Trillium Gold Mines Inc. (TSXV:TGM) (OTCQX:TGLDF) announced that it has entered into two purchase option agreements for the Uchi Gold Project and Satterly Gold Project, to acquire a 100% undivided interest in each area within the Confederation greenstone belt. The agreements further Trillium Gold’s strategic objective to consolidate the Confederation belt and Birch-Uchi greenstone belt, positioning it as the dominant exploration company in the Red Lake Mining District.

Uchi Gold

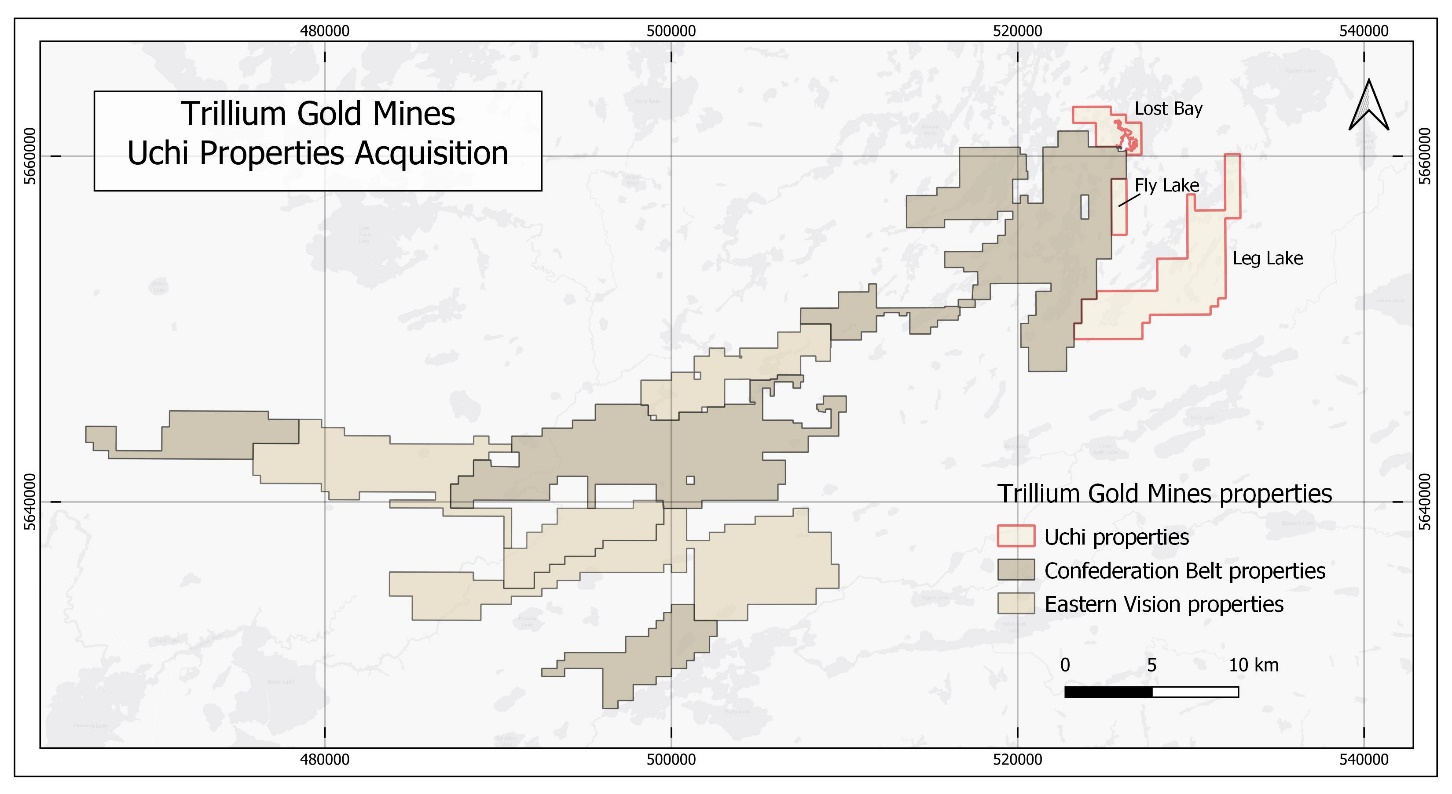

Figure 1: Uchi Gold Option Properties

The Uchi Gold Agreement covers 4,189 hectares of unpatented mining claims immediately adjacent to and adjoining the Company’s Confederation belt properties which already stretch over 100km of favourable structure on trend with Kinross Gold’s Dixie deposit.

The Uchi Gold agreement brings a whole other set of favourable mining claims into the company’s portfolio. Properties include the contiguous and complementary Lost Bay, Fly East, and Leg Lake mining claims. By adding these properties, Trillium extends its Confederation belt property assemblage to the northeast towards its Satterly Lake property. Most notably, the deal boosts Trillium Gold’s foothold in a contiguous land position along the same structural trend that has attracted major mining companies.

Vast, Untapped Potential

The new properties also hold a vast amount of untapped potential, considering how underexplored they are. The Fly East and Leg Lake properties have previously seen limited reconnaissance type exploration, with the majority of exploration having focused on base metals in the 1970s and 1980s. Only eight drill holes were conducted over the properties during that time period.

Then in the early 2000s, platinum group mineralization was targeted, with results of up to 1g/t PGMs and 1.8% copper. At Fly East, some minor gold exploration took place but only indirectly. Considering that both of these properties contain favourable structures and lithologies for both gold and base metals, Trillium Gold has snapped up a strategic package that could be more prospective than envisioned.

To top it off, as part of the Uchi agreement, the company gains the Lost Bay property. This is particularly significant being located close to the historic Bobjo Mine, which in 1929 produced 362 ounces of gold.

The Lost Bay property contains felsic and mafic volcanic rocks with gold mineralization that appears to follow a preferred west-northwest orientation. In the mid-1930s some gold and base metal exploration was performed, targeting South Bay Mine analogues, but these structures were not deemed to be important in the base metal context. Today Trillium Gold has the opportunity to unlock the potential of these structures prospective for gold, base metals (copper/zinc) and PGMs.

Satterly Gold

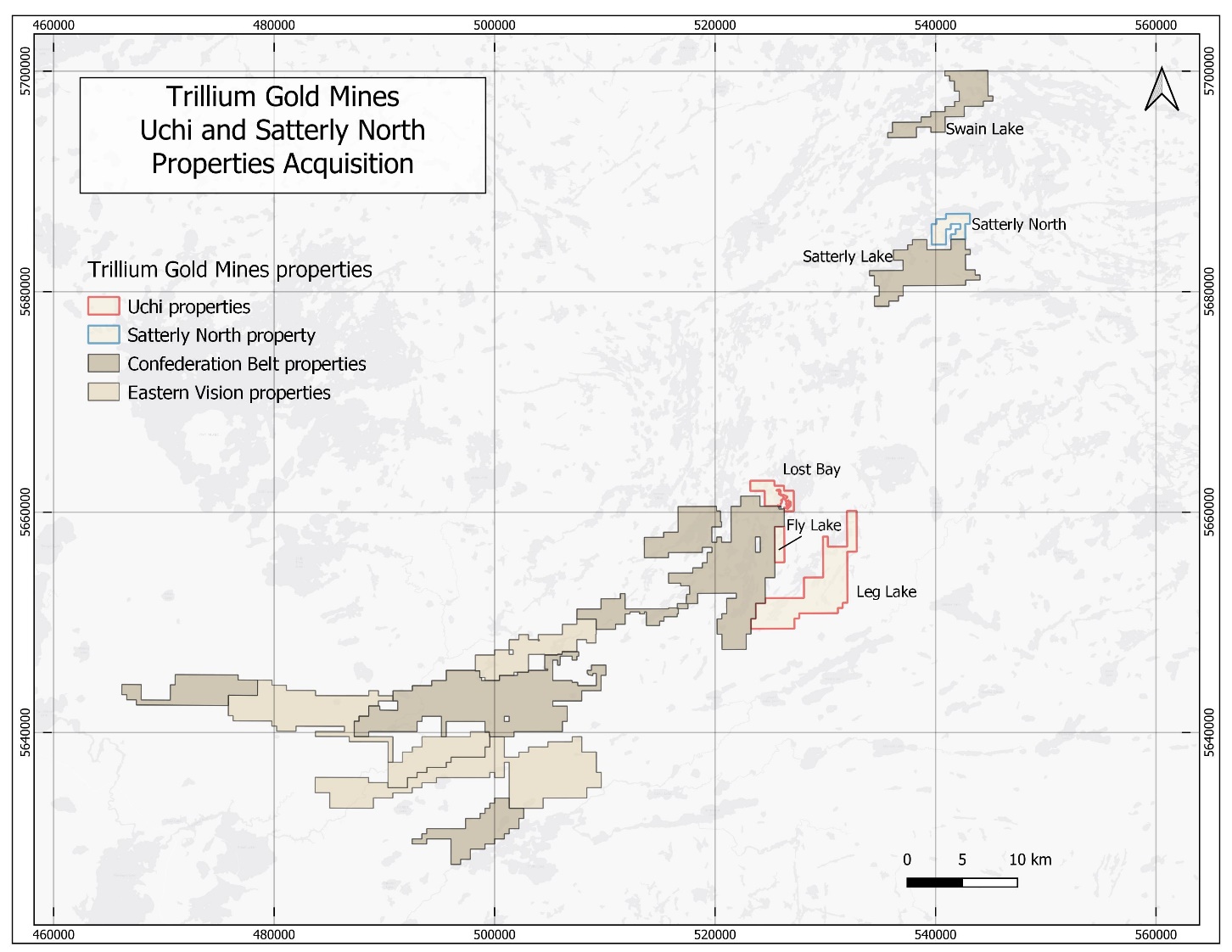

Figure 2: Uchi and Satterly Gold Option Properties

The Satterly Gold Agreement consists of 5 unpatented mining claims covering 565 hectares adjoining the company’s existing Satterly Lake properties located to the northeast of the Confederation belt land package.

Like the other properties, this area has seen sporadic exploration in the 1930s, recommencing gold exploration in the 1990s, and then again in 2009.

The region is underlain by a variety of rock types, including mafic volcanics and intrusives, sediments, and lamprophyre dykes. In the northeast corner of the property, Cominco carried out a local basal till sampling program, which revealed several anomalous results.

These aforenoted purchase option agreements have effectively furthered Trillium Gold’s regional-scale consolidation strategy which has resulted in a dominant land position in the Confederation and Birch-Uchi belts. The potential of the combined property is vast, and the company is ideally positioned to explore and unlock that potential in 2022 and beyond.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.