Thesis Gold (TSXV:TAU) has announced assay results from 2023 drilling at the Thesis II and Thesis III zones of its 100% owned Ranch Gold Project, located in the Toodoggone Mining District of northern British Columbia, Canada.

Ewan Webster, President and CEO, commented in a press release: “The 2023 drilling results at Thesis II and Thesis III represent yet another step towards unlocking the full potential of the Ranch Project. Our targeted strategy for the 2023 program focused on furthering our understanding of the high-grade, near-surface potential at Ranch as we progress towards a maiden resource estimate. We view this as a stepping stone in our ongoing efforts to extend the mineralization at Ranch. Today’s notable step-out headline hole of 60.00 m at 4.53 g/t Au strongly suggests that there is still much to be discovered.”

The drilling is part of a strategic plan to support the development of a maiden resource estimate at Ranch – an important milestone ahead of a forthcoming Preliminary Economic Assessment update. Together with the adjacent Lawyers Gold-Silver Project, Ranch forms Thesis Gold’s contiguous 325 km2 land package in the region.

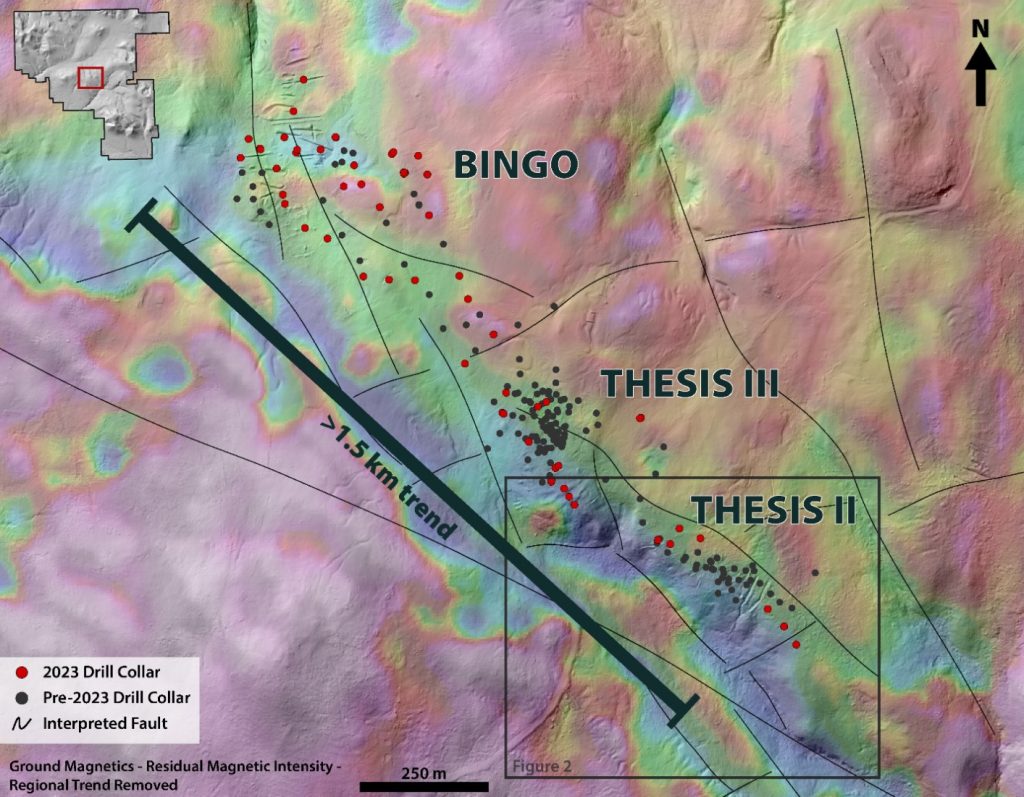

Thesis II and III represent the southern and central zones along the multi-kilometre scale Thesis Structural Corridor, which hosts multiple mineralized domains together with the emerging Bingo zone. On a regional, district and deposit scale, mineralization occurs along intersecting NW-SE and E-W trending faults that have been mapped using magnetic surveys. These regional faults are believed to have acted as conduits for mineralizing fluids in the project’s porphyry and epithermal systems.

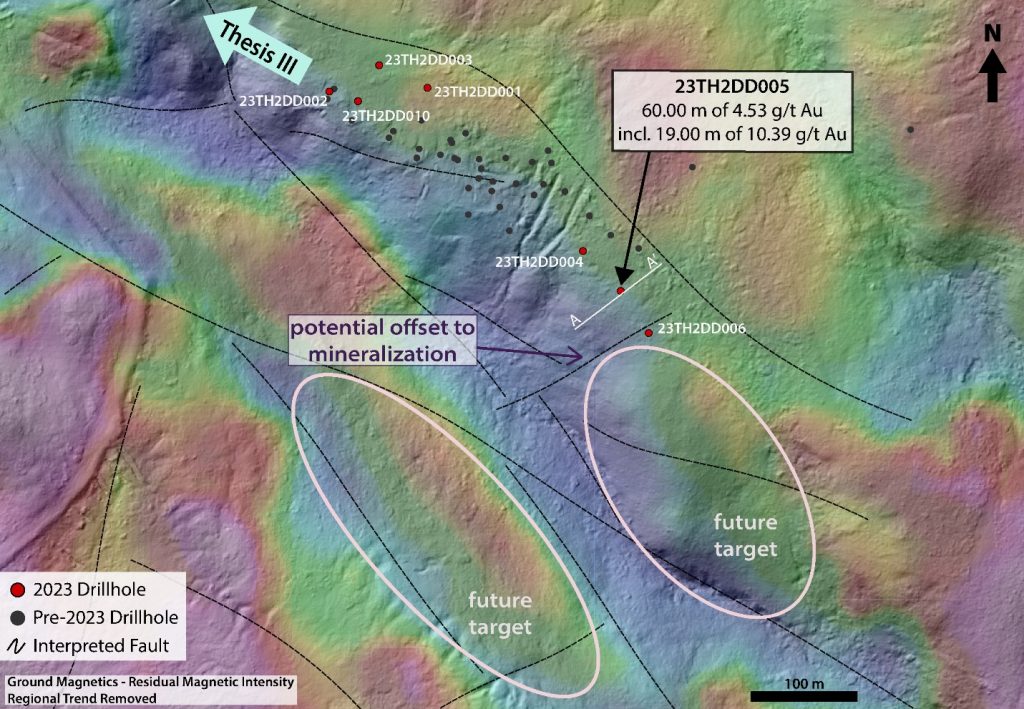

Recent drilling has improved the understanding of how these local faults control the geometry of the gold-mineralized bodies. One exploration hole at the southern end of Thesis II intercepted 60 meters grading 4.53 g/t gold, while a subsequent step-out hole returned only low-grade mineralization. This suggests the NE-oriented structure between the two holes may offset the mineralization to the southwest.

Altered and mineralized rock typically shows a reduced magnetic signature compared to surrounding unaltered host rock. Thesis’ technical team is developing new drill targets along the low-moderate magnetic lineaments that parallel known mineralized trends. Exceptionally broad high-grade intercepts continue to highlight the potential for expansion and new discoveries across the wider Ranch Project over the next year.

Thesis Gold is focused on unlocking the combined potential of the adjoining Lawyers and Ranch projects after its 2022 strategic merger with Benchmark Metals. A recent preliminary economic study outlined plans for a 12-year open pit operation at Lawyers yielding over 160,000 gold-equivalent ounces per year. Integrating the Ranch project aims to improve project economics further. The company’s plans include releasing a combined resource estimate in Q2 2024, followed by an updated preliminary economic assessment in Q3 2024 to showcase the full potential of the projects.

- Drilling at Thesis II was designed to test deeper mineralization identified at the end of the 2022 drilling campaign:

- 23TH2DD005 intersected 60.00 metres (m) of 4.53 grams per tonne gold (g/t Au) beginning 84 m from surface (vertical depth).

- Including 19.00 m of 10.39 g/t Au.

- 23TH2DD005 intersected 60.00 metres (m) of 4.53 grams per tonne gold (g/t Au) beginning 84 m from surface (vertical depth).

- Drilling at Thesis III returned strong near surface mineralization:

- 23TH3DD013 intersected 24.32 m of 2.93 g/t Au beginning at a vertical depth of 32 m.

- 23TH3DD017 intersected 39.90 m of 2.39 g/t Au beginning at vertical depth of 4 m.

- Confirmation and infill drilling from the 2023 season will be incorporated into an upcoming, maiden mineral resource estimate for the Ranch Project scheduled for Q2 2024.

Table 1: 2023 drill results from Thesis II and Thesis III.

| Hole ID | From (m) | To (m) | Interval (m)* | Au (g/t) | |

| 23TH2DD001 | 108.12 | 114.20 | 6.08 | 0.53 | |

| 23TH2DD002 | No Significant Results | ||||

| 23TH2DD003 | No Significant Results | ||||

| 23TH2DD004 | 130.26 | 133.00 | 2.74 | 0.83 | |

| 23TH2DD005 | 31.67 | 33.81 | 2.14 | 0.59 | |

| and | 128.28 | 129.92 | 1.64 | 44.80 | |

| and | 141.00 | 201.00 | 60.00 | 4.53 | |

| incl | 153.00 | 199.80 | 46.80 | 5.61 | |

| incl | 168.00 | 187.00 | 19.00 | 10.39 | |

| incl | 169.00 | 172.00 | 3.00 | 32.84 | |

| incl | 170.00 | 171.00 | 1.00 | 75.60 | |

| incl | 184.00 | 187.00 | 3.00 | 19.09 | |

| incl | 185.00 | 186.00 | 1.00 | 38.30 | |

| 23TH2DD006 | 170.00 | 171.00 | 1.00 | 0.61 | |

| 23TH3DD001 | 11.00 | 24.00 | 13.00 | 1.06 | |

| incl | 21.00 | 24.00 | 3.00 | 2.78 | |

| and | 33.00 | 90.00 | 57.00 | 0.76 | |

| incl | 77.00 | 78.00 | 1.00 | 7.15 | |

| and | 106.00 | 107.00 | 1.00 | 6.79 | |

| 23TH3DD003 | 106.38 | 110.00 | 3.62 | 0.45 | |

| 23TH3DD004 | No Significant Results | ||||

| 23TH3DD005 | 37.00 | 38.28 | 1.28 | 0.72 | |

| 23TH3DD006 | 44.05 | 44.70 | 0.65 | 13.85 | |

| 23TH3DD007 | 9.00 | 16.00 | 7.00 | 3.77 | |

| and | 78.53 | 97.00 | 18.47 | 0.46 | |

| 23TH3DD008 | 6.00 | 14.00 | 8.00 | 1.75 | |

| and | 39.00 | 58.96 | 19.96 | 0.66 | |

| 23TH3DD010 | 16.83 | 31.00 | 14.17 | 0.30 | |

| 23TH3DD011 | No Significant Results | ||||

| 23TH3DD012 | No Significant Results | ||||

| 23TH3DD013 | 2.96 | 5.00 | 2.04 | 0.64 | |

| and | 40.68 | 65.00 | 24.32 | 2.93 | |

| incl | 44.00 | 51.00 | 7.00 | 6.79 | |

| incl | 48.00 | 50.00 | 2.00 | 12.68 | |

| 23TH3DD014 | 119.75 | 121.00 | 1.25 | 1.29 | |

| 23TH3DD015 | 4.00 | 5.00 | 1.00 | 2.30 | |

| and | 21.00 | 33.00 | 12.00 | 0.20 | |

| and | 38.00 | 39.00 | 1.00 | 1.63 | |

| and | 55.00 | 59.00 | 4.00 | 0.47 | |

| 23TH3DD017 | 5.10 | 45.00 | 39.90 | 2.39 | |

| and | 54.08 | 60.00 | 5.92 | 0.67 | |

| 23TH3DD018 | No Significant Results | ||||

| 23TH3DD019 | 124.83 | 133.40 | 8.57 | 0.20 | |

| 23TH3DD020 | No Significant Results | ||||

| 23TH3DD021 | 286.28 | 301.34 | 15.06 | 0.63 | |

| incl | 289.67 | 292.38 | 2.71 | 1.29 | |

| and incl | 298.00 | 300.80 | 2.80 | 1.45 | |

| and | 341.20 | 352.00 | 10.80 | 0.50 | |

| 23TH3DD022 | 280.00 | 285.00 | 5.00 | 0.58 | |

| and | 309.00 | 353.00 | 44.00 | 0.88 | |

| incl | 309.00 | 339.00 | 30.00 | 1.11 | |

| incl | 323.00 | 337.00 | 14.00 | 1.80 | |

| and incl | 346.00 | 353.00 | 7.00 | 0.75 | |

| and | 360.00 | 363.07 | 3.07 | 0.35 | |

*Intervals are core length.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.