Trillium Gold Mines (TSXV:TGM) has announced that it has closed the previously reported purchase option agreements for the Satterly Gold Project and the Uchi Gold Projects. This is a major step for the company in building its dominant land position in the Confederation belt and Birch-Uchi greenstone belts within the Red Lake Mining District.

Uchi Gold Agreement

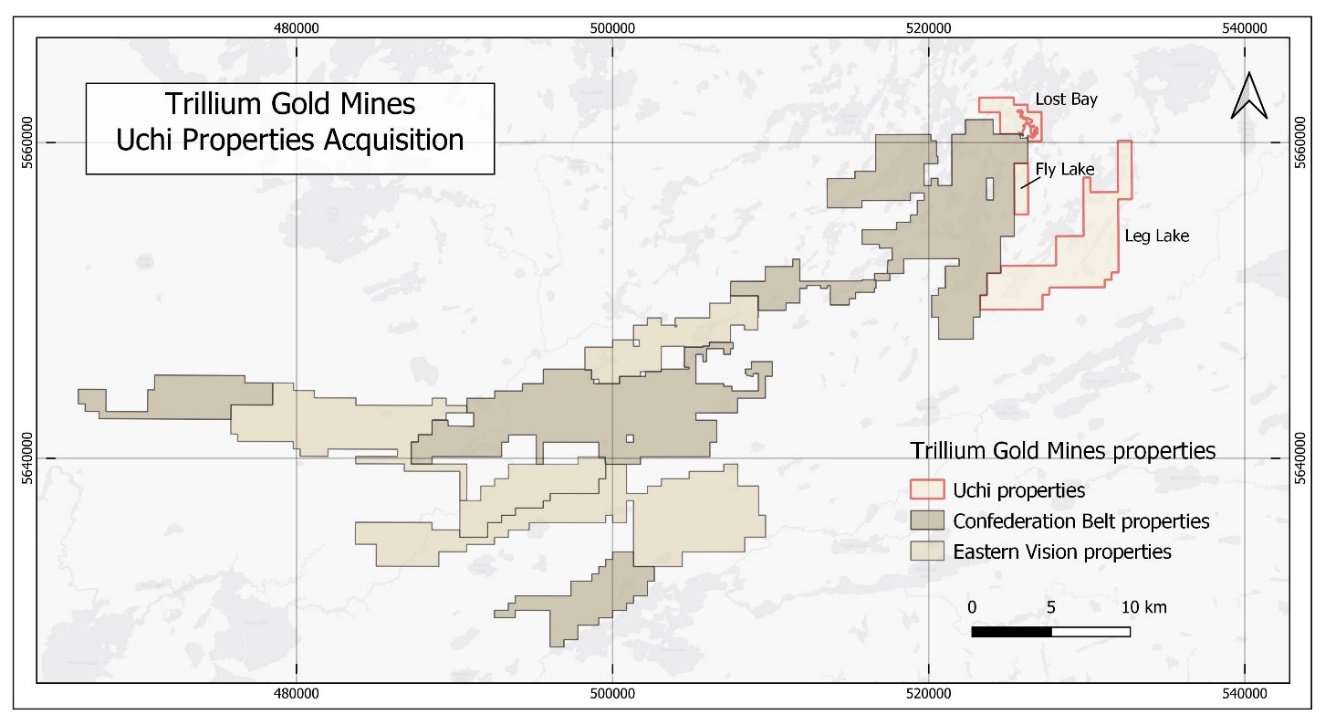

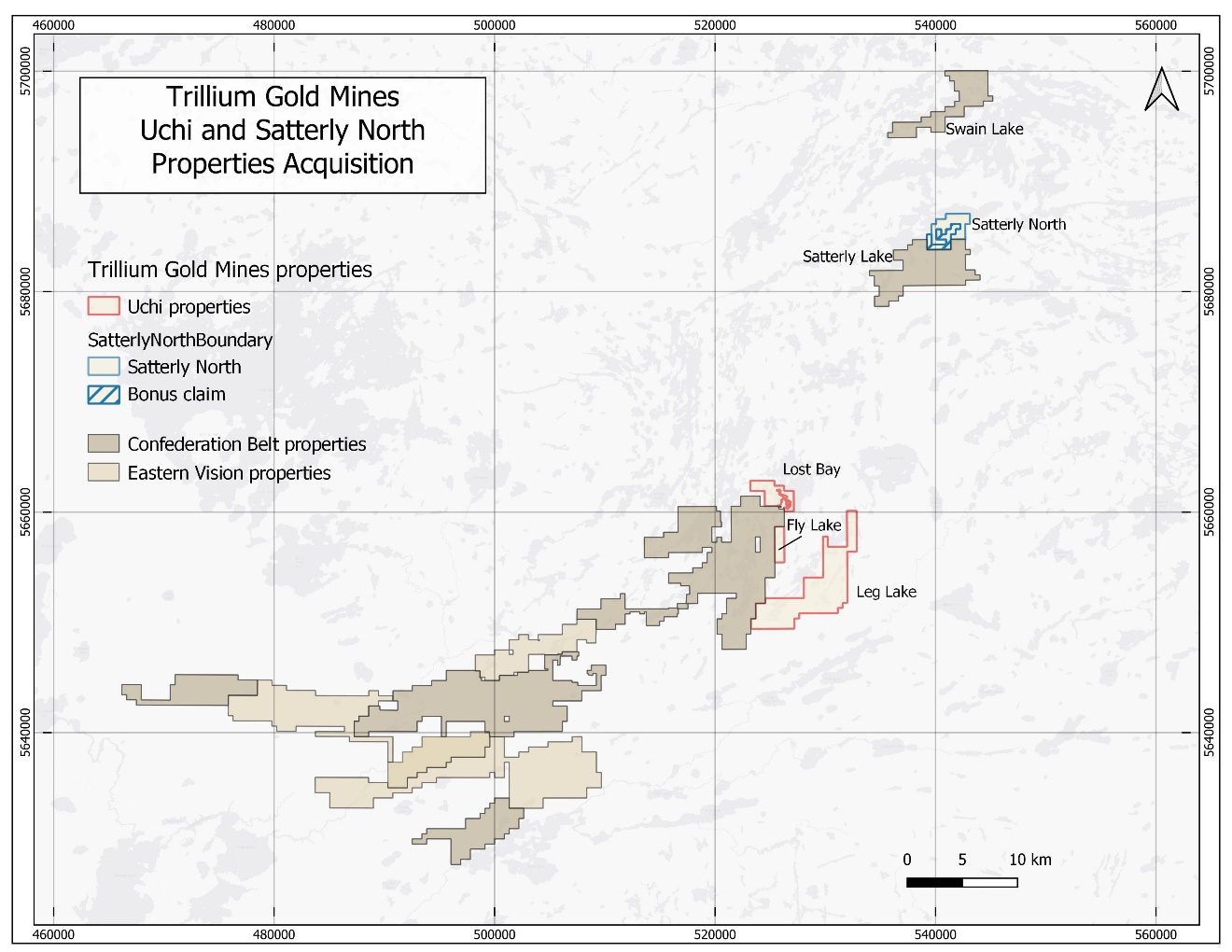

The Uchi Gold Agreement comprises one hundred and eighty-two (182) unpatented mining claims covering 4,189 hectares immediately adjacent to and adjoining the Company’s Confederation belt land position. They consist of the contiguous and complementary Lost Bay, Fly East and Leg Lake mining claims that extend the Company’s existing Confederation belt property assemblage to the northeast towards the Satterly Lake property, and add to Trillium’s dominant position over 100km of favourable structure on trend with Kinross Gold’s Dixie deposit (see Figures 1 & 2 below).

In order to keep the option in good standing, Trillium Gold is required to pay aggregate consideration of $115,000 over a period of three years, issue an aggregate 300,000 common shares, and grant to the vendors a 2.0% net smelter returns royalty on each purchased asset. The Company has the right to repurchase 50% of each royalty (being 1.0%) by paying the holders an aggregate amount equal to $1,000,000.

Satterly Gold Agreement

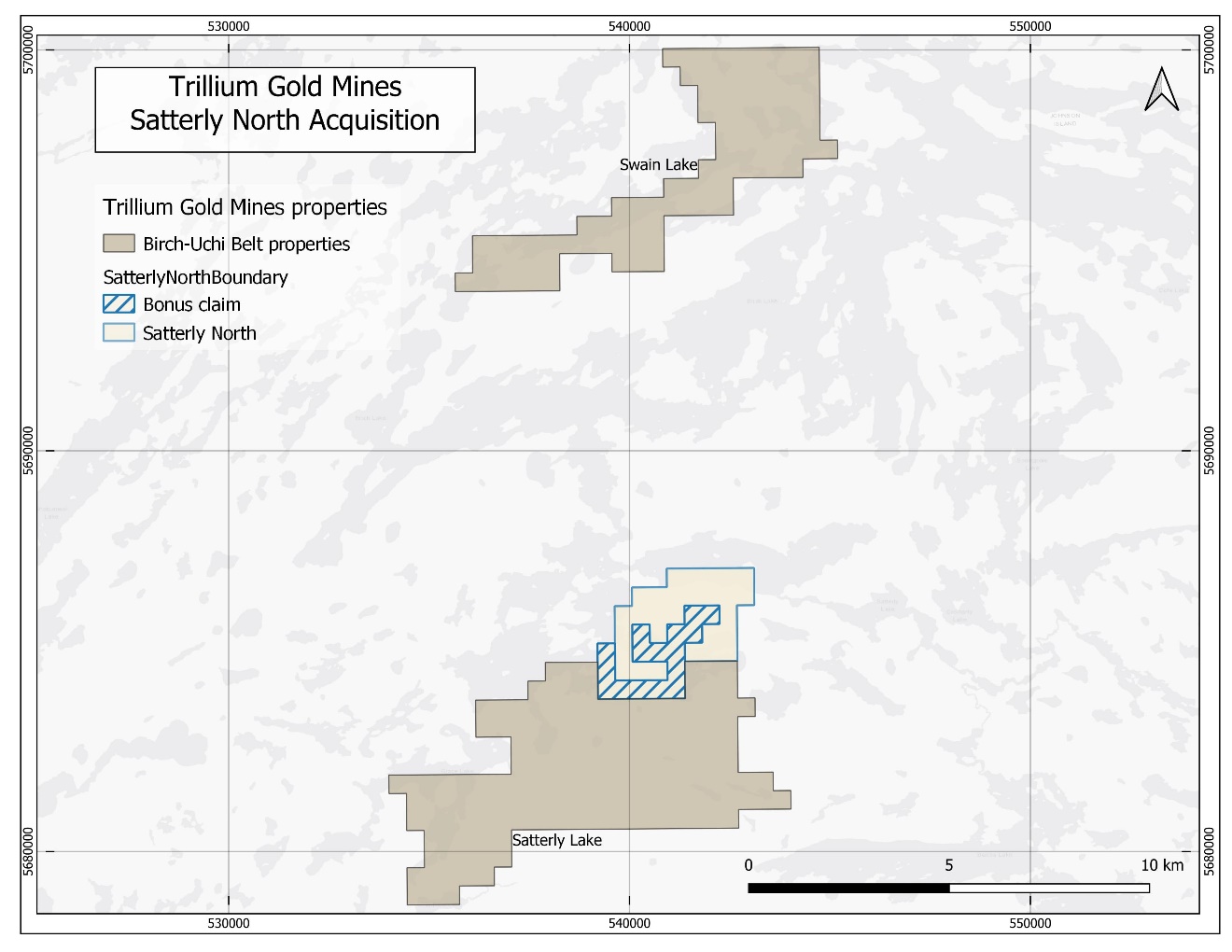

The Satterly Gold Agreement comprises twenty-eight (28) claim cells in five (5) claims covering 565 hectares (called Satterly North). The area has seen sporadic exploration from the 1930’s with renewed gold exploration in the 1990’s and again from 2009. (see Figure 2 below).

In order to keep the option in good standing, Trillium Gold is required to pay aggregate consideration of $63,500 over a period of three years, issue an aggregate 100,000 common shares, and grant to the vendors a 1.5% net smelter returns royalty on each purchased asset. The Company has the right to repurchase 1/3 of each royalty (being 0.5%) by paying the holders an aggregate amount equal to $500,000.

In addition, the vendors have successfully acquired sixteen (16) recently staked cells in one (1) claim covering 323 hectares at a cost equal to the costs of staking (see Figure 3 below).

Source: Trillium Gold Mines

Figure 1: Uchi Gold Option Properties

Figure 2: Uchi and Satterly Gold Option Properties

Figure 3: Satterly Gold Option Property showing sixteen (16) recently staked cells in one (1) claim

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.