Sudbury, Canada, is a great place to mine nickel. The region has been home to some of the world’s largest nickel deposits, and the Sudbury Basin has eight producing mines. When production started over 125 years ago, it was little more than a frontier town in a country that was still finding its footing. Now, however, the area has produced over 11 million tonnes of nickel since that inaugural group of miners decided to put down roots and explore the land.

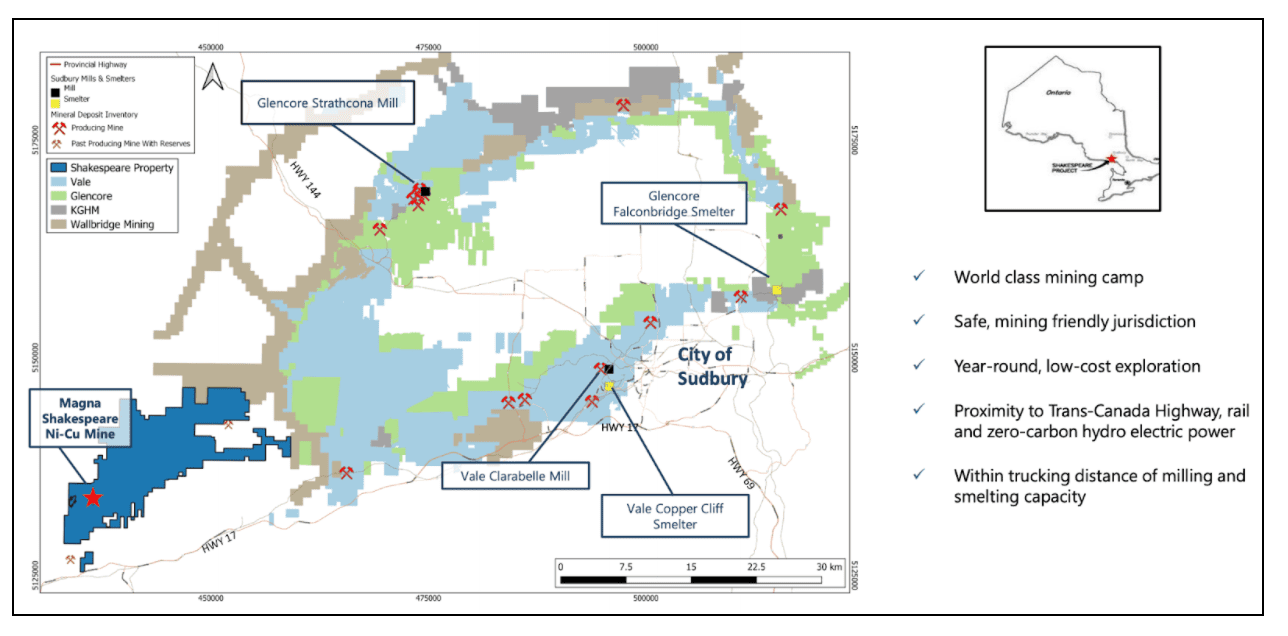

Companies like Vale (NYSE:VALE), KGHM, and Glencore (LON:GLEN), have control of most of the land packages in the region. These major players dominate the area and produce most of the nickel coming out of the Sudbury Basin. However, some junior miners are getting in on the action as well. Magna Mining (TSXV:NICU) has made its mark with a 100% stake in the Shakespeare mine, its flagship project. The mine could be a profitable one for the smaller miner with an indicated open pit resource of 14.4 million tonnes at 0.37% nickel, 0.37% copper, and 0.9g/t total precious metals. Today, Magna Mining begins trading on the TSX Venture Exchange, under the ticker NICU.

After going public, Magna Mining will have the capital to expand and advance its operations at the mine at a faster clip. The first area of focus will be expanding the exploration program to find more of the all-important nickel deposits sitting under the surface. Multiple drill targets have been set near the company’s existing deposit. This expansion of the project and the plan is really the first serious capital expenditure for the region in a long time. Additionally, the property package the company acquired includes more than 180km2 of prospective adjacent land, providing the opportunity for exploration in a section of the area that has seen little exploration in the past.

The company seems to be in the right place at the right time, with nickel fast becoming one of the critical metals for the green and digital transformations taking over the global economy. Elon Musk, CEO of Tesla, mentioned in an earnings call in 2020, “Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel.”

The Tesla boss’s call for more nickel mined in an environmentally conscious and socially responsible way was a wake-up call that the industry needs to step up to the plate and get more of the metals required for batteries, energy storage, and digital devices. Musk also later shared the company’s goal of implementing a battery supply model in North America to facilitate the production of zero high-cost cobalt and more low-cost nickel. It is rare that a company has a client wanting more than they can provide, but this is the state of play for the nickel miners out there right now.

As demand continues to pick up, projects in the Sudbury basin and beyond will also need to accelerate their timelines and invest more into existing nickel projects to keep up. New projects will also be necessary, both from major mining companies and the junior miners entering the field.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.