Timing is everything. Precious metals are up, while almost everything else is down. Gold has soared 38% from last year’s low. This is a big move, but few investors seem to appreciate its significance. Earlier this week, Bank of America announced a gold price target of US$3,000/oz. by the end of 2021. While that might sound aggressive, today’s price of US$1,740/oz. = ~C$2,463/oz. is already quite strong.

The current price is more than enough for well managed juniors, with attractive projects, in safe & prolific jurisdictions, to thrive. Right now, some of the best precious metal jurisdictions, as measured by low-costs plus ample exploration upside, include parts of Mexico, Canada & Australia.

In an April 13, 2020 Myrmikan Research investment letter, Manager Daniel Oliver made strong arguments that gold & silver prices are headed higher, perhaps much, much higher. Mr. Oliver has been published in Forbes, The Wall Street Journal, The Washington Times, Real Clear Markets, National Review, among others. He has a J.D. from Columbia Law School and an MBA from INSEAD.

Most important for the purposes of this article, Oliver is a Director of tiny silver / gold junior Vangold Mining (TSX-V: VGLD) / (OTCQB: VGLDF). {corporate presentation} In his commentary, he unveils three potential paths or scenarios for precious metals.

In the first scenario,

“…the magnitude of the dollar debt overhang is so large—tens of trillions—that policy makers cannot practically prevent the inverted credit pyramid from tipping over. The result is a panic more intense by magnitudes than 2008 or 1929. Gold does well on a relative basis, but falls in nominal terms.”

In the second scenario,

“….trillions of dollars does little to help local businesses & the working class. Wall Street, however, is not just saved, but levers up bailout largess to create spectacular increases in asset prices. Gold spikes in nominal terms as it did from 2009 to 2011 under similar conditions. Gold mining equities soar….”

Finally, in the third scenario,

“….the Fed’s helicopter drop of dollars precipitates a currency crisis. Gold bullion rockets toward $10,000 per ounce. Gold miners (especially marginal, higher risk players) have breath-taking increases, last experienced from 1978 to 1981.“

Oliver believes the first scenario is by far least likely to unfold, an end-of-the-world type of event that we need not focus on because the world would be over…. The remaining two paths are bullish, and extremely bullish, respectively for physical gold & silver and precious metals juniors.

Make no mistake, just because Dan Oliver and a growing cadre of investment experts are talking up precious metals doesn’t guarantee the price will shoot to the moon or even rise from current levels. However, giant hedge, mutual & generalist funds are looking closely at precious metals and the companies that explore for, develop and mine them.

Relative value funds have plenty of industry sectors to avoid, but only a few that offer potential upside combined with low correlation to, and diversification from, the overall market. Glowing reports of precious metals’ fabulous future are a lot more palatable given that a tsunami of global debt obligations will be issued, with no end in sight.

As bad, or perhaps even worse, is governments’ willingness, in a blink of an eye, to direct their central banks to print absurd amounts of money out of thin air. Combined, debt + unfunded & under-funded liabilities will explode much higher. Not by tens or hundreds of billions, but by trillions of dollars. It’s no longer just a theory (ongoing unbelievably large & unsustainable debt), the pandemic has made it a certainty.

Vangold Mining has many positive attributes. Its 100%-owned silver / gold project is in a safe and desirable location in central Mexico, the state of Guanajuato. At its peak in the 18th century, the mines of Guanajuato, especially the world famous Valenciana mine, were considered the largest and richest on the planet. In the 50 years from 1760 to 1810, Guanajuato (mostly from Valenciana) often accounted for 20% of global silver production, primarily from a single extraordinarily rich vein. {corporate presentation}

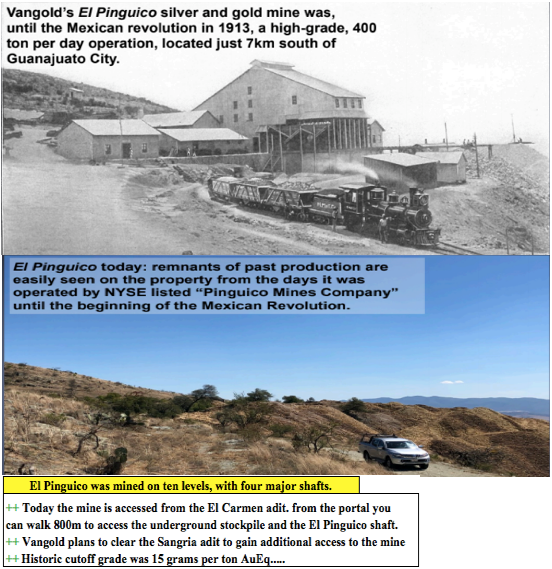

The company’s flagship property hosts the high-grade, past-producing El Pinguico mine that was only shut down due to the Mexican Revolution in 1913 {it wasn’t mined out}. The mine operated on ten levels with four major shafts. From the early 1890s until 1913, El Pinguico was one of the highest grade mines in Guanajuato.

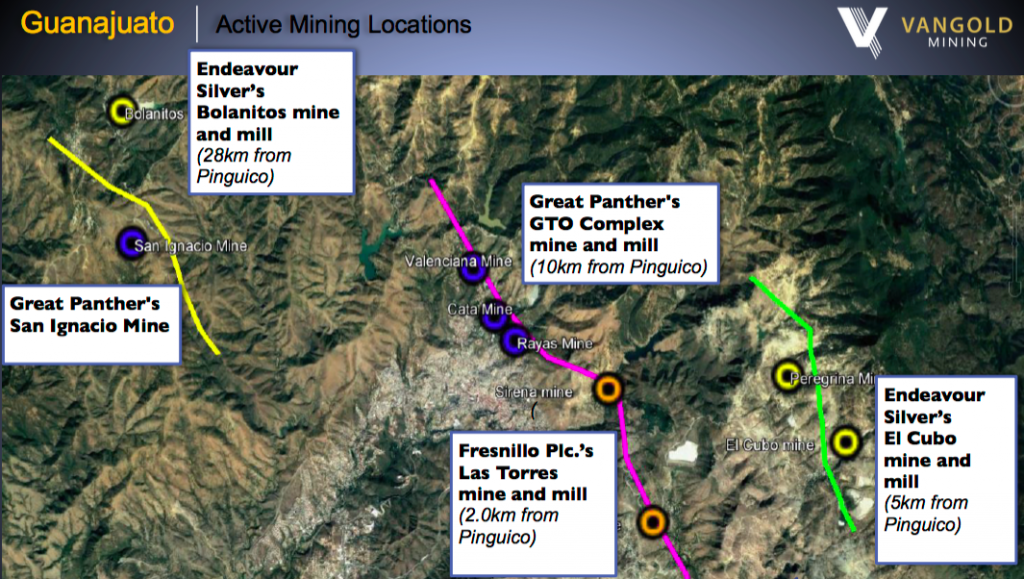

The cut-off grade was reportedly 15 g/t (0.48 oz./t) gold equiv. Mining was done exclusively at the El Pinguico & El Carmen vein systems, which are thought to be splays off of the Mother Vein. El Pinguico is surrounded by well-known players, including — Fresnillo PLC, Endeavor Silver, Great Panther and Argonaut Gold.

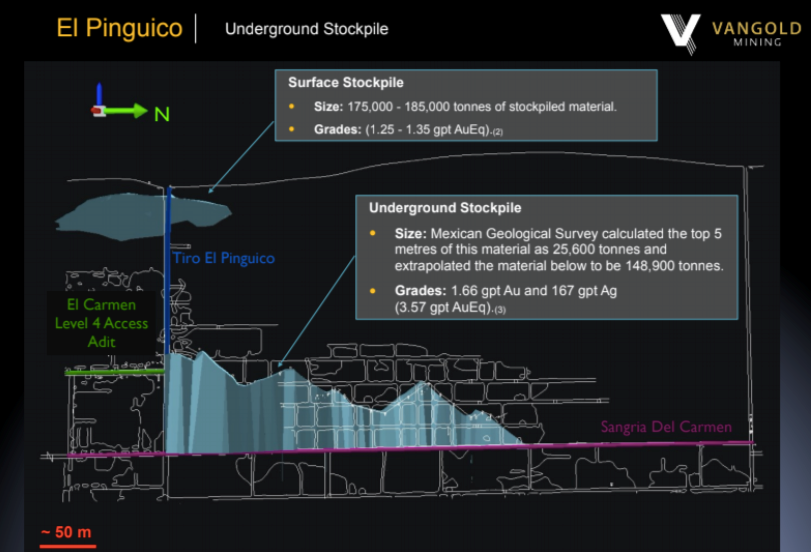

Modest near-term cash flow is possible from exploiting a surface stockpile this year, but more meaningful profit potential exists from extracting (and getting toll-milled) meaningful underground stockpiles grading ~3.6 g/t Au Eq. In 2012, the Mexican Geological Society estimated there were ~174,500 tonnes of material stockpiled underground. Assuming an 85% recovery, that equates to about a 20,000-ounce Au Eq. opportunity.

The plan is to reinvest net cash flow into new exploration & development activities at El Pinguico. It’s critical for readers to understand that Vangold has substantial exploration upside above & beyond monetization of stockpiles. Interestingly, the company stands to benefit from at least three things due to the global pandemic.

First, significantly lower energy costs, second, a favorable move in FX rates (weaker CAD$ & Mexican peso vs. the US$), and third, lower project costs (drilling, mining equipment & services, labor) as people will, presumably, be anxious to get back to work. Globally, unemployment rates are likely to remain elevated for an extended period.

Vangold has a substantial database of valuable exploration data including historical underground channel sampling & drilling. Samples from around the year 1909 include blockbuster grades. The best were; 0.7m @ 23.0 g/t Au + 3,858 g/t Ag, {~61.6 g/t Au Eq.}, another one of 0.8m @ 16.7 g/t Au + 3,054 g/t Ag, {~47.2 g/t Au Eq.}, and a third, 0.7m @ 15.7 g/t Au + 1,793 g/t Ag, {~33.6 g/t Au Eq.}.

As mentioned, prior mining at El Pinguico was from two vein systems (El Pinguico & El Carmen) thought to be offshoots of the Veta Madre (“Mother Vein”). The Veta Madre has been, and continues to be, incredibly important to the region. It stretches at least 25 km and has reportedly produced upwards of 1.2 billion ounces of silver.

From Endeavor’s website, “Silver was originally discovered by Spanish explorers in 1548 and subsequently at Guanajuato in 1552. Guanajuato is considered one of the top three historic silver mining districts in Mexico, having produced an estimated 1.0 to 1.2 billion ounces silver, plus 5 to 6 million ounces gold.”

The Veta Madre is also highly prospective for Vangold as it is known to extend to within 250 meters of the company’s border. Management believes it likely crosses through their property at between 400 and 600 meters depth. Importantly, Vangold is not the only company chasing the Mother vein.

With a much higher gold price, silver not so much (yet), especially in Mexican peso terms, the region has become one of the hotter mining jurisdictions in North America. C$10 billion Fresnillo PLC is reopening a prolific (1970’s to 2002) mine that will bring additional workers, equipment & mining services to the area. The mine reopening is happening next year, just 2 km from Vangold’s project.

In addition to Director Daniel Oliver, Vangold has a tremendous team for a company with a market cap of just C$2.7 million. Led by the highly experienced and well-connected James Anderson, who’s been working hard for the past year to revitalize this story, the company’s ship may have just come in. And, I should add, a rising (gold / silver) tide lifts all boats!

Readers should strongly consider taking a few minutes to review Vangold Mining’s (TSX-V: VGLD) / (OTCQB: VGLDF) brand new {corporate presentation}. Please visit the last two pages which extoll the considerable talents and experience of the management team.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Vangold Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Vangold Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock & warrants in Vangold Mining, and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.