Gold took a kicking over the long weekend. It had moved too far too fast, was overbought and needed a correction. But that’s all it is, IMO.

I don’t use a lot of technical indicators, but every once in a while you find one that seems to work. In gold, it’s the 50 week moving average. Why does it work? Only a complete moron would spend more that one second contemplating that question. Probably it works because everyone thinks it does. There are no reasons for these things.

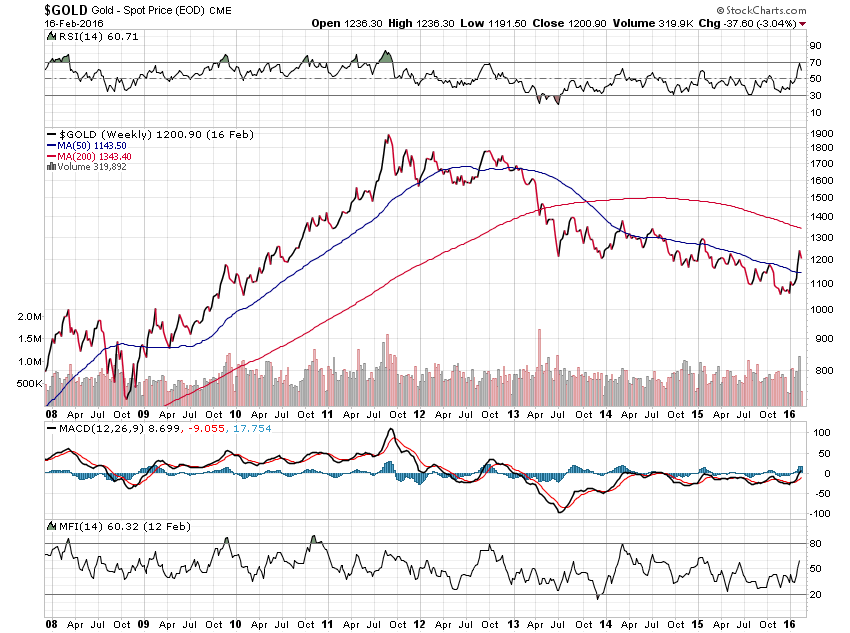

So, here is the chart of the 50 week moving average for gold going back to 2008. When gold got in gear and the bull market resumed, gold traded consistently above its 50 week moving average. When it broke down in late 2012 and slipped into a bear market, gold consistently failed to break above the declining 50 week moving average. Until this year. After last weekend’s bloodletting, it’s still comfortably above the blue line. For my money, gold is in a new bull market until it breaks below that line.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.