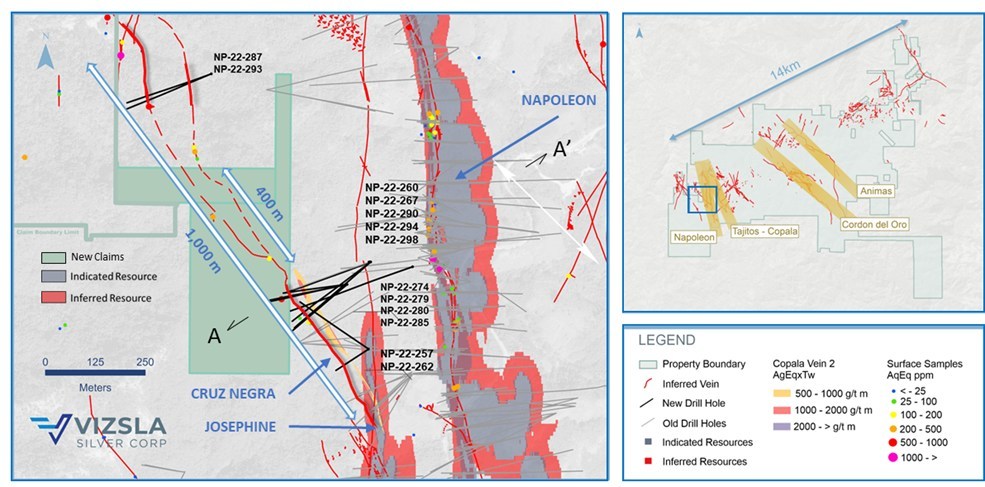

Vizsla Silver (TSXV:VZLA) has announced new results from 13 new drill holes targeting the Cruz Negra Vein in the western portion of the district. The company has reported it has expanded mineralization of West Napolean, and has added new claims at the same time at the 100%-owned Panuco silver-gold project in Mexico.

The results are based on the Cruz Negra Vein, which is 250 meters west of the Napoleon mining area. The northwest and southeast extensions of Cruz Negra, which are currently located on pre-existing Vizsla claims and cover approximately 400 meters of new potentially mineralized vein strike to explore, were added to the claim portfolio.

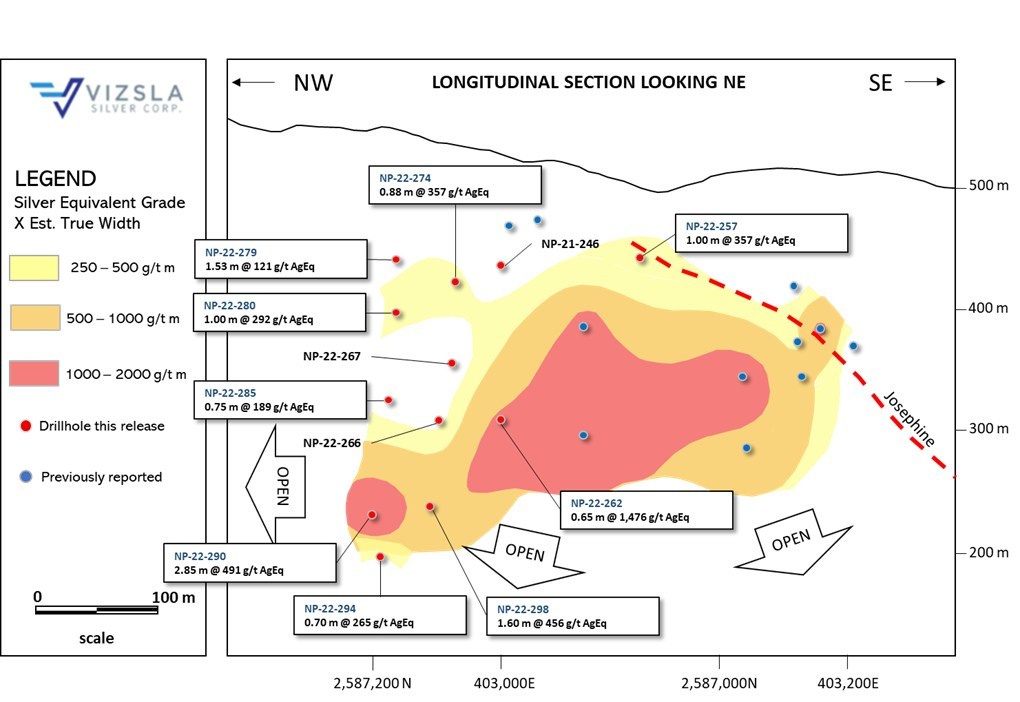

The Vein of the Cruz Negra, 250 meters west of the Napoleon deposit, is an intensely dipping northwest striking vein-breccia. The quartz veining and disseminated sphalerite and galena in the vein breccia are caused by quartz cement bearing disseminated sphalerite and galena. Drilling to date has tested Cruz Negra at a depth of approximately 400 meters from the Josephine Vein.

Furthermore, hole NP-22-293 studied the possible northwest extension and yielded 535 g/t AgEq over 0.76 mTW, revealing that the mineralization extends for another 500 metres on the newly acquired claims. The drilling also displayed potential vein splays or cymoid loops that could significantly impact silver and gold grades.

At Cruz Negra, mineralized intercepts have estimated true widths ranging from 0.65 to 3.10 metres, with grades ranging from 265 to 3,499 g/t AgEq. Mineralization is open at depth and northwest of the current drilling area, where Vizsla plans to complete detailed mapping and start drilling again in the near future to explore the 500 metre gap between known areas of mineralization.

Vizsla’s organic growth plan was implemented in the acquisition of two claims, with a combined surface area of 14.75 hectares that filled most of the 500 m gap between the open-ended intercepts.

Michael Konnert, President and CEO of Vizsla, commented in a press release: “Our ongoing mapping and sampling efforts in the western area of the district have highlighted several new drill ready targets including Cruz Negra. Initial drill results demonstrate mineralized continuity over approximately 400 metres long with large step outs to the northwest, suggesting the vein continues for at least another 500 metres. Our exploration team has done a phenomenal job this year identifying and expanding new mineralized structures directly outboard of the March 2022 resource areas. As of early September, we have achieved data cut-off for inclusion in the updated resource, slated for mid-December, and anticipate a material increase to contained precious metals.”

Highlights from the results are as follows:

- NP-22-274 returned 541 grams per tonne (g/t) silver equivalent (AgEq) over 2.09 metres true width (mTW) (413 g/t silver, 1.99 g/t gold, 0.16% Pb and 0.27% Zn)

- And 357 g/t AgEq over 0.88 mTW (258 g/t silver, 1.54 g/t gold, 0.01% Pb and 0.17% Zn)

- NP-22-262 returned 1,476 g/t AgEq over 0.65 mTW (168 g/t silver, 16.42 g/t gold, 0.86% Pb and 3.26% Zn)

- NP-22-290 returned 491 g/t AgEq over 2.85 mTW (76 g/t silver, 2.60 g/t gold, 0.57% Pb and 6.19% Zn)

- NP-22-293 returned 535 g/t AgEq over 0.76 mTW (481 g/t silver, 1.20 g/t gold, 0.02% Zn and 0.02% Pb)

- NP-22-298 returned 456 g/t AgEq over 1.60 mTW (297 g/t silver, 1.78 g/t gold, 0.31% Pb and 1.23% Zn)

|

Drillhole |

From |

To |

Downhole |

Estimated |

Ag |

Au |

Pb |

Zn |

AgEq |

Vein |

||

|

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

% |

% |

(g/t) |

||||

|

NP-22-257 |

100.50 |

102.00 |

1.50 |

1.00 |

142 |

1.14 |

0.43 |

3.73 |

357 |

Cruz Negra |

||

|

Includes |

101.40 |

102.00 |

0.60 |

0.40 |

316 |

2.72 |

0.53 |

6.50 |

734 |

|||

|

NP-22-262 |

191.60 |

193.35 |

1.75 |

0.65 |

289 |

2.38 |

0.77 |

0.70 |

486 |

HW vein |

||

|

Includes |

191.60 |

192.15 |

0.55 |

0.20 |

741 |

5.88 |

0.33 |

1.26 |

1,165 |

|||

|

NP-22-262 |

253.25 |

255.00 |

1.75 |

0.65 |

168 |

16.42 |

0.86 |

3.26 |

1,476 |

Cruz Negra |

||

|

Includes |

253.25 |

254.50 |

1.25 |

0.46 |

181 |

19.70 |

1.06 |

3.78 |

1,748 |

|||

|

NP-22-266 |

No significant values |

|||||||||||

|

NP-22-267 |

No significant values |

|||||||||||

|

NP-22-274 |

166.05 |

168.90 |

2.85 |

2.09 |

413 |

1.99 |

0.16 |

0.27 |

541 |

HW vein |

||

|

Includes |

168.55 |

168.90 |

0.35 |

0.26 |

2,490 |

12.85 |

0.61 |

0.87 |

3,287 |

|||

|

NP-22-274 |

193.30 |

194.50 |

1.20 |

0.88 |

258 |

1.54 |

0.01 |

0.17 |

357 |

Cruz Negra |

||

|

NP-22-279 |

172.20 |

174.35 |

2.15 |

1.53 |

72 |

0.56 |

0.07 |

0.34 |

121 |

Cruz Negra |

||

|

NP-22-280 |

205.55 |

207.40 |

1.85 |

1.00 |

187 |

1.40 |

0.15 |

0.39 |

292 |

Cruz Negra |

||

|

NP-22-280 |

224.15 |

226.70 |

2.55 |

1.38 |

91 |

0.73 |

0.22 |

0.64 |

137 |

FW vein |

||

|

NP-22-285 |

272.15 |

274.50 |

2.35 |

0.75 |

40 |

1.21 |

0.01 |

1.81 |

189 |

Cruz Negra |

||

|

NP-22-287* |

274.30 |

274.80 |

0.50 |

0.40 |

402 |

1.82 |

0.10 |

0.21 |

505 |

FW vein |

||

|

NP-22-290 |

356.00 |

360.05 |

4.05 |

2.85 |

76 |

2.60 |

0.57 |

6.19 |

491 |

Cruz Negra |

||

|

NP-22-293* |

12.10 |

13.30 |

1.20 |

0.76 |

481 |

1.20 |

0.02 |

0.02 |

535 |

|||

|

NP-22-294 |

378.85 |

379.85 |

1.00 |

0.70 |

66 |

0.43 |

1.27 |

3.91 |

265 |

Cruz Negra |

||

|

NP-22-298 |

380.50 |

383.05 |

2.55 |

1.60 |

297 |

1.78 |

0.31 |

1.23 |

456 |

Cruz Negra |

||

|

Table 1: |

Downhole drill intersections from the holes reported Cruz Negra vein on the Napoleon area. Note: AgEq = Ag ppm x Ag rec. + (((Au ppm x Au rec. x Au price/gram) + (Pb% x Pb rec. x Pb price/t) + (Zn% x Zn rec. x Zn price/t))/Ag price/gram). Metal price assumptions are $20.70/oz silver, $1,655/oz gold, $1,902/t lead and$2,505/t zinc. Metallurgical recoveries applied in the calculation (93% for silver, 90% for gold, 94% for lead and 94 % for zinc), were determined for the Napoleon vein (see press release dated February 17, 2022). NP-22-287* and NP-22-293* were drilled over 500 m NW from Cruz Negra vein intercepts. |

|

Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

|

NP-22-257 |

403,165 |

2,587,117 |

526 |

237.0 |

-59.0 |

192 |

|

NP-22-262 |

403,165 |

2,587,117 |

526 |

304.0 |

-60.0 |

414 |

|

NP-22-266 |

403,171 |

2,587,335 |

534 |

233.0 |

-53.2 |

411 |

|

NP-22-267 |

403,171 |

2,587,335 |

534 |

229.0 |

-44.7 |

354 |

|

NP-22-274 |

403,112 |

2,587,278 |

575 |

230.0 |

-53.2 |

315 |

|

NP-22-279 |

403,112 |

2,587,279 |

575 |

258.0 |

-52.3 |

342 |

|

NP-22-280 |

403,112 |

2,587,279 |

575 |

259.0 |

-61.3 |

423 |

|

NP-22-285 |

403,112 |

2,587,279 |

575 |

263.0 |

-67.9 |

423 |

|

NP-22-287 |

402,772 |

2,587,806 |

465 |

248.0 |

-45.0 |

340 |

|

NP-22-290 |

403,171 |

2,587,335 |

534 |

250.0 |

-59.2 |

417 |

|

NP-22-293 |

402,772 |

2,587,806 |

465 |

249.0 |

-53.3 |

380 |

|

NP-22-294 |

403,167 |

2,587,335 |

541 |

251.0 |

-65.6 |

480 |

|

NP-22-298 |

403,268 |

2,587,318 |

511 |

250.0 |

-45.5 |

465 |

|

|

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.