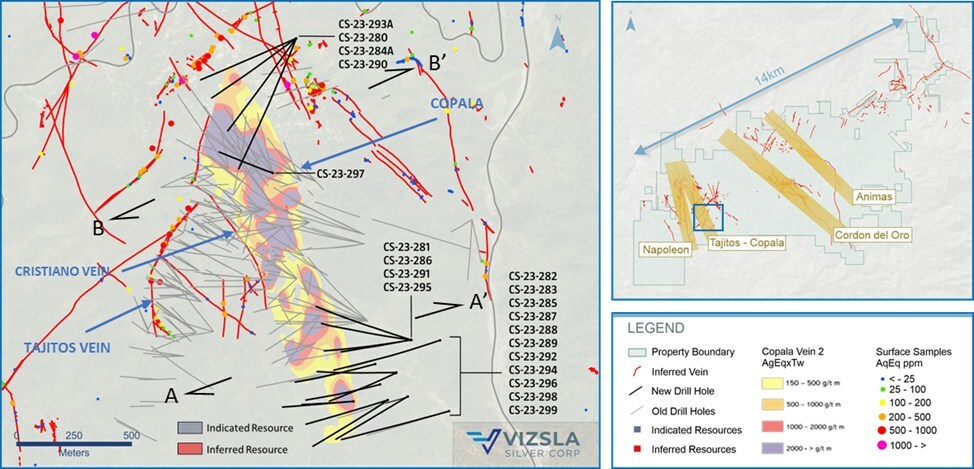

Vizsla Silver (TSXV:VZLA) has disclosed new findings from 20 exploratory drillings at its fully owned, mainstay Panuco silver-gold project, found in Mexico. These results broaden the known mineral-rich areas of the Copala resource area, reaching approximately 370 meters southeast and about 50 meters north.

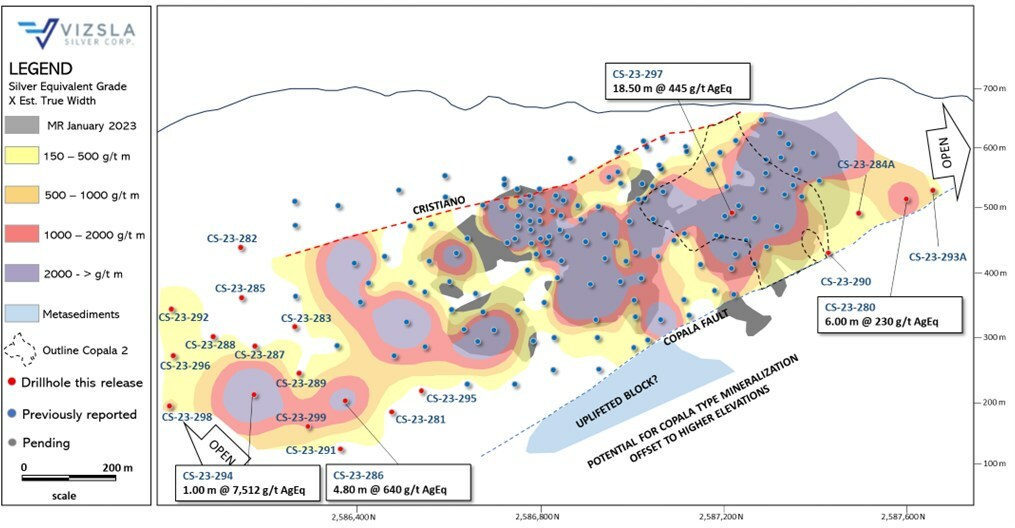

Michael Konnert, President & CEO of Vizsla, commented in a press release: “Expansion drilling at Copala, both to the southeast and north, continue to highlight a robust precious metals structure well beyond the January 2023 resource boundary. The overall strike length now measures approximately 1,670 metres long and remains open in both directions. Additionally, drilling has expanded the high-grade Copala 2 vein situated between Tajitos and Copala main and identified a new near-surface structure called ‘El Habal‘. Moving forward, we will continue to both expand and infill these high-grade zones with three drill rigs in preparation for an updated resource estimate planned for the fourth quarter of 2023. Q4/23.”

The Copala Structure, which predominantly contains precious metals, lies about 800 meters east of the Napoleon Structure in the western segment of the Panuco district. Currently, the indicated resources within the Copala Structure are at 51.1 Moz AgEq with a density of 516 g/t AgEq, and inferred resources at 55.4 Moz AgEq with a density of 617 g/t AgEq. These resources are housed in a large vein-breccia interlayered with host rock, reaching thicknesses up to 82 meters. Vizsla’s geologists suggest that the average dip of the Copala is roughly 46 degrees eastward, varying from 35 degrees in the north to about 52 degrees in the south.

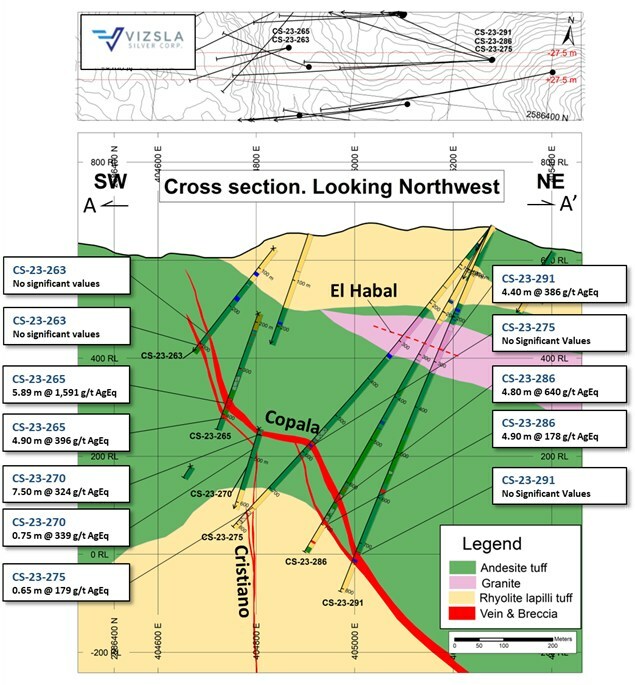

With continuous drilling, mineralization in the Copala Structure has been traced for about 1,670 meters horizontally and approximately 400 meters vertically. The southeast and north regions remain open for high-grade silver-gold mineralization. The recent expansion drillings, consisting of 15 holes in the southern part of Copala and five in the north, targeted the main Copala structure and the Copala 2 vein. Findings show that the Copala structure extends southeastward beyond the initial resource assessment in January 2023. Vizsla aims to perform infill drillings to test and expand high-grade zones identified in the southeast.

The Copala 2 vein, situated at the footwall of the main Copala, is bounded up-dip by Copala, west by Tajitos, and east by the Copala Fault. It has a northeast strike and a southeast dip of roughly 48 degrees, and has been traced for approximately 330 meters horizontally and 290 meters vertically. The company’s previous results from the Copala 2 vein were released on May 19, 2022.

Vizsla geologists have discovered a new near-surface structure named “El Habal” in the southeast with hole CS-23-291. The team is currently re-examining and sampling other holes in the area to understand this newly identified structure.

So far, Vizsla has completed approximately 55,000 meters of its fully funded 90,000-meter drilling program for 2023.

The Panuco project, situated near the city of Mazatlán in southern Sinaloa, Mexico, is a newly consolidated, high-grade discovery encompassing a 7,189.5-hectare, previously producing district. It features more than 86 kilometers of total vein length, 35 kilometers of underground mines, roads, power, and permits.

These deposits, which are mostly silver and gold, originate from siliceous volcanism and crustal extension during the Oligocene and Miocene eras. The deposits lie within continental volcanic rocks correlated to the Tarahumara Formation.

As of a technical report filed on March 10, 2023, the Panuco Project was estimated to contain an in-situ indicated mineral resource of 104.8 Moz AgEq and an in-situ inferred resource of 114.1 Moz AgEq.

Highlights from the results are as follows:

- CS-23-297 returned 445 grams per tonne (g/t) silver equivalent (AgEq) over 18.50 metres true width (mTW) (310 g/t silver and 2.32 g/t gold)

- CS-23-290 returned 760 g/t AgEq over 5.05 mTW (565 g/t silver and 3.48 g/t gold)

- Including 3,469 g/t AgEq over 1.00 mTW (2,838 g/t silver and 12.29 g/t gold)

- CS-23-286 returned 640 g/t AgEq over 4.80 mTW (417 g/t silver and 3.74 g/t gold)

- Including 2,568 g/t AgEq over 0.68 mTW (1,585 g/t silver and 16.20 g/t gold)

- CS-23-294 returned 7,512 g/t AgEq over 1.00 mTW (6,880 g/t silver and 16.50 g/t gold)

Table 1: Downhole drill intersections from the holes reported for Copala structure and Cristiano vein.

|

Drillhole |

From |

To |

Downhole Length |

Estimated True width |

Ag |

Au |

AgEq |

Vein |

|

|

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(g/t) |

|||

|

CS-23-280 |

353.55 |

355.00 |

1.45 |

1.27 |

1,240 |

3.64 |

1,399 |

Copala |

|

|

CS-23-281 |

789.50 |

790.60 |

1.10 |

0.80 |

57 |

26.40 |

1,835 |

Copala 3 |

|

|

CS-23-282 |

No Significant Values |

Copala |

|||||||

|

CS-23-283 |

552.20 |

553.60 |

1.40 |

1.07 |

279 |

0.50 |

293 |

Cristiano |

|

|

CS-23-284A |

No Significant Values |

Copala |

|||||||

|

CS-23-285 |

No Significant Values |

Copala |

|||||||

|

CS-23-285 |

418.10 |

419.35 |

1.25 |

0.78 |

335 |

1.77 |

431 |

Cristiano |

|

|

CS-23-286 |

639.50 |

645.85 |

6.35 |

4.80 |

417 |

3.74 |

640 |

Copala |

|

|

Includes |

643.50 |

644.40 |

0.90 |

0.68 |

1,585 |

16.20 |

2,568 |

||

|

CS-23-286 |

691.50 |

698.50 |

7.00 |

4.90 |

160 |

0.44 |

178 |

Copala 3 |

|

|

CS-23-287 |

No Significant Values |

Copala |

|||||||

|

CS-23-288 |

No Significant Values |

Copala |

|||||||

|

CS-23-289 |

No Significant Values |

Copala |

|||||||

|

CS-23-290 |

No Significant Values |

Copala |

|||||||

|

CS-23-290 |

557.80 |

588.70 |

30.90 |

5.05 |

565 |

3.48 |

760 |

Copala 2 |

|

|

Includes |

557.80 |

563.95 |

6.15 |

1.00 |

2,838 |

12.29 |

3,469 |

||

|

CS-23-291 |

265.50 |

270.00 |

4.50 |

4.40 |

145 |

3.72 |

386 |

El Habal |

|

|

CS-23-291 |

No Significant Values |

Copala |

|||||||

|

CS-23-292 |

458.45 |

459.30 |

0.85 |

0.79 |

239 |

1.51 |

324 |

Copala |

|

|

CS-23-293A |

No Significant Values |

Copala |

|||||||

|

CS-23-294 |

561.70 |

562.80 |

1.10 |

1.00 |

6,880 |

16.50 |

7,512 |

Copala |

|

|

CS-23-295 |

No Significant Values |

Copala |

|||||||

|

CS-23-296 |

No Significant Values |

Copala |

|||||||

|

CS-23-297 |

140.45 |

159.35 |

18.90 |

18.50 |

310 |

2.32 |

445 |

Copala |

|

|

CS-23-297 |

290.00 |

294.00 |

4.00 |

3.65 |

244 |

1.77 |

347 |

Copala 2 |

|

|

CS-23-298 |

631.60 |

633.50 |

1.90 |

1.83 |

212 |

1.14 |

274 |

Copala |

|

|

CS-23-299 |

694.75 |

695.75 |

1.00 |

0.90 |

972 |

3.36 |

1,131 |

Copala |

|

|

Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022). |

Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13.

|

Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

|

CS-23-280 |

404,775 |

2,587,802 |

572 |

234.7 |

-28 |

498 |

|

CS-23-281 |

405,277 |

2,586,491 |

677 |

278.3 |

-61.2 |

811.5 |

|

CS-23-282 |

405,025 |

2,586,223 |

641 |

265.5 |

-45.3 |

444 |

|

CS-23-283 |

405,119 |

2,586,386 |

646 |

258 |

-59.5 |

670.5 |

|

CS-23-284A |

404,775 |

2,587,801 |

572 |

217 |

-26 |

543 |

|

CS-23-285 |

405,025 |

2,586,224 |

641 |

266.5 |

-63.5 |

504 |

|

CS-23-286 |

405,276 |

2,586,491 |

677 |

261 |

-60 |

766.5 |

|

CS-23-287 |

405,141 |

2,586,298 |

645 |

256.1 |

-62.9 |

700.5 |

|

CS-23-288 |

405,174 |

2,586,229 |

656 |

254 |

-58 |

702 |

|

CS-23-289 |

405,211 |

2,586,349 |

661 |

270 |

-62 |

714 |

|

CS-23-290 |

404,776 |

2,587,801 |

572 |

202 |

-25 |

688.5 |

|

CS-23-291 |

405,276 |

2,586,491 |

677 |

261.8 |

-66.6 |

807 |

|

CS-23-292 |

405,174 |

2,586,229 |

656 |

239.6 |

-47.7 |

570 |

|

CS-23-293A |

404,775 |

2,587,802 |

572 |

246 |

-26 |

505.5 |

|

CS-23-294 |

405,210 |

2,586,347 |

648 |

246 |

-64.5 |

735 |

|

CS-23-295 |

405,276 |

2,586,491 |

677 |

288.3 |

-56 |

784.5 |

|

CS-23-296 |

405,261 |

2,586,245 |

665 |

239.7 |

-52.7 |

600 |

|

CS-23-297 |

404,674 |

2,587,217 |

533 |

290 |

-53 |

412.5 |

|

CS-23-298 |

405,440 |

2,586,181 |

629 |

255 |

-49 |

753 |

|

CS-23-299 |

405,401 |

2,586,489 |

618 |

252.3 |

-53.4 |

793.5 |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.