The Toronto Stock Exchange has launched a new battery metals index, allowing investors to track Canadian-listed companies involved in the production and exploration of metals used for battery manufacturing. Common battery metals include lithium, cobalt, and nickel.

Beyond tracking some of the biggest battery metal producers, the index will promote the growth of the critical mineral sector. Investors will also be able to gain insights into the energy transition and which companies are involved in the supply chain of this important industry. For Canada, this is an important index for its overall weighting. Companies involved in critical and battery minerals represented a quarter of the total equity capital raised by the mining sector for the TSX and TSXV. The mining industry in Canada is worth billions annually and is a significant contributor to the country’s GDP.

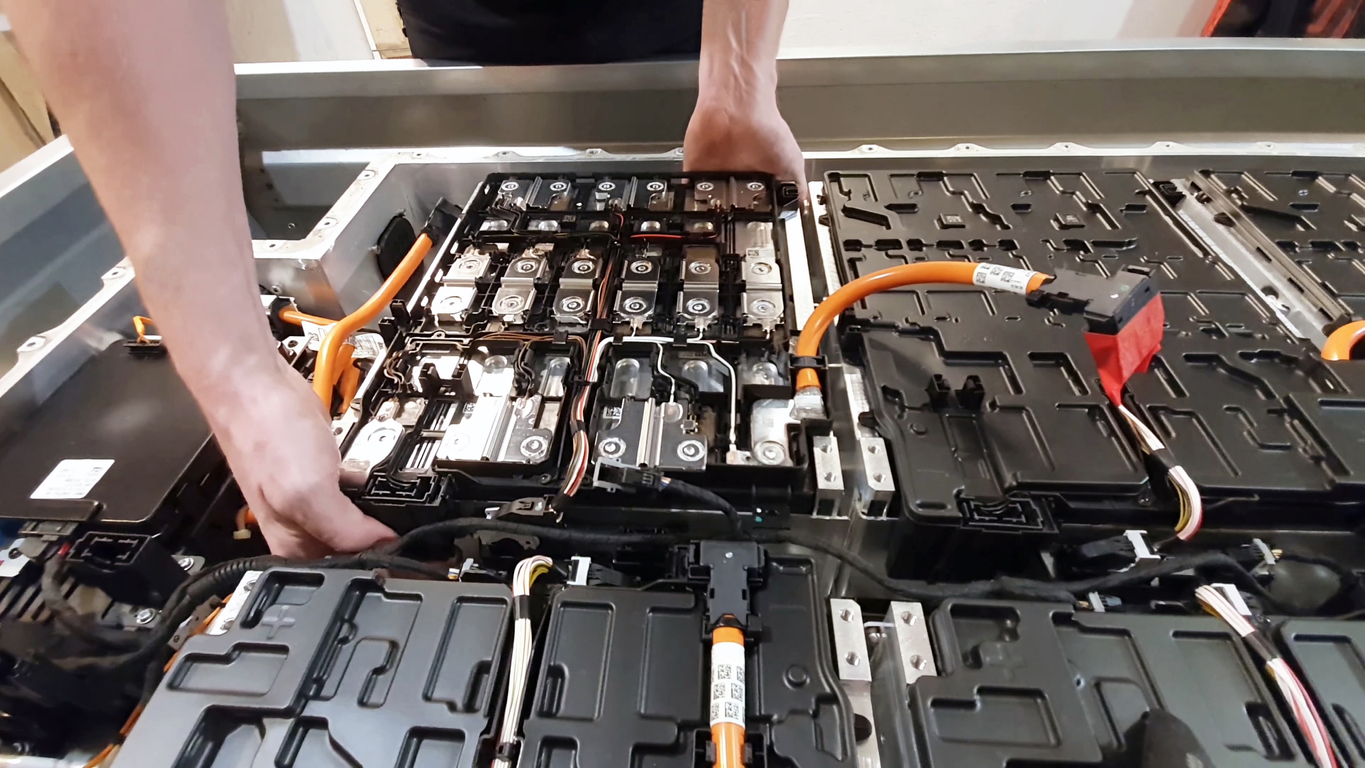

Some of the biggest entrepreneurs in the world have sounded the alarm about the supply/demand issues plaguing the industry. Elon Musk has called for more nickel production, even going so far as to say that Tesla has not ruled out acquiring mining companies and other assets to promote production. Metals like copper, nickel, and other battery minerals like lithium and cobalt are required to support the net-zero goals for global economies, particularly for battery storage from energy generation and electric vehicles.

Loui Anastasopoulos, CEO, TSX and Global Head, Capital Formation, commented: “In keeping with our long history of supporting the growth of the critical minerals industry and the interrelationship with clean technologies, decarbonisation, renewable energy and vehicle electrification, we are pleased to announce the launch of the new S&P/TSX Battery Metals Index. Global demand for battery metals continues to gain momentum and the goal of this new benchmark is to provide investors increased exposure to, and deeper insights into, the cleantech and energy transition story. TSX remains focused on the future, committed to working with our clients and industry stakeholders to seek innovative ways to enable the success of traditional and newly-defined sectors across our diverse and ever-evolving public markets ecosystem.”

The biggest constituents of the S&P/TSX Battery Metals Index will be:

- TRQ: Turquoise Hill Resources Ltd.

- TECK.B: Teck Resources Ltd Class B Subordinate Voting Shares.

- SMT: Sierra Metals Inc.

- FM: First Quantum Minerals Ltd.

- LUN: Lundin Mining Corp.

- ERO: Ero Copper Corp.

- HBM: Hudbay Minerals Inc.

- CGG: China Gold International Resources Corp. Ltd.

- CMMC: Copper Mountain Mining Corp.

- TKO: Taseko Mines Ltd.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.