Last week index score: 36.21 (updated)

This week: 52.74

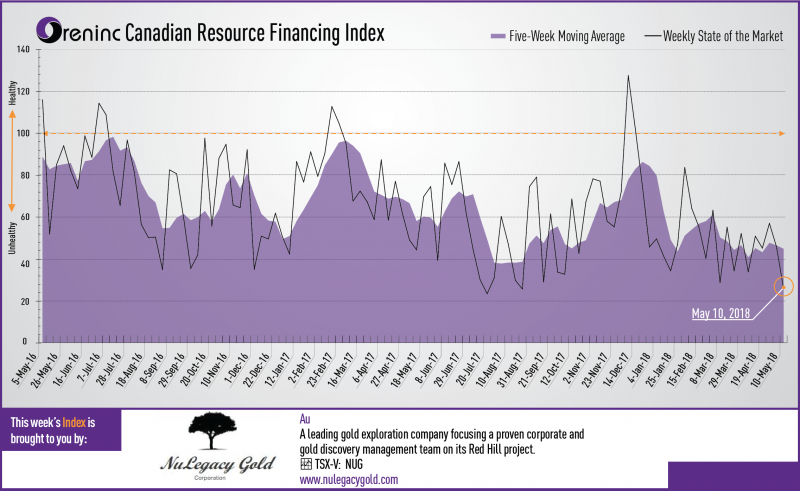

The Oreninc Index rose in the week ending May 18th, 2018 to 52.74 from an updated 36.21 a week ago despite good falling below US$1,300/oz.

Gold finally gave way and fell below the US$1,300/oz level to hit a year-to-date low as the US dollar continued to strengthen, the US ten-year treasury hit a 3% yield and economic data continued to show positive results.

US dollar strength is overpowering geopolitical risk concerns which continue to swirl around: the past week saw the US open its new embassy in Israel in Jerusalem. The ceremony was attended by president Trump’s daughter, Ivanka and provoked mass protests by Palestinians during which Israeli security forces killed dozens.

President Trump’s blunt, hard ball approach to issues also threatened to derail the possibility of talks with North Korean leader Kim Jong-Un after the US carried out extensive war air exercises with South Korea.

On to the money: total fund raises announced increased to C$81.7 million, a two-week low, which included five brokered financings for C$50.5 million, a nine-week high and two bought deal financings for C$20.0 million, a one-week high. The average offer size grew to C$3.5 million, a two-week low and the number of financings grew to 23, a two-week high.

Gold fell to US$1,293/oz from US$1,319/oz a week ago after hitting a low of US$1,285/oz. Gold is now down 0.75% this year. The US dollar index increased again and closed up at 93.63 from 92.54 a week ago. The van Eck managed GDXJ suffered as a result closing down at US$32.84 from US$33.85 last week. The index is down 3.78% so far in 2018. The US Global Go Gold ETF also fell to US$12.98 from US$13.35 a week ago. It is now down 0.23% so far in 2018. The HUI Arca Gold BUGS Index closed down at 177.75 from 182.24 last week. The SPDR GLD ETF again saw sales to close its inventory at 855.28 tonnes from 857.64 tonnes a week ago.

In other commodities, silver also gave up ground to close down at US$16.44/oz from US$16.66/oz a week ago. Likewise, copper closed down at US$3.06/lb from US$3.11/lb last week. Oil continued to post gains to close up at US$71.28 a barrel from US$70.51 a barrel a week ago.

The Dow Jones Industrial Average again saw losses to close down at 24,715 from 24,831 last week. Canada’s S&P/TSX Composite Index continued to see growth to close up at 16,162 from 15,983 the previous week. The S&P/TSX Venture Composite Index also closed up at 786.39 from 782.92 last week.

Summary:

- Number of financings grew to 23, a two-week high.

- Five brokered financings were announced this week for C$50.5m, a nine-week high.

- Two bought-deal financings were announced this week for C$20.0m, a one-week high.

- Total dollars decreased to C$81.7m, a two-week low.

- Average offer size tumbled to C$3.5m, a two-week low.

Financing Highlights

Canadian Zinc (TSX: CZN) entered into an equity financing agreement with RCF VI to purchase 100 million shares @ C$0.20 for gross proceeds of $20 million.

- RCF VI will be issued 50 million warrants exercisable @ C$0.25 until December 31st 2018.

- The proceeds will be used to repay a US$10 million bridge loan advanced by RCF VI and the ongoing development of the Prairie Creek Zn-Pb-Ag project in Northwest Territories, Canada.

Major Financing Openings:

- Canadian Zinc (TSX: CZN) opened a C$20 million offering underwritten by a syndicate led by Resource Capital Fund VI on a best efforts basis. Each unit includes half a warrant that expires in seven months.

- Troilus Gold (TSX-V: TLG) opened a C$10.01 million offering underwritten by a syndicate led by GMP Securities on a bought deal basis. The deal is expected to close on or about June 5th.

- Rio2 (TSX-V: RIO) opened a C$10 million offering underwritten by a syndicate led by Clarus Securities on a bought deal basis. The deal is expected to close on or about June 7th.

- Troilus Gold (TSX-V: TLG) opened a C$7.01 million offering on a best efforts basis. The deal is expected to close on or about June 5th.

Major Financing Closings:

- West African Resources (TSX-V: WAF) closed a C$34.3 million offering on a best efforts basis.

- Silvercrest Metals (TSX-V: SIL) closed a C$17.25 million offering underwritten by a syndicate led by PI Financial on a bought deal basis.

- South Star Mining (TSX-V: STS) closed a C$4.19 million offering underwritten by a syndicate led by Echelon Wealth Partners on a best efforts basis. Each unit included a warrant that expires in 24 months.

- Renaissance Gold (TSX-V: REN) closed a C$3.12 million offering on a best efforts basis.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Website: www.oreninc.com

Last week index score: 45.85 (updated)

This week: 25.90

Prospero Silver (TSX-V: PSL) and Fortuna Silver Mines (TSX:FVI) amended their strategic financing agreement and amended the 2018 work program in Mexico.

NuLegacy Gold (TSX-V: NUG) began drilling on its Red Hill in the Cortez gold trend of Nevada.

Zinc One Resources (TSX-V: Z) announced additional drill results from the Mina Grande Sur zone at its Bongará zinc mine project in north-central Peru.

The Oreninc Index halved in the week ending May 11th, 2018 to 22.90 from an updated 45.85 a week ago as funding again dried up.

Another quiet and less volatile week that saw gold steadily build momentum throughout the week only to lose it at the end. The US and North Korea agreed to meet at a landmark presidential summit in Singapore. Meanwhile, US president Donald Trump pulled the US out of the 2015 Iran nuclear framework deal and said that the US will continue to impose sanctions on the country and any company that continues to do business with it to the ire of European countries.

On to the money…total fund raises announced fell to C$56.5 million, a seven-week low, which included no brokered financings, a five-week low, and no bought deal financings, also a five-week low. The average offer size grew to C$2.9 million, a two-week high although the number of financings fell to 19, a nine-week low. Whilst the dollars announced did not fall much from last week, the absence of broker action saw the Oreninc Index take a proportionally bigger hit.

A flat week for gold as it closed up slightly at US$1,319/oz from US$1,314/oz a week ago. Gold is now up 1.27% this year. The US dollar index, on a tear since mid-April, finally took a hit and closed down at 92.5 from 92.56 a week ago after hitting a high of 93.12. The Van Eck managed GDXJ posted growth through the week and then weakened at the close to end up at US$33.85 from US$33.55 last week. The index is down 0.82% so far in 2018. The US Global Go Gold ETF also saw growth to close up at UA$13.35 from US$13.11 a week ago. It is up 2.61% so far in 2018. The HUI Arca Gold BUGS Index closed up at 182.24 from 181.39 last week. The SPDR GLD ETF again saw sales to close its inventory at 857.64 tonnes from 864.13 tonnes a week ago.

In other commodities, silver made a gain to close up at US$16.66/oz from US$16.53/oz a week ago. Likewise, copper made gains to close up at US$3.11/lb from US$3.08/lb last week. Oil continued to post gains to close up at US$70.51 a barrel from US$69.72 a barrel a week ago, returning to levels last seen in late 2014.

The Dow Jones Industrial Average rebounded from its losses last week to close up at 24,831 from 24,262 last week. Canada’s S&P/TSX Composite Index also saw growth to close up at 15,983 from 15,729 the previous week. The S&P/TSX Venture Composite Index closed up at 782.92 from 772.24 last week.

Summary:

- Number of financings declined to 19, a nine-week low.

- No brokered financings were announced this week, a five-week low.

- No bought-deal financings were announced this week, a five-week low.

- Total dollars fell to $56.5m, a seven-week low.

- Average offer size grew to $2.9m, a two-week high.

Financing Highlights

West African Resources (TSX-V: WAF) is to raise A$35 million to fund pre-development activities at its Sanbrado gold project in Burkina Faso.

- West African will issue 109.4 million shares @ A$0.32.

- The company anticipates completing a revised feasibility study by the end of the second quarter.

Major Financing Openings:

- West African Resources (TSX-V:WAF) opened a $34.3 million offering on a best efforts basis.

- Wealth Minerals (TSX-V: WML) opened a $5 million offering on a best efforts basis. Each unit includes half a warrant that expires in 24 months.

- Aton Resources (TSX-V: AAN) opened a $3 million offering on a best efforts basis. Each unit includes half a warrant that expires in 60 months. The deal is expected to close on or about May 15th.

- ATAC Resources (TSX-V: ATC) opened a $3 million offering on a best efforts basis.

Major Financing Closings:

- Africa Energy (TSX-V: AFE) closed a $57.98 million offering underwritten by a syndicate led by Pareto Securities on a best efforts basis.

- Seabridge Gold (TSX: SEA) closed a $19.73 million offering on a best efforts basis.

- Garibaldi Resources (TSX-V: GGI) closed a $13.05 million offering on a best efforts basis.

- Pacton Gold (TSX-V: PAC) closed a $5.55 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis.

Company News

Prospero Silver (TSX-V: PSL) and Fortuna Silver Mines (TSX: FVI) amended their strategic financing agreement and amended the 2018 work program in Mexico.

- Repricing and exercise of Fortuna’s 5.4 million warrants to provide C$803,571 additional funding for drilling.

- 6,000m drill program to test three additional targets: Buenavista, Bermudez and Trias.

- November 30th deadline agreed for Fortuna to exercise its option rights to select up to two Prospero projects for option to joint venture agreements.

Analysis

The renewed commitment by Fortuna to test new targets is encouraging. The repricing and exercising of Fortuna’s warrants is a non-dilutive way for Prospero to secure more funding at a premium to market price for the planned work and removes warrant overhang from the stock.

NuLegacy Gold (TSX-V: NUG) began drilling on its Red Hill in the Cortez gold trend of Nevada.

- An initial 15,000 feet of drilling or 12 holes. Results will determine the second stage of drilling.

- 2018 drilling and field exploration budget of C$5.0 million with emphasis on discovery of new, additional gold zones.

Analysis

With a new season of drilling commencing following an extended winter break, the company is looking to step out from and grow the size of its existing discoveries as well as continuing to find new mineralized areas to increase the overall size and scope of Red Hill. The next couple of months should see regular news flow from the company.

Zinc One Resources (TSX-V:Z) announced additional drill results from the Mina Grande Sur zone at its Bongará zinc mine project in north-central Peru.

- Highlights included 8.2m @ 42.7% Zn.

- 81 drill holes for 1,811m drilled to date.

Analysis

This portion of the Mina Grande Sur drill program was designed to determine the extent of the mineralization so obtaining additional high-grade intersections is a bonus and attest to the robustness of Mina Grande Sur, which should be reflected in the upcoming resource calculation.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Website: www.oreninc.com

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Highbank Resources Ltd. Highbank Resources Ltd. |

HBK.V | +50.00% |

|

ADD.V | +50.00% |

|

RG.V | +50.00% |

|

ERA.AX | +50.00% |

|

BCU.V | +40.00% |

|

PLY.V | +33.33% |

|

ERL.AX | +33.33% |

|

PLY.V | +33.33% |

|

HLX.AX | +33.33% |

|

MRQ.AX | +33.33% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan