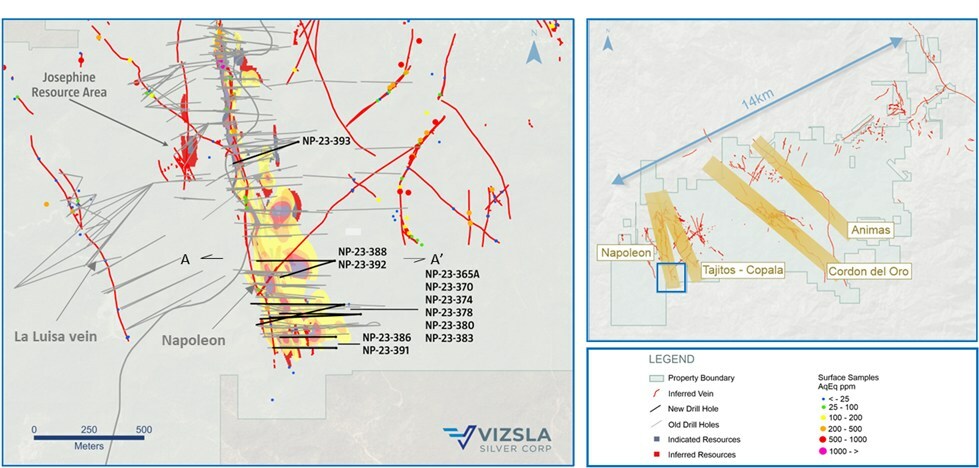

Vizsla Silver Corp. (TSXV:VZLA) has reported results from 11 new drill holes at the southern extension of the Napoleon Vein, within the company’s Panuco silver-gold project located in Mexico. The recent findings are focused on the western part of the district and are part of a 90,000-metre resource infill and expansion or discovery-focused drilling initiative.

Michael Konnert, President and CEO, commented in a press release: “Infill and expansionary drilling targeting the southern extent of Napoleon continues to intersect high silver and gold grades on both the main vein and its overlapping splay structures. We have now identified several splay veins branching off the main Napoleon structure located within both the footwall and hanging wall that remain open for future expansion. Most notable is the shallow dipping Hanging Wall 4 structure which returned 646 grams per tonne silver equivalent over ten meters true width and is open down dip. We continue to view the Napoleon Area as a primary target for future resource growth and development. Of the six drill rigs currently turning on the property, infill drilling continues at Napoleon with one rig. In addition to drilling, we are pleased to announce Vizsla has achieved 1.5 million work hours without a lost time incident at Panuco. This is yet another major milestone for the Company and is a testament to the focus and dedication of every Vizsla employee and contractor working on the Project.”

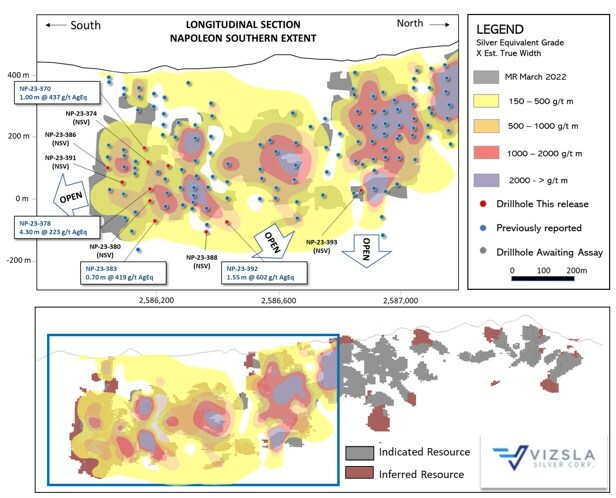

The Napoleon Southern Extent has revealed enhanced comprehension of the mineralization controls along the vein corridor. The pattern of metal zonation and alteration indicates that the corridor is tilted. The southern reach of the drilling appears at the top of the mineralized horizon, close to the surface. Previously reported high-grade gold assay values near the surface were consistent with this model, according to releases dated December 16, 2021, and March 29, 2022.

The infill drilling assay results show additional high-grade silver and gold values in vein splays located at the hanging wall of the primary Napoleon structure. These vein splays are typically situated between 25 to 120 meters into the hanging wall and often include high concentrations of lead and zinc along with precious metal values. Recent drilling suggests that the shallow-dipping Hanging Wall 4 splay remains open down dip to the east. Results from the hole designated NP-23-388 have prompted further exploration to the east and depth along Hanging Wall 4. Vizsla continues to work on structural and 3D geological modelling to help design specific drilling targets for further exploration of these vein splays.

In related news, Vizsla Silver also announced a significant safety milestone at the Panuco site. The company has achieved 1.5 million work hours without any lost time incidents. The accomplishment was attributed to the dedication of the safety department, employees, and contractors in maintaining a strong safety culture and ensuring safe working conditions throughout the project’s life.

Highlights from the results are as follows:

- NP-23-388 returned 646 grams per tonne (g/t) silver equivalent (AgEq) over 10.00 metres true width (mTW) (217 g/t silver, 3.03 g/t gold, 1.44 % lead and 5.44 % zinc),

- including: 3,625 g/t AgEq over 0.95 mTW (1,590 g/t silver, 25.50 g/t gold, 7.28 % lead and 5.80 % zinc),

- and 1,323 g/t AgEq over 0.78 mTW (159 g/t silver, 0.89 g/t gold, 4.97 % lead and 26.70 % zinc)

- NP-23-391 returned 1,568 g/t AgEq over 1.90 mTW (908 g/t silver, 7.37 g/t gold, 1.62 % lead and 4.91 % zinc),

- including: 2,205 g/t AgEq over 0.65 mTW (1,500 g/t silver, 8.96 g/t gold, 2.05 % lead and 3.98 % zinc)

- And 648 g/t AgEq over 3.20 mTW (559 g/t silver, 1.53 g/t gold, 0.23 % lead and 0.49 % zinc),

- including: 1,720 g/t AgEq over 0.96 mTW (1,500 g/t silver, 3.89 g/t gold, 0.61 % lead and 1.22 % zinc)

- NP-23-392 returned 989 g/t AgEq over 2.50 mTW (527 g/t silver, 3.78 g/t gold, 2.13 % lead and 4.98 % zinc),

- including: 2,465 g/t AgEq over 0.69 mTW (1,500 g/t silver, 9.97 g/t gold, 5.25 % lead and 6.66 % zinc).

|

Drillhole |

From |

To |

Downhole |

Estimated |

Ag |

Au |

Pb |

Zn |

AgEq |

Vein |

|

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(g/t) |

% |

% |

(g/t) |

||

|

NP-23-365A |

No significant values |

HW 7 |

||||||||

|

NP-23-365A |

No significant values |

HW 2 |

||||||||

|

NP-23-365A |

454.65 |

455.15 |

0.5 |

0.45 |

178 |

8.33 |

0.07 |

0.17 |

736 |

Napoleon |

|

NP-23-365A |

No significant values |

FW 1 |

||||||||

|

NP-23-365A |

496.5 |

497.5 |

1 |

0.85 |

290 |

1.71 |

1.05 |

1.56 |

473 |

FW 2 |

|

NP-23-370 |

346.1 |

346.65 |

0.55 |

0.45 |

597 |

0.72 |

0.02 |

0.04 |

606 |

HW 6 |

|

NP-23-370 |

No significant values |

HW 2 |

||||||||

|

NP-23-370 |

432.05 |

433.25 |

1.2 |

1 |

349 |

1.58 |

0.05 |

0.13 |

437 |

Napoleon |

|

NP-23-374 |

303.9 |

306.05 |

2.15 |

1.7 |

90 |

0.95 |

0.02 |

0.03 |

149 |

HW 7 |

|

NP-23-374 |

No significant values |

HW 2 |

||||||||

|

NP-23-374 |

527.9 |

529.25 |

1.35 |

1 |

34 |

0.32 |

0.02 |

0.02 |

173 |

Napoleon |

|

NP-23-374 |

No significant values |

FW 2 |

||||||||

|

NP-23-374 |

585.8 |

586.25 |

0.45 |

0.45 |

433 |

2.92 |

0.83 |

1.19 |

667 |

FW 3 |

|

NP-23-378 |

555 |

556 |

1 |

0.9 |

1,135 |

1.29 |

1.14 |

4.74 |

1,348 |

HW 2 |

|

NP-23-378 |

563.8 |

569 |

5.2 |

4.3 |

73 |

1.42 |

0.46 |

1.24 |

223 |

Napoleon |

|

Includes |

566.9 |

568 |

1.1 |

0.91 |

284 |

1.92 |

1.44 |

3.28 |

555 |

|

|

NP-23-378 |

575.9 |

577.5 |

1.6 |

1.1 |

1,805 |

16.56 |

0.2 |

0.38 |

2,817 |

FW 1 |

|

Includes |

576.5 |

577.5 |

1 |

0.69 |

2,780 |

26.1 |

0.29 |

0.55 |

4,376 |

|

|

NP-23-378 |

588 |

588.6 |

0.6 |

0.46 |

184 |

1.48 |

0.6 |

15.9 |

865 |

FW 2 |

|

NP-23-380 |

317.05 |

322.45 |

5.4 |

4.1 |

111 |

0.64 |

0.01 |

0.01 |

147 |

HW 7 |

|

NP-23-380 |

554.2 |

555.7 |

1.5 |

1.35 |

551 |

1.08 |

1.29 |

6.23 |

849 |

HW 2 |

|

NP-23-380 |

581.25 |

581.7 |

0.45 |

0.4 |

346 |

2.21 |

0.8 |

4.29 |

650 |

Napoleon |

|

NP-23-383 |

No significant values |

HW 7 |

||||||||

|

NP-23-383 |

616.15 |

618.1 |

1.95 |

1.27 |

207 |

2.37 |

4.43 |

14.37 |

1,005 |

HW 2 |

|

Includes |

616.8 |

617.8 |

1 |

0.65 |

270 |

4.15 |

8.4 |

23.2 |

1,621 |

|

|

NP-23-383 |

636.25 |

637 |

0.75 |

0.7 |

154 |

1.37 |

1.04 |

4.21 |

419 |

Napoleon |

|

NP-23-386 |

140.9 |

141.85 |

0.95 |

0.78 |

218 |

0.24 |

0.21 |

0.43 |

241 |

HW 7 |

|

NP-23-386 |

410.35 |

410.75 |

0.4 |

0.3 |

430 |

1.59 |

0.08 |

0.22 |

517 |

HW 2 |

|

NP-23-386 |

414.35 |

415.6 |

1.25 |

0.85 |

177 |

0.73 |

0.11 |

0.25 |

226 |

Napoleon |

|

NP-23-386 |

536.8 |

537.25 |

0.45 |

0.4 |

444 |

10.3 |

0.46 |

1.11 |

1,162 |

FW 3 |

|

NP-23-388 |

No significant values |

HW 5 |

||||||||

|

NP-23-388 |

426.25 |

437.8 |

11.55 |

10 |

217 |

3.03 |

1.44 |

5.44 |

646 |

HW 4 |

|

Includes |

434.8 |

435.9 |

1.1 |

0.95 |

1,590 |

25.5 |

7.28 |

5.8 |

3,625 |

|

|

Includes |

435.9 |

436.8 |

0.9 |

0.78 |

159 |

0.89 |

4.97 |

26.7 |

1,323 |

|

|

NP-23-388 |

556.8 |

559 |

2.2 |

1.95 |

31 |

0.59 |

1.46 |

6.36 |

343 |

HW 2 |

|

NP-23-388 |

No significant values |

Napoleon |

||||||||

|

NP-23-391 |

No significant values |

HW 7 |

||||||||

|

NP-23-391 |

420.1 |

424.1 |

4 |

3.2 |

559 |

1.53 |

0.23 |

0.49 |

648 |

HW 2 |

|

Includes |

422.35 |

423.55 |

1.2 |

0.96 |

1,500 |

3.89 |

0.61 |

1.22 |

1,720 |

|

|

NP-23-391 |

No significant values |

Napoleon |

||||||||

|

NP-23-391 |

483.6 |

484.85 |

1.25 |

1 |

64 |

0.72 |

0.81 |

0.77 |

160 |

FW 1 |

|

NP-23-391 |

526.15 |

528.2 |

2.05 |

1.9 |

908 |

7.37 |

1.62 |

4.91 |

1,568 |

FW 2 |

|

Includes |

526.15 |

526.85 |

0.7 |

0.65 |

1,500 |

8.96 |

2.05 |

3.98 |

2,205 |

|

|

NP-23-392 |

408.1 |

410.65 |

2.55 |

2.5 |

527 |

3.78 |

2.13 |

4.98 |

989 |

HW 4 |

|

Includes |

409.25 |

409.95 |

0.7 |

0.69 |

1,500 |

9.97 |

5.25 |

6.66 |

2,465 |

|

|

NP-23-392 |

450.5 |

451.5 |

1 |

0.95 |

258 |

1.62 |

1.95 |

15.45 |

967 |

HW 3 |

|

NP-23-392 |

No significant values |

HW 2 |

||||||||

|

NP-23-392 |

644.6 |

646.6 |

2 |

1.55 |

40 |

1.96 |

0.62 |

11.4 |

602 |

Napoleon |

|

NP-23-393 |

258.15 |

259.2 |

1.05 |

0.8 |

204 |

3.52 |

1.42 |

6.52 |

706 |

HW 4 |

|

NP-23-393 |

485.35 |

486.35 |

1 |

0.6 |

65 |

0.38 |

1.34 |

13.85 |

627 |

HW 3 |

|

NP-23-393 |

No significant values |

Napoleon |

||||||||

|

Table 1: Downhole drill intersections from the holes completed along the Napoleon main and vein splays. Note: AgEq = Ag g/t x Ag rec. + ((Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t))/Ag price/gram. Metal price assumptions are $24.00/oz silver, $1,800/oz gold, $2,424.4/t lead and $2,975.4/t zinc. Metallurgical recoveries assumed are 93% for silver, 90% for gold, 94% for lead and 94% for zinc. Metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022). |

|

Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

|

NP-23-365A |

403,888 |

2,586,230 |

434 |

270 |

-49 |

636.0 |

|

NP-23-370 |

403,891 |

2,586,232 |

434 |

258 |

-40 |

534.0 |

|

NP-23-374 |

403,967 |

2,586,189 |

467 |

267 |

-43 |

621.0 |

|

NP-23-378 |

403,967 |

2,586,189 |

467 |

268 |

-52 |

674.0 |

|

NP-23-380 |

403,967 |

2,586,189 |

467 |

268 |

-56 |

702.0 |

|

NP-23-383 |

403,967 |

2,586,189 |

467 |

270 |

-60 |

750.0 |

|

NP-23-386 |

403,856 |

2,586,035 |

450 |

271 |

-60 |

582.0 |

|

NP-23-388 |

403,849 |

2,586,432 |

477 |

253 |

-68 |

705.0 |

|

NP-23-391 |

403,854 |

2,586,086 |

449 |

271 |

-63 |

558.0 |

|

NP-23-392 |

403,849 |

2,586,432 |

477 |

270 |

-61 |

738.0 |

|

NP-23-393 |

403,683 |

2,586,973 |

480 |

251 |

-57 |

582.0 |

|

Table 2: Napoleon vein drillhole details. Coordinates in WGS84, Zone 13. |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

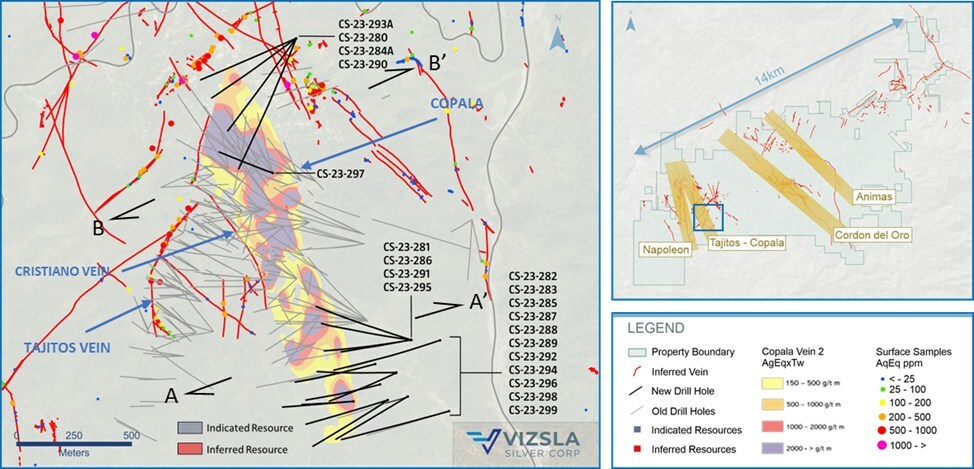

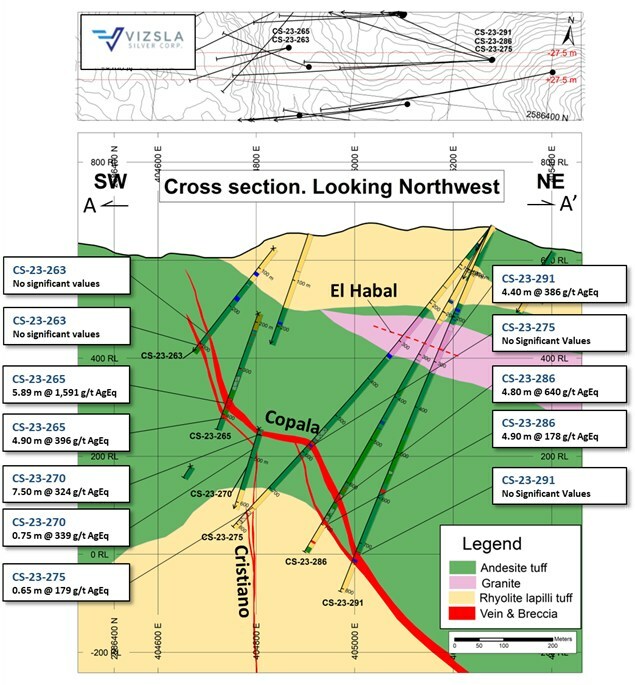

Vizsla Silver (TSXV:VZLA) has disclosed new findings from 20 exploratory drillings at its fully owned, mainstay Panuco silver-gold project, found in Mexico. These results broaden the known mineral-rich areas of the Copala resource area, reaching approximately 370 meters southeast and about 50 meters north.

Michael Konnert, President & CEO of Vizsla, commented in a press release: “Expansion drilling at Copala, both to the southeast and north, continue to highlight a robust precious metals structure well beyond the January 2023 resource boundary. The overall strike length now measures approximately 1,670 metres long and remains open in both directions. Additionally, drilling has expanded the high-grade Copala 2 vein situated between Tajitos and Copala main and identified a new near-surface structure called ‘El Habal‘. Moving forward, we will continue to both expand and infill these high-grade zones with three drill rigs in preparation for an updated resource estimate planned for the fourth quarter of 2023. Q4/23.”

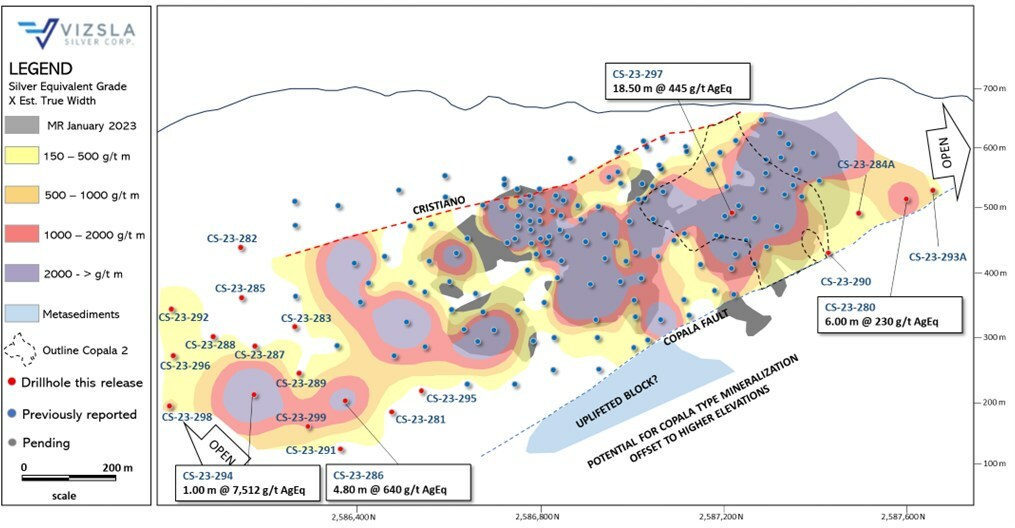

The Copala Structure, which predominantly contains precious metals, lies about 800 meters east of the Napoleon Structure in the western segment of the Panuco district. Currently, the indicated resources within the Copala Structure are at 51.1 Moz AgEq with a density of 516 g/t AgEq, and inferred resources at 55.4 Moz AgEq with a density of 617 g/t AgEq. These resources are housed in a large vein-breccia interlayered with host rock, reaching thicknesses up to 82 meters. Vizsla’s geologists suggest that the average dip of the Copala is roughly 46 degrees eastward, varying from 35 degrees in the north to about 52 degrees in the south.

With continuous drilling, mineralization in the Copala Structure has been traced for about 1,670 meters horizontally and approximately 400 meters vertically. The southeast and north regions remain open for high-grade silver-gold mineralization. The recent expansion drillings, consisting of 15 holes in the southern part of Copala and five in the north, targeted the main Copala structure and the Copala 2 vein. Findings show that the Copala structure extends southeastward beyond the initial resource assessment in January 2023. Vizsla aims to perform infill drillings to test and expand high-grade zones identified in the southeast.

The Copala 2 vein, situated at the footwall of the main Copala, is bounded up-dip by Copala, west by Tajitos, and east by the Copala Fault. It has a northeast strike and a southeast dip of roughly 48 degrees, and has been traced for approximately 330 meters horizontally and 290 meters vertically. The company’s previous results from the Copala 2 vein were released on May 19, 2022.

Vizsla geologists have discovered a new near-surface structure named “El Habal” in the southeast with hole CS-23-291. The team is currently re-examining and sampling other holes in the area to understand this newly identified structure.

So far, Vizsla has completed approximately 55,000 meters of its fully funded 90,000-meter drilling program for 2023.

The Panuco project, situated near the city of Mazatlán in southern Sinaloa, Mexico, is a newly consolidated, high-grade discovery encompassing a 7,189.5-hectare, previously producing district. It features more than 86 kilometers of total vein length, 35 kilometers of underground mines, roads, power, and permits.

These deposits, which are mostly silver and gold, originate from siliceous volcanism and crustal extension during the Oligocene and Miocene eras. The deposits lie within continental volcanic rocks correlated to the Tarahumara Formation.

As of a technical report filed on March 10, 2023, the Panuco Project was estimated to contain an in-situ indicated mineral resource of 104.8 Moz AgEq and an in-situ inferred resource of 114.1 Moz AgEq.

Highlights from the results are as follows:

- CS-23-297 returned 445 grams per tonne (g/t) silver equivalent (AgEq) over 18.50 metres true width (mTW) (310 g/t silver and 2.32 g/t gold)

- CS-23-290 returned 760 g/t AgEq over 5.05 mTW (565 g/t silver and 3.48 g/t gold)

- Including 3,469 g/t AgEq over 1.00 mTW (2,838 g/t silver and 12.29 g/t gold)

- CS-23-286 returned 640 g/t AgEq over 4.80 mTW (417 g/t silver and 3.74 g/t gold)

- Including 2,568 g/t AgEq over 0.68 mTW (1,585 g/t silver and 16.20 g/t gold)

- CS-23-294 returned 7,512 g/t AgEq over 1.00 mTW (6,880 g/t silver and 16.50 g/t gold)

Table 1: Downhole drill intersections from the holes reported for Copala structure and Cristiano vein.

|

Drillhole |

From |

To |

Downhole Length |

Estimated True width |

Ag |

Au |

AgEq |

Vein |

|

|

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(g/t) |

|||

|

CS-23-280 |

353.55 |

355.00 |

1.45 |

1.27 |

1,240 |

3.64 |

1,399 |

Copala |

|

|

CS-23-281 |

789.50 |

790.60 |

1.10 |

0.80 |

57 |

26.40 |

1,835 |

Copala 3 |

|

|

CS-23-282 |

No Significant Values |

Copala |

|||||||

|

CS-23-283 |

552.20 |

553.60 |

1.40 |

1.07 |

279 |

0.50 |

293 |

Cristiano |

|

|

CS-23-284A |

No Significant Values |

Copala |

|||||||

|

CS-23-285 |

No Significant Values |

Copala |

|||||||

|

CS-23-285 |

418.10 |

419.35 |

1.25 |

0.78 |

335 |

1.77 |

431 |

Cristiano |

|

|

CS-23-286 |

639.50 |

645.85 |

6.35 |

4.80 |

417 |

3.74 |

640 |

Copala |

|

|

Includes |

643.50 |

644.40 |

0.90 |

0.68 |

1,585 |

16.20 |

2,568 |

||

|

CS-23-286 |

691.50 |

698.50 |

7.00 |

4.90 |

160 |

0.44 |

178 |

Copala 3 |

|

|

CS-23-287 |

No Significant Values |

Copala |

|||||||

|

CS-23-288 |

No Significant Values |

Copala |

|||||||

|

CS-23-289 |

No Significant Values |

Copala |

|||||||

|

CS-23-290 |

No Significant Values |

Copala |

|||||||

|

CS-23-290 |

557.80 |

588.70 |

30.90 |

5.05 |

565 |

3.48 |

760 |

Copala 2 |

|

|

Includes |

557.80 |

563.95 |

6.15 |

1.00 |

2,838 |

12.29 |

3,469 |

||

|

CS-23-291 |

265.50 |

270.00 |

4.50 |

4.40 |

145 |

3.72 |

386 |

El Habal |

|

|

CS-23-291 |

No Significant Values |

Copala |

|||||||

|

CS-23-292 |

458.45 |

459.30 |

0.85 |

0.79 |

239 |

1.51 |

324 |

Copala |

|

|

CS-23-293A |

No Significant Values |

Copala |

|||||||

|

CS-23-294 |

561.70 |

562.80 |

1.10 |

1.00 |

6,880 |

16.50 |

7,512 |

Copala |

|

|

CS-23-295 |

No Significant Values |

Copala |

|||||||

|

CS-23-296 |

No Significant Values |

Copala |

|||||||

|

CS-23-297 |

140.45 |

159.35 |

18.90 |

18.50 |

310 |

2.32 |

445 |

Copala |

|

|

CS-23-297 |

290.00 |

294.00 |

4.00 |

3.65 |

244 |

1.77 |

347 |

Copala 2 |

|

|

CS-23-298 |

631.60 |

633.50 |

1.90 |

1.83 |

212 |

1.14 |

274 |

Copala |

|

|

CS-23-299 |

694.75 |

695.75 |

1.00 |

0.90 |

972 |

3.36 |

1,131 |

Copala |

|

|

Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022). |

Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13.

|

Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

|

CS-23-280 |

404,775 |

2,587,802 |

572 |

234.7 |

-28 |

498 |

|

CS-23-281 |

405,277 |

2,586,491 |

677 |

278.3 |

-61.2 |

811.5 |

|

CS-23-282 |

405,025 |

2,586,223 |

641 |

265.5 |

-45.3 |

444 |

|

CS-23-283 |

405,119 |

2,586,386 |

646 |

258 |

-59.5 |

670.5 |

|

CS-23-284A |

404,775 |

2,587,801 |

572 |

217 |

-26 |

543 |

|

CS-23-285 |

405,025 |

2,586,224 |

641 |

266.5 |

-63.5 |

504 |

|

CS-23-286 |

405,276 |

2,586,491 |

677 |

261 |

-60 |

766.5 |

|

CS-23-287 |

405,141 |

2,586,298 |

645 |

256.1 |

-62.9 |

700.5 |

|

CS-23-288 |

405,174 |

2,586,229 |

656 |

254 |

-58 |

702 |

|

CS-23-289 |

405,211 |

2,586,349 |

661 |

270 |

-62 |

714 |

|

CS-23-290 |

404,776 |

2,587,801 |

572 |

202 |

-25 |

688.5 |

|

CS-23-291 |

405,276 |

2,586,491 |

677 |

261.8 |

-66.6 |

807 |

|

CS-23-292 |

405,174 |

2,586,229 |

656 |

239.6 |

-47.7 |

570 |

|

CS-23-293A |

404,775 |

2,587,802 |

572 |

246 |

-26 |

505.5 |

|

CS-23-294 |

405,210 |

2,586,347 |

648 |

246 |

-64.5 |

735 |

|

CS-23-295 |

405,276 |

2,586,491 |

677 |

288.3 |

-56 |

784.5 |

|

CS-23-296 |

405,261 |

2,586,245 |

665 |

239.7 |

-52.7 |

600 |

|

CS-23-297 |

404,674 |

2,587,217 |

533 |

290 |

-53 |

412.5 |

|

CS-23-298 |

405,440 |

2,586,181 |

629 |

255 |

-49 |

753 |

|

CS-23-299 |

405,401 |

2,586,489 |

618 |

252.3 |

-53.4 |

793.5 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

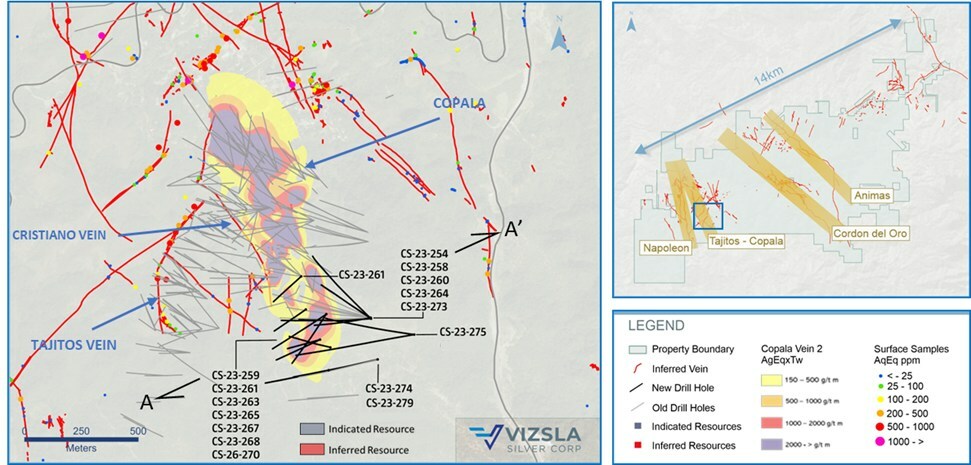

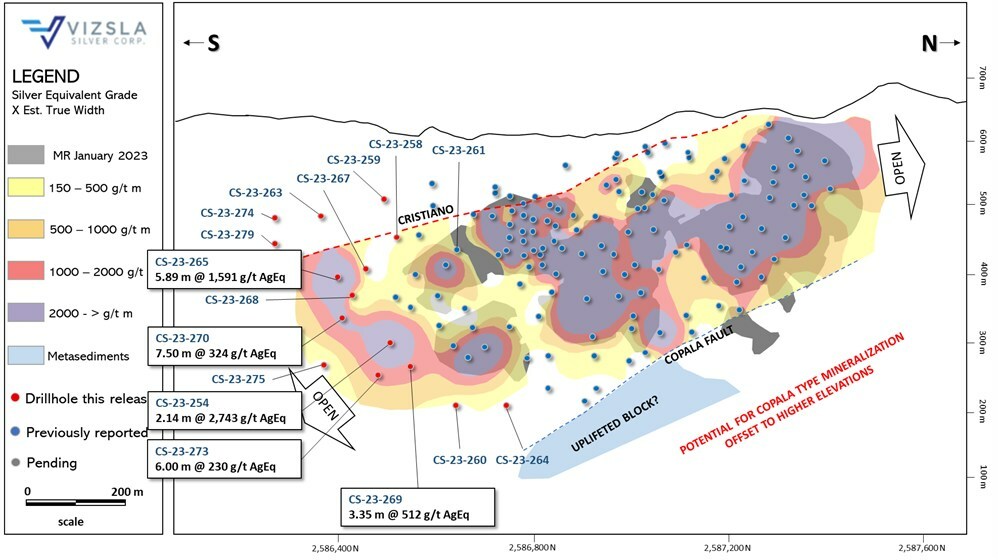

Vizsla Silver (TSXV: VZLA) has unveiled new drilling results from 16 extension holes at the Copala resource area within the company’s flagship Panuco silver-gold project in Mexico. The latest findings demonstrate a 150-meter lateral expansion of the Copala mineralized footprint to the southeast. The Copala structure, primarily composed of precious metals, is situated in the western part of the Panuco district, about 800 meters east of the Napoleon structure. Current indicated resources at Copala include 51.1 Moz AgEq at 516 g/t AgEq, with inferred resources of 55.4 Moz AgEq at 617 g/t AgEq, hosted in a broad envelope of vein-breccia and host rock up to 82 meters thick.

Michael Konnert, President & CEO, commented in a press release: “Step-out drilling along the southern extent of Copala continues to deliver high-grades over broad widths, beyond the January 2023 resource wireframes. Today’s results extend the Copala mineralized footprint by ~150m to the south of previously reported drilling and represents a potential shoot of new mineralization with a vertical profile of ~280m. We currently have four drill rigs targeting Copala, three focused on expanding the current resource base on the south and one exploration rig testing the lateral potential, to the north. With numerous open-ended intercepts containing very high silver and gold grades over large intervals up to 82m thick, the Copala structure remains a primary focus for both resource expansion and exploration ahead of the next resource update planned for the fourth quarter of 2023.”

Vizsla geologists have identified an average dip of approximately 46° to the east in the Copala structure, which varies from 35° in the northern sector to 52° in the southern sector. With ongoing drilling, mineralization has now been tracked along roughly 1,250 meters of strike length and 400 meters down dip. High-grade silver-gold mineralization remains open to the southeast and north. The recently completed resource expansion drilling, consisting of 16 holes spaced at around 100-meter intervals in Copala’s southern extent, revealed that the structure extends southeast beyond the January 2023 resource and has the potential to host additional high-grade shoots down dip. Holes CS-23-265, -270, -254, -273, and -269 all intersected precious metal-rich mineralization with grades exceeding 1,000 g/t m over a vertical distance of around 280 meters.

Vizsla has completed approximately 35,000 meters of its fully funded 90,000-meter 2023 drilling program. The Panuco silver-gold project, a recently consolidated high-grade discovery located in southern Sinaloa, Mexico, near Mazatlán, spans 7,189.5 hectares. The past-producing district boasts over 86 kilometers of total vein extent, 35 kilometers of underground mines, roads, power, and permits. The Panuco Project is home to an estimated in-situ indicated mineral resource of 104.8 Moz AgEq and an in-situ inferred resource of 114.1 Moz AgEq. An updated NI 43-101 technical report, titled “Technical Report on the Mineral Resource Estimate Update for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico,” was filed on SEDAR on March 10, 2023, with an effective date of January 19, 2023.

Highlights from the results are as follows:

- CS-23-265 returned 1,591 grams per tonne (g/t) silver equivalent (AgEq) over 5.89 metres true width (mTW) (1,403 g/t silver and 4.24 g/t gold)

- Including 4,842 g/t AgEq over 1.62 mTW (4,245 g/t silver and 13.24 g/t gold)

- And 396 g/t AgEq over 4.90 mTW (345 g/t silver and 1.12 g/t gold)

- Including 1,005 g/t AgEq over 1.24 mTW (923 g/t silver and 2.17 g/t gold)

- CS-23-254 returned 2,743 g/t AgEq over 2.14 mTW (1,319 g/t silver and 22.46 g/t gold)

- Including 5,222 g/t AgEq over 1.03 mTW (2,320 g/t silver and 45.40 g/t gold)

- CS-23-269 returned 1,080 g/t AgEq over 1.45 mTW (789 g/t silver and 5.13 g/t gold) hosted within a broader interval grading 512 g/t AgEq over 3.35 mTW

Table 1: Downhole drill intersections from the holes reported for Copala structure and Cristiano vein.

|

Drillhole |

From |

To |

Downhole |

Estimated |

Ag |

Au |

AgEq |

Vein |

||||

|

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(g/t) |

||||||

|

CS-23-254 |

520.00 |

527.75 |

7.75 |

5.72 |

128 |

0.82 |

175 |

HW splay |

||||

|

CS-23-254 |

535.40 |

538.30 |

2.90 |

2.14 |

1,319 |

22.46 |

2,743 |

Copala |

||||

|

Includes |

535.40 |

536.80 |

1.40 |

1.03 |

2,320 |

45.40 |

5,222 |

|||||

|

CS-23-254 |

No significant assays |

Cristiano |

||||||||||

|

CS-23-258 |

No significant assays |

Copala |

||||||||||

|

CS-23-259 |

No significant assays |

Copala |

||||||||||

|

CS-23-259 |

215.90 |

216.30 |

0.40 |

0.38 |

321 |

1.31 |

387 |

Cristiano |

||||

|

CS-23-260 |

No significant assays |

Copala |

||||||||||

|

CS-23-261 |

No significant assays |

Copala |

||||||||||

|

CS-23-261 |

366.95 |

367.50 |

0.55 |

0.35 |

256 |

1.27 |

323 |

Cristiano |

||||

|

CS-23-263 |

No significant assays |

Copala |

||||||||||

|

CS-23-264 |

No significant assays |

Copala |

||||||||||

|

CS-23-265 |

380.60 |

388.95 |

8.35 |

5.89 |

1,403 |

4.24 |

1,591 |

Copala |

||||

|

Includes |

386.65 |

388.95 |

2.30 |

1.62 |

4,245 |

13.24 |

4,842 |

|||||

|

CS-23-265 |

402.00 |

407.95 |

5.95 |

4.90 |

345 |

1.12 |

396 |

Cristiano |

||||

|

Includes |

403.50 |

405.00 |

1.50 |

1.24 |

923 |

2.17 |

1,005 |

|||||

|

CS-23-267 |

345.00 |

346.50 |

1.50 |

1.15 |

93 |

0.61 |

127 |

Copala |

||||

|

CS-23-267 |

438.70 |

440.80 |

2.10 |

1.68 |

652 |

2.96 |

806 |

Cristiano |

||||

|

Includes |

438.70 |

440.00 |

1.30 |

1.04 |

916 |

4.31 |

1,143 |

|||||

|

CS-23-268 |

No significant assays |

Copala |

||||||||||

|

CS-23-268 |

429.35 |

430.50 |

1.15 |

1.05 |

171 |

0.89 |

219 |

Cristiano |

||||

|

CS-23-269 |

512.45 |

515.80 |

3.35 |

3.35 |

376 |

2.41 |

512 |

Copala |

||||

|

Includes |

512.45 |

513.90 |

1.45 |

1.45 |

789 |

5.13 |

1,080 |

|||||

|

CS-23-270 |

439.80 |

448.20 |

8.40 |

7.50 |

289 |

0.82 |

324 |

Copala |

||||

|

Includes |

439.80 |

441.20 |

1.40 |

1.25 |

1,220 |

2.40 |

1,297 |

|||||

|

Includes |

447.00 |

448.20 |

1.20 |

1.07 |

524 |

2.63 |

665 |

|||||

|

CS-23-270 |

475.50 |

476.40 |

0.90 |

0.75 |

284 |

1.11 |

339 |

Cristiano |

||||

|

CS-23-273 |

523.50 |

529.85 |

6.35 |

6.00 |

158 |

1.23 |

230 |

Copala |

||||

|

CS-23-274 |

No significant assays |

Copala |

||||||||||

|

CS-23-274 |

No significant assays |

Cristiano |

||||||||||

|

CS-23-275 |

No significant assays |

Copala |

||||||||||

|

CS-23-275 |

753.65 |

754.50 |

0.85 |

0.65 |

158 |

0.48 |

179 |

Cristiano |

||||

|

CS-23-279 |

No significant assays |

Copala |

||||||||||

|

CS-23-279 |

No significant assays |

Cristiano |

||||||||||

|

Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022). |

Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13.

|

Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

|

CS-23-254 |

405,085 |

2,586,570 |

696 |

266.0 |

-63.0 |

661.5 |

|

CS-23-258 |

404,834 |

2,586,561 |

651 |

271.7 |

-62.7 |

321.0 |

|

CS-23-259 |

404,798 |

2,586,610 |

637 |

235.9 |

-44.0 |

237.0 |

|

CS-23-260 |

405,085 |

2,586,570 |

697 |

307.0 |

-68.0 |

708.0 |

|

CS-23-261 |

404,778 |

2,586,756 |

629 |

227.0 |

-68.0 |

421.5 |

|

CS-23-263 |

404,860 |

2,586,478 |

662 |

245.0 |

-50.0 |

333.0 |

|

CS-23-264 |

405,085 |

2,586,570 |

697 |

314.0 |

-62.0 |

795.0 |

|

CS-23-265 |

404,861 |

2,586,478 |

662 |

254.0 |

-69.0 |

433.5 |

|

CS-23-267 |

404,888 |

2,586,590 |

664 |

235.1 |

-65.3 |

582.0 |

|

CS-23-268 |

404,906 |

2,586,444 |

654 |

287.0 |

-71.5 |

538.5 |

|

CS-23-269 |

405,085 |

2,586,570 |

697 |

281.0 |

-66.8 |

678.0 |

|

CS-23-270 |

404,888 |

2,586,590 |

664 |

215.7 |

-71.0 |

691.5 |

|

CS-23-273 |

405,084 |

2,586,574 |

700 |

260.8 |

-69.7 |

730.5 |

|

CS-23-274 |

404,898 |

2,586,343 |

648 |

259.0 |

-45.0 |

411.0 |

|

CS-23-275 |

405,275 |

2,586,500 |

670 |

261.0 |

-52.0 |

810.0 |

|

CS-23-279 |

404,898 |

2,586,343 |

648 |

259.0 |

-59.0 |

477.0 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

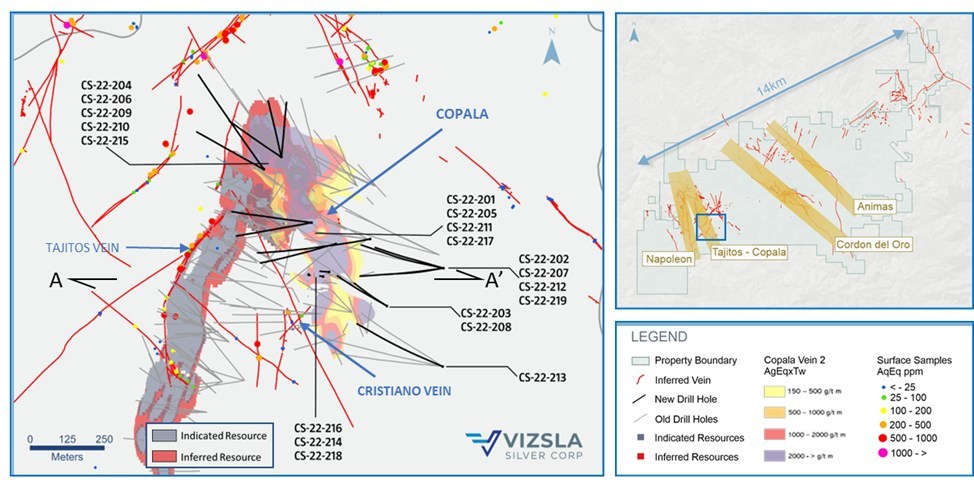

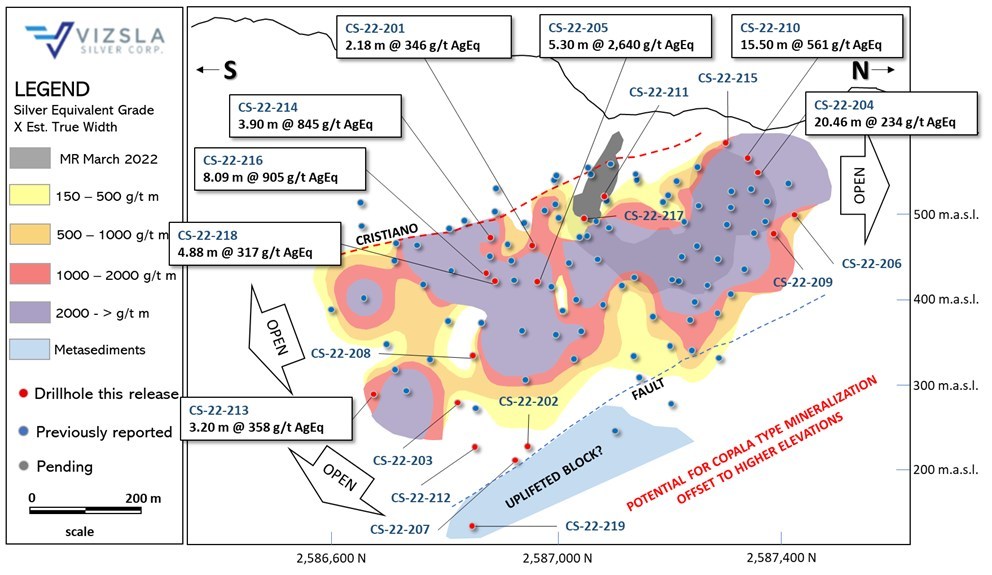

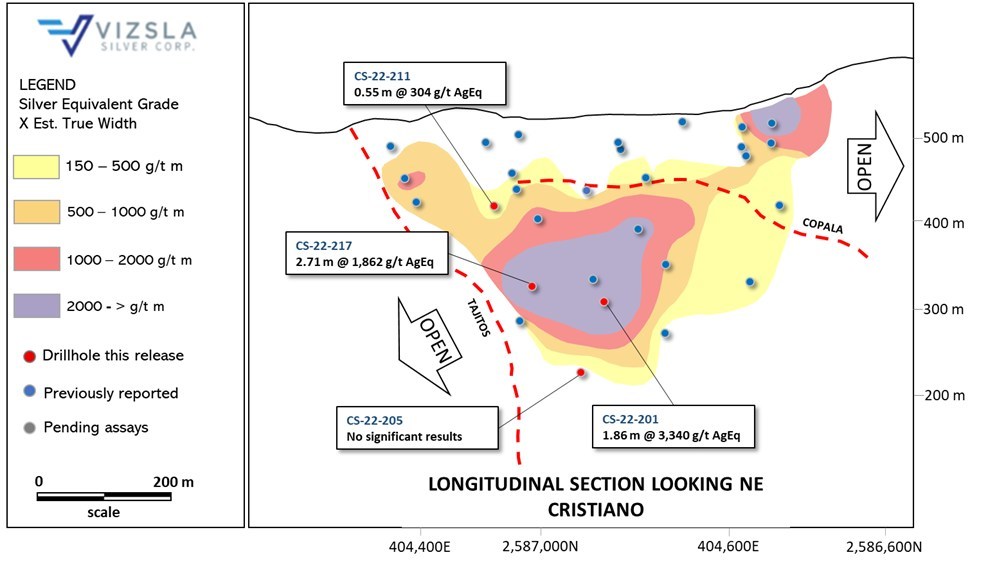

Viszla Silver (TSXV:VZLA) has reported new results from 19 new drill holes at the Tajitos – Copala resource area at the Panuco silver-gold project in Mexico. The company’s intercepts are a part of the ongoing 2022 infill-expansionary drill program at the Copala and Cristiano structures in the western section of the district.

Infill results now support grade continuity in the south-central portion of the Copala structure. Continued resource expansion drilling to the north and southeast highlights that mineralization remains open.

Michael Konnert, President and CEO commented in a press release: “The Copala structure continues to impress with high precious metals grades over very broad width. Infill drilling within the Tajitos-Copala resource area continues to highlight exceptional mineral continuity marked by multiple intervals grading well over 1,000 grams per tonne, while expansionary drilling to the north and southeast demonstrate a growing high-grade footprint. Additionally, at Cristiano, drilling has now traced mineralization over 600 metres long by 300 metres deep. We note that Cristiano was not included in the maiden resource, however, given its near surface, high-grade continuity, we expect it will contribute materially to the pending resource update. We have had a phenomenal year of exploration success at Panuco and have expanded mineralization well beyond the March 2022 resource boundary at virtually every zone. Given the amount of new high grade drill results, inclusion of new mineralized structures, and the fast-approaching holiday season, we have elected to publish the resource update in early 2023. We are extremely pleased with the outcome of our 2022 programs and look forward to another outstanding year as we continue to grow and de-risk the Panuco Project in 2023.”

Highlights from the results are as follows:

Highlights

- CS-22-205 returned 2,640 grams per tonne (g/t) silver equivalent (AgEq) over 5.30 metres true width (mTW) (2,101 g/t silver and 9.54 g/t gold)

- Including 4,563 g/t AgEq over 0.58 mTW (3,080 g/t silver and 23.60 g/t gold)

- CS-22-210 returned 561 g/t AgEq over 15.50 mTW (425 g/t silver and 2.31 g/t gold)

- And 2,044 g/t AgEq over 1.01 mTW (1,630 g/t silver and 7.34 g/t gold)

- CS-22-216 returned 905 g/t AgEq over 8.09 mTW (626 g/t silver and 4.48 g/t gold)

- CS-22-201 returned 3,340 g/t AgEq over 1.86 mTW (2,536 g/t silver and 13.65 g/t gold)

- CS-22-217 returned 1,862 g/t AgEq over 2.71 mTW (1,495 g/t silver and 6.56 g/t gold)

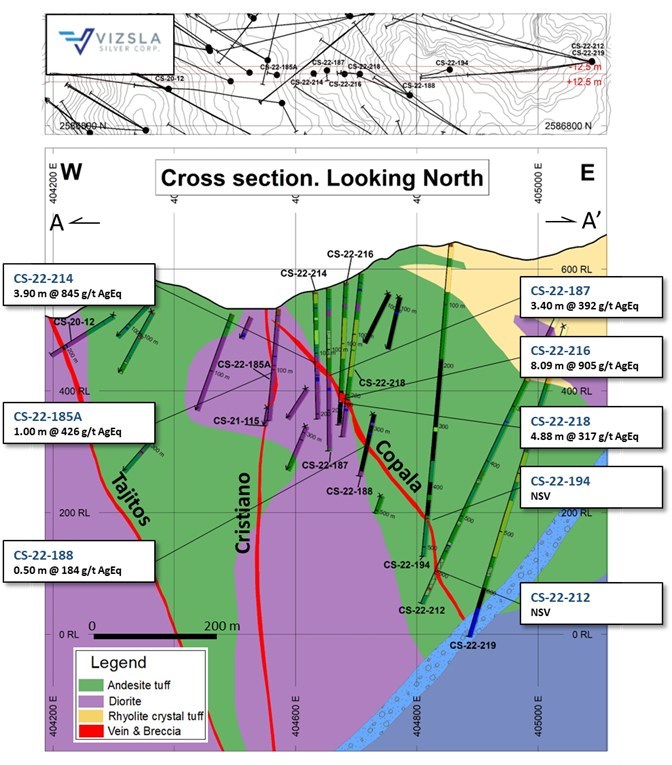

The Copala Structure is located in the western portion of the Panuco district at the northern extent of the Tajitos structure. Copala hosts high precious metals grades (up to 11,053 g/t silver and 33.50 g/t gold over 1.26 mTW) contained within a broader envelope of vein-breccia interlayered with host rock, up to 82 metres thick. Ongoing interpretations by Vizsla’s geologists suggest Copala has an average dip of ~46° to the east (~35° in its northern sector and steepening to ~52° in the southern sector).

Drilling at Copala has now traced mineralization along approximately 1,000 metres of strike length and approximately 400 metres down dip. High-grade silver-gold mineralization remains open to the north and southeast with ongoing detailed structural and geologic interpretations indicating the potential for mineralization to continue into the footwall side of the Tajitos Vein. The ongoing infill-drilling program, which consists of 25 holes drilled at 25 metre centers, was designed to assess grade continuity and to provide sample material for future metallurgical tests. To date, infill-holes CS-22-201, CS-22-205, CS-22-214, CS-22-216 and CS-22-218 have confirmed high-grade at tighter spacing. Additionally, step-out holes drilled to the east, particularly holes CS-22-202, CS-22-207 and CS-22-219, suggest an uplifted block of basement metasediments in fault-contact with andesites and diorite (see figures 2 and 4). Vizsla´s team is working on interpretations to determine the amount of displacement by the fault, to define a target elevation for Copala type mineralization on the footwall side (east) of the fault; i.e. an uplifted block on the east creates potential for Copala type mineralization at shallower elevation. Vizsla plans to test this hypothesis with drill-holes collared on the footwall side of the fault.

The Cristiano Vein is a precious metals rich structure located at the southwestern margin of the Copala structure. Cristiano is marked by a quartz-carbonate epithermal-vein striking N25°W that dips sub-vertical (85°) to the NE. Drill-holes intersecting Cristiano to date, highlight a high-grade zone plunging to the NW, with vertical extent of 300 metres and approximate strike length of 600 metres. The Cristiano Vein ranges in thickness from 0.7 mTW to 3.5 mTW, with a weighted average grade of 542 g/t silver equivalent.

The Cristiano Vein was initially discovered while targeting the Tajitos-Copala veins, where drilling intercepted the well-mineralized, NW-SE trending fault. Ongoing drilling has now led to new observations and interpretations allowing Vizsla geologists to plan drill holes specifically designed to explore Cristiano along strike and to depth. To the northwest, Cristiano intersects and offsets the Tajitos Vein, suggesting Cristiano post-dates Tajitos mineralization, thus creating a drill target on the footwall of Tajitos (Figure 3). Additionally, open ended intercepts to the southeast suggest mineralization continues in this direction.

Source: Vizsla Silver

| Drillhole | From | To | Downhole Length | Estimated True width | Ag | Au | AgEq | Vein | ||

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||

| CS-22-201 | 212.25 | 214.80 | 2.55 | 2.18 | 237 | 1.74 | 346 | Copala | ||

| Includes | 212.25 | 213.55 | 1.30 | 1.11 | 427 | 3.22 | 629 | |||

| CS-22-201 | 392.15 | 396.00 | 3.85 | 1.86 | 2,536 | 13.65 | 3,340 | Cristiano | ||

| Includes | 392.90 | 393.30 | 0.40 | 0.19 | 7,740 | 57.60 | 11,343 | |||

| Includes | 393.70 | 394.60 | 0.90 | 0.43 | 6,220 | 27.20 | 7,742 | |||

| CS-22-202 | No significant values | Copala | ||||||||

| CS-22-203 | No significant values | Copala | ||||||||

| CS-22-204 | 132.00 | 158.70 | 26.70 | 20.46 | 175 | 0.99 | 234 | Copala | ||

| Includes | 147.25 | 148.50 | 1.25 | 0.96 | 569 | 2.92 | 739 | |||

| Includes | 153.30 | 154.30 | 1.00 | 0.77 | 454 | 2.43 | 597 | |||

| Includes | 156.50 | 157.50 | 1.00 | 0.77 | 673 | 3.42 | 872 | |||

| Includes | 157.50 | 158.70 | 1.20 | 0.92 | 575 | 4.08 | 828 | |||

| CS-22-205 | 283.00 | 288.50 | 5.50 | 5.30 | 2,101 | 9.54 | 2,640 | Copala | ||

| Includes | 284.60 | 285.20 | 0.60 | 0.58 | 3,080 | 23.60 | 4,563 | |||

| CS-22-205 | 553.00 | 553.30 | 0.30 | 0.16 | 85 | 0.24 | 96 | Cristiano | ||

| CS-22-206 | 181.10 | 185.80 | 4.70 | 3.11 | 168 | 0.90 | 221 | Copala | ||

| CS-22-207 | No significant values | Copala | ||||||||

| CS-22-208 | No significant values | Copala | ||||||||

| CS-22-208 | 484.00 | 485.50 | 1.50 | 1.12 | 347 | 0.38 | 350 | FW Splay | ||

| Includes | 485.05 | 485.50 | 0.45 | 0.34 | 873 | 0.99 | 883 | |||

| CS-22-209 | 148.00 | 166.05 | 18.05 | 10.00 | 74 | 0.56 | 109 | Copala | ||

| Includes | 163.45 | 164.20 | 0.75 | 0.42 | 639 | 5.22 | 970 | |||

| CS-22-210 | 117.75 | 140.70 | 22.95 | 15.50 | 425 | 2.31 | 561 | Copala | ||

| Includes | 120.30 | 120.90 | 0.60 | 0.41 | 2,710 | 22.30 | 4,125 | |||

| Includes | 130.60 | 131.40 | 0.80 | 0.54 | 1,285 | 7.24 | 1,716 | |||

| Includes | 131.40 | 132.00 | 0.60 | 0.41 | 1,800 | 9.69 | 2,371 | |||

| Includes | 132.55 | 134.05 | 1.50 | 1.01 | 1,630 | 7.34 | 2,044 | |||

| CS-22-211 | No significant values | Copala | ||||||||

| CS-22-211 | 240.00 | 241.85 | 1.85 | 0.55 | 154 | 2.24 | 304 | Cristiano | ||

| CS-22-211 | 283.25 | 284.50 | 1.25 | 1.25 | 1,103 | 3.76 | 1,296 | Tajitos | ||

| CS-22-212 | No significant values | Copala | ||||||||

| CS-22-213 | 545.10 | 548.60 | 3.50 | 3.20 | 294 | 1.19 | 358 | Copala | ||

| Includes | 546.50 | 547.95 | 1.45 | 1.33 | 308 | 2.08 | 436 | |||

| CS-22-214 | 114.00 | 121.05 | 7.05 | 3.90 | 593 | 4.07 | 845 | Copala | ||

| Includes | 115.50 | 116.80 | 1.30 | 0.72 | 2,020 | 13.50 | 2,850 | |||

| Includes | 116.80 | 117.50 | 0.70 | 0.39 | 681 | 4.22 | 937 | |||

| CS-22-215 | 112.50 | 115.50 | 3.00 | 2.35 | 216 | 0.66 | 248 | Copala | ||

| Includes | 114.00 | 115.50 | 1.50 | 1.18 | 335 | 1.03 | 385 | |||

| CS-22-216 | 181.00 | 194.50 | 13.50 | 8.09 | 626 | 4.48 | 905 | Copala | ||

| Includes | 184.65 | 186.00 | 1.35 | 0.81 | 1,250 | 14.00 | 2,170 | |||

| Includes | 186.00 | 186.95 | 0.95 | 0.57 | 2,230 | 18.10 | 3,376 | |||

| Includes | 186.95 | 188.20 | 1.25 | 0.75 | 1,170 | 7.54 | 1,631 | |||

| CS-22-217 | No significant values | Copala | ||||||||

| CS-22-217 | 325.50 | 330.35 | 4.85 | 2.71 | 1,495 | 6.56 | 1,862 | Cristiano | ||

| Includes | 327.60 | 328.75 | 1.15 | 0.64 | 1,295 | 4.59 | 1,535 | |||

| Includes | 328.75 | 329.10 | 0.35 | 0.20 | 13,118 | 63.70 | 16,783 | |||

| CS-22-218 | 209.60 | 215.30 | 5.70 | 4.88 | 197 | 1.86 | 317 | Copala | ||

| Includes | 211.50 | 213.00 | 1.50 | 1.28 | 283 | 3.19 | 493 | |||

| Includes | 213.00 | 214.15 | 1.15 | 0.98 | 280 | 2.58 | 446 | |||

| CS-22-219 | No intercepted | |||||||||

Table 1: Downhole drill intersections from the holes reported for the new splay vein at the foot wall of Copala. Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $20.70/oz silver and $1,655/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022).

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| CS-22-201 | 404,724 | 2,586,986 | 595 | 257 | -57.7 | 462.0 |

| CS-22-202 | 405,087 | 2,586,905 | 646 | 282 | -63.6 | 634.5 |

| CS-22-203 | 404,896 | 2,586,778 | 666 | 302 | -75.0 | 556.5 |

| CS-22-204 | 404,539 | 2,587,280 | 553 | 304 | -30.8 | 250.2 |

| CS-22-205 | 404,840 | 2,587,003 | 590 | 260 | -50.0 | 596.5 |

| CS-22-206 | 404,541 | 2,587,280 | 552 | 347 | -35.0 | 237.0 |

| CS-22-207 | 405,087 | 2,586,905 | 646 | 286 | -68.2 | 628.0 |

| CS-22-208 | 404,896 | 2,586,778 | 666 | 299 | -67.9 | 505.5 |

| CS-22-209 | 404,541 | 2,587,280 | 553 | 5 | -43.3 | 257.0 |

| CS-22-210 | 404,482 | 2,587,238 | 553 | 323 | -30.0 | 451.0 |

| CS-22-211 | 404,643 | 2,587,058 | 557 | 277 | -39.5 | 349.5 |

| CS-22-212 | 405,087 | 2,586,905 | 646 | 263 | -64.9 | 658.5 |

| CS-22-213 | 405,084 | 2,586,574 | 700 | 295 | -58.8 | 637.5 |

| CS-22-214 | 404,632 | 2,586,883 | 568 | 91 | -89.1 | 208.5 |

| CS-22-215 | 404,482 | 2,587,237 | 553 | 298 | -30.0 | 300.0 |

| CS-22-216 | 404,681 | 2,586,877 | 582 | 271 | -87.0 | 234.0 |

| CS-22-217 | 404,643 | 2,587,058 | 557 | 260 | -54.0 | 452.0 |

| CS-22-218 | 404,701 | 2,586,892 | 595 | 271 | -84.6 | 270.0 |

| CS-22-219 | 405,087 | 2,586,905 | 565 | 262 | -71.4 | 681.0 |

Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

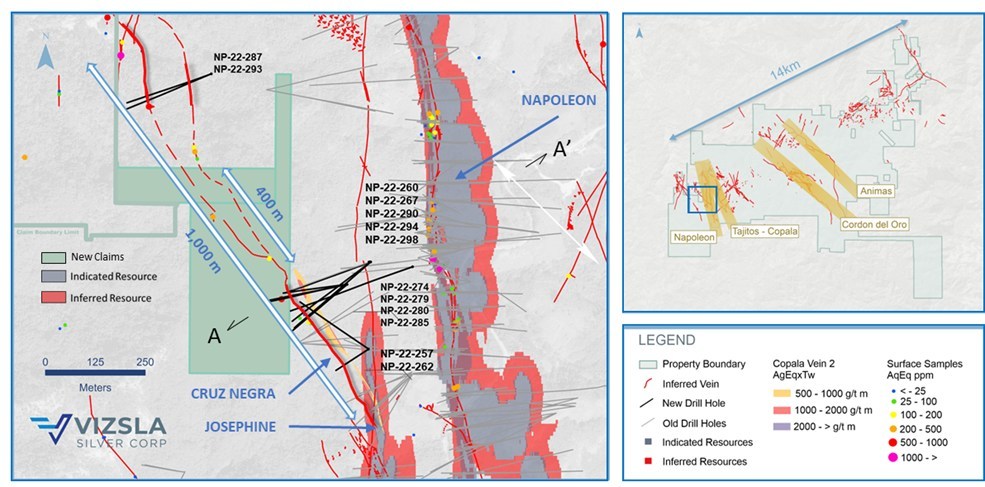

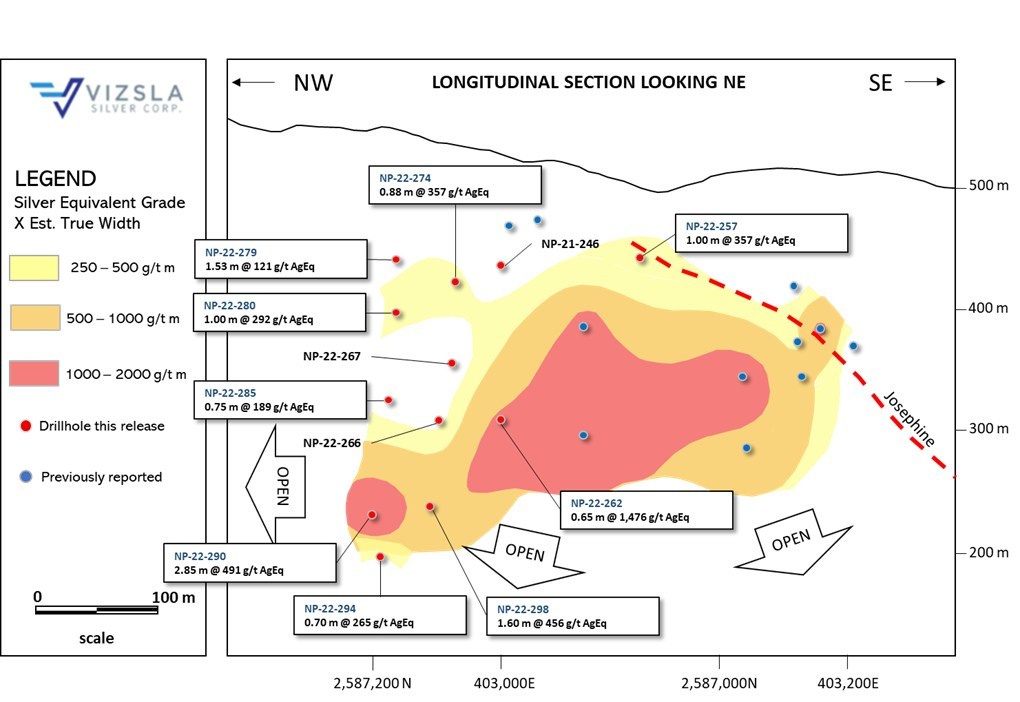

Vizsla Silver (TSXV:VZLA) has announced new results from 13 new drill holes targeting the Cruz Negra Vein in the western portion of the district. The company has reported it has expanded mineralization of West Napolean, and has added new claims at the same time at the 100%-owned Panuco silver-gold project in Mexico.

The results are based on the Cruz Negra Vein, which is 250 meters west of the Napoleon mining area. The northwest and southeast extensions of Cruz Negra, which are currently located on pre-existing Vizsla claims and cover approximately 400 meters of new potentially mineralized vein strike to explore, were added to the claim portfolio.

The Vein of the Cruz Negra, 250 meters west of the Napoleon deposit, is an intensely dipping northwest striking vein-breccia. The quartz veining and disseminated sphalerite and galena in the vein breccia are caused by quartz cement bearing disseminated sphalerite and galena. Drilling to date has tested Cruz Negra at a depth of approximately 400 meters from the Josephine Vein.

Furthermore, hole NP-22-293 studied the possible northwest extension and yielded 535 g/t AgEq over 0.76 mTW, revealing that the mineralization extends for another 500 metres on the newly acquired claims. The drilling also displayed potential vein splays or cymoid loops that could significantly impact silver and gold grades.

At Cruz Negra, mineralized intercepts have estimated true widths ranging from 0.65 to 3.10 metres, with grades ranging from 265 to 3,499 g/t AgEq. Mineralization is open at depth and northwest of the current drilling area, where Vizsla plans to complete detailed mapping and start drilling again in the near future to explore the 500 metre gap between known areas of mineralization.

Vizsla’s organic growth plan was implemented in the acquisition of two claims, with a combined surface area of 14.75 hectares that filled most of the 500 m gap between the open-ended intercepts.

Michael Konnert, President and CEO of Vizsla, commented in a press release: “Our ongoing mapping and sampling efforts in the western area of the district have highlighted several new drill ready targets including Cruz Negra. Initial drill results demonstrate mineralized continuity over approximately 400 metres long with large step outs to the northwest, suggesting the vein continues for at least another 500 metres. Our exploration team has done a phenomenal job this year identifying and expanding new mineralized structures directly outboard of the March 2022 resource areas. As of early September, we have achieved data cut-off for inclusion in the updated resource, slated for mid-December, and anticipate a material increase to contained precious metals.”

Highlights from the results are as follows:

- NP-22-274 returned 541 grams per tonne (g/t) silver equivalent (AgEq) over 2.09 metres true width (mTW) (413 g/t silver, 1.99 g/t gold, 0.16% Pb and 0.27% Zn)

- And 357 g/t AgEq over 0.88 mTW (258 g/t silver, 1.54 g/t gold, 0.01% Pb and 0.17% Zn)

- NP-22-262 returned 1,476 g/t AgEq over 0.65 mTW (168 g/t silver, 16.42 g/t gold, 0.86% Pb and 3.26% Zn)

- NP-22-290 returned 491 g/t AgEq over 2.85 mTW (76 g/t silver, 2.60 g/t gold, 0.57% Pb and 6.19% Zn)

- NP-22-293 returned 535 g/t AgEq over 0.76 mTW (481 g/t silver, 1.20 g/t gold, 0.02% Zn and 0.02% Pb)

- NP-22-298 returned 456 g/t AgEq over 1.60 mTW (297 g/t silver, 1.78 g/t gold, 0.31% Pb and 1.23% Zn)

|

Drillhole |

From |

To |

Downhole |

Estimated |

Ag |

Au |

Pb |

Zn |

AgEq |

Vein |

||

|

(m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

% |

% |

(g/t) |

||||

|

NP-22-257 |

100.50 |

102.00 |

1.50 |

1.00 |

142 |

1.14 |

0.43 |

3.73 |

357 |

Cruz Negra |

||

|

Includes |

101.40 |

102.00 |

0.60 |

0.40 |

316 |

2.72 |

0.53 |

6.50 |

734 |

|||

|

NP-22-262 |

191.60 |

193.35 |

1.75 |

0.65 |

289 |

2.38 |

0.77 |

0.70 |

486 |

HW vein |

||

|

Includes |

191.60 |

192.15 |

0.55 |

0.20 |

741 |

5.88 |

0.33 |

1.26 |

1,165 |

|||

|

NP-22-262 |

253.25 |

255.00 |

1.75 |

0.65 |

168 |

16.42 |

0.86 |

3.26 |

1,476 |

Cruz Negra |

||

|

Includes |

253.25 |

254.50 |

1.25 |

0.46 |

181 |

19.70 |

1.06 |

3.78 |

1,748 |

|||

|

NP-22-266 |

No significant values |

|||||||||||

|

NP-22-267 |

No significant values |

|||||||||||

|

NP-22-274 |

166.05 |

168.90 |

2.85 |

2.09 |

413 |

1.99 |

0.16 |

0.27 |

541 |

HW vein |

||

|

Includes |

168.55 |

168.90 |

0.35 |

0.26 |

2,490 |

12.85 |

0.61 |

0.87 |

3,287 |

|||

|

NP-22-274 |

193.30 |

194.50 |

1.20 |

0.88 |

258 |

1.54 |

0.01 |

0.17 |

357 |

Cruz Negra |

||

|

NP-22-279 |

172.20 |

174.35 |

2.15 |

1.53 |

72 |

0.56 |

0.07 |

0.34 |

121 |

Cruz Negra |

||

|

NP-22-280 |

205.55 |

207.40 |

1.85 |

1.00 |

187 |

1.40 |

0.15 |

0.39 |

292 |

Cruz Negra |

||

|

NP-22-280 |

224.15 |

226.70 |

2.55 |

1.38 |

91 |

0.73 |

0.22 |

0.64 |

137 |

FW vein |

||

|

NP-22-285 |

272.15 |

274.50 |

2.35 |

0.75 |

40 |

1.21 |

0.01 |

1.81 |

189 |

Cruz Negra |

||

|

NP-22-287* |

274.30 |

274.80 |

0.50 |

0.40 |

402 |

1.82 |

0.10 |

0.21 |

505 |

FW vein |

||

|

NP-22-290 |

356.00 |

360.05 |

4.05 |

2.85 |

76 |

2.60 |

0.57 |

6.19 |

491 |

Cruz Negra |

||

|

NP-22-293* |

12.10 |

13.30 |

1.20 |

0.76 |

481 |

1.20 |

0.02 |

0.02 |

535 |

|||

|

NP-22-294 |

378.85 |

379.85 |

1.00 |

0.70 |

66 |

0.43 |

1.27 |

3.91 |

265 |

Cruz Negra |

||

|

NP-22-298 |

380.50 |

383.05 |

2.55 |

1.60 |

297 |

1.78 |

0.31 |

1.23 |

456 |

Cruz Negra |

||

|

Table 1: |

Downhole drill intersections from the holes reported Cruz Negra vein on the Napoleon area. Note: AgEq = Ag ppm x Ag rec. + (((Au ppm x Au rec. x Au price/gram) + (Pb% x Pb rec. x Pb price/t) + (Zn% x Zn rec. x Zn price/t))/Ag price/gram). Metal price assumptions are $20.70/oz silver, $1,655/oz gold, $1,902/t lead and$2,505/t zinc. Metallurgical recoveries applied in the calculation (93% for silver, 90% for gold, 94% for lead and 94 % for zinc), were determined for the Napoleon vein (see press release dated February 17, 2022). NP-22-287* and NP-22-293* were drilled over 500 m NW from Cruz Negra vein intercepts. |

|

Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

|

NP-22-257 |

403,165 |

2,587,117 |

526 |

237.0 |

-59.0 |

192 |

|

NP-22-262 |

403,165 |

2,587,117 |

526 |

304.0 |

-60.0 |

414 |

|

NP-22-266 |

403,171 |

2,587,335 |

534 |

233.0 |

-53.2 |

411 |

|

NP-22-267 |

403,171 |

2,587,335 |

534 |

229.0 |

-44.7 |

354 |

|

NP-22-274 |

403,112 |

2,587,278 |

575 |

230.0 |

-53.2 |

315 |

|

NP-22-279 |

403,112 |

2,587,279 |

575 |

258.0 |

-52.3 |

342 |

|

NP-22-280 |

403,112 |

2,587,279 |

575 |

259.0 |

-61.3 |

423 |

|

NP-22-285 |

403,112 |

2,587,279 |

575 |

263.0 |

-67.9 |

423 |

|

NP-22-287 |

402,772 |

2,587,806 |

465 |

248.0 |

-45.0 |

340 |

|

NP-22-290 |

403,171 |

2,587,335 |

534 |

250.0 |

-59.2 |

417 |

|

NP-22-293 |

402,772 |

2,587,806 |

465 |

249.0 |

-53.3 |

380 |

|

NP-22-294 |

403,167 |

2,587,335 |

541 |

251.0 |

-65.6 |

480 |

|

NP-22-298 |

403,268 |

2,587,318 |

511 |

250.0 |

-45.5 |

465 |

|

|

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan