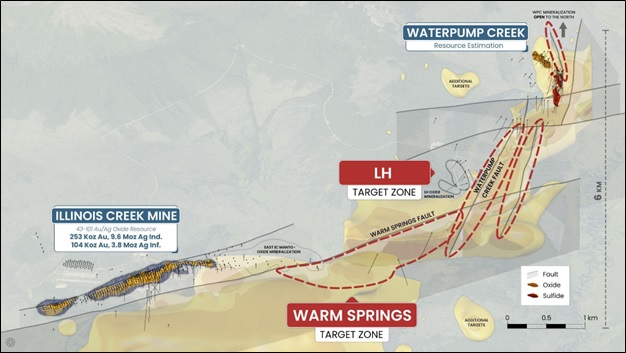

Western Alaska Minerals (TSXV:WAM) has announced a significant development at its Warm Springs target, a key part of the company’s ongoing exploration efforts in Alaska. The company intersected its first gold mineralization at the site, which is part of a broader effort to explore and expand the mineral resource potential in the region. This discovery, along with other encouraging drill results, indicates a new, mineral-rich pathway that could significantly extend the known mineral system in the area.

Kit Marrs, founder and CEO of Western Alaska Minerals, commented in a press release: “Finding gold at Warm Springs opens up a whole new gold target zone within the eight-kilometer-long trend between the Illinois Creek and Waterpump Creek resources. This is an exciting complement to our high-grade silver-zinc-lead resource at Waterpump Creek.

To date, WAM has completed nine drill holes at the Warm Springs target, with notable mineralization intercepted in seven of the nine holes. These drill holes revealed extensive alteration and oxide mineralization, as well as localized base-metal sulfide mineralization. The technical team reports a core recovery rate of 90.1% for the intercepted mineralization, with a combination of gold, copper, and other metals.

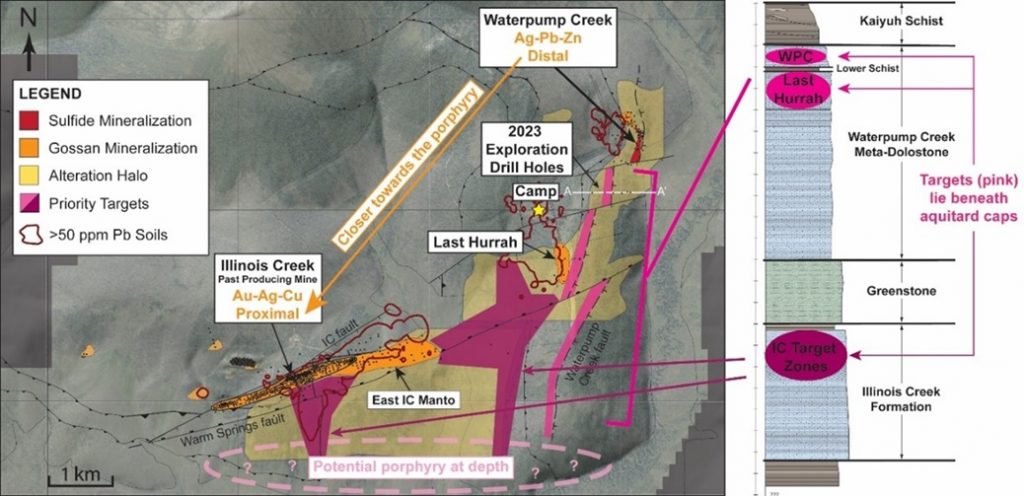

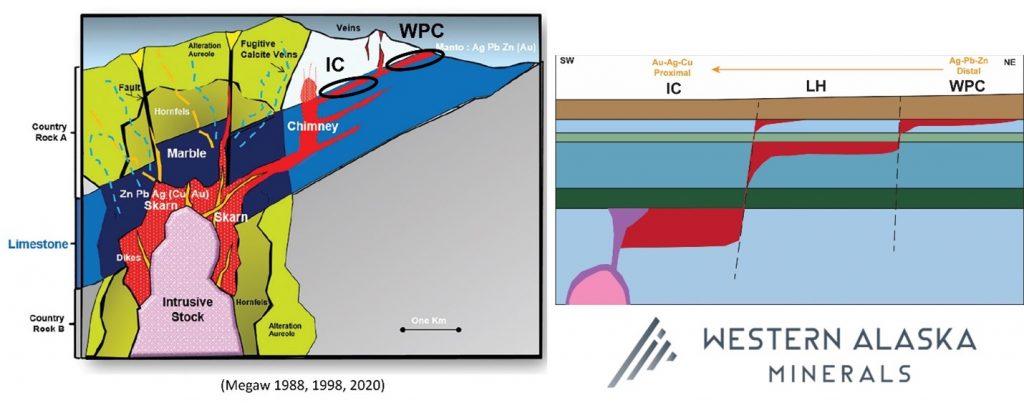

Dr. Peter Megaw, a renowned geologist and technical advisor for WAM, highlighted the significance of the results, stating that the discovery of gold and copper in multiply brecciated zones suggests the presence of a major pathway for mineralizing fluids. These fluids could connect the Warm Springs target to other known mineral resources in the region, including the Illinois Creek gold-copper resource and the Waterpump Creek silver-lead-zinc deposit. Megaw also indicated that the possibility of a parallel structure to the Illinois Creek Fault opens up further exploration potential.

The Warm Springs target is believed to be a key extension of the Illinois Creek carbonate replacement deposit (CRD) system. This complex mineralization has evolved over multiple stages, with WAM’s drilling providing valuable insights into the structure and content of the resource.

The company’s first drill hole at the site, IC24-0004, intercepted four distinct zones of mineralization, including:

1. Pyrite and hydrothermal quartz breccia with elevated gold, arsenic, and copper levels.

2. Recrystallized ankerite, containing trace amounts of galena.

3. Silica and oxide breccia, subdivided into limonite-dominant and hematite-dominant areas.

4. Oxidized manto gossans, with elevated levels of lead and manganese.

These mineralized zones, ranging from 18.7 to 53.65 meters in thickness, combine for a total of 100 meters of mineralization in the drill hole. This discovery represents a major step forward in understanding the Warm Springs target’s potential and its role within the broader Illinois Creek system.

In addition to Warm Springs, WAM also drilled four holes at the LH target zone, located west of the project’s airstrip. The LH target has long been considered a potential high-grade extension of the Waterpump Creek silver-lead-zinc zone, which has shown considerable promise in previous explorations.

WAM’s 2024 drilling efforts at the LH target have not yet yielded significant sulfide manto mineralization. However, the drill holes did intercept a few gossans, which warrant further investigation. Four surface trenches were also cut to refine the exploration model for the zone. Based on the initial drilling and trenching, WAM now interprets the LH target as a vertically oriented feature, likely positioned higher in the CRD system than previously thought. Mineralization is expected to be deeper than earlier estimates. Further assays are pending for both the drilling and trenching at the LH zone.

The Warm Springs discovery is part of a broader exploration effort by WAM to map and develop a large-scale carbonate replacement deposit (CRD) system in Alaska. The company’s Illinois Creek property, which includes past-producing gold and silver mines, hosts a range of mineral prospects across a 73,120-acre land package. This region, originally discovered by Anaconda Minerals in the early 1980s, encompasses multiple CRD targets, including Waterpump Creek and the Round Top copper prospects.

WAM’s strategy is to link the Warm Springs mineralization with other deposits in the district, potentially creating a large and mineable CRD system. The proximity of the Warm Springs target to other known mineral resources, including gold, silver, lead, and zinc, adds significant potential to this exploration. The company believes that the Warm Springs structure could be a critical new “spoke” in the mineral system, offering an opportunity to expand resources both laterally and vertically.

As WAM awaits further assay results from both the Warm Springs and LH targets, the company remains committed to advancing exploration across its claims. Future drilling will aim to confirm and expand the findings from this year’s program, with the ultimate goal of developing a scalable, mineable resource in western Alaska.

According to Andrew West, Vice President of WAM and a certified professional geologist, the data gathered so far has been rigorously verified to ensure accuracy. West’s 30 years of experience in mineral resource exploration provide confidence in the potential of the Warm Springs target and its significance within WAM’s broader exploration strategy.

Highlights from the results are as follows:

- Two gold zones intercepted in drill hole IC24-0004:

- 1.29 g/t Au over 4.68 meters within massive pyrite, including:

- 12.5 g/t Au and 0.9% Cu over 0.18 meters

- 2.13 g/t Au over 2.96 meters, including:

- 5.57 g/t Au over 1.01 meters

- 1.29 g/t Au over 4.68 meters within massive pyrite, including:

- Discovery of a new and separate mineralized structure parallel to the Illinois Creek Fault, opening the potential of a new “spoke” to the system.

- First significant copper and gold mineralization intercepted since WAM initiated exploration in 2021.

- The gold-bearing zone is located approximately 1.4 km southeast of the Illinois Creek gold-silver resource

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

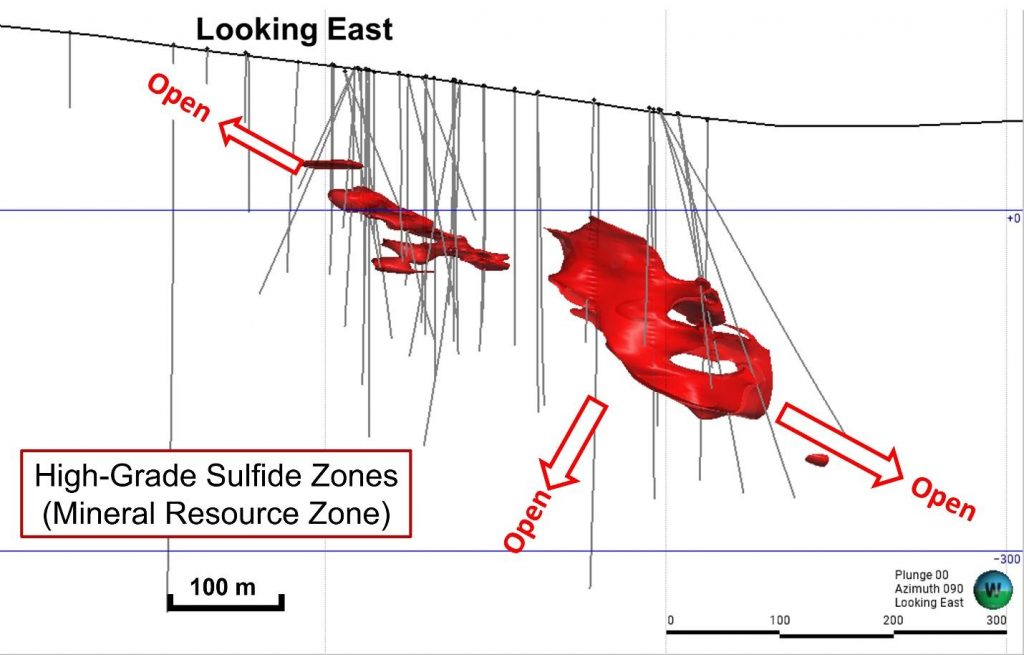

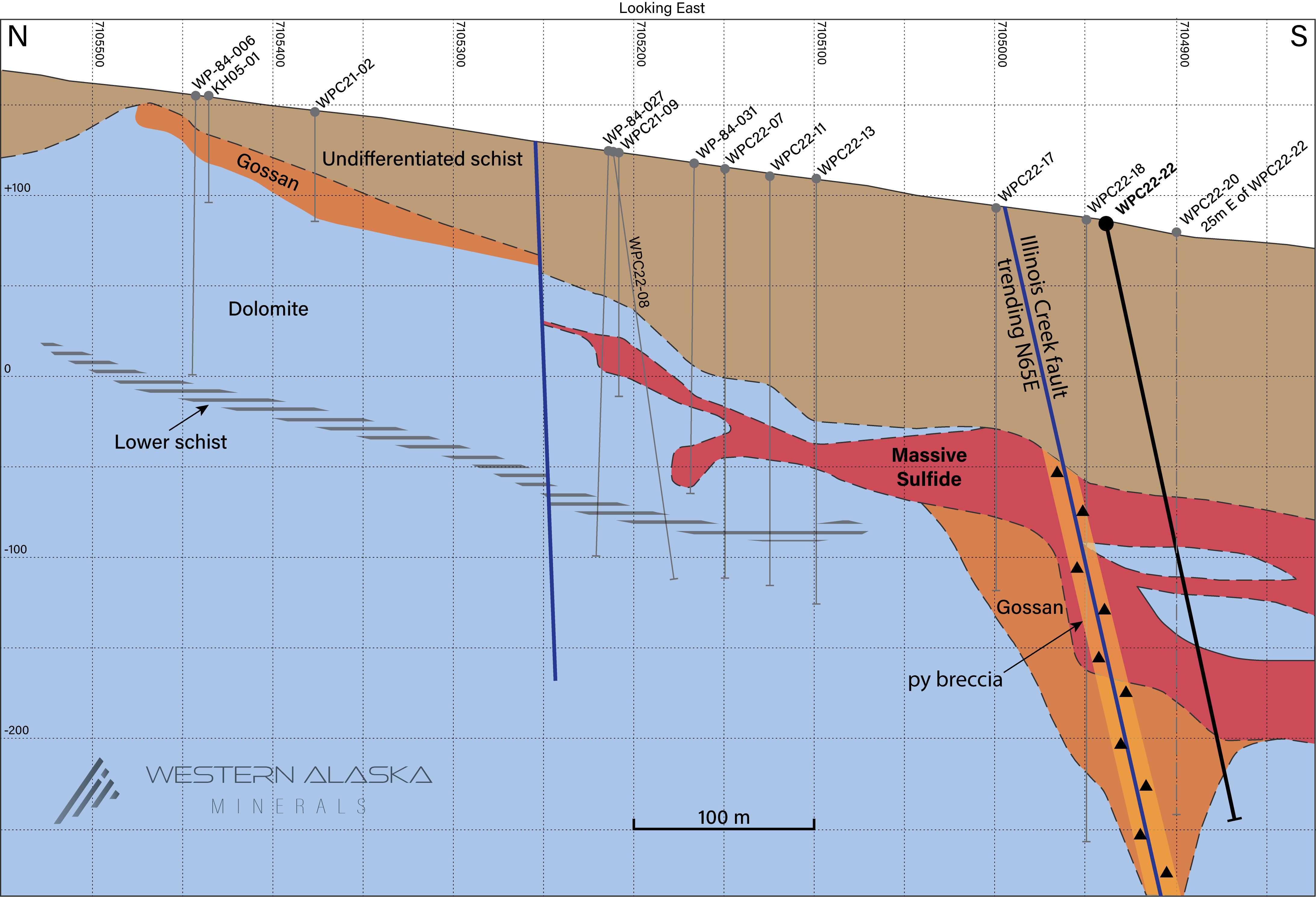

Figure 1. A long-section view of the sulfide zone (looking east). As indicated, the resource is open to the north, south (subject to a cross-cutting fault), and southwest. Source: Western Alaska Minerals

Western Alaska Minerals (TSXV:WAM) has announced an initial mineral resource estimate for the Waterpump Creek Zone at its 100% owned Illinois Creek project located in western Alaska.

The mineral resource estimate includes indicated resources of 1.96 million tonnes at 516 g/t silver, 5.8% lead and 14.6% zinc. Inferred resources are 0.43 million tonnes at 508 g/t silver, 6.2% lead and 13.1% zinc.

CEO Kit Marrs commented in a press release: “We believe we have a tiger by the tail at Illinois Creek and decided to proceed with an inferred resource estimate to demonstrate to the market the robust high grade (and high margin potential) of the WPC deposit as we’ve carried it from discovery to a significant volume of high-grade mineralization. This resource says we’re moving in the right direction and we’re looking forward to following the mineralization 7.5 km to the southwest back towards the past-producing Illinois Creek mine. We are in the early stages of developing a robust portfolio of base and precious minerals crucial for various industries. Silver, with its vital role in solar production and numerous industrial applications, and zinc, recognized as a critical mineral in the energy transition, defence, and agriculture sectors, are pivotal in driving the clean energy transition. Waterpump Creek, hosting a high-grade resource, significantly contributes to our sustainable future aspirations. This highlights our commitment to sustainable exploration practices and underscores the immense potential ahead for us at WAM.”

The resource estimate was prepared by independent qualified persons Dr. Bruce Davis and Susan Lomas of Lions Gate Geological Consulting Inc. It is based on historical and recent drill results totalling over 16,000 metres in 87 holes completed between 1983 and 2023.

The estimate uses a base case cut-off grade of 200 g/t silver equivalent considering metal prices of $24/oz silver, $1/lb lead and $1.30/lb zinc. It covers three sulfide zones at the Waterpump Creek prospect which is interpreted as the distal extension of the over 7.5 km long Illinois Creek carbonate replacement deposit system.

The company states the resource estimate will justify further exploration in the area to expand resources. Additional exploration targets have been defined along the interpreted extensions of the mineralized structures.

The full National Instrument 43-101 technical report for the mineral resource estimate will be filed within 45 days. Western Alaska Minerals says the estimate represents a cornerstone for potential development and expansion of resources across the broader Illinois Creek district.

- 2.39Mt @ 977 g/t silver equivalent (“AgEq”) for 75.0 Moz AgEq . The zinc equivalent is 26.32% ZnEq.

- Attractive mining thicknesses ranging from 5 to 49 meters and widths ranging from 25 to 70 meters over a strike length of 495 meters.

- All-in discovery rate of 3198 AgEq ozs/meter drilled.

- Robust resource that is relatively insensitive up to a cut-off grade up to 600 g/t AgEq.

- Significant zinc component adds important critical minerals potential.

Table 1. Waterpump Creek Sulfide Zone Inferred Mineral Resource Summary (200 g/t AgEq cut-off)

| Sulfide Inferred Resources – Waterpump Creek Resource Area | ||||||||||||

| Class | Tonnes (M) | Average Grade | Contained Metal | |||||||||

| AgEq (g/t) | AgEq (oz/t) | Ag (g/t) | Pb (%) | Zn (%) | ZnEq (%) | AgEq (Moz) | Ag (Moz) | Pb (Mlbs) | Zn (Mlbs) | ZnEq (Mlbs) | ||

| Inferred | 2.39 | 977 | 31.4 | 279 | 9.84 | 11.25 | 26.32 | 75.0 | 21.4 | 518 | 592 | 1384 |

- The effective date of the Mineral Resource is February 20, 2024. The QPs for the Mineral Resource are Dr. Bruce Davis FAusIMM and Susan Lomas, P. Geo of Lions Gate Geological Consulting Inc (LGGC).

- CIM Definition Standards were used for mineral resource classification and in accordance with CIM MRMR Best Practice Guidelines. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. It is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- AgEq reporting cut-off grade calculation is based on estimated recoveries from preliminary metallurgical test work of 75% Ag, 70% Pb, and 84% Zn and metal prices of US$24.00/oz Ag, US$1.00/lb Pb, and US$1.30/lb Zn and cost inputs suitable for underground extraction method.

- The AgEq and ZnEq grade calculations used in the table above are based on the same metal prices (as point #3 above) and are not subject to recovery.

- This Initial Inferred Mineral Resource Estimate is merely a beginning and demonstrates the high-grade nature of the mineralized system and that more exploration is fully warranted.

- High-Grade: The resource silver equivalent grade compares well with the most successful high grade silver projects in production or development over the last decade including Silver Crest (Las Chispas), MAG Silver (Juanicipio), Adriatic (Vares), and now Vizsla Silver (Copala).

- Under-Drilled: Substantial discovery rate in just 23,450 meters of drilling (15,550 meters of drilling was completed by WAM and 7,900 meters was completed by Anaconda and NovaGold).

- Expansion Potential: The 2023 WAM 3D IP survey results demonstrate significant exploration potential both immediately north of WPC resource and south along the 7.5 km LH trend. In addition, the geophysics support a major new target, the Warm Springs target, which further connects the WPC/LH trend with the historic Illinois Creek mine gossan oxide Au/Ag deposit.

- Existing NI 43-101 compliant Au-Ag oxide resource estimate: The past-producing Illinois Creek oxide Au-Ag mine, located approximately 7.5 km to the SE of WPC has an indicated estimate of 253 Koz Au, 9.5Moz Ag and an inferred estimate of 104Koz Au, 3.8Moz Ag.

Table 2. Sensitivity table showing Waterpump Creek Sulfide Inferred Resources at various AgEq cut-off grades.

| Sulfide Inferred Resources – Waterpump Creek Resource Area | ||||||||||||

| Cut off (AgEq g/t) | Tonnes (M) | Average Grade | Contained Metal | |||||||||

| AgEq (g/t) | AgEq (oz/t) | Ag (g/t) | Pb (%) | Zn (%) | ZnEq (%) | AgEq (Moz) | Ag (Moz) | Pb (Mlbs) | Zn (Mlbs) | ZnEq (Mlbs) | ||

| 0 | 2.39 | 976 | 31.4 | 278 | 9.83 | 11.24 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1385 |

| 100 | 2.39 | 976 | 31.4 | 278 | 9.83 | 11.24 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1385 |

| 150 | 2.39 | 976 | 31.4 | 278 | 9.83 | 11.24 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1385 |

| 200 | 2.39 | 977 | 31.4 | 279 | 9.84 | 11.25 | 26.3 | 75.0 | 21.4 | 518 | 592 | 1384 |

| 250 | 2.38 | 980 | 31.5 | 279 | 9.86 | 11.27 | 26.4 | 74.9 | 21.4 | 517 | 591 | 1383 |

| 300 | 2.37 | 982 | 31.6 | 280 | 9.89 | 11.30 | 26.4 | 74.9 | 21.4 | 517 | 591 | 1382 |

| 400 | 2.33 | 993 | 31.9 | 284 | 10.02 | 11.40 | 26.7 | 74.4 | 21.3 | 515 | 585 | 1373 |

| 500 | 2.27 | 1007 | 32.4 | 288 | 10.20 | 11.51 | 27.1 | 73.5 | 21.1 | 511 | 576 | 1357 |

| 600 | 2.20 | 1021 | 32.8 | 293 | 10.37 | 11.63 | 27.5 | 72.3 | 20.7 | 504 | 565 | 1335 |

| 800 | 2.01 | 1051 | 33.8 | 303 | 10.78 | 11.87 | 28.3 | 67.8 | 19.5 | 477 | 525 | 1252 |

| 1000 | 1.36 | 1113 | 35.8 | 320 | 11.46 | 12.54 | 30.0 | 48.5 | 13.9 | 343 | 375 | 896 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Western Alaska Minerals (TSXV:WAM) recently completed its 2023 exploration activities at the Illinois Creek Carbonate Replacement Deposit (CRD) project, which it wholly owns. Located in central Alaska, the project encompasses approximately 30,000 hectares.

CEO Kit Marrs commented in a press release: “It is rare for a junior exploration company to control, in a stable mining jurisdiction, an entire, intact system of this scale, that even at this early stage is showing the hallmarks of a well-mineralized CRD system. It took several tries with the drill bit at WPC, but once we intercepted the exceptionally high-grade silver-lead-zinc sulfides there, it took just two seasons of drilling to flesh out a substantial zone, justifying the calculation of an initial mineral resource estimate. Results to date suggest that WPC is just the fingertip of a 6 km-long mineralized trend that runs back to Illinois Creek, of which only 8% has been drill tested to date. With our updated understanding of the system, we are excited to be zeroing in at Last Hurrah and continuing to trace high-grade mineralization back towards Illinois Creek.”

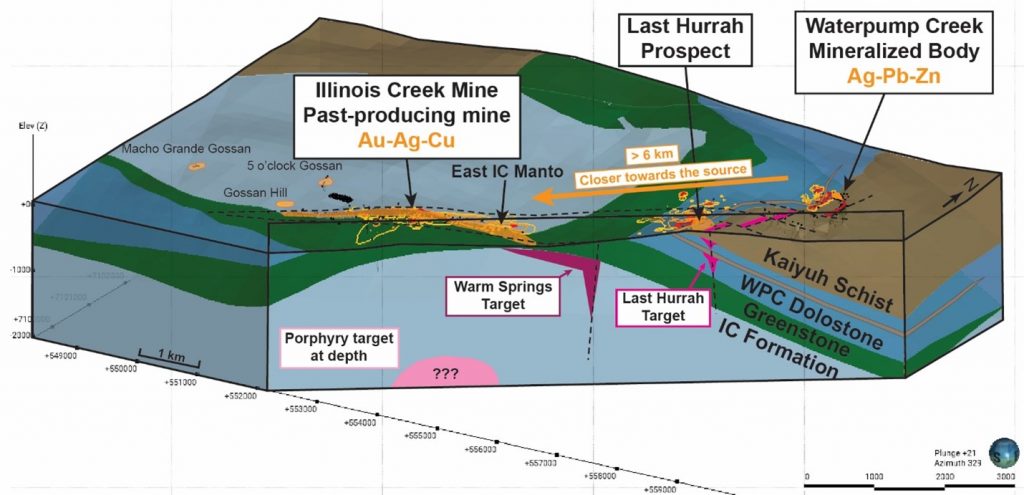

The site includes a six-kilometer corridor of CRD-style alteration, structural features, and stratigraphy favorable for mineral deposits. This corridor connects the previously mined Illinois Creek Mine, known for gold and silver deposits, with the Waterpump Creek massive sulfide CRD deposit, rich in silver, lead, and zinc.

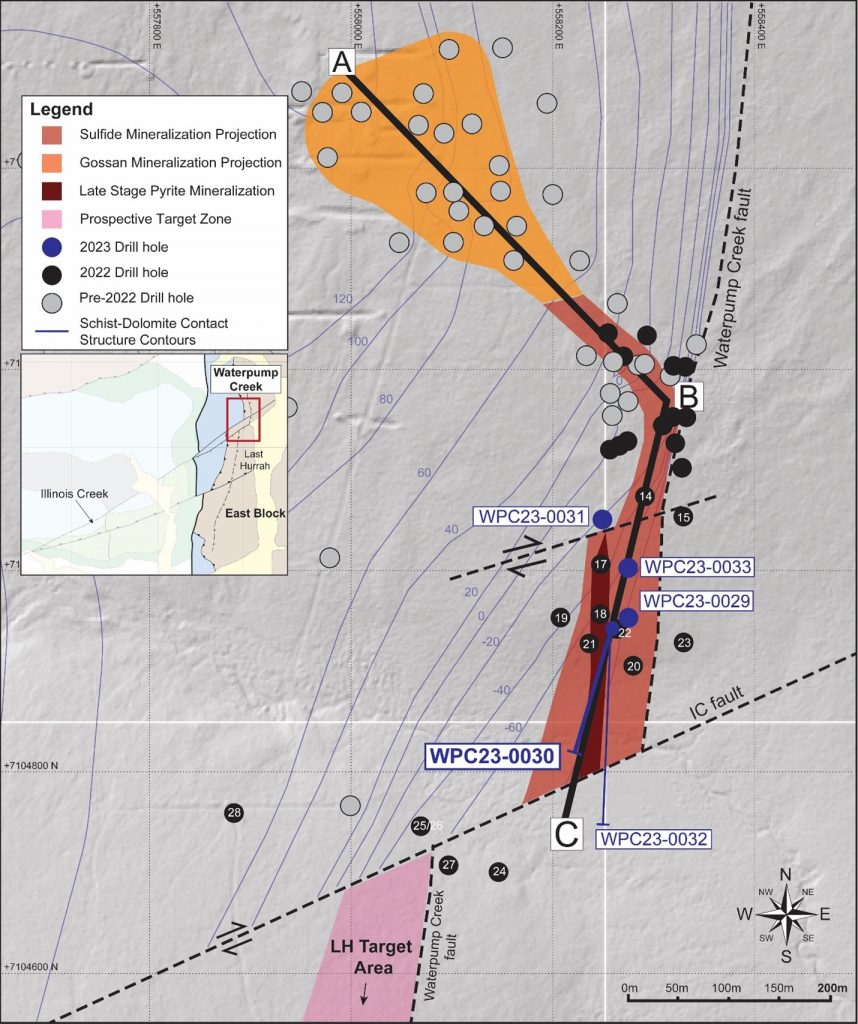

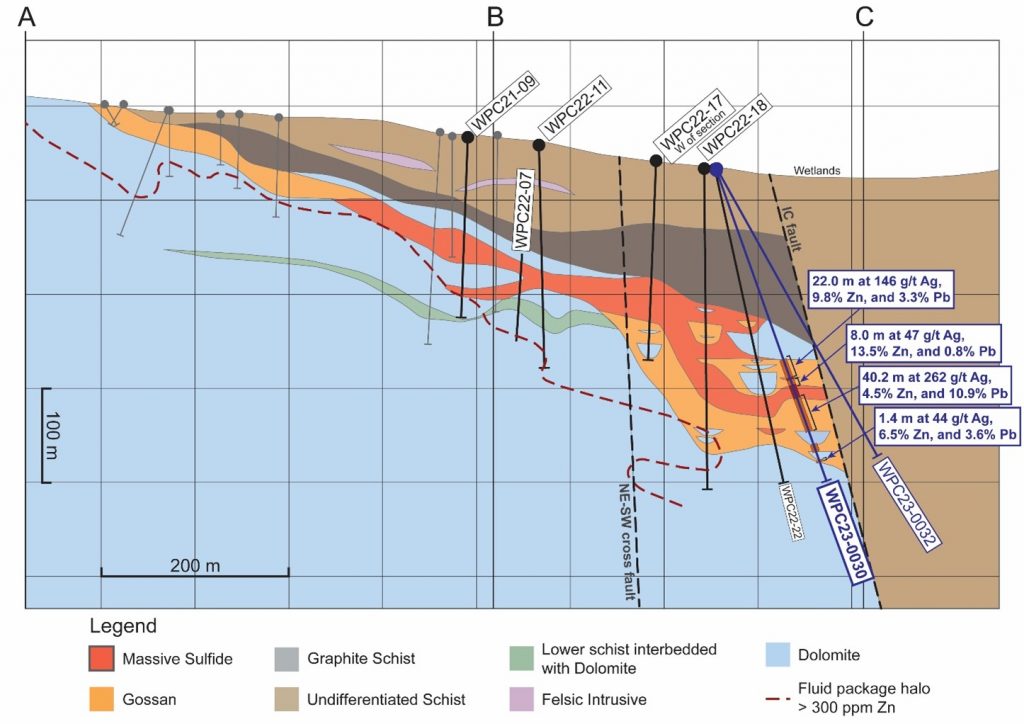

In 2023, WAM focused its drilling efforts on two areas: Waterpump Creek and the Last Hurrah target area. At Waterpump Creek, five drill holes totaling 1,706 meters aimed to expand the known high-grade sulfide mineralization. The most notable outcome was from drill hole WPC23-30, which intersected significant mineralization, including 40.2 meters with high concentrations of silver, lead, and zinc.

The exploration then shifted to the Last Hurrah area, located 700 meters south across a fault line. This site, based on geophysical surveys and previous drilling, was believed to be part of the mineralized corridor. Nine drill holes totaling 3,412 meters were completed here, encountering broad zones of CRD alteration and dispersed mineralization. Two of these holes indicated the potential for mineralization in deeper limestone units, suggesting new avenues for exploration across the property.

The company’s technical team is integrating these findings into an enhanced district model, which is being prepared for the next drilling season. This model also includes a reinterpretation of the geophysics.

WAM’s exploration results support the theory of a continuous and intensifying pattern of CRD-style mineralization and alteration extending south and west. This pattern aligns with the district’s zonation, transitioning from low-temperature silver-zinc-lead mineralization at Waterpump Creek to higher-temperature copper-gold-silver deposits at Illinois Creek.

Additional exploration at the Last Hurrah area in 2023 revealed strong CRD alteration in most drill holes, with fugitive carbonate veins indicative of proximity to mineralization. Geophysical surveys suggested an increase in the alteration’s extent toward the Illinois Creek mine. However, no massive sulfides were intersected in this area.

A comprehensive 3-D resistivity and induced polarization survey conducted over Waterpump Creek and Last Hurrah target areas by DIAS Geophysical highlighted key structural and stratigraphic controls of CRD mineralization. The survey also identified distinct fault structures, including a potential north-south fault that could be controlling the mineralizing fluids.

The 2023 drilling program at Waterpump Creek, comprising five holes totaling 1,706 meters, yielded significant results. These included high-grade silver-lead-zinc infill and expansion, with notable intercepts in multiple drill holes. This data is contributing to a preliminary NI 43-101 compliant resource estimate, expected to be published in early 2024.

Highlights from the results are as follows:

- In-fill and additional high-grade intercepts from step-out drilling at Waterpump Creek were completed, adding 45 meters to the mineralization trend, allowing for an initial NI 43-101 complaint resource estimate, anticipated in Q1 2024.

- Exploration drilling at Last Hurrah yielded strong CRD alteration which correlates with both the 2005 and 2023 modelled geophysics (Figures 1,3, and 4). More importantly, the alteration and anomalous geochemistry occur in two separate stratigraphic units, effectively doubling the exploration potential.

- The 2023 and prior drilling results now indicate that three carbonate units exist, separated by impermeable or unreactive units, and a progressive southwesterly shift of mineralization focus from the uppermost carbonate at WPC, through the middle unit at LH and the deepest known unit at Illinois Creek (Figure 2).

- This new geologic recognition, combined with advanced remodeling of the eleven square-kilometer high-resolution 3D geophysical survey covering both WPC and Last Hurrah, is helping to determine the structural and stratigraphic controls on mineralizing fluid migration from the probable porphyry source near the Illinois Creek Mine, through Last Hurrah to WPC (Figure 3).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Western Alaska Minerals (TSXV:WAM) has released the initial assay results from the step-out phase of its second-year of drilling at the Waterpump Creek Carbonate Replacement Deposit. The results indicate that Hole WPC23-0030 has expanded the Waterpump Creek zone to 495 meters in strike length.

The hole was part of a two-drill program aiming to examine the continuation of the Waterpump Creek system southwards. Notably, this hole was drilled from the same pad as WPC22-022, albeit at an angle of -70° facing south. WPC22-022 had previously been identified as intersecting a structure believed to be a feeder chimney, with several high-grade zones of mineralization, as reported on December 7, 2022. Further details on these findings, along with intercepts from other drills, were provided in a press release dated July 6, 2023, which also detailed the outcomes from the step-out hole WPC23-0032 that identified the Illinois Creek fault’s location.

Kit Marrs, CEO of Western Alaska Minerals, commented in a press release: “We welcome this proof that high-grade mineralization at Waterpump Creek remains open to the south and that the distinctive CRD alteration seen there is turning up in our drilling 700m farther south at Last Hurrah. We look forward to continuing drilling at Last Hurrah to find the sulphides that the alteration is telling us should be nearby and trace it back towards WPC, which may just be the tip of the finger of a major CRD manto”.

Characteristically, the intercepts mentioned are dominated by in-situ gossan intertwined with residual galena. Throughout the intercepts, Pb and Zn carbonates and oxides are observed. The identified gap in mineralization from 249.3 to 262.1 in the referenced table is attributed to a significant amount of late-stage pyrite, comparable to what was found in WPC22-018 and WPC22-022.

When considering this year’s results, along with data from the previous 26 drill holes at Waterpump Creek, there’s confirmation of the continuity of massive sulfides ranging between 30 to 75 meters in width and 495 meters in length, which show a gentle plunge towards the south.

Update on Phase II Drilling at Last Hurrah Target

The initial drilling at the Last Hurrah target, which is situated 700 meters south of Waterpump Creek, has been completed. Positioned across the Illinois Creek fault from Waterpump Creek, Last Hurrah was earmarked as a potential site due to a reinterpretation of past geology, soil geochemistry, geophysical examinations, and previous drills carried out by Anaconda and NovaGold.

Four holes, spaced at intervals of approximately 120 meters, were drilled along an east-west line, focusing on the north-south-aligned alteration vectors. These holes aimed to pinpoint mineralization in this previously uncharted territory. Each of these holes revealed widespread and intricate alteration, including signs of sanding, bleaching, and UV fluorescence. This suggests that the area experienced multiple episodes of hydrothermal fluid activity. Hole LH23-0005 was a standout, displaying the distinct “Barbeque Rock” fluorescence (vivid orange and pink under Shortwave UV), accompanied by anomalous Pb and Zn values as evidenced by a hand-held XRF Analyzer.

These findings are consistent and similar to the data from hole WPC22-021, which was drilled 30 meters away from the high-grade sulfide intercept in hole WPC22-022, strongly hinting at the close vicinity of mineralization.

Highlights from the results are as follows:

- Step-out drill hole WPC23-0030:

- Cumulative 71.6 meters of multiple high-grade zones

- 22.0m of 146 gpt Ag (4.7 opt), 3.3% Pb and 9.8% Zn

- 40.2m of 262 gpt Ag (8.4 opt), 10.9% Pb and 4.5% Zn, including

- 5.3 meters of 729 gpt Ag (23.4 opt), 24.1% Pb and 3.1 % Zn, and

- 8.6 meters of 493 gpt Ag (15.8 opt), 22.9% Pb and 2.6% Zn

- Extends the WPC system at least 45 meters down plunge to the south and demonstrates continuity of the system.

- Extends WPC system to 495m in total length.

- Cumulative 71.6 meters of multiple high-grade zones

- Last Hurrah Drilling:

- The Company is excited to share visuals from the first drilling at Anaconda’s “Last Hurrah”* target, which appears to be an offset continuation of Waterpump Creek. Hole LH23-0005 cut 21.4m of strongly ultraviolet fluorescent “Barbecue Rock” in “Fugitive Calcite” veining, a proximal “exhaust” feature of CRD mineralization according to CRD expert, Dr. Peter Megaw, technical advisor to WAM. Similar Barbeque Rock surrounds mineralization at the Waterpump Creek deposit, where it occurs within 25m to 50m of high-grade CRD massive sulphide mineralization.

Table 1. Drill intercepts within hole WPC23-0030.

| Hole | From | To | Thickness | Ag | Ag | Zn | Pb |

| (meters) | (meters) | (meters) | g/t | oz/t | % | % | |

| WPC23-0030 | 216.6 | 238.6 | 22.0 | 146 | 4.7 | 9.8 | 3.3 |

| WPC23-0030 | 241.4 | 249.3 | 8.0 | 47 | 1.5 | 13.5 | 0.8 |

| WPC23-0030 | 260.6 | 300.8 | 40.2 | 262 | 8.4 | 4.5 | 10.9 |

| Including | 264.7 | 270.1 | 5.3 | 729 | 23.4 | 3.1 | 24.1 |

| Including | 278.3 | 286.9 | 8.6 | 493 | 15.8 | 2.6 | 22.9 |

| WPC23-0030 | 334.6 | 336.0 | 1.4 | 44 | 1.4 | 6.5 | 3.6 |

*All intercepts are core length; true widths have not been determined for the above intercepts but are thought to be greater than 80% of actual drill thicknesses.

Table 2. Hole Location table.

| Hole | Azimuth | Dip | Length (m) | UTM East (m) | UTM North (m) | Elevation (m) |

| WPC23-0030 | 185 | -70 | 365.2 | 558260 | 7104945 | 87 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

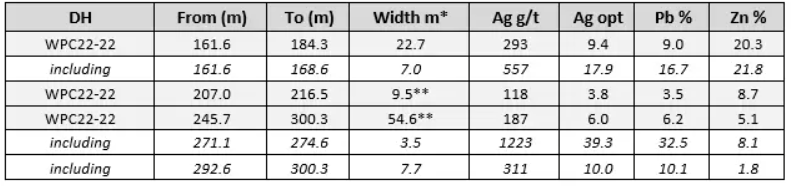

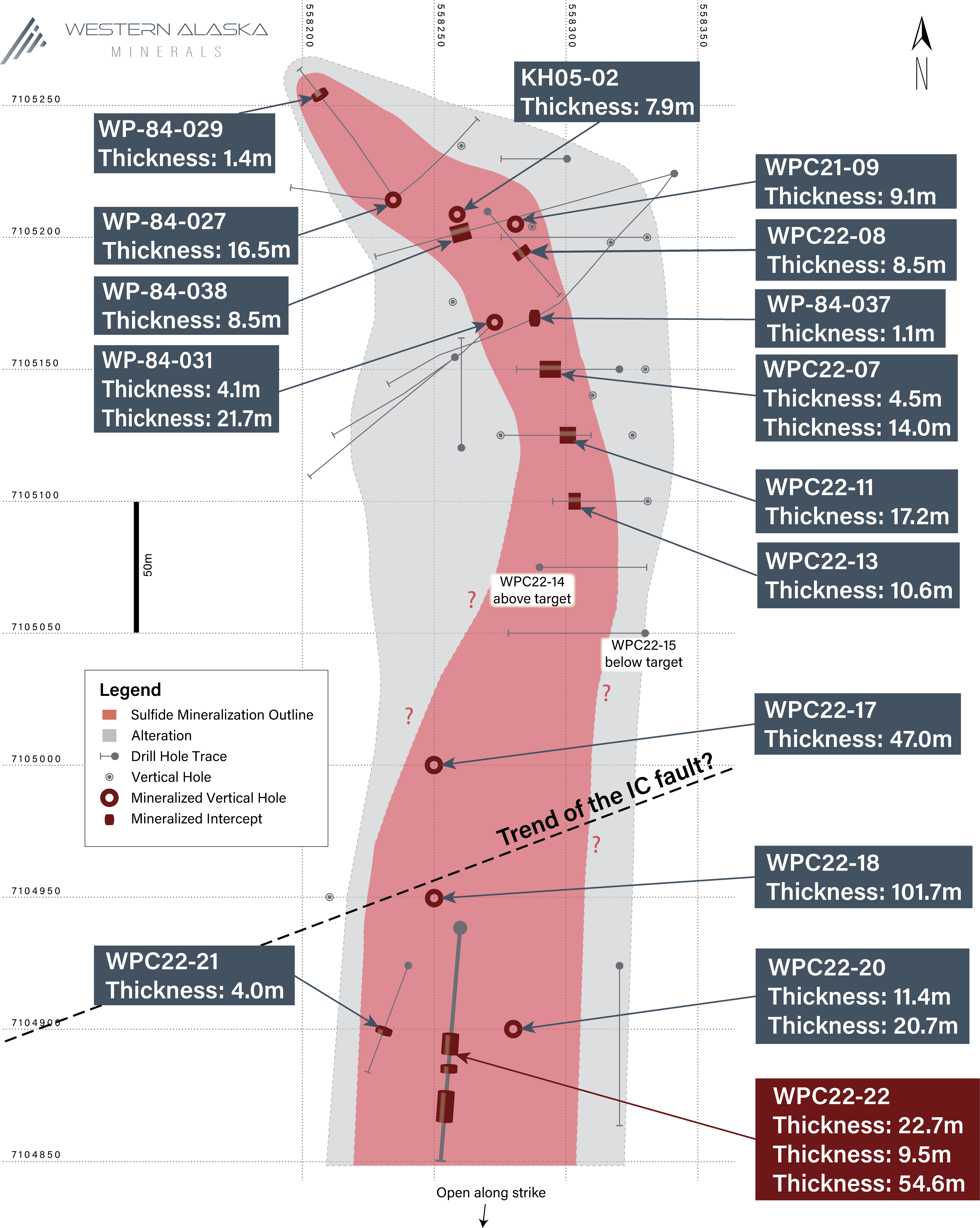

Western Alaska Minerals (TSXV:WAM) has reported new drill assay results from drill hole WPC22-22 at the Waterpump Creek Carbonate Replacement Deposit from three multistage massive sulfide horizons. Mineralization is currently open and will continue to be the company’s focus as part of its expanded 2023 drill program.

Western Alaska Minerals CEO, Kit Marrs, commented in a press release: “The overall grades in this hole are outstanding with some exceptional intervals with silver grades up to 39 oz/ton in one of the internal zones. These three high-grade intercepts total over 86 meters in composite thickness and tie together with similar mineralization in ten other holes to give us 400 meters of continuous high-grade mineralization linked to the sulfide chimney cut in WPC22-18. All the signs indicate this is part of a major CRD system and we can’t wait to start the 2023 drill season and continue tracing this mineralization south where we think these zones coalesce and become thicker.”

Highlights from the assay results are as follows:

The best results are 54.6 Meters Grading 187 g/t Silver (6.0 oz/ton), 6.2% Lead and 5.1% Zinc (Including: 3.5 Meters Grading 1223 g/t Silver (39.3 oz/ton), 32.5% Lead and 8.1% Zinc)

- WPC22-22 is located 50 meters south of WPC22-18, which cut 101m of massive and semi-massive sulfides interpreted as a feeder chimney

- The WPC22-22 high-grade intercepts appear linkable to high-grade zones in the interpreted WPC22-18 chimney

- The three intercepts show classic multi-phase CRD-style massive sulfide mineralization with silver-rich lead mineralization stages cutting earlier zinc-rich stages (See Table 1)

- Similar mineralization has now been cut at similar elevations in 11 drill holes indicating a continuous elongate body 30 to 75 meters wide and 400 meters in length (See Figure 2)

- Grades in the middle and lower sulfide intervals were high enough to allow for thicker intervals to be reported than in the prior news release of 9/22/2022.

The discussion below incorporates visual data from drillholes WPC22-21 and -22 and from previous drill holes (See news release of September 22, 2022). Assay results from WPC22-21 will be reported when received and vetted.

Mineralization Observations

Hole WPC22-22 cut three significant zones of massive to semi-massive sphalerite and argentiferous galena in a matrix of secondary dolomite like that seen in previous drilling press releases. The intercepts are separated by highly altered and weakly to unmineralized dolomitic host rock. All the intercepts clearly show multiple cross-cutting stages of mineralization. Distinctive zones of silver-rich galena cut separate lower-silver sphalerite stages. There are at least two separate stages of sphalerite.

Data from this release continue to show a strong correlation between silver and lead with each 1% lead associated with approximately 1 oz/ton silver. Zinc grades appear far more variable and reflect different stages of mineralization.

Table 1. Highlight assay results from drill hole WPC22-22. All Company Waterpump Creek results can be found on the website along with more technical details.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CMB.V | +900.00% |

|

ZEU.AX | +50.00% |

|

VO.V | +36.36% |

|

MTB.V | +33.33% |

|

CASA.V | +30.00% |

|

GBE.AX | +28.00% |

|

POS.AX | +25.00% |

|

AFM.V | +23.33% |

|

GTE.AX | +21.05% |

|

GTC.V | +20.00% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan