I continue to receive questions regarding the direction of the market, to which I can only reply “I don’t know.” I certainly have thoughts about the factors affecting metals markets, but am not under the illusion that I KNOW where the market is headed.

What I do know is that my money is best invested, in tranches, in the best companies in the sector. The best companies are led by the best management teams and, besides the pure exploration companies, are the owners of the highest quality projects.

By high quality, I’m referring to their economics. The best projects have robust economics at today’s metal prices.

It’s my opinion that when market sentiment does eventually change, the bull portion of the next cycle will be HUGE. Along with the supply shortages that I see in the fundamentals of most of the metals, the demand side of the equation looks particularly strong as, globally, the world begins to push toward electrification.

With the short-term direction of the market hard to gauge, one avenue for investors who want to give themselves the potential to profit in the relative immediate future, is to look at exploration companies with a program happening now or in the near future.

Like development companies, the best exploration companies are headed by the best management teams, who have chosen their exploration projects by a set of criteria which gives them the best possible chance at success.

I highly encourage investors to meet, or at the very least call, the people who are running the companies with which they are going to place their money. One of the questions that I think needs to be asked is how the company came to the conclusion that the project they are going to be exploring gives them the best chance at finding a mineral deposit of value.

A company which has been one of my favourites for some time now is Adventus Zinc Corporation (ADZN:TSXV). They are developing their Curipamba project in Ecuador. While I’m looking forward to an updated PEA on Curipamba in the new year, it’s Adventus’ exploration potential with their Pijili and Santiago projects that has my full attention – and excitement – at the moment.

Let’s take a look!

Determining Potential Value in Exploration

Determining the upside potential or value of an exploration company isn’t easy, as much of the criteria is subjective in nature. Here are, in my opinion, a few of the most important points to ponder when it comes to evaluating investment in an exploration company:

#1 – Quality of the Management Team – Take a good look at the management team and any advisors or consultants associated with the company. Past success is a very good indicator of future potential. A good CEO should be able to clearly define the details, mainly the why and how of their upcoming exploration program.

#2 – Jurisdiction –Typically, the regions with the highest potential for uncovering a high value mineral deposit are those which have the most associated risk. It’s imperative to do your due diligence and understand where you are putting your money. Know your risk tolerance – buyer beware.

#3 – A Project’s Historical Work – Answer the following questions:

- In what stage of exploration is the project?

- Has surface work been completed? Grab samples, soil samples, geophysics?

- Is the project drill ready? How were the targets chosen?

- Historical work on the project?

- Has the project already been explored by multiple companies?

- If yes, what were their results? Why should you expect anything different?

NOTE: If a company is looking at exploring or developing a project that has already had a lot of work or exploration completed on it, the company needs to clearly outline how their exploration approach is different from the previous operators, and why it has a chance to be successful.

#4 – Cash – Cash is especially important in the current market. Does the company have enough money to execute on the exploration program that they have planned?

#5 – If unsuccessful, will I be able to sell? – This is an important question to answer and is partially overlapped with the previous point regarding cash. For me, I want to speculate in a company that will have cash remaining after their exploration program is complete in both positive and negative scenarios. An even better situation is to speculate in a company that will have cash remaining and an additional project(s) further down the development path, to which the market can assign value. In my opinion, you don’t want to be invested in a company that doesn’t have any money at this point in the market cycle, let alone own one with a recent unsuccessful exploration program.

Adventus’ Exploration Potential

Let’s use the criteria I just outlined to look at Adventus.

#1 – Quality of the Management Team – In my opinion, the Adventus team is as good as they come in the junior resource sector. The company is led by CEO, Christian Kargl-Simard, who has over 14 years of experience in both technical and finance roles in the mining industry. Additionally, and core to the team, is VP Corporate Development, Sam Leung. Leung has over 10 years of experience in the mining industry, having worked for Lundin Mining Corporation prior to joining Adventus. Finally, and key to Adventus’ exploration efforts in Ecuador, is VP Exploration Jason Dunning. Dunning has over 20 years experience in the mining industry and has worked in a similar role for Alamos Gold Inc., Selwyn Resources Ltd. and Yukon Zinc Corporation.

In addition to the main team, a major strength of the company, in my opinion, is in their association and close connection with Altius Minerals. For those who are unaware, Altius is both a diversified mining royalty company and mineral exploration project generator. Altius is headed by CEO, Brian Dalton, who is also Chairman of Adventus’ Board of Directors.

Also, Dr. Lawrence Winter, Altius’ VP Exploration, is an advisor to Adventus and, in my experience, has a top notch reputation throughout the resource sector.

People are key to the success of any company and, in the case of Adventus, I’m confident that this team will make 2019 a pivotal year in the company’s development.

#2 – Jurisdiction – Adventus’ project exploration and development focus is in Ecuador. For those who are unaware, Ecuador has a rocky past when it comes to mining investment. In my opinion, however, it’s changing in a direction that is attractive to mining investment and is a place where I have invested my cash. Earlier this year, I wrote an article regarding Ecuador’s mining investment attractiveness; for those considering investment in Ecuador, I believe it’s a must-read.

#3 – Historical Work

Adventus is in, what I consider to be, a highly advantageous position when it comes to exploration and development in Ecuador; they are partnered with Salazar Resources, a junior resource company led by a senior Ecuadorian management team.

The Curipamba project was the first deal on which the two companies partnered, giving Adventus the opportunity to earn-in on 75% of the project, given development and payment requirements over a 5-year period.

Since this initial deal, Adventus and Salazar have expanded their relationship into an Ecuador-wide exploration Alliance. The Alliance ownership is 80% Adventus and 20% Salazar, and allows the Alliance Board, which is made up of Sam Leung and Jason Dunning of Adventus, and Fredy Salazar, to pick and choose what they feel are the highest potential projects, and bring them into the Alliance for exploration and development.

Pijili Project

The first project to be brought into the Alliance is the Pijili project, which was granted to Salazar by the Republic of Ecuador.

The Pijili project consists of 3 concessions totalling 3,246 hectares, and is located in the Ecuadorian province of Azuay. Its potential has been revealed only through the legally permitted artisanal mining which is currently taking place – exploration through modern techniques has yet to take place.

Artisanal miners are mining precious metals bearing structures via several small open pits and underground tunnels. Also, Salazar notes that there is visible evidence of copper mineralization along the walls of the small open pits.

In their most recent news release, Adventus announced the commencement of an airborne MobileMT geological survey of the Pijili and Santiago projects. As VP of Exploration, Jason Dunning, cites in the news release,

“MobileMT will greatly enhance drill hole targeting by defining high-priority targets for follow-up in early 2019. This is the first time there will be a deep penetrating, uniform dataset for Pijilí and Santiago projects that will allow us to more accurately visualize the geological and structural framework in 3D to define potentially prospective host rocks for intrusion-related mineralization.”

Pijili presents a blank slate for exploration, one that I believe holds a ton of mineral potential.

Santiago Project

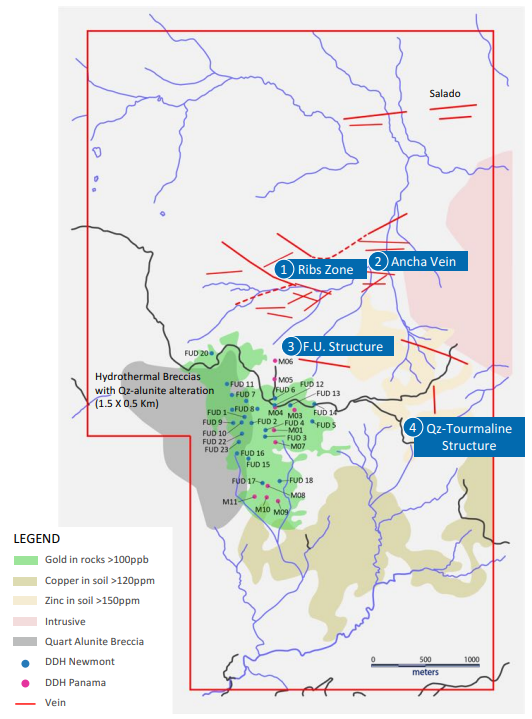

The second project brought into the Alliance is the Santiago project, which is roughly 110 km west of Lundin’s Forte del Norte gold deposit. Santiago consists of a single concession, which covers an area of 2,350 hectares.

Unlike Pijili, Santiago has seen the use of modern exploration techniques, which has exposed a series of vein occurrences. The occurrences have yielded good reconnaissance chip sampling results. Here are a few highlights, which can be found on Salazar’s website and SEDAR.

Espanola Vein

2.0 m @ 28.1g/t Au and 231 g/t Ag

1.0 m @ 26.0 g/t Au and 242 g/t Ag

Quartz-Tourmaline Vein

1.9 m @1.19 g/t Au, 14.3 g/t Ag and 296 ppm Mo

3.3 m @ 0.59g/t Au, 36.6 g/t Ag and 390 ppm Mo

Ribs Zone and Ancha Vein

1 m @ 1.29 g/t Au and > 100 g/t Ag

1 m @1.65 g/t Au and > 100 g/t Ag

F.U. Structure

1.40 m @ 4.8 g/t Au and 378 g/t Ag

1.20 m @ 6.4 g/t Au and 136 g/t Ag

In addition to the chip samples, Santiago has seen historical drilling on the project by a previous operator, Newmont Mining Corporation.

The historical results are very intriguing as they exhibit characteristics of a Cu-Au porphyry system. I must, however, caution anyone from drawing any conclusions from these results as they are not confirmable – the drill core is unavailable.

Here are a few of the highlights, which can be found on SEDAR:

Hole FU 01 – Interval 0 to 323 m, 0.37 g/t Au, 0.23% Cu – 0.47% CuEq

Hole FU 02 – Interval 129 to 300 m, 0.5 g/t Au, 0.33% Cu – 0.66% CuEq

Hole FU 08 – Interval 0 to 300 m, 0.24 g/t Au, 0.11% Cu – 0.27% CuEq

As mentioned earlier, Adventus has announced an airborne MobileMT geological survey of Santiago, which will assist the exploration team in identifying the highest potential drill targets.

Personally, I will be watching for news from the airborne work and the targets that Adventus decides to pursue. In my opinion, there’s a lot of potential here.

#4 – Cash – In Adventus’ current corporate presentation, the company lists their cash position as $10 million, as of October 30th 2018. Given the current market dynamics, this is a great position to be in. Additionally, I might add, Adventus has enjoyed the uncanny ability to raise money through this bear market portion of the resource cycle, which I expect will continue in the future.

#5 – Downside Risk – Currently, as an investor of Adventus, I believe the biggest risk to my capital comes from the jurisdiction – Ecuador, for reasons I outlined in my article. While there’s risk of failure in exploration at Pijili and Santiago, I don’t see the stock price taking a big hit for failure. Given the MCAP and the value I assign to Adventus’ assets, I see little to no value assigned to exploration upside at Pijili or Santiago.

Furthermore, given Adventus’ cash position, their access to funds and the assets they hold under management, I believe the risk to reward potential presented by the exploration is fantastic.

Conclusion

The end of the year is upon us and with it typically comes a great opportunity to buy the best junior resource companies at a discount. While no one can predict the direction of a market with any consistency, buying the highest quality companies, with catalysts for share price appreciation, puts us, in my opinion, in the best possible position to profit.

To me, Adventus is one of those high quality companies that give the investor multiple avenues for success. First, you have their flagship Curipamba project, which should have an updated PEA early in the new year. Second, you have their high potential exploration projects, Pijili and Santiago, whose upside potential, in my opinion, hasn’t been factored into Adventus’ MCAP as of yet. Third, you have Adventus’ portfolio of Irish projects, for which they are actively looking to find a JV partner. Finally, you have Adventus’ large stake in Canstar Resources, who will be beginning their inaugural exploration program on their Newfoundland based projects next year.

I’m looking forward to 2019!

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares in Adventus Zinc Corporation. All Adventus Zinc Corporation analytics were taken from their website and press release. I have NO business relationship with Adventus Zinc Corporation.

Titan Mining Corporation (TSX: TI) is a Canadian-based mining company which produces zinc concentrate at its 100%-owned Empire State Mine (“ESM”) in St. Lawrence County, New York State. ESM includes a suite of seven historic zinc mines. One of these – ESM #4 mine – has recently restarted production and, with both near-mine and regional exploration activities underway, this historic mining district is being revived. Backed by strong leadership and local community support, Titan Mining is focused on discovering and developing additional high-grade, low-cost mineral resources, increasing production and extending the mine life at ESM.

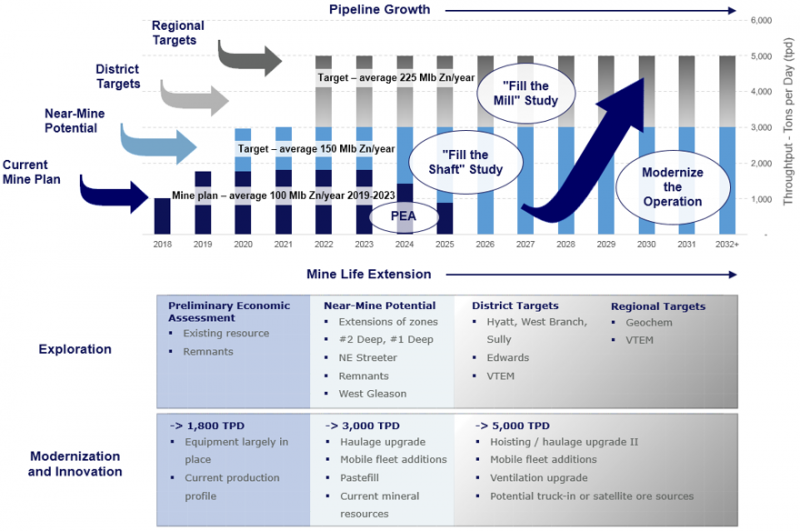

Built for Growth – Leveraging Excess Capacity to Drive Cash Flow

St. Lawrence County has a rich history of mining which spans 100 years. Titan Mining controls over 80,000 acres of mineral rights in the district and has established mining and processing infrastructure. Mill commissioning was completed and the first ore hoisted at ESM in late January 2018. Mill throughput is expected to ramp up to a rate of 1,800 tons per day (“tpd”) by the first quarter of 2019. The capacity of the shaft and mill are both significantly higher at 3,800 tpd and 5,000 tpd, respectively.

Backed by a positive long-term outlook for zinc prices, Titan Mining is moving forward with the revival of the mining district. Strong leadership and local community support are two key factors in this success.

Leadership at Titan Mining

Chair and CEO Richard Warke has spent over thirty years in the global resource sector, with a focus on mining. An experienced and well-respected leader in the resource industry, Richard Warke has a successful, long-term track record of creating shareholder value at the Augusta Group of Companies – this includes the merger of Newcastle Gold into Equinox Gold (~C$200M deal in 2017) and the sale of Arizona Mining (sold for ~C$2.1B in 2018), Augusta Resource Corporation (sold for ~C$666M in 2014) and Ventana Gold Corp. (sold for ~C$1.6B in 2011).

The rest of the management team at Titan Mining is comprised of executives with an extensive track record in capital markets and responsible exploration, development and operations.

Directors at Titan Mining include George Pataki, the former, three-term Governor of New York, and Donald Taylor and Robert Wares, award-winning explorers with a combined 65 years of experience in mineral exploration and research. Donald Taylor received the Prospectors and Developers Association of Canada’s (“PDAC”) 2018 Thayer Lindsley Award for the 2014 discovery of the Taylor lead-zinc-silver deposit in Arizona. Robert Wares is the co-winner of the PDAC’s 2007 “Prospector of the Year Award” for the discovery of the Canadian Malartic gold deposit in Quebec.

Local Community Support

The company is well aware that the discovery, development and production of mineral resources requires broad community support and is committed to partnering with the local community. To promote local growth, the company purchases goods and services from nearby businesses and has developed a training program to provide prospective local workers with the skills needed to become qualified underground miners. Program graduates become part of the workforce of over 200 people, of which approximately 70% are from the local area. The result is a 21st century mine with strong local support and potential for impressive growth.

The reopening of the mine on June 12, 2018 was a cause for celebration in the town of Gouverneur, New York, and other communities surrounding the mine. Organizations such as the New York Power Authority (“NYPA”) and Workforce Development Institute are supporting the mine by providing funds for the new miners’ training program. NYPA has also committed to provide low-cost power from the St. Lawrence-Franklin D. Roosevelt Power Project as part of an initiative to help businesses in the North Country over the long term.

Looking to the Future

Based on an updated preliminary economic assessment filed in May 2018, ESM is forecast to produce an annual average of 80 million pounds of payable zinc in concentrate over its eight-year mine life, at C1 cash costs of US$0.70/lb and all-in sustaining costs (“AISC”) of US$0.79/lb of zinc(1). With first concentrate shipped in March 2018, the company expects to achieve commercial production in Q3/18.

There is good potential to increase both production and mine life at ESM. A study has already commenced on an expansion of production at ESM #4 mine to 3,000 tpd in 2020, and an extension of the mine life beyond the initial estimate of eight years. In 2022, management is targeting further expansion of production to fill the mill capacity of 5,000 tpd.

Production growth and mine life extension are expected to be supported by the recently-expanded mineral resources at the mine, further near-mine mineral resource additions, and district and regional exploration. In June, the company identified several mineralized zones close to the #4 shaft at the mine. These zones contain historic mineralized material and are open down-plunge. If economic, there is potential for them to be developed relatively quickly and with lower capital expenditure than would be required for more distal zones.

The restart of mining in this historic district is driven by attractive economic returns. Modernization and innovation are expected to be an integral part of the growth plan at ESM, driving an increase in productivity of up to 20-40%, and lowering costs at the mine.

Titan Mining is positioned to benefit from any strengthening in zinc prices, which are currently supported by low inventories, and expects to transition to positive free cash flow in H2/18.

1. C1 cash costs are defined as site-level cash operating costs (mining, processing, G&A, royalties), plus off-site transportation and treatment charges. AISC refers to all-in sustaining costs which are defined as C1 cash costs plus sustaining capital. C1 cash costs and AISC per pound are calculated by dividing the C1 cash costs and AISC, respectively, by the payable metal production expected in the period.

On Wednesday, Breakwater Resources (TSX: BWR) agreed to a $663 million takeover from Nyrstar which marks the second takeover of a TSX listed zinc miner this year. Farallon Mining (TSX: FAN), was also taken out by Nyrstar. So we ask, should investors think zinc?

Zinc is used primarily for galvanizing steel to prevent it from rusting and to make copper-based alloys like brass. Galvanized steel is used for outdoor construction materials and transportation materials. Zinc is not a particularly abundant element, in fact, it makes up only 0.007% of the Earth’s crust. Zinc is often found in the ground as zinc sulfide.

Most of the supply of zinc is derived from mines in China, Australia and Peru. The world’s top three zinc mining companies are Xstrata, Teck Resources (TSX: TCK.B) and Glencore while the top three zinc smeltering companies are Nyrstar, Xstrata and Korea Zinc.

For investors who are inclined to think zinc we highlight three Canadian listed stocks with exposure in the sought after base metal.

Trevali Mining (TSX: TV) is an integrated junior with exposure to zinc, silver and lead. The company has operations in Canada and Peru. Adam Low, an analyst at Raymond James, thinks Trevali may be the next zinc company to make the transition from developer to producer. He has an “outperform” rating on the stock and a target of $2.40 a share and notes that the company’s shares are trading at just 0.37 times net asset value. Shares of Trevali Mining are up $0.17 today trading at $1.46. Trevali is part of the notable Canadian mining group the Cardero Group whose past success incudes the development and sale of Corriente Resources for $679 million to China’s Tongling Nonferrous Metals Group Holdings and China Railway Construction Corp.

On March 17, 2011, Rathdowney Resources (TSX-V: RTH) completed a reverse takeover of Coreland Capital, a shell company (CPC) listed on the TSX Venture Exchange. Concurrent with the takeover and in association with their partner Hunter Dickinson, another reputable independent Canadian mining group, Rathdowney raised just over $34 million privately at $1.00 per share to develop their projects. Rathdowney’s shares have been trading for just under a $1.00 recently. Yesterday, the company announced that it had commenced drilling on its flagship zinc-lead project in southern Poland. MiningFeeds.com featured Rathdowney Resources in our recent Base Metals issue and we sat down with John Barry, the company’s President & CEO, for an exclusive interview – CLICK HERE – to read more.

Canada Zinc Metals (TSX-V: CZX) is a pure-play zinc junior with extensive property holdings in British Columbia. In 2005, Canada Zinc Metals entered an earn-in option agreement for 65% of its lead project coined the Akie property. A few years later Canada Zinc acquired 100% of the Akie property and additional claims pursuant to a takeover and later completed its first NI 43-101 report. After the report was released one of China’s largest base metals companies, Tongling Nonferrous Metals Group, made a substantial investment in Canada Zinc Metals. Earlier this week, Canada Zinc Metals began additional exploration and extension drilling on its Akie property. The company’s shares are trading for just under $0.50 today. MiningFeeds.com featured Canada Zinc Metals as a “Stock to Watch” in our recent Base Metals issue and connected with Peeyush Varshney, President & CEO, for a one-on-one discussion – CLICK HERE – for the interview.

Disclosure: at publication Canada Zinc Metals is a client of MiningFeeds.com.

Eritrea, a funnel shaped country that borders The Red Sea, was, because of its unstable political history, a bit of a mystery to the international mining community. But an unprecedented era of peace and stability is changing things quickly.

Eritrean society is ethnically heterogeneous. The Tigrinya people and the Tigre people together make up about 80% of the country’s total population. The rest of the country consists of various other Afro-Asiatic groups. Like its demographic makeup, mining deposits in Eritrea are also heterogeneous; since the Eritrean government embraced mining development in the 1990’s a number of unique deposits have been found in the country that consist of a combination of gold, silver, copper and zinc.

Eritrea’s government, however, is a stark counterpoint to the country’s diversity. Eritrea is a single-party state. The government is run by the People’s Front for Democracy and Justice (PFDJ). No other political groups are currently allowed to organize, although the Constitution of 1997, which has not been implemented, provides for the existence of multi-party politics. In 2008, the government of Eritrea made it more attractive for foreign companies to prospect and develop projects when they set their stake at 10 percent with an option to buy a further 30 percent. Industry analysts consider this to be a relatively small claim compared to other countries in North Africa like Egypt which mandates a 50 percent stake or Sudan at 60 percent. And as a result, some industry experts predicted an impending mining boom in Eritrea.

A video released in 2009 focusing on the Eritrean mining industry provides an excellent overview of the country and its approach to mining:

The bottom line for international miners? The Eritrean government is proactive and pro-mining. The Ministry of Energy and Mines carried out modern technology-backed study and exploration activities in 2010 with a view to reinforcing the ongoing mining endeavors in the country. Alem Kibreab, director general of the Mining Department, explains the mineral resources in the country are owned by the people themselves and that the Government shoulders the responsibility of their management. Since the 2008 policy that encourages mining investment in Eritrea, Mr. Kibreab notes that twenty foreign companies are now engaged in studying, exploring and mining in the country.

Eritrea’s most advanced project is the Bisha mine operated by Nevsun Resources (TSX:NSU). Its 27 million tonnes of ore reportedly contain 1 million ounces of gold, 11.9 million ounces of silver, 800 million pounds of copper and over 1 billion pounds of zinc. The Bisha mine went into full commercial production in February of this year and Nevsun recently reported the mine produced 105,000 ounces of gold from January to April. Within the deposit, gold and silver is found in the top 35 meters and will be mined over the first two years. During last week’s sell-off in commodities shares of Nevsun faired extremely well and were actually up $0.08 on the week closing at $5.25.

Another company developing gold, silver, copper and zinc projects in Eritrea is Sunridge Gold (TSX-V:SGC). Sunridge has four projects with a combined NI 43-101 resource of 1.05 million ounces of gold, 31.8 million ounces of silver, 1.28 billion pounds of copper and 2.05 billion pounds of zinc. The company’s Debarwa deposit has similar geology to Nevsun’s Bisha mine. The company has been relatively quite of late on the news front but drill results are expected soon from Emba Derho (one of the company’s three northern deposits); and, an updated resource calculation is expected this month from their flagship Debarwa deposit factoring in drill programs conducted in 2009 and 2011. Sunridge Gold also survived the recent correction unscathed closing the week unchanged at $0.95.

NGEx Resources (TSX:NGQ), a diversified international mining company that boasts Lukas Lundin as its Chairman, also has a foothold in Eritrea. NGEx’s Hambok project is located near the Bisha mine and in January, 2009 the company reported a NI 43-101 indicated resources estimated of 231 million pounds of copper, 530 million pounds of zinc, 2.3 million ounces of silver and 68,000 ounces of gold. The mini-mining meltdown was less kind to NGEx Resources, shares of the company were down $0.13 to close the week at $3.36.

Zinc, the fourth most used metal on the planet trailing only iron, aluminum and copper, has a worldwide annual production of roughly ten million tonnes. Zinc’s primary use is in the galvanizing process of steel and in making alloys including brass and bronze. Although zinc doesn’t get anywhere near the same amount of attention as its sexier cousin copper, that may begin to change. China’s refined copper imports fell 43 percent in March year over year due to high stock piles and strong international prices while their Zinc imports surged 108 percent over last year.

In November 2006, Zinc prices hit a record high of US$4,580 tonne. At the time, analysts cited that the growing demand for zinc in China could increase by 56% by 2010 which certainly helped fuel the fire. China became a net importer of zinc in 2004. With the onset of the “Great Recession” in 2008 the price of zinc declined dramatically to just above $1,000 per tonne, far below the bullish projections a few years earlier. But in the first quarter of 2009, as marginal zinc mines were being shut down all over the world, zinc began a swift and steady recovery, reaching US$2,560 per tonne by the end of the same year, just slightly higher than where it trades today.

Today, China produces about a quarter of the world’s zinc and consumes a third of it. And overall, Zinc consumption in China has tripled since 2000 – China consumes more zinc than USA, Japan, India, Germany, Italy and Belgium combined. Some analysts, however, believe this time China’s demand for zinc will continue unabated. This, coupled with demand from other emerging nations around the world is expected to push consumption to 15.5 million tonnes per year by 2020.

Peeyush Varshney, President and CEO of TSX-V listed Canada Zinc Metals is solidly in this camp. In August, 2005 Canada Zinc Metals entered an earn-in option agreement for 65% of its Akie property. A few years later, in 2007, the company acquired 100% of the Akie property and their entire claim package pursuant to a takeover. The next year the company completed its first NI 43-101 report on the Akie property. Soon after, China came calling in the form of Tongling Nonferrous Metals Group which subsequently made a substantial investment in Canada Zinc Metals. MiningFeeds.com sat down with Peeyush Varshney, President & CEO of Canada Zinc Metals to find out more about the company’s Chinese shareholder and what else is in store for 2011.

Your main project is the Akie zinc-lead-silver deposit in B.C., Canada. Could you give us an overview on the region?

The Akie deposit, and in fact all of our property holdings, are located in the highly prospective Kechika Trough which is the southern-most portion of the Selwyn Basin. This basin is host to several of the world’s largest zinc-lead deposits and is one of the most prolific zinc-lead districts on the planet.

What is the existing infrastructure in the region and how might this benefit the company down the road?

The infrastructure around our Akie deposit is relatively advanced. Akie is situated just above B.C.’s largest lake, Williston Lake, home to the largest hydro-power plant in the province. In 2008, we completed the construction of a road to the deposit. The roads connect to the town of Mackenzie (260 km to the south) where there is an existing rail line which could be utilized to haul concentrate. From Mackenzie we could transport the concentrate to Trail, British Columbia, where Teck Resources has a zinc smelter; or, transport the concentrate to the deep sea port of Prince Rupert on the west coast of B.C. From there, the concentrate could be loaded on to ships and transported to smelters in Asia.

You finished your NI 43-101 resource estimate in 2008, what is the resource estimate on the project and do you see further exploration upside?

Using a conservative 5% zinc cut-off grade, the deposit has an inferred resource of 23.6 million tonnes of 9.1 % combined zinc + lead (7.6% zinc, 1.5% lead) and 13 grams per tonne silver, this equates to 3.95 billion pounds of zinc, 780 million pounds of lead and 8.95 million ounces of silver. The resource calculation from 2008 only includes the drilling we did until the end of 2007. It does not include the drilling done in 2008 or 2010. The Akie deposit remains open in all directions so the resource could certainly be much larger than our current 43-101 calculation.

You have some notable shareholders in the company, could you tell us about them and what it means to the company?

Tongling Nonferrous Metals Group currently owns approximately 35% of the Company. Based in Tongling, Anhui Province, Tongling is a state-owned company and one of China’s largest copper smelting companies. Tongling is involved in exploration, mining, ore processing, smelting and refining; and, processing of copper, lead, zinc, gold, silver and other non-ferrous and rare metals. We were contacted by Tongling in the summer of 2008, they visited the Akie deposit and made an investment in the Company.

Lundin Mining is also a strategic shareholder of the Company – they have participated in several of our private placements and hold approximately a 5% equity interest.

Along with the Akie deposit, our significant prospective land package in the Kechika Trough represents a potential long-term development opportunity for both Canada Zinc Metals and major mining companies. Our properties could potentially provide zinc-lead concentrate for several decades to come.

What are your plans for the remainder of 2011?

Our primary objective this year is to continue doing the work required to advance the project to the completion of a preliminary economic assessment and pre-feasibility study. Currently, a geotechnical drilling program is taking place on the Akie property. From this information, we will submit an application to the government to allow us to proceed with an underground exploration program. We also anticipate a new surface drill program to test some very high priority targets elsewhere on the Akie property.

On a corporate level, we are continuing discussions with several large base metal mining companies that have shown interest in our Company and our extensive property holdings.

This interview was featured in 10 Base Metal Stocks to Watch – Part 1 – CLICK HERE for the article.

Disclosure: at publication Canada Zinc Metals is a client of MiningFeeds.com.

Are we on the cusp of a zinc shortage? Around the world, almost 2.4 million tonnes per year of zinc mine production will close between 2011 and 2016. The Skorpion mine in Namibia, the Tara and Lisheen mines in Ireland, the Perseverance and Brunswick mines in Canada and the Cerro Lindo operation in Peru, and several others, are soon to be exhausted and closed. With increasing demand projected by many industry experts, some think the zinc market profile may become very tight, particularly from 2012-2016.

Hunter Dickinson (HDI), the largest private mining group in Canada, shares that opinion. HDI, based in Vancouver, is a diverse operation with experience around the world. Over its quarter-century of existence the group has explored for mines, developed them, and has gained expertise in project engineering, project financing and partnering.

In 2007 HDI subtly shifted its corporate development strategy. The new strategy focused on building and maintaining a value-added interest in a portfolio of mineral companies. After the briefest of pauses during the economic downturn, the strategy was fully implemented last year. From the top down, Hunter Dickinson is bullish on base metals. HDI President & CEO Ronald Thiessen recently noted, “While many continue to temper optimistic views on the global economy with a sense of caution, it is hard to argue that copper and other base metal commodity prices are strengthening at a surprisingly fast rate – exceeding predictions of pundits and investors alike.”

HDI now has five companies under management, including a 30% interest in Heatherdale Resources (TSXV: HTR); a 23% interest in Curis Resources (TSXV: CUV); a 41% interest in Northcliff Resources (private); a 41% interest in Constantia Resources (private); and, an 11% interest in Rathdowney Resources. In 2007 Hunter Dickinson invested $7 million privately in Rathdowney which, at the time, had secured a large prospective lead-zinc land package in Ireland.

When the economic crisis hit in 2008, Rathdowney’s management team realized that a pure exploration play would likely not attract much attention from the investment community. Instead, the company set out to secure a more senior project. Already established in Europe, Rathdowney turned its attention to Poland, and its well know Upper Silesian lead-zinc bearing zone. The company was able to secure in mid-2010, after considerable effort over a two year period, the concessions for an advanced stage project with substantial historical resources of lead and zinc from the Polish government.

On March 17, 2011 Rathdowney completed its reverse takeover of Coreland Capital, a shell company (CPC) listed on the TSX Venture Exchange. Concurrent with the takeover and in association with HDI, Rathdowney raised just over $34 million privately at $1.00 per share to develop their projects. The company has drill targets ready in Ireland and a work program established in Poland to maximize conversion of historical resources into NI 43-101 compliance. MiningFeeds.com connected with Rathdowney President & CEO John Barry from his office in Ireland to find out more about their projects.

When you started Rathdowney, could you tell us why did you target zinc? And why did you focus on Europe, particularly Ireland and Poland?

It was early 2007 and the price of zinc was soaring. Some major zinc mines were slated to close in the medium term and the Chinese appetite for zinc was becoming ravenous. This year China will consume 44 per cent of world zinc mine supply. In the past China was a “swing” player in supply demand for the metal, quickly switching from net importer to net exporter depending on price. As the emerging economies grow and become richer and more sophisticated the raw need for copper and iron for infrastructure shift to second-cycle metals such as zinc as the middle-class expands and its main use for galvanising steel in construction increases with growing demand for cars and white goods (appliances). In Ireland, Rathdowney staked a large land position second only to Boliden and Teck. The best place to find a new mine is near an old mine and Ireland has world-class zinc mines such as Navan (5th largest in the world) and Lisheen (10th largest).

Hunter Dickinson (HDI) in Vancouver welcomed the idea of gaining a foothold in the exploration and development of base metals in Europe and became an early investor. Then in September 2008 Lehman Brothers collapsed and triggered the greatest global economic convulsion in living memory and the appetite for exploration risk almost completely evaporated. We had assembled a crack team which was amply funded and we had the support of HDI so we had to react quickly and find more advanced projects which had much less exploration risk. It so happened that our Chief Geologist Mike Mlynarczyk was Polish and Duncan Large our technical adviser based in Germany could provide insights into the advantages and opportunities for a first-mover into the Upper Silesian zinc-lead district of Poland.

Your project in Poland is clearly your lead horse, can you talk about the history behind the project and what the non-compliant 43-101 resources estimate looks like?

Zinc has been mined in Upper Silesia in southern Poland since the 12th century. The USGS estimates that it is the largest carbonate-hosted zinc district in the world in terms of total zinc metal endowment which is a measure of the total amount of metal ever mined and still in the ground. Since World War II and particularly during the 1970’s and 1980’s Polish geological surveys delineated zinc-lead deposits, with resources under a Soviet-era classification system some of which would be considered historic estimates under Canadian standards, northwest of the historic city of Krakow in Upper Silesia. State mining companies exploited some of these resources moving northwards in a serial or piecemeal fashion. Resources supported long-life mines and a customised zinc smelter was built. You have to understand the command-economy mind-set. Why would you need to explore and develop new mines when your existing mine could supply your smelter for forty years or more? Also, Poland has a quite bureaucratic permitting process based on Polish administrative law and acquiring exploration ground particularly containing major resources which have been officially gazetted is not a trivial process. Rathdowney staked exploration ground over the footprints of substantial deposits to the north of the Pomorzany Mine and nearby concentrator-smelter complex at Boleslaw. It took about 15 months to permit the first exploration concession. Poland is not a place where you can fly in and acquire quality exploration assets. A sustained presence and patience is required and Rathdowney committed to this process early on by assigning Mike Mlynarczyk to a full-time posting in Krakow. It was worth it because Rathdowney investors have 100 per cent exposure to exploration success with no equity held by any third-party vendor. Some 180 kilometres of diamond drilling had been completed but evidence is only in the State archives. The replacement value of the historical drilling is probably close to C$40 million. Rathdowney has electronically captured this vast amount of historical drilling in a project database and having raised C$34 million – on St. Patrick’s Day it so happened – the team is soon to embark on an aggressive resource verification drilling program on the Olza Project with an exploration target of 20 million tonnes to 120 million tonnes at around 6% Zinc equivalent. The State-owned Pomorzany mine will be exhausted in the next few years and is scheduled for closure in 2016. The sustainability of this historic mining district now depends on Rathdowney’s aggressive resource delineation program and there is no time to lose.

What type of infrastructure is available in the area (Poland)?

It could not be better. The best remaining historical resources are now within Rathdowney’s concessions and are located only 30 kilometres from the State-owned concentrator and zinc smelter. The concentrator can process 2.5 million tonnes of ore and the smelter can refine 100,000 tonnes of refined zinc metal. Also there is a rail spur from the main Warsaw-Katowice rail line which runs through the concession area right to the Boleslaw concentrator-smelter.

Your Irish concessions are spread throughout Ireland, and I noticed, strategically located either adjacent to existing mines or development projects. What is happening in the region and who else is operating there?

New Boliden operates the Navan Mine about 45 kilometres northwest of Dublin produces about 200,000 tonnes of zinc in concentrate and 40,000 tonnes of lead – there are no zinc smelters in Ireland. In Tipperary, Vedanta now operates the Lisheen Mine where some 1.5 million tonnes of ore are mined per year at an average grade of 12 per cent zinc and nearly 2 per cent lead. Lisheen is expected to close in 2014.

In recent years in the Pallas Green area of southern Ireland Xstrata in partnership with Junior explorer Minco has delineated an inferred resource of 24.1 million tonnes averaging 7.85% zinc and 1.35% Pb. There are some 23 drill rigs operating on the Pallas Green project. Nearby at Stonepark Teck in partnership with Connemara Mining are very optimistic about a new zinc discovery. Six drill rigs are churning through a 25,000 metre diamond drill program planned for this year. In County Clare, Lundin Mining in partnership with Belmore Resources is exploring the Kilbriken zinc-lead discovery where five drill-rigs are in operation. Drilling continues to cut thick high-grade zinc-lead-silver sulphide mineralisation. Rathdowney’s Mallow and Galway project areas are in this district straddling know mineralised structures.

It takes good people to develop good projects. Could you tell us about your team and also your relationship with Hunter Dickinson?

Yes people are as important if not more important than a particular project itself. If you back good people they will generate quality projects and that is exactly what happened with Rathdowney. I was having a pint of Guinness with David Hall in a Dublin pub and we came to the realization that there was only a handful of junior zinc explorers but lots of companies out looking for the next big discovery in copper. To the west and south lay the Midland Ore Field which, although small in area, is acre for acre one of the richest exploration districts in the world for zinc. There was some quality exploration ground available but we realised we would have to focus the best minds in the business to discover the next generation of concealed carbonate-hosted zinc deposits. I had worked on exploring the peripheral parts of the Navan resource back in 1988 and I joined the exploration team at Lisheen shortly after discovery in 1990 so I knew my way around the Irish zinc-lead district. David and I asked Dick Sillitoe one of the world’s foremost copper exploration geologists and Duncan Large an internationally respected expert on carbonate-hosted zinc-lead to help as technical advisors. Then Ron Holman, a retired octogenarian and discoverer of the Ballinalack zinc-lead deposit near Rathdowney’s Westmeath project areas, joined the team. Bill Fisher who at one stage was Boliden’s VP for Exploration also agreed to become technical advisers to Rathdowney. When Hunter Dickinson took an interest Mark Rebagliati was able to add his considerable experience to the mix. So we have a highly experience international team with a track record of discovery. This is why I like to say that with Hunter Dickinson and its pool of expertise that Rathdowney has the muscle of a major with the flexibility of a junior. The team has regular technical review sessions which support and provide guidance for our very talented team of geologists in Poland and Ireland. We have regular brain-storming sessions and now that the drill targets have been selected we look forward to engaging and passionate discussion and of course exciting results.

This interview appeared in 10 Base Metal Stocks to Watch – Part 2 – CLICK HERE – for the article.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CTN.V | +50.00% |

|

GTR.AX | +50.00% |

|

DMI.V | +33.33% |

|

AAZ.V | +33.33% |

|

MTB.V | +33.33% |

|

CASA.V | +30.00% |

|

EXN.TO | +27.27% |

|

RG.V | +25.00% |

|

RMD.V | +25.00% |

|

CRI.V | +25.00% |

Articles

FOUND POSTS

Uzbek Gold Miner NMMC Moves Closer to Potential London IPO

March 11, 2025

SQM Reduces Spending as Lithium Market Weakness Persists

March 7, 2025

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan