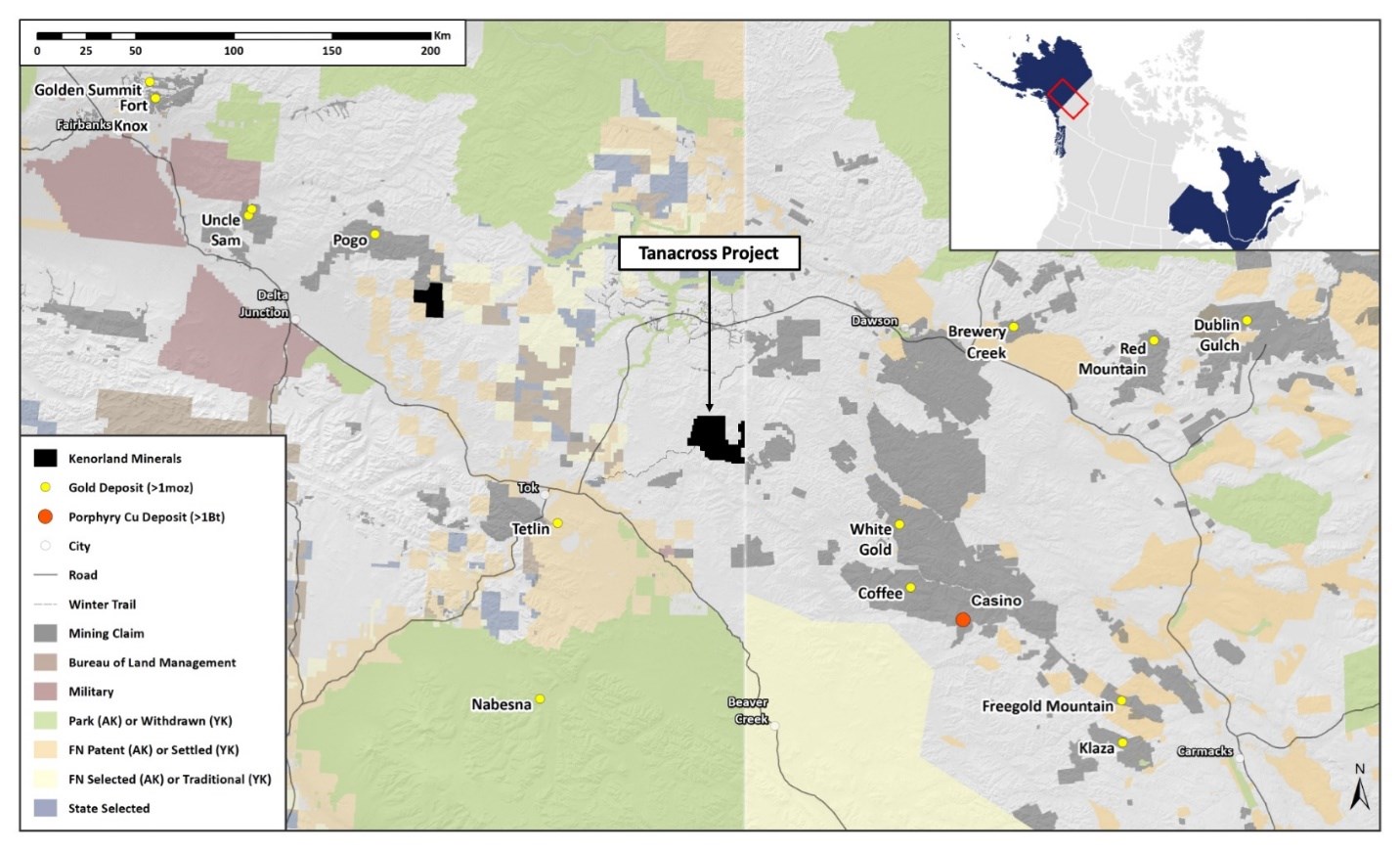

Kenorland Minerals (TSXV:KLD) has announced that an earn-in agreement with Antofagasta (LSE:ANTO) has been signed for the Tanacross copper-gold project in eastern Alaska. Antofagasta is granted the option to acquire a 70% interest in the Tanacross project by spending US$30,000,000 over 8 on exploration. As part of the agreement, the company will need to deliver a NI 43-101 compliant preliminary economic assessment report for the project.

The Tanacross project is 45,000 hectares of Alaskan state-owned land roughly 70 kilometres northeast of Tok. Located near the Alaska Highway, Tanacross hosts a cluster fo late Cretaceous porphyry coper occurrences. These are spread out across West Taurus, East Taurus, and Bluff. The region is known for similar systems, locating the project in an advantageous zone. Tanacross has already had 17,076 metres of drilling over 67 drill holes since 1971 when the initial discovery of East Taurus was made by the Duval Corporation.

Zach Flood, CEO of Kenorland, commented in a press release: “We’re very excited to be working with Antofagasta on the Tanacross Project. The property, which covers numerous mineralised systems and target areas, warrants significant exploration to unlock the discovery potential that we believe exists. We look forward to getting back on the ground as soon as possible to begin work which will lead towards drill-target definition.”

Agreement Terms

Antofagasta can earn a 70% interest in Tanacross by making cash payments in an aggregate amount of US$1,000,000 plus a success payment of US$4,000,000 upon exercise of the option and spending US$30,000,000 on exploration over eight years, with a firm commitment to spend US$1,000,000 in year one, and delivering the Report. During the option period, Antofagasta will fund all exploration and Kenorland will be the initial operator.

Once Antofagasta has earned its 70% interest, Kenorland and Antofagasta will form a 30:70 joint venture. If either party’s interest in the joint venture falls below 10%, that party’s interest will be converted to a 2% NSR, one quarter of which can be purchased by the other party for US$2,000,000.

Source: Kenorland Minerals

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As the shift towards electric vehicles (EVs) gears up to full speed, rising opposition towards new mines in regards to the environment has started to become louder in recent months. The United States has plenty of reserves of copper, lithium, and other important metals to build millions of EVs, but looming concerns surrounding existing and future mines may end up delaying this transition.

The tension between environmentalists and miners won’t be going anywhere as we head into 2022, when US policymakers are expecting groundbreaking moves from big names such as Ford Motor Co, General Motors, and more.

Just earlier this year, President Joe Biden danced around the idea that he prefers to rely on outside allies to supply EV parts in an effort to calm down environmentalists. For U.S automakers, this choice could result in stressful competition with international suppliers as everyone seems to be ready to go electric. Biden also issued an executive order to ideally create half of all new vehicles electric in 2030.

Choosing to import metals rather than getting them from the US is somewhat counterproductive from an environmental standpoint. It could end up boosting greenhouse gas emissions when shipping overseas to the US processing facilities, which defeats the purpose of building EV’s in an effort to combat these climate issues.

An analysis done by Reuters found that “proposed U.S. mining projects could produce enough copper to build more than 6 million EVs, enough lithium to build more than 2 million EVs and enough nickel to build more than 60,000 EVs.”

Those estimates were made based on the volume of minerals used to make the world’s most popular EV, the Tesla Model 3, according to a study by Benchmark Mineral Intelligence. Other EV models and companies may use a different volume depending on their make and design.

James Calaway, executive chairman of Ioneer Ltd, a lithium-boron supplier, said “If we don’t start getting some mining projects under construction this coming year, then we will not have the raw materials domestically to support EV manufacturing.”

Many states have chosen to or are on the fence about opposing future mining projects and reversing decisions already made regarding building new mines. Washington is one of the places still figuring out how to balance regulating mining and the environment. For example, the U.S Fish and Wildlife are adamant about labelling a rare flower that lives on Ioneer’s Nevada lithium site as endangered. Simultaneously, The U.S Department of Energy is deciding if they are going to lend the company over $300 million to build the mine.

Conflicting Agendas

That is just one recent example of the confusion surrounding wanting to combat climate change while also not wanting to build new mines to create necessary materials to build EV’s in an effort to combat climate change.

In Minnesota, state regulators are debating whether or not to revoke or reissue permits to PolyMet Mining Corp, which is controlled by giant miner Glencore. In early 2022, judges will decide whether or not to reverse mines that were already approved by Former President Donald Trump to Lithium Americas (TSX:LAC) and Rio Tinto PLC (ASX:RIO).

Even Biden chose to block Antofagasta Plc’s (LSE:ANTO) Twin Metals copper and nickel mine project in Minnesota for 20 years this past October. The future underground mine would have been a major copper supplier towards EV’s in the US.

Despite that decision, the White House is working towards showing its support for the mining industry, including Lithium Americas’ proposed lithium mine, and a California geothermal lithium project funded in part by GM.

Biden’s EV goal “means good-paying union jobs for working people in responsible mining operations that will both supply battery minerals and protect the environment,” Tom Conway, head of the United Steelworkers recently said.

It will be a long-lasting challenge trying to balance what is best for the environment and what needs to happen for the economy in order to support the mining industry and green transition.

Gabriel Boric, a young leftist millennial was just elected as Chile’s new president on Sunday, and he is ready to make important changes for the nation and fellow Chileans.

Boric won 56% of the votes compared to his main opponent, lawmaker José Antonio Kast, who won 44% of the votes with more than 90% of polling stations releasing their data.

One of the first major changes of the young new leader will be drafting a new constitution, which will likely bring about updated legal and political changes surrounding environmental issues, gender inequality, Indigenous rights, just to name a few important issues.

One of those issues, mining, remains in the balance as some of the world’s biggest mining companies wait for decisions and the new president to set the tone through policy.

A Liberal Shift

Boric, who is 35, will be the youngest leader of Chile and most liberal since President Salvador Allende, who left behind a 17 year long excruciating dictatorship. Kast, who has a past of supporting the past military dictatorship, tweeted a photo of himself and Boric congratulating him on his “grand triumph,” saying “from now on, he is the president-elect of Chile and deserves all our respect and constructive collaboration.”

Outgoing President Sebastian Pinera also held a video conference call with Boric to congratulate him, and said “I am going to be the president of all Chileans,” in his brief TV appearance.

Boric will take over the office in March, and was able to win the majority of the votes from the public by committing to change the lasting effects from the 1973 to 1990 dictatorship. He plans to raise taxes on the “super-rich” in order to expand social services, fight inequality and focus on ways to help the economy into the green movement by implementing more environmentally friendly methods for production.

“We are a generation that emerged in public life demanding our rights be respected as rights and not treated like consumer goods or a business,” Boric said. “We know there continues to be justice for the rich, and justice for the poor, and we no longer will permit that the poor keep paying the price of Chile’s inequality.”

Mining Companies Wait for Decisions

As Chileans celebrate the young leader and his potential, important and necessary changes the country needs, it is somewhat unclear how the mining industry will adapt to new changes from the millennial president. As talks of a greener economy continue, Boric does not want to take away incentives to invest in the mining sector, according to Kracht, head of the mine engineering department at the University of Chile and a director at copper research center CESCO. However, Boric may find difficulty balancing his agenda with balancing the success of the country’s mining industry.

“There’s no intention to change the rules of the game, just to strengthen institutionality so that things function better,” Kracht said.

Chile is home to some of the biggest copper mining companies in the world, including state-owned Codelco, BHP Billiton (ASX:BHP), Glencore (LON:GLEN), Anglo American (LON:AAL) and Antofagasta (LON:ANTO). Having this many big miners in one country shows the work Boric has cut out for himself in the coming years.

The National Mining Society (Sonami) said in a statement that voters have “sent a clear message” about the need to maintain Chile’s economic and social development. “We trust that the spirit of programmatic convergence, moderation and openness to dialogue shown during the last week of the campaign will prevail,” it added.

However, an already alarming decision has already been made from Boric regarding future mining operations. He pledged to oppose the $2.5 billion iron-copper mine, known as the Dominga mine, which was just approved in August after years of legal battles back and forth.

“We don’t want more ‘sacrifice zones’ (areas of high pollution), we don’t want projects that destroy our country, destroy communities and we exemplify a case that has been symbolic: No to Dominga,” Boric said.

This is an environmentally controversial project that investors will be watching out for in the future. His pledge to oppose the mine could be seen as a warning shot for companies outside of ESG compliance. Besides such projects, the economic benefits of the mining industry and the large windfall taxes they produce for the country will be at the top of every discussion for Chile’s Constitutional Assembly.

Environmental reform is only one side of the agenda for the incoming President, and while some projects will need to adjust to regulations or shifts in the economic climate, the mining industry is prepared to deal with challenges from a shifting political climate.

Multiple Mineral Channels

Chile is also home to the world’s largest lithium reserves, the important metal that is being used around the world for mainly electric vehicle batteries. These EV batteries eliminate the need for gases and fossil fuels, which have a huge negative impact on the environment.

Boric in the past has criticized privatization in the mining sector and would like to see the state have its own lithium firm. The country is also debating raising taxes on mining firms, which Boric supports, along with a stalled bill to protect glaciers in the mineral-rich Andes. The mining industry fears this new bill could potentially “risk current mines and obstruct new ones.”

Firms affected by these potential changes include Codelco, as well as Anglo American’s Los Bronces, Los Pelambres of Antofagasta, and Caserones, linked to JX Nippon Mining. While major mining companies may see their tax bills rise, junior mining companies could remain largely unaffected as this only applies to certain larger thresholds for projects that exploration companies might not pass.

Boric is passionate about saving the environment, but also understands these changes need to be gradual in order to support its mining firms and economy.

“Not everything can be done at the same time and we will have to prioritize to make progress that allows us to improve, step by step, the lives of our people,” he said.

It is unclear how the decisions of the new, young president will pan out. The environment is an important and necessary aspect of life for everyone, and the mining sector is an important and crucial part of the economy. Mining companies will be anxiously watching for signs of a friend or foe in the Presidential Palace.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Antofagasta’s Centinela mine in Chile is the company’s first to obtain the international Copper Mark. The Copper Mark program is voluntary and open to all industry members. The certification is a bonus for the miner as it forges a sustainable path forward at its mines. The Copper Mark conveys a copper producer’s commitment to meet industry sustainability standards throughout operating practices and is a signal to investors and other stakeholders that the company has a credible verification of those practices at copper production sites.

The General Manager of Centinela Carlo Espinoza said, “After a rigorous process, involving self-assessment and an independent audit, we are very proud to be the first mining operation in the company to obtain the Copper Mark, which certifies that our operating and other processes are carried out in accordance with the best sustainability practices in the industry.”

The certification can be applied for mines, smelters, and refineries as well. The Copper Mark is not a simple program to enter and requires that the mine in question meets the criteria for a sustainable copper project. It requires a steady flow of information on site-level, risk-management practices, and public reporting on the positive on-the-ground impact.

Ivan Arriagada, CEO of Antofagasta plc, commented: “The importance of obtaining this certification lies in Antofagasta’s commitment to modern and sustainable mining, which transparently incorporates the best practices for the global mining industry.”

The Copper Mark is a difficult compliance bar to pass, requiring compliance with 32 criteria spread over five main categories, including business and human rights, community, labour and working conditions, environment, and governance. Once the initial mark has been awarded, Copper Mark continues to follow up the initial certification with continuous review within the first year. After the first year, Copper Mark returns every three years to certify ongoing compliance with the criteria on the ground at the mine and throughout management.

While many certifications are less stringent than Copper Mark, they do not prove the sustainability and ESG importance of a project as comprehensively. Companies that obtain the certification for their mine, smelter, or refineries are able to use the mark in corporate literature, invoices, contracts, etc., as well as directly on the company’s copper products and packaging. This “seal of approval” clearly states to the buyer that the producer is meeting the industry sustainability standards in operating practices and is continuing with stringent compliance through Copper Mark.

Another mine owned by Antofagasta and Barrick Gold (50% each), Zaldivar should also obtain the Copper Mark next month in September 2021. Antofagasta aims to certify its other two mining operations known as Los Pelambres and Atucoya and has plans to begin the certification process with Copper Mark shortly, according to the company.

In a world that demands more commitment and stricter regulations for the mining industry as it moves toward a greener future, the Copper Mark could become an important industry standard. Companies may find themselves left out of ESG portfolios if they cannot meet the certification standards as well. Additionally, copper is an important metal for the global decarbonization efforts, and mining the critical metal will require cleaner and more efficient practices in the coming decade.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

For countries to reap the rewards of their natural resources, they need to make sure there is a favourable climate for miners and businesses operating within their borders. For Ecuador’s new president Guillermo Lasso, that means welcoming mining companies with open arms as they work to build a sector that is critical to Ecuador’s national economy. Chile hosts some of the biggest mining companies in the world, including BHP Group Ltd. (NYSE:BHP), Anglo American Plc (LSE:AAL.L), Glencore Plc (GLNCY), Antofagasta Miners (LSE:ANTO.L), and Freeport-McMoRan Inc. (NYSE:FCX).

Walking a Tightrope

Recent discussions by lawmakers in Chile could throw the country’s status as a mining hotspot into question. If investors or companies get spooked by the new tax, it could hamper efforts to invest in new projects or expand the ones currently operating in the region. Particularly for proposed royalty deals on copper and lithium sales, the ongoing discussions now could throw a wrench into the works of years of planning and investment.

Foreign investment in the country is an essential source of stimulus and job creation. The mining industry contributes massively to the national economy, and it has made Chile the biggest copper-producing nation in the world. With the new bill approved just last week imposing higher taxes on sales, and cash generated based on the current running price of copper, those contributions could begin to dry up.

A Painful Tax

Initially, lawmakers wanted to impose a 3% flat royalty for mining companies extracting copper and lithium. The valuable metals have seen steady price increases over the years, and with the coming electrification of the global economy, this trend shows no signs of abating.

A new version of the bill proposes a marginal rate of 15% on sales with copper prices between $2 and $2.50 per pound and up to 75% on any revenue generated from fees about 4%. This sliding scale has miners concerned about the future of their operations in the country, as copper’s price seems to have no slowdown in sight. If the bill were approved today, with current copper prices, the royalty rate would be 21.5%. Miners would be able to discount refining costs and some other tax write-offs for any copper sold as refined cathode, but the cut would be almost prohibitive for them.

“You can absolutely try and take more from the golden goose…”

This proposed tax would hit the biggest mining companies the hardest, with the bill affecting miners that produce more than 12,000 tonnes of copper and 50,000 tonnes of lithium per year. One of the companies that would be affected is speaking out against the proposed bill, as it would cut into the country’s status as a mining partner for some of the largest mining companies in the world. According to Ragnar Udd, President of BHP Minerals Americas, “You can absolutely try and take more from the golden goose but you just need to be very clear on what the implications are on that long term. The sort of reforms that are being put forward at the moment will be really quite damaging to the industry.”

“These are tax levels akin to expropriation…”

Even though the proposed tax has miners worried for the future of their operations, it is unlikely that the bill will be passed, especially in its current form. He believes the current system is fine, under which miners are charged a variable rate of up to 14% on operating profit. This rate only applies to large producers and does not affect the less competitive mines, giving them a shot at growth and keeping the country competitive for international investors.

For now, worry and outright opposition are the state of play, as one prominent mining group president has already touched on. Resistance is strong, and this is unlikely to let the bill pass as is. Sonami president Diego Hernandez issued a statement calling the project unconstitutional. He made it clear that the consequences of the proposed bill on the industry and the country would be severe and damaging. With this bill, Sonami (an organization representing copper miners in Chile) predicts that 12 of the 15 biggest miners operating in the country would end up operating at a loss.

Diego Hernandez himself has made it clear that the bill is unacceptable: “These are tax levels akin to expropriation and this is going to inhibit investment immediately.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan