Collective Mining Ltd. (TSXV:CNL) has announced that the high-resolution and deep-penetrating Induced Polarization survey over the Pound target, is progressing on schedule and will be finished in March 2022.

Ari Sussman, Executive Chairman of Collective commented in a press release: “Our San Antonio project has the potential to yield multiple mineralized porphyry and breccia systems. Following on from the exciting grassroots discovery at Pound, we are focused on defining the morphology of this sulphide rich breccia body and other potential porphyry systems. Once the IP results have been interpreted and incorporated with all newly generated data, the Company will provide details on the next phase of drilling for the project in 2022.”

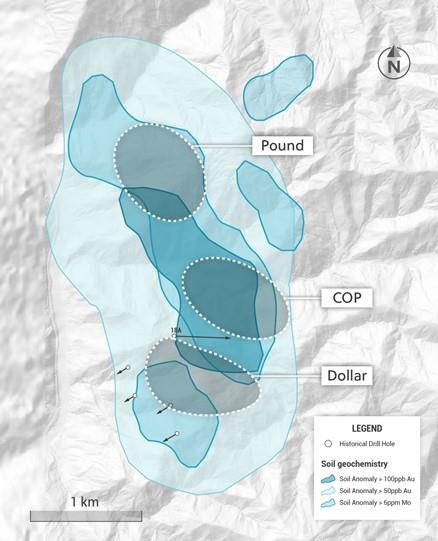

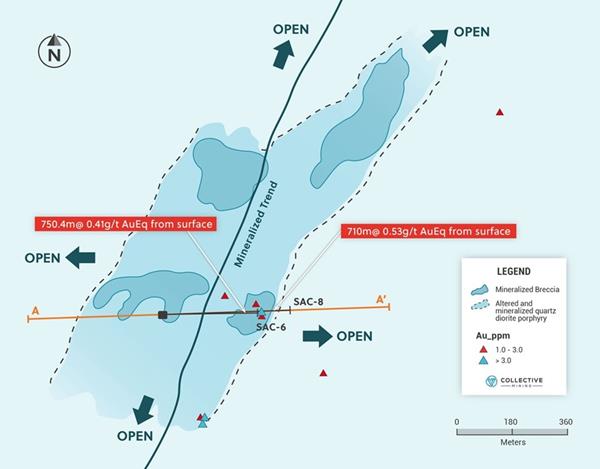

Highlights of the Survey (Figures 1 and 2)

- The primary objective of the survey is to define the size and shape of the pyrite bearing, mineralised breccia body at Pound. The target has been mapped over a strike length of 1.3 kilometres and is open in all directions.

- Previous reconnaissance drilling from two holes returned broad intercepts as follows:

- 710 metres at 0.53 g/t gold equivalent from surface including 133 metres at 0.92 g/t gold equivalent from 470 metre depth (SAC-8); and

- 750 metres at 0.41 g/t gold equivalent from surface including 187 metres at 0.59 g/t gold equivalent from 60 metre depth (SAC-6).

- (Please refer to the press release dated October 27, 2021 for further details including how the AuEq calculation was estimated).

- The IP survey will cover two blocks totalling an area of 2.4 km2 and will also include the COP and Dollar targets. Previous drilling at Dollar returned an intercept 74 metres at 0.62 g/t gold equivalent from 547 metre downhole within a porphyry hosting a stockwork of quartz-magnetite veins which can be drill tested starting at elevations of 600 metres below the previous hole from a valley floor at the base of a mountain slope.

- The COP target has not yet been drilled and is defined by highly anomalous molybdenum (8 ppm to 108 ppm) and gold (up to 2.74 g/t) in soils in association with altered diorite porphyry and quartz veinlets.

- The deep penetrating IP survey will generate 3D chargeability and resistivity data for minimum vertical depths of 800 metres and has been designed to search for disseminated sulphide, porphyry and breccia systems. This IP system has previously been successful in delineating large, mineralized porphyry alteration systems and high-grade veins at the Olympus target within the Guayabales project where three diamond drill rigs are currently operating with first assay results anticipated in March 2022.

Source: Collective Mining

Figure 1: Plan View of the Area Being Covered by IP at the San Antonio Project

Reconnaissance Drilling at the Box Target, Guayabales Project

The Company recently completed a small reconnaissance drilling campaign (three holes totaling 1,011 meters) at the Box target, which is located on the western side of the Guayabales project. The Box target is hosted within a variety of porphyritic diorites that intrude into carbonaceous schist and siltstone rocks.

Surface mapping, rock and soil sampling had revealed soil anomalies related to polymetallic carbonate base-metal veins (“CBM”) in diorite porphyries and at the contact with schist country rocks.

An IP survey was conducted at the conclusion of the field work to reveal three shallow chargeability anomalies known as central, west, and east. Each anomaly was probed with a reconnaissance hole; the results are as follows:

- BOC001 was drilled northwards into the central chargeability anomaly and intersected a broad sericite-pyrite zone with occasional CBM veins in hydrothermal breccia and diorite porphyry returning an intercept of 93 metres grading 0.3 g/t gold, 4 g/t silver and 20 ppm of molybdenum from 127 metres downhole. Further downhole, a CBM vein was intersected at 307 metres depth with a 1.2 metre intersection length yielding 8.7 g/t gold, 47 g/t silver, 7.1% zinc and 5.7% lead.

- BOC002 was drilled to test the western chargeability anomaly and intersected relatively unaltered porphyritic diorite with disseminated sulphides and one quartz-carbonate vein returning 3.1 g/t gold over 70 cm from a downhole depth of 99 metres.

- BOC003 drill tested the eastern chargeability anomaly associated with a northerly trending fault zone and intersected diorite porphyry in faulted contact with schist country rock.

- The area North of BOC001 demonstrates the best potential for follow up exploration. BOC001 is interpreted to represent the peripheral, phyllic alteration zone (pyrite-sericite-quartz) to a gold bearing (grades of 0.5 to 2 g/t gold), fine grained, porphyry diorite located approximately 200 metres north of the hole intercept. This porphyry body is coincident with a hi magnetic anomaly and requires a follow up IP survey and drill testing.

Source: Collective Mining

A Team Reunited From Continental Gold

Collective Mining is a South American exploration and development firm that focuses on identifying and exploring prospective mineral deposits. The goal of the Company is to repeat its previous success in Colombia by making a major new mineral discovery and extending the projection to production, according on the team that developed and sold Continental Gold Inc. for approximately $2 billion in enterprise value.

40% of the Company’s outstanding shares are owned by management, insiders, and close family and friends, all of whom are in full agreement with investors. Collective currently has the option to acquire up to a 100% interest in two projects located in Colombia.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.