The GDP is considered the nation’s report card because it provides the broadest measure of economic activity. What does the US’s latest report on the state of the economy, the US’s GDP report card, say in regards to further monetary easing, yes or no?

Lets break it down into a pro/con list, the pros are actually negative stats but are positive for more quantitative easing (QE3).

Second Quarter Report Card, Pro

- The Commerce Department said gross domestic product expanded at a 1.7 percent annual rate. GDP growth is sluggish – the economy’s average sustainable growth rate has historically been between 2.5% and 3.0% – a growth rate of between two percent and 2.5 percent is generally seen as needed just to hold the jobless rate steady.

- The unemployment rate ticked up to 8.3 percent in July (and has exceeded eight percent for 42 straight months) so despite the Fed’s best efforts the unemployment rate is still climbing, payroll increases averaged 73,000 in the second quarter, down from 226,000 in the prior three months. More disturbing, nearly half of the unemployed people in the US have now been out of work for six months or longer, that’s up from the traditional median unemployment duration of ten weeks.

- Consumer spending, which accounts for about 70 percent of U.S. economic activity, was 1.7 percent, down from the first quarter’s 2.4 percent pace. A smaller rise is expected for the third quarter with demand for big-ticket items such as automobiles cooling.

- Rising fuel costs and the prospect of tax changes and government budget cuts – the so called “fiscal cliff” in the U.S., the $600 billion of tax increases and spending cuts that will take effect automatically at the end of the year are hurting consumer confidence.

- There was a pull-back in restocking by businesses wary of sluggish domestic demand. Also growth in business investment in equipment and software was lowered to a 4.7 percent pace, the slowest since the third quarter of 2009 and softer export growth is expected. Factory orders data showed demand for non-defense capital goods excluding aircraft – a measure watched as an indicator of business confidence and future spending – fell 4 per cent in July, following a 1.7 per cent decline in June. The months of May and April saw declines of 2.1 per cent.

The Bright Spots, Con

- Stronger export growth.

- Wages and salaries from April through June rose by $56.1 billion after a revised $133.5 billion first-quarter gain that was bigger than the previous estimate of $123.3 billion.

- Disposable income adjusted for inflation rose 3.1 percent from April through June after a 3.7 percent gain in the first quarter.

- The saving rate in that same period climbed to four percent from 3.6 percent in January through March.

- The index of pending home re-sales climbed 2.4 percent to 101.7, the highest since April 2010.

Reason, and Room, to Ease

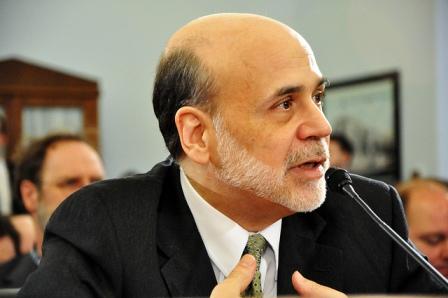

At this point, QE3 is a real possibility. According to Federal Reserve chief Ben Bernanke, “We have seen no net improvement in the unemployment rate since January. Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time.”

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.