Tax loss season is upon us, and with it comes discounts on some of the best companies in the junior resource sector. In particular, Marathon Gold stood out for me; it just released a great update to its NI 43-101 resource estimate, moving a portion of its inferred gold ounces to the measured and indicated categories and increasing its gold resource by roughly 30% overall. The market reaction? “Yawn,” or basically no movement in the stock. This is music to my ears – I bought another tranche.

What’s my point? Sometimes, the market doesn’t see or understand the value proposition, especially when the sector for the given company isn’t in favour.

Today, I’m sharing my research on a copper company which is set to (very soon) finalize their acquisition of a major copper project in northern British Columbia (BC). I think this should result in a re-rating in their share price, as their current MCAP is around 3 times less than the acquisition cost of the project. This company is Desert Star Resources.

Let’s take a closer look.

Desert Star Resources (DSR:TSXV)

MCAP – $8.5 million (at the time of writing)

Shares – 18,947,901

Fully Diluted – 26,169,901

Kutcho High Grade Copper-Zinc-Gold-Silver Project

On June 15th, 2017 Desert Star announced it had signed a definitive agreement to acquire 100% of the Kutcho high grade copper-zinc-gold-silver project from Capstone Mining Corporation. The deal was comprised of cash, $28.8 million CAD and, upon completion of the acquisition and concurrent financing, 9.9% of the issued and outstanding shares of Desert Star.

Wheaton Precious Metals

On August 10, 2017, the purchase of Kutcho got a huge boost with the announcement that Desert Star had agreed to terms on a non-binding Early Deposit Precious Metals Purchase Agreement with Wheaton Precious Metals Corporation. The agreement will see Wheaton pay Desert Star $65 million USD for up to 100% of the payable silver production, and up to 100% of the payable gold production produced from the Kutcho Project.

Additionally, and in line with management’s goal for the project, if the processing capacity of the mine increases to 4,500 tpd or more within 5 years of attaining commercial production, a further $20 million USD will be payable to Desert Star.

Furthermore, on October 31, 2017, Desert Star announced it had entered into a non-binding Term Sheet for a $20 million CAD Subordinated Secured Convertible Term Debt Loan with Wheaton Precious Metals. Bringing the total financing package to over $100 million CAD.

In my view, an investment by Wheaton Precious Metals speaks volumes about the quality of the people and the project. The Wheaton Precious Metals team, while not infallible, has a great track record for finding projects that are future mines. In saying this, be mindful that a stream on the project, while helping early on with the funding of the mine, does remove some of the potential future value. In the case of the Kutcho Project, the precious metals only account for 8% of the revenue, making it a small part of the overall Kutcho Project value.

Desert Star’s People – Built for Success

The acquisition of the Kutcho Project from Capstone and management’s ability to secure over $100 million CAD in funding via Wheaton Precious Metals, in my mind, speaks volumes about CEO and Director, Vince Sorace’s, ability to lead the company. Sorace has over 25 years of experience in international business and capital markets, and has held senior leadership roles in a number of other companies.

Sorace’s COO, Rob Duncan, has over 26 years of experience in mineral exploration and held senior leadership roles for a number of other mining companies. In particular, he has extensive technical experience with VMS systems such as Kudz Ze Kayah and Wolverine in the Yukon’s Finlayson District and Izok Lake in Nunavut.

Rory Kutluoglu, a professional geologist, has 10 years experience in the mining industry. His most recent success was with Kaminak Gold Corp., where he was the exploration manager and played an instrumental role in the Coffee Gold Project’s development, which was acquired by Goldcorp in 2016. Kutluoglu is Desert Star’s VP of Exploration and will be focusing on expanding Kutcho resources.

Also, Allison Rippin-Armstrong, formerly with Kaminak Gold Corp, brings her 20 years of experience in permitting, regulatory processes and environmental compliance for resource companies to the Desert Star management team. Rippin-Armstrong will play an invaluable role as she leads relations with the First Nations Tahltan Central Government (TCG) and aids the company in the permitting process.

To note, there is one particular addition to Desert Star’s Board of Directors that I think will be an x-factor for the company as they develop Kutcho. The appointment of Bill Bennett, BC’s former Mining Minister, to the Board of Directors should pay major dividends, as he helps the company navigate the permitting process.

Additionally, on the Board of Directors, is Stephen Quinn and Jay Sujir. Also, Desert Star has three advisors; Peter Meredith, former Chairman of Ivanhoe Mines; Rob Carpenter, former CEO of Kaminak Gold; and Stuart Angus, former Chairman of Nevsun Resources. This advisory board is another huge plus for this junior company, as each of these men have been successful in the mining industry.

Northern British Columbia

The Kutcho Project is made up of 46 mineral exploration claims encompassing 17, 060 hectares, and is located in northern British Columbia.

Source: Prefeasibility Study Technical Report on the Kutcho Project

As you can see on the map, Dease Lake is the largest community near Kutcho, sitting roughly 100 km west, and is cited as having a population of 335 people in the technical report. As well, Dease Lake is about 400 km north of the Port of Stewart and 600 km north of Smithers.

Access to Kutcho is via a seasonal road from HWY 37 or gravel airstrip, which is located on the property at the junction of Kutcho and Andrea creeks.

Tahltan Territory

On October 26, 2017, Desert Star announced a communications agreement with the Tahltan Central Government (TCG). The TCG is the governing body of the Tahltan Nation, which works to protect the Aboriginal rights and title, ecosystem and natural resources of the Tahltan community.

Tahltan territory encompasses 93,500 square kilometres in northwestern BC, running parallel to the Alaskan/Canadian border. Their three main communities are Telegraph Creek, Dease Lake and Iskut.

A good relationship with the TCG is integral to the future development of the Kutcho Project into an operating mine.

BC and its NDP Provincial Leadership

This past May, BC’s provincial election turned out the way many rural and business people had hoped, with the Liberals retaining control of the provincial government. This minority win, however, didn’t last long, as the NDP, the Liberals’ closet provincial leadership competitor, and the Green Party combined forces to displace the Liberals and took control of the province.

The NDP have a reputation of being bad for business – and with good cause. I cite Ontario in the 90s and, most recently, the NDP’s current control of what was formerly Canada’s richest province, Alberta. From a number of perspectives, but most importantly from a business perspective, these examples show the potential downside of the NDP ideology.

In saying this, however, it isn’t a done deal that all business is doomed because the NDP has taken over, just a higher probability, in my opinion. Further, I would be remiss if I didn’t point out that the Liberals and Conservatives aren’t without fault when it comes to bad policy decisions that have negatively affected business.

So what do I think about investing in mining in BC? Currently, I do see risk in investing in BC given the current political leadership. However, as I mentioned in the beginning of this article, investing in quality companies is the key to success in the junior resource sector. Therefore, if I’m able to find a quality company at the right price, I’m willing to take on more political risk.

In the case of Desert Star, I think that the Kutcho Project is quality and worth the associated jurisdictional risk. Bill Bennett and Allison Rippin Armstrong will prove invaluable as they help the company navigate the permitting process to ensure that this project has the best chance of being approved in a timely manner.

Updated Prefeasibility Study

Upon signing the definitive agreement with Capstone to acquire the Kutcho Project, Desert Star approached JDS Energy and Mining Inc. to update their 2011 PFS on the Project. The update to the PFS is intended to show the project’s economics based on current costs, metal prices, exchange rates, mineral resources and metallurgical interpretations.

Source: Prefeasibility Study Technical Report on the Kutcho Project

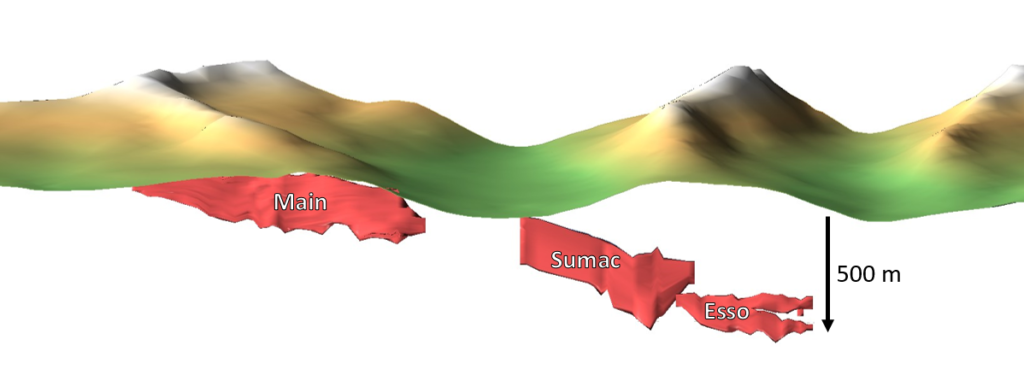

The Kutcho Project is made up of 3 mineralized zones: Main, Esso and Sumac. These 3 zones are Kuroko-type volcanogenic massive sulphide (VMS) deposits and are aligned in a westerly plunging linear trend. The PFS mine planning and economics only consider the Main and Esso zones, as the Sumac Zone only has inferred resources.

Source: Kutcho Project’s 3 Mineralized Zones

Currently, the mine plan calls for a starter pit to be constructed on the Main Zone, which will be used to mine roughly 0.4 Mt of preliminary mill feed. The pit will then give way to an underground portal which will be used to access the rest of the deposit.

As you can see in the image above, the Main Zone deposit is at surface, has a strike length of about 1.5 km, and extends approximately 260 m down dip. The Esso Zone sits about 1.5 km away from the Main Zone, and is located roughly 400 m below surface, extending 240 m down dip, and has a strike length of 640 m.

The PFS estimates the mine to have the following production and economic statistics:

- Production Rate – 2,500 tpd

- Mine Life – 12 years

- Average Annual Copper Production – 33 Mlbs

- Average Annual Zinc Production – 42 Mlbs

- After-tax NPV@8% – $265 million CAD

- After-IRR – 27.6%

- After-tax Payback – 3.5 years

- Initial CAPEX Cost – $220.7 million

Kutcho Metallurgy

The biggest question mark surrounding the Kutcho Project, in my opinion, is its metallurgy. JDS remarks,

“The mineralogy of the Kutcho deposits is complex and requires a similarly complex approach to produce copper and zinc concentrates at reasonable recoveries and concentrate grades.” ~ PFS 1-3

The PFS economic case is based off of a 84.7% copper recovery with a saleable concentrate grade of 27.6% copper, zinc content of 7.3%, gold content of 2.5 g/ton, and a silver content of 268.6 g/ton. The zinc recovery is expected to be 75.7%, with a concentrate grade of 55.1% zinc and 1.2% copper.

Deviations from the expected recoveries or further use of reagents and increased power consumption are concerns due to the complex nature of the mineralization. Further metallurgical work on the Project is scheduled for Q3 and Q4 of 2018, and will provide the company with a good chance to optimize the metallurgical process, which could have a positive impact on Kutcho’s economics.

Kutcho Expansion and Exploration Potential

The company has outlined a few scenarios for Kutcho’s upside growth potential, which are: Existing Resource Conversion, Down Dip Extension and project expansion through exploration. Let’s go through each one briefly:

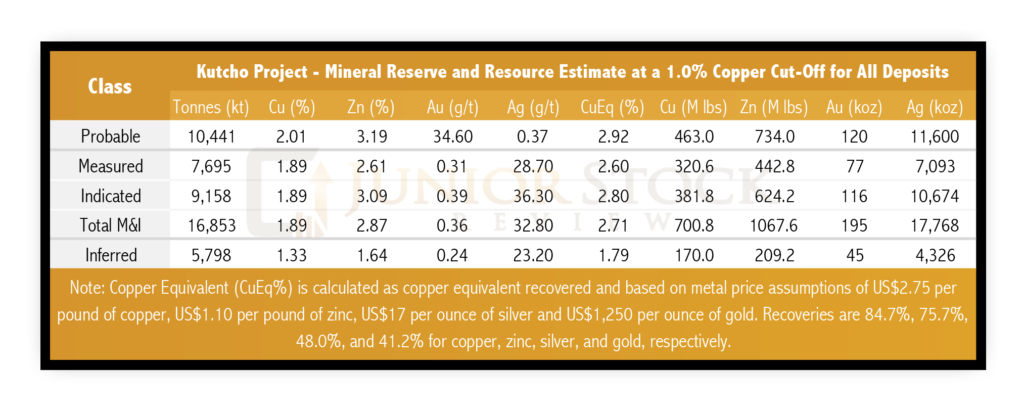

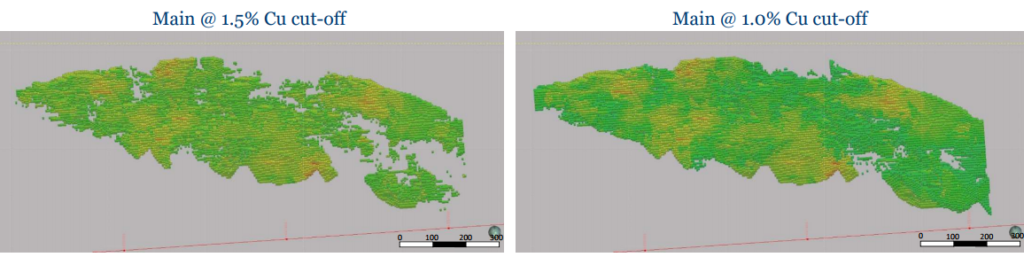

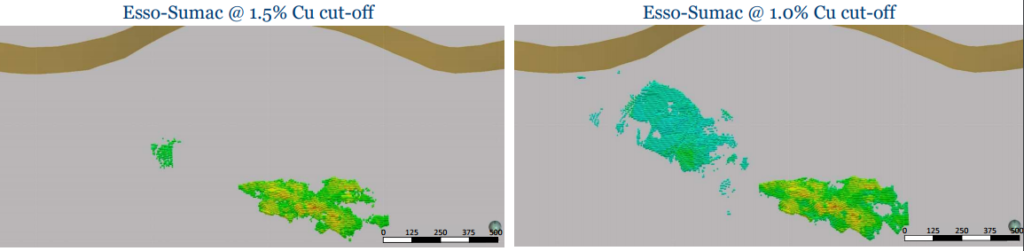

- First, by lowering the cut-off grade from 1.5% to 1.0% copper, the reserve tonnage could grow roughly by 5.0 Mt. Secondly, with further infill drilling, the current inferred resource of 5.8 Mt @ 1.79% CuEq could potentially be moved into the measured and indicated resource category and, thus, be included in the economics of the project.

PUSH: Watch for infill drilling results on the deposit, which is scheduled to occur in Q2 and Q3 of 2018. Drill results showing continuity should be a sign that this deposit is going to get bigger.

PUSH: A resource update will follow the infill drilling and should be completed by the end of 2018 or the first quarter of 2019.

Main Zone Block Model Cut-off Comparison

Esso-Sumac Zone Block Model Cut-off Comparison

- Secondly, the Main and Esso Zones are open at depth and along strike. Desert Star estimates 60% of the Main Zone and 50% of the Esso Zone’s strike length is open down dip, with the potential to add 1 to 3 Mt in the Main Zone and 300 to 600 Kt in the Esso Zone.

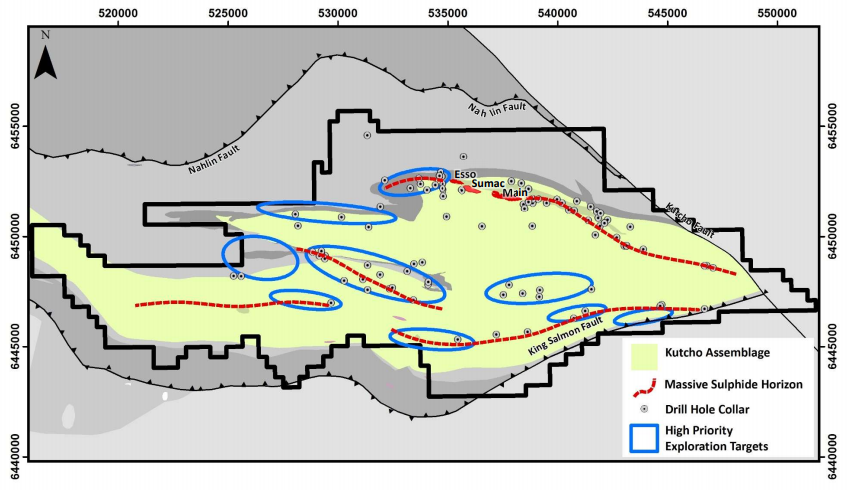

- Finally, the Kutcho Project has a large land package with multiple repeated VMS sulphide horizons that haven’t seen extensive exploration. In the image below, you can see the high priority targets outlined in blue. Currently, exploration drilling is set to occur in Q4 of 2018.

Kutcho Project Exploration Targets

Concluding Remarks

There isn’t a mining project in the world that doesn’t have at least a couple of question marks. In Desert Star’s case, I see two main areas of risk; first, the metallurgical complexity of the mineralization, and second, BC’s NDP government. The company, however, has taken steps to address both of these risks. First, with further metallurgical work scheduled for Q3 and Q4 in 2018, and for the jurisdictional risk, they have appointed Bill Bennett, to the Board and Allison Rippin-Armstrong to the management team, whose combined experience in navigating the permitting process should prove to be invaluable.

For me, the investment case for Desert Star Resources is straightforward, and I have summarized what I think are the company’s strengths and, ultimately, the reasons I think Kutcho has the potential to become BC’s next producing copper mine in the years ahead.

- Good management team and Board of Directors – In particular, Bennett has x-factor type experience and influence to move Kutcho to production in a timely manner.

- Advisory Board which includes Peter Meredith, former Chairman of Ivanhoe Mines; Rob Carpenter, former CEO of Kaminak Gold; and Stuart Angus, former Chairman of Nevsun Resources.

- Over $100 million CAD in funding via an agreement with Wheaton Precious Metals, paving the way to the final investment decision in 2020.

- After-tax NPV @8% of $265 million CAD and after-tax IRR of 27.6% – Desert Star’s Kutcho high grade Cu-Zn-Au-Ag Project has an updated PFS which shows positive economics at current metal prices and exchange rates- $2.75 USD/lbs Cu, $1.10 USD/lbs Zn, $1250 USD/oz, $17 USD/oz.

- Deposit growth potential through the reduction in the resource cut-off grade, which could see the reserve tonnage grow by roughly 5.0 Mt and the measured and indicated resource tonnage by roughly 5.8 Mt

- The Main and Esso Zones are open at depth and along strike – If the continuity of the deposit continues, Desert Star estimates that the Main Zone could grow between 1 to 3 Mt, and Esso Zone could grow between 300 and 600 Kt.

- Kutcho’s district scale land package could yield further mineralization via a few high priority targets that have been identified on the property.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni , P.Eng

Founder – Junior Stock Review

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Brian Leni is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Brian Leni is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Brian Leni’s online newsletter, especially if the investment involves a small, thinly-traded company that isn’t well known.

Brian Leni’s past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Brian Leni owns shares in the companies he features. For those reasons, please be aware that Brian Leni can be considered extremely biased in regards to the companies he writes about and features in his newsletters. You should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Brian Leni may buy or sell at any time without notice to anyone, including readers of this newsletter.

Brian Leni shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Brian Leni does not undertake any obligation to publicly update or revise any statements made in this newsletter.

Desert Star is a Sponsor of Junior Stock Review. Brian Leni does not own shares in Desert Star Resources.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

CZN.AX | +50.00% |

|

RUG.V | +33.33% |

|

GCX.V | +33.33% |

|

AFR.V | +33.33% |

|

CASA.V | +30.00% |

|

SRI.AX | +28.57% |

|

BSK.V | +25.00% |

|

GQ.V | +25.00% |

|

GZD.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan