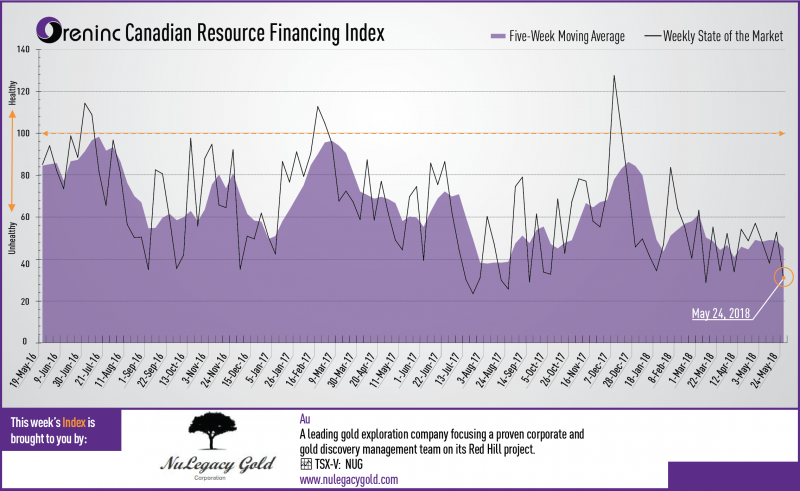

Last week index score: 52.74

This week: 30.90

The Oreninc Index fell in the week ending May 25th, 2018 to 30.90 from 52.74 a week ago despite gold recovering from the prior weeks’ fall below US$1,300/oz.

Gold recovered from a brief sojourn below the US$1,300/oz level as risk returned with US president Donald Trump calling off a landmark summit with North Korean leader Kim Jong Un. The yield on the US ten-year treasury fell below 3% as suggestions from the US Federal Reserve about a temporary rise in inflation raised questions over whether there will be multiple interest rate increases this year. All good news for gold. All eyes will be on the US Federal Reserve Open Market Committee meeting on June 12-13.

On to the money: total fund raises announced fell to C$38.8 million, an eleven-week low, which included two brokered financings for C$10.8 million, a two-week low and one bought deal financing for C$7.0 million, a two-week low. The average offer size fell to C$2.9 million, a three-week low and the number of financings fell to 13, an eleven-week low.

Gold closed at US$1,309/oz from US$1,293/oz a week ago. Gold is now down 0.04% this year. The US dollar index continued to increase and closed up at 94.25 from 93.63 a week ago. The Van Eck managed GDXJ made a slight gain after a volatile week closing up at US$32.89 from US$32.84 last week. The index is down 3.63% so far in 2018. The US Global Go Gold ETF fell slightly to close at US$12.93 from US$12.98 a week ago. It is now down 0.61% so far in 2018. The HUI Arca Gold BUGS Index closed up at 180.20 from 177.75 last week. The SPDR GLD ETF continued to sell off and closed its inventory at 848.50 tonnes from 855.28 tonnes a week ago.

In other commodities, silver made a small gain on a volatile week to close up at US$16.51/oz from US$16.44/oz a week ago. Copper showed a similar pattern to close up at US$3.07/lb from US$3.06/lb last week. Oil was the main loser of the week with its price taking a dump at the end of the week to close down at US$67.88 a barrel from US$71.28 a barrel a week ago.

The Dow Jones Industrial Average returned to growth to close up at 24,753 from 24,715 last week. Canada’s S&P/TSX Composite Index showed a slight loss to close down at 16,075 from 16,162 the previous week. The S&P/TSX Venture Composite Index also closed down at 775.41 from 786.39 last week.

Summary:

- Number of financings crumbled to 13, an eleven-week low.

- Two brokered financings were announced this week for C$10.8m, a two-week low.

- One bought-deal financing was announced this week for C$7.0m, a two-week low.

- Total dollars plunged to C$38.8m, an eleven-week low.

- Average offer size dropped to C$2.9m, a three-week low.

Financing Highlights

Probe Metals (TSX-V: PRB) opened a C$14 million financing.

- Bought deal with Sprott Capital Partners and a syndicate of underwriters

- Flow through units @ C$1.90 and non flow-through units @ C$1.15

- Each unit consists of one share and half a warrant exerciseable @ C$1.45 for two years.

- Underwriters option to purchase C$2.1 million in units.

- Gross proceeds will fund exploration on Probe’s projects in Québec.

- Closing is expected on June 19th.

Major Financing Openings:

- Great Bear Resources (TSX-V: GBR) opened a C$7.83 million offering on a best efforts basis. Each unit includes half a warrant that expires in 24 months.

- Probe Metals (TSX-V: PRB) opened a C$7 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis. Each unit includes half a warrant that expires in 24 months. The deal is expected to close on or about June 19th.

- Probe Metals (TSX-V: PRB) opened a C$7 million offering on a best efforts basis. The deal is expected to close on or about June 19th.

- Para Resources (TSX-V: PBR) opened a C$6.4 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months.

Major Financing Closings:

- SRG Graphite (TSX-V: SRG) closed a C$8 million offering underwritten by a syndicate led by National Bank Financial on a best efforts basis. Each unit included a warrant that expires in 12 months.

- Wealth Minerals (TSX-V: WML) closed a C$6.25 million offering on a best efforts basis. Each unit included half a warrant that expires in 24 months.

- Zinc One Resources (TSX-V: Z) closed a C$3.89 million offering on a best efforts basis. Each unit included half a warrant that expires in 36 months.

- Alexandra Capital (TSX-V: AXC) closed a C$2.6 million offering on a best efforts basis.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Last week index score: 45.85 (updated)

This week: 25.90

Prospero Silver (TSX-V: PSL) and Fortuna Silver Mines (TSX:FVI) amended their strategic financing agreement and amended the 2018 work program in Mexico.

NuLegacy Gold (TSX-V: NUG) began drilling on its Red Hill in the Cortez gold trend of Nevada.

Zinc One Resources (TSX-V: Z) announced additional drill results from the Mina Grande Sur zone at its Bongará zinc mine project in north-central Peru.

The Oreninc Index halved in the week ending May 11th, 2018 to 22.90 from an updated 45.85 a week ago as funding again dried up.

Another quiet and less volatile week that saw gold steadily build momentum throughout the week only to lose it at the end. The US and North Korea agreed to meet at a landmark presidential summit in Singapore. Meanwhile, US president Donald Trump pulled the US out of the 2015 Iran nuclear framework deal and said that the US will continue to impose sanctions on the country and any company that continues to do business with it to the ire of European countries.

On to the money…total fund raises announced fell to C$56.5 million, a seven-week low, which included no brokered financings, a five-week low, and no bought deal financings, also a five-week low. The average offer size grew to C$2.9 million, a two-week high although the number of financings fell to 19, a nine-week low. Whilst the dollars announced did not fall much from last week, the absence of broker action saw the Oreninc Index take a proportionally bigger hit.

A flat week for gold as it closed up slightly at US$1,319/oz from US$1,314/oz a week ago. Gold is now up 1.27% this year. The US dollar index, on a tear since mid-April, finally took a hit and closed down at 92.5 from 92.56 a week ago after hitting a high of 93.12. The Van Eck managed GDXJ posted growth through the week and then weakened at the close to end up at US$33.85 from US$33.55 last week. The index is down 0.82% so far in 2018. The US Global Go Gold ETF also saw growth to close up at UA$13.35 from US$13.11 a week ago. It is up 2.61% so far in 2018. The HUI Arca Gold BUGS Index closed up at 182.24 from 181.39 last week. The SPDR GLD ETF again saw sales to close its inventory at 857.64 tonnes from 864.13 tonnes a week ago.

In other commodities, silver made a gain to close up at US$16.66/oz from US$16.53/oz a week ago. Likewise, copper made gains to close up at US$3.11/lb from US$3.08/lb last week. Oil continued to post gains to close up at US$70.51 a barrel from US$69.72 a barrel a week ago, returning to levels last seen in late 2014.

The Dow Jones Industrial Average rebounded from its losses last week to close up at 24,831 from 24,262 last week. Canada’s S&P/TSX Composite Index also saw growth to close up at 15,983 from 15,729 the previous week. The S&P/TSX Venture Composite Index closed up at 782.92 from 772.24 last week.

Summary:

- Number of financings declined to 19, a nine-week low.

- No brokered financings were announced this week, a five-week low.

- No bought-deal financings were announced this week, a five-week low.

- Total dollars fell to $56.5m, a seven-week low.

- Average offer size grew to $2.9m, a two-week high.

Financing Highlights

West African Resources (TSX-V: WAF) is to raise A$35 million to fund pre-development activities at its Sanbrado gold project in Burkina Faso.

- West African will issue 109.4 million shares @ A$0.32.

- The company anticipates completing a revised feasibility study by the end of the second quarter.

Major Financing Openings:

- West African Resources (TSX-V:WAF) opened a $34.3 million offering on a best efforts basis.

- Wealth Minerals (TSX-V: WML) opened a $5 million offering on a best efforts basis. Each unit includes half a warrant that expires in 24 months.

- Aton Resources (TSX-V: AAN) opened a $3 million offering on a best efforts basis. Each unit includes half a warrant that expires in 60 months. The deal is expected to close on or about May 15th.

- ATAC Resources (TSX-V: ATC) opened a $3 million offering on a best efforts basis.

Major Financing Closings:

- Africa Energy (TSX-V: AFE) closed a $57.98 million offering underwritten by a syndicate led by Pareto Securities on a best efforts basis.

- Seabridge Gold (TSX: SEA) closed a $19.73 million offering on a best efforts basis.

- Garibaldi Resources (TSX-V: GGI) closed a $13.05 million offering on a best efforts basis.

- Pacton Gold (TSX-V: PAC) closed a $5.55 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis.

Company News

Prospero Silver (TSX-V: PSL) and Fortuna Silver Mines (TSX: FVI) amended their strategic financing agreement and amended the 2018 work program in Mexico.

- Repricing and exercise of Fortuna’s 5.4 million warrants to provide C$803,571 additional funding for drilling.

- 6,000m drill program to test three additional targets: Buenavista, Bermudez and Trias.

- November 30th deadline agreed for Fortuna to exercise its option rights to select up to two Prospero projects for option to joint venture agreements.

Analysis

The renewed commitment by Fortuna to test new targets is encouraging. The repricing and exercising of Fortuna’s warrants is a non-dilutive way for Prospero to secure more funding at a premium to market price for the planned work and removes warrant overhang from the stock.

NuLegacy Gold (TSX-V: NUG) began drilling on its Red Hill in the Cortez gold trend of Nevada.

- An initial 15,000 feet of drilling or 12 holes. Results will determine the second stage of drilling.

- 2018 drilling and field exploration budget of C$5.0 million with emphasis on discovery of new, additional gold zones.

Analysis

With a new season of drilling commencing following an extended winter break, the company is looking to step out from and grow the size of its existing discoveries as well as continuing to find new mineralized areas to increase the overall size and scope of Red Hill. The next couple of months should see regular news flow from the company.

Zinc One Resources (TSX-V:Z) announced additional drill results from the Mina Grande Sur zone at its Bongará zinc mine project in north-central Peru.

- Highlights included 8.2m @ 42.7% Zn.

- 81 drill holes for 1,811m drilled to date.

Analysis

This portion of the Mina Grande Sur drill program was designed to determine the extent of the mineralization so obtaining additional high-grade intersections is a bonus and attest to the robustness of Mina Grande Sur, which should be reflected in the upcoming resource calculation.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Website: www.oreninc.com

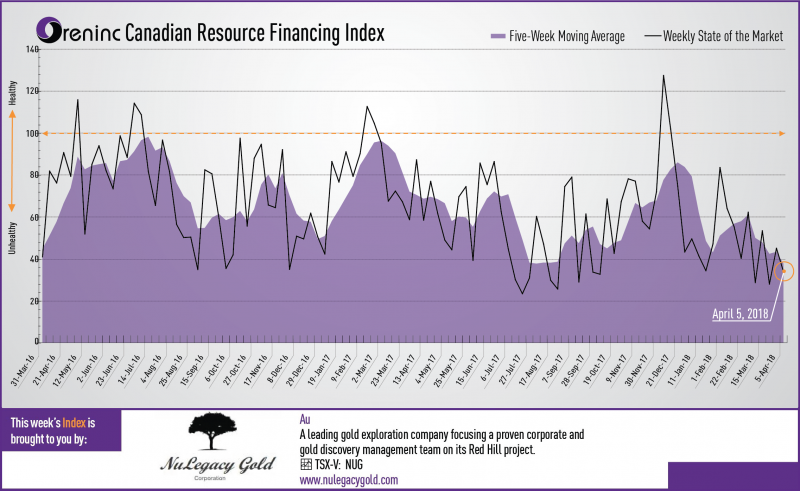

Last week index score: 45.10 (updated)

This week: 33.86

NuLegacy Gold (TSX-V: NUG) appointed John Budreski to its board.

The Oreninc Index fell in the week ending April 6th, 2018 to 33.86 from an updated 45.10 a week ago as the lack of brokered action outweighed the increase in dollars announced.

Market volatility continues with the stock markets and metals commodities alternately getting dinged and recovering as US president Donald Trump and China stand off over trade, or more specifically, their bilateral trade balance.

China responded to Trump’s previous discourse about implementing tariffs on some US$50 billion of trade on the grounds that China steals US intellectual property with its own tariffs on $50 billion worth of US goods in a move that sees it ready to wage a trade war “to the end.” Not to be outdone, Trump responded at the end of the week with the threat of another US$100 billion of tariffs against Chinese products. Given the trade imbalance between the two nations – China exported US$505 billion to the US in 2017 and imported just US$130 billion – it has fewer exports with tariffs than Trump. However, beyond physical products China could look at trade in services such as tourism and education or make life difficult for US companies operating in its territory such as Apple and Starbucks. Then again, China is the biggest foreign holder of US Treasury debt, owning about US$1.17 trillion and it could cut the amount of US debt it buys.

So, in another choppy week, gold actually ended on a positive note after a weaker-than-expected US employment report for March from the Labor Department showed the key non-farm payrolls number up 103,000, which was a big miss to the downside.

On to the money: total fund raises announced increased to C$120.7 million, a five-week high, but which included no brokered financings and no bought-deal financings. The average offer size nearly doubled to C$7.1 million, a 64-week high.

Another volatile week for gold during saw the yellow metal close up at US$1,32/oz from US$1,325/oz a week ago despite hitting a mid-week high of US$1,341/oz. Gold is now up 2.32% this year. Meanwhile, the US dollar index closed up at 90.20 from 89.97 a week ago. The van Eck managed GDXJ closed up at US$32.39 from US$32.15 last week. The index is down 5.10% so far in 2018. The US Global Go Gold ETF closed down at US$12.51 from US$12.71 a week ago. It is down 3.84% so far in 2018. The HUI Arca Gold BUGS Index closed up at 177.59 from 175.41 last week. The SPDR GLD ETF saw buying return to close up at 859.99 tonnes from 846.12 tonnes a week ago.

In other commodities, the silver slightly up at US$16.40/oz from US$16.36/oz a week ago. Copper showed a slight increase to close at US$3.04/lb from US$3.02/lb last week. Oil put in another losing week and closed down at US$62.17 a barrel from US$64.94 a barrel a week ago.

The Dow Jones Industrial Average closed down at 23,932 from 24,103 last week. Likewise, Canada’s S&P/TSX Composite Index fell to 15,207 from 15,367 the previous week. The S&P/TSX Venture Composite Index closed down at 769.15 from 796.67 last week.

Summary:

- Number of financings dropped to 17, a four-week low.

- No brokered financings were announced this week, a 13-week low.

- No bought-deal financings were announced this week, a two-week low.

- Total dollars increased to C$120.7m, a five-week high.

- Average offer size nearly doubled to C$7.1m, a 64-week high

Financing Highlights

Nemaska Lithium (TSX: NMX) entered into an investment agreement with SoftBank Group for a C$99.1 million private placement @ C$1.12.

- SoftBank to acquire up to 9.9% of Nemaska.

- Nemaska needs to raise US$775-825 million to fund the construction and commissioning of its Whabouchi mine and Shawinigan lithium plant.

- As long as SoftBank holds at least 5% of Nemaska’s shares, it has a right of first offer to purchase up to 20% of the lithium hydroxide and lithium carbonate produced at Shawinigan from spodumene concentrate from Whabouchi at pre-agreed discounts applicable to a pre-determined market price-based formula.

- SoftBank can also nominate a director.

Major Financing Openings:

-

- Nemaska Lithium (TSX-V: NMX) opened a C$99.08 million offering on a best efforts basis.

- Euromax Resources (TSX-V: EOX) opened a C$5.22 million offering on a best efforts basis. Each unit includes a warrant that expires in two years.

- Loncor Resources (TSX-V: LN) opened a C$2.6 million offering on a strategic deal basis.

- Commander Resources (TSX-V: CMD) opened a C$2.5 million offering on a best efforts basis. Each unit includes a warrant that expires in two years.

Major Financing Closings:

- Asanko Gold (TSX: AKG) closed a C$22.47 million offering on a strategic deal basis.

- Kennady Diamonds (TSX-V: KDI) closed a C$10 million offering on a strategic deal basis.

- Tinka Resources (TSX-V: TK) closed an C$8.06 million offering underwritten by a syndicate led by GMP Securities on a bought deal basis. Each unit included half a warrant that expires in a year.

Company News

NuLegacy Gold (TSX-V: NUG) appointed John Budreski to its board. Budreski, MBA/BEng has over 35 years of capital markets and executive management experience and is the CEO of Morien Resources.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan