Three Valley Copper (TSXV:TVC) is a company committed to environmental compliance with ESG criteria at the highest levels of compliance. TVC carries out best environmental practices in its operations, thus providing great value to shareholders in the long term. At the same time, the company is committed to maintaining strong community relations through actions that reduce environmental impact.

Three Valley Copper builds strong relationships with the community under the policy of an open and permanent dialogue based on generating results that bring benefits to those involved. In this way, TVC achieves conflict resolution in an efficient manner.

In May 2021, The Valley Copper received some neighbors from the community to show them the protocols in an in situ controlled blasting event. During the visit, community members were able to verify that the protocols required by regulatory authorities are applied on a daily basis at the operations. The event took place in an atmosphere of mutual respect and concern with the Sustainability Manager and other TVC executives.

These are some of the points that visitors and members of the community confirmed:

- Compliance with the protocols and procedures required for blasting to reduce dust emissions as much as possible.

- TVC’s commitment to the measures in place to control dust from the Don Gabriel mine and the Manquehua road.

- It was agreed with the community to maintain an open and constructive dialogue.

- It was communicated that an on-site inspection of the shock monitoring station will be carried out by an expert in order to verify and inform the community of the station’s operating methodology.

The contributions made by TVS are based on emphasizing the ability to work in community. This method not only helps to establish relationships with the community but also favors community involvement, resulting in better project management and, therefore, better results. This synergy allows the development of the territory to be boosted.

Social Responsibility, and a Foundation to Back it Up

The Three Valley Foundation was created in 2014 and its main distinctive feature is that it is made up of members of the community, representing the valleys of Chalinga, Cárcamo and Chuchiñi. It is through this foundation that Three Valley Copper channels its investment and carries out the financing of various social projects related to education, social infrastructure, rural health posts and more.

The Environmental Aspect

Three Valley Copper is in a continuous search for process improvement and total openness of its operations to the external community. It is also committed to caring for the environment through strict compliance with environmental legislation.

Three Valley has had a comprehensive Environmental Qualification Resolution in place for its operations since 2009. The Environmental Qualification Resolution provides companies with the fundamental instructions and permits necessary to execute operations in a sustainable manner in order to guarantee respect for the environment in a physical and social way.

Some of the environmental obligations that Three Valley Copper has in the EQR are:

- Uninterrupted monitoring of air and water quality.

- Reforestation of 250 hectares with native species.

- Construction of a petroglyph park at Quimenco.

The Minera Tres Valles project operates with renewable biomass energy that was contracted to reduce the carbon footprint, as one of its priorities is the constant care of the environment. As another measure for environmental care, Three Valley Copper keeps its water consumption to a minimum, which has earned it several awards for its efficient use of this invaluable resource.

Cultural Appreciation and Protection

Three Valley Copper’s project territory is characterized by its social and cultural heritage. As its name indicates, it is located in the heart of three surrounding valleys called Chalinga, Chuchiñi and Cárcamo.

The value of its social and cultural heritage is reflected in the traditions coming from this land.

One of the typical traditions of the region is the transhumance which is a type of seasonal grazing in continuous movement where cattle are taken from the valleys and lowlands to the Andes mountains and vice versa.

Pilgrims celebrate the Virgin Mary with dances, songs and praises, which is one of the most important religious festivities in the Chuchiñí and Manquehua valleys.

In this region you can also find petroglyph art made by the pre-Columbian cultures that inhabited the valleys, generally following the watercourses.

The people have left traces of their culture that later generations will have the opportunity to know and continue to enjoy.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

On January 10, Three Valley Copper, (TSXV:TVC), a junior gold exploration, development, and production company based in Toronto, Canada, began trading on the OTCQB under the symbol “TVCCF”. Shares of Three Valley Copper continue to trade on the TSX Venture Exchange.

The move will expand the company’s accessibility across the border in the biggest capital market available, and allow U.S.-based investors to have more efficient access to trading TVC shares. This will ultimately broaden the company’s investor base.

Three Valley Copper’s primary asset, Minera Tres Valles in Salamanca, Chile, is the focus of the company’s efforts and the primary asset of interest for investors. It is a producing mine with 46,348 hectares at the property, with approximately 90% of the property remaining unexplored. The potential for new discovery is high at MTV, and a new exploration drilling program will begin shortly.

The company recently increased its ownership in Minera Tres Valles from 91.1% to 95.1%, gaining further operational control. The company is now in the process of expanding capacity at the site to increase copper production in 2022 and 2023. Planned exploration will continue in 2022, and shareholders on both sides of the border stand to gain significantly from the advancement of this project.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC) has announced that it has increased its ownership of Minera Tres Valles to 95.1%, following the closing of the previously announced bought deal financing. This increases the company’s share of MTV from the previous 91%. About $9 million of the previously announced bought deal financing was used to subscribe to the newly issued shares of Minera Tres Valles.

The closing of the bought deal financing on November 25 gave the minority shareholder, and SRH Chile SpA the opportunity subscribe for newly issued shares of MTV. Since the minority shareholder declined to participate, their shares were diluted from an 8.9% stake to 4.9%. Critically, Three Valley Copper expects that the minority shareholder’s position will likely be diluted further if they decline to participate in any future anticipated MTV share issuances.

The increased ownership of MTV will give Three Valley Copper better operational control over production and future exploration at the property.

Minera Tres Valles is in the process of expanding its capacity in order to increase copper production in 2022 through to 2023. The company is targeting 13-000 to 16,000 tonnes of copper cathode production in 2023. Ultimately all Three Valley Copper shareholders will benefit from the increased copper production at Minera Tres Valles. As the majority shareholder of MTV, Three Valley Copper, and its shareholders stand to gain significantly from the future advancement of the project as well as planned exploration at the property. MTV is still 10% unexplored, with potential future discoveries waiting in the 46,348 hectares of exploratory lands.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC) has announced its financial results for the three months and nine and months periods ended on September 30, 2021. As the company has closed its bought deal financing and looks to explore its huge property in Chile, the company is moving quickly in multiple areas of the business.

The multi-pronged approach to the project includes increasing copper production and furthering exploration of the property. The Minera Tres Valles property is 91.1% owned by Three Valley Copper, and is located in Salamanca, Chile. The property consists of 46,000 hectares of exploratory lands, of which 95% are still unexplored. The company’s position as a producer of 99.99% copper cathodes and an explorer of this large property puts it in a unique position in a copper market that is contnually clamoring for more.

Michael Staresinic, President and Chief Executive Officer of Three Valley Copper (TSXV:TVC), commented in a press release: “This past quarter showed a marked improvement with our flagship project, the construction and development of our underground mine, Papomono. Since the renegotiation of this contract in August, the contractor has performed much better than we previously experienced with multi 200-meter month advancements. We are approaching 90% completion of the required meters to begin producing and expect our first caving of ore to begin in January 2022.”

“As we continued our assessment of Papomono during the quarter given its paramount importance to the Company, it was concluded that to further ensure its successful ramp-up during 2022 and maximize its economic benefit, we decided to bring forward sustaining capital expenditures originally planned for later years to 2022. This decision came at a time when our open pit operations at Don Gabriel continued its underperformance delivering less ore at a lower grade that will lead to cathode production at the lower end of our 2021 revised guidance. The Company’s original plan for 2021 included reinvesting the cash flows delivered by Don Gabriel to fund development of Papomono but unfortunately, this has not happened and we foresaw near-term capital stresses to the business. Our announced strategic review in October was, in part, to help address this and quickly led to a required near-term financing raising gross proceeds of C$18.2 million.”

“With this financing we eliminated the short-term liquidity issue that was on the horizon allowing us to continue completing Papomono in January 2022 and increasing production in 2022. The completion of Papomono continues to be our focus and any deviation or delay would be value destructive to stakeholders. Our senior lenders agreed with us and as a condition of the financing, continued their strong partnership by agreeing to forbear on the debt repayments due in the first three quarters of 2022 while we together continue to renegotiate new repayment terms of the senior debt facility.”

“This new capital also allows the strategic review process to move forward without undue pressure. This new capital secures a better future for the MTV project and assists the strategic review process underway which ultimately we believe will increase shareholder value.

“Our exploration program continues and with over 46,000 hectares available to explore with highly prospective exploration targets including the 100 outcrop copper occurrences identified and 170,000 meters of diamond drilling performed by previous owners, we expect to provide preliminary results from this campaign in the first half of 2022. We hope this is the beginning of a multi-year exploration program and expansion of the copper resources contained in our land tenure.

“We are very proud of our health and safety record with every health and safety statistic reporting below the country averages and specific to COVID-19, our initiated on-site vaccination program has resulted in approximately 94% of the workforce receiving both doses of the vaccine and nearly 100% of the workforce has opted to participate. We have already begun a booster shot program to supplement this.

“Much has been accomplished by the team in Chile during 2021 through a restart of mining operations all complicated by the complexities of COVID-19. The copper price has remained above $4 per pound for almost all of 2021 and we see this level of support continuing. And the longer this trend continues, the more capital and attention the industry will attract. Three Valley Copper will not be overlooked. TVC is uniquely positioned among junior copper companies to take advantage of this coming cycle – fully built infrastructure, producing operations with defined deposits and, a rich land package in a very good neighborhood.”

Highlights from the press release are as follows:

Corporate

- The Company, through its indirectly held subsidiary (SRH Chile SpA), subscribed for additional common shares of MTV for approximately $1.0 million, resulting in the Company’s indirect holding of MTV increasing from 90.3% to 91.1% effective August 16, 2021.

- On October 4, 2021, the Company delivered to the minority shareholder of MTV (the “Minority Shareholder“) the required written notice of its intention to acquire the remaining interest in MTV held by the Minority Shareholder as per the call option notice requirements of the MTV shareholders’ agreement.

- On October 20, 2021, the Company engaged an independent financial advisor to review and evaluate potential alternatives that may further maximize value for the shareholders of the Company. These alternatives may include, inter alia, potential mergers, strategic partnerships, acquisition or dispositions of assets and/or refinancing or amending terms of the Company’s long-term debt.

- On November 25, 2021, the Company successfully closed a bought-deal offering (the “Bought-Deal Financing“) and issued a total of 56,681,000 units (the “Units”) and 819,000 additional common share purchase warrants (each, an “Additional

Warrant”) at an offering price of CAD$0.32 per Unit, for gross proceeds of CAD$18.2 million. Each Unit consists of one common share in the capital of the Company and one common share purchase warrant (each a “Warrant”). Each Additional Warrant and each Warrant is exercisable into one common share of the Company at an exercise price of CAD$0.45 for a period of 30 months from the closing of the Bought-Deal Financing. - Prior to closing the Bought-Deal Financing, the Company and its subsidiaries executed an undertaking agreement (the “Undertaking”) with the MTV senior secured lenders (the “Lenders“) to amend the loan repayment terms of the secured prepayment facility entered into with the Lenders and amended as part of MTV’s Judicial Reorganization Agreement (the “Amended Facility“). The Company and the Lenders have undertaken to execute a binding agreement to amend the loan repayment terms of the Amended Facility on or prior to September 30, 2022. Under the terms of the Undertaking the Lenders have agreed not to accelerate or enforce their rights or remedies under the Amended Facility should MTV fail to (i) make scheduled loan repayments on March 31, 2022, June 30, 2022 and September 30, 2022 and/or (ii) replenish the operating reserve account to reestablish the minimum reserve as required under the Amended Facility (each, a “Specific Event of Default“). As per the terms of the Undertaking, the forbearance period is from November 22, 2021 to October 1, 2022. The Undertaking also provides that the net proceeds of the Bought-Deal Financing that closed on November 25, 2021 will not be used to repay any of the loans outstanding under the Amended Facility during the forbearance period. The Lenders will cease to be bound by the Undertaking (i) should the Company not invest the net proceeds received on CAD$16 million of the Bought-Deal Financing into MTV between the closing of the financing on November 25, 2021 and April 30, 2022, (ii) if an event of default occurs under the Amended Facility other than a Specified Event of Default, or (iii) if the Company and the Lenders fail to enter into a definitive agreement by September 30, 2022, pursuant to which the loan repayment schedule in the Amended Facility is revised.

Operations

- The Company continued to further advance the development of Papomono during the third quarter of 2021. MTV completed the critical ventilation shaft and the ore pass, which will further accelerate the speed of its continued advance. As at October 31, 2021, the development of Papomono is approximately 77% complete and 87% of the required meters to begin producing have been completed.

- In August 2021, MTV negotiated an extension of its underground development contractor’s contract to include the remaining development work following the initial construction and development phase of the block caving project. This has enabled the contractor to have more success with their recruiting efforts of skilled workers, and as a result, performance improved significantly in August, September, and October with over 200 meters of advancement each month, a rate not seen since the construction began. The block caving construction project is on track for completion in early 2022 with the planned ramp-up of production during 2022.

- Effective August 1, 2021 MTV entered into an amendment to the offtake agreement (the “Offtake“) specific to the fixed price sales component with Anglo American Marketing Limited (“AAML“). Under the terms of the amendment, the remaining monthly deliveries of copper cathodes due under the fixed price portion of the Offtake are deferred until May 1, 2022 and all sales of copper cathodes commencing August 1, 2021 until April 30, 2022 will be sold at the prevailing spot price for copper cathode, less a nominal amount.

- Copper cathode production was 1,138 tonnes at an average grade of 0.52%, increasing production 10% from 1,035 tonnes at an average grade of 0.53% for the three months ended June 30, 2021, mainly due to a higher average grade of ore purchased from third-party small miners and Empresa Nacional de Minera (“ENAMI“) compared to the second quarter of 2021.

- For the nine months ended September 30, 2021, capital expenditures of $9.3 million were incurred related to the construction and development of the incline block caving mine at the Papomono Masivo deposit.

Financial

- Reported gross loss of $0.9 million on a realized average copper price2 of $3.58 compared to $2.82 in Q3 2020.

- Adjusted EBITDA from continuing operations1 of negative $0.4 million compared to negative $0.9 million in Q3 2020.

- Net loss per share attributable to owners of the Company of $0.02 compared to $0.01 in Q3 2020.

- During September 2021, the Company drew down the remaining $6 million loan facility available to it under the terms of the Amended Facility. This additional senior secured debt has substantially the same security and terms as defined in the Amended Facility but with a fixed annual interest rate of 11%.

Operational Results Summary

| Three months ended | Nine months ended | |||||||||||

| Operating information | Sept. 30, 2021 | Sept. 30, 2020 | Sept. 30, 2021 | Sept. 30, 2020 | ||||||||

| Copper (MTV Operations) | ||||||||||||

| Total ore mined (thousands of tonnes) | 178 | 49 | 550 | 351 | ||||||||

| Grade of ore mined (% Cu) | 0.52 | % | 0.88 | % | 0.54 | % | 0.86 | % | ||||

| Total waste mined (thousands of tonnes) | 739 | 118 | 1,358 | 853 | ||||||||

| Ore Processed (thousands of tonnes) | 231 | 90 | 680 | 474 | ||||||||

| Cu Production (tonnes) | 1,138 | 1,077 | 3,073 | 3,789 | ||||||||

| Cu Production (thousands of pounds) | 2,509 | 2,374 | 6,775 | 8,353 | ||||||||

| Change in inventory ($000s) | $ | 3,563 | (11 | ) | $ | 10,427 | (4,421 | ) | ||||

| Cash cost of copper produced 1 (USD per pound) | $ | 3.40 | $ | 2.44 | $ | 3.49 | $ | 2.75 | ||||

| Realized copper price 2 (USD per pound) | $ | 3.58 | $ | 2.82 | $ | 3.48 | $ | 2.46 | ||||

1 Cash cost per pound of copper produced includes all costs absorbed into inventory including inventory write-downs less non-cash items such as depreciation and non-site charges. It is a non-IFRS performance measure. Refer to Non-IFRS Performance Measures.

2 Realized copper price is a non-IFRS performance measures. Refer to Non-IFRS Performance Measures.

Ore Production

- Ore mined of 165,222 tonnes at a grade of 0.47% from Don Gabriel representing 93% of ore mined.

- 73% of ore processed from Don Gabriel; 22% from third-party small miners and ENAMI; 5% from Papomono Masivo.

- Produced 2.5 million pounds of 99.99% pure copper cathodes at a cash cost per pound produced1 of $3.40.

- Sold 2.3 million pounds of copper cathodes at an average realized copper price2 of $3.58 per pound.

- High unit costs expected throughout 2021 and into 2022 as the Company expects to operate below capacity until Papomono Masivo is in full production.

Construction and Development of Papomono Masivo

- Mineral reserve estimate for Papomono Masivo is 3,067kt of proven and probable mineral reserves (at a copper grade of 1.51%).

- Block caving construction 77% complete and 87% of the required meters to begin producing have been completed as at October 31, 2021 with 19 opened construction fronts.

- High grade ore being extracted as part of construction process.

- In August 2021, MTV negotiated an extension of the underground contractor, Aura, contract to include the remaining development work following the initial construction and development phase of the block caving project. This has enabled Aura to have more success with their recruiting efforts of skilled workers.

- Aura delivered significantly improved performance since August 2021 with over 200 meters of advance per month from August to October. October 2021 was the best month since commencement of the project with 220 meters of advance. The block caving construction project is on track for completion in early 2022.

Exploration

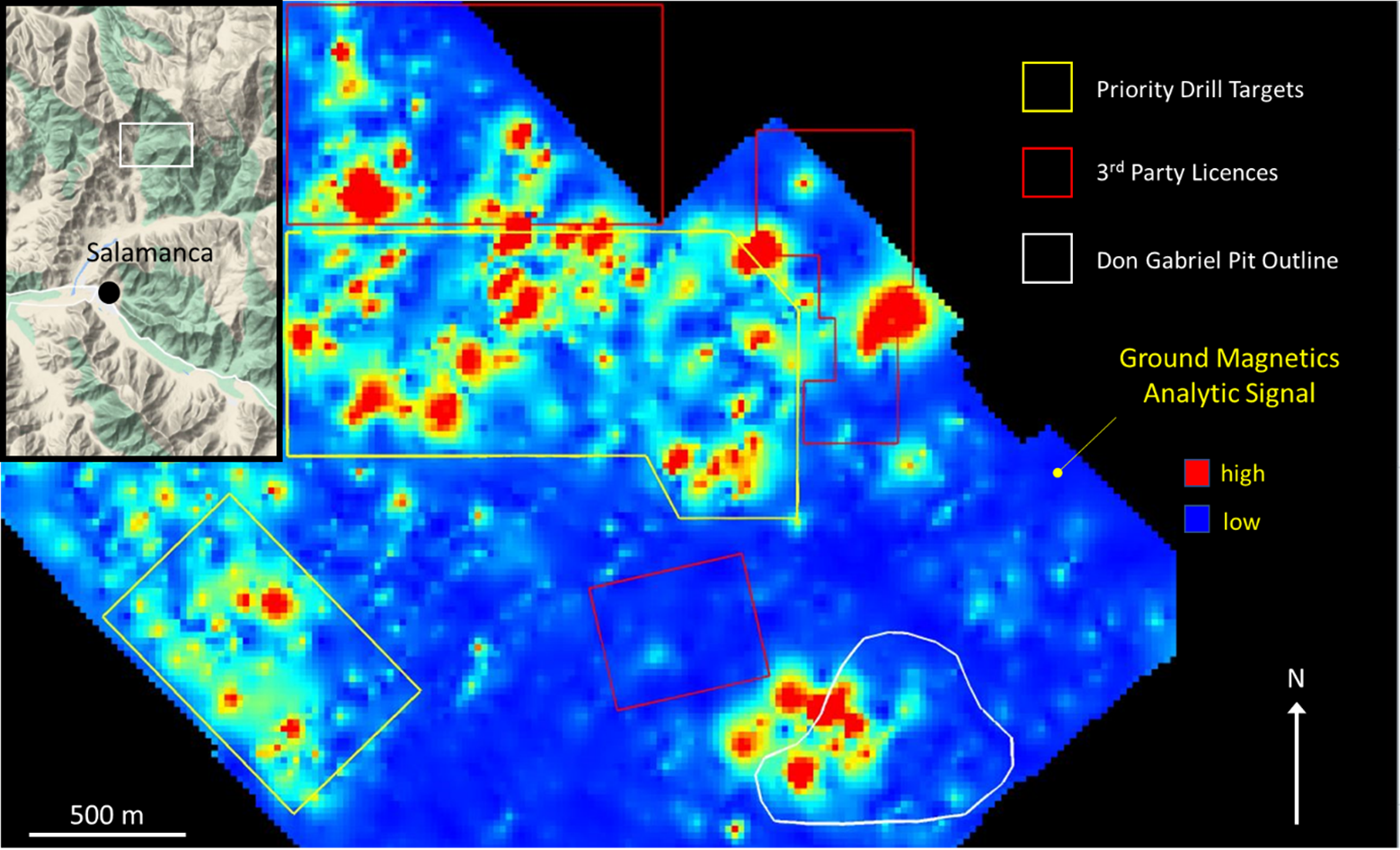

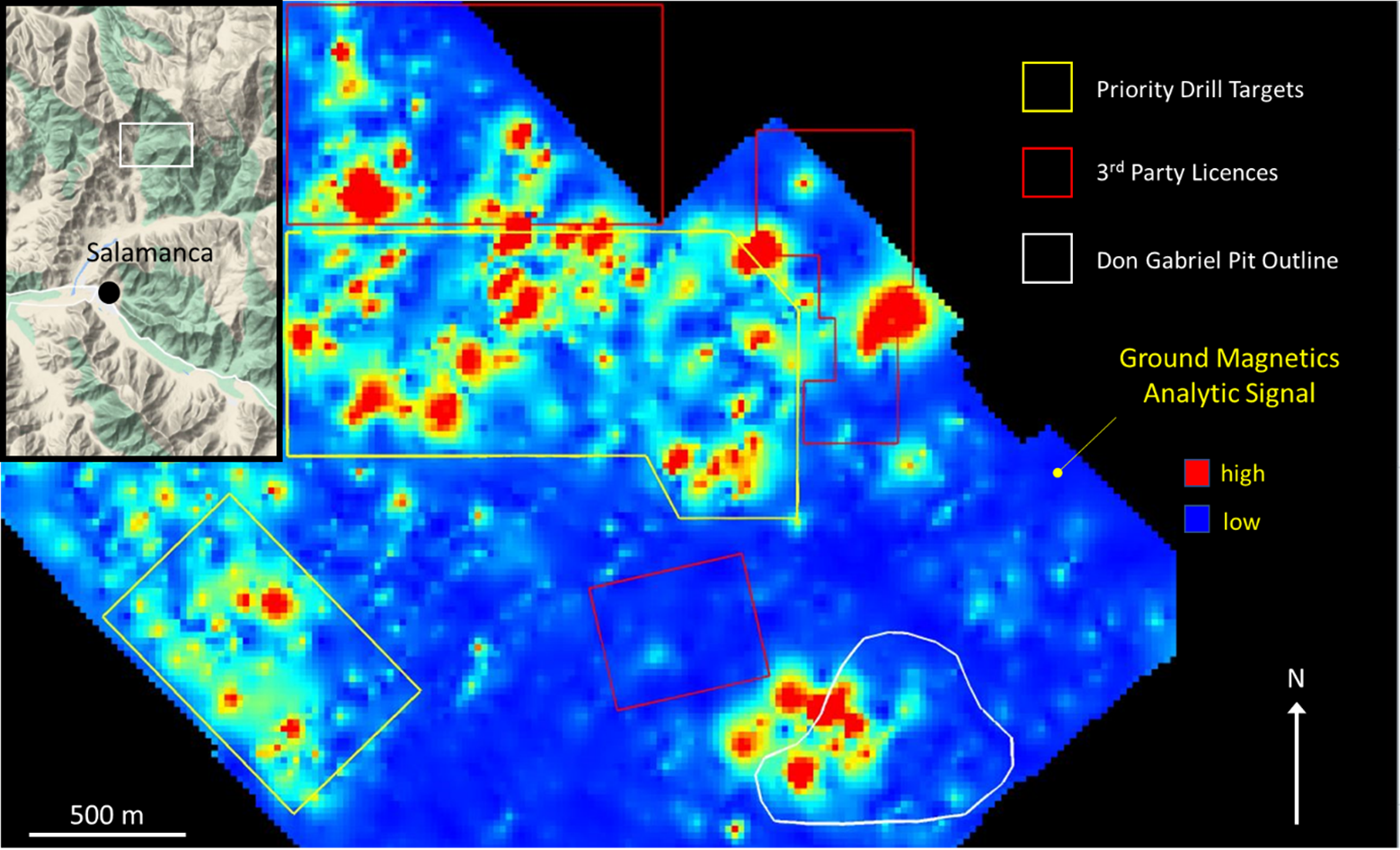

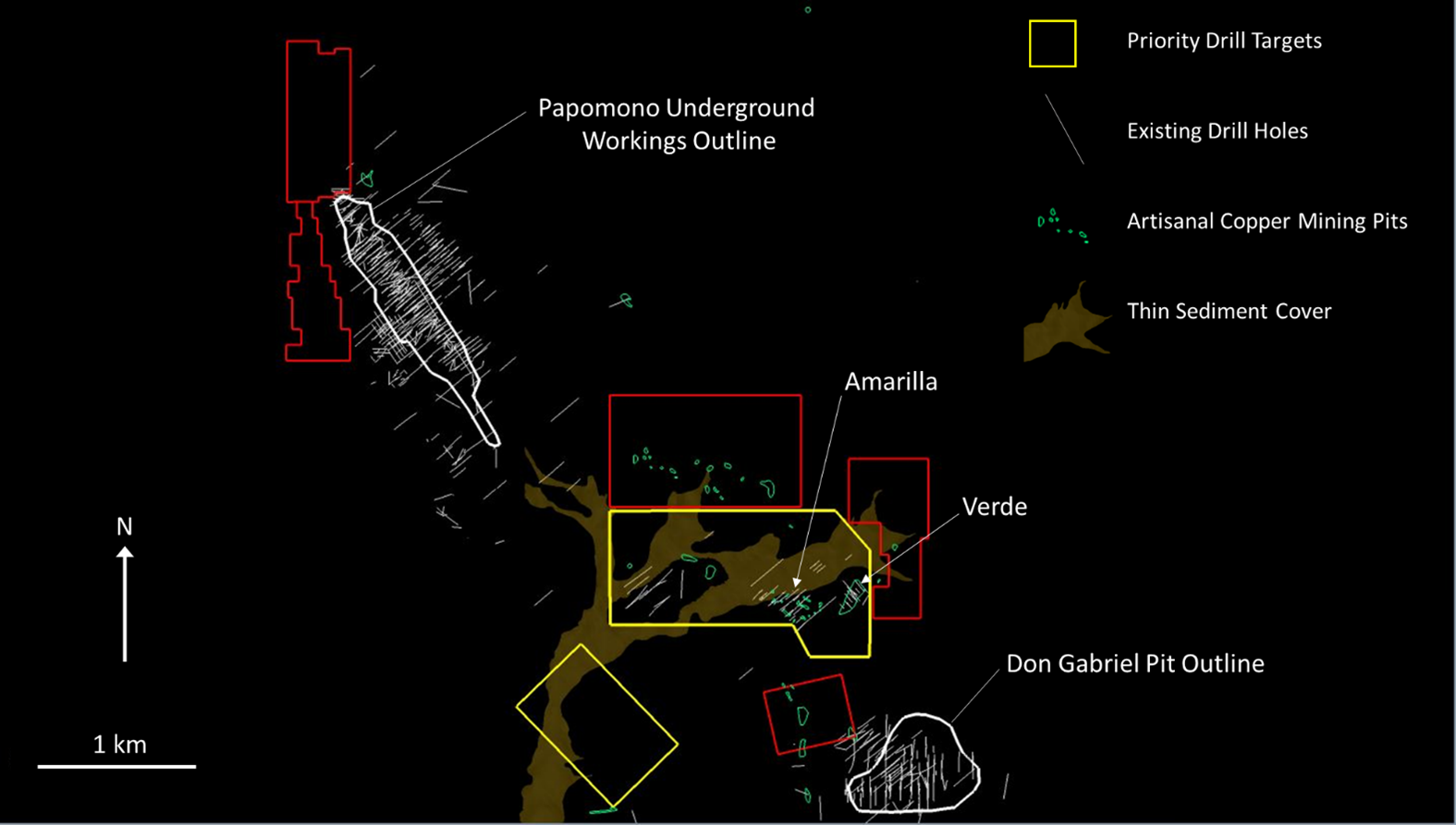

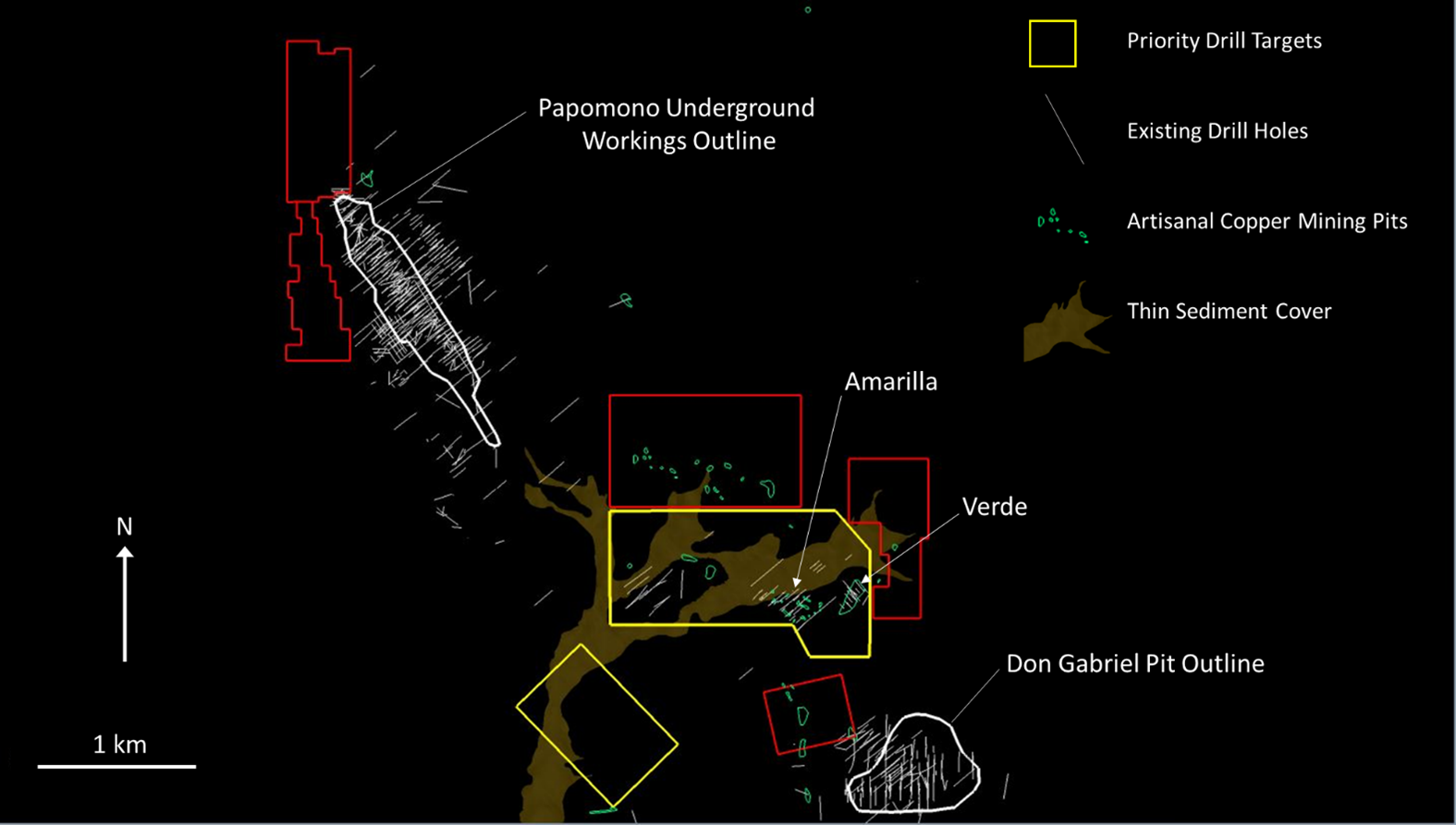

- In September 2021, the Company commenced its 2021 near mine exploration drilling program on MTV focused on testing high-potential copper targets located between Don Gabriel and Papomono, which sit approximately 3 kilometers apart.

- On September 28, 2021, the Company announced that it has identified a new porphyry target in its license area. The identified central core has dimensions of approximately 2km by 1km. This target is an example of the broader potential of this property as copper porphyry deposits are associated with some of the largest long life copper mines in the world, with Chile hosting the greatest concentration of these deposits.

- Dr. John Mortimer, senior exploration geologist, is leading the Company’s explorations activities and executing the exploration program at MTV.

- Significant strategic land package of over 46,000 hectares.

- Property in the well-known copper producing Coquimbo region which has Antofogasta Minerals’ Los Pelambres mine located approximately 50 kilometers to the east of MTV.

- With more than 100 copper outcrop occurrences and 70 artisanal mining sites with geological characteristics similar to that of the Papomono and Don Gabriel orebodies, together with near-term infill drilling opportunities, the Company believes there is significant exploration potential.

COVID-19

- Beginning in March 2021 and in conjunction with the Chilean Ministry of Mining, the Ministry of Health and the Regional Mining Secretary of Coquimbo, MTV initiated an on-site vaccination program by offering vaccinations to all MTV employees and contractors. To date, 2021, approximately 94% of the workforce have received both doses of the vaccine and nearly 100% of the workforce has opted to participate.

- MTV continued its vaccination campaign in October 2021, offering booster shots on site to all workers.

- In the third quarter of 2021, COVID-19 restrictions eased in Chile as cases trended downward, resulting in little impact on the Company’s operations during this period. Should these restrictions reappear in the future, the effect of the COVID-19 pandemic on the Company’s business activities will create elevated uncertainty and may further impact production and previous guidance.

- The Company continues its preventative, mitigating and containment measures to actively minimize the spread of COVID-19.

Financial Results Summary

| Three months ended | Nine months ended | |||||||||||

| Financial information (in thousands) | Sept. 30, 2021 | Sept. 30, 2020 | Sept. 30, 2021 | Sept. 30, 2020 | ||||||||

| Revenue | $ | 8,362 | $ | 5,610 | $ | 22,873 | $ | 17,700 | ||||

| Gross loss | $ | 881 | $ | 552 | $ | 3,070 | $ | 9,546 | ||||

| Net loss from continuing operations | $ | 1,474 | $ | 335 | $ | 9,407 | $ | 21,167 | ||||

| Net loss from discontinued operations | $ | — | $ | — | $ | — | $ | 2,241 | ||||

| Net loss for the period | $ | 1,474 | $ | 335 | $ | 9,407 | $ | 23,408 | ||||

| Net loss per share attributable to owners of the Company | $ | 0.02 | $ | 0.01 | $ | 0.16 | $ | 0.48 | ||||

| EBITDA from continuing operations 1 | $ | 2,254 | $ | 1,873 | $ | 1,347 | $ | (12,695 | ) | |||

| Adjusted EBITDA from continuing operations 1 | $ | (392 | ) | $ | (926 | ) | $ | 440 | $ | (4,529 | ) | |

| Gain (loss) on portfolio investments | $ | — | $ | 1,038 | $ | 107 | $ | (1,294 | ) | |||

| Impairment of non-current assets | $ | — | $ | — | $ | — | $ | (7,628 | ) | |||

| Reversal (write-down) of inventory | $ | — | $ | 665 | $ | (2,474 | ) | $ | (3,441 | ) | ||

| Gain on modification of debt | $ | — | $ | 3,487 | $ | — | $ | 3,487 | ||||

| Cash used in operating activities before working capital changes | $ | (1,229 | ) | $ | (1,097 | ) | $ | (103 | ) | $ | (4,412 | ) |

1 Refer to Non-IFRS Performance Measures

Financial Results

Revenues of $8.4 million for the three months ended September 30, 2021 were generated predominantly from the sale of copper cathodes. Finished goods inventory at September 30, 2021 was approximately $2.9 million. Copper cathodes sold for the three months ended September 30, 2021 of 1,060 tonnes was higher than the comparative quarter in 2020 of 858 tonnes with their respective revenues based on an average realized copper price of $3.58 per pound and $2.82 per pound.

The Company reported a gross loss of $0.9 million for the three months ended September 30, 2021, mainly due to higher operating costs resulting from lower-than-expected grades of the ore mined from Don Gabriel. A reversal of previous write-down of inventory of $0.7 million that was recorded as a decrease to cost of sales offset the gross loss of $0.6 million for the comparable quarter.

Revenues of $22.9 million for the nine months ended September 30, 2021 were generated predominantly from the sale of copper cathodes. Copper cathodes sold for the nine months ended September 30, 2021 of 2,975 tonnes was lower than the comparative period in 2020 of 3,068 tonnes. The decrease in tonnes of the copper cathodes sold in 2021 was more than offset by the average realized copper price of $3.48 per pound, which increased by 41% from $2.46 per pound in the nine months ended September 30, 2020.

The Company reported a gross loss of $3.1 million for the nine months ended September 30, 2021 that includes a write-down of inventory, net of reversals of $2.5 million that is recorded as an increase to cost of sales. Included in the gross loss of $9.5 million for the comparable period, is a write-down of inventory, net of reversals of $3.4 million that is recorded as an increase to cost of sales.

In accordance with the Offtake with AAML, MTV sold 46% of its copper cathode production at $2.89 per pound for the three months ended September 30, 2021. This percentage is higher than the expected 40% as copper cathode production was lower during the nine months ended September 30, 2021 than was anticipated when the fixed priced portion of the contract was entered into.

Effective August 1, 2021 MTV entered into an amendment to the Offtake specific to the fixed prices sales component with AAML. Under the terms of the amendment, the remaining monthly deliveries of copper cathodes due under the fixed price portion of the Offtake are deferred until May 1, 2022 and all sales of copper cathodes commencing August 1, 2021 until April 30, 2022 will be sold at the prevailing spot price for copper cathode, less a nominal amount. The remaining 12 months of contracted delivery amounts of the fixed price portion of the contract will resume on May 1, 2022 at the previous agreed fixed price of $2.89 per pound.

The increasing copper price together with MTV’s obligation to sell a set amount of its production at $2.89 per pound affected the economics of purchasing ore from third-party small miners at market until July 31, 2021, but thereafter, the amendment to the Offtake significantly benefited ore supply from third-party small miners. The amendment allowed the Company to purchase ore from third-party miners at more competitive rates driving a progressive increase in ore supply up to October 2021, when MTV purchased over 21,000 tonnes of ore from third-party miners, which was 17% above the expected 18,000 tonnes.

The Company’s general and administrative expense for the three and nine months ended September 30, 2021 was $1.3 million and $3.2 million compared to $0.8 million and $3.2 million, respectively, in the comparative periods, showing an increase in marketing expenses in the three months ended September 30, 2021, compared to the same period of 2020.

Finance expenses for the three and nine months ended September 30, 2021 totaled $2.4 million and $6.8 million compared to $1.2 million and $4.5 million, respectively, in the comparative periods, as the average balance of the Company’s long-term debt grew. Given the current grace period achieved for the long-term debt under MTV’s restructuring in 2020, cash interest payments made during the three and nine months ended September 30, 2021 amounted to $1.1 million and $1.8 million, respectively.

The Company reported a quarterly net loss attributable to owners of the Company of $1.3 million or $0.02 per share. Adjusted EBITDA (see Non-IFRS Financial Measures ) from continuing operations for the three months ended September 30, 2021 was negative $0.4 million or $0.01 per share. For the comparable quarter in 2020, the Company reported a net loss attributable to owners of the Company of $0.3 million or $0.01 per share and Adjusted EBITDA from continuing operations of negative $0.9 million or $0.03 per share.

In the first three quarters of 2021, the Company reported a net loss attributable to owners of the Company of $7.6 million or $0.16 per share. Adjusted EBITDA (see Non-IFRS Financial Measures ) from continuing operations for the nine months ended September 30, 2021 was $0.4 million or $0.01 per share. For the comparable quarters of 2020, the Company reported a net loss attributable to owners of the Company of $16.2 million or $0.48 per share and Adjusted EBITDA from continuing operations of negative $4.5 million or $0.14 per share.

In the first three quarters of 2021, cash used in operating activities was $9.8 million (cash used of $0.1 million before changes in non-cash components of working capital), compared with 2020 when cash used in operating activities was $2.4 million (cash used of $4.4 million before changes in non-cash components of working capital).

Cash Position, Working Capital and Net Debt

Cash and cash equivalents decreased to $6.7 million at September 30, 2021 from $12.0 million at December 31, 2020 mainly due to $9.8 million used in operating activities, $7.7 million of disbursed capital expenditures mainly related to the construction and development of Papomono Masivo and $1.8 million of interest payments; all partially offset by $8.3 million of net proceeds from the April 2021 bought deal financing, $6.2 million of net proceeds from loans and borrowings and $0.4 million of net proceeds from the exercise of warrants.

The Company has working capital (see Non-IFRS Financial Measures ) of $3.1 million at September 30, 2021 and approximately $27.5 million as at the date hereof. Cash position as at the date hereof is approximately $17.8 million.

The Company is substantially leveraged. The Company’s net debt (see Non-IFRS Financial Measures ) at September 30, 2021 was $67.1 million. The Company’s debt position continues to increase as it capitalizes interest and remains in a grace period for the majority of its debt (see the Undertaking in Recent Highlights previously).

Health and Safety

For the three months ended September 30, 2021, there was no Lost-Time Incident. MTV’s annual injury frequency index continues to remain below the average of the mining industry in Chile. The Company and MTV devote considerable time and effort to ensure that workers and contractors return safely to their families after each shift. Safety statistics are monitored and compared to the country and peer averages, and MTV pro-actively engages in education and assessment to achieve a goal of zero lost-time incidents.

Community and Environment

MTV continues to actively work with local communities and stakeholders and for the three months ended September 30, 2021, the MTV Foundation continued the funding of projects agreed to by the MTV Foundation board, which is largely composed of community representatives to help MTV understand the true needs of its neighbors, such as starting an eco-friendly cooperative at a local school. MTV’s ore purchase program also ensures support from local miners, buying ore from over 26 providers and supporting the development of over 300 small-scale miners through local mining unions.

Ongoing Arbitration

As previously disclosed, the Company is involved in an arbitration proceeding with the Minority Shareholder of MTV. The arbitration proceeding is continuing and no further material developments have occurred. The Company remains confident in its position and is monitoring the arbitration proceeding and its process closely.

Qualified Persons

The scientific and technical content contained in this news release is taken from the technical report (the “ Technical Report “) entitled “Minera Tres Valles Copper Project, Salamanca, Coquimbo Region, Chile NI 43-101 Technical Report” prepared by Dr Antonio Luraschi, RM CMC, Manager of Metallurgic Development and Senior Financial Analyst, Wood, Mr Alfonso Ovalle, RM CMC, Mining Engineer, Wood, Mr Michael G. Hester, FAusIMM, Vice President and Principal Mining Engineer, Independent Mining Consultants, Inc., Mr Enrique Quiroga, RM CMC, Mining Engineer, Q&Q Ltda, Mr Gabriel Vera, RM CMC, Metallurgical Process Consultant, GVMetallurgy, and Mr Sergio Alvarado, RM CMC, Consultant Geologist, General Manager and Partner, Geoinvestment Sergio Alvarado Casas E.I.R.L. all of whom were independent qualified persons as defined by NI 43-101 at the time the Technical Report was prepared. The Technical Report was filed by TVC on SEDAR (www.sedar.com) on December 14, 2018 and subsequently amended and restated on May 27, 2021. Readers are encouraged to read the Technical Report in its entirety except for certain sections withdrawn by the Company in relation to disclosure regarding the Preliminary Economic Assessment appearing in the Technical Report (see press release dated April 12, 2021).

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC) announced this morning that it had closed the previously announced bought-deal offering and exercise of the over-allotment option. The financing will help the company advance the Minera Tres Valles copper project in Chile, and fund exploration at the site. Additionally, funds will be used for working capital and general corporate purposes as Three Valley Copper explores, develops, and produces 99.99% copper cathodes at its flagship property.

Initially, the company entered into an agreement with co-lead underwriters and joint bookrunners PI Financial Corp. and Eight Capital for a C$10 million bought deal financing.

Then, shortly after, due to significant investor demand, PI Financial Corp and Eight Capital amended the agreement to increase the size of the deal.

Details of the financing are as follows:

The Company issued a total of 56,681,000 units (the “Units”) on a bought deal basis, at an offering price of C$0.32 per Unit (the “Offering Price”), which included 6,681,000 Units issued pursuant to the exercise of the over-allotment option, and issued 819,000 additional Common Share purchase warrants (each, a “Warrant”) pursuant to the exercise of the over-allotment option at an offering price of C$0.08 per Warrant, for gross proceeds of approximately C$18.2 million. Each Unit consists of one Class A common share (a “Common Share”) in the capital of the Company and one Warrant. Each Warrant entitles the holder thereof to purchase one Common Share at a price of C$0.45 for a period of 30 months following the closing of the Offering.

Source: Three Valley Copper

Michale Staresinic, CEO of Three Valley Copper (TSXV:TVC) commented in a press release: “This new equity capital coupled with the concessions provided by our senior lenders provide a roadmap for the Company to complete its flagship project at MTV, Papomono is on schedule to begin its first caving operations in January 2022 followed by an increasing production profile during 2022 and ultimately reach near production capacity in 2023. In parallel, we continue the strategic review process announced by the Company in October and welcome our new shareholders with the closing of this equity raise, and thank our existing shareholders for their ongoing support.

“With copper prices firmly above US$4 per pound for the majority of 2021, we continue to believe this level of price support for copper will continue in the long-run. The electric vehicle revolution, infrastructure stimulus spending, and world consensus on decarbonization back our strong conviction that our pure-play copper project with 46,000 hectares of underexplored lands will produce strong results for shareholders once we are able to reach production capacity. Our new shareholders see this too and we welcome their support through this Offering.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

It was announced yesterday that Three Valley Copper Corp (TSXV:TVC) has entered into an undertaking between itself and its secured lenders of Minera Tres Valles, the Company’s primary asset that is 91.1% owned and located near Salamanca, Region de Coquimbo, Chile.

The company, with its direct and indirect wholly-owned subsidiaries including MTV and the lenders, have agreed to create a definitive binding agreement to revise the loan repayment schedule as set forth in the loan facility agreement.

Michael Staresinic, President and CEO of Three Valley Copper, said in a press release: “Our senior lenders continue to work as partners with us. This is an important first step in restructuring MTV’s debt obligations to improve cash flow from MTV in 2022 as we complete the development of the Papomono mine and ramp up production in 2022. Papomono is nearing completion and we remain on schedule to complete our first caving of ore in January 2022.”

Terms and conditions of the undertaking include the lenders agreeing not to accelerate or enforce their rights or remedies under the Facility Agreement if MTV were to fail to make scheduled loan repayments on March 31, 2022, June 30, 2022 and September 30, 2022 and/or replenish the operating reserve account to reestablish the Minimum Reserve as required under the Facility Agreement.

Also included in the conditions, the proceeds of the recently announced bought-deal financing of C$16 million will not be used to repay any of the loans outstanding under the Facility Agreement during the Forbearance Period. The Forbearance period is from November 22, 2021, to October 1, 2022. That financing was upsized from C$10 million after significant investor interest was expressed.

This undertaking follows the recent announcement to increase the size of the previously announced bought deal financing to an aggregate of 50,000,000 units of the Company at a price of C$0.32 per Unit. This is an excellent step forward with TVC’s partners and helps to secure financing that is expected to close later this week.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC) took an important step today in funding the advancement of the company’s flagship 91.1% owned Minera Tres Valles copper mining project. Initially, it entered into an agreement with co-lead underwriters and joint bookrunners PI Financial Corp. and Eight Capital for a C$10 million bought deal financing.

Then, shortly after, due to significant investor demand, PI Financial Corp and Eight Capital amended the agreement to increase the size of the deal. It now consists of 50,000,000 units at a price of C$0.32 per unit for gross proceeds of C$16,000,000.

The deal includes 50,000,000 units of common shares at a price of C$0.32, and one common share purchase warrant for each unit. These are exercisable into one common share of the company at a price of C$0.45 for a period of 30 months following the closing of this offering.

Advancing the MTV Mission

This will help fund the advancement of exploration and development at the company’s Minera Tres Valles project and for working capital and general corporate purposes. The offering is expected to close on or around November 19, 2021, subject to regulatory approvals including the approval from the TSX Venture Exchange where Three Valley is listed under the symbol “TVC”.

The underwriters also have the option, exercisable at the offering price for a period of 30 days following the closing, to purchase up to an additional 15% of the units or the components of the units to cover over-allotments and for market stabilization purposes.

Strategy Comes Into Focus

The announcement comes on the heels of the October 20 announcement that the company had initiated a strategic review to explore alternatives for the enhancement of shareholder value. The goal is to maximize production at Minera Tres Valles, and increase cash flows from its mining assets in Chile.

This will encompass a thorough evaluation of the development strategy, business plan, market valuation, and capital structure, and could bring into focus a number of new opportunities for the company going forward. While this financing is one of them, strategies could include mergers, strategic partnerships, acquisitions, restructuring, and refinancing of long-term debt.

Through the strategic review, Three Valley will be able to chart a clear path forward for the end of 2021 and into early 2022 as it looks to explore, develop, and produce at Minera Tres Valles. The property consists of 46,000 hectares, 95% of which are unexplored, presenting a large opportunity and potential for future development.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC) is reviewing its development strategy, business plan, market valuation, and capital structure in a bid to deliver enhanced shareholder value and maximize production and cash flows.

The company’s 91.1% owned Minera Tres Valles property near Salamanca, Region de Coquimbo, Chile will be the focus of the evaluation, during which the company will consider mergers, strategic partnerships, acquisitions or disposition, restructuring or refinancing of its long-term debt, and any other options available to Three Valley to maximize shareholder value.

To complete the review, PI Financial has been retained. While the process does not guarantee a transaction or investment, the company looks to be aiming for the best strategies for maximizing results at its Papomono Masivo deposit. Papomono Masivo (PPM) has become a priority for Three Valley and the company is aiming to hit an increased production profile at Minera Tres Valles by ramping up production there.

Although the exploration program will be temporarily scaled back during the strategic review process, the review may reveal optimal paths forward for its exploration efforts to maximize drill programs. The review process will evaluate any and all alternative avenues for maximizing value, and the exploration program is a key pillar of shareholder value at Three Valley Copper.

Accelerating Investment, Revising 2022 Outlook and Guidance

PPM is a critical catalyst for Minera Tres Valles, and the successful development of this deposit continues to be a priority. For this reason, management has reviewed the preliminary development and mining plans at PPM and has decided to increase capital expenditures in 2022 instead of deferring some of those into the latter years of the mine life. This decision was made after a thorough review and concluded with a forecast from Three Valley that additional capital of approximately US$10 million in 2022 will be needed to achieve the recently announced production guidance. This decision will keep the program on track and keep the project on track for its timeline.

Don Gabriel

The Don Gabriel mine has experienced a lower head grade than initially forecasted, and as such, Three Valley Copper put a number of remedial measures in place in the third quarter. The delay between the implementation of those measures and the improved results may take a number of months to appear, due to the workflow of a heap leach operation. Initially, Three Valley had anticipated that copper production at Don Gabriel along with the recent drawdown of the remaining US$6 million of senior debt in September would support those operations and the ongoing PPM project. With production lower than expected and the Don Gabriel mine being the company’s primary source of ore to produce copper cathodes for 2021, Three Valley’s tight liquidity position has been amplified. Several factors are contributing to the liquidity crunch, including the company’s mostly fixed operating cost base, increased capital demands due to the PPM deposit 2022 development, and scheduled debt repayments due to begin March 2022.

A Path Forward

As such, Three Valley has announced that it does not expect to generate sufficient cash from operations to fully fund 2021 operations, planned investment activities, plus debt service obligations in March 2022 and the increased sustaining capital expenditures next year for PPM. To secure funding, Three Valley has initiated discussions with senior secured lenders and the company’s offtake provider.

This may allow the company to make changes to the existing loan agreement, inter alia, bridge loan financing, waivers of operating covenants, deferrals of or renegotiation of repayment terms, and/or renegotiation of the fixed-price portion of the offtake agreement. In the event of a successful strategic review and/or negotiations with the company’s senior secured lenders, Three Valley Copper will have the liquidity necessary to execute the planned production expansion at Minera Tres Valles.

Three Valley Copper (TSXV:TVC) stock was up 6% to CA$0.53 yesterday.

The Company’s revised preliminary operating outlook1 for 2022 at MTV is as follows:

| Revised | Original | ||

| Operating information | Year Ended | Year Ended | |

| Copper (MTV Operations) | Dec. 31, 2022 | Dec. 31, 2022 | |

| Cu Production (tonnes) | 8,000 – 10,000 | 8,000 – 10,000 | |

| Cu Production (pounds) | 17.6M – 22.0M | 17.6M – 22.0M | |

| Cash Cost per Pound Produced2 | $2.75 – $3.25 | $2.75 – $3.25 | |

| Capital Expenditures3 ($ millions) | $15 – $20 | $5 – $10 |

In the absence of a successful strategic review event and/or renegotiations with its senior secured lenders which will require financial liquidity solutions for MTV before the end of 2021, additional material changes to the Company’s revised preliminary outlook above will then be required.

- Preliminary guidance is based on certain estimates and assumptions, including but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations, metallurgical performance and foreign exchange rates. Please refer to the amended and restated technical report prepared by Wood Independent Mining Consultants, Inc., in respect of the Minera Tres Valles Copper Project (the “Technical Report”) dated May 27, 2021 and to the Company’s SEDAR filings for complete risk factors related to the Company and MTV.

- Cash Cost is a non-IFRS measure – Cash costs of production include all costs absorbed into inventory less non-cash items such as depreciation. Cash costs per pound produced are calculated by dividing the aggregate of the applicable costs by copper pounds produced.

- Planned capital expenditures (“CAPEX”) for 2022 are focused primarily on open pit expansion, plant CAPEX and sustaining CAPEX of PPM for the inclined block-caving mining project. It is expected that by early 2022, the underground operation at PPM will begin production and the resulting production growth is expected to lower per unit operating costs in 2022 and 2023 as the results of this CAPEX are realized.

Source: Three Valley Copper

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper Corp. (TSXV:TVC) has announced a corporate and operating update for its 91.1% owned Minera Tres Valles property near Salamanca, Region de Coquimbo, Chile. The company also provided guidance for 2022 and 2023, and news of a new copper porphyry target.

December 2020 saw construction begin at Papomono Masivo which has proven and probable reserves of approximately 102 million pounds of contained copper with an average grade of 1.51%4. Papomono’s development is currently at 71% for horizontal works and 85% for vertical works. Expectations are that Papomono will be completed at the end of 2021 or in early 2022. Production is expected to then ramp up in 2022.

“We continue to improve the development rate of this project during the month of August (the advance rate being the best month on record), and we expect the fourth quarter’s projected advance rate to be similar,” said Joe Phillips, COO of the Company. “We have completed the critical ventilation shaft and the ore pass which will further accelerate the speed of our continued advance. We remain on track to commence the caving/mining process in December 2021 or early 2022.”

2022 and 2023 to Capitalize on Momentum

Guidance for 2022 and 2023 has also been provided by Three Valley Copper (TSXV:TVC) since the positive progress for the Papomono project is moving swiftly:

Copper production is expected to significantly increase in 2022 compared to 2021’s production range of 4,500 to 5,500 tonnes as the initial construction of the PPM project concludes and mining of PPM begins during the 2022 ramp-up year. Thereafter, it is expected that annual production between 13,000 and 16,000 tonnes of copper cathode will be attained in 2023 approaching the operation’s full production capacity. The Company’s production profile includes mineralized material from both Don Gabriel and PPM during 2022 and predominantly from PPM during 2023 together with material from ENAMI and third-party miners expected during both years. Looking forward to 2022 and 2023, Cash Costs are expected to fall significantly driven by higher grades from PPM and throughput coupled with decreased capital development and other sustaining capital programs. As the Company exits 2021 and completes its budgeting process, updates to this preliminary guidance may be required.

Source: Three Valley Copper

New Target Identified

Three Valley Copper commenced its near-mine exploration program at Minera Tres Valles on September 15 and has now announced it has identified a new copper porphyry target in its license area.

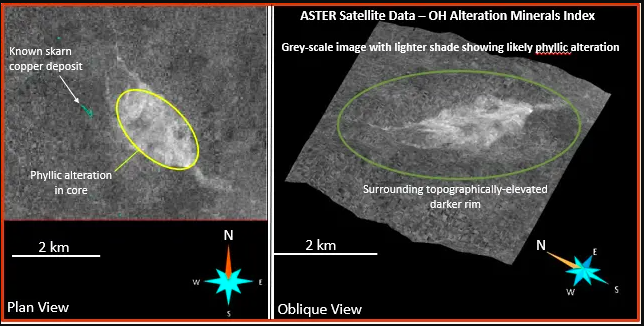

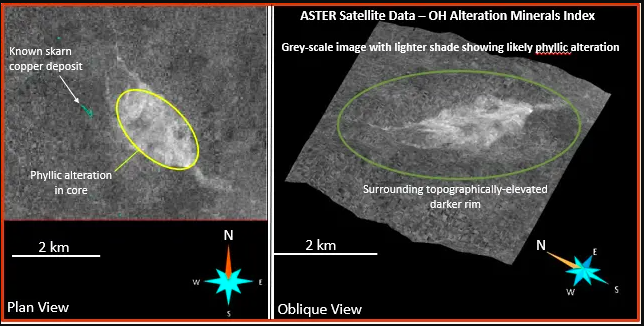

Previously mapped as a late Cretaceous granitoid intrusive, the identified targets displays likely hydrothermal alteration characteristics of the phyllic zone of porphyry copper deposits. This was determined after processing ASTER satellite data from the United States Geological Survey.

The newly identified central core is approximately 2 kilometres by 1 kilometre, and this outlines the surface footprint of the new target. A nearby copper deposit has been described as a skarn, and it should be noted that copper skarns are often nearby porphyry deposits. The fact that they are often located near one another is a very positive indicator for this new target and Three Valley Copper.

Michael Staresinic, President and CEO of Three Valley Copper commented, “John Mortimer, our exploration consultant, has identified an exciting target for the Company. Copper porphyry deposits are associated with some of the largest long-life copper mines in the world, with Chile hosting the greatest concentration of these deposits. This target is an example of the broader potential of this property as we continue to identify additional targets on our 46,000-hectare land package. This target forms part of our new exploration sections in our corporate presentation available on our website at https://www.threevalleycopper.com.

The recently announced exploration campaign will continue as planned, focusing on 6,000 to 8,000 metres of proposed drilling near Minera Tres Valles’ existing mines. Once this exploration campaign is completed, Three Valley Copper (TSXV:TVC) will direct its efforts toward this new exciting copper porphyry target.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC) announced this morning the start of its near mine exploration drilling program at its Minera Tres Valles project in the Salamanca region of Coquimbo, Chile. A geophysical survey of the area was conducted by Zonge Ingenieria y Geofisica Chile (SA) under the previous ownership of Compania Minera Latino Americano (LTDA), a subsidiary of Vale, in 2005. This information was used by the exploration team to plan the 2021 exploration program at the property, including geophysical, magnetic, and IP chargeability anomalies and similarity anomalies related to the Papomono and Don Gabriel mines.

Kickoff

The commencement of the exploration drilling program marks the beginning of a critical prong of Three Valley Copper’s business model. As a company exploring, developing, and producing copper, Three Valley is in a unique position to unlock the value of the assets it explores. Minera Tres Valles could be one of those assets.

Michael Staresinic, President and CEO of Three Valley Copper (TSXV:TVC) had this to say about the news: “Since Vale first staked the property and found our two deposits named Don Gabriel and Papomono in 2005/2006, little further exploration has been performed on the property.

“A majority of Vale’s 170,000 meters of diamond drilling was focused on defining these two deposits. Multiple targets were identified elsewhere on the 46,000-hectare land package although detailed follow-up was postponed while delineation of Don Gabriel and Papomono was prioritized.

“Our drill program will test high-potential copper targets located between Don Gabriel and Papomono, which sit approximately 3 kilometers apart. This initial area of focus represents less than 5 square kilometers or approximately 1% of our land package. We believe this is an excellent opportunity to identify new near-surface copper occurrences close to our existing mines and mineral processing plant.”

The Site

The Papomono and Don Gabriel mines are TVC’s two main ore sources but the exploration campaign looks to explore areas where two of the largest and longest third-party miners on the property operate, containing oxide-rich capsthat MTV facilities develop and process. It is also noteworthy that between the Papomono and Don Gabriel mine where Verde is located, there is a collection of artisanal pits. MTV believes similar geophysical features of the District and maps of similar copper mineralized rocks will help determine drilling targets for the upcoming program.

The possibility of being part of a larger mineralized system is consistent with available geophysical soil data. The initial drilling is expected to be between 6,000 and 8,000 meters, with a budget of $2.5 million for the drilling. Drilling will be carried out with existing surface infrastructure and current environmental approvals. The exploration team will evaluate the results of the new drill holes as they become available and incorporate them into a dynamic design and management program.

Mining, The Right Way

Minera Tres Valles is also a symbol of what Three Valley Copper (TSXV:TVC) is aiming for. The mine received visitors from the surrounding communities at the site for a demonstration of an in-situ controlled blasting event. The purpose of the event was to teach the protocols required by the regulatory authorities to the community representatives and show correct compliance with regulations. Now, TVC will put its ESG plan into action with the drill program.

The company produces Electrolytic Copper Cathodes (Grade A) of 99.99% purity. That copper is often used in electric equipment like technology, battery parts, and the copper can easily be drawn and formed into wires.

With the current focus on global decarbonization efforts, this particular type of copper is seeing massive demand growth. Electrolytic copper undergoes refining or purification through the process of electrolysis. That purification is by far the simplest method of achieving purity levels 99.99% in copper and makes Three Valley Copper’s product particularly valuable in a world that is rapidly going electric.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper (TSXV:TVC), the majority owner of the Minera Tres Valles (Three Valley Mine) in Chile, is located in the town of Salamanca in the Choapa Province. The mine is 91.1% owned by the Canadian company, with the rest of the mine (30%) being owned by the Chilean group, Vecchiola S.A.

Three Valley’s approach to mining means its commitment to ESG principles comes first in the process from development to production, and consultation is critical to this process. One of the ways the company is achieving this is through bringing visitors to the mine to ensure the company is being totally transparent with everyday operations.

In May, Minea Tres Valles received visitors from nearby communities in Salamanca for a demonstration of an in-situ controlled blasting event. This blasting event allowed Three Valley to teach the protocols requires by the regulatory authorities to the community representatives and show correct compliance with regulations. This transparency is something most companies don’t bother with and is what Three Valley seems set on dedicating itself to.

The event was directed by the Sustainability Manager and other managers from Minera Tres Valles and included the president of the surrounding communities for the project. They included: Viviana Varas, president of the Manquehua Community, Iris Astudillo, president of the El Senor de la Tierra Community, Fredy Rivera, president of the El Tebal community, and Wenceslao Layana, present of the Chalinga Agricultural Community.

Critical points with the blasting event included and were confirmed by all parties:

- Minera Tres Valles complies with the required protocols to perform blasts and it complies with the procedures necessary for lowering dust emissions, measuring these via established monitoring stations that record MP10 emissions and vibration levels. The Company has not surpassed regulatory limits in any of its recordings measured in past months.

- There are 15 other mining operations in the Chalinga area, with no association to MTV.

- MTV is committed to maintaining the current measures used for controlling the dust that is released from the Don Gabriel Mine and Manquehua road. These environmental actions were demonstrated, and the community representatives were satisfied with the results obtained.

- It was agreed to keep the table open, continuing constructive, transparent and collaborative dialogue between the communities and MTV. This communication will be direct and immediate through WhatsApp groups, where items of common interest, such as the blasting schedule, will be previously notified.

- The next activity that will be discussed with this panel will be the scheduling of the community inspection of MTV’s MP10 monitoring station, with a third-party specialist who will explain how the emissions are recorded. Likewise, an onsite inspection of the shock (vibrational) monitoring station will be performed by an expert, in order to verify and learn about the operational methodology used at this station.

While most companies end consultation once the project has begun, the importance of Miner Tres Valles is not lost on management. Three Valley Copper is looking to set an important precedent for the region and the industry as it consults with local communities, particularly during a time of great necessity due to the ongoing health pandemic.

Mining Manager of Minera Tres Valley Sergio Molina commented, “It is thanks to these opportunities to discuss and participate with the leaders of surrounding communities that give MTV that tools to understand and respond to the questions from our neighbours; this promotes a great closeness with the Company, receiving reliable information from the source.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Three Valley Copper Corporation (“TVC” or the “Company”, formerly SRHI Inc.) announced today its financial and operating results from the second quarter of 2021, which is the three and six months that ended June 30th, 2021.

The Company is focused on growing copper production from, and further exploration of, its primary asset, Minera Tres Valles SpA (“MTV”). Located in Salamanca, Chile, MTV is 91.1% owned by the Company and MTV’s main assets are the Minera Tres Valles mining complex and its 46,000 hectares of exploratory lands. The Company’s financial statements and management’s discussion and analysis (“MD&A”) are available at www.threevalleycopper.com and www.sedar.com.

Highlights

Corporate

- Successfully closed a bought deal offering (“Offering”) including the full exercise of the over-allotment option for net proceeds of approximately $8.3 million.

- The Company, through its indirectly held subsidiary (SRH Chile SpA), subscribed for additional common shares of MTV for approximately $6.8 million, resulting in the Company’s indirect holding of MTV increasing from 70% to 90.3% effective June 3, 2021. Effective August 16, 2021, a further subscription was executed resulting in the Company’s indirect holding of MTV increasing to 91.1%.

- On June 22, 2021, the Company formally changed its name to Three Valley Copper Corp. and began trading on the TSXV under the symbol TVC. In conjunction with the name change, the Company launched a new website (www.threevalleycopper.com).

Operations

- Retained Dr. John Mortimer as the Company’s independent exploration geologist to lead the renewed exploration program that commenced in the second quarter of 2021.

- Successfully settled union strike without disruption leaving monthly wages unaffected in a new 3 year agreement.

- Copper cathode production was 1,035 tonnes at an average grade of 0.53%, increasing 15% from 900 tonnes at an average grade of 0.57% for the three months ended March 31, 2021 as the restart and scaling up of operations continued during the second quarter of 2021.

- For the six months ended June 30, 2021, capital expenditures of $6.1 million were incurred related to the construction and development of the incline block caving mine at the Papomono Masivo deposit, consistent with annual guidance of $12 – $15 million total capex. Construction continues and is approximately 50% complete, targeting production commencing early 2022.

- Effective August 1, 2021, an amendment to the offtake agreement was executed deferring the remaining 12 months of contracted delivery amounts of the fixed price sales component (at $2.89/lb) until May 1, 2022. All sales of copper cathodes commencing August 1, 2021 until April 30, 2022 will be sold at the prevailing spot price for copper cathode, less a nominal amount.

Financial

- Reported gross loss of $4.3 million (including a write-down of inventory of $4.2 million primarily on long-term inventory) on a realized copper price1 of $3.37 compared to $2.42 in Q2 2020.

- Adjusted EBITDA from continuing operations1 of $0.1 million compared to $(1.8) million in Q2 2020.

- Net loss per share attributable to owners of the Company of $(0.12) compared to $(0.10) in Q2 2020.

Source: Three Valley Copper Corp.

Three Valley Copper Corp or “TVC” is located in the Cretaceous belt of Chile and has over 46,000 hectares of land to explore and mine. TVC already has over 100 copper occurrences and 70 “artisanal exploitation points” registered with geological features similar to those of its “identified orebodies.” They are currently producing 99.999% pure copper from its mineral reserves, with up to 18,500 tonnes of pure copper cathodes annually, which are the highest quality cathodes available on the market. TVC has also completed 170,000 meters of diamond drilling, and has a handful of other successful Chilean copper mines. TVC has great potential in the copper mining industry as only roughly less than 10% of their 46,000 hectares has been explored, leaving thousands of hectares yet to be investigated.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

MiningFeeds is pleased to report that updates about Three Valley Copper will be covered in full here on MiningFeeds.com, as the company develops and produces at its copper properties in Chile. The company has been on something on a run lately, and we will be bringing you all the updates as they come to ensure you don’t miss anything.

The company’s recent name change was accompanied by an update to the website, a ticker symbol change, as well as a brand new investor presentation. Common shares and warrants trade on the TSX Venture Exchange under the new name and symbols “TVC” and “TVC.WT” after it was changed from SRHI to Three Valley Copper.

In a June statement, Michael Staresinic, President and CEO of Three Valley Copper, commented, “We are pleased to announce a rebranding of the company that reflects its transformation. We want our company name and symbol to clearly reflect our business and its deep roots in Chile.”

The Three Valley Mine

The company’s primary asset, Minera Tres Valles (Three Valley Mine), is located in Salamanca, Chile and is 90.3% owned by the company. The main assets at the property are the mining complex and 46,000 hectares of exploratory lands.

The Canadian copper mining company’s projects are located in the prolific Cretaceous belt of Chile that hosts a large number of rich deposits. The company produces Electrolytic Copper Cathodes (Grade A) of 99.999% purity. That copper is often used in electric equipment like technology, battery parts, and the copper can easily be drawn and formed into wires.

With the current focus on global decarbonization efforts, this particular type of copper is seeing massive demand growth. Electrolytic copper undergoes refining or purification through the process of electrolysis. That purification is by far the simplest method of achieving purity levels 99.999% in copper and makes Three Valley Copper’s product particularly valuable in a world that is rapidly going electric.

Two-Pronged Approach

The company has two main deposits: Papomono Masivo and Don Gabriel. The company’s strategy is to produce ECC, while simultaneously exploring its property to increase the visibility of the mine and extend the life of the mine. Both deposits are located in a 10 kilometre wide corridor of middle to upper Cretaceous volcanic rocks. This property is bounded by north-south-trending faults and stand as examples of stratabound, manto-type copper deposits.

Three Valley’s projects are in progress and advancing rapidly, and MiningFeeds will keep readers informed of any progress and new information for the complete picture of Three Valley Copper.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

RTG.TO | +60.00% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

AFR.V | +33.33% |

|

CASA.V | +30.00% |

|

SRI.AX | +28.57% |

|

BSK.V | +25.00% |

|

GZD.V | +25.00% |

|

PGC.V | +25.00% |

|

GQ.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024