In a recent interview, Hudbay Minerals CEO Peter Kukielski stated that he believes that BHP Group’s recently rejected $39 billion offer for Anglo American has increased the value of copper assets. This could signal a growing willingness among large miners to pay a premium for existing copper mines, and spark a potential bidding war.

Hudbay plans to initiate a formal sale process later this year for a minority stake in its Arizona Copper World project. The company has already engaged in preliminary discussions with interested parties.

Copper Demand and Prices

BHP’s offer for Anglo American, though ultimately rejected, highlights the industry’s focus on copper. Three-month copper prices on the London Metal Exchange recently peaked above $10,200 a metric ton, driven by expected demand for the metal in electrification technologies.

Hudbay’s Copper World project is currently under construction and projected to produce an average of 92,000 metric tons of copper annually over its first ten years. Phase 1 development has an estimated cost of C$1.3 billion ($950.6 million). Kukielski indicated that Hudbay will look for joint-venture partners once necessary permits have been obtained.

Canadian Miners as Targets

Analysts see Canadian copper miners as potential acquisition targets due to a global shortage of new copper mines. Hudbay itself has been active in domestic acquisitions, purchasing Copper Mountain last year for C$439 million. However, RBC Capital Markets has also suggested Hudbay could become a takeover target if copper prices decline.

BHP Group Ltd.’s proposed £31.1 billion ($38.8 billion) takeover of Anglo American aimed to create a mining giant with significantly increased copper production. The all-share deal would have required Anglo to first spin off its controlling interests in South African platinum and iron ore companies. Anglo American rejected the offer, deeming it an undervaluation.

A BHP-Anglo combination would have given BHP roughly 10% of the world’s copper mine supply. Market watchers anticipate a significant copper supply shortage, which is expected to drive prices higher. This deal, while unsuccessful, could spark interest from other major miners looking to increase their copper exposure.

Anglo American, with attractive South American copper operations, has been a long-considered takeover target. However, its complex structure involving commodities like platinum and diamonds, along with its significant South African holdings, has deterred potential suitors.

Anglo American has recently faced setbacks due to price drops in some of its key commodities and operational challenges. These factors have contributed to a decline in its valuation, potentially increasing its vulnerability to takeovers.

The BHP-Anglo proposal, despite its rejection, suggests a return to mega-deals in the mining sector after a decade of cautious activity. With larger cash reserves and a renewed focus on investor confidence, the industry appears ready for a potential wave of mergers and acquisitions.

Commodities giant Glencore is also reportedly considering an approach to acquire Anglo American, according to two sources familiar with the matter. This development suggests a potential bidding war could emerge for the 107-year-old mining company.

Discussions within Glencore are in preliminary stages, and it remains uncertain whether the company will formally approach Anglo with an offer. However, Glencore’s interest comes on the heels of BHP Group’s recently rejected $39 billion all-stock takeover proposal.

BHP May Still Be in the Running

A source familiar with BHP’s plans previously indicated that the Australian mining giant is exploring an improved offer for Anglo American. BHP has until May 22nd to make a formal bid, suggesting the company may remain in contention.

Anglo American’s appeal lies primarily in its prized Chilean and Peruvian copper assets. Demand for copper is projected to surge due to its widespread applications in electric vehicles, renewable energy infrastructure, and expanding AI technologies.

Anglo American and Glencore currently hold equal 44% stakes in Chile’s Collahuasi mine, which boasts some of the world’s largest copper reserves. Anglo’s diverse portfolio also includes platinum, iron ore, diamonds, steelmaking coal, and a fertilizer project, adding to its attractiveness.

Since BHP’s offer became public, Anglo American’s share price has climbed over 30%. The company had previously underperformed its mining peers after experiencing production downgrades and asset writedowns earlier this year.

Glencore’s Concurrent Acquisition, and the South Africa Factor

Glencore’s potential interest in Anglo comes as it finalizes a $6.9 billion acquisition of a 77% stake in Teck’s Canadian coal unit. The deal is anticipated to close by the third quarter of this year.

Anglo’s significant holdings in South Africa, including shares in Anglo Platinum (Amplats) and Kumba Iron Ore, could raise strategic considerations for potential buyers. BHP exited South Africa in 2015, but Glencore maintains coal and chrome operations in the country.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

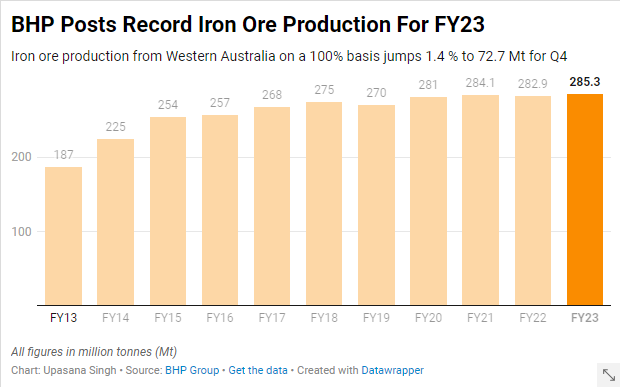

BHP (ASX:BHP) has announced a record high in its annual iron ore production, bolstered by steady operations at its South Flank mine in Western Australia. However, the company has noted that it is preparing for higher operational costs.

BHP also reaffirmed that production at South Flank would reach full capacity of 80 million metric tons per annum, on a 100% basis, by the end of fiscal 2024. Iron ore production was augmented by an improved rail performance at the mines in Western Australia, albeit the company did experience a slight setback due to adverse weather conditions from tropical Cyclone Ilsa in the quarter.

Iron ore output from Western Australia was reported to be 72.7 million metric tons (Mt) in the three months leading up to June 30. Although impressive, this number fell slightly short of Visible Alpha estimates of 73 Mt, according to UBS.

BHP, the world’s leading miner by market capitalization, disclosed that unit costs at its Western Australian iron ore operations, along with its Chilean copper mine, Escondida, are likely to reach the higher end of predicted ranges. Despite this, capital and exploration expenditure is set to be below the annual guidance due to foreign exchange fluctuations.

BHP also release an exciting forecast for fiscal 2024, predicting an iron ore output of between 282 and 294 million metric tons from Western Australia. The mid-point forecast shows a 0.9% increase over the annual production of 285.3 million metric tons for fiscal 2023.

The company highlighted a boost in copper production, following its $6.4 billion acquisition of OZ Minerals in May. Copper production rose by 9% to 1,716.5 thousand metric tons in the fiscal year, and the outlook for fiscal 2024 is promising, with production estimated between 1,720 and 1,910 thousand metric tons.

This surge in copper production is largely attributable to the anticipated higher grades at the world’s top copper mine and the successful integration of OZ Minerals into BHP’s South Australian operations.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

BHP (ASX:BHP) is reportedly thinking about increasing its A$8.4 billion ($5.6 billion)offer for OZ Minerals Ltd. If they go through with this, it would mean that the leading miner in the world would have a bigger role in providing metals that are necessary for the transition to green energy sources.

In August, BHP rejected OZ Minerals’ first approach, claiming it undervalued the company’s prospects in precious metals like copper and nickel. On Friday, shares in OZ Minerals finished at A$25.25.

If this large acquisition goes through, it will be just one more in a series of big changes at the world’s biggest miner since Mike Henry became CEO in early 2020. The company has revived its interest in major deals, exited the oil and gas industry, and is pouring billions of dollars into a new potash mine in Canada.

According to the individuals, BHP may raise its A$25 per share offer for OZ Minerals as soon as this month. It wasn’t immediately clear what amount BHP would raise its bid, or whether OZ Minerals would accept a new offer from BHP.

Deliberations are ongoing and there’s no certainty that BHP will decide to return with a higher price, according to the people. A representative for BHP declined to comment, while a spokesperson for OZ Minerals couldn’t immediately be reached for comment outside regular business hours in Australia.

BHP’s strategies include diversifying into commodities that are linked to trends such as low-emissions travel and clean energy — particularly copper for solar power and nickel for lithium-ion batteries. It continues to be a major iron ore and steelmaking coal producer, as well as a significant iron ore miner, this year deciding to keep its last energy coal mine.

BHP has interests in mining copper along with OZ Minerals, which runs copper mines in South Australia, where BHP maintains its enormous Olympic Dam operation and Oak Dam prospect.

BHP’s desire to buy OZ Minerals is indicative of the company’s return to large-scale transactions, with its last major one being the $12.1 billion acquisition of Petrohawk Energy Corp. in 2011. However, it has made more modest purchases of copper and nickel assets since then.

Last year, the firm was defeated in its attempt to acquire nickel after losing a large sum of money on its six-month pursuit of Canadian miner Noront Resources Ltd., which was outbid by Australian billionaire Andrew Forrest.

The world’s largest producers are all optimistic about copper, anticipating increasing demand in cities and electric cars as the global economy decarbonizes. Rio Tinto Group reached a final agreement to acquire all remaining shares of Turquoise Hill Resources Ltd., which owns a large copper mine in Mongolia, earlier this month.

The long-term prospects for copper remain encouraging, but the metal’s price has plummeted dramatically since earlier this year, with concerns growing that Europe’s energy crisis, a tighter monetary policy by the Federal Reserve, and China’s Covid Zero plan will continue to weigh on demand.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Copper bounced back over $8,000 a tonne last week on hopes that the worst of China’s economic downturn was behind it, but the bellwether metal is now flirting with a bear market once again — with a nearly 20% decline so far in 2022.

On Tuesday, while releasing its full-year results, BHP based on 2021’s total production of just over 1 million tonnes, warned that prices might significantly weaken in the next few years. That trend could then reverse in the second half of the decade.

Short-term supply gains may be possible thanks to new output from projects and expansion in central Africa, Chile, Peru, and Mongolia. These should come on stream through 2024 and keep the market well-supplied. The company’s guidance for a 4%-16% increase in copper production in the next 12 months and rising primary supply should dovetail with the higher scrap levels supported by increasing end-of-life pool size out of China.

Electrification is the major factor driving projections for a spike in demand from the mid-to-late 2020s. Renewable power generation, electric vehicles, and energy storage are all expected to grow exponentially, with copper an essential input.

Grade declines, water constraints, resource depletion, and increasing complexity at known developments all have an effect on costs. This is why companies have been reluctant to invest in new copper projects, even as the price of the metal has more than tripled since early 2016

Grade decline is the natural result of the depletion of easy-to-find, high-grade ore deposits. This has been a factor in the rising costs of copper production for a number of years.

Water constraints are an increasingly important issue for the copper industry, especially in Chile, the world’s largest producer. Record low rainfall in many parts of the world have created challenges for both mines and smelters that require large volumes of water to operate.

BHP also noted that capital spending and demand in the space are disconnected right now. For an upside case for demand by 2030, the industry’s capex could hit $250 billion. However, S&P Global notes that spending in 2024 for most copper producers in the list of the 80 largest miners (excluding diversified miners) could be roughly half that of the calendar year 2014.

Uncertainty in the copper market due to fluctuating demand from China, the world’s largest consumer, has been a key factor weighing on prices in recent years. While Chinese demand is expected to continue to grow in the long term, it is unlikely to do so at the same breakneck pace as in previous years.

China’s economic growth is expected to slow in the coming years as the country grapples with structural problems such as high levels of debt. This could lead to weaker demand for copper in the short term but a continued upward trend through the rest of the decade, coinciding with BHP’s overall outlook.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

BHP (ASX:BHP) is looking to its Canadian potash project to mitigate current and future risks to global fertilizer supplies due to the Russian conflict. The company’s $5.7 billion Jansen potash project in Canada is set to be accelerated with Stage 1 first production being pushed to 2026. This is an acceleration of a full year as the company had planned to begin production at the project in 2027. The war in Ukraine has hit supplies of important grains, as well as fertilizers. This is because Russia and Belarus currently account for 40% of global production, and the instability, as well as actions, have cut off supply.

In the middle of February, Belarusian state-owned potash miner Belaruskali sparked concerns by announcing force majeure on its contracts. This alarmed a market that was already struggling with skyrocketing prices. Since then, further sanctions on Russia have worsened the situation, cutting off supplies.

BHP CEO Mike Henry is now looking to the company’s Canadian project, located in a politically and geographically stable mining jurisdiction. This would reduce the supply-side disruption risks. Henry spoke about this at the Bank of America Metals and Mining conference earlier this week: “[Supply-side disruption linked to the war in Ukraine] has positively reinforced the decision we’ve taken to enter potash. We are making good progress and we’re looking at potential to accelerate Jansen Stage 1 first production into 2026.”

Potash is expected to be produced in Jansen at a rate of about 4.2 million tonnes each year during the first phase. Stage 2 would produce an additional 4 million tonnes every year, for a capital intensity of between $800 and $900 per tonne, nearly 30% lower than the planned costs for Stage 1.

Now, the company has begun studies for a second phase of the project’s development, which could advance things faster. With the $5.7 billion investment, BHP had given roughly $1.4 billion in contracts as of late April and an additional $200 million since the firm released first-half results in February, which cover port infrastructure, underground mining systems, and other shaft and surface construction projects.

“If we decide to bring on all four stages, and at prices just half of where they are today, we’d be generating around $4 billion to $5 billion of EBITDA [earnings before interest, depreciation, tax and amortisation] per year,” Henry said at the conference.

Potash shortages are a concern not just for the mining industry but for agricultural industries. Potash is valuable to farmers because it can be used as fertilizer. Fertilizers boost crop yields, which is important for food security. The current situation with Russian supplies has led to higher prices and could create food shortages.

BHP’s move to accelerate its Jansen project is a response to this potential crisis. By increasing production, the company can help to offset any potential disruptions in supply and ensure that farmers have access to the potash they need. With the potential to produce 17 million tonnes per year with the four phases of development, the single Canadian project would account for approximately 25% of the global demand for potash.

Current supply chain issues could take three years to resolve due to the current situation, and the company is moving quickly to shore up its projects and resources for the future.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As the war in Ukraine continues, and sanctions against Russian business continue to expand, mining companies have been exiting businesses in the country. Rio Tinto (ASX:RIO), BHP (NYSE:BHP), and more have been selling assets in Russia as they mak their exit.

Canada’s Kinross Gold (NYSE:KGC) is the latest company to dump holdings there, selling the Kupol and Dvoinnoye operating mines; exploration assets, including the Chulbatkan project; and related infrastructure to Highland Gold Mining and other associates in a $680 million cash deal. Under the agreement, Kinross will receive $400 million in cash for the Kupol mine and surrounding exploration rights.

When the transaction closes, Kinross will receive $100 million, with another $150 million to be paid out before the end of 2023, an additional $100 million before the end of 2024, and a final payment of $50 million before the end of 2025.

Highland Gold CEO Vladislav Sviblov commented in a press release: “Our largest mining hubs are located in the Khabarovsk and Chukotka regions, precisely where these mines are located, and we, therefore, anticipate operational, logistical and management synergies. We also intend to maintain the high operating standards of the previous owner, and to invest in employee development.”

Deals in the country are tightly linked with government approval and oversight considering the stakes, and the Russian Federation Ministry of Industry and Trade, Denis Manturov, commented: “Kinross Gold followed the second of the three options proposed by the government for foreign investors with choosing a civilised way out of Russian projects. Therefore, we support the execution of such a deal: the result will be a stable flow of tax revenues, save of working places and support for social projects in the regions of presence.”

A Civilized Way Out

For mining companies with assets in Russia, the path out of the country has been swift. The largest mining companies in the world have all pulled out or are in the process of selling assets, and while the reasons behind it vary, sanctions and political risk are the primary drivers.

Kinross Gold is the latest company to sell its Russian assets, with the sale totaling $680 million, and many other companies are in discussions to exit their businesses in the country.

The European Union has likewise stated that in response to Russia’s invasion of Ukraine, the European Commission will impose a ban on Russian coal and other items. A potential EU ban on Russian coal import, according to a Reuters source, would be worth around €4bn per year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

BHP’s (NYSE:BHP) copper operation, Spence, located in northern Chile, has begun its journey to autonomy by inaugurating its first drilling rig. This event marks the beginning of the implementation of many other projects that seek autonomy and safer, more competitive and sustainable mining practices.

The equipment used is the Pit Viper 351 model, which is operated remotely from the Spence control room located approximately 2 kilometres from the mine pit. The use of this equipment will significantly reduce the exposure to operational health and safety risks of the workforce, which is a strategy that will continue to be implemented throughout the current year.

Five Rigs to be Commissioned

Five autonomous drilling rigs will be commissioned gradually over time. The plan is that in the future 100% of the drilling fleet will be autonomous. Similarly, it is planned that during 2022 the operation will make a strong decision regarding the autonomy of its truck fleet.

Regarding the implementation of these changes Pedro Hidalgo, the head of Autonomy at BHP Minerals Americas said, “Spence’s first autonomous drilling rig is the spearhead of a broader program that we are implementing at BHP’s main operations in Chile. We are not only working on drills but also on autonomous trucks. We are very pleased to meet this first milestone that will allow us to advance in the Autonomy Program at both Spence and Escondida”.

The active participation of Spence workers has been fundamental for the development of the project. From the study stage, which began two years ago, to date.

Spence Copper Mine

For the project, Spence opened 16 new job categories such as autonomous drill controllers and autonomous drill yard operators. The selected employees underwent an arduous training and special training with a duration of approximately 200 hours divided into practical and theoretical learning.

BHP built a US$2.46 billion concentrator plant for the Spence project last year, capable of generating 95,000 tons of material per day. The plant is expected to extend the life of the Spence mine by producing 300,000 tons per year until at least 2026. Spence’s first copper sales are expected to take place in the first quarter of the year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Investors in the mining sector are preparing for what should be another strong year for the industry by adding a total of $86.3 billion of market capital to the top mining companies in the Top 50 ranking in 2021.

The overall value of the Top 50 ended 2021 at just under $1.4 trillion after peaking a little above that. This amount represents an increase of about $100 billion since the beginning of the year and double the market capitalization they had during March and April 2020, i.e., the peak of the pandemic.

Coal Doesn’t Go Cold

With no exposure to iron ore other than trading, Glencore (OTC:GLNCY) and its investors bucked the trend by closing the year with $25 billion.

The Swiss multinational company, Glencore, a commodity trading and production company, has not abandoned coal mining. Like its peers, its coal, gas and oil trading arm is benefiting from rising energy prices.

The performance of coal miners in 2021, especially in China, is the clearest evidence of the volatility of commodity markets. Although only a short time ago, towards the end of the year coal miners and their coal divisions in the diversifieds were threatening to drop out of the ranking altogether.

The rest of the three remaining coal companies (the ranking excludes power companies that operate their own mines such as Shenhua Energy) rose and Coal India halted its decline. The world’s largest coal miner, Coal India was number 4 in the rankings four years ago.

Lithium on the Rise

The high demand for electric cars has caused lithium prices, used for the motors and battery technology, to remain high, and their rebound has been prolonged. At the moment, the top three lithium producers, listed in the Top 50 ranking, have a global value of more than $66 billion.

Tianqi Lithium briefly dropped its position in the rankings in 2019, due to its market value being below $5 billion. However, China’s Shenzhen-listed Lithium producer is now ranked in the top 20 of the majors, with a value of about $25 billion surpassing SQM.

For its part, Albemarle (NYSE:ALB), the world’s number one producer, has risen 59% since the year began which made its investors $10 billion richer. Charlotte, North Carolina-based Albemarle announced that it intends to buy, with the aim of expanding downstream, a Chinese lithium producer.

Ganfeng, the leading manufacturer of lithium chemicals (a company not ranked as mining is not a major part of its business) is striving to secure investment in that sector of production. For its part, copper producer Codelco is advancing work on its lithium project. However, concessions in Chile could become scarce or disappear altogether in the decades to come.

Pilbara Minerals is currently ranked 54th but Pilbara is expected to enter the top 50 mining rankings very soon, as the company continues to post record highs and operations at the Pilgangoora project are ramping up to supply the huge demand for spodumene for Chinese transformers.

Rio Tinto’s (ASX:RIO) Jadar project is not off to a good start in Serbia. The Anglo-Australian company’s lithium business is likely to start to look up in the rankings in the next few years as well as Sibanye’s entry into battery metal with an acquisition in Nevada.

Iron Ore, and More

Falling iron ore prices and the decline of copper in the market in the last months of 2021 affected the ranking position of the big three companies, BHP (NYSE:BHP), Rio Tinto (ASX:RIO) and Vale (NYSE:VALE). Over the course of last year, they lost a total of $56 billion.

Last year, BHP had a valuation of almost $200 billion being worth slightly more than oil company Royal Dutch Shell for some time. This made it the most valuable stock in the UK.

A sign of the belief investors have in the effect on mining for the green energy transition is the fact that BHP has lost almost $50 billion despite activating the search for nickel for battery manufacturing. Rio Tinto, for its part, has lost $43 billion since its peak. These losses are indicators that iron ore mining remains central to the sector.

The fall in iron ore caused South Africa’s Kumba Iron Ore to have its worst valuation of the year, plummeting 30%. Australia’s Fortescue Metals, the world’s fourth largest iron ore producer, plunged by $13 billion over the year. While its ranking fell six places as its trading arm, Fortescue Future Industries, got off to a slow start.

CSN Mineração, one of the biggest mining IPOs since Glencore’s in 2011, dropped out of the 50 ranking in its first quarter debut. But thanks to last year’s 87% rise, the Cleveland-Cliffs company is ranked in the top 50 after spending years in obscurity.

Uranium

For the first time after many years, the value of uranium producers is once again ranked in the top 50.

Kazakhstan’s Kazatomprom expanded its stock exchange listing beyond Almaty. As a result, the company has doubled in value this year. Kazakhstan, responsible for about 40% of uranium production, despite the turmoil in the country, has not affected the fortunes of the state-controlled company.

AngloGold Ashanti, Cameco’s main rival, has been overtaken by Cameco leaving Cameco out of the rankings at the end of the year. However, the stock’s performance since the Dec. 31 close would see the Saskatoon-based company move back up the rankings in the hope that it can take advantage of the revival of uranium mining and the problems in Kazakhstan.

A Banner Year

Overall, the mining industry had a banner year with record investor inflows. The bullishness of 2021 is likely to continue as the pandemic recedes and producers get back to normal with production targets as well as a more balanced and predictable supply chain.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Due to drops in copper output from state-owned Codelco and BHP’s Escondida mine, Chile saw its total copper production drop in November by 0.6% year-on-year down to 481,800 tonnes, according to the Chilean Copper Commission (Cochilco) report published on Tuesday.

When compared to the previous year during the same period, Codelco experienced an output drop of 7.4% in November, decreasing to 153,800 tonnes. This was a total 0.4% drop in production in 2021 so far for the copper company. Codelco is approaching its 50th year since it was created in 1976, and mainly focuses on the exploration, development, and refining process of copper.

The world’s largest copper mine, BHP’s Escondida, also experienced an output drop in November. Extraction fell 11.6% compared to last year, totaling 80,300 tonnes for the month. In 2021 through November, the mine recorded a 14.5% drop in output.

BHP’s Escondida is the world’s biggest producer of copper concentrates and cathodes. The copper deposit is located in the Atacama Desert in Northern Chile, 170km southeast of Antofagasta. The name ‘Escondida’ actually means ‘hidden’ in Spanish because it is hidden by hundreds of meters of overburden. Oppositely, the Collahuasi copper mine, which is a joint venture by Glencore and Anglo American, reported a 5.1% year-on-year rise in production to 50,700 tonnes, according to Cochilco.

Shifting Politics

The biggest recent change for Chile was the election of a new president, Gabriel Boric. Many in the mining and copper industry have concerns regarding new rules and regulations surrounding the mining sector that Boric has already begun to discuss.

Boric has already pledged to oppose the $2.5 billion iron-copper mine known as the Dominga mine, after years of legal battles back and forth. He is passionate about the environment and believes the high pollution that would come from this mine would not be worth what it could produce and create.

Boric, who is 35, will be the youngest leader in the history of Chile since President Salvador Allende, and plans to make a plethora of changes to the nation, including drafting a new constitution. The 2022 year will be a time of change and adaptation for the entire mining industry under his new environmentally focused changes and rules. While Boric will be aiming for an environmentally friendly and ESG mining environment, there may be compromises to be found yet, as slowing down an industry that is so critical to the Chilean economy would not be feasible without serious consequences.

Models Prove the Chilean Upward Trend

Chile is the world’s largest copper producer, from January until August 2021, Chile’s copper production totaled 3.73 million metric tons. In 2020, Chile’s copper production was about 5.7 metric tons, accounting for approximately 28.5 % of the global copper production that year.

According to trading economics models, Chilean copper production is projected to trend around 540.00 thousands of tonnes in 2023.

Not only is Chile the world’s largest copper producer, but they also have some of the biggest lithium reserves in the world. Boric in the past has criticized privatization in the mining sector and would like to see the state have its own lithium firm, but has not touched on these plans again since pledging to create one.

As the global pandemic and supply and demand continue to change and update, and Boric takes his place as president in March, Chile can expect to see lots of changes in the upcoming 2022 year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Gabriel Boric, a young leftist millennial was just elected as Chile’s new president on Sunday, and he is ready to make important changes for the nation and fellow Chileans.

Boric won 56% of the votes compared to his main opponent, lawmaker José Antonio Kast, who won 44% of the votes with more than 90% of polling stations releasing their data.

One of the first major changes of the young new leader will be drafting a new constitution, which will likely bring about updated legal and political changes surrounding environmental issues, gender inequality, Indigenous rights, just to name a few important issues.

One of those issues, mining, remains in the balance as some of the world’s biggest mining companies wait for decisions and the new president to set the tone through policy.

A Liberal Shift

Boric, who is 35, will be the youngest leader of Chile and most liberal since President Salvador Allende, who left behind a 17 year long excruciating dictatorship. Kast, who has a past of supporting the past military dictatorship, tweeted a photo of himself and Boric congratulating him on his “grand triumph,” saying “from now on, he is the president-elect of Chile and deserves all our respect and constructive collaboration.”

Outgoing President Sebastian Pinera also held a video conference call with Boric to congratulate him, and said “I am going to be the president of all Chileans,” in his brief TV appearance.

Boric will take over the office in March, and was able to win the majority of the votes from the public by committing to change the lasting effects from the 1973 to 1990 dictatorship. He plans to raise taxes on the “super-rich” in order to expand social services, fight inequality and focus on ways to help the economy into the green movement by implementing more environmentally friendly methods for production.

“We are a generation that emerged in public life demanding our rights be respected as rights and not treated like consumer goods or a business,” Boric said. “We know there continues to be justice for the rich, and justice for the poor, and we no longer will permit that the poor keep paying the price of Chile’s inequality.”

Mining Companies Wait for Decisions

As Chileans celebrate the young leader and his potential, important and necessary changes the country needs, it is somewhat unclear how the mining industry will adapt to new changes from the millennial president. As talks of a greener economy continue, Boric does not want to take away incentives to invest in the mining sector, according to Kracht, head of the mine engineering department at the University of Chile and a director at copper research center CESCO. However, Boric may find difficulty balancing his agenda with balancing the success of the country’s mining industry.

“There’s no intention to change the rules of the game, just to strengthen institutionality so that things function better,” Kracht said.

Chile is home to some of the biggest copper mining companies in the world, including state-owned Codelco, BHP Billiton (ASX:BHP), Glencore (LON:GLEN), Anglo American (LON:AAL) and Antofagasta (LON:ANTO). Having this many big miners in one country shows the work Boric has cut out for himself in the coming years.

The National Mining Society (Sonami) said in a statement that voters have “sent a clear message” about the need to maintain Chile’s economic and social development. “We trust that the spirit of programmatic convergence, moderation and openness to dialogue shown during the last week of the campaign will prevail,” it added.

However, an already alarming decision has already been made from Boric regarding future mining operations. He pledged to oppose the $2.5 billion iron-copper mine, known as the Dominga mine, which was just approved in August after years of legal battles back and forth.

“We don’t want more ‘sacrifice zones’ (areas of high pollution), we don’t want projects that destroy our country, destroy communities and we exemplify a case that has been symbolic: No to Dominga,” Boric said.

This is an environmentally controversial project that investors will be watching out for in the future. His pledge to oppose the mine could be seen as a warning shot for companies outside of ESG compliance. Besides such projects, the economic benefits of the mining industry and the large windfall taxes they produce for the country will be at the top of every discussion for Chile’s Constitutional Assembly.

Environmental reform is only one side of the agenda for the incoming President, and while some projects will need to adjust to regulations or shifts in the economic climate, the mining industry is prepared to deal with challenges from a shifting political climate.

Multiple Mineral Channels

Chile is also home to the world’s largest lithium reserves, the important metal that is being used around the world for mainly electric vehicle batteries. These EV batteries eliminate the need for gases and fossil fuels, which have a huge negative impact on the environment.

Boric in the past has criticized privatization in the mining sector and would like to see the state have its own lithium firm. The country is also debating raising taxes on mining firms, which Boric supports, along with a stalled bill to protect glaciers in the mineral-rich Andes. The mining industry fears this new bill could potentially “risk current mines and obstruct new ones.”

Firms affected by these potential changes include Codelco, as well as Anglo American’s Los Bronces, Los Pelambres of Antofagasta, and Caserones, linked to JX Nippon Mining. While major mining companies may see their tax bills rise, junior mining companies could remain largely unaffected as this only applies to certain larger thresholds for projects that exploration companies might not pass.

Boric is passionate about saving the environment, but also understands these changes need to be gradual in order to support its mining firms and economy.

“Not everything can be done at the same time and we will have to prioritize to make progress that allows us to improve, step by step, the lives of our people,” he said.

It is unclear how the decisions of the new, young president will pan out. The environment is an important and necessary aspect of life for everyone, and the mining sector is an important and crucial part of the economy. Mining companies will be anxiously watching for signs of a friend or foe in the Presidential Palace.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Talks have begun between BHP (ASX:BHP), the world’s biggest mining company, and billionaire Andrew Forrest’s Wyloo Metals in regards to the takeover of Noront Resources, a Canadian nickel company.

Both companies are trying to acquire the nickel producer, but in October BHP increased its all-cash offer for Noront to C$0.75 per share. This offer surpassed Wyloo’s $0.70 proposal, which promoted the discussion between the two companies.

“BHP and Wyloo Metals have engaged in initial conversations and are considering a mutually beneficial arrangement regarding the acquisition of Noront by BHP,” the company said in a statement.

Acquiring Noront would include the Eagle’s Nest nickel asset in Canada’s so-called Ring of Fire, a high-grade deposit of the electric-vehicle battery metal, as well as copper and palladium.

“Wyloo Metals is considering the potential of a mutually beneficial arrangement with BHP insofar as this arrangement can deliver greater deal certainty to Noront shareholders,” Wyloo said in a statement on Wednesday.

BHP announced on Tuesday it has made the decision to extend the tender expiry for its takeover from Nov. 9 to Nov. 16.

The Drive for Nickel Now

Nickel is a popular metal for lots of things but one of the most well-known uses is to make alloys for steel. Steel is used in products such as cookware, cutlery, and even medical equipment because it is easy to keep clean. Mining nickel is a similar process to mining copper and may even use the same equipment in some scenarios. Nickel comes from ores, either sulfide or a laterite ore, which will use different procedures depending on which you are mining.

The future of nickel mining is bright as the demand for stainless steel and alloys remains consistent, as well as the electric vehicle movement becoming more popular than ever. Lithium is known to be used widely in EV’s, but nickel is also used in rechargeable batteries, which makes it handy for the EV market as well.

It is important for companies and legislation to closely watch nickel production as it can be harmful towards the environment when produced in excessive amounts.

As the company focuses on Noront, BHP is also focused on reducing its presence and operations in the coal industry, but not as quickly as once predicted. BHP have been planning to exit the coal industry for at least two years now and still have ties to certain mines as the asset is becoming more valuable due to coal’s rally.

BHP has already sold a stake in the Cerrejon thermal coal mine in Colombia and is close to a deal to sell some Australian coking coal mines. However, they are taking their time with the Mt Arthur mine in Australia and considering potential better future offers if they arise since coal is becoming more valuable.

A Difficult and Slow Exit

According to people familiar with the matter, BHP has already declined offers for Mt Arthur that didn’t meet its valuation “with uncertainty around future liabilities.”

The Company was looking into exiting the industry, along with other big names such as Anglo American Plc because investors were not comfortable with these huge companies mining the dirtiest source of fuel. However, the urgency is much less and it is unclear if and when it will rise again.

BHP CEO Mike Henry last month said the plan to exit thermal coal was largely business-based, rather than being driven solely from an environmental standpoint.

There “wasn’t any push toward becoming fossil-fuel free,” he said at a shareholder meeting. “It was simply a cold-eyed assessment on how those commodities fit with the BHP portfolio, how we saw the long-term value and the ability to compete for capital in the BHP portfolio.”

Prices for thermal coal exported from Australia also spiked last month to a record high. The cost is beginning to drop again though as China creates plans to ease a supply crunch that results in power outages.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining companies often need to contend with adverse factors and environments. Mining requires a complex infrastructure of mining equipment, transportation, and resource management. The last thing miners want to contend with is a dangerous or politically unstable jurisdiction.

However, some companies are finding that the risk far outweighs the reward and are willing to work in jurisdictions often avoided by most companies. This includes countries that contain deposits of metals and minerals gaining in value and demand, making the investment and risk worth the effort.

BHP (NYSE:BHP) is one of those companies, as CEO Mike Henry recently said that BHP is prepared to shift out of its usual operational comfort zone of advanced economies to work in “tougher jurisdictions”. Why would BHP take on more risk in countries that have politically volatile environments? To gain exposure to commodities like copper, nickel, or cobalt, for which demand is booming as they are needed for the green energy transition underway.

Investment in projects in these areas will require careful planning and understanding the political climate of areas typically avoided by mining companies. BHP’s scale and expertise will allow it to manage those risks to capitalize on the potential profits.

Henry commented, “But of course, the size of the opportunity needs to be commensurate with the increased management effort that is going to be required to pursue opportunities in jurisdictions that we may not currently be operating in,” Henry said.

Where and When?

The Democratic Republic of Congo (DRC) is host to Ivanhoe Mines’s (TSX:IVN) Kamoa-Kakula mine, also known as Western Foreland. This mine has been profitable for the company, and BHP is now holding talks with Ivanhoe over an exploration site adjacent to Kamoa-Kakula.

The DRC has also made it clear that it wants to open it doors wide for foreign investment, particularly for its copper and cobalt deposits. This would exploring outside of many companies’ “comfort zones”, but would also put companies who invest in these countries at an advantage in the future.

Besides the growing demand for these metals and minerals, there is also the probability that politically volatile jurisdictions could transform rapidly into stable ones, making it even more attractive for mining companies. But the miners who are first into these countries will have more attractive terms and a lower overall cost as incentives are higher and competition is lower.

While BHP is prepared to move into new areas, the company will be exploring opportunities in the “areas we like” as well. That may mean higher costs as some projects become less accessible, but BHP is prepared to invest in the effort to maximise returns in countries it has operational experience.

Henry continued, “I want to be clear we don’t see exploration success as being confined to moving into new jurisdictions. We know there is more copper to be found in the areas we like but it is going to be harder to find and perhaps deeper, which is going to bring different technological and financial challenges,” he said.

The Democratic Republic of Congo’s First Mover Advantage

In an effort to court more foreign investment, the DRC has paved the way for simpler and smoother deals to be made with lower taxes and support from local communities. This has made it a new focus for some miners.

Murray Hitzman, a former US Geological Survey scientist who spent more than a decade touring the southern Congo and advising mining projects, said the region’s rich cobalt and copper deposits began life at the bottom of shallow, ancient seas eight hundred million years ago. Over time, sedimentary rocks were buried under gentle hills, and salty liquids containing metals seeped into the earth and mineralized the rock.

A quarter of the world’s gold, tin and tantalum reserves are produced by artisanal and small miners. The artisanal miners are particularly interested in copper and cobalt; cobalt is a major attraction due to its high value-weight ratio, but efficient copper mining requires large-scale operations. A handful of mines provide semi-formal access for artisanal miners as part of the site, but industrial mining companies are in the default position of refusing to cooperate with them.

Africa Moving Rapidly

In recent decades, African governments have lifted restrictions and privatized their mining industries, attracting significant foreign direct investment. As a result, these industries have been dominated by transnational corporations such as Glencore, AngloAmerican, and Barrick Gold. These companies operate outside the formal reach and control of African governments and sit next to artisanal and small-scale mining sectors.

At the peak of the commodity boom in 2007 when the Democratic Republic of Congo began implementation of the EITI, decades of conflict, political instability, corruption, looting, and mineral smuggling decimated the mining sector, once the country’s growth engine. In the last decade of civil war and conflict, flagship industrial mining has declined, while informal artisanal mining has expanded. Now that peace has returned to most parts of the country and a new democratically elected government is in place, the potential is excellent for mining to contribute to economic growth.

The Government of the Democratic Republic of Congo is also helping artisanal miners to earn a living by opening up new artisanal mining zones. The increasing global demand for battery minerals represents a unique opportunity to develop a model for socially responsible business. The benefits of this model can be applied to the estimated 40 million artisanal miners around the world who work to extract various minerals for a living.

Cobalt is an indispensable mineral used in batteries for electric cars, computers, and mobile phones. Demand for cobalt is rising as electric cars are sold in Europe, where governments encourage sales with generous environmental bonuses. Recent projections from the World Economic Forum and the Global Battery Alliance suggest that demand for cobalt to be used in batteries by 2030 will quadruple as a result of the boom in electric vehicles.

While the country has pledged approximately $6 billion to revamped infrastructure and expanding electricity and water access to new areas, infrastructure remains a major challenge. The Democratic Republic of Congo has one of the biggest minerals reserves in Africa, with copper reserves of 120 million tonnes and cobalt reserves among the largest in the world, over 45 million tonnes of lithium reserves, 31 million tonnes of niobium, zinc, and manganese, and over 7 million tonnes of gold reserves of 600 tonnes. To mine all those minerals takes a lot of energy.

A 700 MW deficit exists in the former Katanga province in the mining sector, where there are no projects, resulting in 1 GW of energy imports from neighboring countries. However, with companies like BHP looking to possibly enter the country for new projects, all of that could change very quickly.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Nickel is an indispensable compound in steel production and is known as the “silent saviour” because it plays a role in the global transition to clean energy and is one of the key metals for battery assembly in electric vehicles for companies like Tesla, Volkswagen, Mercedes, and more. In 2020, despite the global pandemic, global nickel production totalled 22 million tonnes. Global nickel mining production is expected to rise again this year, with GlobalData estimating an increase of 6.8% to 25 million tonnes.

According to the US Geological Survey, total nickel reserves are estimated at 94 million tonnes. That total counts Australia and Indonesia as holding some of the largest reserves in the world, with big production numbers as well.

Production slowdowns were not a particular problem for the nickel mining industry, and the industry was more than able to make up for lockdowns and restrictions by keeping operations running in multiple countries using caution and the right safety measures. The total 22 million tonnes produced in 2020 is a testament to the resiliency of the industry and the fact that while demand may have shrunk temporarily in the period, production must continue to keep up with ongoing demand that continues to rise.

The Top 10 Nickel Producers

Russia Norilsk Nickel (OTC:NILSY)

Russia Norilsk Nickel (Nornickel) was the top nickel producer with approximately 178 kilotons (kt) of production, up from 172 kn in 2019. The Nornickels Kola Division, which includes five mines, is being reviewed for its environmental footprint and has pledged $5 billion over the next decade to clean up the pipelines on the Kola Peninsula.

Vale (NYSE:VALE), Glencore (OTC:GLNCY)

From its Brazilian proejcts, Vale (NYSE:VALE) is in second place with 167.6kt, down from about 171kt the year before. PT Vale Indonesia says it plans to begin construction of its Pomalaa nickel project next year. The mining giants in third, fourth and fifth place are Glencore (OTC:GLNCY), which has assets in Australia, Canada and Europe and collectively produced 101.6kt and 108kt in 2019 ; followed by BHP (ASX:BHP) with 74.8kt from its nickel west business in Australia, and Anglo American (LSE:AAL) with 43.6kt from its Brazilian business.

The Chinese company MCC JJJ Mining, whose production is based on its ownership of 85% of Ramu Mine in Papua New Guinea, rounds out the top ten and is one point behind Finnish Terrafame with 28.6 kts of nickel production in 2020. Perth-based IGO produced 29.5kts and Terrafames followed close behind with 28.7kTS.

A Metal for an Electric Future

Nickel is known as the “silent saviour” because it plays a role in the global transition to clean energy and is one of the key metals for battery assembly in electric vehicles. The nickel group is of extreme importance to the global economy and the mining industry in countries in every corner of the globe.

Metallic mineralization occurs in the hard nickel group, which includes nickel, cobalt, copper and chromium. The economic concentration of nickel is found in sulphide and laterite-rich deposits in Australia, Indonesia, South Africa, Russia and Canada which together account for more than 50% of the nickel resources in the world. Nickel mining has increased significantly over the last three decades, and known nickel reserves and resources are growing rapidly.

Due to the enormous use and demand for Canada’s nickel specifically, nickel-related products are exported to more than 100 countries. Nickel and its compounds are indispensable for the manufacture of countless products on which we depend.

Nickel, long used as a corrosion-resistant material in the steel industry, has exploded due to the mass production of cheap electronic equipment, most of which uses nickel in manufacturing. Demand for nickel has also increased in recent years and is becoming increasingly important in the electric vehicle industry. As demand for renewable energy increases, electric cars are increasingly dependent on copper, nickel, cobalt and other metals.

As the world moves away from fossil fuels, the demand for copper, nickel, cobalt and other metals will continue to rise. A 2017 World Bank report says that the industry will demand copper and nickel by 2050 at an increase of 250% if the world builds enough wind technology to keep global warming below 2 degrees – an increase over the Paris climate agreement benchmark. With the additional need from energy storage technologies, the demand for nickel will increase by 1,200 percent.

The same applies to cobalt, which is needed for lithium-ion batteries and can be degraded. According to a report by the World Bank on a low carbon future, there will be strong demand for a wide range of base and precious metals. In addition to the usual suspects such as cobalt and lithium-ion, the list includes aluminium, silver, steel, nickel, lead and zinc.

Cobalt is a silver-grey metal that was developed as a by-product of copper and nickel mining and is an important component of the cathode of lithium-ion batteries. Nickel is another ingredient needed in batteries and is expected to account for a large proportion of future batteries.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Teck Resources Ltd. (NYSE:TECK) is exploring options for its metallurgical coal business including a sale or spin-off that could mark the unit up to $8 billion, sources with knowledge of the matter said. Teck is working with consultants to explore strategic alternatives for the coal block, insiders said to Bloomberg News, citing confidential information.

Teck isn’t the only company to reconsider its assets. Major commodity producers are under increasing pressure to reduce fossil fuels in response to investor concerns about climate change. BHP Group (ASX:BHP) recently agreed to sell its oil and gas assets to Australian company Woodside Petroleum Ltd last month and is attempting to exit the coal business.

This is a recurring and growing trend in the industry as coal mining falls out of favour for the critical tech and other metals needed for a carbon-neutral economy. Copper, aluminum, lithium, nickel, and cobalt are some of the preferred business units that are seeing investment from mining companies.

Each of them is critical to the battery supply chain, electric vehicle (EV) manufacturing, or energy industries and will be required in massive amounts. This is also driving the need for clean steel and other metals while simultaneously reducing the size of coal divisions.

Anglo American PLC (LSE:AAL) produced more than 21 million tonnes of steel coal last year at four sites in western Canada. The company spun off its South African coal division in a separate IPO in June. Consultations are still at an early stage and the company has yet to decide whether to retain the South African unit, it said.

Anglo American accounted for about 35% of gross profit before depreciation and amortization in 2020, according to its website. An exit from coal would free up resources for Anglo American (LSE:AAL) to accelerate its plans for commodities like copper for which demand is accelerating on the powerful tailwind of a coming electrified global economy.

Metallurgical coal, a key raw material for steel production, remains one of the world’s most polluting industries and is under considerable pressure from policymakers to clean up their act. China, the world’s largest metal producer, has even hinted at curbing steel production to reduce carbon emissions. Still, metallurgical coal prices have continued to rise this year as investors fuel steel demand on a global economic recovery and sustained needs as the transition to cleaner sources continues.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As copper prices began to rapidly rise earlier in the year, competition between the biggest mining companies has been extra intense this year. Between copper being a vital metal as we move forward with the green energy transition and the disruptions due to the Covid-19 pandemic, the demand for copper has only grown.

The top 10 copper mining companies were just released and produce over half of the world’s copper output, with most of the global copper supply produced by giant mining companies.

Despite the impact from the pandemic, worldwide copper production still surpassed the 20-million-tonne mark in 2020.

Let’s take a look at the top three companies and what they accomplished in 2020. Here are the top 10 copper mining companies:

Codelco

Chile’s Codelco was by far the biggest copper mining company in 2020, producing 1727.50 Kt, as they implemented a four step plan to help overcome operational challenges and continue copper production.

Codelco recently broke ground at their Salvador copper mine, which is the Rajo Inca project. This is a $1.4 billion dollar expansion of the copper mine, and is expected to increase the operating life of the mine by around 47 years and increase output by 50%. This salvador mine has been in operation since 1959 and the expansion will change it from an underground mine to an open pit. Full production at the new section is set to begin in the first half of 2023, and it is expected to yield 90,000 tonnes per year.

BHP Group (NYSE:BHP)

Australia’s BHP Group was the second largest copper producing company in 2020, producing 1188.50 Kt. According to the BHP group, this is enough copper to build over 420,000 wind turbines. The Company did experience a disruption in production due to the pandemic, resulting in a shutdown for a period of time.

In recent news, BHP Group just approved a multi billion dollar investment for Jansen Potash mine in Saskatchewan. According to the provincial government, $5 billion has already been spent on production and another 7.5 billion will be used to complete the new operation. This is said to be the largest investment in the history of the province of Saskatchewan.

Glencore (OTC:GLNCY)

The third largest copper mining company in 2020 was Switzerland’s company Glencore, producing 1182.30 Kt of copper in 2020. Glencore operates more than 180 sites and offices in 35 different countries, which means the impact of Covid-19 varied depending on the country. With all of their precautions in place, they managed to be in the top three copper mining companies in 2020.

Glencore recently signed a partnership with Britishvolt for a long term supply of cobalt. According to Glencore, “The deal highlights the need for strategic partnerships between raw material and battery producers on the roadmap to net-zero; with Environmental, Social and Governance a growing focus of investors.”

Overall, the price of copper has and is continuing to rise at a fast rate, especially due to the green energy movement. Investing in copper mining companies is a good way to benefit from that price, and helps stay on top of the most current copper trends.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

For countries to reap the rewards of their natural resources, they need to make sure there is a favourable climate for miners and businesses operating within their borders. For Ecuador’s new president Guillermo Lasso, that means welcoming mining companies with open arms as they work to build a sector that is critical to Ecuador’s national economy. Chile hosts some of the biggest mining companies in the world, including BHP Group Ltd. (NYSE:BHP), Anglo American Plc (LSE:AAL.L), Glencore Plc (GLNCY), Antofagasta Miners (LSE:ANTO.L), and Freeport-McMoRan Inc. (NYSE:FCX).

Walking a Tightrope

Recent discussions by lawmakers in Chile could throw the country’s status as a mining hotspot into question. If investors or companies get spooked by the new tax, it could hamper efforts to invest in new projects or expand the ones currently operating in the region. Particularly for proposed royalty deals on copper and lithium sales, the ongoing discussions now could throw a wrench into the works of years of planning and investment.

Foreign investment in the country is an essential source of stimulus and job creation. The mining industry contributes massively to the national economy, and it has made Chile the biggest copper-producing nation in the world. With the new bill approved just last week imposing higher taxes on sales, and cash generated based on the current running price of copper, those contributions could begin to dry up.

A Painful Tax

Initially, lawmakers wanted to impose a 3% flat royalty for mining companies extracting copper and lithium. The valuable metals have seen steady price increases over the years, and with the coming electrification of the global economy, this trend shows no signs of abating.

A new version of the bill proposes a marginal rate of 15% on sales with copper prices between $2 and $2.50 per pound and up to 75% on any revenue generated from fees about 4%. This sliding scale has miners concerned about the future of their operations in the country, as copper’s price seems to have no slowdown in sight. If the bill were approved today, with current copper prices, the royalty rate would be 21.5%. Miners would be able to discount refining costs and some other tax write-offs for any copper sold as refined cathode, but the cut would be almost prohibitive for them.

“You can absolutely try and take more from the golden goose…”

This proposed tax would hit the biggest mining companies the hardest, with the bill affecting miners that produce more than 12,000 tonnes of copper and 50,000 tonnes of lithium per year. One of the companies that would be affected is speaking out against the proposed bill, as it would cut into the country’s status as a mining partner for some of the largest mining companies in the world. According to Ragnar Udd, President of BHP Minerals Americas, “You can absolutely try and take more from the golden goose but you just need to be very clear on what the implications are on that long term. The sort of reforms that are being put forward at the moment will be really quite damaging to the industry.”

“These are tax levels akin to expropriation…”

Even though the proposed tax has miners worried for the future of their operations, it is unlikely that the bill will be passed, especially in its current form. He believes the current system is fine, under which miners are charged a variable rate of up to 14% on operating profit. This rate only applies to large producers and does not affect the less competitive mines, giving them a shot at growth and keeping the country competitive for international investors.

For now, worry and outright opposition are the state of play, as one prominent mining group president has already touched on. Resistance is strong, and this is unlikely to let the bill pass as is. Sonami president Diego Hernandez issued a statement calling the project unconstitutional. He made it clear that the consequences of the proposed bill on the industry and the country would be severe and damaging. With this bill, Sonami (an organization representing copper miners in Chile) predicts that 12 of the 15 biggest miners operating in the country would end up operating at a loss.

Diego Hernandez himself has made it clear that the bill is unacceptable: “These are tax levels akin to expropriation and this is going to inhibit investment immediately.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

GCX.V | +100.00% |

|

AAZ.V | +50.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

CRB.AX | +33.33% |

|

CASA.V | +30.00% |

|

GEM.V | +28.57% |

|

PGC.V | +25.00% |

|

MTB.AX | +25.00% |

|

AGD.AX | +23.81% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024