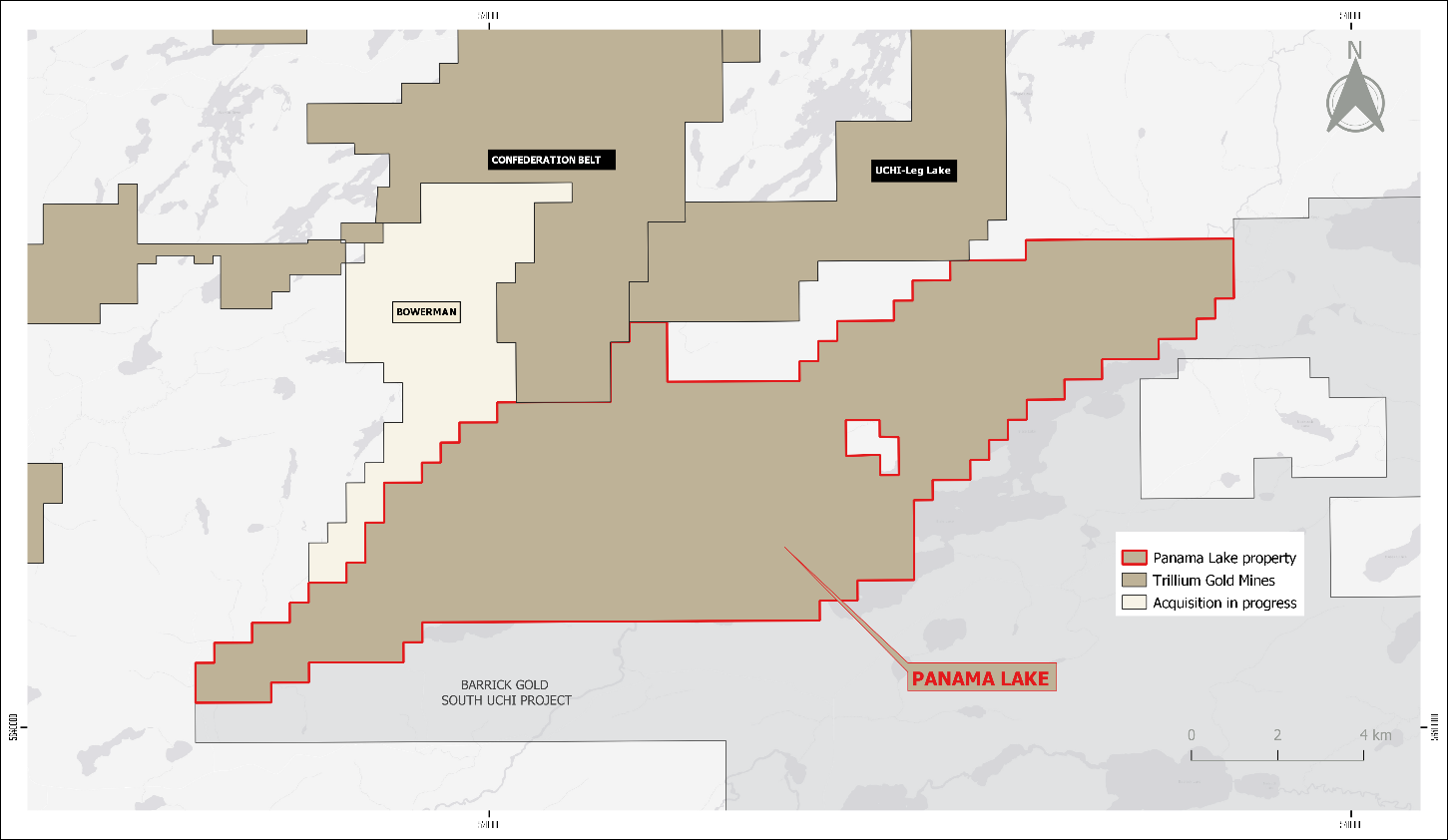

Trillium Gold (TSXV:TGM) has signed a purchase and sale agreement to acquire the rights and title to the Panama Lake Property owned by St. Anthony Gold Corp. The project is located on the same structural trend as Kinross Gold’s Dixie Deposit, only 80 kilometres away, and extends Trillium’s dominant contiguous land package in the Confederation belt by an additional 9,882 hectares.

Figure 1: Map showing Trillium Gold’s Panama Lake Gold Project

The details of the agreement are as follows:

Pursuant to an assignment and assumption agreement to be entered into on the closing of the transactions contemplated by the Purchase Agreement (the “Assignment Agreement” together with the Original Option Agreement, the “Option Agreement”), among Trillium Gold and St. Anthony Gold, St. Anthony Gold will assign all of its rights and obligations under the Original Option Agreement to Trillium Gold. In addition, pursuant to the Assignment Agreement, Benton Resources Inc. (“Benton Resources”) will agree to consent to the assignment and will agree to register 100% of the Property’s title to Trillium Gold while retaining its 50% ownership interest in the Property until such time as Trillium Gold fulfils its option to earn 100% interest.

Terms of the Agreement

Pursuant to the terms of the Purchase Agreement, at closing, Trillium Gold will pay St. Anthony Gold, Cdn $500,000 in cash and issue 1,000,000 common shares in the capital of Trillium Gold (the “Common Shares”). In the event Trillium Gold acquires a 100% interest in the Property, St. Anthony Gold may cause Trillium Gold to exercise its Buy-Back Right under the Option Agreement (as further discussed below) to repurchase from Benton Resources one-half of the 2% Net Smelter Royalty on the Property and convey such repurchased 1% Net Smelter Royalty to St. Anthony Gold in exchange for a cash payment by St. Anthony Gold to Trillium Gold of $1,000,000.

Pursuant to the terms of the Option Agreement, in order for Trillium Gold to earn a 70% interest in the Property, it will pay to Benton Resources Cdn $100,000 in cash or the equivalent in Common Shares, based on the 10-day value weighted average price (“VWAP”) of Trillium Gold’s Common Shares traded on the TSXV prior to issuance by October 24, 2022, and complete $250,000 in exploration expenditures on the Project by April 24, 2023. Trillium Gold has the option to earn 100% ownership of the Property by paying Benton Resources a further $300,000 in cash or the equivalent in Common Shares, based on the 10-day VWAP of Trillium Gold’s Common Shares traded on the TSXV prior to issuance and complete $300,000 in exploration expenditures on the Project in each case by October 24, 2023. Benton Resources has the right to retain a 2.0% NSR on the Project, subject to the option of Trillium Gold to buy back one-half of such royalty (being 1.0%) for Cdn $1,000,000 (the “Buy Back Right”). In the event that Trillium Gold completes a NI 43-101 compliant resource estimate for the Property, Trillium Gold will issue to Benton Resources Common Shares with the amount of Common Shares issuable to be determined based on the number of ounces of gold in the NI 43-101 report and the market price of the Common Shares at the time.

The Common Shares of Trillium Gold issued under the Purchase Agreement will be subject to a four-month holding period from the closing date. The Purchase Agreement is subject to the approval of the TSXV and other applicable regulatory authorities.

Source: Trillium Gold Mines

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.