On Tuesday, Solaris Resources (TSX:SLS made significant gains in their Warintza drilling campaign in southeast Ecuador and announced a new discovery at Warintza East, located ~1km east from their Warintza Central deposit where resource expansion drilling is ongoing. Warintza East is part of a more extensive copper mining campaign in the Warintza area that spans over a 35 square kilometre region and comprises five main mining targets.

Solaris Resources has been a massive player in the South American copper drilling industry for some time now, with copper and gold projects in Ecuador, Chile, Peru, and Mexico. However, their recent work in the Cordillera del Condor Mountain region of Ecuador is one of their more exciting and promising projects to date. The area is known to be ripe with tens of millions of tonnes of contained copper and millions of ounces of gold and hosts nearby mines of Lundin Gold’s Fruta del Norte mine and a Chinese consortium’s Mirador mines.

We spoke with Daniel Earle, CEO of Solaris Resources, on the results at the Warintza project and took a look at some of the biggest reasons why this company is set for the next major leap.

So far, each stage of the drill program has continued to yield positive results with discoveries. Three discoveries have been made so far, with two more targets still left to drill. Mr. Earle said, “We drilled a hole at what we call Warintza West in February, which resulted in a discovery there, and then just yesterday we drilled a hole at Warintza East, which resulted in a new discovery there. So now three discoveries within this cluster of copper deposit targets, and that leaves two more major targets to drill in the future.”

“All of our drill holes, and all of the historical drill holes, have all hit economic copper mineralization, so there is nothing drilled on this property that hasn’t resulted in economic copper.”

With Warintza South and Yawi next up on the list of discovery drilling as well as expanding Warintza Central and East, more results seem likely to continue the trend of fruitful discoveries as every single target has been a success so far.

Cash balances will allow for a very long runway for the company, with about $60 million on the balance sheet right now and approximately $20 million needed for the remaining 2021 capex: “We will be testing Warintza South and Yawi targets before the end of the year. And all of that will be covered by the $20 million budget.”

That will leave a sizable remainder for the company as it looks toward its next possible major milestone, a sale.

“By the time the calendar rolls over to 2022, we are going to be looking at a process to sell this entire company. We will still be in a very strong cash position.”

With the stock breaking above $13 recently and showing no signs of abating, the company is still not at a valuation that might match the scale of the current drilling at the Warintza Central deposit and existing and potential discoveries at the other regions.

The Company is undergoing a resource expansion drill campaign at Warintza Central which hosts a historical inferred resource of 124 million tonnes grading 0.7% copper equivalent, based on very limited, shallow historical drilling. An updated resource estimate is expected in Q4 2021 and drilling has already demonstrated that the new resource will be an order of magnitude larger. The company’s target at Warintza Central alone is to define a copper resource of 1 billion tonnes, which could ultimately see Solaris Resources triple its current valuation, not inclusive of any additional discoveries made on the property.

Mr. Earle pointed out that the Augusta Group track record bears out a pattern that may serve as a useful model for its exit strategy: “Our last company within the Augusta Group, we sold for $2.1 billion in 2018, that was at a multiple of essentially 100 percent of the net asset value of the primary assets. In Solaris today, we are trading at approximately one-third of that level.”

“So we have a lot of work to do to extract a representative evaluation here at Solaris.”

Pushing that valuation is another tailwind the market is providing: “This copper price cycle is going to be much more powerful because of greater fiscal and monetary stimulus, and number two, we have these megatrends in place of decarbonization and electrification.”

“Electrification of the residential sector, of the industrial sector, smart grids, grid storage, all these other kinds of areas of growth that are all incredibly copper intensive.”

That need is bigger than ever, possibly pointing to something bigger than just the effects of a price cycle. While copper price behaviour has matched expectations, the effect is also being multiplied by current conditions and the grand expectations of an electric future beyond anything anyone has ever seen before.

In understanding the scale and importance of Warintza, Daniel Earle notes that it is important to consider the context within which it resides and possible comparables for the project and company, “I think the key is just to understand the context around what we have here and what we are going to achieve, and to look at the global comparables for an asset like this.”

“You have to look at some of the best copper development assets in the world if you want to understand the context of what we are trying to do.”

A key copper project in Peru – Anglo American’s (LN:AAL) Quellaveco, may be a potential future comparable once the resource estimate is released. While that mine has a long proven track record, Warintza may be the project to match or surpass it. Solaris holds some other key advantages with its project that may allow the company to get a higher return out of its exploration efforts.

“We’re going to do it at much lower elevation, adjacent to a highway, adjacent to a power grid that is supplied by low cost, emission-free, renewable power, with abundant freshwater, with a low-cost and skilled labor force in Ecuador.”

“You realize that this is something totally unique.”

First Results Are In

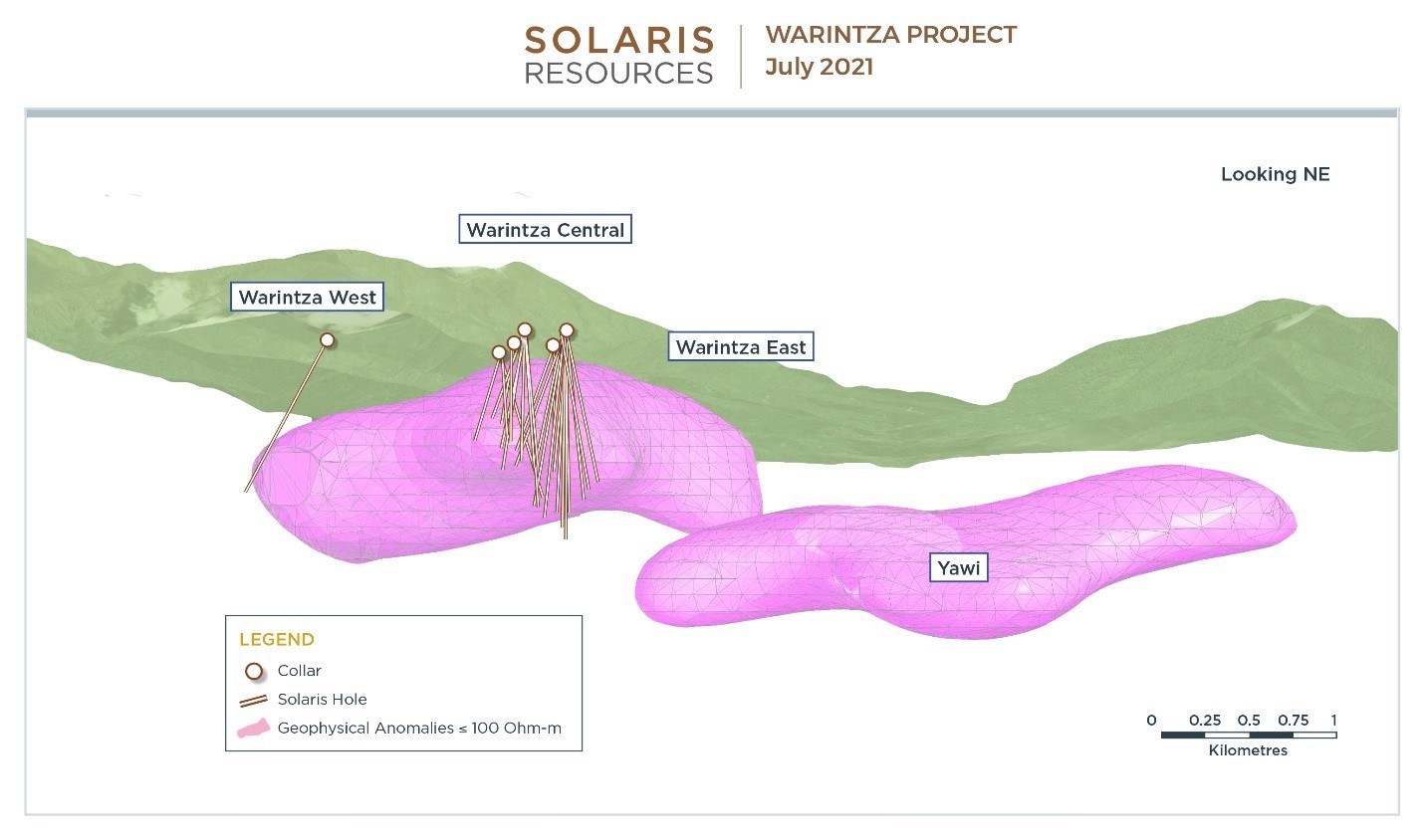

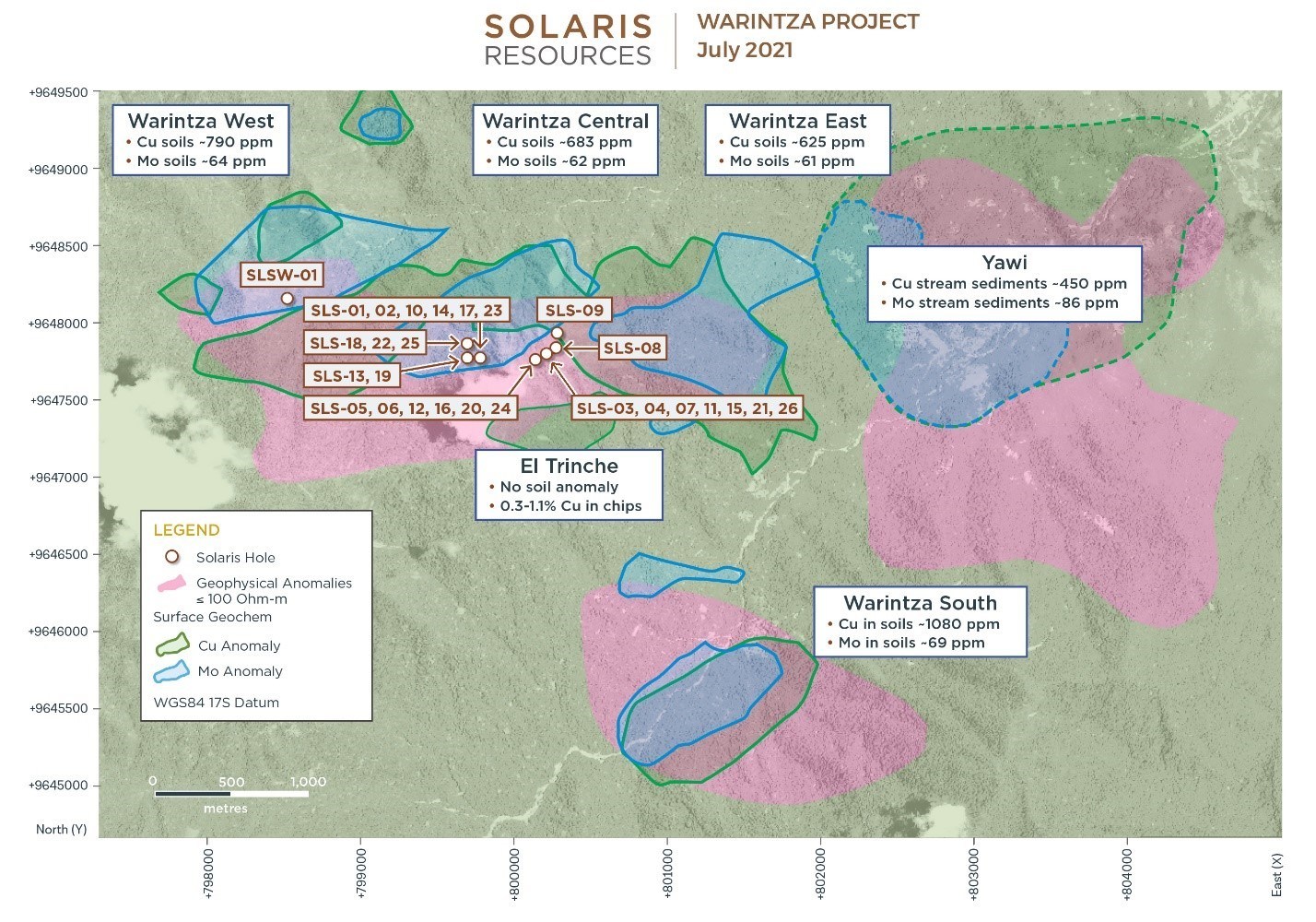

Highlights are listed below, with corresponding images in Figures 1 and 2 and detailed results in Tables 1-2. A dynamic 3D model is available on the Company’s website.

Highlights

- SLSE-01 was the first hole ever drilled at Warintza East and collared approximately 1,300m east of Warintza Central, where recent eastern extension drilling intersected 1,000m of 0.60% CuEq¹ from surface (see press release dated July 7, 2021), with the Central zone still open in this direction

- SLSE-01 was drilled to a total depth of 1,213m with assays reported herein for the first 320m of core from surface, which were given priority in transport, cutting, preparation and assaying – results for the balance of the hole are expected in late August/early September

- SLSE-01 returned 320m of 0.46% CuEq¹ from surface, including 54m of 0.70% CuEq¹, in an open interval, marking a significant new discovery from surface at Warintza East, one of the five main targets within the 7km x 5km cluster of porphyry targets defined on the property

- Warintza East is defined by coincident overlapping copper and molybdenum soil anomalies, measuring approximately 1,200m in strike, and a high-conductivity geophysical anomaly that extends from the target through Warintza Central (refer to Figure 1)

- Further drilling will target the expansion of Warintza East, with a focus on the open area between Warintza Central and this new discovery (refer to Figure 2)

Table 1 – Warintza East Partial Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLSE-01 | July 20, 2021 | 0 | 320 | 320 | 0.36 | 0.02 | 0.05 | 0.46 |

| Including | 0 | 54 | 54 | 0.49 | 0.01 | 0.05 | 0.56 | |

| Including | 162 | 216 | 54 | 0.60 | 0.02 | 0.04 | 0.70 | |

| Notes to table: True widths cannot be determined at this time. | ||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSE-01 | 801485 | 9648192 | 1170 | 1212 | 260 |

Source: Solaris Resources

Figure 1

Figure 2

Source: Solaris Resources

Future Plans

In the upcoming weeks, the company plans to continue resource expansion drilling at Warintza Central, with the updated resource estimate expected in Q4 2021, as well as continue discovery drilling at Warintza West and East and undrilled targets at Warintza South and Yawi. Solaris’ VP Exploration commented on the drilling campaign, “The discovery at Warintza East marks the third major copper discovery within the voluminous 7km x 5km Warintza porphyry cluster. Importantly,the footprint of Warintza East overlaps conceptual pit designs for Warintza Central, which itself continues to grow eastward with recent results. Future drilling will focus on the open, undrilled area between these two zones.”

Copper prices have been on a rapid rise and have even recently hit all-time highs. With global demand for copper predicted to only rise further, the Warintza project’s expected ROI seems to have one direction – higher.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.