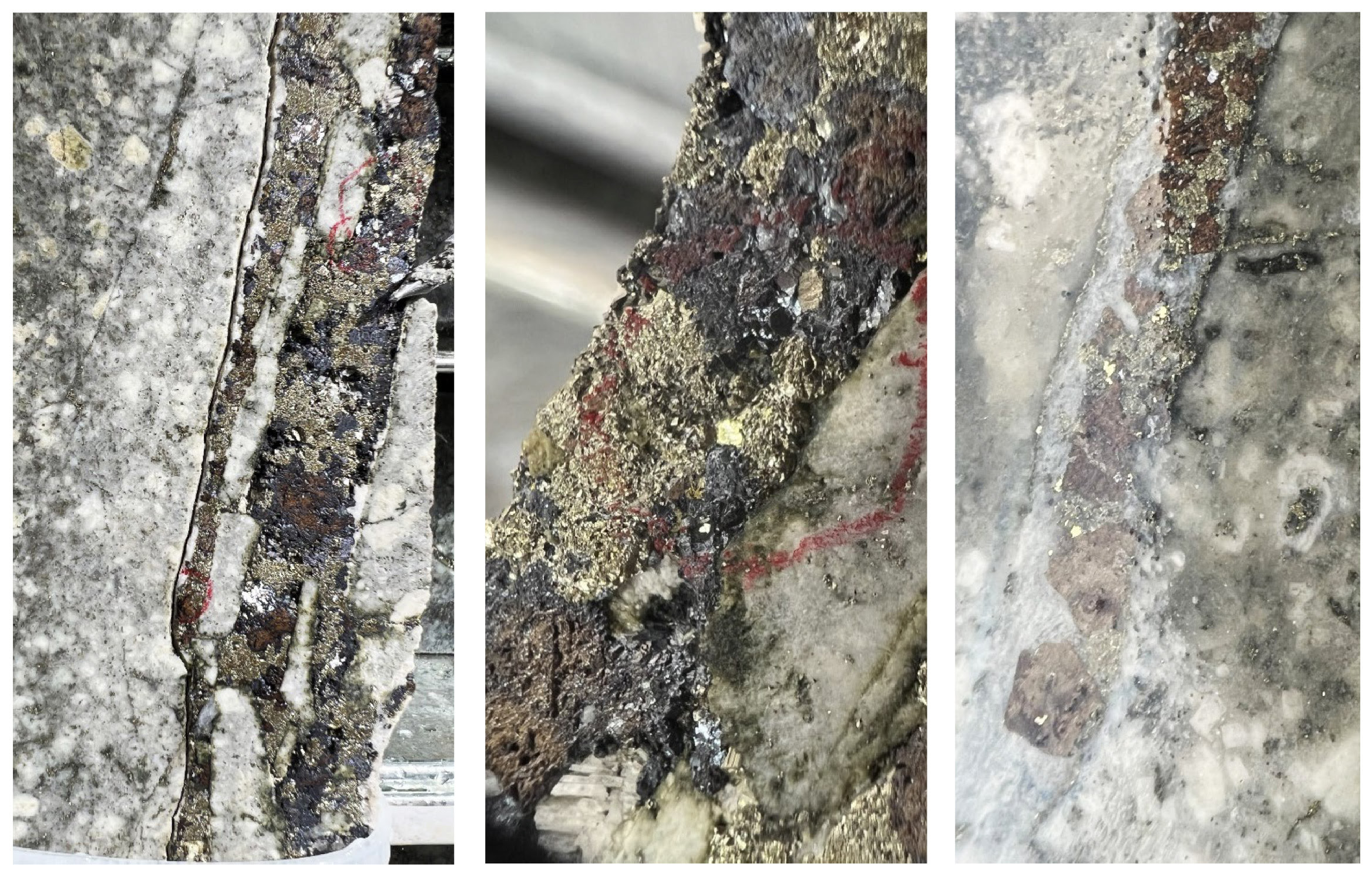

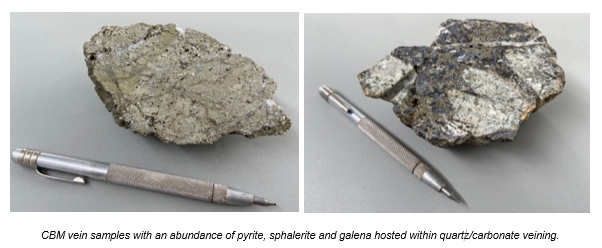

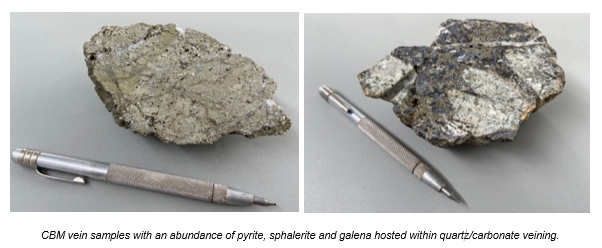

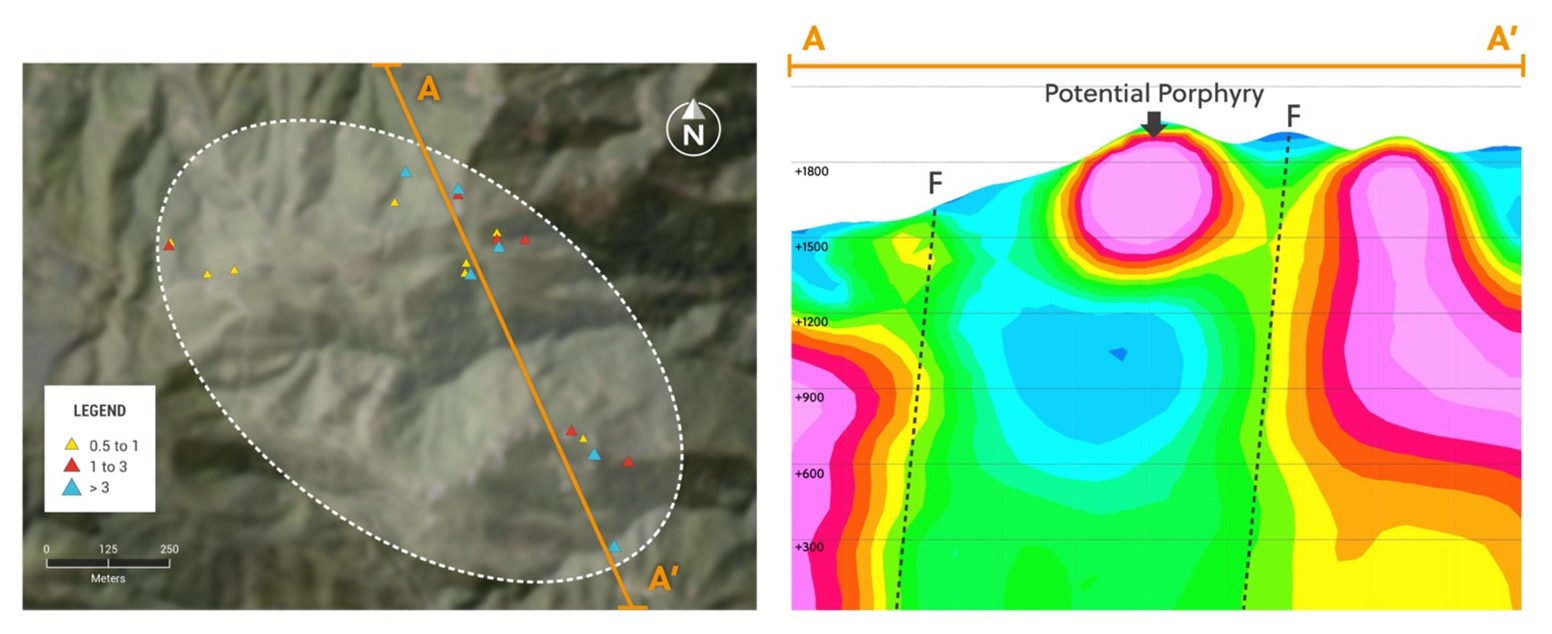

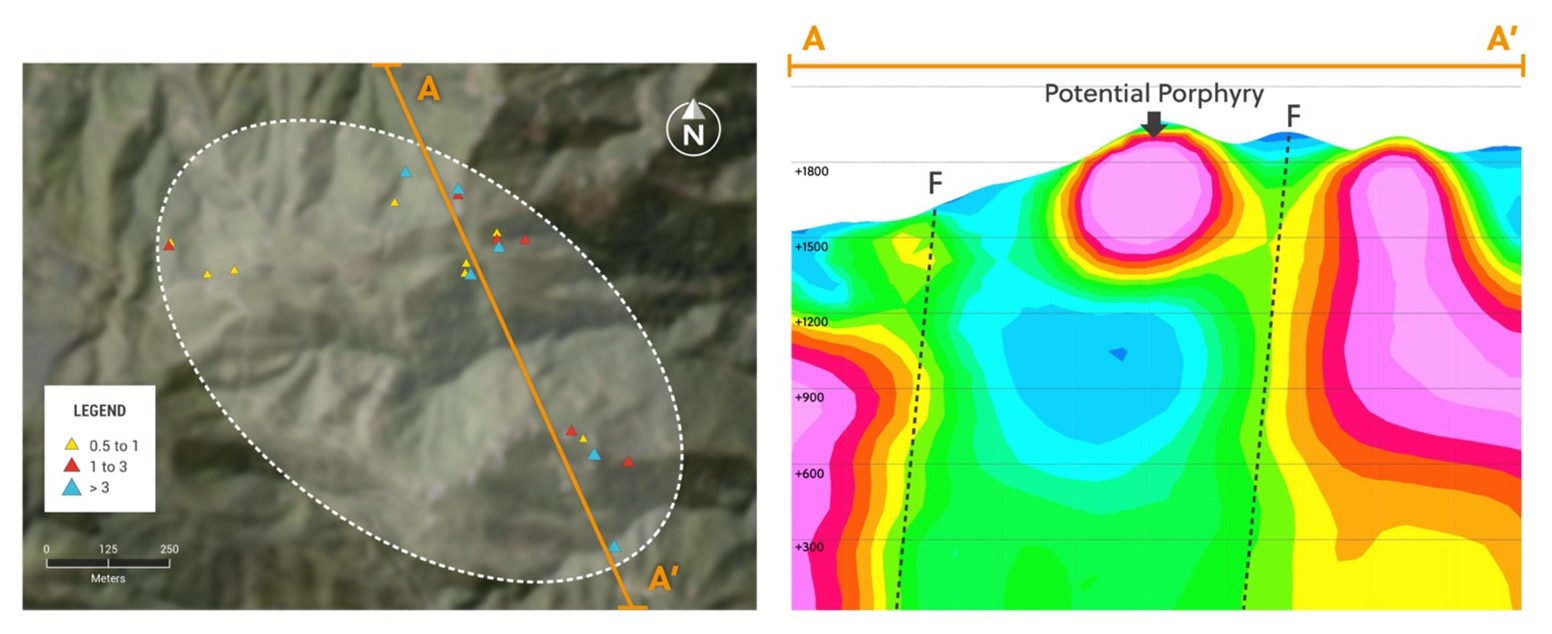

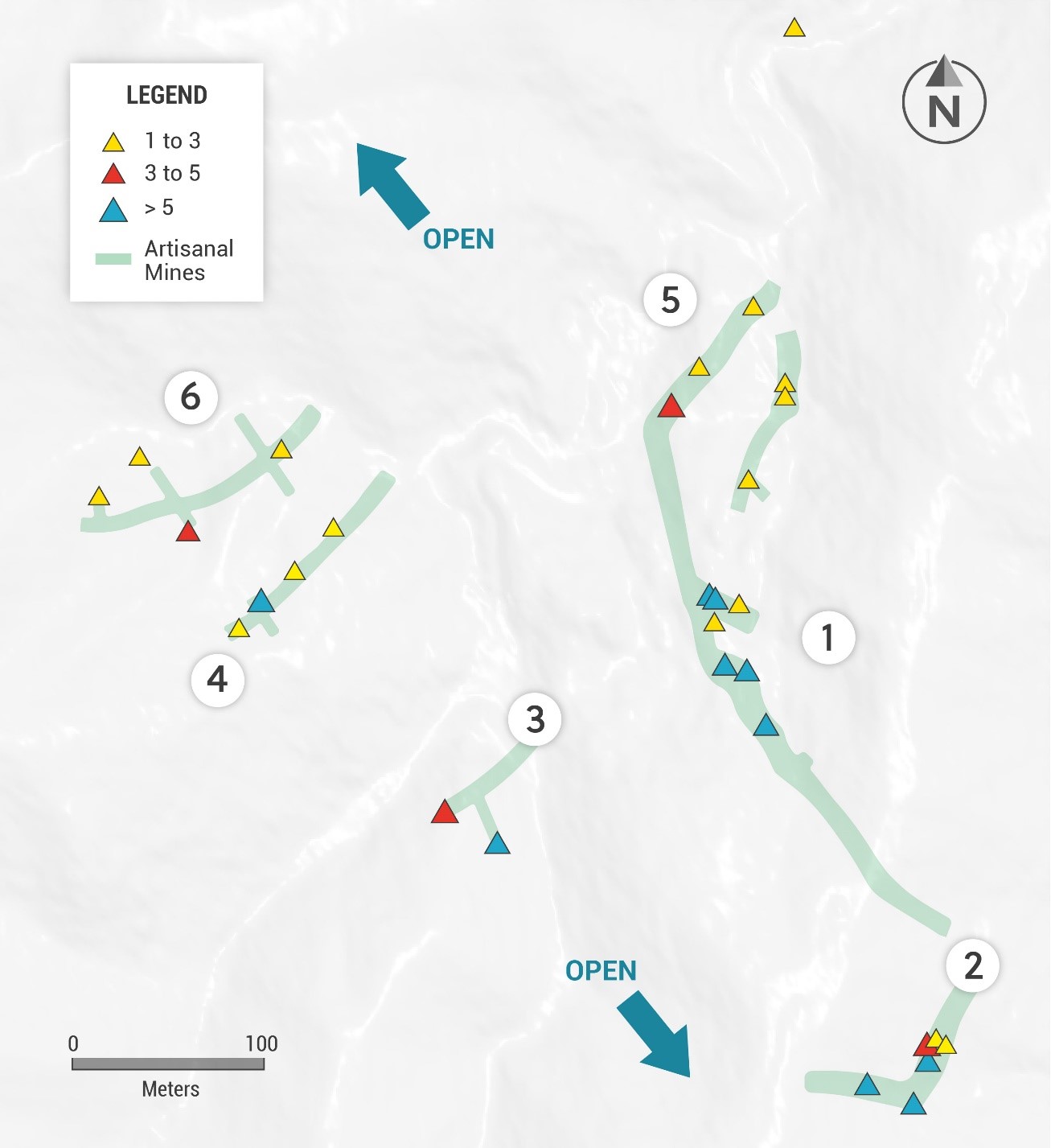

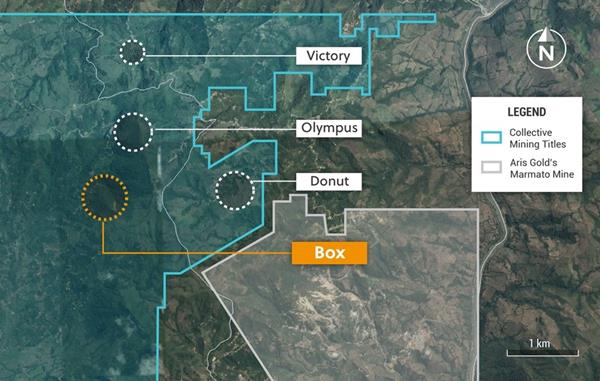

- The CBM veins hosted within the Trap target are all located within a north-to-south trending corridor that has been mapped for a strike length of 1.2 kilometres and is open in both directions along strike. The veins occur within a zone up to 100 metres in width and are hosted within a quartz diorite porphyry which has been bleached white by intense sericite alteration and contains multiple discrete shear planes. The CBM veins are sulphide-rich (pyrite, chalcopyrite, sphalerite and galena) and are associated with quartz carbonate veins within this structural corridor.

- The Company is presently drilling the first reconnaissance diamond hole, TRC-1, into the central portion of the target area where the vein density is highest. Up to five widely spaced diamond holes covering 600 metres of strike length will be drilled to understand the grade tenor and continuity of the target.

Table 1: Chip Channel Sample Assay Results

Sample IDLength (m)Au (g/t)Ag (g/t)Zn %Pb%Cu%Mo%AuEq (g/t)*CM32940.303.4668713.061.541.860.00128.41R50240.258.942270.270.061.630.00215.50CM34190.1410.612830.020.420.010.00114.79R50020.708.53120.090.130.020.0028.47R55590.608.081 7.69R50260.600.491723.821.390.300.0017.30R50252.203.90383.230.280.150.0017.19R55610.305.6910 5.56R50591.705.07140.010.000.060.0025.19CM34310.083.88690.000.140.000.0024.85R50390.704.63180.010.020.020.0004.74R55570.204.193 4.03R50571.001.91760.070.000.110.0123.36R50631.402.14550.040.040.140.0053.27R51531.000.661330.030.000.200.0073.19R51541.502.35180.030.000.220.0223.13R50472.002.11220.680.250.020.0013.02R50641.200.89800.030.000.390.0143.00CM34240.602.53110.400.070.020.0002.95R51562.001.59430.060.010.250.0032.75R50580.301.3940.020.000.520.0022.44R51351.001.57460.020.020.050.0022.36R50612.001.73170.020.010.140.0012.22CM003882.001.9740.010.000.010.0062.00R51370.901.43230.070.010.030.0061.87CM003291.501.54200.020.050.010.0031.86CM003471.801.8910.040.010.000.0001.86R51380.251.08200.050.010.210.0021.81R55580.401.881 1.80R51362.001.09190.020.010.140.0021.64R55690.701.4410.000.000.000.0001.38CM003471.001.1100.050.140.020.0001.21R50030.401.0150.060.020.030.0011.15

*Channel chip samples reported above are over true horizontal sampling widths. Sample grades are uncapped. Channel samples are representative of 2-dimensional space and as a result, should not be relied upon as being representative of average grades anticipated in any future resource estimate or mining scenario. AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.017 x 0.95) + (Cu (%) x 2.06 x 0.95) + (Mo (%) x 6.86 x 0.95) +(Zn(%)*0.80*0.95)+(Pb(%)*0.46*0.95), utilizing metal prices of Cu – US$4.50/lb, Mo – US$15.00/lb, Zn – 1.75 US$15.00/lb, Pb – US$1.00/lb, Ag – $25/oz and Au – US$1,500/oz and recovery rates of 95% for Au, Ag, Cu; Zn; Pb and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

Source: Collective Mining

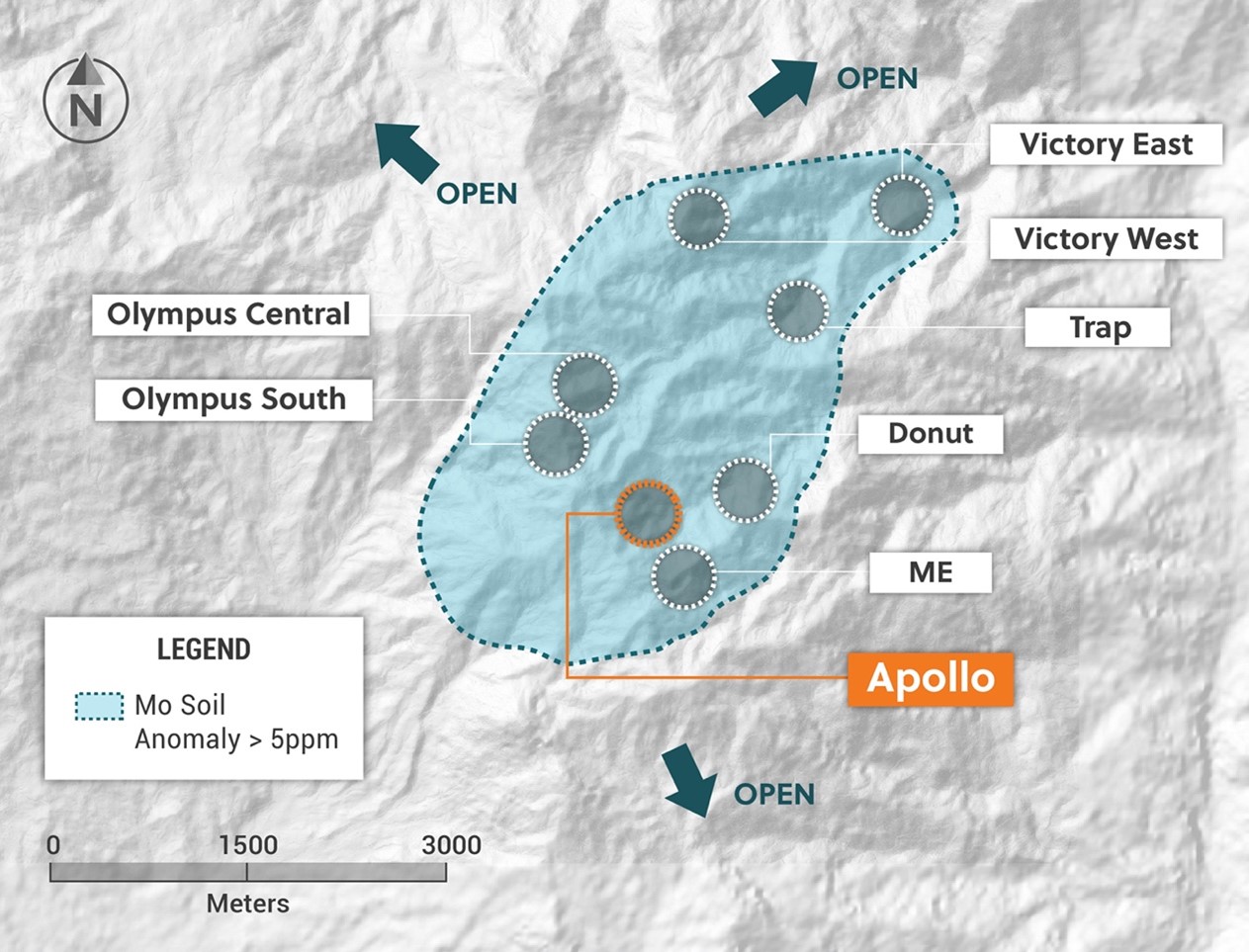

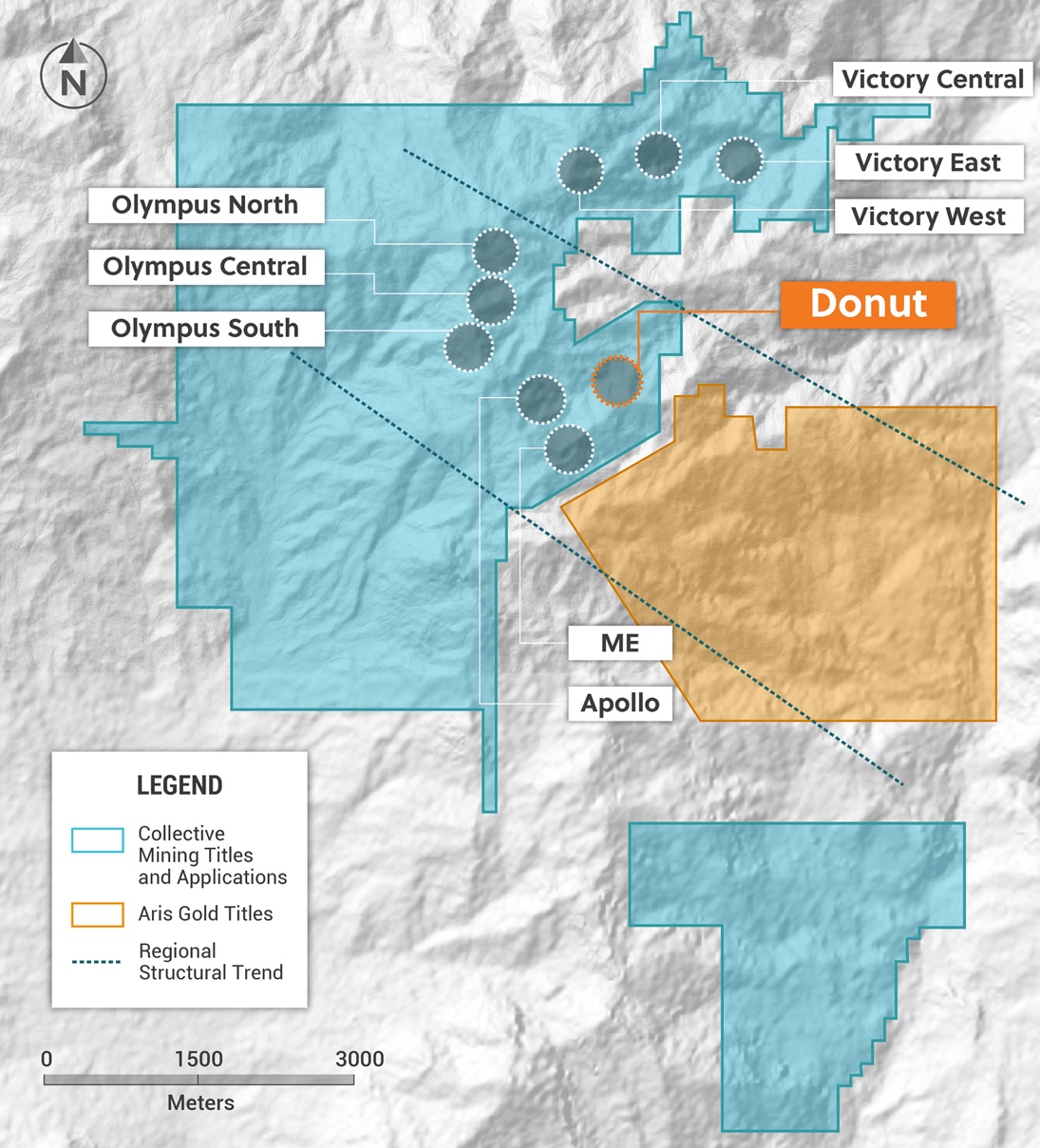

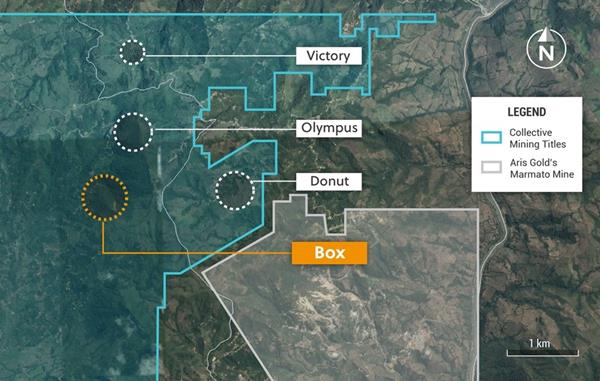

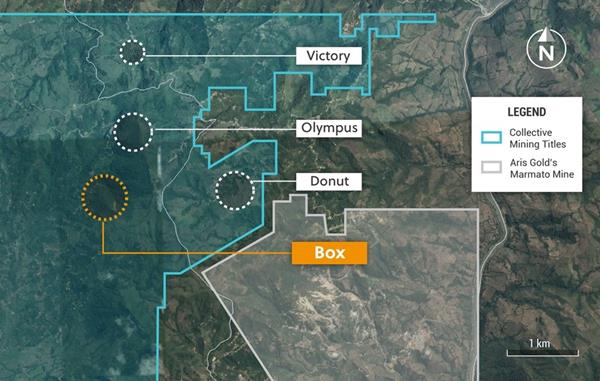

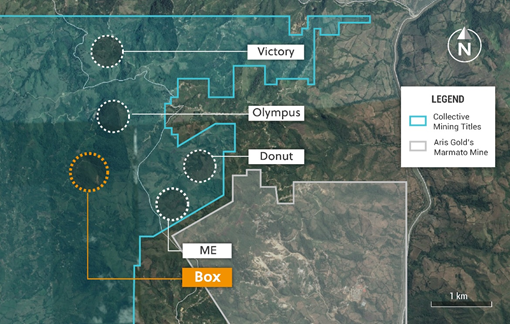

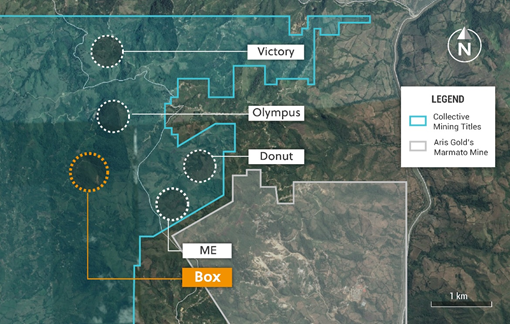

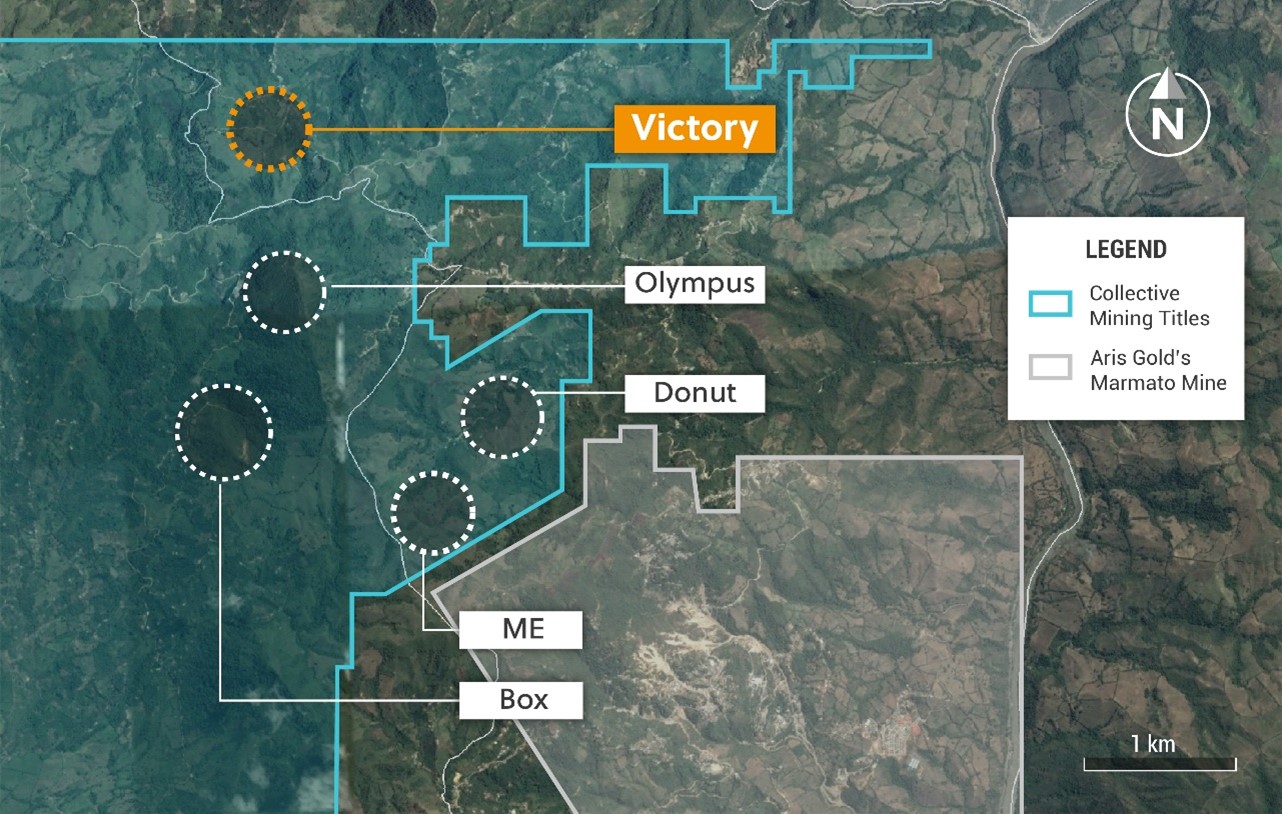

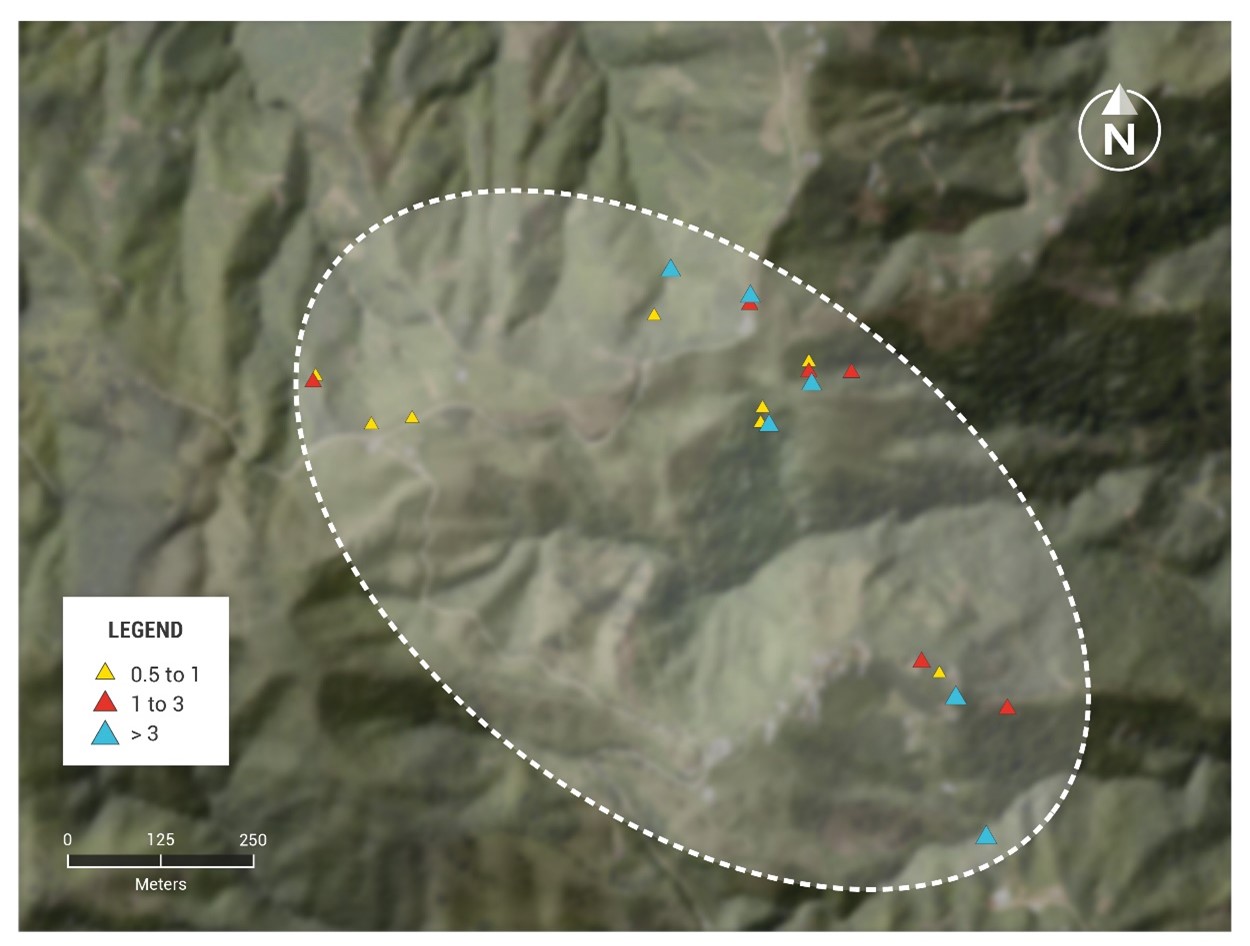

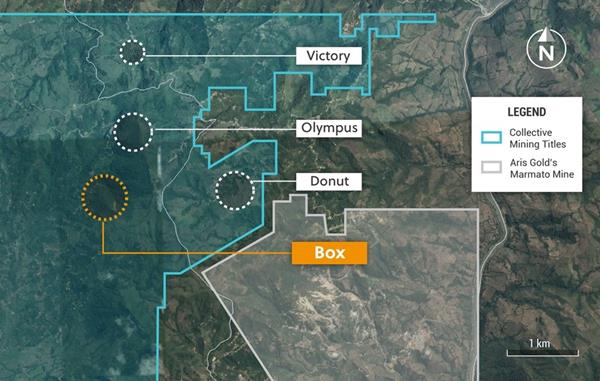

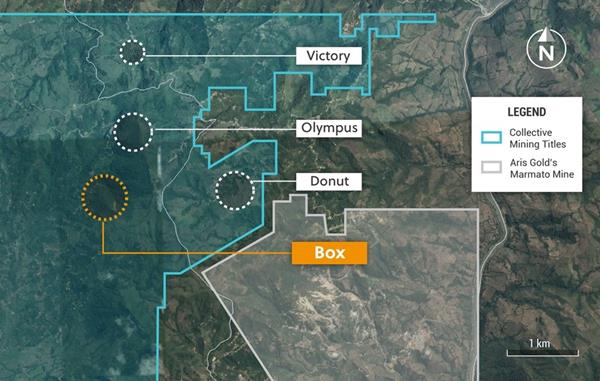

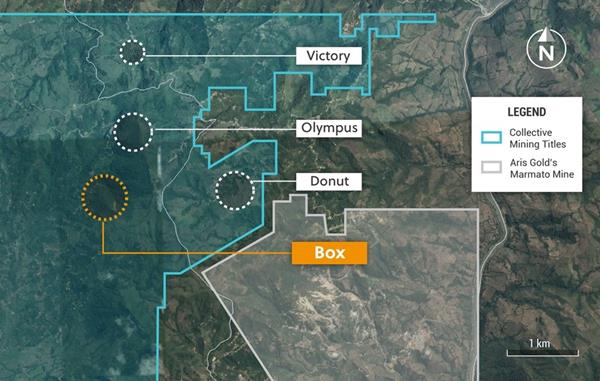

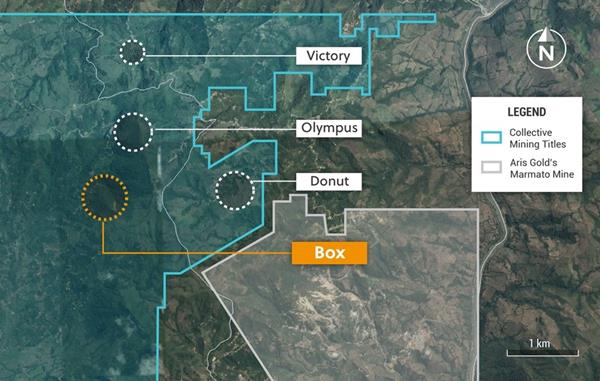

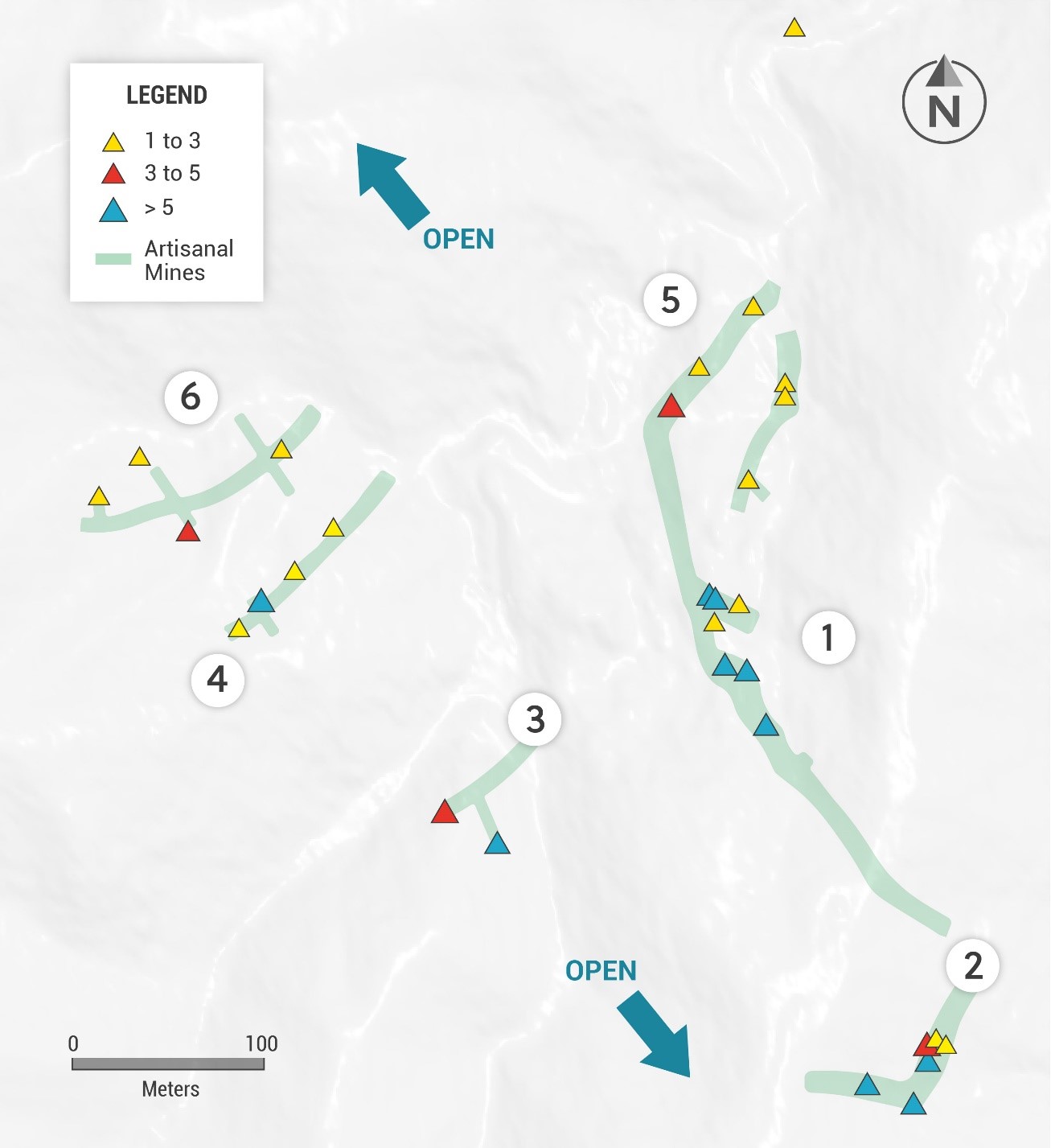

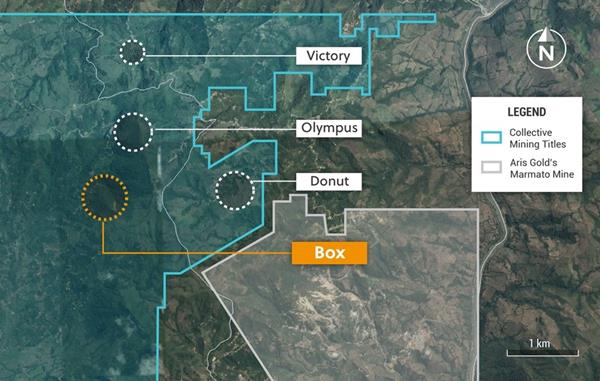

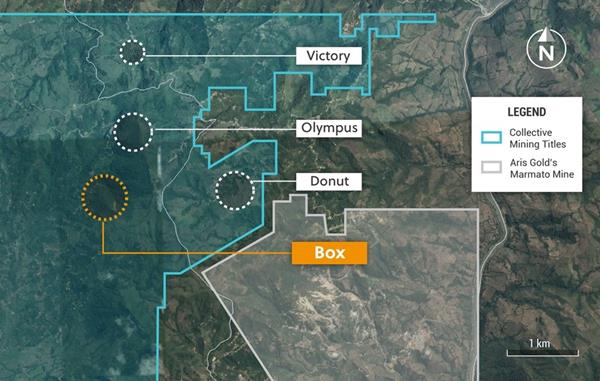

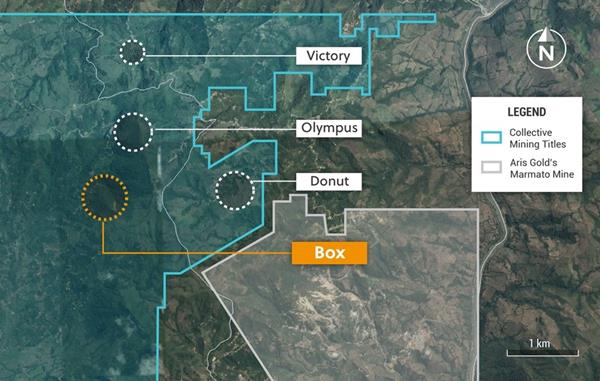

Figure 1: Plan View of the Guayabales Project Highlighting the Trap Target

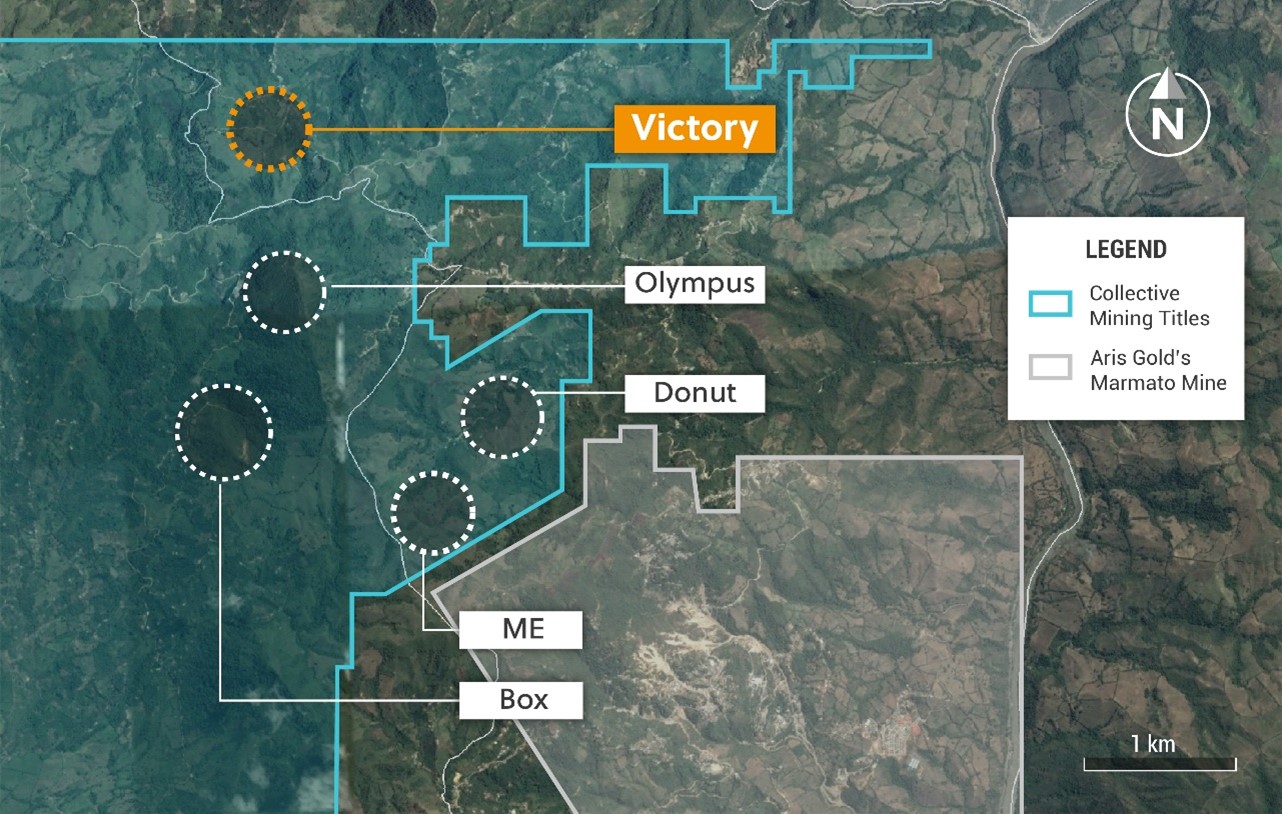

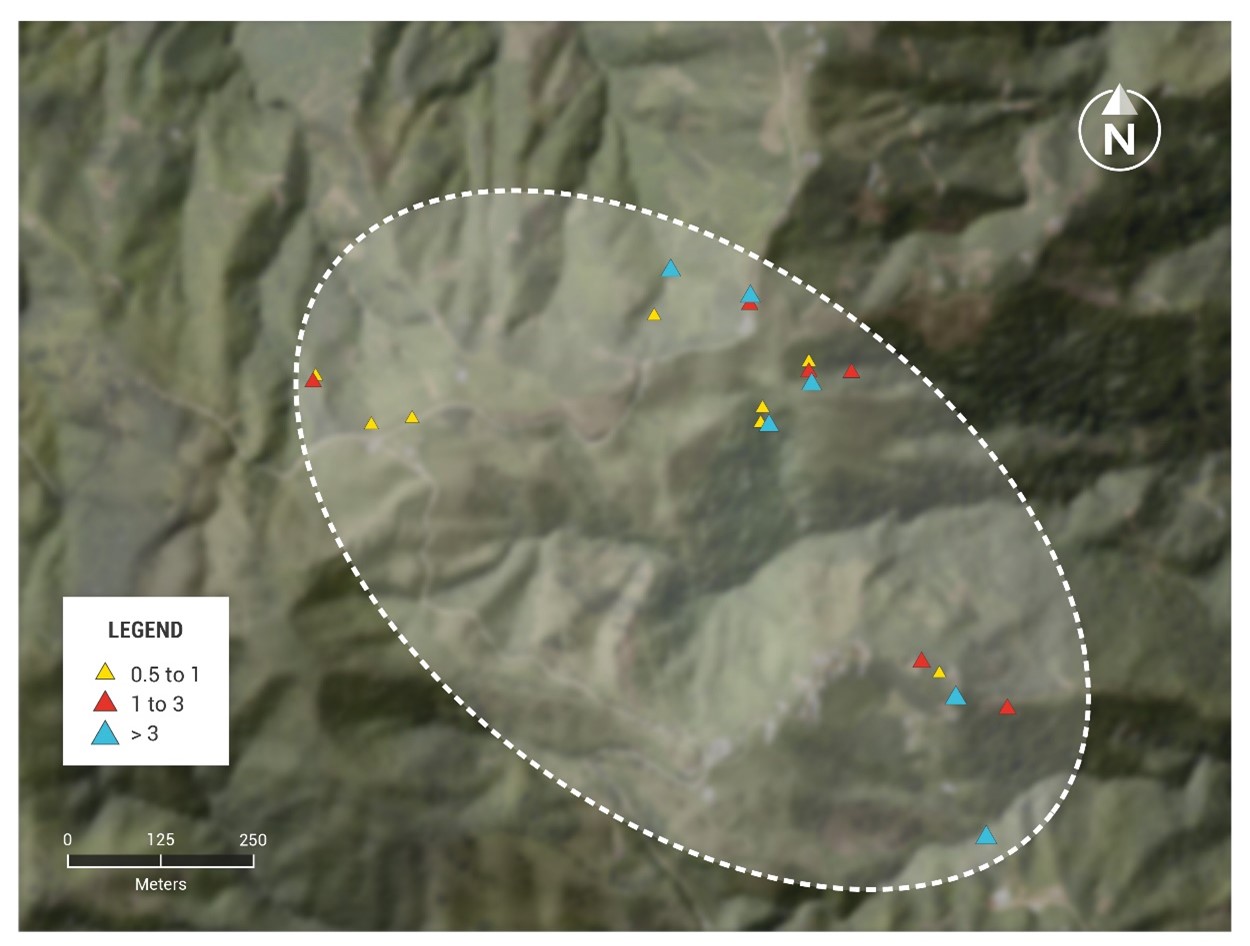

Figure 2: Trap Target has a 1.25 km Strike Length and is Open in Both Directions Along Strike

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) will participate in several upcoming virtual and in-person conferences, giving investors and potential investors the opportunity to learn more about the company’s progress at its Guayabales and San Antonio projects in Colombia. The company has also launched a new website design at https://collectivemining.com, with an intuitive and informative layout for investors to learn more about the company and get in touch.

Management will discuss a range of topics including its ongoing 20,000+ metre drill program that has so far yielded three discoveries from four targets, with visual encouraging intercepts from a fifth target.

The company most recently announced that it had expanded the Olympus Target discovery holes with high-grade vein systems and reported channel sampling of 221 g/t gold, and 812 g/t silver. Ongoing drilling at Guayabales includes three diamond drill rigs turning at the Olympus, Apollo, and Trap targets.

Upcoming Conferences

121 Mining Investment, New York, NY – June 6-7, 2022 – Investors may sign up here to register and arrange a meeting with Company management.

PDAC, Toronto, ON – June 13-15, 2022 – Investors may register here and visit the Company at booth 2714.

Source: Collective Mining

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

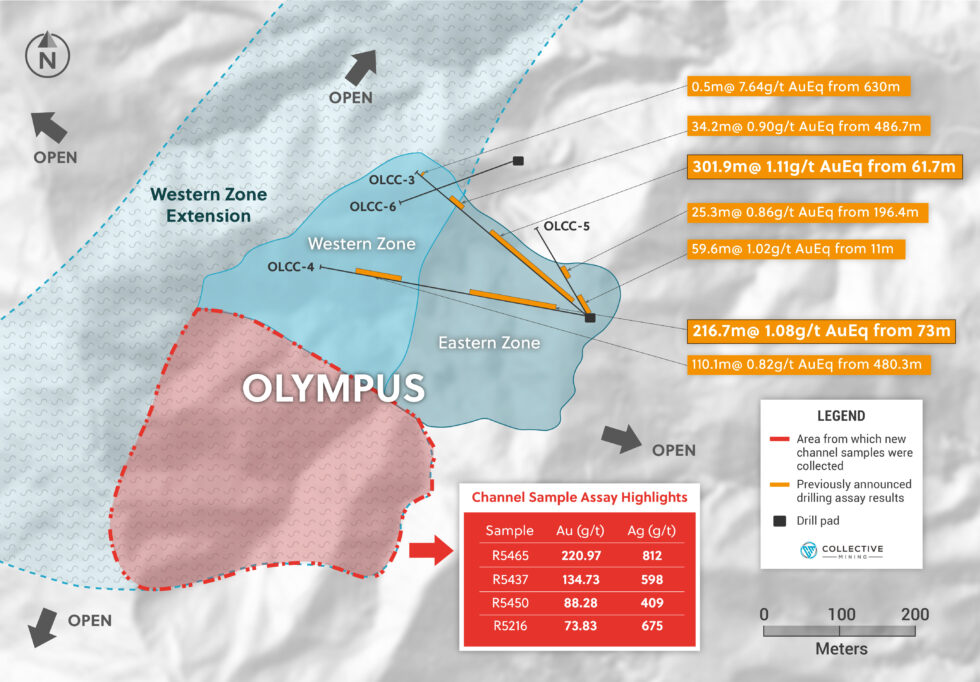

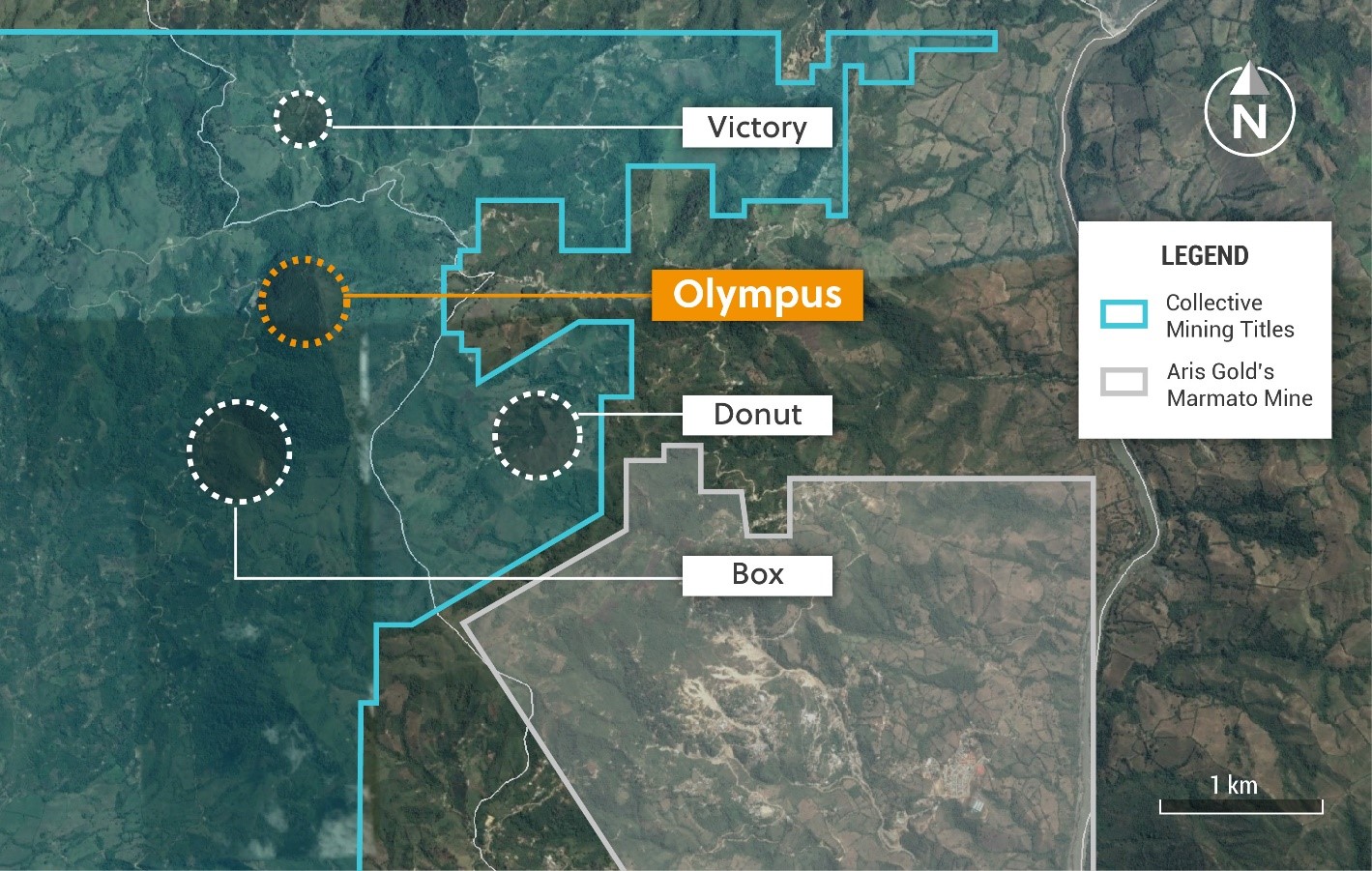

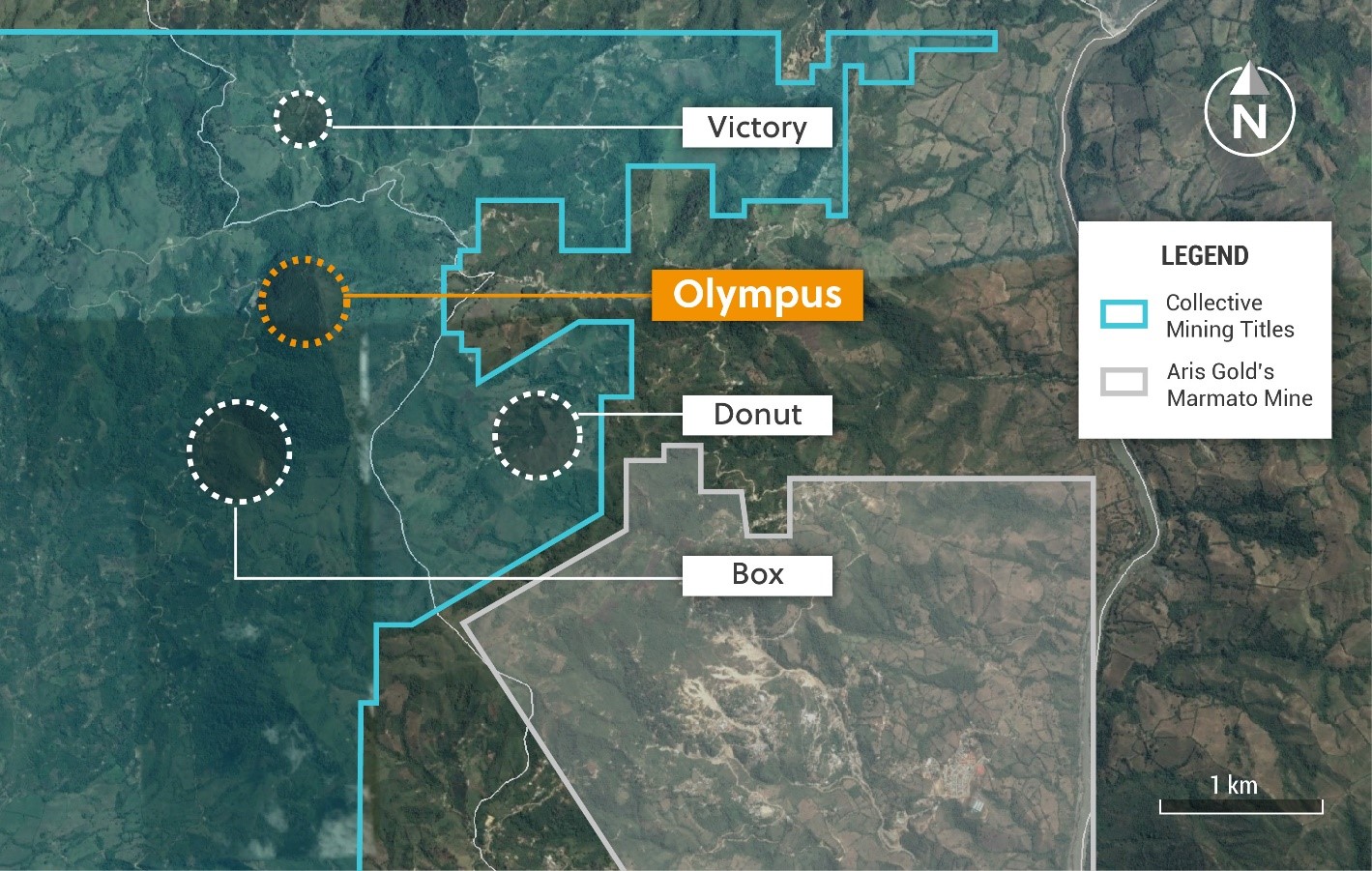

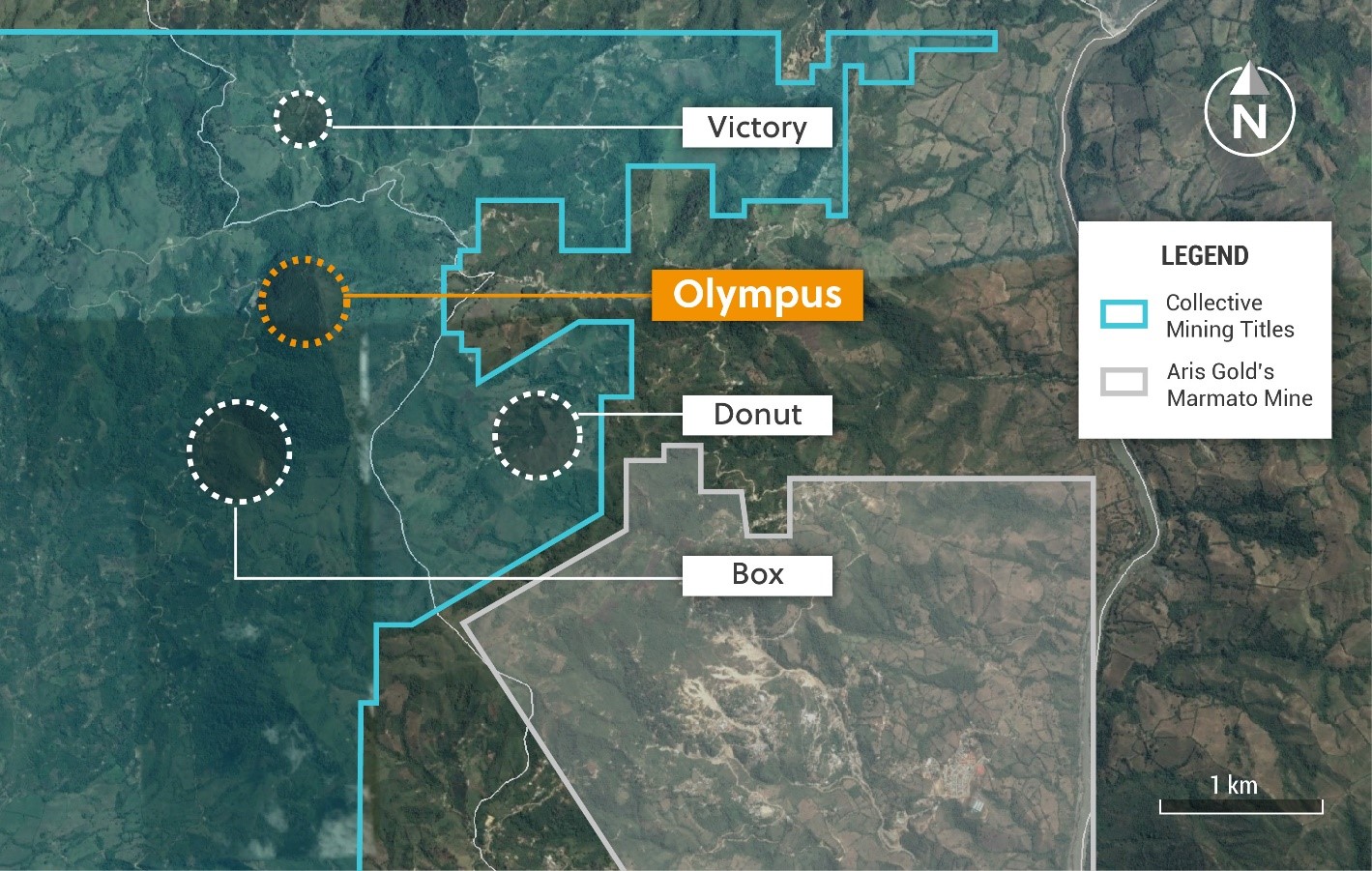

Collective Mining (TSXV:CNL) has announced sample assay results from its grassroot-generated Olympus target at the Guayabales project in Colombia. Results showed high-grade gold and silver high-grade vein systems, with channel sampling up to 221 g/t gold and 812 g/t silver. Results come from ongoing drilling at Guayabales where the company has three diamond drill rigs turning at the Olympus, Apollo, and Trap targets. The current results expand on the recently announced discovery holes at Olympus of 302 metres at 1.11 g/t gold equivalent and 216.7 metres at 1.08 g/t gold equivalent.

Highlights from the results are as follows:

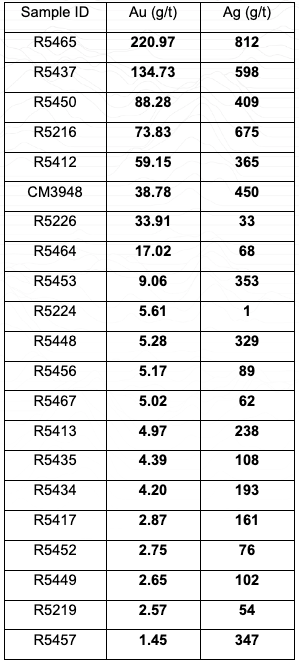

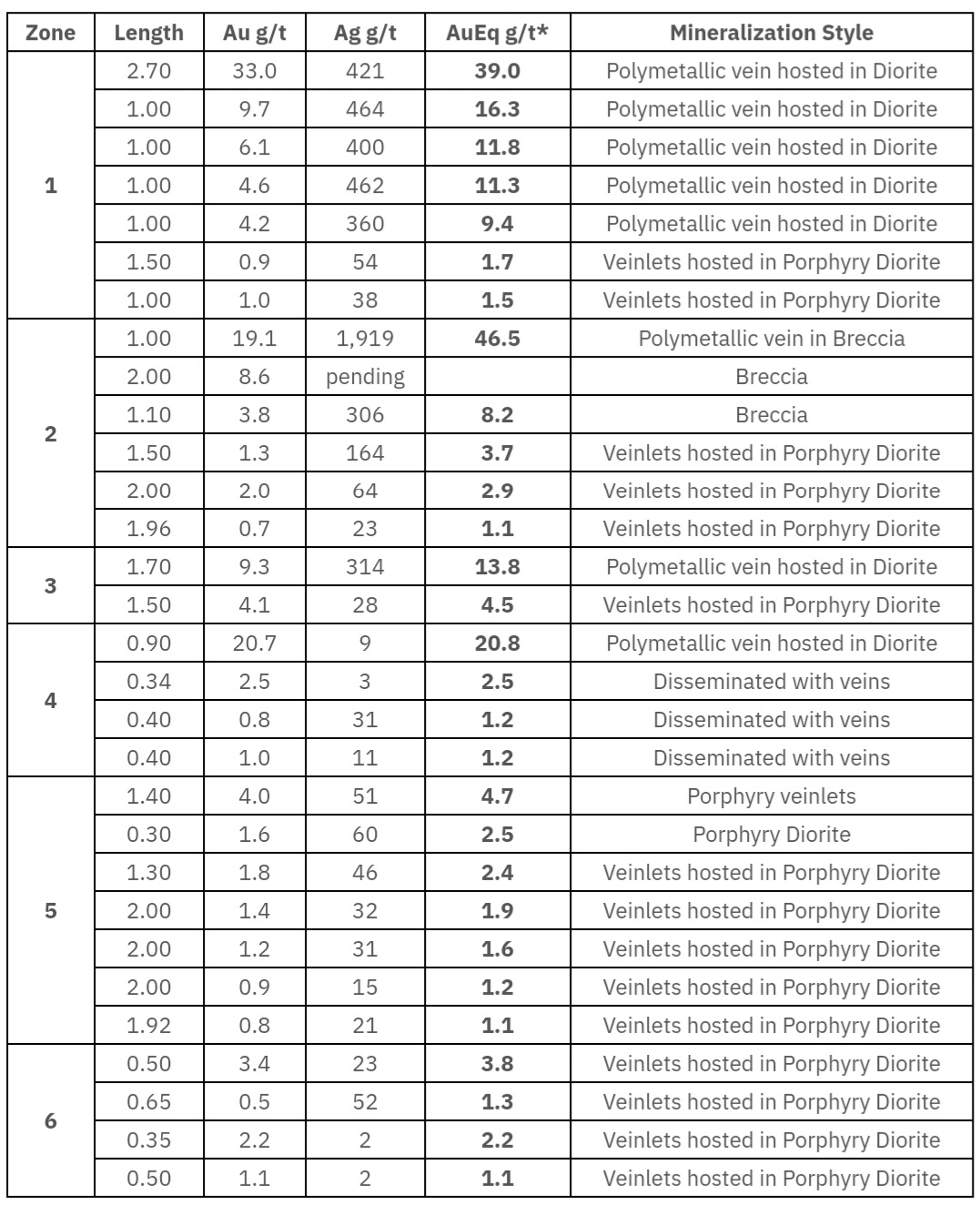

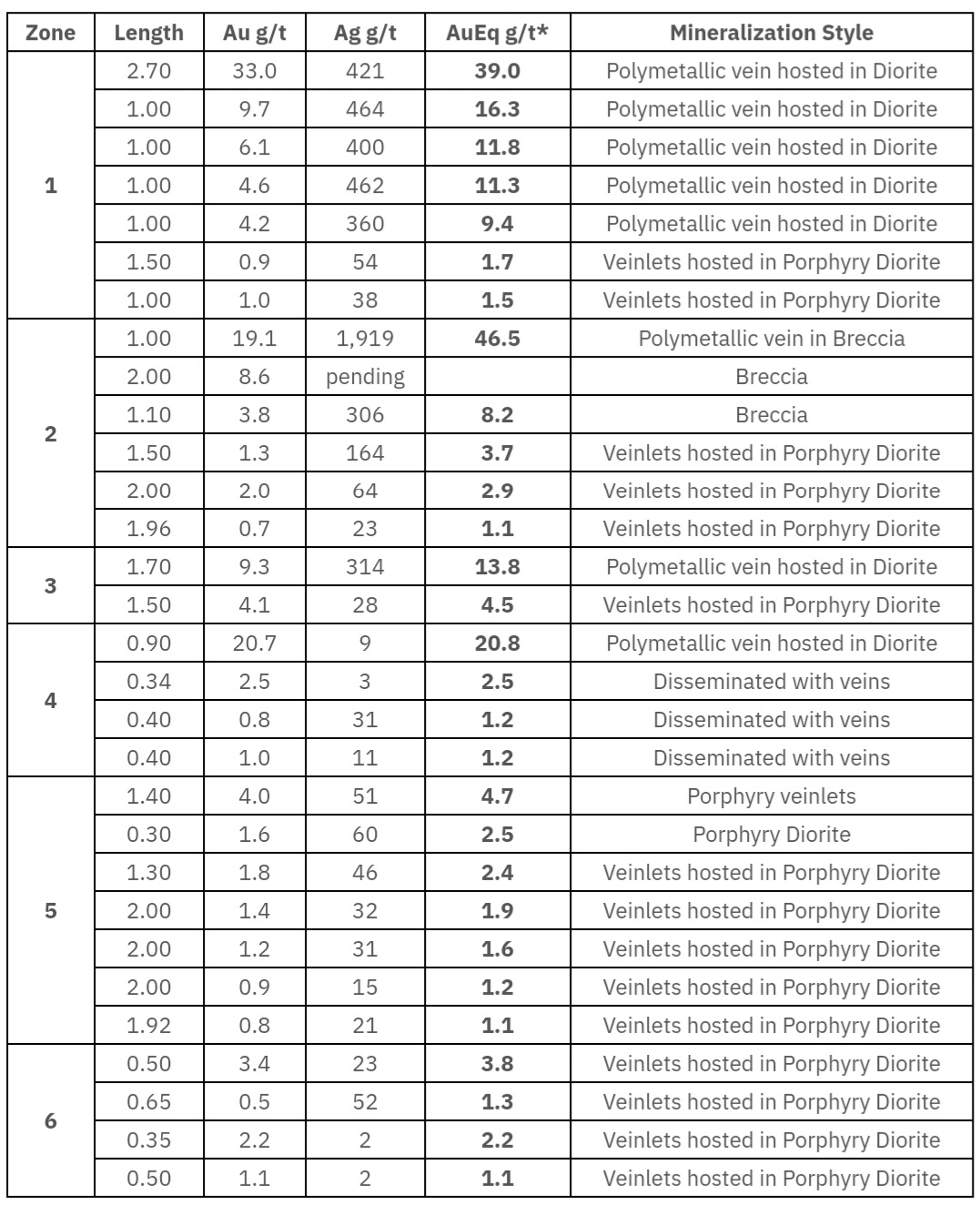

Assay results of chip channel samples taken from veins located within historical, shallow underground workings from Olympus confirm the continuation of the high-grade carbonate base metal (“CBM”) sheeted vein system into the southwest portion of the target area with results as follows:

Table 1: Chip Channel Sample Assay Results from Olympus

*Channel chip samples reported above are over true horizontal sampling widths of between 0.1 and 1 metre. Sample grades are uncapped

**Channel samples are representative of 2-dimensional space and as a result should not be relied upon as being representative of average grades anticipated in any future resource estimate or mining scenario.

***Assay results for base metals are still pending for all samples listed.

- Multiple CBM veins were sampled, where possible at Olympus, over an area measuring 250 metres x 250 metres from limited and partial exposures of rock in old tunnels. The CBM veins are sulphide rich and associated with intense sericite-illite alteration superimposed on porphyry diorite and mineralized, hydrothermal breccia. Porphyry-related CBM veins can demonstrate robust continuity over significant vertical and lateral dimensions.

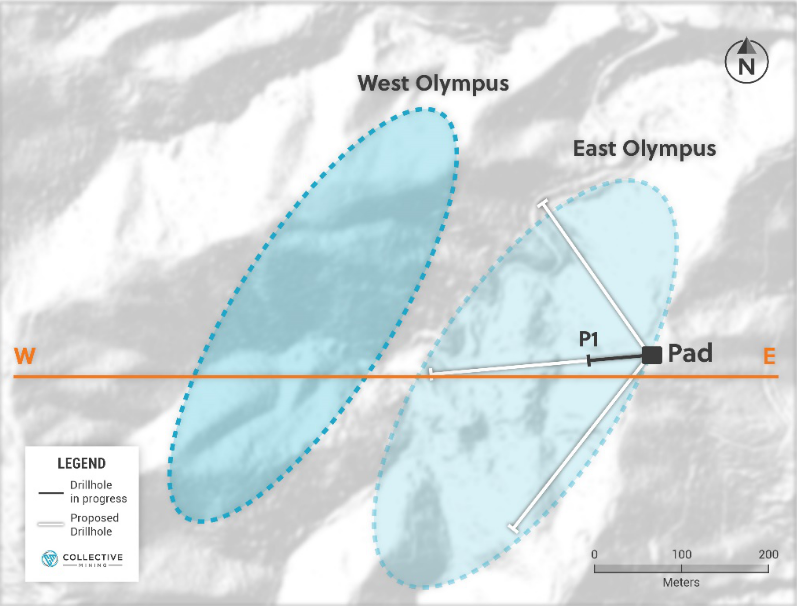

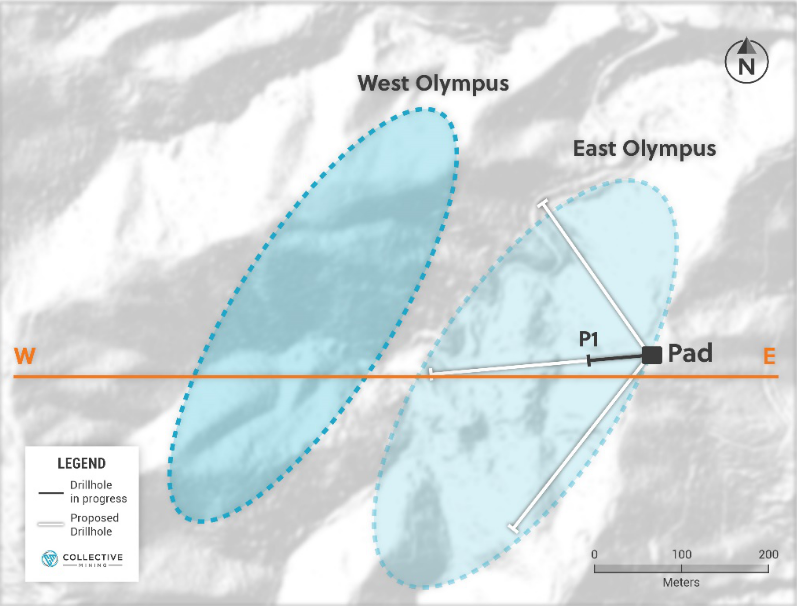

- Drilling, underground sampling and surface mapping to date have expanded Olympus to a target area measuring more than 1,400 metres by 900 metres, which hosts over 50 artisanal mines with over 25 veins mapped from available exposures. The Company believes that the probability is high that additional veins will be discovered as exploration ramps up. The Olympus target is open to the east, west, northwest, south and at depth.

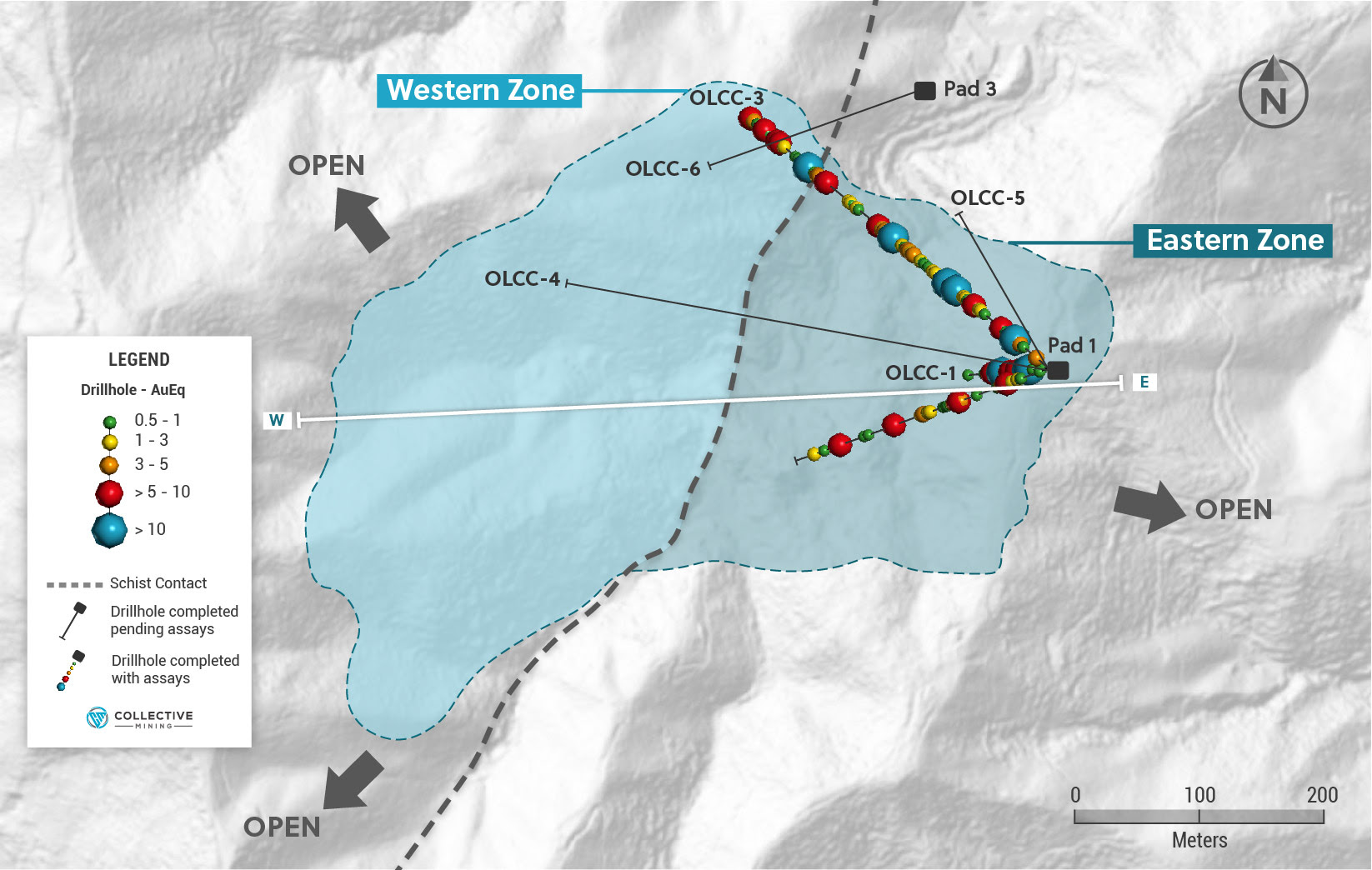

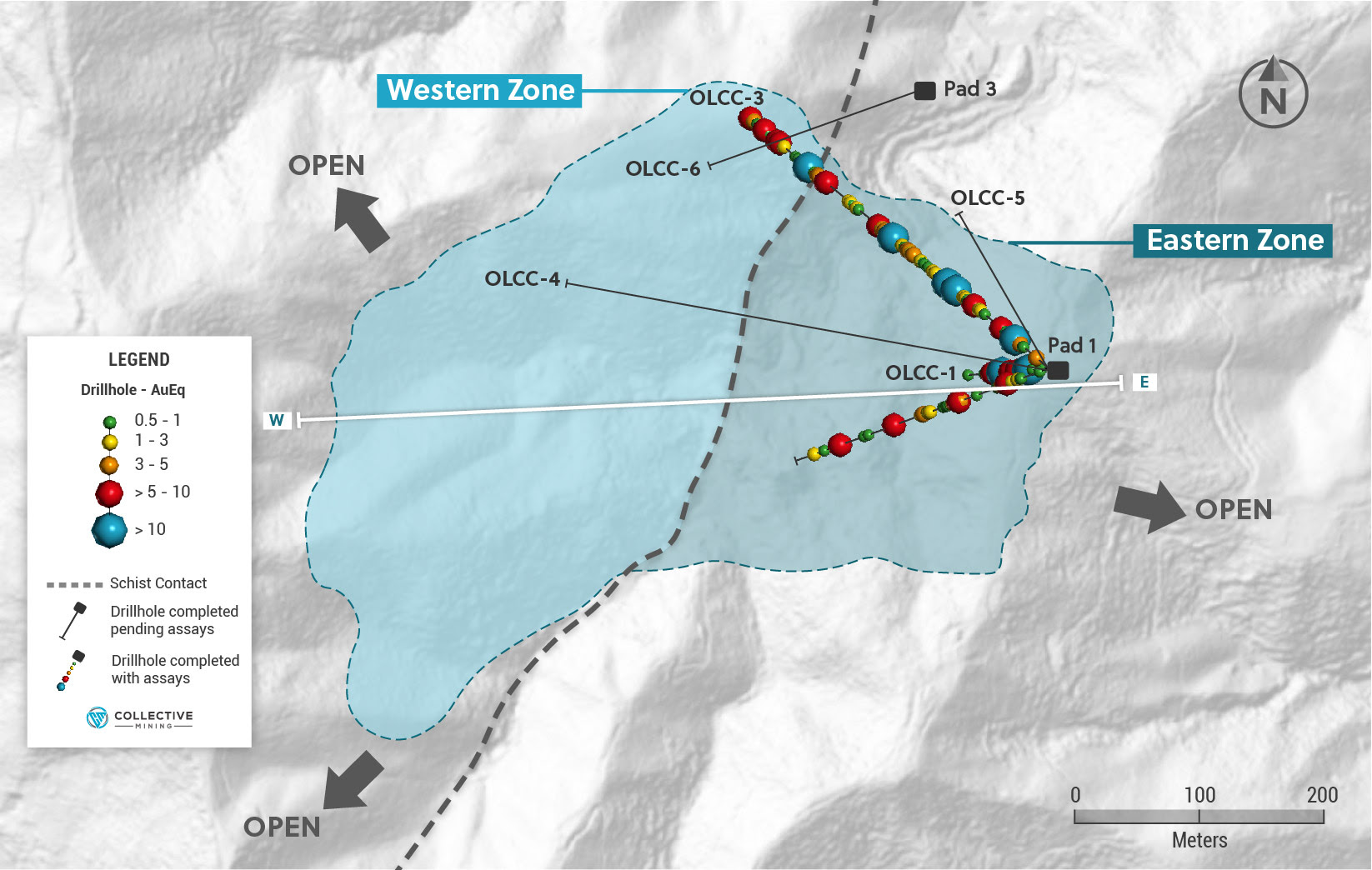

- Olympus now includes two mineralized zones. Both zones contain multiple porphyry and overprinting CBM veins associated with intense pyrite-sericite-carbonate alteration and hosted in a porphyry diorite (Eastern zone) and within schist country rocks intruded by porphyritic diorite (Western zone).

- The highest-grade samples collected to date at Olympus come from areas that have yet to be drill tested by the Company. Diamond drilling completed to date has only focused on a small northern portion of the Eastern and Western zones while recent surface and underground mapping has expanded the Western zone to the west and southwest.

- The Company is planning to move two underground rigs in Q2 into the area covered by these high-grade channel sampling results.

“With the scale of veining and alteration at Olympus and mineralized systems that come to surface, the Company now believes that we have a discovered a vein and broad mineralized system,” commented Ari Sussman, Executive Chairman. “The more exploration we undertake, the more high-grade veins we find. We will remain aggressive with drilling at Olympus and look forward to commencing the first underground drill-hole into the high-grade vein portion of the system in June 2022.”

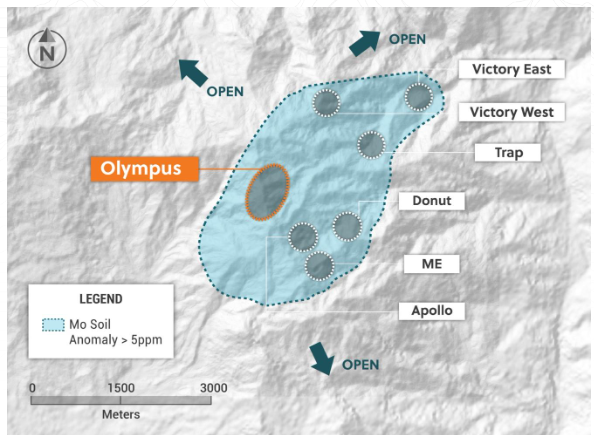

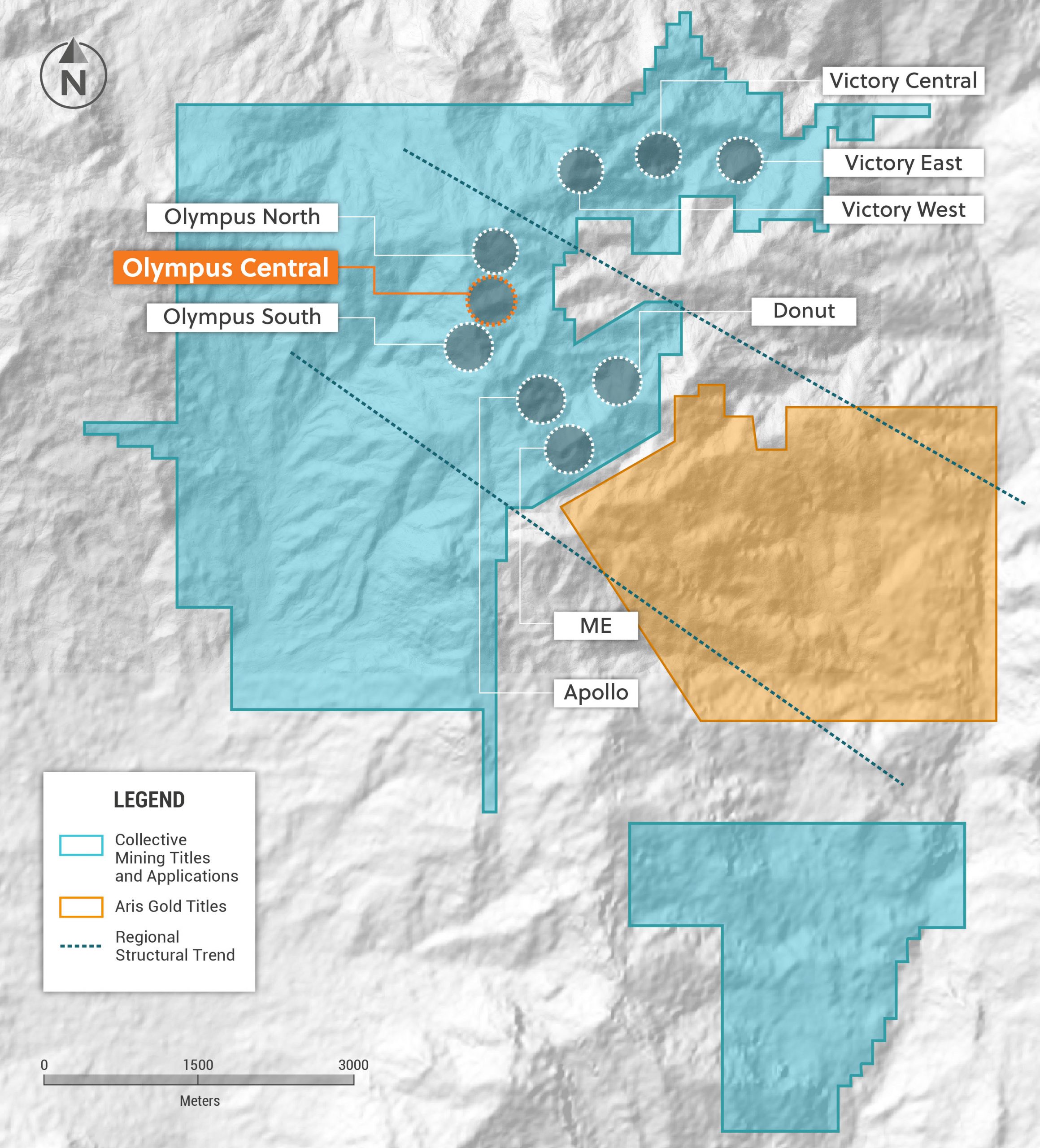

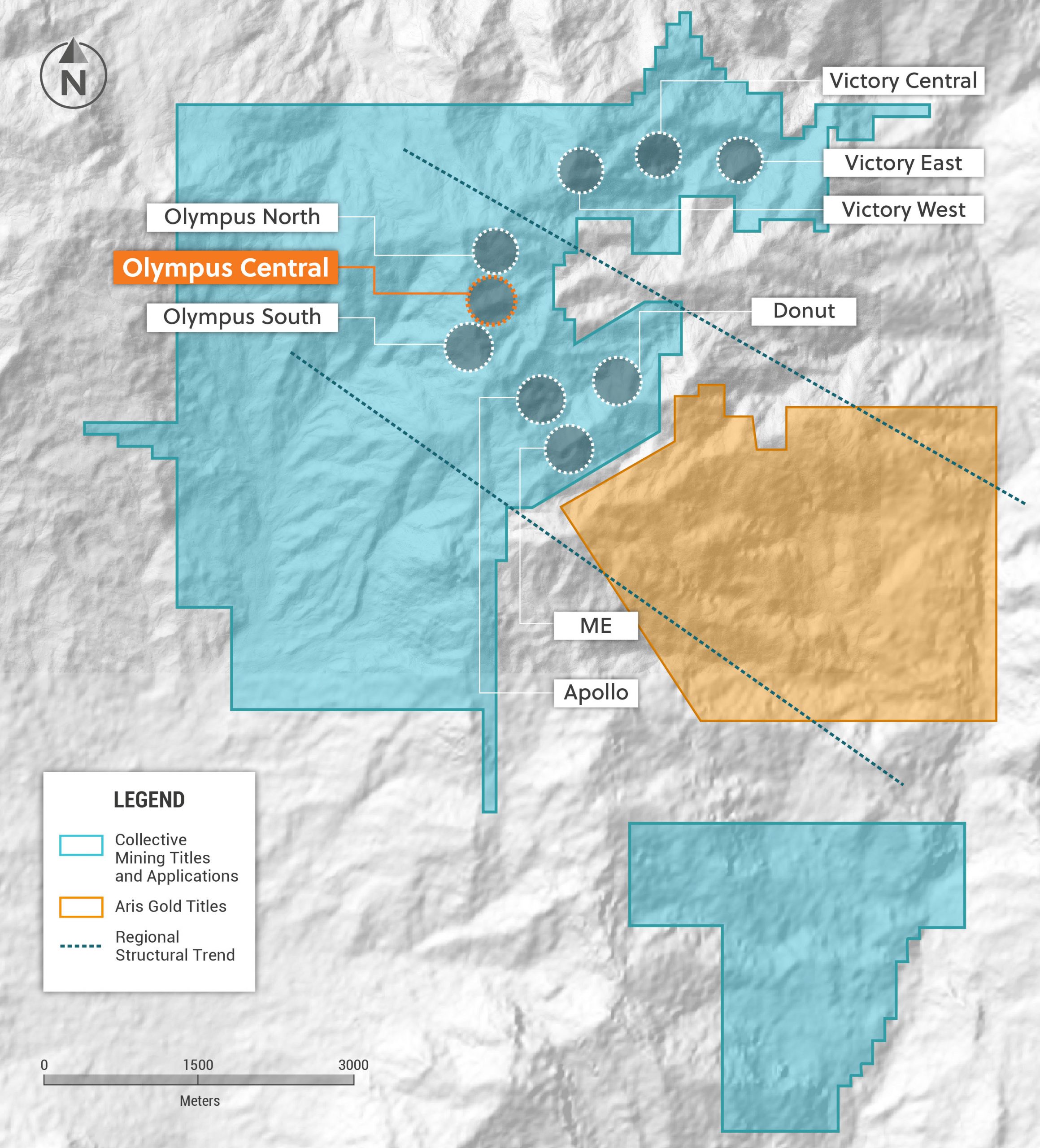

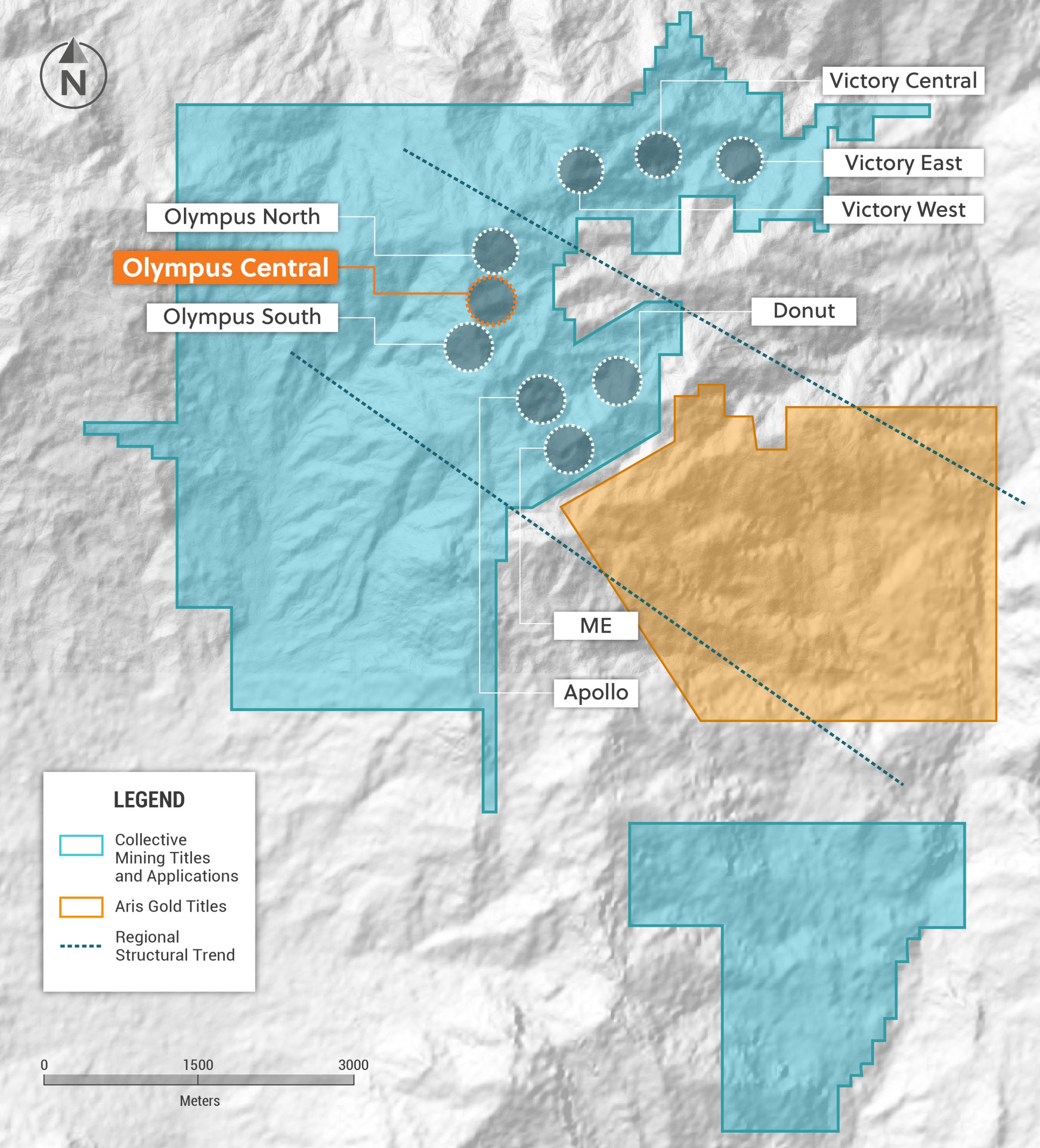

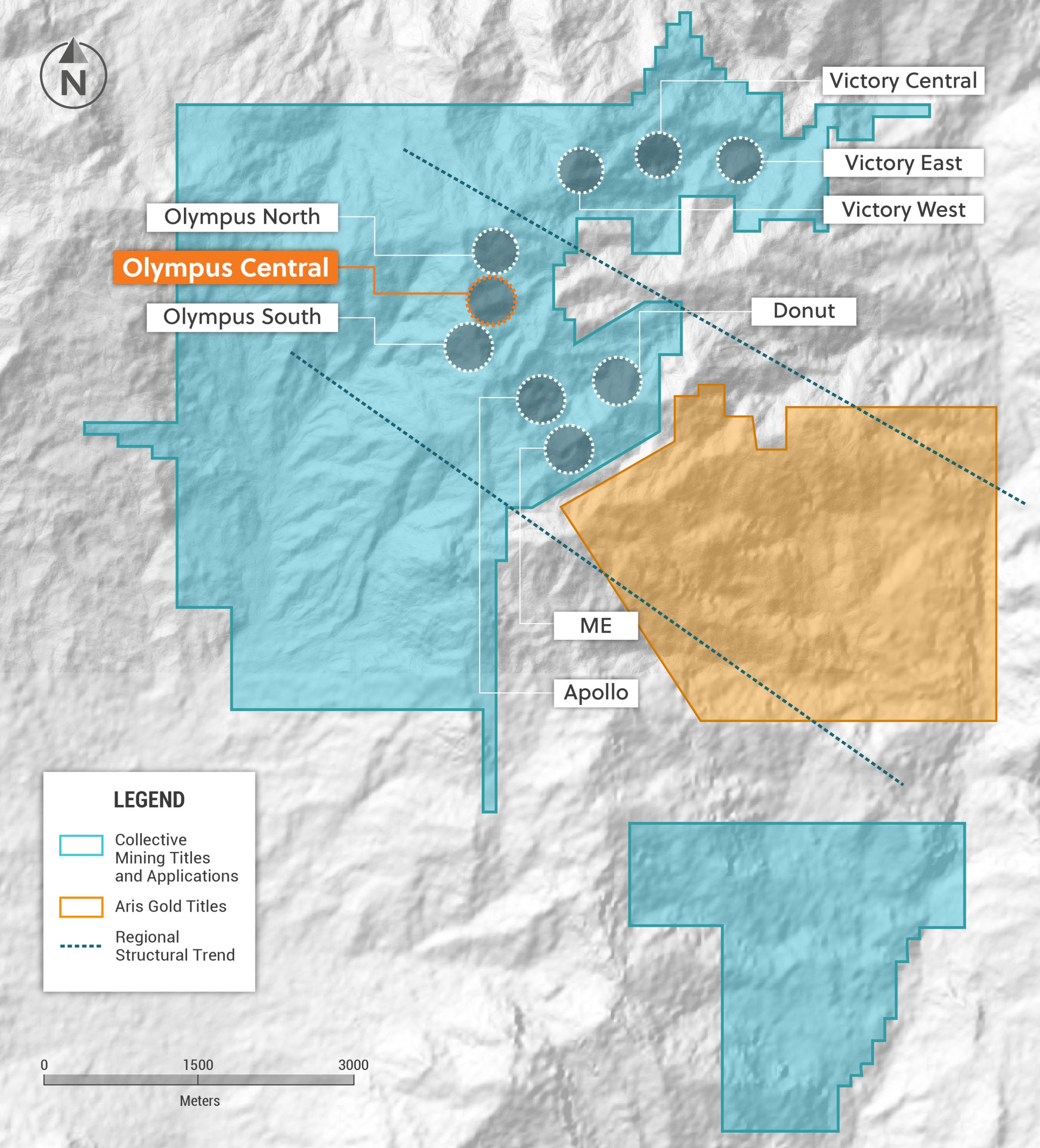

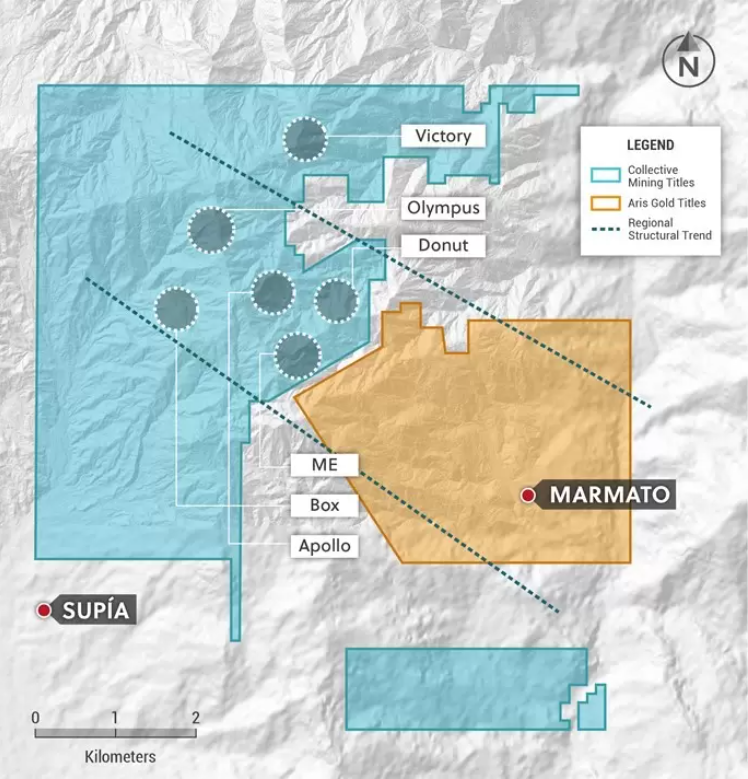

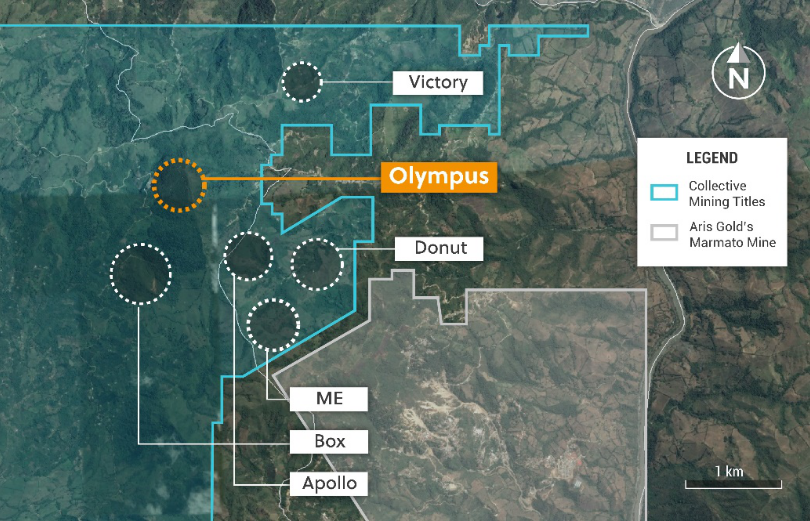

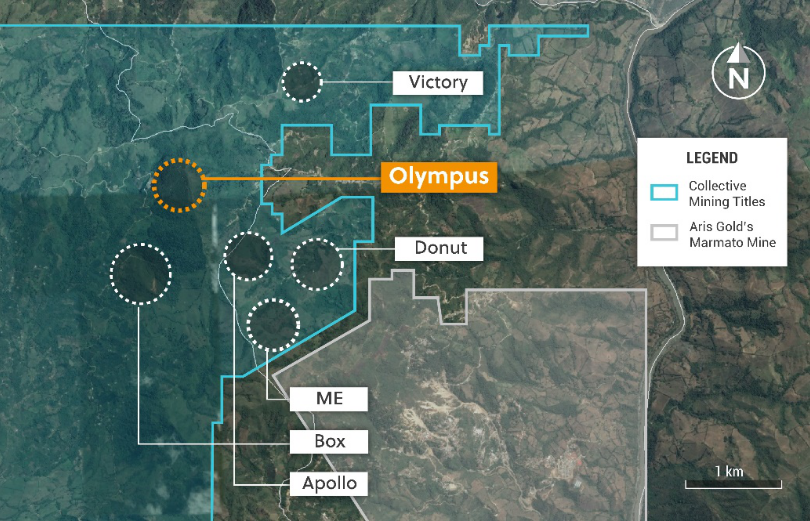

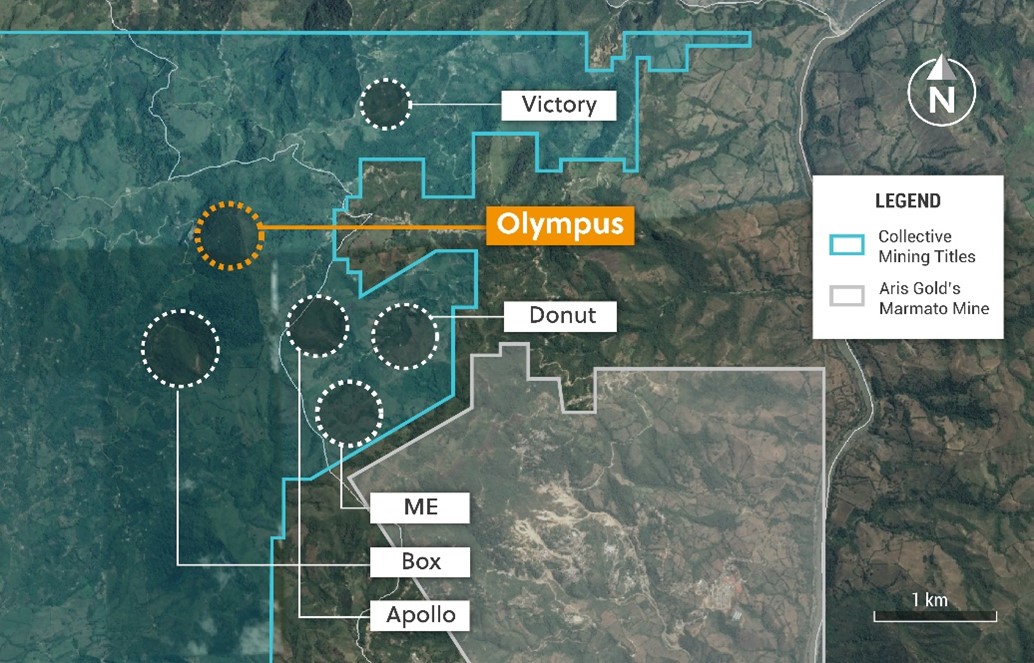

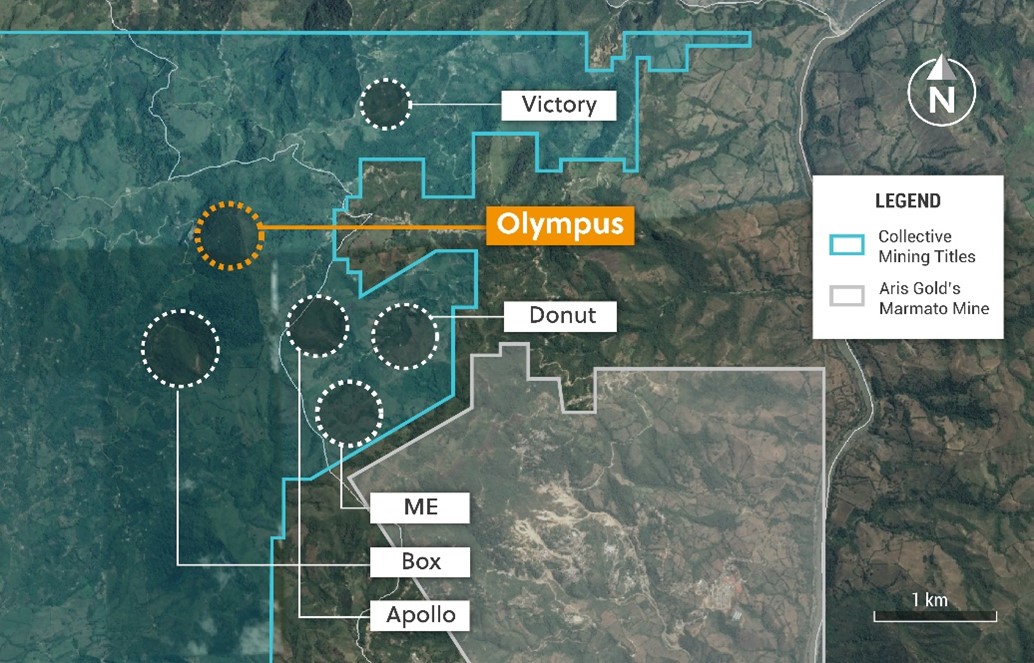

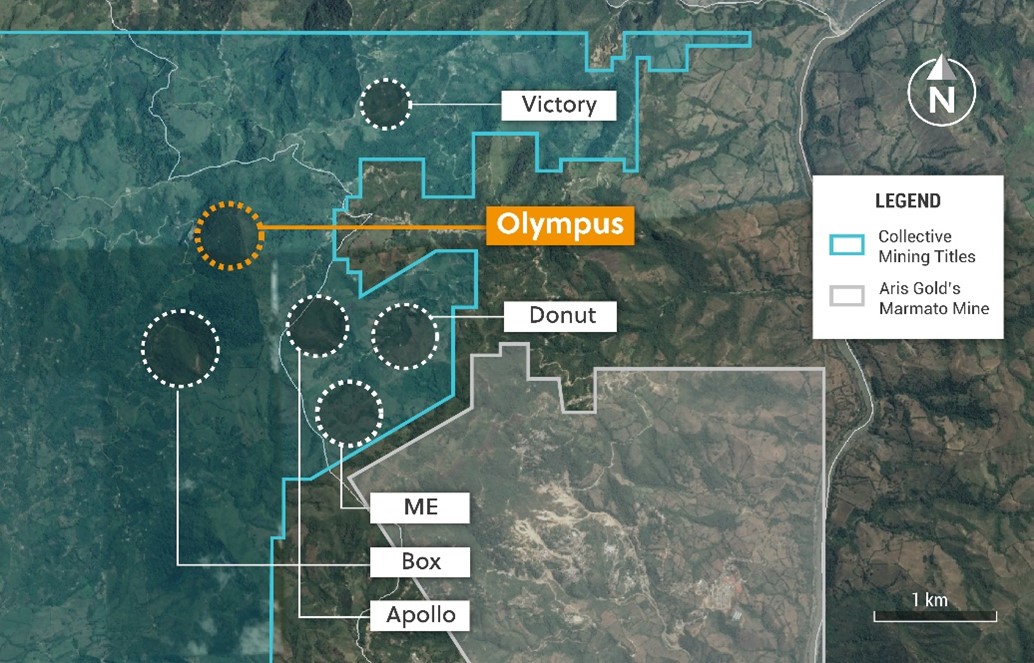

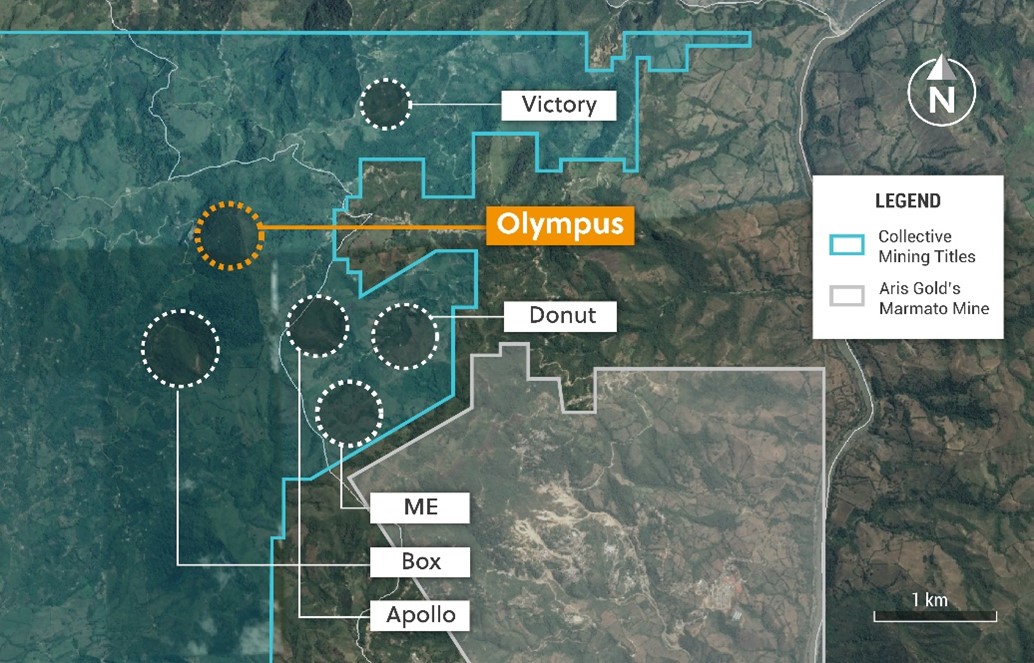

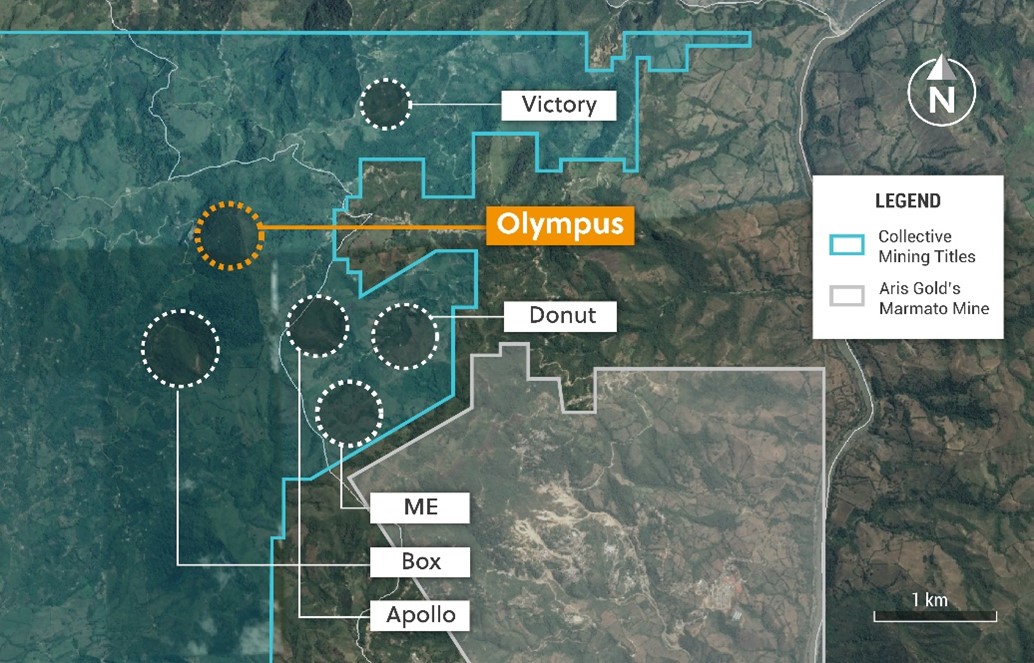

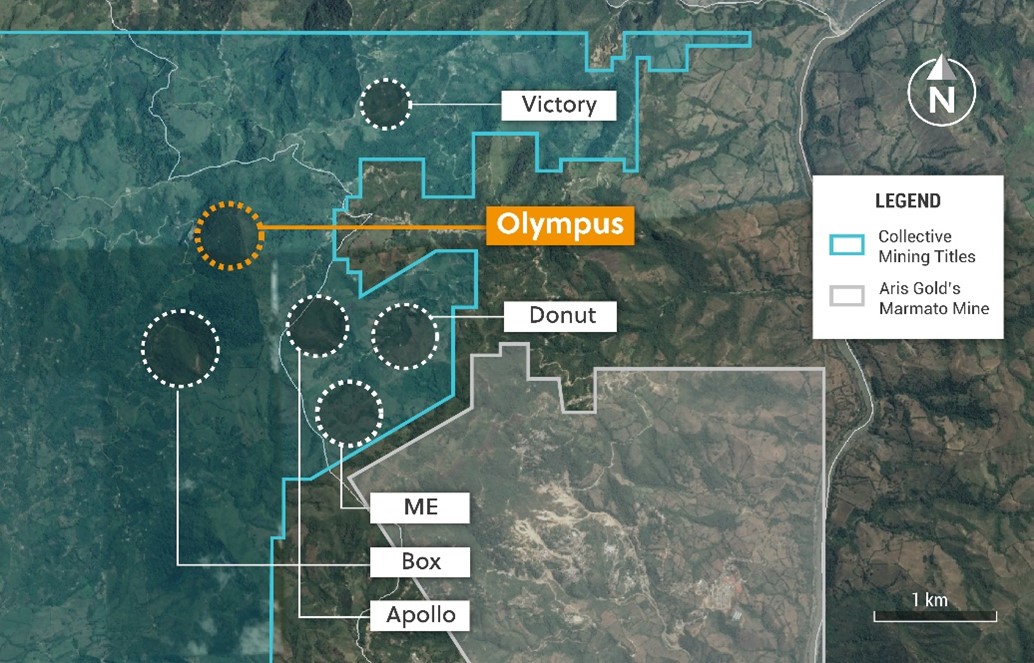

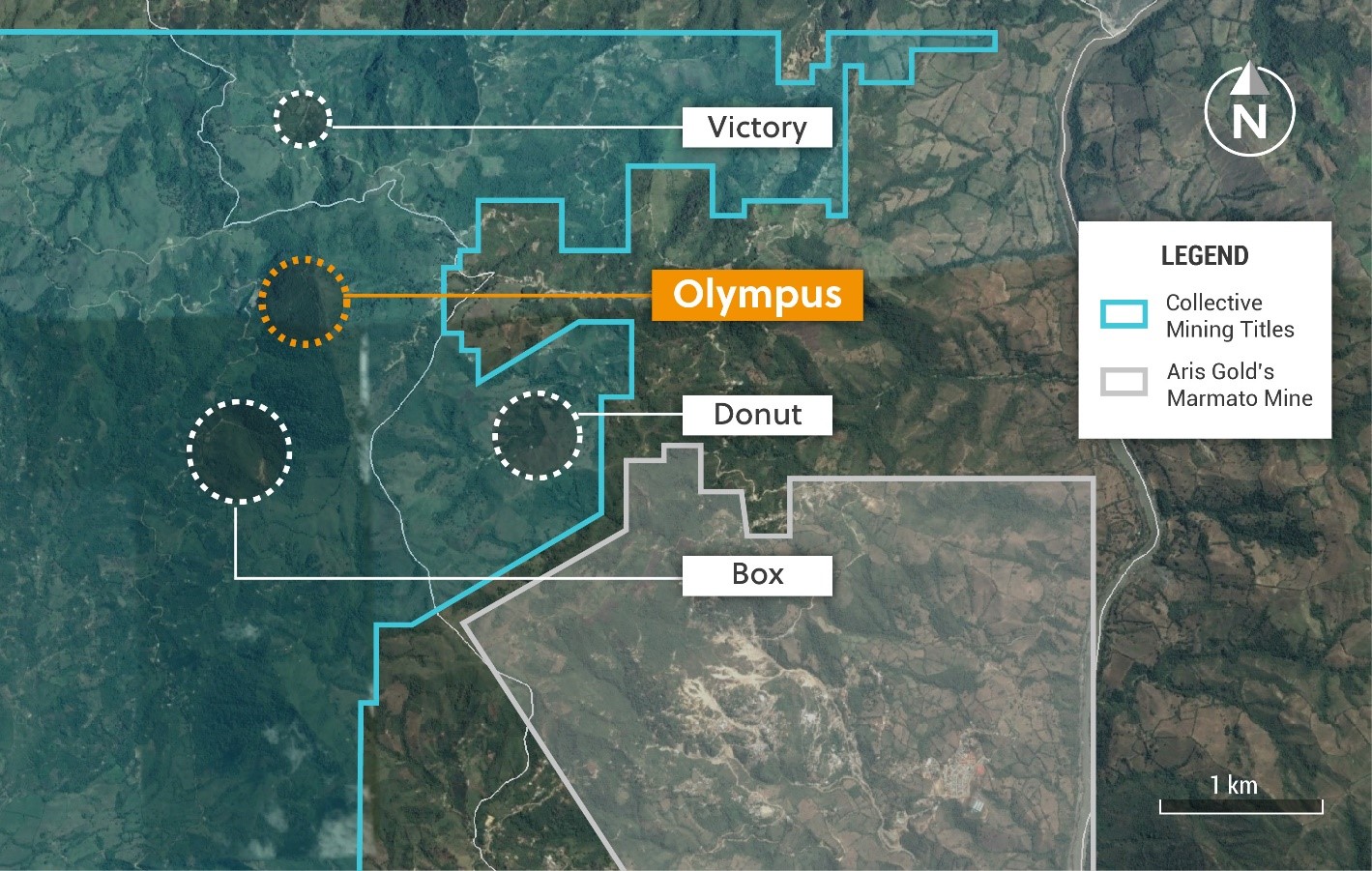

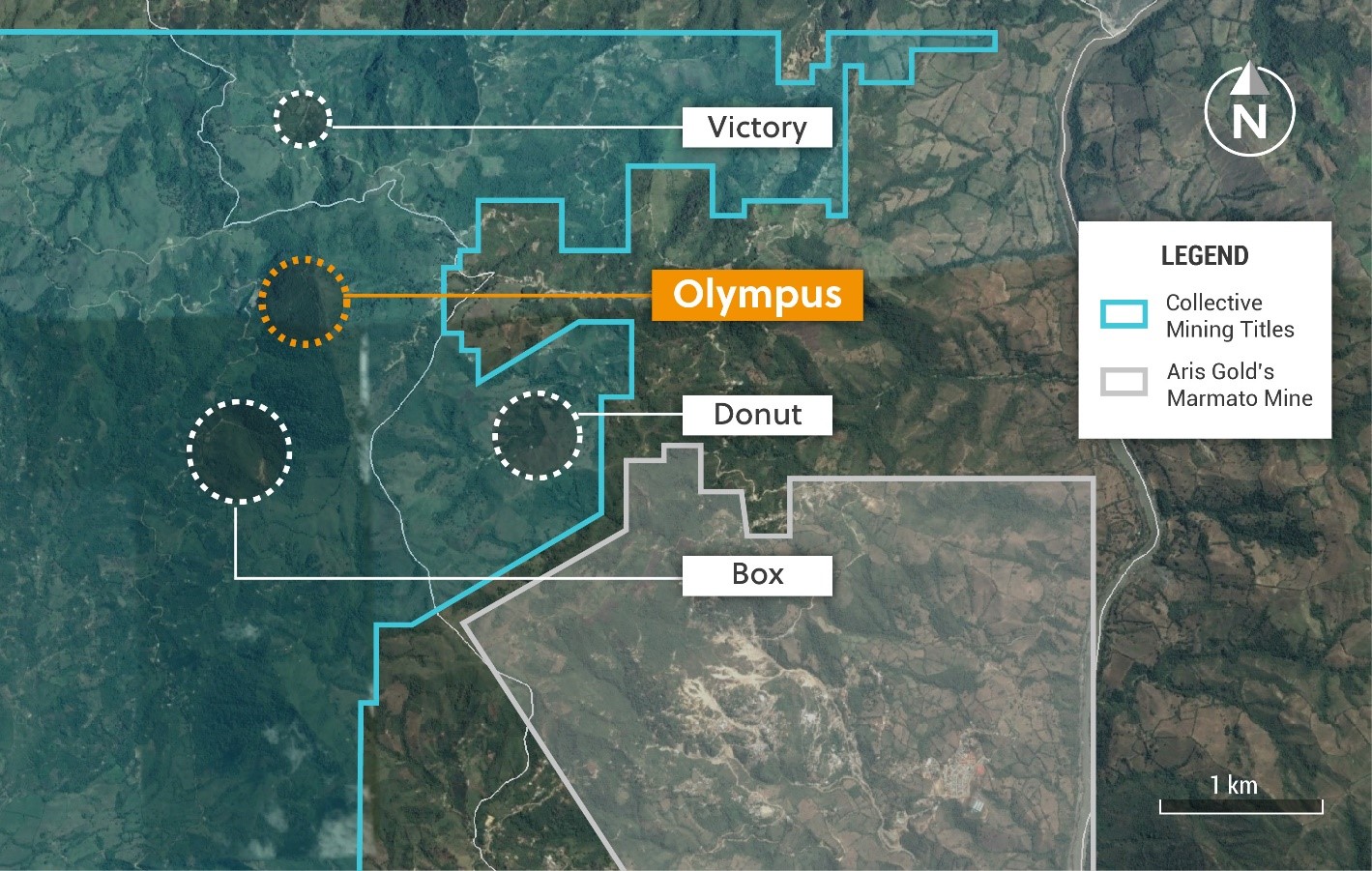

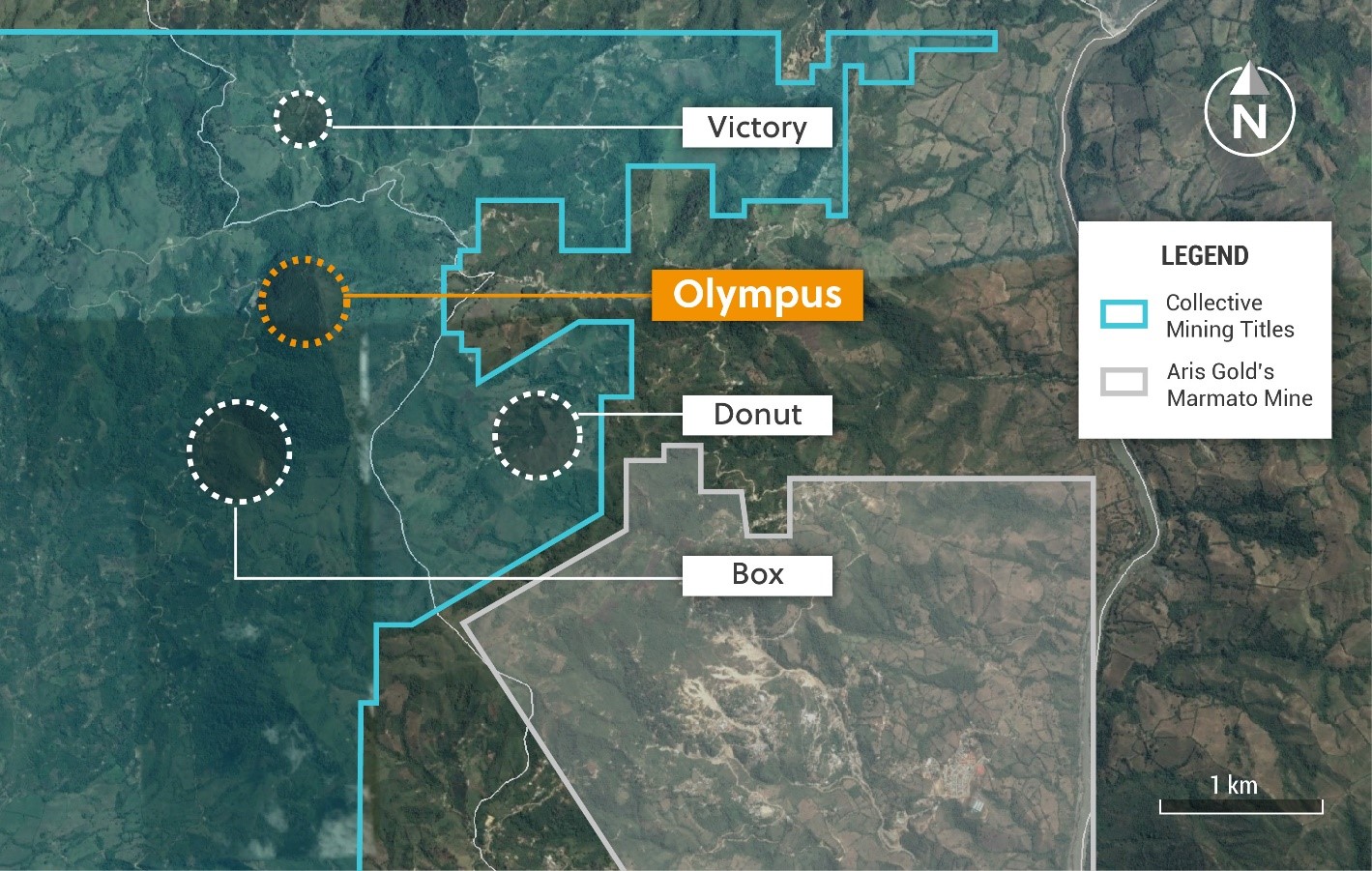

Figure 1: Plan View of the Guayabales Project and the Olympus South Target

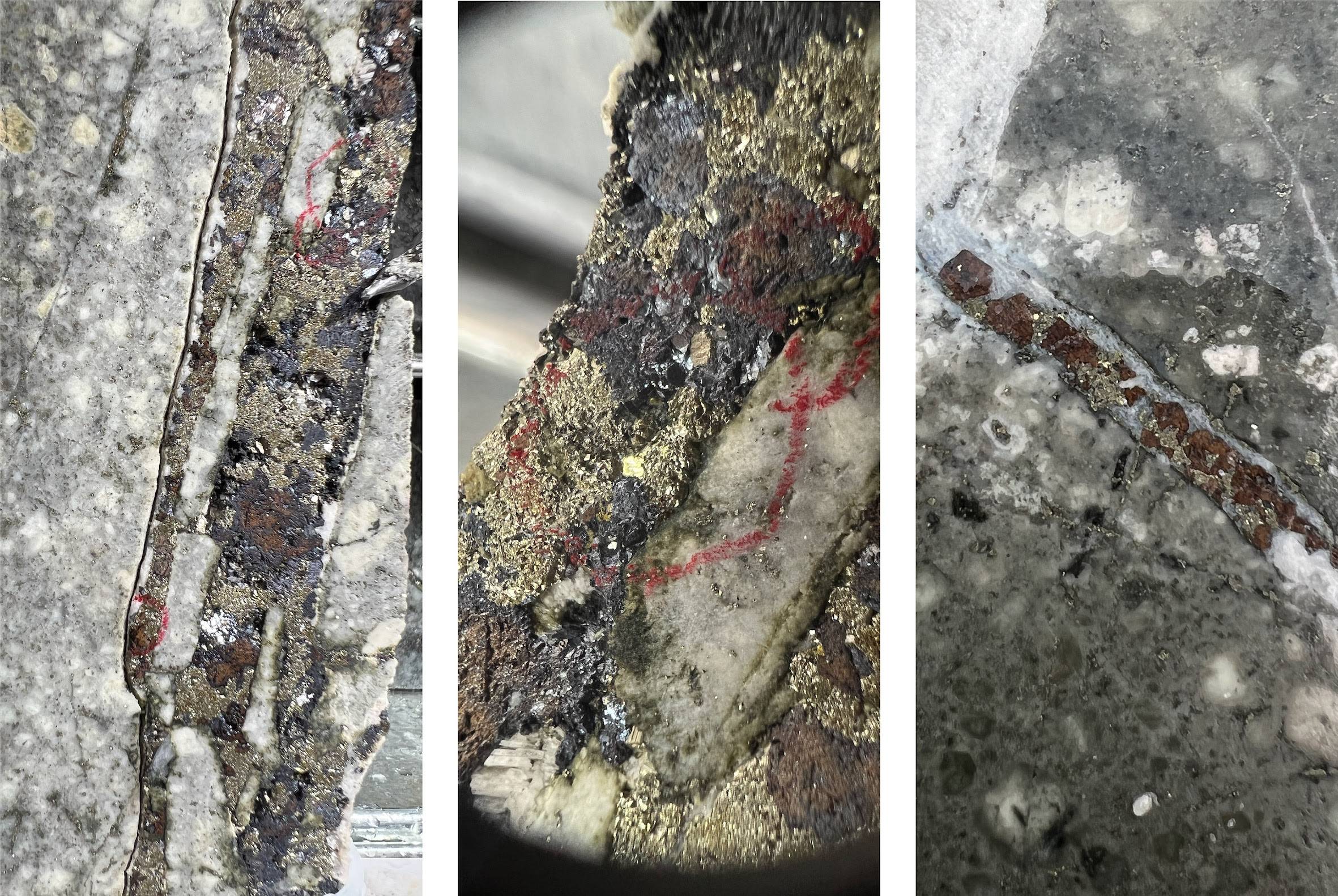

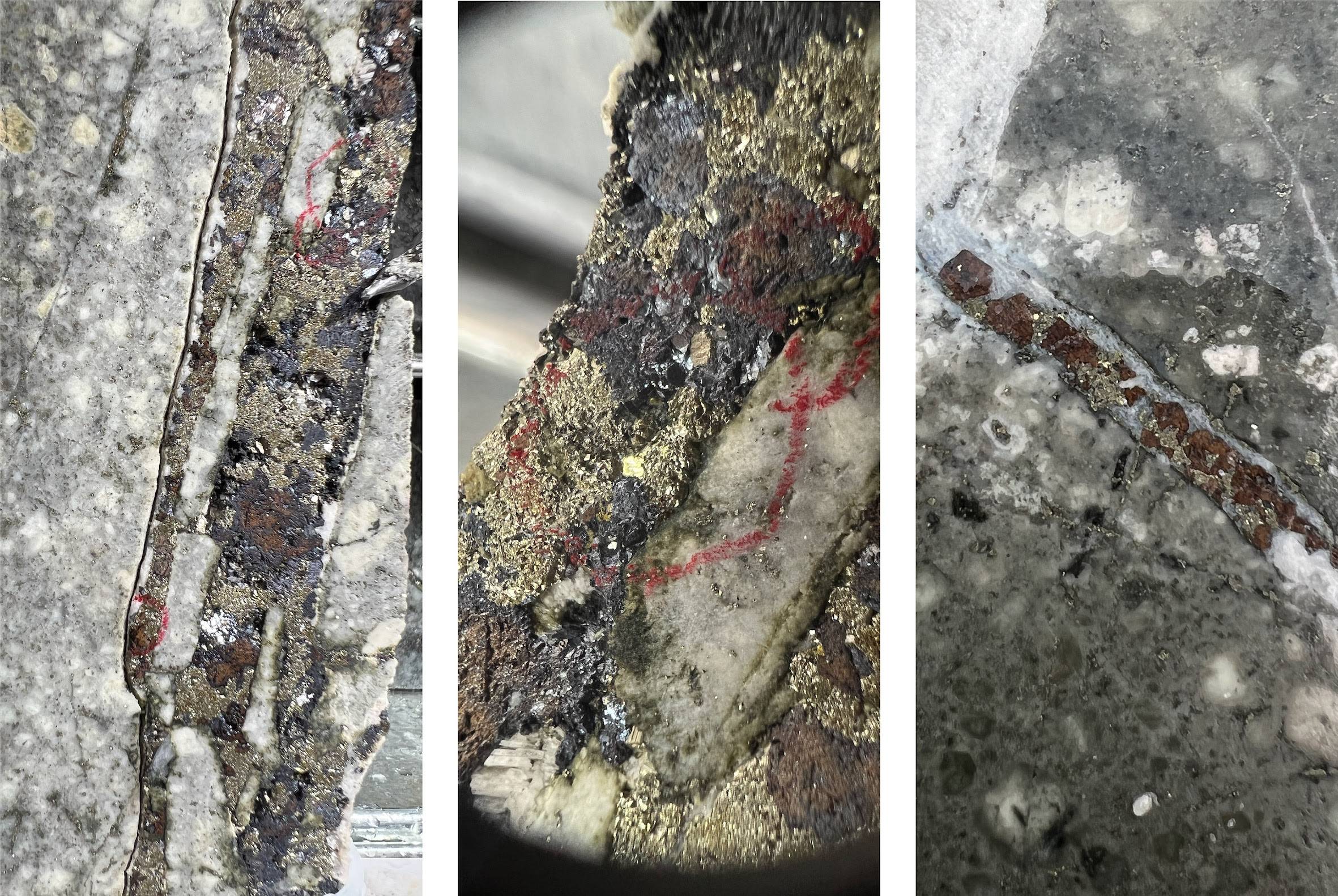

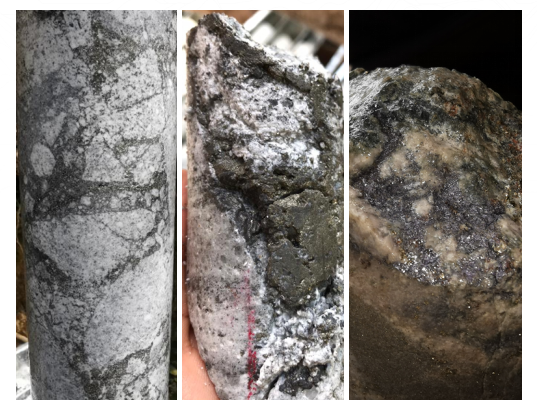

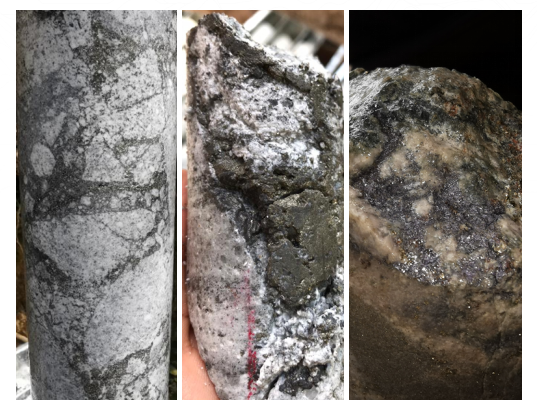

Figure 2: Photos of High-Grade Polymetallic Grab Samples Taken at Olympus

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

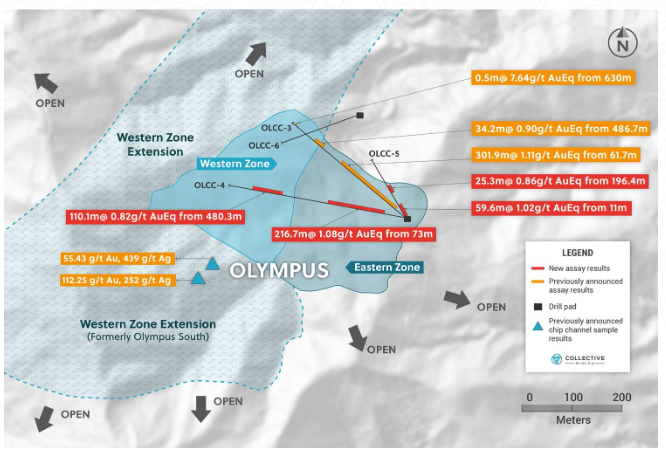

Collective Mining (TSXV:CNL) has announced major assay results from the Olympus Target within the Gauayabales project in Colombia. The results were from four additional diamond drill holes, and included 216.7m grading 1.08g/t gold equivalent. The company has also expanded the target area for follow-up exploration based on revised geological modelling data. Guayabales has seen multiple discoveries and follow-up drilling, as part of the minimum 20,000-metre program in 2022. The drill program is fully financed, with three diamond drill rigs operating at various targets.

Ari Sussman, Executive Chairman of Collective Mining, commented in a press release: “The Olympus target is advancing rapidly due to our exploration work and geological understanding and this has resulted in a 125 percent expansion of the target area. We are extremely excited about the precious metal potential of the system given the broad intercepts of gold and silver mineralization encountered in early drilling, the sheer size of the alteration system and the plethora of high-grade gold and silver-bearing, porphyry related, CBM veins. All the ingredients are in place for Olympus to evolve into a multi-million-ounce precious metal deposit. As our team understands full-well from our prior experience of exploring and developing the Buriticá project in Colombia, porphyry-related CBM veins can demonstrate robust continuity over significant vertical and lateral dimensions. Analogous to Olympus are both the multi-million-ounce high-grade Marmato and Buriticá systems, with each deposit measuring more than 1.5 vertical kilometres. The Marmato project is located approximately 3 kilometres to the southeast of Olympus and is situated within the same structurally controlled, porphyry intrusion – CBM vein, corridor.”

Highlights from the drill results are as follows:

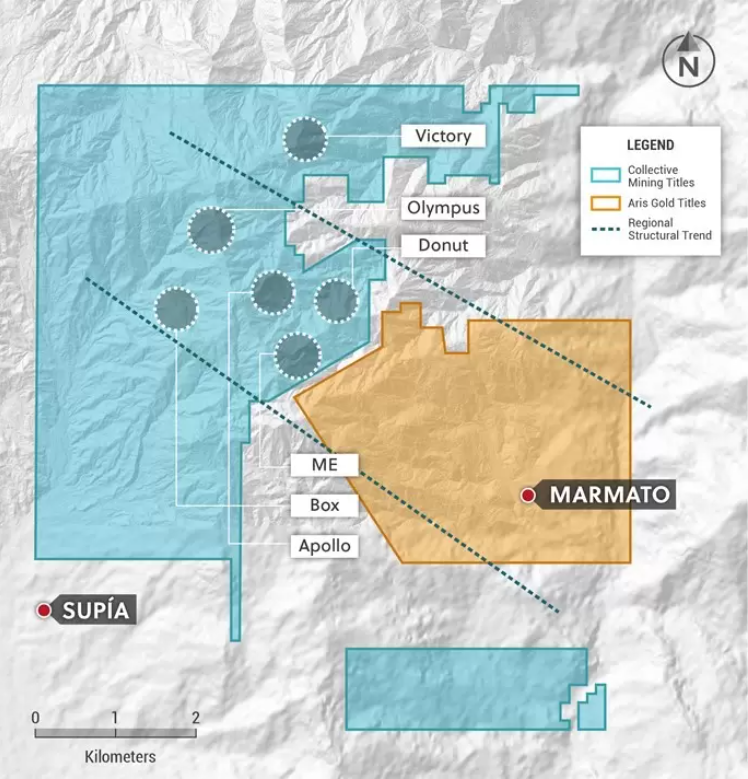

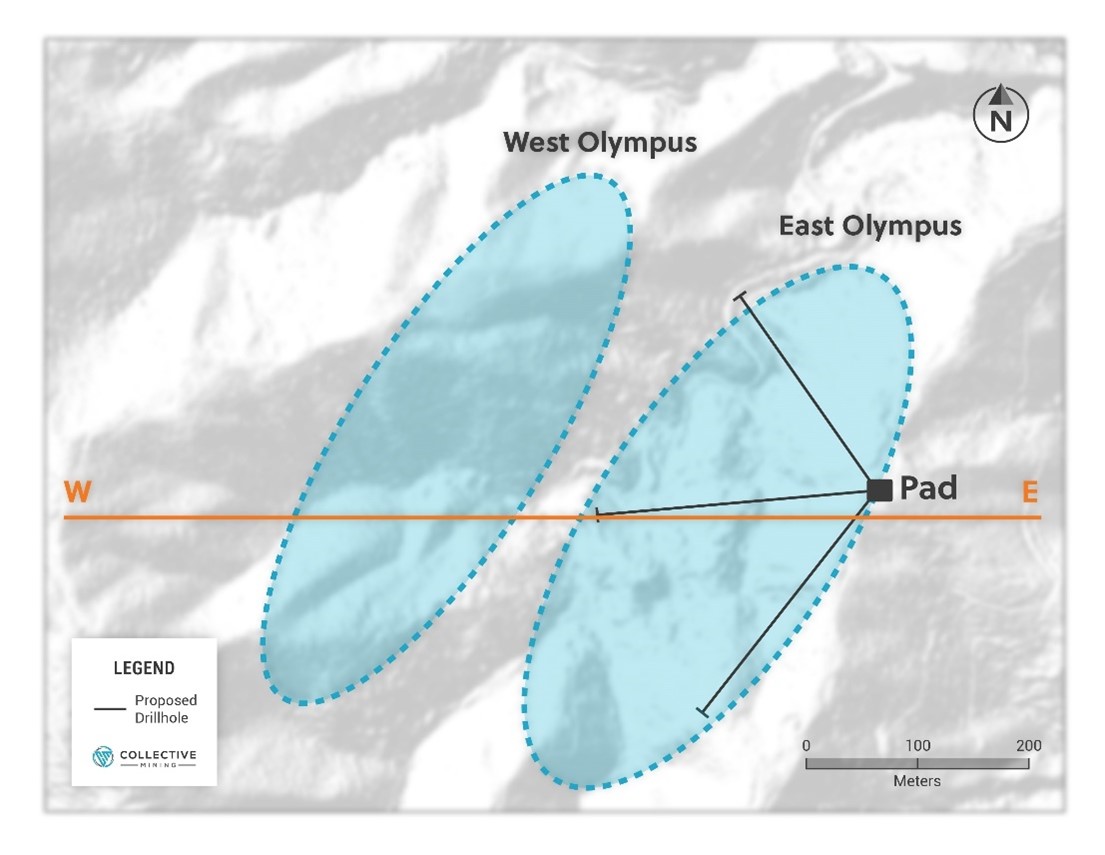

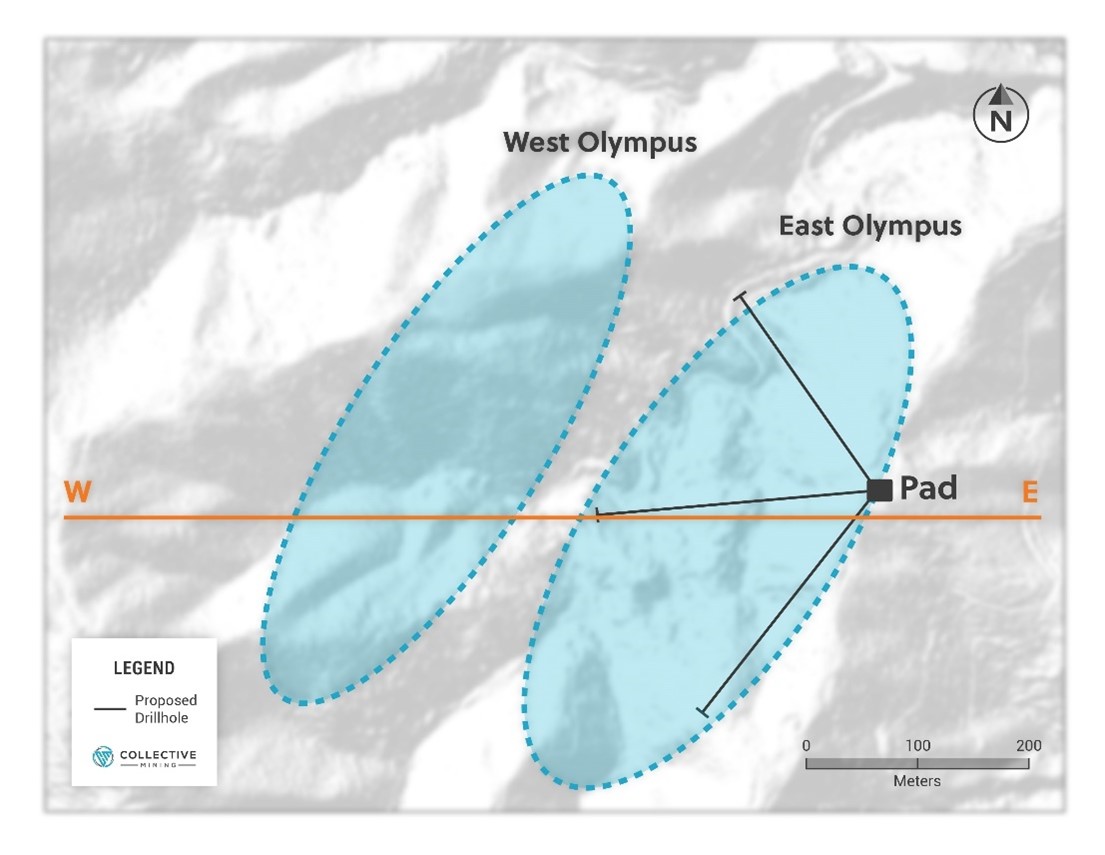

- As a result of geological modelling, drilling, underground sampling and detailed mapping, the Company now interprets Olympus Central and Olympus South to be one large interconnected mineralized system measuring up to 1.4 kilometres north-south by 900 metres east-west. The area, which will now be referred to simply as “Olympus,” remains open for expansion to the northwest, west, south and east.

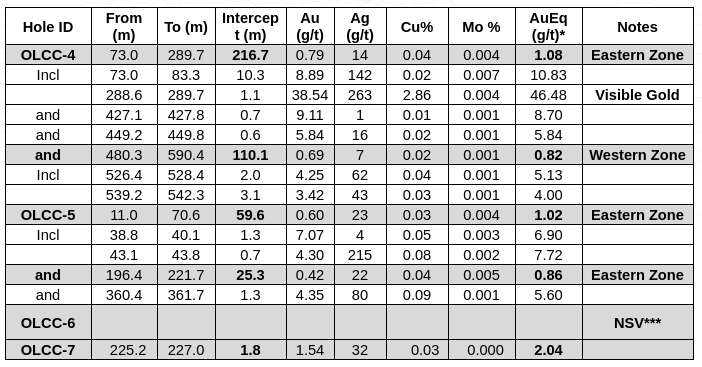

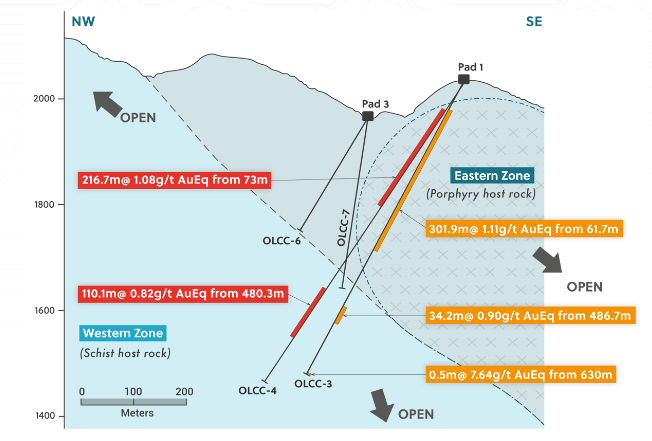

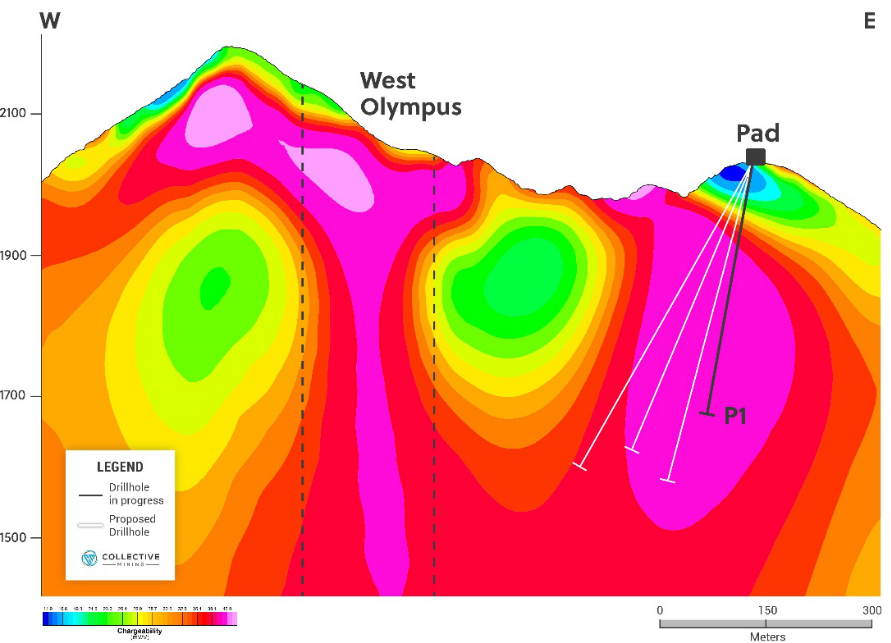

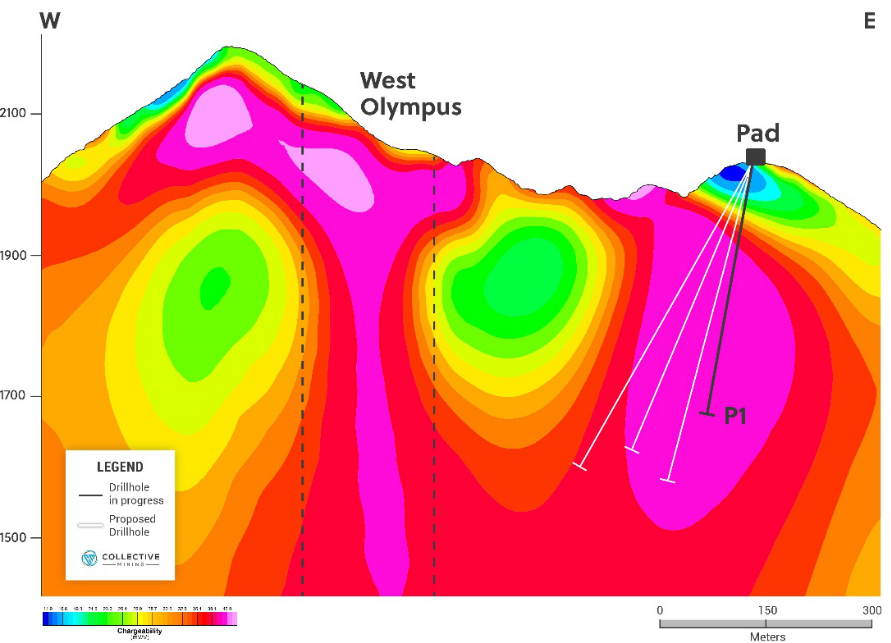

- Olympus hole OLCC-4 was drilled westward at a 60-degree angle and intersected both the mineralized Eastern and Western zones. The Eastern Zone is hosted primarily within porphyry diorite and has carbonate base metal (“CBM”) veins overprinting it while the Western Zone is hosted predominately within schist country rock impregnated by multiple zones of sheeted CBM veins with results as follows:

- 216.7 metres @ 1.08 g/t gold equivalent from 73 metres down-hole (Eastern Zone, drill hole OLCC-4)

- 110.1 metres @ 0.82 g/t gold equivalent from 480.3 metres down-hole (Western Zone, drill hole OLCC-4)

- Olympus hole OLCC-5 was drilled to the northwest at 70-degree angle and intercepted the Eastern Zone as follows:

- 59.6 metres @ 1.02 g/t gold equivalent from 11 metres down-hole before crossing into a late phase intrusion which appears to have eliminated the mineralization in this location. Additional patchy mineralization in the Eastern Zone was encountered further down-hole including 25.3 metres @ 0.86 g/t gold equivalent. The Company will focus future drilling in the Eastern Zone along strike to the south where it remains wide open for expansion. Lastly, this hole was not drilled far enough to intersect the projection of the Western Zone.

- Recent surface mapping and interpretation of drill data has led to a refinement of the Company’s model for the Western Zone. The schist-intrusive contact is shallow dipping and daylights at surface in the west for at least 200 metres of strike. Future drilling will target the untested, shallow projection of the Western Zone. Holes OLCC-6 and OLCC-7 were unfortunately, not drilled deep enough to intersect this Western Zone projection at depth (see Figure 3).

- Exploration work to date within both historical and current artisanal mines has outlined more than 25 veins. Previously announced chip channel sampling assay results have confirmed the high-grade nature of the veins with precious and base metal grades assaying up to 485 g/t gold, 1,919 g/t silver, 2.86% copper and combined zinc and lead grades in excess of 25 percent. Drilling completed thus far by the Company has been principally focused on the northern portion of the eastern zone and has not therefore tested below these high grade, artisanal mines. An extensive chip channel sampling campaign has been undertaken within the old mines with assay results anticipated in the near term.

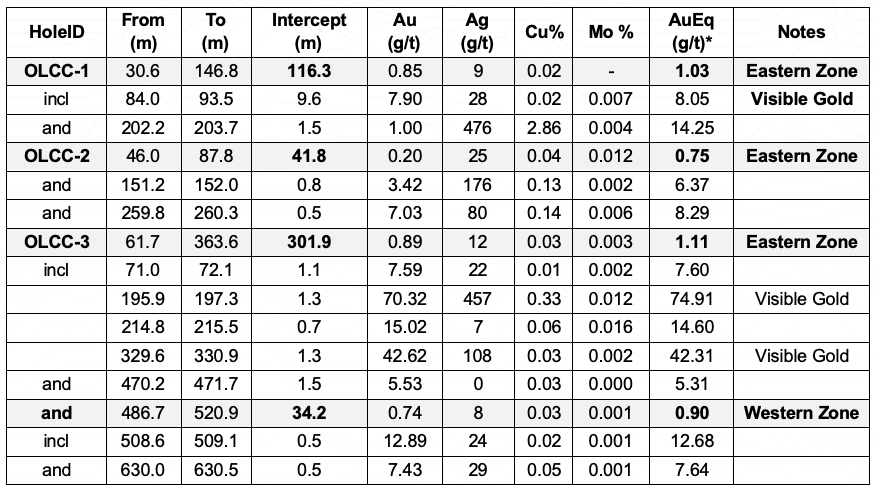

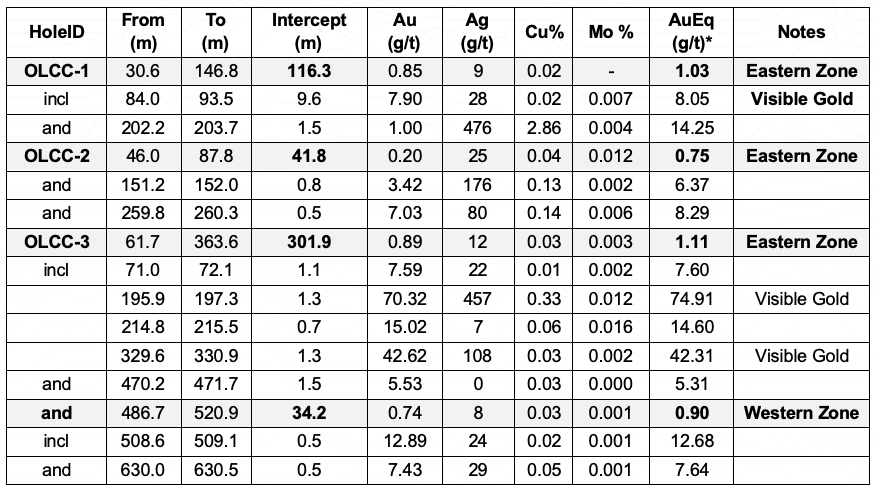

Table 1: Assay Results

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.017 x 0.95) + (Cu (%) x 2.06 x 0.95) + (Mo (%) x 6.86 x 0.95), utilizing metal prices of Cu – US$4.50/lb, Mo – US$15.00/lb, Ag – $25/oz and Au – US$1,500/oz and recovery rates of 95% for Au, Ag, Cu and Mo.

Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown, and grades are uncut.

*** No significant values reported in this intercept

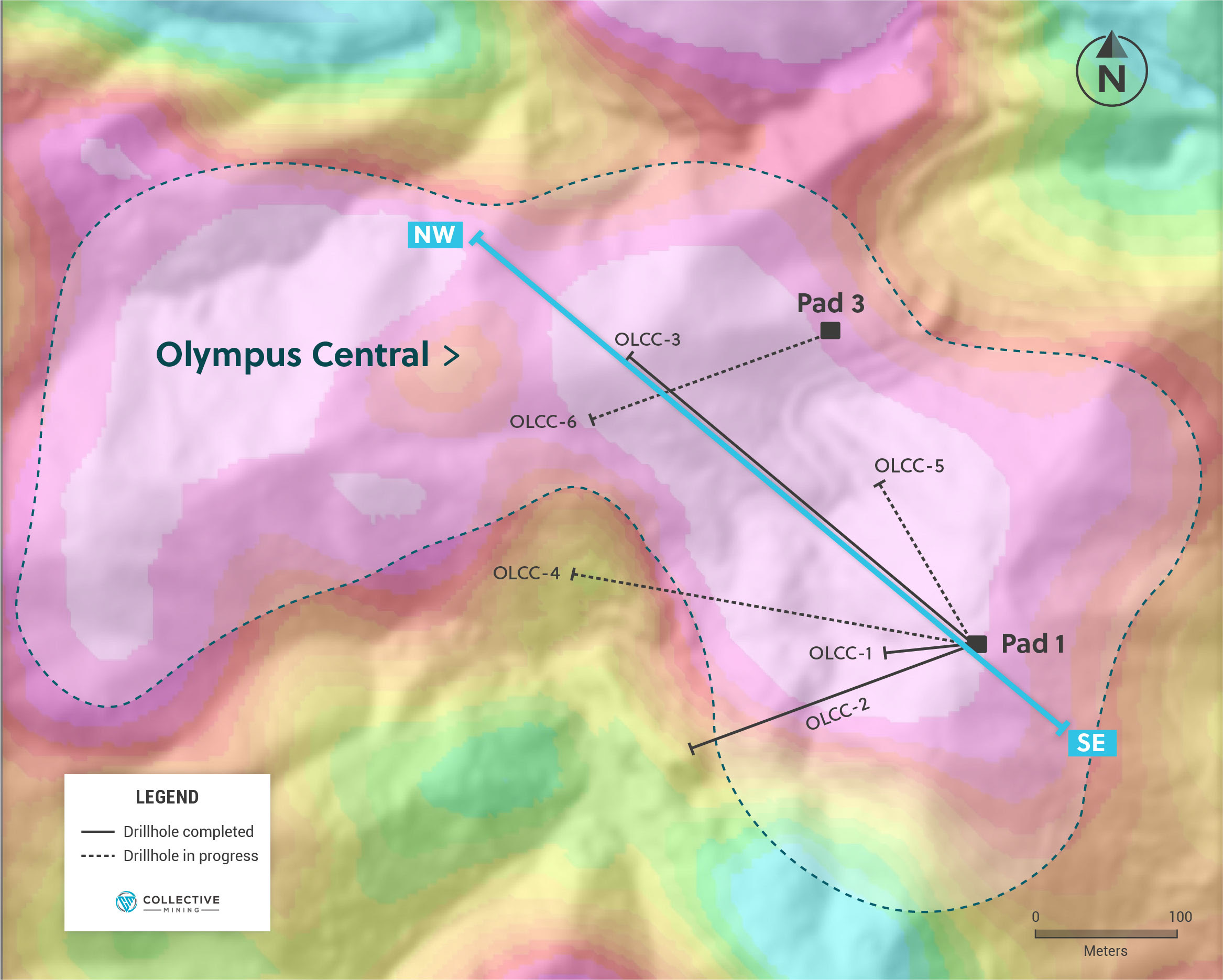

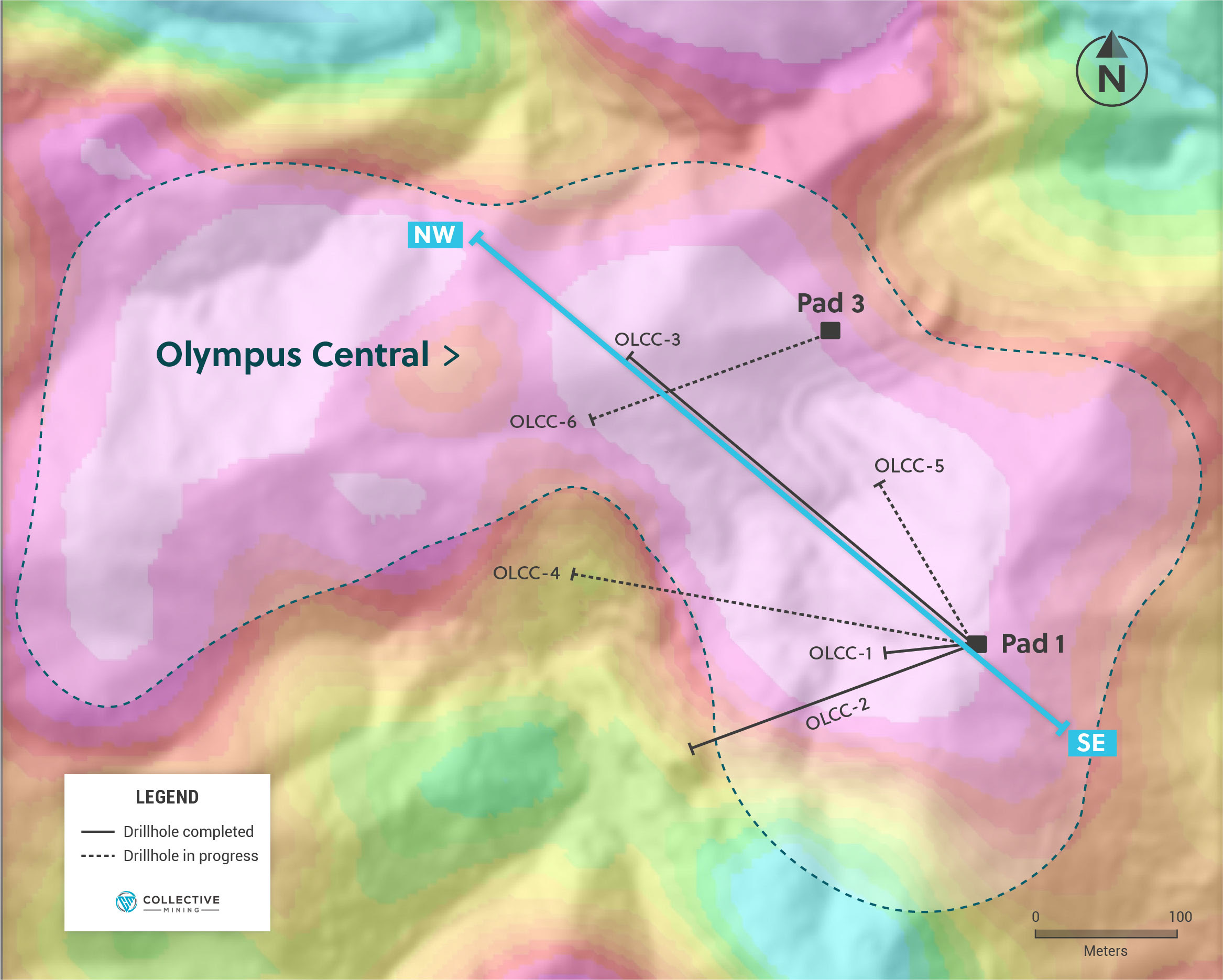

Figure 2: Plan View of the Olympus Target

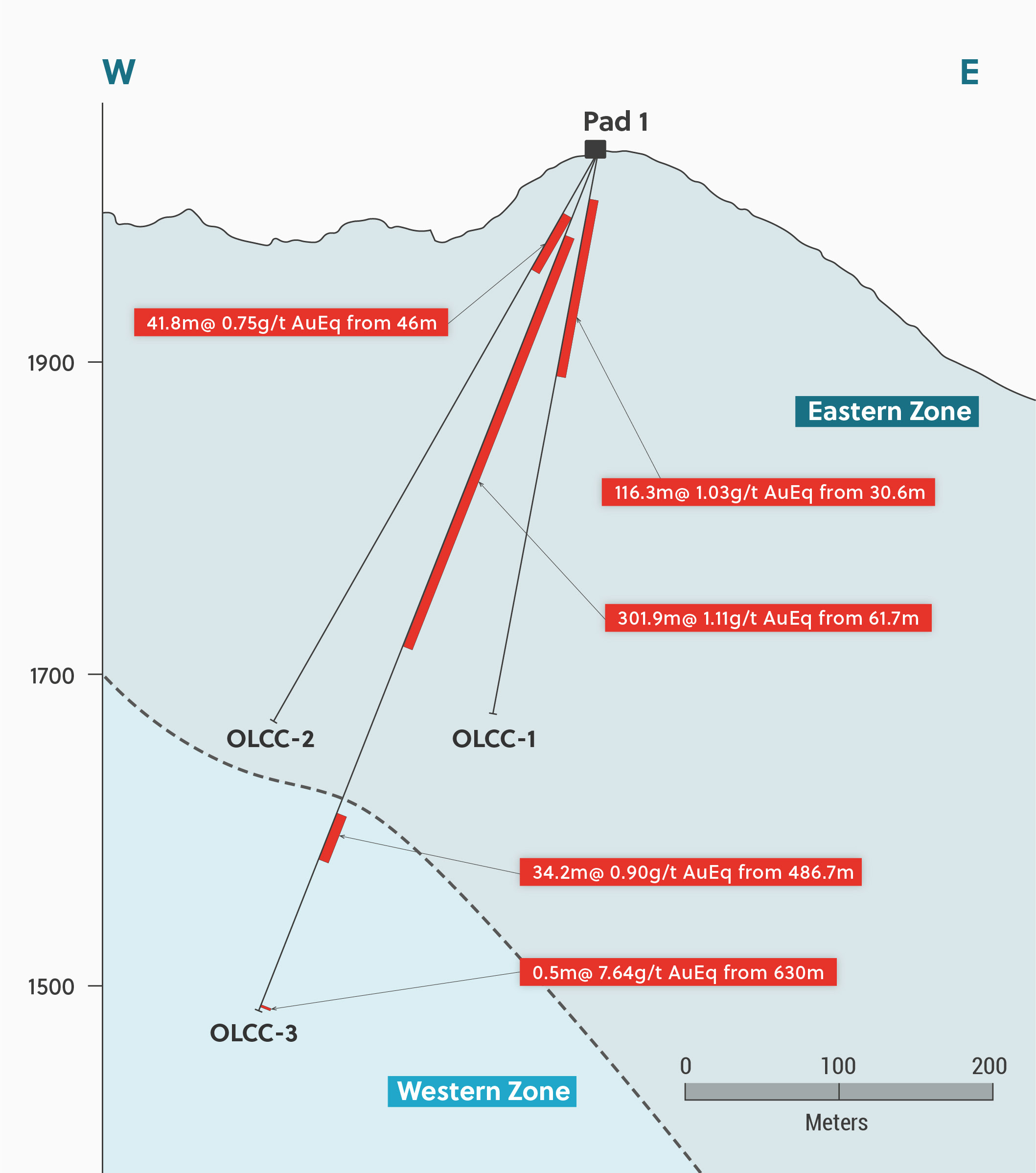

Figure 3: Cross Section W-E as Outlined on the Olympus Plan View Image

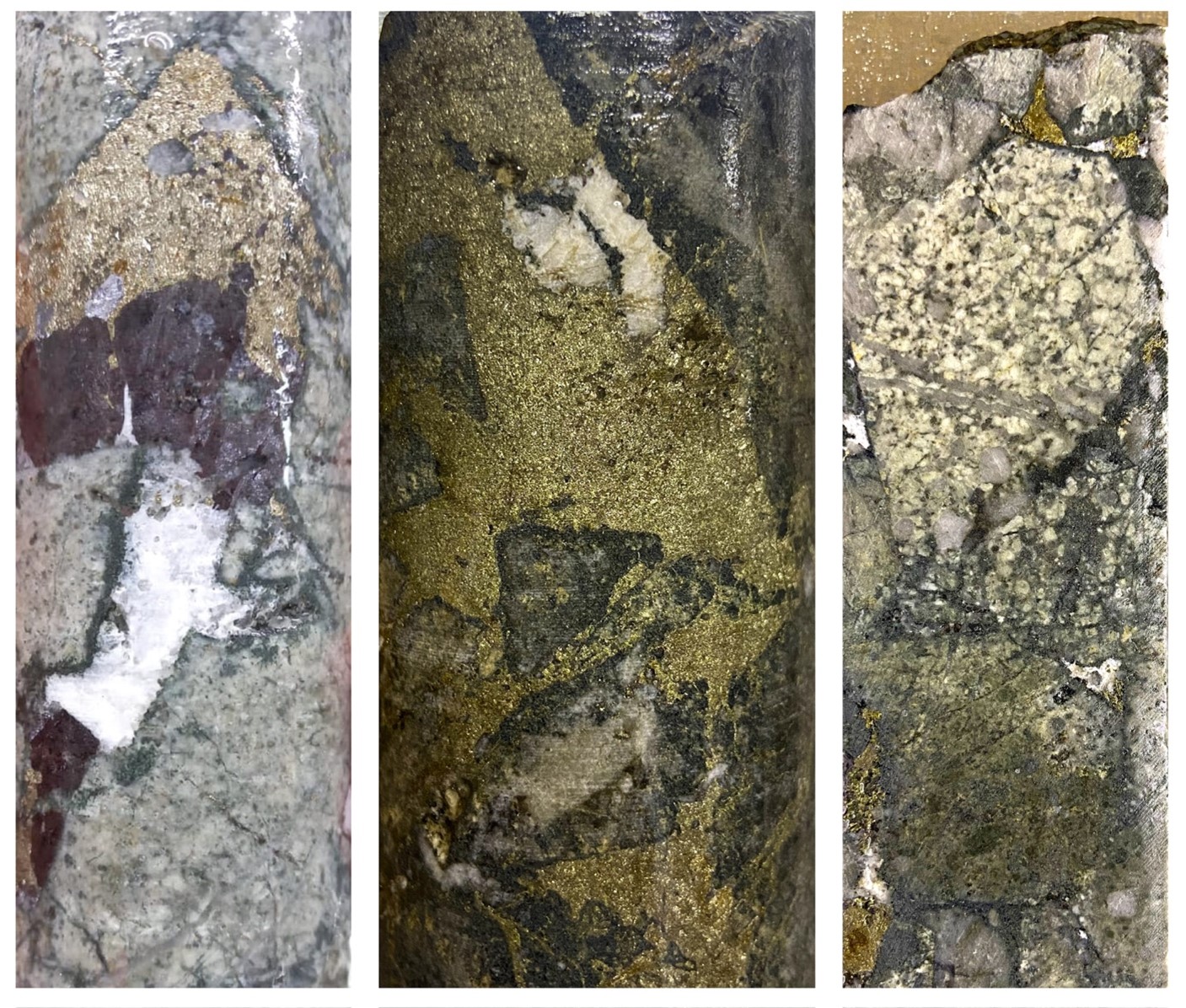

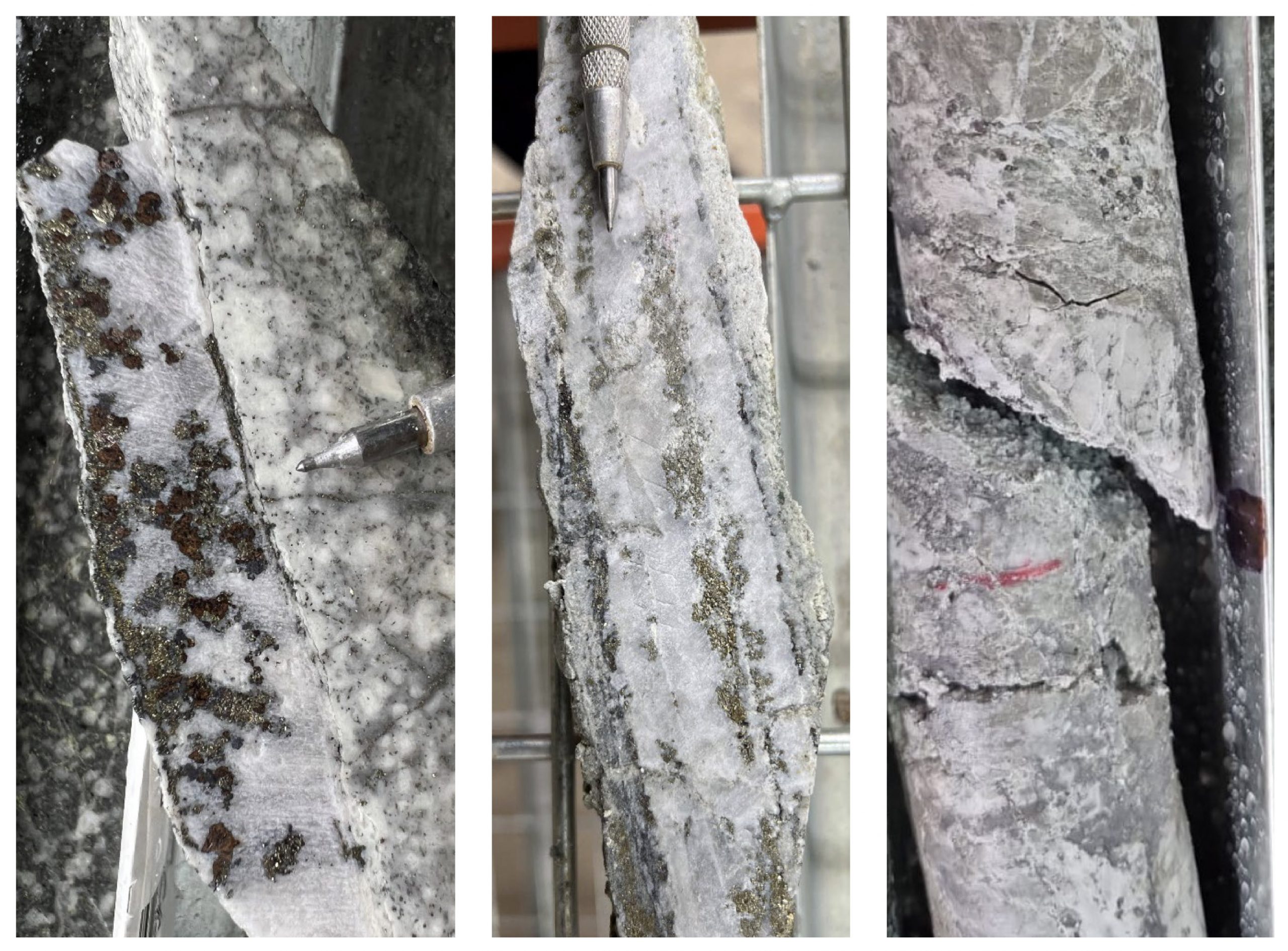

Figure 4: Drill Hole OLCC-4 Core Photos

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) announced yesterday it had intercepted a broad zone of mineralization at the second diamond drill hole at the Apollo target. A second rig has been mobilized, and the company expects assay results from the first hole at Apollo to be ready in the near term. Collective has three drill rigs at Guayabales, with ongoing drilling at Apllo and Olympus. The goal for the drilling is to expand on the announced Olympus Central discovery hole (302 metres @ 1.11 g/t gold equivalent).

Ari Sussman, Executive Chairman of Collective Mining, commented in a press release: “The Guayabales project continues to demonstrate that it has been blessed with a remarkable mineral endowment. We are early in the first inning of unlocking the potential of this asset and already we have drilled three potentially significant discoveries characterized by broad zones of mineralization. Assay results are expected from both Olympus and Apollo in the near term and our fully funded drill program will continue unabated through the balance of 2022.”

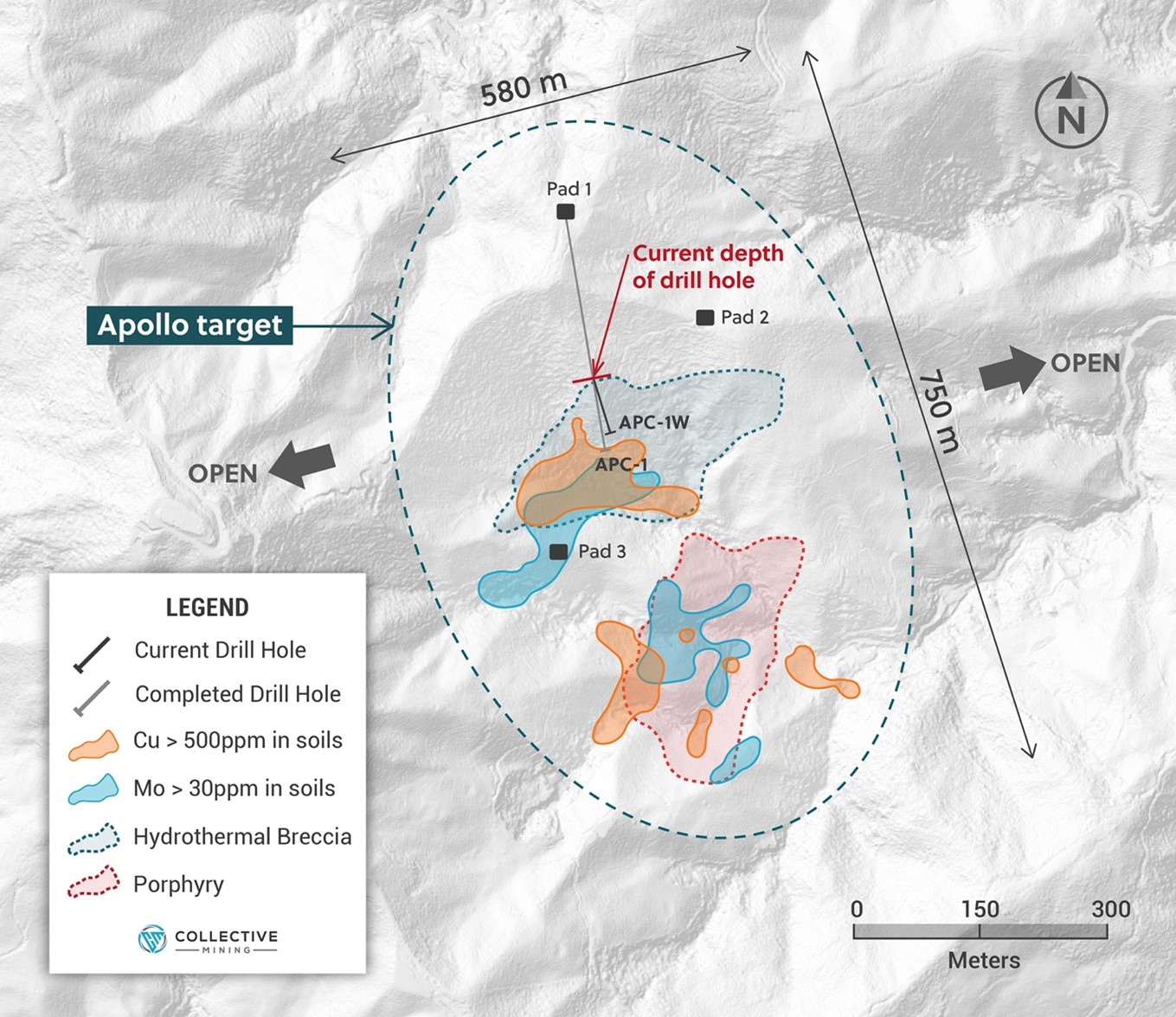

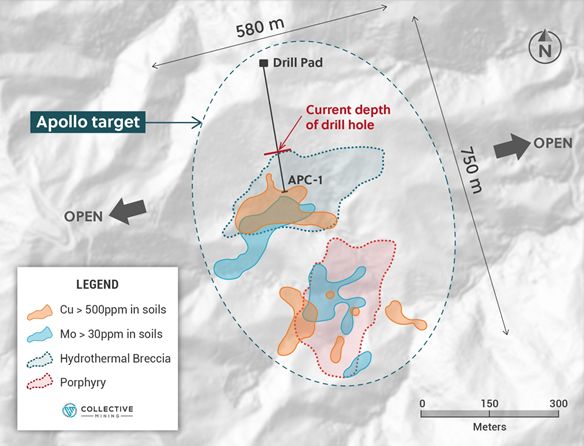

A porphyry target in the south and a porphyry-related hydrothermal breccia target flanking the north side have been outlined at Apollo through surface mapping and soil and rock chip sampling. The porphyry and breccia targets are characterized by coincidental high-grade copper and molybdenum soil anomalies measuring greater than 500 parts per million (“ppm”) and 30 ppm, respectively. Apollo spans 750 metres X 580 metres and remains open to the east, west and south for further expansion.

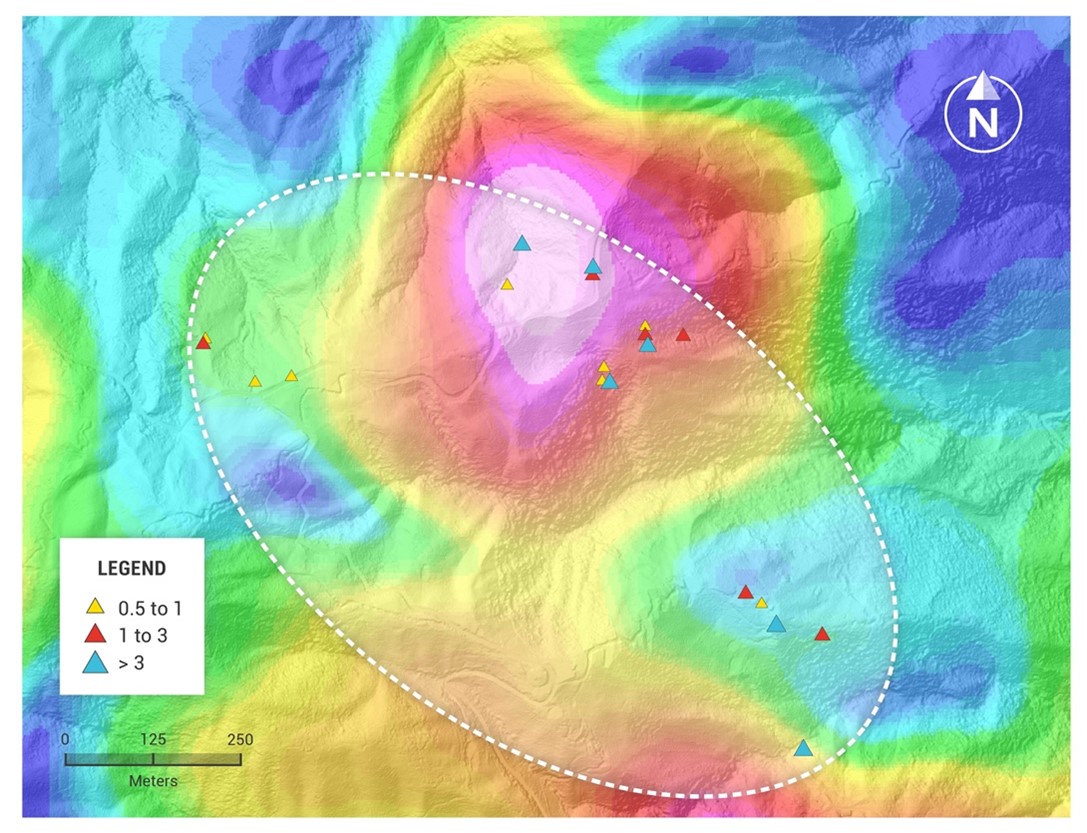

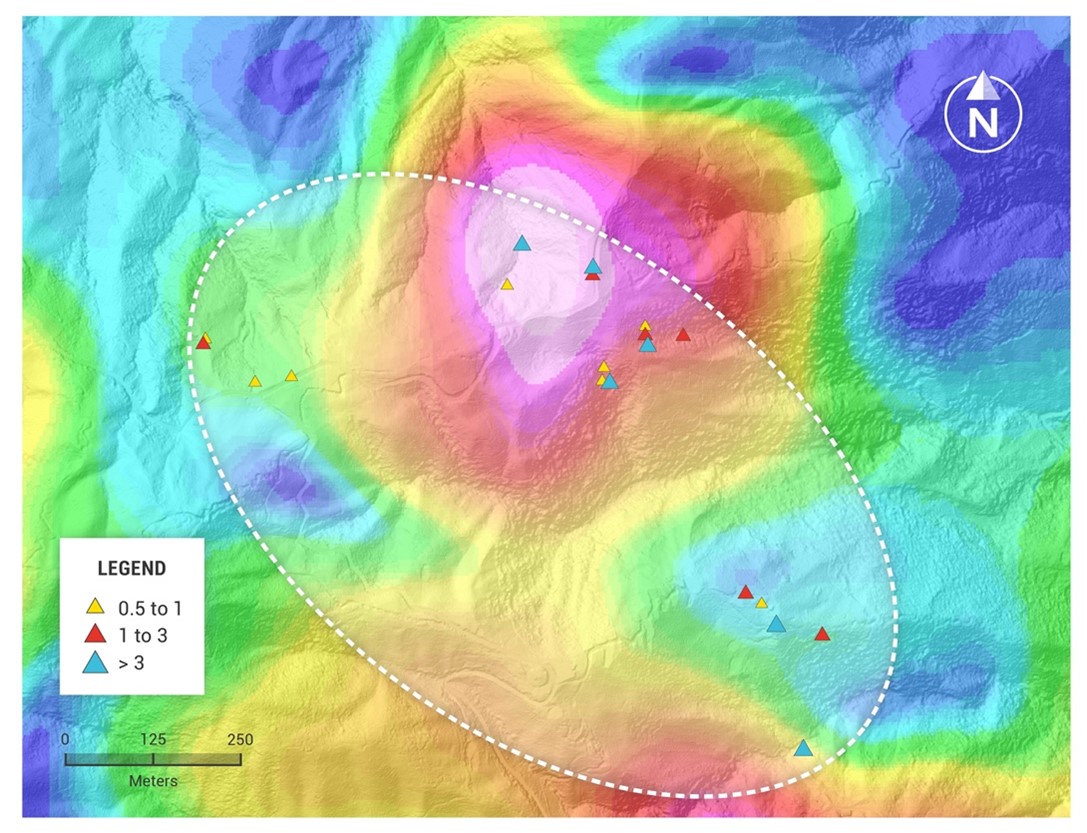

Figure 2: Plan View of the Apollo Target Area Outlining Porphyry and Breccia Targets Overprinted by High-Grade Coincidental Copper and Molybdenum Soil Anomalies

Highlights from the results are as follows:

- A maiden diamond drill program at Apollo began in April 2022 with the initial hole (“APC-1”) now complete to a final length of 438.7 metres. Beginning at 280 metres down hole, APC-1 intercepted favorable porphyry related hydrothermal breccia mineralization over a core length totalling between 85-90 metres. Core from this hole has been sent to the lab and assay results are expected shortly.

- Given the significant distance from the drill pad and to expedite drilling at Apollo, the Company is currently drilling at wedge hole (“APC-1W”), which was kicked-off from APC-1 at 213 metres down-hole. Drilled at a slightly steeper angle and to the east, APC-1W is currently at 85 metres and is still drilling within favorable visual breccia mineralization. Drilling of the hole will continue until the hole exits from the breccia mineralization.

- The breccia matrix consists of approximately 4-5% pyrite and 1-1.5% chalcopyrite with overprinting carbonate base metal (“CBM”) veins in places (see press release dated April 12, 2022, for further details).

- Considering the encouraging visual mineralization over broad widths intersected in both drill holes, the Company has initiated construction of two additional drill pads at Apollo (“Pad 2” and “Pad 3”), which will provide the Company with significantly better locations to test the full extent of the potential at Apollo. The rig that is currently drilling APC-1W will be moved to Pad 2 shortly and a second diamond drill rig will mobilize to Pad 3 shortly thereafter.

- Importantly, the mineralized breccia intercepts in APC-1 and APC-1W does not correspond with the coincidental high-grade copper and molybdenum soil anomalies covering both breccia and porphyry targets at Apollo. As a result, drill holes from Pad 2 and Pad 3 will also be designed to test both anomalies.

- The reader should be cautioned that only assay results from a certified third-party laboratory can confirm whether any amounts of precious or base metals are present in the breccia matrix currently being intersected in the drill hole. As such, visual core inspection presented herein should be viewed as speculative in nature.

Source: Collective Mining

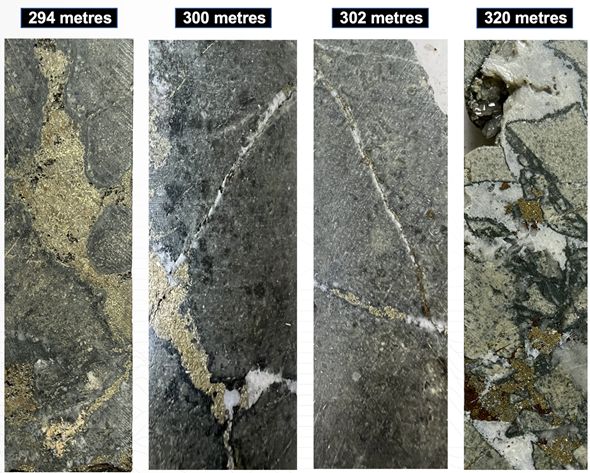

Figure 3: Core Photos from Drill Hole APC-1W

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) has announced this morning that it has begun drilling at its maiden drill at the Apollo target. Collective recently announced an Olympus Central discovery hole of 302 metres @ 1.11 g/t gold equivalent, and has drills operating at the Apollo and Olympus Central targets. These are part of the four diamond drill rigs currently operating at Guayabales. These two targets are located approximately 600 metres apart, with the Apollo target sitting to the southeast of Olympus Central.

Ari Sussman, Executive Chairman, Collective Mining, commented: “Our shotgun approach for 2022 of testing multiple targets at the Guayabales project with reconnaissance drilling has provided us with spectacular returns. The latest potential discovery at Apollo is currently at 70 metres in down hole length and remains in strongly mineralized breccia as the hole continues to advance. We now plan to accelerate exploration at Apollo and look forward to receiving assay results from this intercept in the coming weeks.”

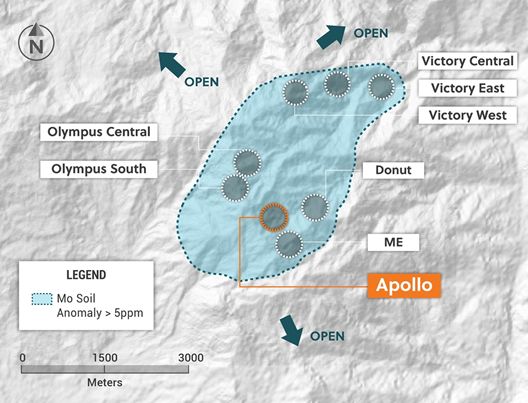

Figure 1: Plan View of the Guayabales Project Highlighting the Apollo Target

Highlight from the news are as follows:

A maiden diamond drill program at Apollo recently began with the initial 500-metre-long hole (APC-1) well underway. Beginning at 280 metres down hole, the Company has intersected a porphyry related, hydrothermal breccia with the matrix consisting of approximately 5% pyrite and 1.5% chalcopyrite (according to core logging). The pyrite has potential to contain gold and chalcopyrite is sulphide mineral containing copper and iron. Additionally, a late overprint of carbonate base metal (“CBM”) veins is present in places and as a result and based on previous similar intercepts, could introduce additional gold and silver into the system.

- Drill hole APC-1 is currently at 350 metres in length and continues to intersect strongly mineralized breccia (70 metres total thus far). Assay results for this hole are expected over the coming weeks.

- Surface mapping, soil and rock sampling at Apollo has outlined a target area measuring at least 750 metres x 580 metres open to the east, west and south.

- The main target at Apollo is a porphyry system with a porphyry related breccia system flanking the porphyry veining on its northern side. Both systems outcrop at surface.

- Soil sampling at Apollo has outlined two coincidental high-grade copper and molybdenum in soil anomalies measuring more than 500 parts per million (“ppm”) copper and 30 ppm molybdenum and covering the target area.

- The current hole will only test the northern portion of this mineralized system with both soil anomalies remaining largely untested for future drilling.

- The Company plans to immediately begin constructing additional drill pads to the south of the current pad to better attack the target area from closer range.

- The reader should be cautioned that only assay results from a certified third-party laboratory can confirm whether any amounts of precious or base metals are present in the breccia matrix currently being intersected in the drill hole. As such, visual core inspection presented herein should be viewed as speculative in nature.

Source: Collective Mining

Figure 2: Plan View of the Apollo Target Area Outlining Porphyry and Breccia Targets Overprinted by High-Grade Coincidental Copper and Molybdenum Soil Anomalies

Figure 3: Core Photos from Drill Hole APC-1 Labeled with the Down Hole Depth Where Mineralization was Encountered

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

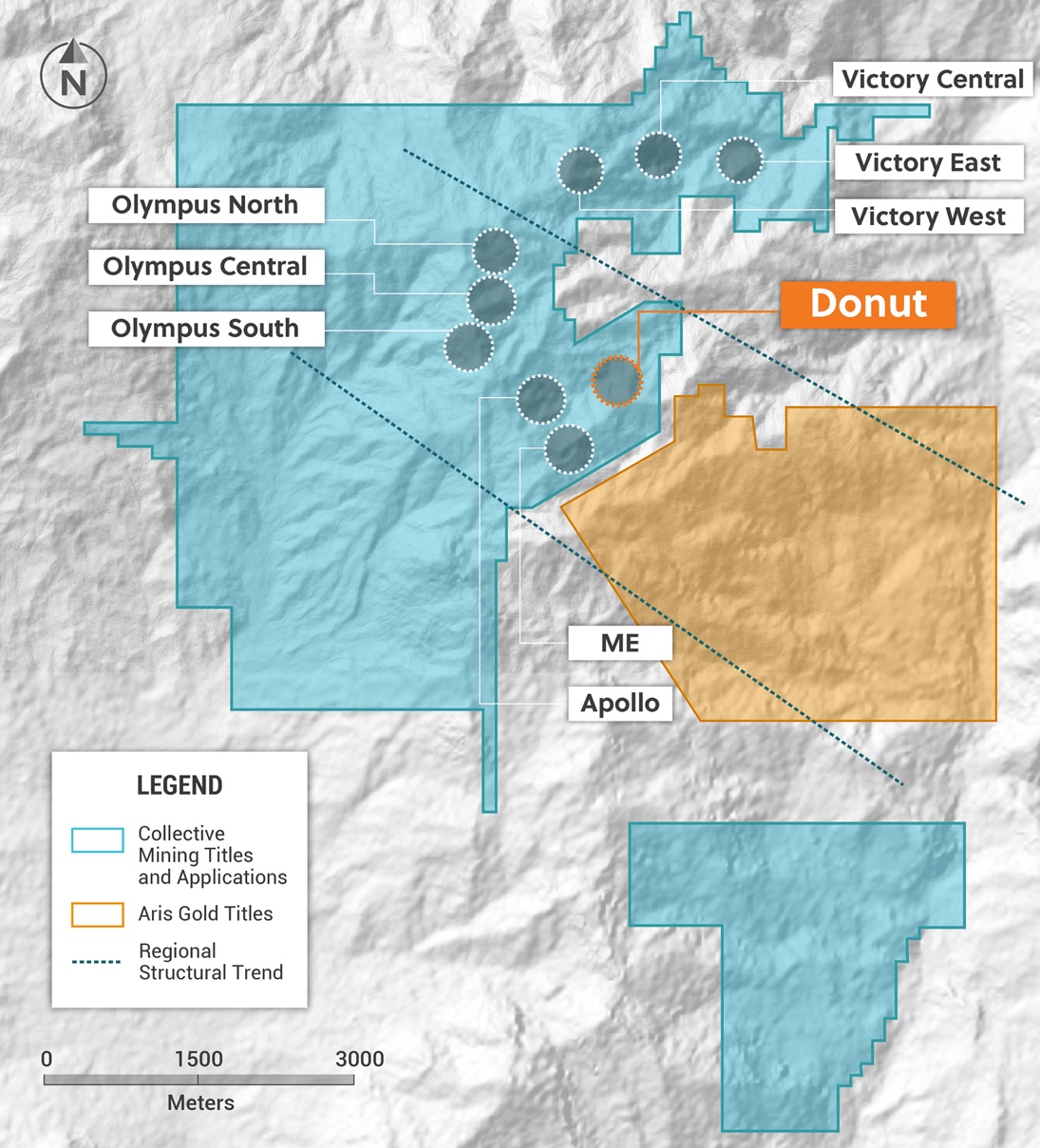

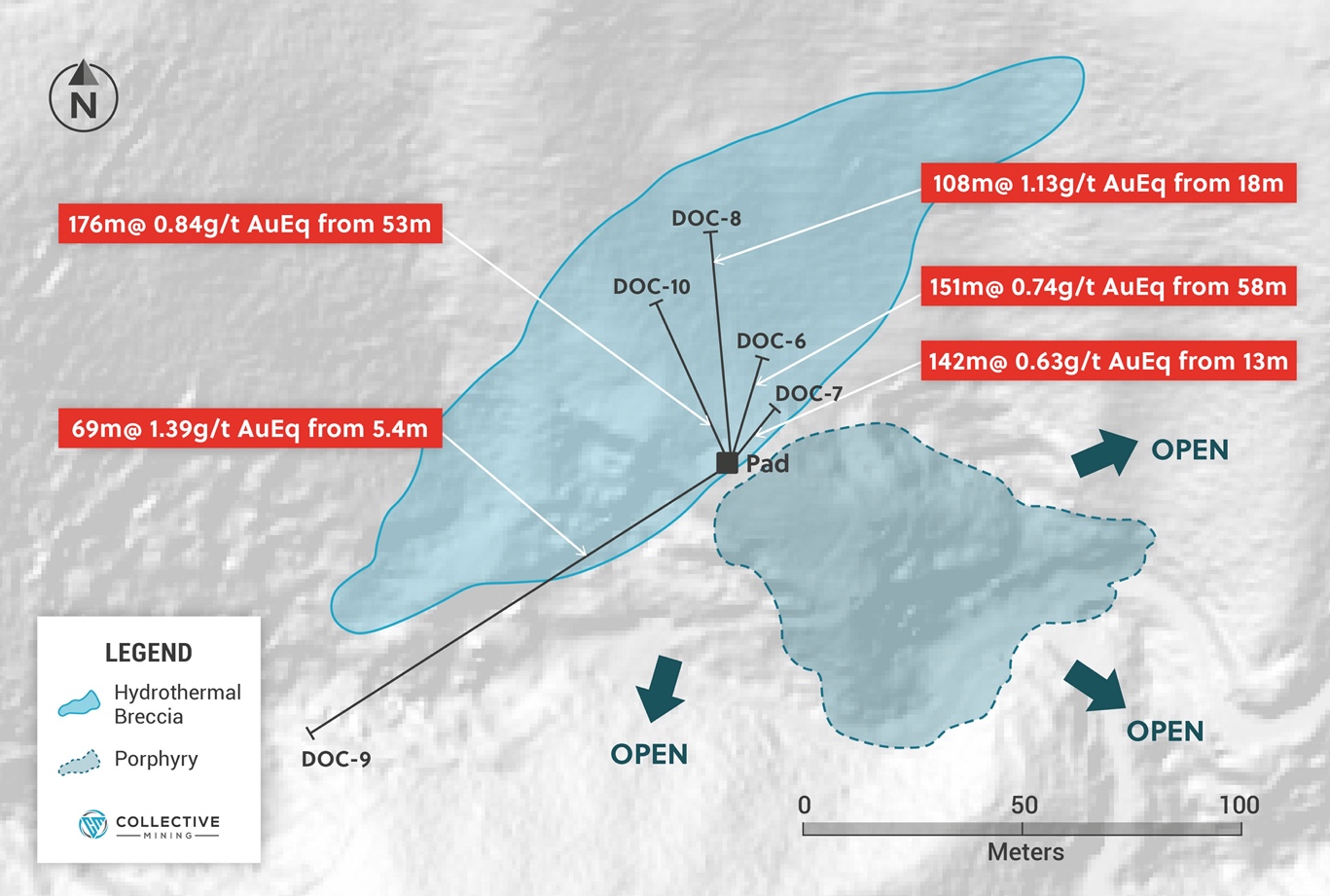

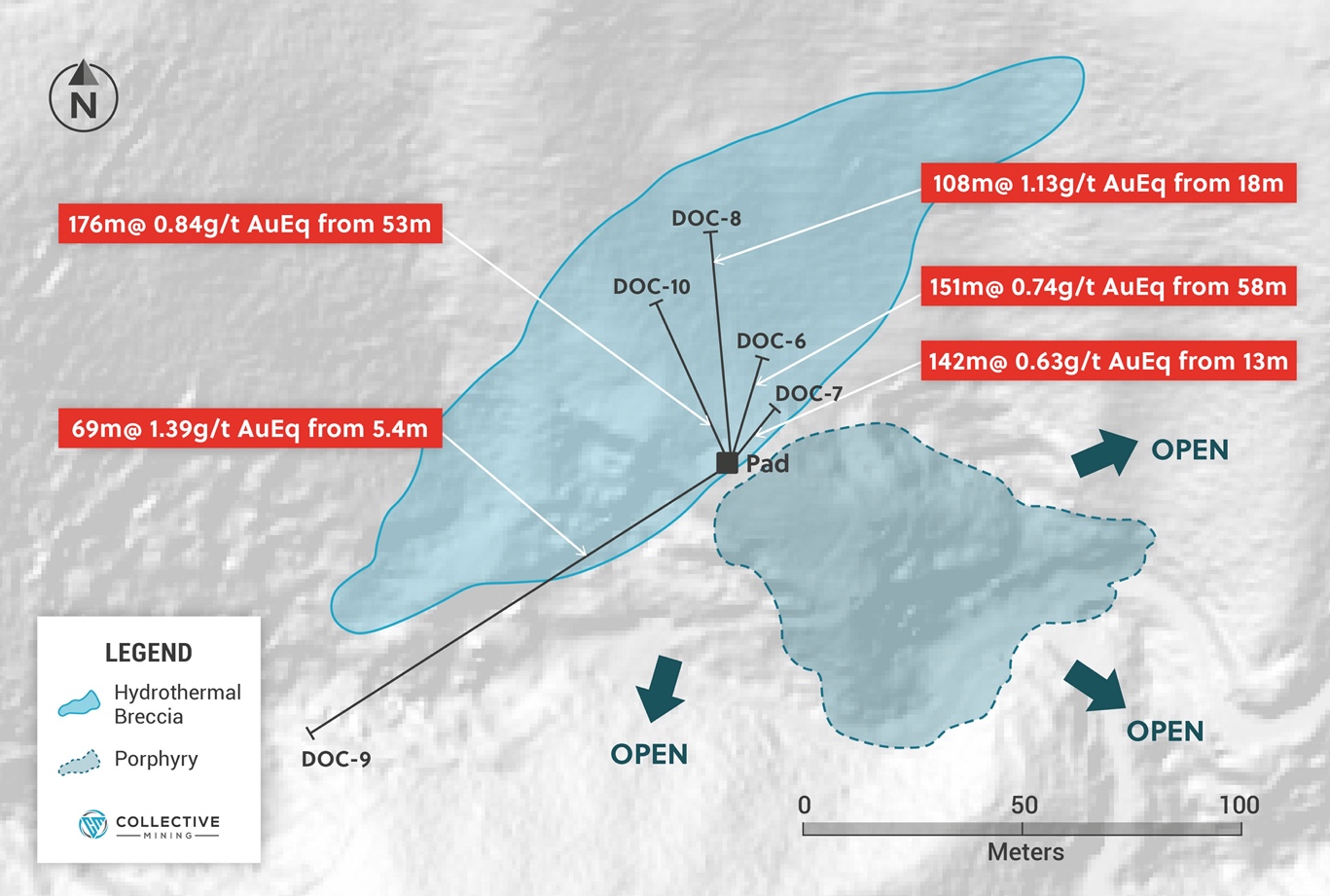

Collective Mining (TSXV:CNL) has published assay results for the final five diamond drill holes completed at the Donut Target in late 2021 as part of its maiden drill program at the Guayabales project, located in Caldas, Colombia. 2022’s drill plan of completing a minimum of 20,000 metres is already underway, with Collective currently operating four diamond drill rigs at the Guayabales Project.

A recent discovery at Olympus Central has directed the program’s focus toward expanding the discovery hole of 302 metres @1.11 g/t gold equivalent. At the same time, the company plans to test for the first suite of new targets: Victory East, Victory West, Olympus South, and Apollo. The expansion of the discovery hole as well as the first tests on the new targets will aim to deliver further results in the coming quarters.

Ari Sussman, Executive Chairman of Collective Mining, commented: “Over the course of the past year, Collective has drilled five grassroots generated targets and made three significant new discoveries, two of which are at the Guayabales project and one at the San Antonio project. In my career, I have never been involved in projects as prospective as our current portfolio. We plan on remaining aggressive for the balance of 2022 and will focus on expanding the mineralization at Olympus Central, where we recently drilled the discovery hole yielding 302 metres from near surface at 1.11 g/t gold equivalent.

“Additionally, over the next two weeks we will begin drilling at the Apollo target, which is characterized by coincidental copper and molybdenum soil anomalies blanketing outcropping porphyry related veins and breccias. By the middle of Q2, 2022 maiden drill programs will begin at the Victory East and Victory West targets, both of which are large scale copper and gold porphyry targets. Finally, drill programs to test the high-grade vein system at Olympus South and the porphyry potential at Donut will commence in early Q3, 2022.”

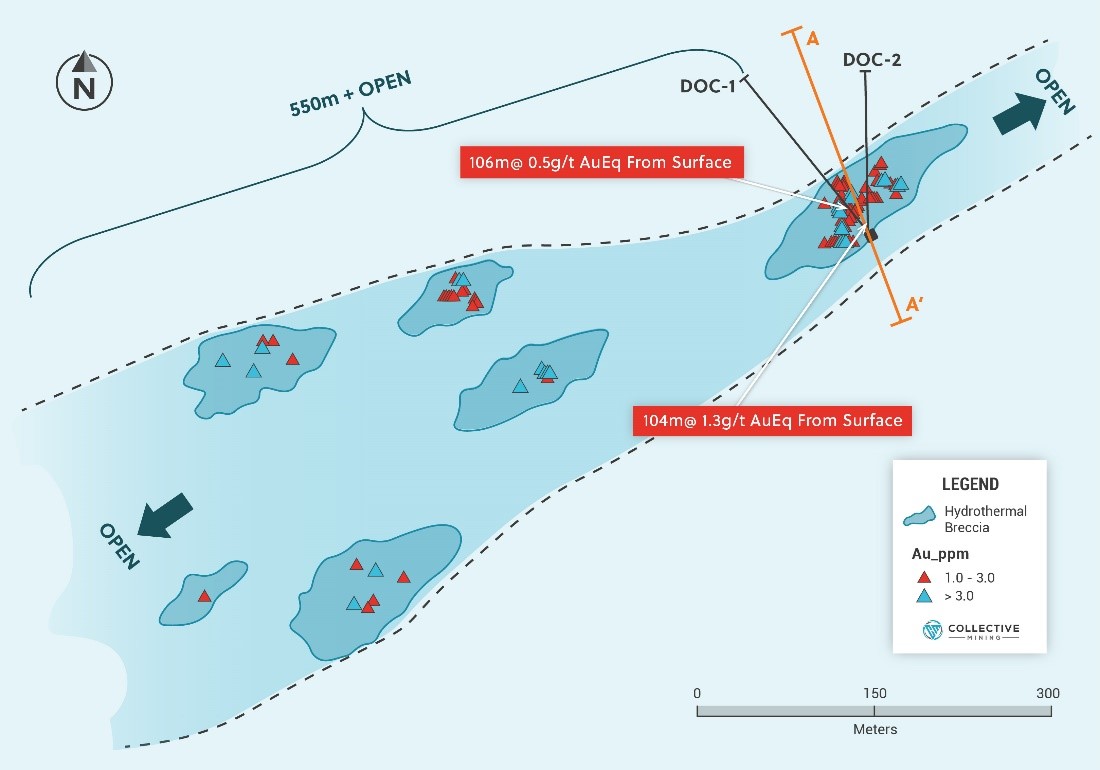

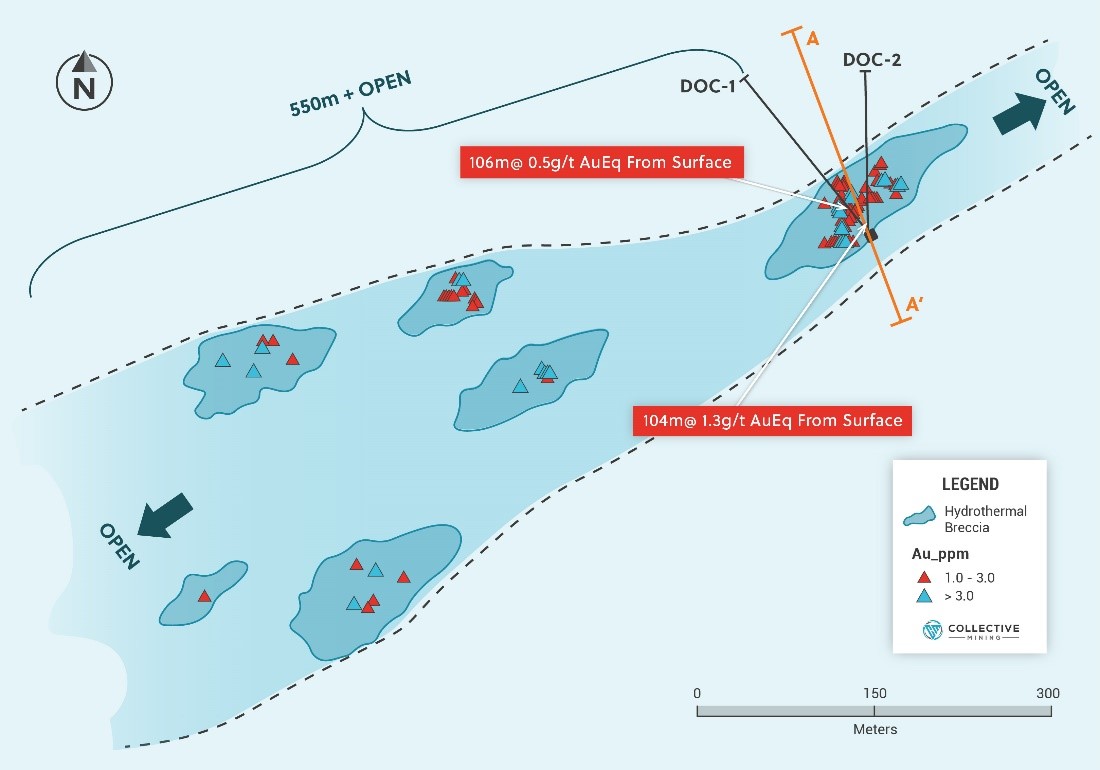

Figure 2: Plan View of the Donut Target Area

Table 1: Assay Results for drill holes DOC-6 – DOC-10

| Hole ID | From (m) | To (m) | Intercept (m) |

Au (g/t) |

Ag (g/t) |

Cu % | Mo % | AuEq (g/t)* |

| DOC-6 | 58.0 | 209.1 | 151.1 | 0.54 | 11 | 0.03 | 0.002 | 0.74 |

| Incl. | 58.0 | 88.6 | 30.60 | 0.83 | 10 | 0.03 | 0.002 | 1.02 |

| DOC-7 | 13.0 | 155.2 | 142.2 | 0.36 | 13 | 0.03 | 0.002 | 0.63 |

| DOC-8 | 18.0 | 125.7 | 107.7 | 0.78 | 21 | 0.02 | 0.001 | 1.13 |

| Incl. | 27.9 | 30.4 | 2.50 | 15.62 | 6 | 0.03 | 0.001 | 14.99 |

| DOC-9 | 5.4 | 74.3 | 68.9 | 0.97 | 24 | 0.03 | 0.002 | 1.39 |

| DOC-10 | 53.5 | 229.7 | 176.2 | 0.44 | 22 | 0.03 | 0.002 | 0.84 |

| Incl | 53.5 | 99.6 | 46.10 | 0.44 | 34 | 0.04 | 0.002 | 1.06 |

* AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.017 x 0.95) + (Cu (%) x 2.06 x 0.95) + (Mo (%) x 6.86 x 0.95), utilizing metal prices of Cu – US$4.50/lb, Mo – US$15.00/lb, Ag – $25/oz and Au – US$1,500/oz and recovery rates of 95% for Au, Ag, Cu and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown, and grades are uncut.

Source: Collective Mining

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

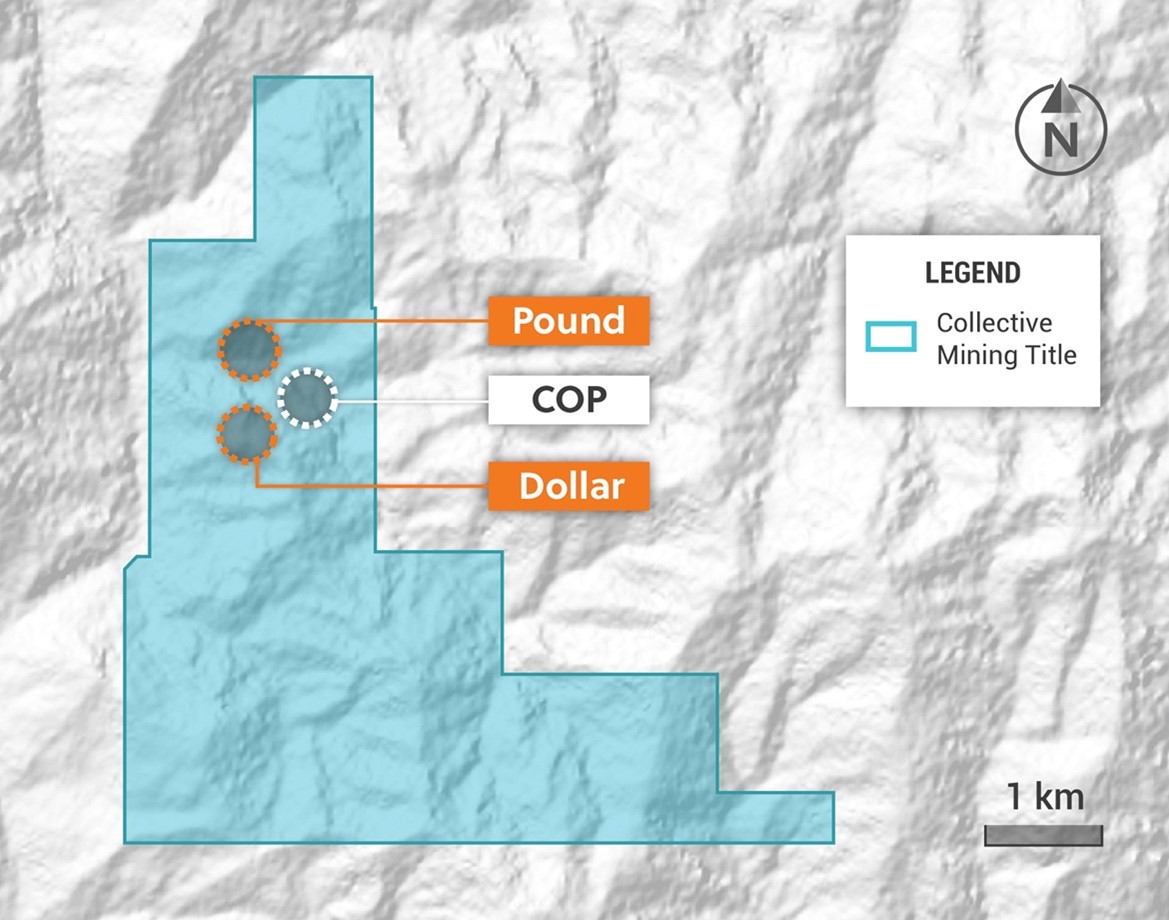

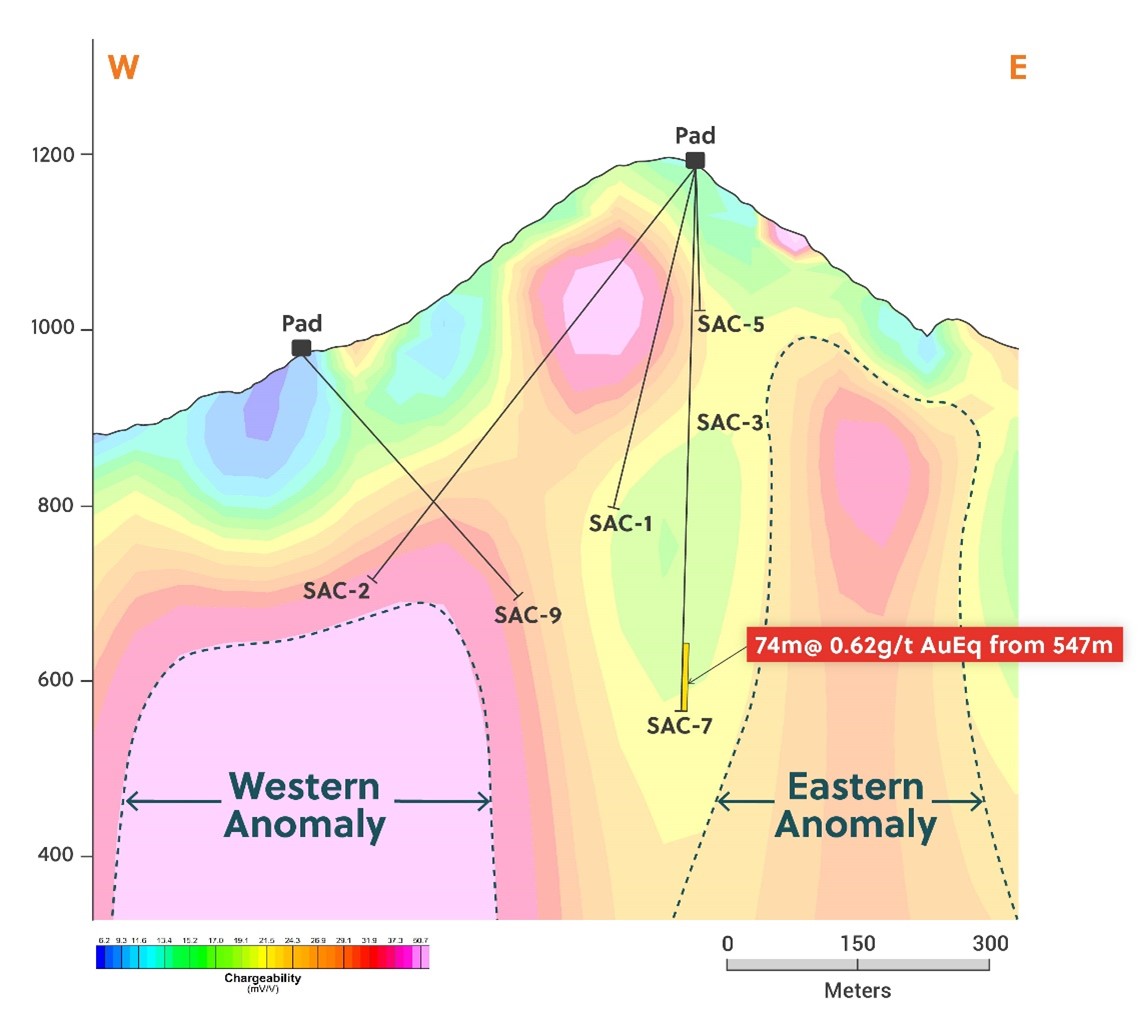

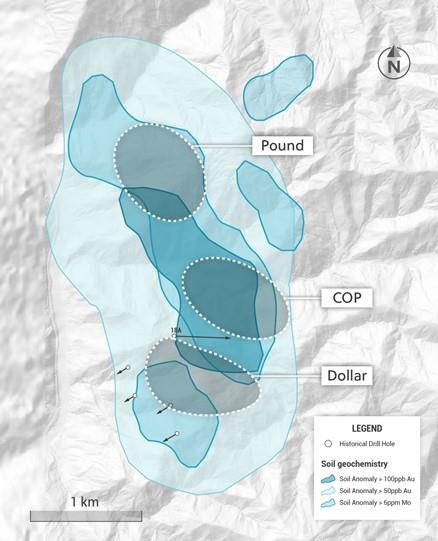

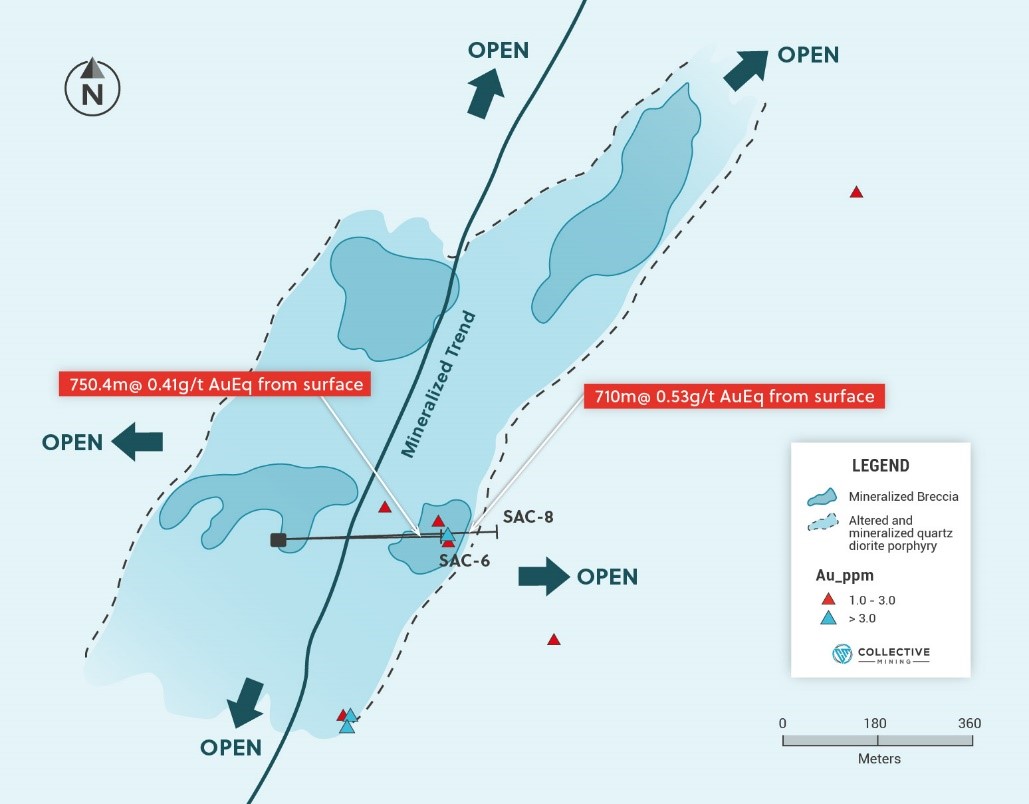

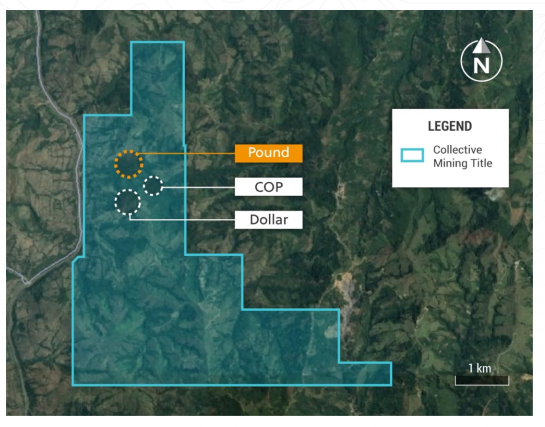

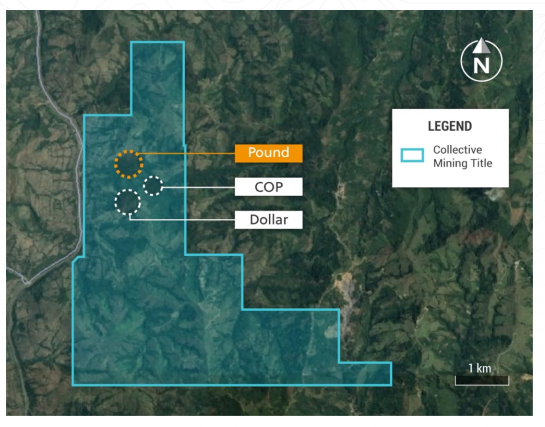

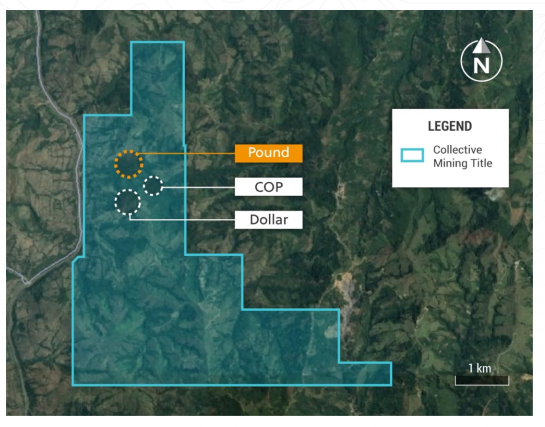

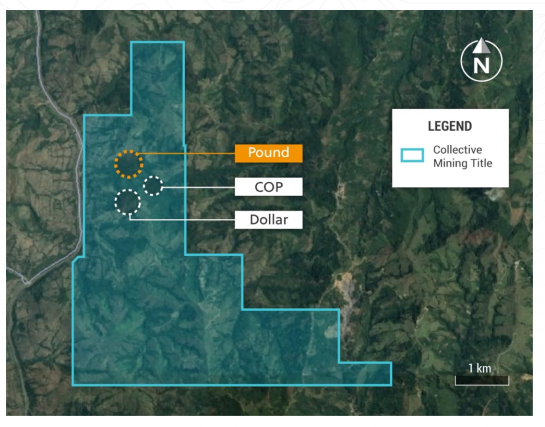

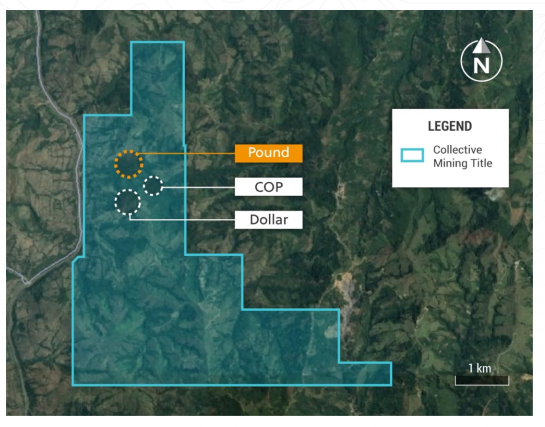

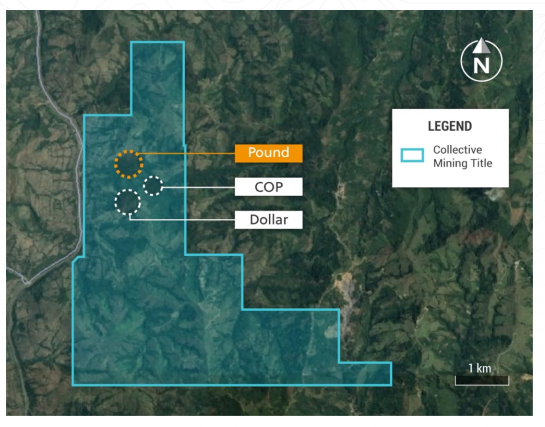

Collective Mining (TSXV:CNL) announced this morning the completion of an Induced Polarization, ground geophysical survey on part of its San Antonio project located in Caldas, Colombia. The survey area covered 2.75 square kilometres and encompasses the previously defined, priority targets named Pound and Dollar. The Company previously announced that it had made a significant grassroot drilling discovery at Pound target as part of its Phase I program at San Antonio.

Ari Sussman, Executive Chairman of Collective Mining, commented: “The IP survey in San Antonio clearly outlines exciting targets for follow up drilling. At the Pound target, there is now a clear opportunity to expand the wide and continuous zones of mineralization previously intersected from surface with further drilling into the mineralized schist and along northern extensions to the breccia. At the Dollar target, our previous drilling only clipped the edge of the highly chargeable western anomaly and internal modelling of grade shells from drilling are pointing directly to the untested eastern anomaly. Drill planning is already underway for a follow up program to begin in the second half of 2022.”

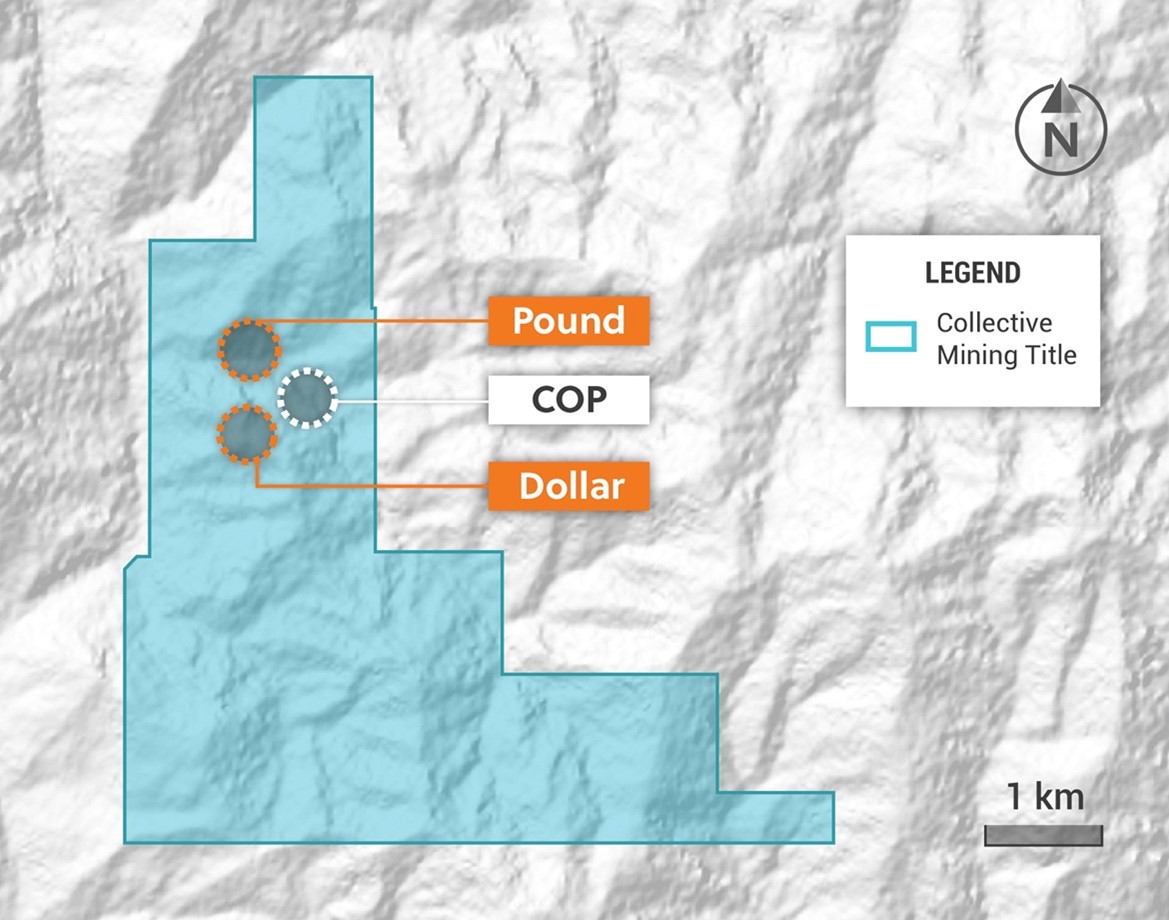

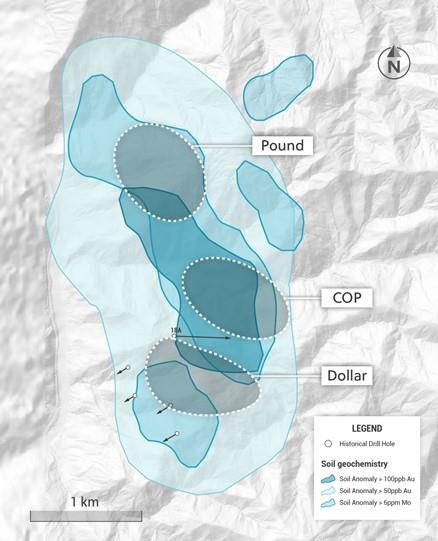

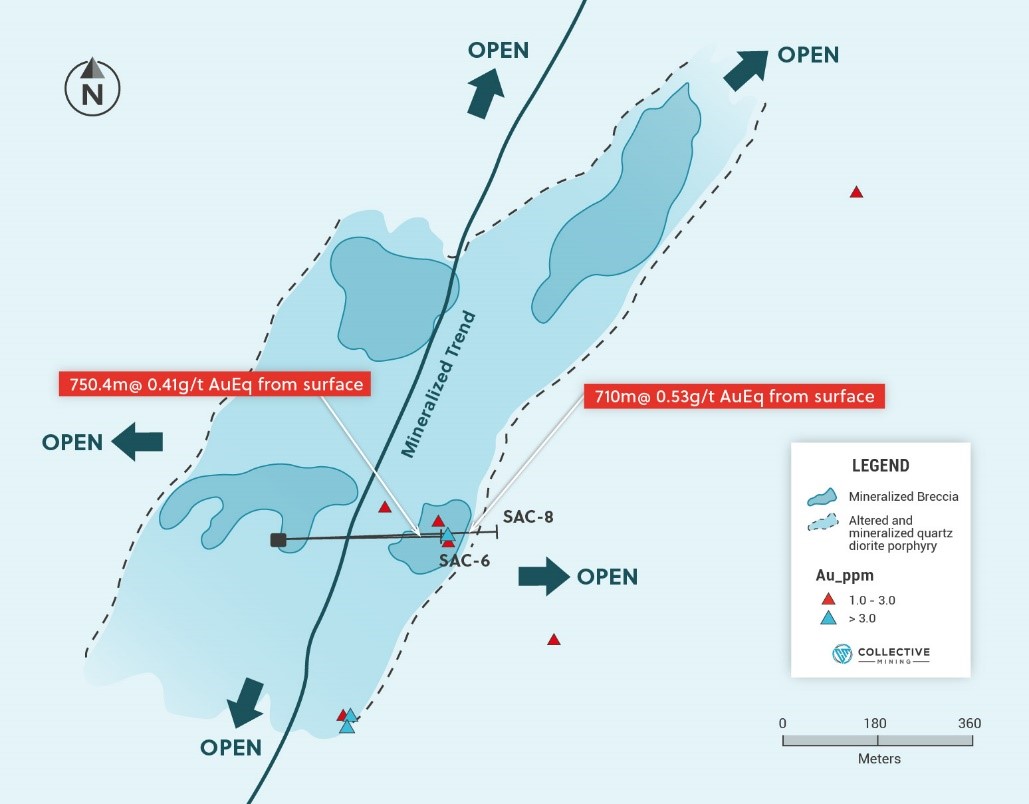

Figure 1: Plan View of the San Antonio Project Highlighting the Pound and Dollar Targets

Highlights from the survey include:

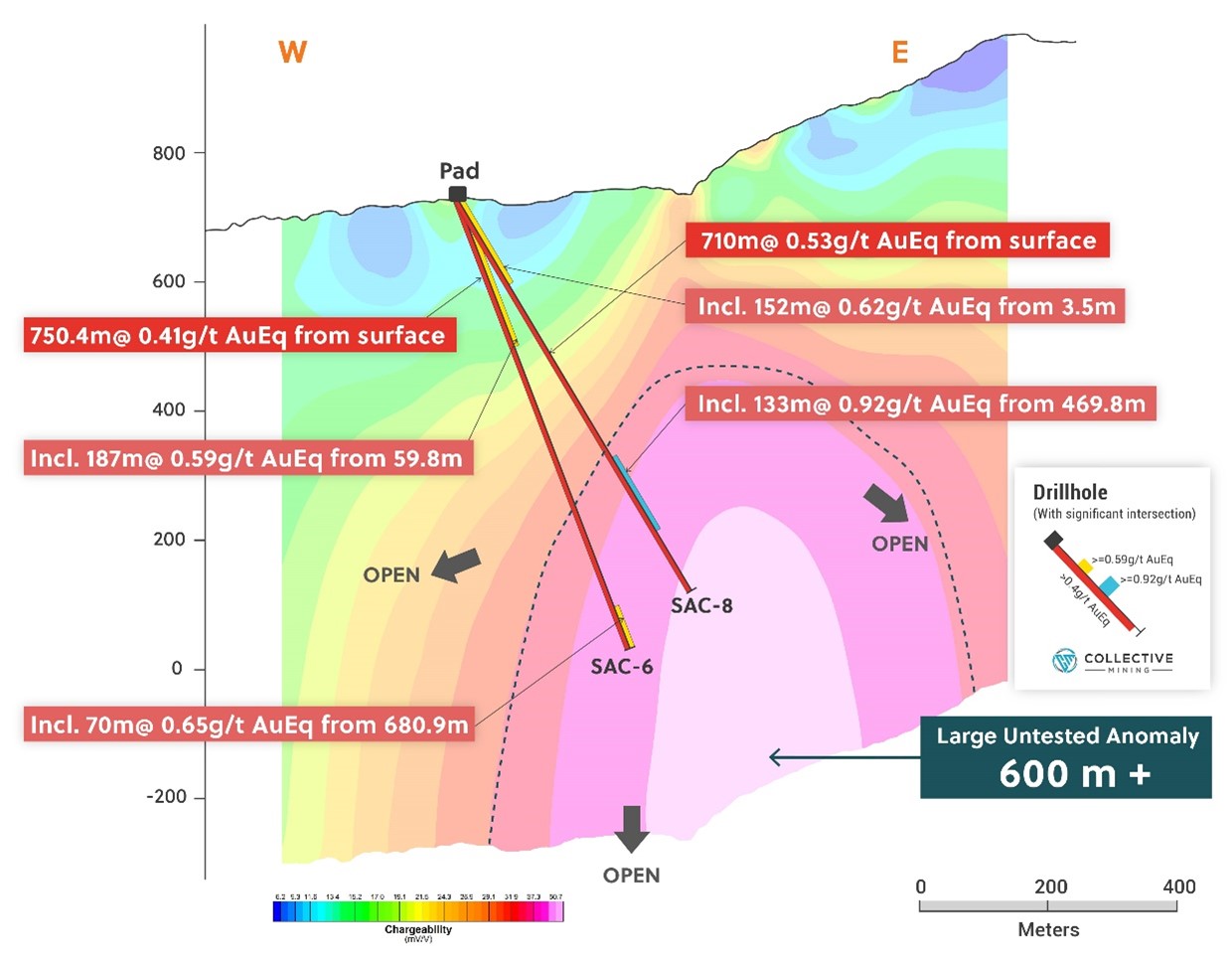

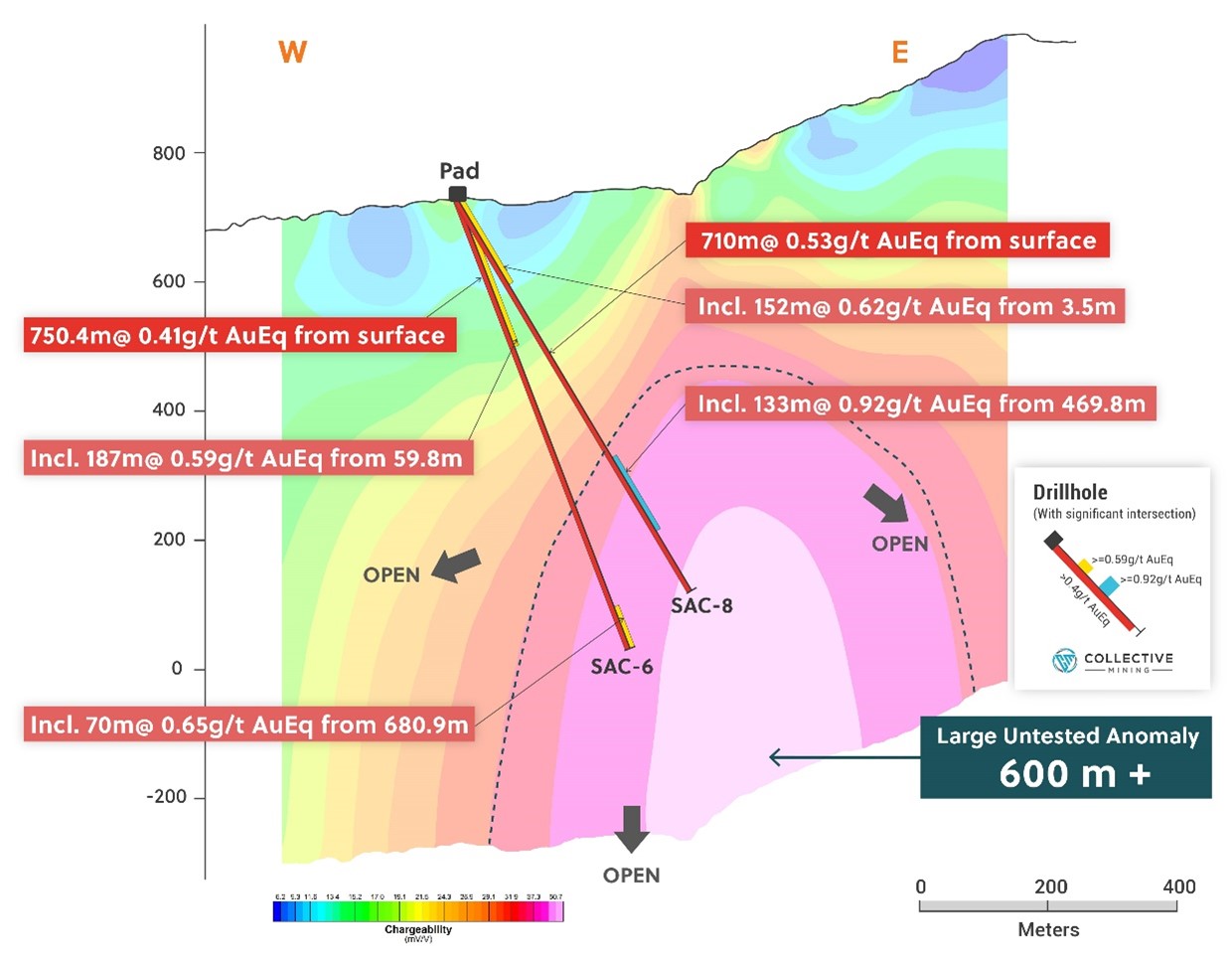

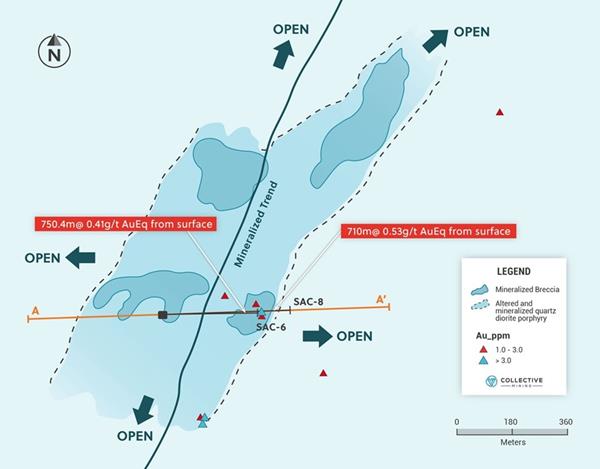

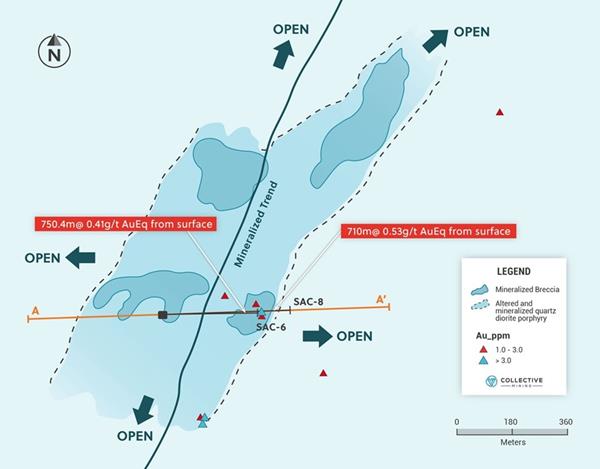

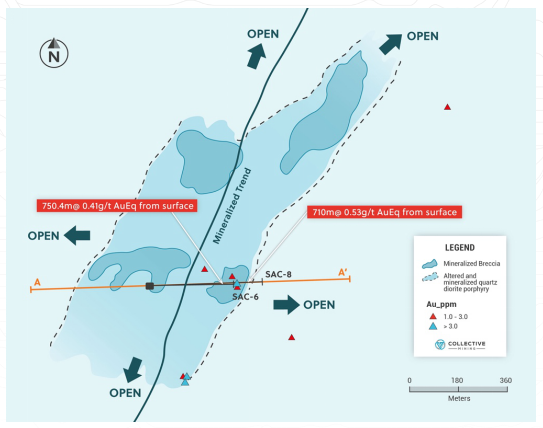

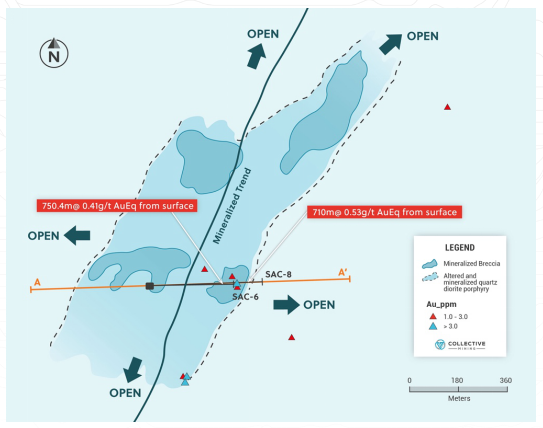

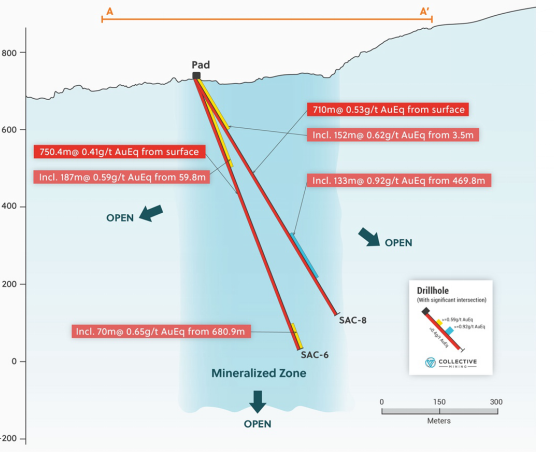

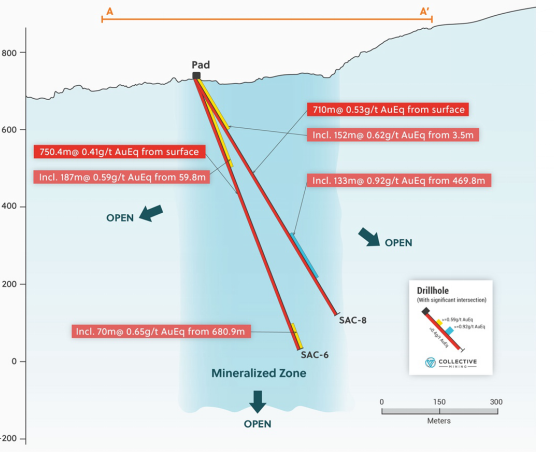

- The Pound target is coincident with a circular chargeability anomaly present at shallow depths and covering a diameter of 600 metres. Previous reconnaissance drilling of two holes returned broad, continuous, mineralized intercepts from surface of 710 metres grading 0.53 g/t AuEq (SAC-6) and 750 metres @ 0.41 g/t AuEq (SAC-8). The Pound intercepts relate to mineralization hosted within breccia, porphyry and schist rocks. The IP work clearly demonstrates that the contact zone and the mineralized schist body are open to the north, south and east and can be tested from relatively shallow elevations.

- Importantly, both drill holes into the Pound target ended in mineralization in the schist body with copper and molybdenum grades increasing at depth and including 70 metres at 0.12% copper in SAC-6 and 133 metres @ 0.15% copper in SAC-8.

- The chargeability IP data at Pound also demonstrates potential extensions of the mineralized breccia body to the NNW for at least another 800 metres.

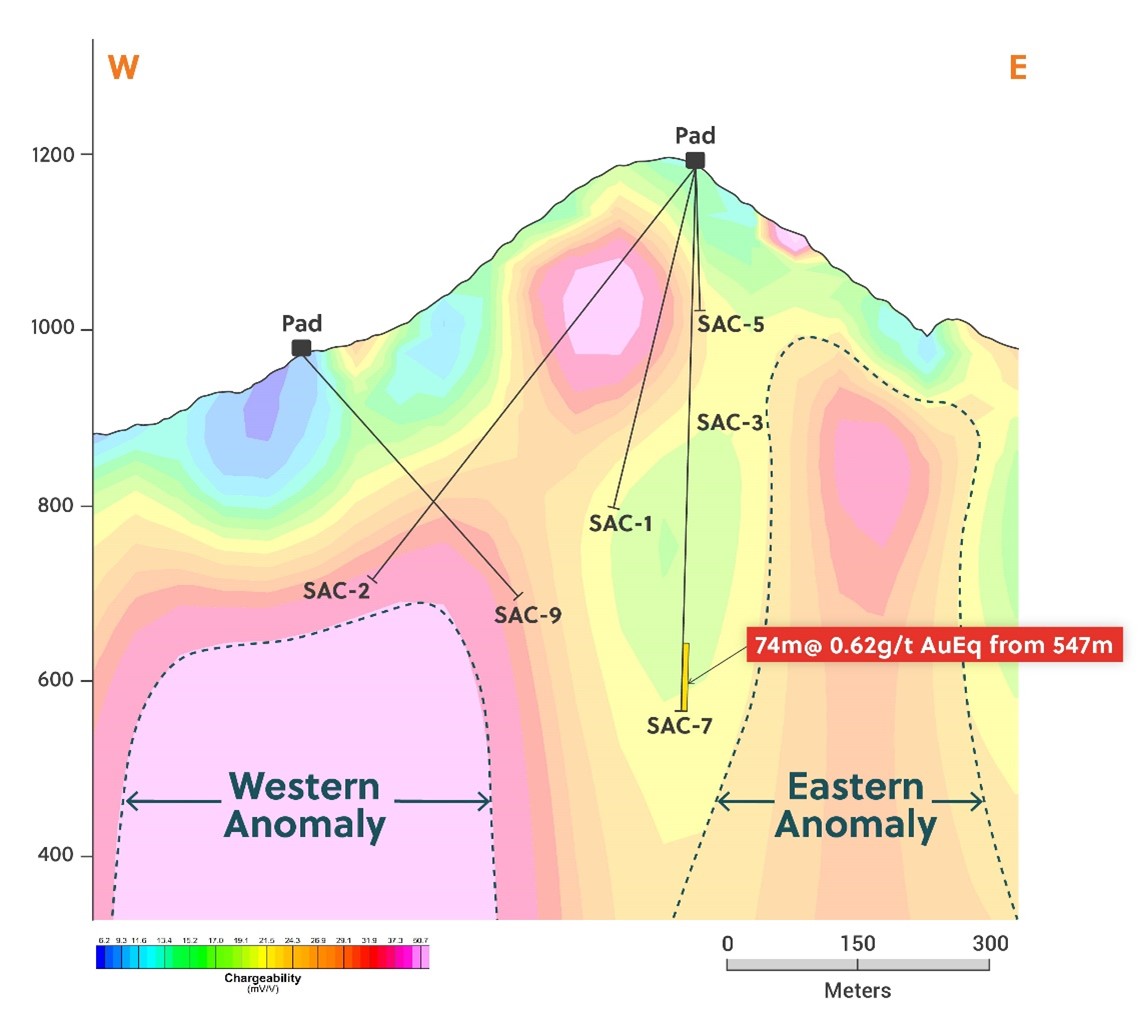

- IP data at the Dollar target highlights chargeability anomalies directly to the west and east of the area previously drill tested in the Phase I campaign.

- The western anomaly is located approximately 300 metres below surface and covers an area measuring 600 metres across by 500 metres vertical. Previous drilling only clipped the edge of this body in two holes; both of which demonstrate increasingly, porphyry related, potassic alteration within a quartz diorite porphyry near the end of each hole. Peripheral drilling at Dollar previously intersected 74 metres grading 0.62 g/t gold equivalent from a quartz magnetite stockwork in the quartz diorite porphyry.

- The more subtle porphyry shaped eastern anomaly is located approximately 75 metres below surface and measures 250 metres across by 900 metres vertical. No previous drill testing was conducted within this anomaly but modelling of grade shells from prior holes indicate an eastern dip to the highest-grade mineralization towards the anomaly.

- The target extensions at Pound and new targets at Dollar will be followed up with diamond drilling programs during the second half of 2022.

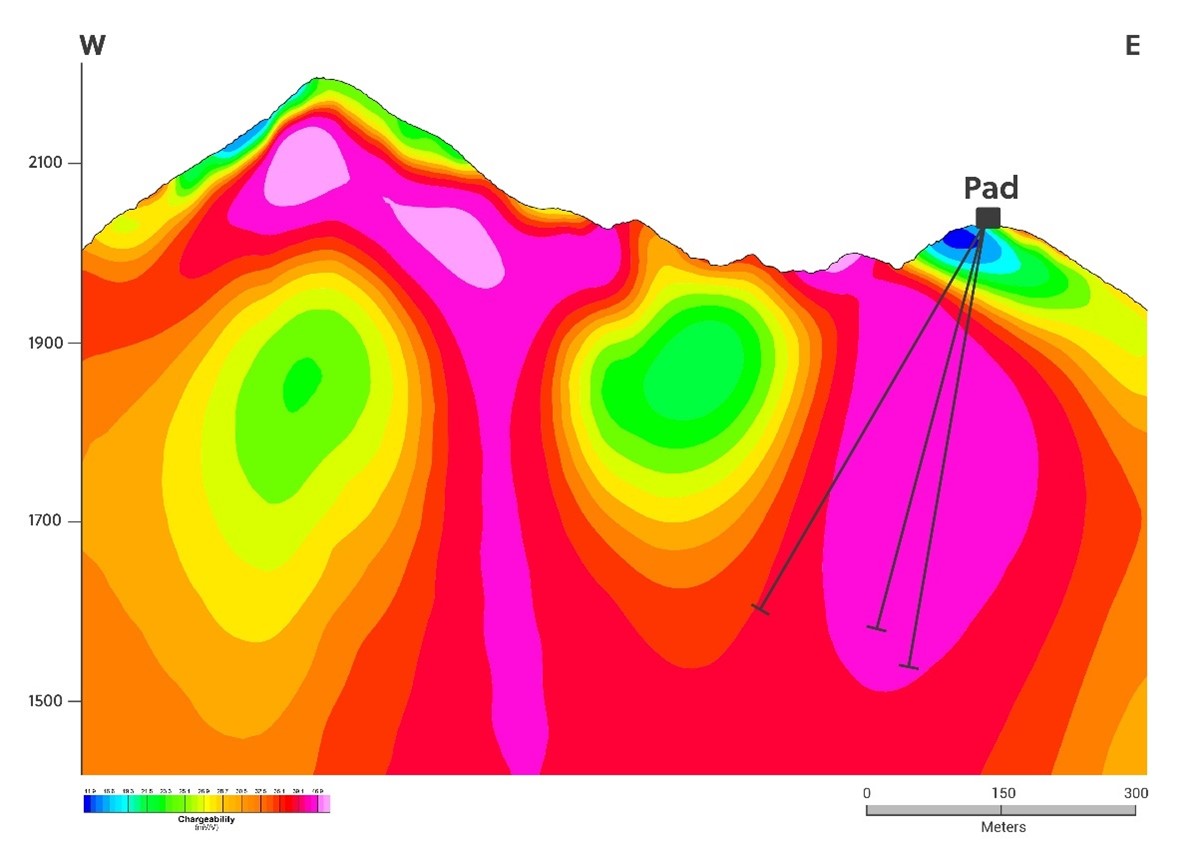

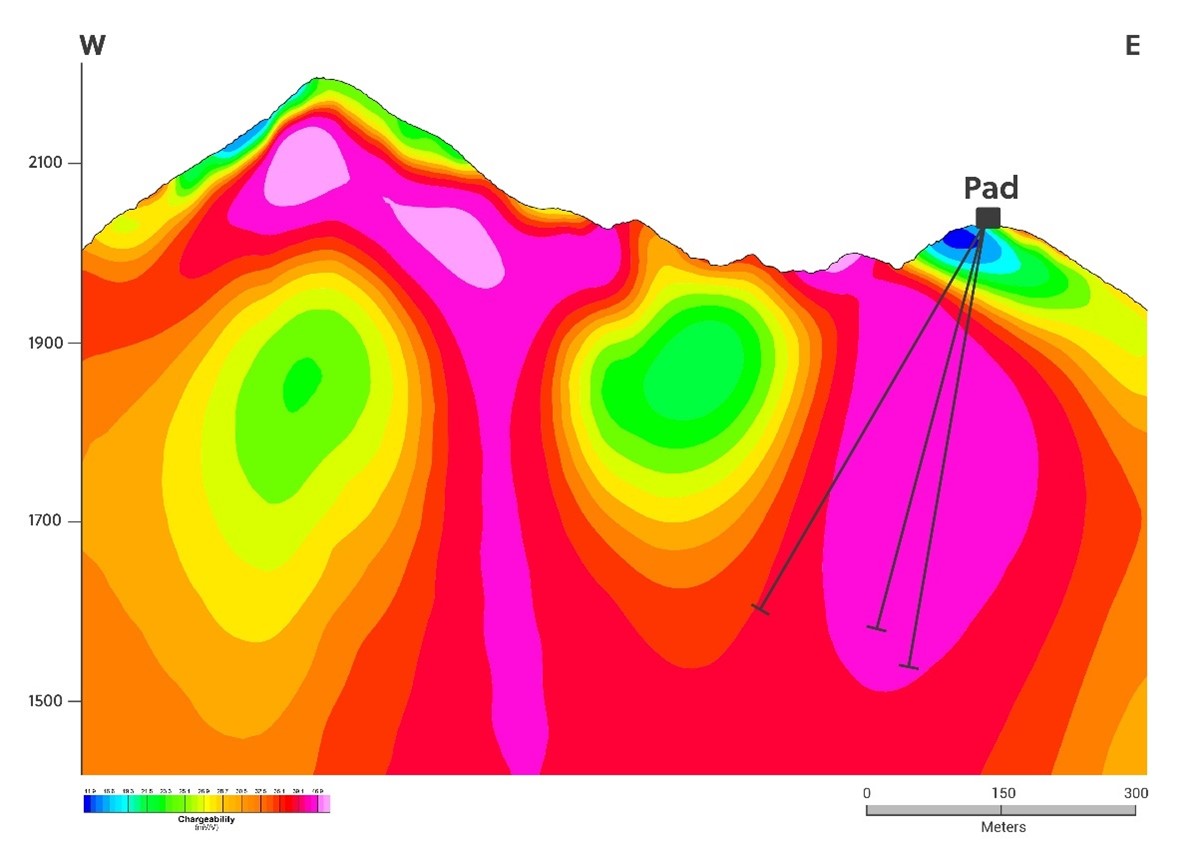

Figure 2: Section View of the Pound Target Outlining a Significant Chargeability Anomaly Directly Contiguous to the Bottom of the Two Prior Discovery Drill Holes

Figure 3: Section View of the Chargeability Anomalies at Dollar. The Western Anomaly Was Clipped at the Top by Prior Drilling While the Eastern Anomaly Has Yet to be Drill Tested

Collective Mining is a South American exploration and development firm specializing in identifying and prospecting for prospective mineral project. The team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value is leading the Company’s mission to repeat its past success in Colombia by making a significant new mineral discovery and developing the project to production.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) announced that it has signed an agreement with the Caldas Coffee Growers Committee and the municipalities of Supia and Marmato to jointly expand the program that helps to improve the quality of life of coffee growers and their families in Caldas. This alliance will benefit 1,652 coffee growers and their families as well as members of local communities.

The Committee is part of the National Federation of Coffee Growers of Colombia, a highly influential institution in Colombian agriculture that is responsible for overseeing the development of the country’s coffee industry.

Due to the success of the first program that took place in 2021, the parties involved in the alliance decided to expand the program and its activities under the terms of the previous agreement. Among the changes they made to the program was to expand the partnership to Marmato, one of the three municipalities that comprise the company’s projects.

Carlos Yesid Castro Marin, Mayor of Marmato, commented: “We are pleased to be part of this collaborative agreement and have the support of Collective Mining who articulated the initiative for the benefit of our mining communities”.

Collective Mining will contribute 32% of the total investment of the accumulated funds of the members of the strategic alliance, accumulated at $420,000 by 2022.

Marco Antonio Londoño Zuluaga, Mayor of Supía stated: “This is a very important step to promote sustainable development with the inclusion of mining activity. This project demonstrates that respectful and responsible mining is possible”.

These funds will be used to improve local infrastructure and coffee production by building aqueducts for the villages of Hojas Anchas and La Bodega.

Omar Ossma, CEO and President of Collective stated: “Caldas is the second largest coffee producing department in the country and it is well known as one of the traditional coffee regions in Colombia. Supporting the coffee industry and improving access to water for local communities are two pillars of our ESG strategy for 2022. This alliance aims to contribute to social development in the Caldas region while we keep our promise to create value and share it with the people where we explore our projects.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) has announced this morning the results of the first three diamond drill holes at the Olympus Central Target. The Central Target is within the Guayabales project, in the Class department of Colombia.

Collective Mining presently has three diamond drill rigs working at Olympus, with two rigs testing the Olympus Central Target and one rig drilling on the Olympus South Target as part of its 2022 minimum 20,000-meter program. Prior to the end of March 2022, a fourth diamond drill rig is planned to start drilling at the Guayabales deposit.

The discovery marks an important milestone for the company and an exciting catalyst for investors who have been anticipating discovery news for some time.

Ari, Executive Chairman of Collective Mining, commented in a press release: “The broad intercepts from the initial drilling results at the Olympus Central Target represent a major gold and silver discovery within the Guayabales project. Our work to date has defined a large area of known mineralization and these results simply represent the beginning of drill testing within this target. With multiple drill holes advancing and plans to begin testing other major targets at Guayabales in the near term, including an outcropping copper and gold porphyry system at the Victory Target, there is much to look forward to as our fully funded drill program advances in 2022.”

Highlights from the discovery are as follows:

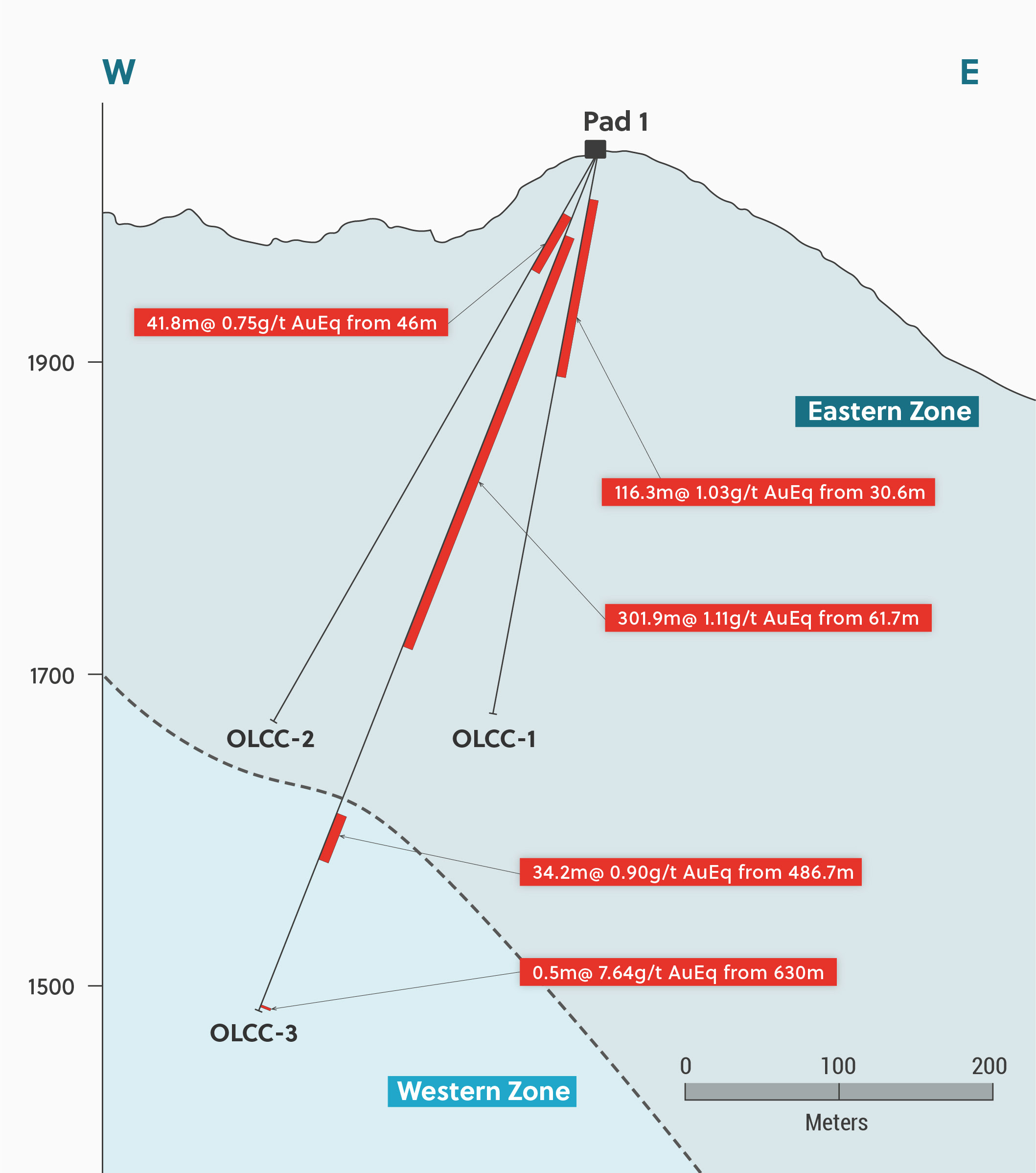

- The Olympus Central discovery hole, OLCC-3, was drilled to the northwest at a 60-degree angle to the center of an induced polarization chargeability anomaly. The drill hole totalled 630.5 metres in length and intersected mineralization up to a vertical depth of approximately 400 metres. Two distinct zones of broad mineralization were encountered in the drill hole.

- The first zone in OLCC-3 (“Eastern Zone”), which began near surface in a quartz diorite porphyry intrusion, contains multiple high grade, carbonate-base metal veins (“CBM”) enveloped by broad sericite-pyrite, lower grade halos with results as follows:

- 301.9 metres @ 1.11 g/t gold equivalent from 61.7 metres depth including 1.3 metres at 74.91 g/t gold equivalent with visible gold observed within this CBM vein.

- The second zone in OLCC-3 (“Western Zone”), which is located further down hole and is hosted within country rocks (schists and metasediments), is impregnated by multiple zones of sheeted CBM veins and enveloped by sericite-pyrite alteration as follows:

- 34.2 metres @ 0.90 g/t gold equivalent from 486 metres depth including 0.5 metres @ 12.68 g/t AuEq.

- OLCC-3 ended in high-grade mineralization with the final sample from 630-630.5 metres depth averaging 0.5 metres @ 7.64 AuEq.

- OLCC-1 was drilled steeply to the west at an 80-degree angle into the southern periphery of the induced polarization chargeability anomaly and intercepted a broad zone of mineralization in the Eastern Zone beginning near surface as follows:

- 116.3m @ 1.03 g/t gold equivalent from 30.6 metres depth including 9.6 metres @ 8.05 g/t gold equivalent with visible gold observed locally.

- OLCC-2 was drilled to the southwest at a 60-degree angle and only intercepted sporadic and moderate mineralization. The hole was drilled outside of the induced polarization chargeability anomaly into an area now interpreted to be a late intrusion dyke that has stoped-out mineralization in a small area at this location.

- The Olympus target (South, Central and North) covers an area of 1.25 kilometres by 0.75 metres and remains open for expansion.

- Three additional drill holes have been completed to date with assays pending while another three drill holes are currently advancing within the Olympus Central Zone. As a result of the new grassroots discovery at Olympus, the Company plans to accelerate drilling in 2022 by stepping out along the Eastern and Western Zones of mineralization at various elevations.

- There are over 50 historical and current artisanal mines that have been identified within the Olympus target to date and drilling completed thus far by the Company has not tested below the vast majority of these mines as the discovery hole, OLCC-3, was drilled in the northern extension of the system. As announced previously, grab samples from within artisanal workings found significant high-grades precious and base metal bearing CBM veins (see press releases announced sampling results dated December 1, 2021, December 14, 2021, and January 12, 2022).

- A short overview video of the drill core in discovery hole OLCC-3 has been prepared by David Reading, Special Advisor and QP under NI 43-101 and can be viewed by clicking here or by copying and pasting the following link into your browser https://youtu.be/sPUyg6GEIoA

Source: Collective Mining

Table 1: Assay Results for drill holes OLCC-1 – OLCC-3

Figure 2: Plan View of the Olympus Central Target

Figure 3: Cross section W-E of Olympus Central Target

Figure 4: Drill Hole OLCC-3 at 196 metres Depth: CBM Vein with Visible Gold, Sphalerite, Chalcopyrite and Pyrite (red circles indicate areas where visible gold is observed)

A New Approach

Collective Mining also recently announced that it was quickly advancing its high-resolution and deep-penetrating Induced Polarization survey over the Pound Target at the San Antonio project. The survey is progressing according to schedule and the company expects it to be finished in March 2022.

Ari Sussman, Executive Chairman of Collective commented in a press release: “Our San Antonio project has the potential to yield multiple mineralized porphyry and breccia systems. Following on from the exciting grassroots discovery at Pound, we are focused on defining the morphology of this sulphide rich breccia body and other potential porphyry systems. Once the IP results have been interpreted and incorporated with all newly generated data, the Company will provide details on the next phase of drilling for the project in 2022.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) has announced this morning the completion of the first three drill holes in the Olympus Central target of the Guayabales project, Colombia with a total of 1,423 meters. Assay results are expected in the coming days and are an important catalyst for the company and the stock.

The Olympus target is divided into three zones called Olympus Central, Olympus South and Olympus North which together measure approximately 1.25 km x 0.75 km.

As part of its minimum 20,000-meter program for 2022, Collective Mining has three diamond drill rigs operating at Olympus and a fourth rig is expected to commence drilling at the Guayabales project shortly before the end of March.

“This initial drill program at Olympus represents the first holes drilled on the Olympus Central target and we are excited about the multiple styles of mineralization over potentially wide intercept lengths. Visually, the intersection of multiple CBM-bearing vein zones at the Olympus Central target shares numerous features with the multi-million ounce gold-silver Marmato deposit. We will continue to be aggressive with drilling through the remainder of 2022 and are excited about the initial near-term assay results,” commented Ari Sussman, CEO of Collective

The geological log from the drill holes highlights the following important data:

- Two distinct zones of mineralization have been identified to date resembling historical underground adit sampling which primarily are rich in gold and silver.

- The first zone, which consists of a matrix that includes sericite-pyrite alteration associated with a stockwork of carbonate base metal (“CBM”) veins has been intersected in holes OLCC1 and OLCC3. This zone was intersected up to 360 metres in downhole length in OLCC3.

- The second zone, consisting of country rocks (schists and metasediments) impregnated by multiple zones of sheeted CBM veins, was intersected further downhole in OLCC3 from 485 metres in depth and is up to 150 metres in length. The hole was terminated at a 633 metres depth with a CBM veinlet observed at the end of the hole.

- Mineralization in drilling to date has been intersected over a vertical depth of approximately 400 metres.

- IP chargeability anomalies are coincident with the sulphide mineralization in the Olympus Central target.

- OLCC1 was drilled at the southern periphery of the Olympus Cental chargeability anomaly and intersected the most abundance of sulphides while within the chargeability anomaly.

- OLCC2 almost immediately drilled out of the Olympus Central chargeability anomaly and only intercepted sporadic sulphide mineralization

- OLCC3 was drilled into the centre of the Olympus Central chargeability anomaly to a total depth of 633 metres and intercepted the strongest visual mineralization to date.

- Stepout drilling continues with holes OLCC4, OLCC5 and OLCC6. All holes are advancing well and are intersecting sulphide mineralization including CBM veins.

Source: Collective Mining

Figure 2: Plan View of the Olympus Central Target

Figure 3: Carbonate Base Metal Veins Observed in Drill Hole OLCC3

Figure 4: Olympus: OLCC3 at 196 metres depth: CBM vein with Visible Gold, Sphalerite, Chalcopyrite, Pyrite and Carbonates

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining Ltd. (TSXV:CNL) has announced that the high-resolution and deep-penetrating Induced Polarization survey over the Pound target, is progressing on schedule and will be finished in March 2022.

Ari Sussman, Executive Chairman of Collective commented in a press release: “Our San Antonio project has the potential to yield multiple mineralized porphyry and breccia systems. Following on from the exciting grassroots discovery at Pound, we are focused on defining the morphology of this sulphide rich breccia body and other potential porphyry systems. Once the IP results have been interpreted and incorporated with all newly generated data, the Company will provide details on the next phase of drilling for the project in 2022.”

Highlights of the Survey (Figures 1 and 2)

- The primary objective of the survey is to define the size and shape of the pyrite bearing, mineralised breccia body at Pound. The target has been mapped over a strike length of 1.3 kilometres and is open in all directions.

- Previous reconnaissance drilling from two holes returned broad intercepts as follows:

- 710 metres at 0.53 g/t gold equivalent from surface including 133 metres at 0.92 g/t gold equivalent from 470 metre depth (SAC-8); and

- 750 metres at 0.41 g/t gold equivalent from surface including 187 metres at 0.59 g/t gold equivalent from 60 metre depth (SAC-6).

- (Please refer to the press release dated October 27, 2021 for further details including how the AuEq calculation was estimated).

- The IP survey will cover two blocks totalling an area of 2.4 km2 and will also include the COP and Dollar targets. Previous drilling at Dollar returned an intercept 74 metres at 0.62 g/t gold equivalent from 547 metre downhole within a porphyry hosting a stockwork of quartz-magnetite veins which can be drill tested starting at elevations of 600 metres below the previous hole from a valley floor at the base of a mountain slope.

- The COP target has not yet been drilled and is defined by highly anomalous molybdenum (8 ppm to 108 ppm) and gold (up to 2.74 g/t) in soils in association with altered diorite porphyry and quartz veinlets.

- The deep penetrating IP survey will generate 3D chargeability and resistivity data for minimum vertical depths of 800 metres and has been designed to search for disseminated sulphide, porphyry and breccia systems. This IP system has previously been successful in delineating large, mineralized porphyry alteration systems and high-grade veins at the Olympus target within the Guayabales project where three diamond drill rigs are currently operating with first assay results anticipated in March 2022.

Source: Collective Mining

Figure 1: Plan View of the Area Being Covered by IP at the San Antonio Project

Reconnaissance Drilling at the Box Target, Guayabales Project

The Company recently completed a small reconnaissance drilling campaign (three holes totaling 1,011 meters) at the Box target, which is located on the western side of the Guayabales project. The Box target is hosted within a variety of porphyritic diorites that intrude into carbonaceous schist and siltstone rocks.

Surface mapping, rock and soil sampling had revealed soil anomalies related to polymetallic carbonate base-metal veins (“CBM”) in diorite porphyries and at the contact with schist country rocks.

An IP survey was conducted at the conclusion of the field work to reveal three shallow chargeability anomalies known as central, west, and east. Each anomaly was probed with a reconnaissance hole; the results are as follows:

- BOC001 was drilled northwards into the central chargeability anomaly and intersected a broad sericite-pyrite zone with occasional CBM veins in hydrothermal breccia and diorite porphyry returning an intercept of 93 metres grading 0.3 g/t gold, 4 g/t silver and 20 ppm of molybdenum from 127 metres downhole. Further downhole, a CBM vein was intersected at 307 metres depth with a 1.2 metre intersection length yielding 8.7 g/t gold, 47 g/t silver, 7.1% zinc and 5.7% lead.

- BOC002 was drilled to test the western chargeability anomaly and intersected relatively unaltered porphyritic diorite with disseminated sulphides and one quartz-carbonate vein returning 3.1 g/t gold over 70 cm from a downhole depth of 99 metres.

- BOC003 drill tested the eastern chargeability anomaly associated with a northerly trending fault zone and intersected diorite porphyry in faulted contact with schist country rock.

- The area North of BOC001 demonstrates the best potential for follow up exploration. BOC001 is interpreted to represent the peripheral, phyllic alteration zone (pyrite-sericite-quartz) to a gold bearing (grades of 0.5 to 2 g/t gold), fine grained, porphyry diorite located approximately 200 metres north of the hole intercept. This porphyry body is coincident with a hi magnetic anomaly and requires a follow up IP survey and drill testing.

Source: Collective Mining

A Team Reunited From Continental Gold

Collective Mining is a South American exploration and development firm that focuses on identifying and exploring prospective mineral deposits. The goal of the Company is to repeat its previous success in Colombia by making a major new mineral discovery and extending the projection to production, according on the team that developed and sold Continental Gold Inc. for approximately $2 billion in enterprise value.

40% of the Company’s outstanding shares are owned by management, insiders, and close family and friends, all of whom are in full agreement with investors. Collective currently has the option to acquire up to a 100% interest in two projects located in Colombia.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Colombia focused Collective Mining Ltd announced further high-grade gold and silver vein grab sample assay results from it’s grassroot generated Olympus target located within the Guayabales project in Colombia in a recent press release.

The company currently has two diamond drill rigs operating at Olympus with a third rig anticipated to commence drilling in approximately one week. The company has a minimum 20,000 metre program for 2022, in which all three drills are a part of.

Ari Sussman, Executive Chairman of Collective commented “Olympus continues to deliver in terms of high-grade veins and porphyry potential. The recent IP work has now considerably extended the target. This extremely exciting grass roots discovery will be a priority area for drilling in 2022 and the company is committed to constructing enough drill pads to test the full potential extent of the mineralized system.”

The highlights from the results are as follows:

Assay results of grab samples taken from veins located within historical, shallow underground adits from the northwestern region to the Olympus target confirm the continuation of the high-grade carbonate base metal (“CBM”) sheeted vein system with results as follows:

Table 1: Grab Sample Assay Results from the Northwestern Sector of Olympus

| Sample ID | Au g/t | Ag g/t |

| CM3350 | 112.3 | 544 |

| CM3516 | 57.1 | 634 |

| CM3341 | 55.4 | 439 |

| CM3351 | 25.4 | 521 |

| CM3334 | 10.9 | 268 |

| CM3349 | 7.3 | 206 |

| CM3336 | 7.2 | 179 |

| CM3339 | 7.0 | 474 |

| CM3345 | 5.7 | 144 |

| CM3346 | 4.5 | 107 |

| CM3347 | 3.3 | 68 |

- Multiple CBM vein systems were sampled, where possible, over a 250-metre-wide area from limited and partial exposures of rock. These new high-grade samples now extend the known CBM vein exposure at Olympus to an area measuring more than 600 metres by 600 metres. The CBM veins are sulphide rich and coincident with IP chargeability anomalies. Recently revised interpretation of the IP data by the Company has now expanded the surface area of Olympus to 1,250 metres north-south by 750 metres east-west.

- Preliminary logging of the first completed holes into the eastern portion of Olympus indicates that the Company has intersected multiple CBM veins hosted within intensely altered porphyry diorite and hydrothermal breccia.

- Collective has made the Olympus target a 2022 priority area for drilling due to its grade, potential size, and multiple mineralization styles, including porphyries, high-grade carbonate base metal veins and breccias.

Source: Collective Mining

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

After a busy and successful 2021, Canada-based junior gold mining company Collective Mining (TSXV:CNL) is charting a path forward for 2022 that will highlight it’s Guayabales and San Antonio projects in Caldas, Colombia. After being listed on the TSX Venture Exchange through an RTO on May 28, 2021, the company went on to achieve a number of successful exploration campaigns at the Guayabales and San Antonio projects.

As a result of the success of the drill programs and discoveries, the company has decided to focus on some key targets in the new year. At Guayabales, the Olympus and Victory targets will be the focus of the drill campaign, but the company is also planning additional metres of drilling at the Donut and Box targets. The company has pushed up deadlines thanks to the success of the program so far and may do so again. If the exploration results in the first half of 2022 are successful, Collective could begin to test the earlier-stage Apollo and ME targets.

On the other side of the 20,000+ metre diamond drilling program, a deep penetrating ground IP survey will bein in January 2022 at San Antonio. Upon completion of the survey, the company will begin its follow-up drill program at the Pound target. Collective Mining is also looking at the possibility of testing the COP target at San Antonio for the first time during this period.

2022 is set to be an exciting year for the company, with an accelerated timeline in place for the 20,000+ metre drill program at Guayabales and San Antonio. If 2021 is anything to go by, then it could be another year of discoveries and advancing these two highly prospective properties in Colombia.

Some of the highlights from 2021 include:

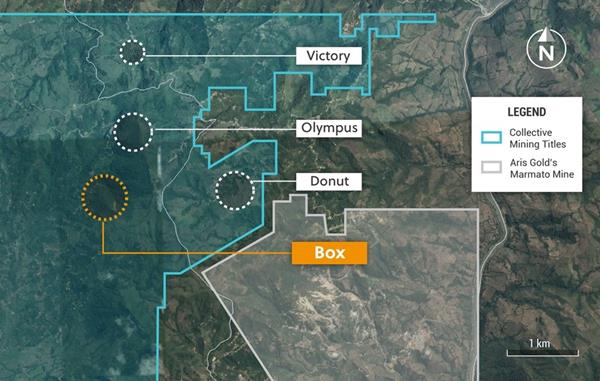

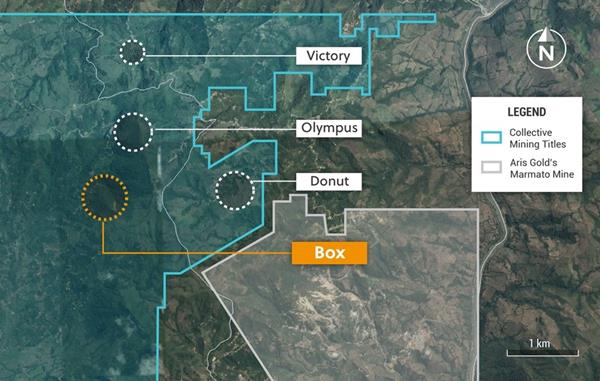

Guayabales Project (Figure 1)

4,838 metres of diamond drilling has been completed at the project as of December 22, 2021.

Due to the operating team’s extensive Colombian experience, the Company was able to rapidly advance surface exploration at Guayabales, which in turn lead to the discovery of a 3.5 kilometre x 3 kilometre cluster encompassing six porphyry targets for diamond drilling.

Donut Target: The Company made a significant grassroots discovery with multiple broad drill intercepts in predominantly breccia beginning at surface. Highlights from holes completed to date are as follows:

* AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.016 x 0.90) + (Cu (%) x 1.83 x 0.92) + (Mo (%) x 4.57 x 0.92), utilizing metal prices of Cu – US$4.00/lb, Mo – US$10.00/lb, Ag – $24/oz and Au – US$1,500/oz and recovery rates of 95% for Au, 90% for Ag, 92% for Cu and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown, and grades are uncut.

Assays for several completed drill holes remain outstanding and will be announced once received in Q1, 2022.

Olympus Target: A high-grade porphyry related, carbonate base metal (“CBM”) vein system, measuring 1,000 metres x 600 metres and open in all directions has been outlined through detailed surface sampling and geophysics. High-grade samples have been collected throughout the target area with highlights as follows:

*The reader should be cautioned that grab samples are selective in nature and as a result should not be relied upon as being representative of average grades anticipated in any future resource estimate or mining scenario.

** Only samples CM003570 and CM003571 reported above were analyzed for base metal grades.

A maiden diamond drilling program utilizing two rigs commenced at the Olympus target on December 1, 2021, and visual logging of the two completed holes to date highlights the discovery of multiple mineralized CBM veins hosted within intensely altered porphyry diorite and hydrothermal breccia units. Initial assay results are expected in January 2022.

Box Target: Three reconnaissance diamond drill holes were recently completed at the Box Target to test an altered and mineralized porphyry target with associated carbonate base metal veins. Visual inspection of the core for drill holes 1 and 3 indicates that multiple CBM veins and altered porphyry style mineralization were intercepted but appears to be distal to a potassic core of a porphyry system. Assay results are expected in mid to late Q1, 2022.

Victory Target: Extensive reconnaissance work is ongoing and has both significantly enhanced the 1000 metre x 600 metre porphyry target and has resulted in the discovery of a new carbonate base metal vein system directly flanking the eastern edge of the porphyry target. Multiple samples from both the porphyry and the Victory East vein target have been collected with results expected in Q1, 2022.

San Antonio Project (Figure 2)

4,310 metres of diamond drilling was completed at the project in 2021 resulting in a significant bulk tonnage grassroots discovery at the Pound Target. Mineralization at Pound, which begins from surface, is related to hydrothermal breccia and highly altered quartz diorite intrusive which have been overprinted by late stage, polymetallic veins. Subsequent follow up exploration has expanded the strike length of the target to at least 1.3 kilometres with assay results as follows:

* AuEq (g/t) = (Au (g/t) x 0.95) + (Ag g/t x 0.013 x 0.90) + (Cu (%) x 1.83 x 0.92) + (Mo (%) x 4.57 x 0.92), utilizing metal prices of Cu – US$4.00/lb, Mo – US$10.00/lb, Ag – $20/oz and Au – US$1,500/oz and recovery rates of 95% for Au, 90% for Ag, 92% for Cu and Mo.

** a 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown and grades are uncut.

Corporate and Sustainability

The Company successfully completed an RTO and was listed on the TSX Venture Exchange on May 28, 2021.

The Company raised C$28.5 million through a combination of a private placement financing and the exercise of warrants related to said financing.

As a result of successful exploration campaigns during the course of the year, the Company’s share price gained approximately 200% from the date of listing on the TSXVenture Exchange.

The Company’s multi-pronged and comprehensive ESG program for 2021 resulted in the recognition by local stakeholders as a transparent and trustworthy entity. Numerous programs were implemented throughout the year highlighted by the strategic alliance with the National Coffee Federation of Colombia and the Municipality of Supía to promote water utilities, infrastructure improvements, as well as to provide technical assistance for more than 400 coffee-growing families representing 6,000 people from 35 different communities.

Source: Collective Mining

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) has announced new further high-grade, polymetallic vein grab sample results from the western side of the grassroot generated Olympus target at the Guayabales project in Colombia. These are additions to previous grab sample results from the eastern portion of Olympus that were announced on December 1, 2021.

Figure 1: Plan View of the Guayabales Project and the Olympus Target

Ari Sussman, Executive Chairman of Collective Mining, commented in a press release: “Olympus is an extremely exciting grass roots discovery for the Company and locates in an area with no previous drilling or modern exploration work. High-grade polymetallic assay results to date are so compelling that we have prioritized Olympus for drilling in 2022 with a much expanded and fully funded drill program currently being finalized ahead of the new year. Olympus is a very large mineralized system measuring at least 1,000 metres X 600 metres on surface and the veins and porphyry are coincident with IP chargeability anomalies that can be followed to depths of up to 800 metres below surface.”

A third diamond drill rig is expected to be added at Guayabales in addition to the two rigs currently operating at part of Collective’s maiden 10,000 metre drill program. The third rig is anticipated to begin operating later in December.

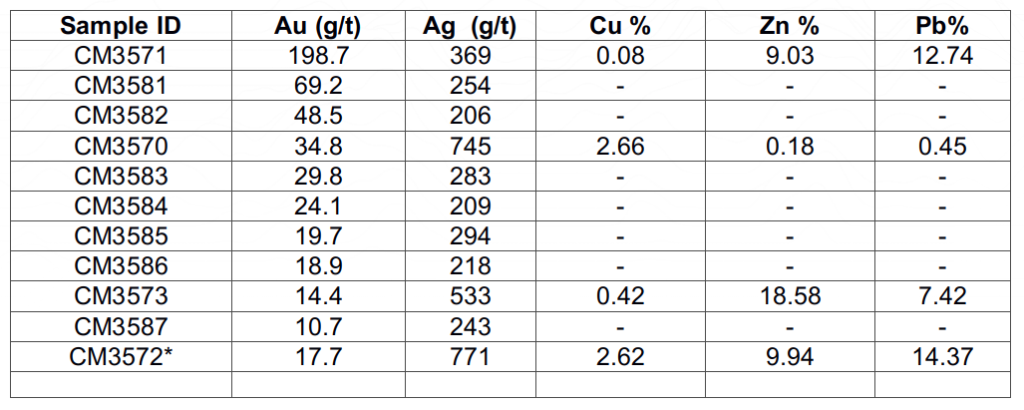

Highlights (Table 1 and Figures 1 to 4)

- Assay results of grab samples taken from veins located within historical, shallow underground adits on the western side of Olympus continue to confirm the presence of a significant high-grade carbonate base metal (“CBM”) sheeted vein system. Four of the samples were also selected to be assayed for base metals with results as follows:

- Table 1: Grab Sample Assay Results from the Western Sector of Olympus**

- * Gold and Silver assays previously reported on December 1, 2021. Sample was collected from eastern side of Olympus.

**The reader should be cautioned that grab samples are selective in nature and as a result should not be relied upon as being representative of average grades anticipated in any future resource estimate or mining scenario.

*** Only samples CM003570 through CM003573 were assayed for base metal grades. - Preliminary logging of the first completed hole into the eastern portion of Olympus highlights multiple CBM veins hosted with intensely altered porphyry diorite and hydrothermal breccia. The CBM veins contain pyrite, galena, chalcopyrite and sphalerite sulphides.

- As a result of the grab sample results and the visual logging of the first hole, the Company will commence diamond drilling with a second rig in December and will soon commence construction of a third drill pad in early January 2022.

Figure 2: Plan View of Olympus with Proposed Drill Holes Traces Superimposed

Figure 3: Olympus Section View Showing Drill Hole Traces into a Chargeability High

Figure 4: Photos of High-Grade Polymetallic Grab Samples Taken at Olympus

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Figure 1: Plan View of the Guayabales Project and the Olympus Target. Source: Collective Mining

This morning, Collective Mining (TSXV:CNL) announced it had received positive sample results from the Olympus Target. The grassroot generate target returned high-grade gold and silver grab sample results. The Olympus target is within the Guayabales project in Colombia.

With these positive results, the company also announced that it had commenced drilling at the Olympus target with an initial drill hole. Guayabales has two operating diamond drill rigs at Guayabales, and is advancing its maiden 10,000 metre drill program quickly. The company is also planning to add a third diamond drill rig in December 2021. Collective also expects to receive the first assay results from the project in the first quarter of 2022.

Ari Sussman, Executive Chairman of Collective Mining (TSXV:CNL) commented in a press release: “Olympus is without question a tier-one target covering a significant area with robust IP targets and multiple mineralization styles that include high-grade veins, hydrothermal breccia and porphyry veinlet stockwork. This is a key priority target for the Company as it has the potential to yield large-scale, high-grade and bulk tonnage systems.With our maiden drill program now underway at Olympus, we look forward to receiving first assay results in early Q1, 2022.”

Highlights (Table 1 and Figures 1 to 4)

- Rock chip assay results of grab samples taken from veins located within historical, shallow underground adits on the eastern side of Olympus have confirmed the presence of a significant carbonate base metal (“CBM”) system with results as follows:

Table 1: Grab Sample Assay Results from the Eastern Sector of Olympus

| Sample ID* | Au (g/t) | Ag (g/t) |

| CM3546 | 485.3 | 325 |

| CM3574 | 72.4 | 271 |

| CM3544 | 58.2 | 99 |

| CM0237 | 33.0 | 100 |

| CM1996 | 20.7 | 9 |

| CM0252 | 19.1 | 1,919 |

| CM3572 | 17.7 | 771 |

| CM2009 | 12.4 | 362 |

| CM2004 | 11.9 | 26 |

| CM2086 | 10.6 | 32 |

*The reader should be cautioned that grab samples are selective in nature and as a result should not be relied upon as being representative of average grades anticipated should a deposit be defined in the future.

- Olympus covers a significant area measuring 1,000 metres north-south by 600 metres east-west and remains open for further expansion.

- A recently completed, hi-resolution, induced polarization (“IP”) survey has outlined multiple chargeability anomalies from surface to depths of up to 800 metres which are interpreted by the Company to relate to disseminated and vein sulphide systems associated with a large porphyry body.

- Diamond drilling has commenced at the first pad and will drill test below the high-grade grab sample areas and the IP chargeability anomalies. A second rig is anticipated to arrive at site shortly and will commence drilling in December 2021.

- An additional series of assay results for rock chip grab samples taken from the western portion of Olympus are expected in the near term. The outstanding grab samples are visually similar to the samples for which assay results are reported herein within abundant sulphide mineralization observed.

Source: Collective Mining

Figure 1: Plan View of the Guayabales Project and the Olympus Target

Figure 1: Plan View of the Guayabales Project and the Olympus Target. Source: Collective Mining

Plan View of Olympus with Proposed Drill Holes Traces Superimposed

Figure 3: Olympus Section View Showing Drill Hole Traces into a Chargeability High

Figure 4: Photos of High-Grade Grab Samples Taken at Olympus

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Collective Mining (TSXV:CNL) announced on Monday that their follow-up drilling on the recent grassroots discovery at the Donut target intercepted long and continuous zones of mineralization from the surface. The Donut target is at the Guayabales project in Colombia and is the first out of five outcropping and grassroot targets generated by the Company to be drill tested.

The company currently has two diamond drill rigs on site as part of its maiden 10,000 metre drill program with a third rig to be added in early Q1, 2022.

Ari Sussman, Executive Chairman of Collective Mining, commented: “We are absolutely thrilled with the results of the first five drill holes into Donut, which is a complete virgin grassroots discovery. Importantly, the results mark an important step in our vision of once again untapping the enormous geological potential of Colombia by discovering the next large-scale deposit in the country. The first ever drill hole is now advancing in the Box target and later this month, we will begin drilling our maiden hole into the Olympus target.”

Highlights from the press release are as follows:

- Broad and continuous gold (“Au”) and silver (“Ag”) mineralization hosted predominately in breccia has been intersected from surface in diamond drill holes DOC-3 and DOC-4 at the Donut target as follows:

- Drilled to the north, DOC-3 intercepted 163 metres at 1.3 g/t gold equivalent from surface including 2 metres at 83.2 g/t gold and 37 g/t silver from 155.6 metres depth; and

- Drilled steeply to the southwest, DOC-4 intercepted 260 metres at 0.6 g/t gold equivalent from surface including 69 metres @ 0.9 g/t gold and 8 g/t silver from 183 metres depth (DOC-4).

- DOC-5, which was drilled to the southeast, intersected a narrower interval of mineralized breccia before passing through a fault. Upon exiting the fault at 81 metres down-hole, late phase (lower grade) porphyry style mineralization was encountered over a significant interval as follows:

- 275 metres at 0.2 g/t gold, 5 g/t silver, 0.07% copper from surface.

- Donut is located at the NW end of a SW trending zone of outcropping breccia mineralization which, to date, has been traced to the SW for 550 metres along strike and remains open for further expansion to the SW.

“Potassic altered diorite porphyry overprinted by phyllic assemblages and sulfide cemented breccia dominate Donut drill holes. Banded quartz-magnetite veins cutting diorite porphyry at depth and as common clasts in breccia at shallower levels indicates excellent potential to discover a large porphyry system nearby the existing new breccia discovery at Donut,” commented Dick Tosdal, Special Advisor to Collective Mining and world-renowned expert on porphyry systems.

This intercept confirms that a porphyry system exists in the Donut target area. In order to better pinpoint a potential location for a concealed well-mineralized porphyry, a special survey is planned and once that is completed there will be follow-up additional diamond drilling.

Drilling was recently completed for holes DOC 6 through DOC 10 and samples were sent to the lab for analysis. Additional assay results are expected in Q4, 2021.

Figure 1: Plan View of the Guayabales Project and the Donut Target is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/73fc402b-5fb4-451b-85d0-e3ae439b457d

Figure 2: Plan View of the Donut Target Area is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/45408cf8-9286-4069-a56a-e7e73836c984

Figures 3: Drill Core Photos are available at:

DOC-3: https://www.globenewswire.com/NewsRoom/AttachmentNg/c796b708-f7c3-44f9-99fb-524f1eba9b9b

DOC-4: https://www.globenewswire.com/NewsRoom/AttachmentNg/e386c984-4141-4fc7-811f-e39c728c87d4

DOC-5: https://www.globenewswire.com/NewsRoom/AttachmentNg/9c3290f1-f9cf-4c16-8855-d5e1ba0be905

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

This morning, Collective Mining (TSXV:CNL) has announced that is has made a significant grassroot discovery at the Pound target within the San Antonio project. This comes right on the heels of the recent discovery at the Donut target at its Guayabales property.

One of three targets generated at the San Antonio project, reported assay results are from the recently completed Phase 1 reconnaissance drill program which tested two of these targets.

Ari Sussman, Executive Chairman of Collective Mining commented in a press release: “The wide and continuous zones of mineralization intersected from surface at Pound are exciting and suggest we are either peripheral to or above a very large porphyry system. It is extremely pleasing that we have made brand new significant discoveries with the initial drill holes into grass root generated targets at both our Guayabales and San Antonio projects. With funding in place through 2022, the Company will become aggressive in the short-term with follow up drilling on our new discoveries and testing newly generated targets across the project portfolio.”

Highlights (Tables and Figures 1 to 5)

- Continuous gold (“Au”), silver (“Ag”) and base metal (copper and molybdenum) mineralization has been intersected from surface, over the full core lengths of two reconnaissance diamond drill holes at Pound as follows:

- 710 metres at 0.53 g/t gold equivalent from surface including 133 metres at 0.92 g/t gold equivalent from 470 metre depth (SAC-8); and

- 750 metres at 0.41 g/t gold equivalent from surface including 187 metres at 0.59 g/t gold equivalent from 60 metre depth (SAC-6).

- 710 metres at 0.53 g/t gold equivalent from surface including 133 metres at 0.92 g/t gold equivalent from 470 metre depth (SAC-8); and

- Importantly, both drill holes ended in mineralization with copper and molybdenum grades increasing at depth including:

- 70 metres at 0.12% copper and 89 ppm molybdenum from 681 metre depth (SAC-6); and

- 133 metres at 0.15% copper and 27 ppm molybdenum from 470 metre depth (SAC-8).

- Pound mineralization is related to hydrothermal breccia and highly altered, quartz diorite intrusive which have been overprinted by late stage, polymetallic veins. Pound is located within a NE-SW trending corridor, as defined by mineralized breccia and altered intrusive, which is open in all directions and has been mapped to date over a strike length of approximately 1.3 kilometres.

- The alteration system associated with Pound (advanced Argillic litho-cap) is related to the upper and peripheral portions of a porphyry system. The Company is currently reviewing its options for follow up exploration which would include initiating a Phase II diamond drill program and a high-resolution and deep penetrating IP survey as has recently and successfully been undertaken at the Guayabales project.

Table 1 Initial Diamond Drilling Results at the Pound Target

| Hole ID | From

(m) |

To

(m) |

Intercept

Interval (m)** |

Au

(g/t) |

Ag (g/t) | Zn

(ppm) |

Pb

(ppm) |

Cu % | Mo % | AuEq

(g/t)* |

| SAC-6 | 0 | 750 | 750 | 0.32 | 6 | 454 | 303 | 0.02 | 0.001 | 0.41 |

| Incl. | 60 | 247 | 187 | 0.50 | 9 | 274 | 63 | 0.00 | 0.000 | 0.59 |

| And | 681 | 750 | 70 | 0.41 | 2 | 79 | 11 | 0.12 | 0.009 | 0.65 |

| SAC-8 | 0 | 710 | 710 | 0.40 | 6 | 352 | 130 | 0.04 | 0.001 | 0.53 |

| Incl. | 4 | 156 | 152 | 0.50 | 11 | 281 | 65 | 0.01 | 0.000 | 0.62 |

| And | 470 | 603 | 133 | 0.61 | 6 | 504 | 307 | 0.15 | 0.003 | 0.92 |

* AuEq (g/t) = (Au (g/t) x 0.95) + (Ag g/t x 0.013 x 0.90) + (Cu (%) x 1.83 x 0.92) + (Mo (%) x 4.57 x 0.92), utilizing metal prices of Cu – US$4.00/lb, Mo – US$10.00/lb, Ag – $20/oz and Au – US$1,500/oz and recovery rates of 95% for Au, 90% for Ag, 92% for Cu and Mo.

** a 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown and grades are uncut.

Geological Details of the San Antonio Project

The San Antonio (“SA”) Project is located in the Middle Cauca Gold Belt (“MCB”), 80 km south of Medellin and 50 km north of Manizales, Department of Caldas, Colombia. The MCB has been the most prolific belt for Miocene aged, porphyry and epithermal vein discoveries within Colombia and multi-million ounce discoveries in recent years include Buriticá, La Colosa, Nueves Chaquiro and Marmato.

The SA covers an area of 3,853 hectares and hosts multiple quartz diorite, diorite intrusive and breccia bodies of Miocene age which intrude basement schists and younger volcano-sedimentary packages.

Three specific grassroots exploration targets have been outlined by surface mapping, sampling, soil geochemistry, geophysical modelling, and shallow scout drilling. These are referred to as the Dollar, COP and Pound targets.

The Pound target is located in the northern portion of the project, is defined by multiple hydrothermal breccia bodies hosted within highly altered diorite and quartz diorite intrusive and overprinted by late stage, polymetallic veins. This zone of altered intrusive and breccia bodies trends NE-SW and has been mapped for a strike length of plus 1.3 kilometres. The zone is still open to the NE and SW. Outcrop exposures on the southern border of this target area include epithermal vein systems within a preserved lithocap of advanced argillic alteration which is superimposed on hydrothermal breccia bodies which grades laterally and downwards into intermediate argillic alteration assemblages. These rocks are interpreted to reflect preservation of the shallow levels of the porphyry system. The initial two reconnaissance diamond drill holes, SAC-6 and SAC-8, were drilled to respective downhole depths of 750 metres and 710 metres and intersected various hydrothermal breccia (pyrite matrix), altered quartz diorite intrusive and late-stage polymetallic veins. All the rock units have been hydrothermally altered with an earlier sericitic event overprinted by a strong, advanced argillic phase with various aluminosilicates. At depth, various diorite phases display disseminations and aggregates of chalcopyrite and molybdenite in contact with large blocks of metamorphic schist. The target remains open in all directions and further work is envisaged and will commence with a deep penetrating, high-resolution, induced polarization survey down to minimum depths of 900m below surface followed by a Phase II expanded diamond drilling program. Exploration targets include the mineralized breccia and a porphyry system postulated to occur below the lithocap.