By Tina Leto

The odds seem to be against uranium. Fukushima’s nuclear power plant is still disabled; the U.S. Supreme Court seems to be leaning towards staying Virginia’s moratorium on uranium mining, and projects such as Berkeley Energía’s Salamanca mine in Spain are facing major opposition.

So, why mine uranium and why now?

The answer is quite simple, actually. There is increased demand, and, after a period of volatility, prices are going up.

A series of current events are increasing demand and pushing up the value of U308. Bank of America Merrill Lynch commodities team raised its uranium concentrate price estimates for 2018, 2019 and 2020 by 3%, 22% and 32%, respectively.

Cameco CEO Tom Gitzel has a bullish look on uranium but remarked prices still have a long way to go to create some sort of optimism in the market, things are moving forward, even if it is in a slow and steady pace. The current spot price is up 40% from last year and has reached its highest level in over two-and-a-half years at around $28.75/lbs.

So, what is happening?

First, we need to take into account that, nearly eight years after the Great East Japan Earthquake, the resource-poor country has already reactivated five nuclear plants and nine reactors and has approved a 20-year operations extension for the Tokai Daini reactor located some 115 kilometres northeast of central Tokyo.

Although it is unlikely that it achieves it by 2030 as promised by the government, the Land of the Rising Sun is working towards its goal of generating a fifth of its electricity from nuclear plants in the next decade. To achieve this, of course, they will need the raw material, uranium.

Then we have China, whose uranium demand is expected to grow to around 10,800 tonnes by 2020 and rise to between 16,300 tonnes and 18,500 tonnes by 2025. The Xi administration has said it will spend $2.4 trillion to expand its nuclear power generation by 6,600% and in the near term, it plans to connect five reactors to the electricity grid and start building six to eight additional units.

In Southeast Asia, India is carrying out an aggressive growth policy reliant on nuclear power that uses both local and imported uranium. At present, the subcontinent has 22 nuclear reactors, 14 of which use foreign inputs, and it is in the process of finishing up six new units. In the next few years, 19 reactors are expected to be built.

In the Middle East, Saudi Arabia commenced reactor procurement discussions with supplier countries, as it plans to build two large nuclear power reactors and projects 17 GWe of nuclear capacity by 2040 to provide 15% of the kingdom’s power.

Canada, on the other hand, just launched its Small Modular Reactor Roadmap to promote the construction of such infrastructures, which are capable of generating up to 300 MW for small and remote communities and mines that are not connected to the electric grid.

As all of this is happening, supply is starting to see cuts given the decision by Canada’s Cameco to suspend its McArthur River/Key Lake operations in Saskatchewan, the world’s largest uranium mine, and the resolution of Kazakhstan’s state-owned Kazatomprom to lower output by 20% over the next three years as well as perform another 6% production cut over previous expectations.

*image courtesy of Bloomberg

In addition to the reduced supply, Kazatomprom recently sold 8.1 million lbs of its annual production to Yellow Cake, a new uranium holding company that raised $200 million in a London-based IPO and whose management is buying and storing large amounts of the metal in anticipation of higher prices.

Back in March, the World Nuclear Association reported that there are 448 reactors operative and 57 new reactors under construction, 158 reactors planned or on order, and another 351 proposed. The need for uranium is there and it is not going anywhere. Financial advisors believe that global consumption will grow from about 172 million lbs in 2017 to some 190 million lbs in 2019 while a supply gap should be in place by 2022-2023.

The balance seems to be slowly shifting into a deficit for the first time in more than a decade and, on top of all the cuts previously mentioned, the decision of producers like Cameco to buy larger quantities of material from the spot market going forward to fulfill long-term sales contracts will add upward pressure to the prices.

A drill hole away from a game changer

In other words, now is the time to invest in uranium stocks. With three projects underway, Azincourt Energy Corp (TSX.V: AAZ) is betting on a bright nuclear future. The primary focus of the Vancouver-based explorer and developer is its advanced exploration joint-venture with Skyharbour Resources, the 25,000+ ha East Preston Project, located in the Athabasca Basin, Saskatchewan where their team generated new drill targets to follow up after a successful geophysical exploration program.

Azincourt President and CEO Alex Klenman “These targets are similar to NexGen’s Arrow deposit and Cameco’s Eagle Point mine. East Preston is near the southern edge of the western Athabasca Basin, where targets are in a near surface environment without Athabasca sandstone cover.”

This region is gathering a lot of attention lately, especially after Skyharbour’s option partner Orano Canada (formerly Areva) announced recently that it plans to spend $2.22 million over the next year on exploration and drilling programs at the Preston project, which is right next door to the Azincourt/Skyharbour JV on East Preston.

In the next six years, big player Orano may end up investing about $6.04 million on exploration at Preston in exchange for up to 70% of the project. This is a hot zone of exploration with the Preston property and Azincourt/Skyharbour’s East Preston to be drilled at the same time. Who will make the first major discovery is anyone’s guess but, as always, it only takes one drill hole to transition from dwarf to giant.

Skyharbour President and CEO Jordan Trimble “Over the past decade, we have seen a number of notable discoveries in the Athabasca Basin. The most notable of which was made by Nexgen Energy, at their Arrow deposit (25 km away from Skyharbour and Azincourt’s East Preston Project) where they have hundreds of millions of lbs of uranium at a high grade and boast a $1B market cap.”

And Azincourt seems to be betting at growing big time in the uranium space. Besides East Preston, the company led by Alex Klenman carries 10% of the Fission 3.0 Patterson Lake North project in Athabasca, and it recently acquired three highly prospective Peruvian-based properties known as the Escalera Group.

The South American project consists of three concessions occupying over 7,400 hectares on the Picotani Plateau, which have yielded historical samples of 6500 ppm uranium and recent samples of 3500 ppm uranium. Escalera is currently undergoing a mapping and sampling program.

According to Azincourt’s management, this latter grassroots play in an emerging uranium district combined the firm’s presence in the world-famous Athabasca basin are the well-founded pillars that boost its confidence in the silvery-white metal.

About the author: Tina Leto is a seasoned Canada-based writer focusing on the resource world.

Over the last month, I’ve received numerous questions pertaining to the direction of the gold price. The fact is, I don’t have a crystal ball and, while I believe we will see higher gold prices in the future, I have no idea when, and really, I don’t care.

Why? Simply, I don’t invest in junior mining companies because I believe the price of gold is going to go up. I believe you invest in junior mining companies because you see value creation via discovery, or you see a clear path in the development of a project into a future mine.

There are many ways to make money in the junior resource sector, but for me, it’s a process which is linked to finding quality – the best people, who pick the best projects and execute well thought-out plans to achieve a specific goal.

In particular, discovery pays in any part of the market cycle and, therefore, while the risks associated with exploration are HUGE, I think it’s prudent to invest in the highest quality gold exploration companies the market has to offer.

Today, I would like to bring your attention to Klondike Gold Corp., a gold exploration company that is cashed up and ready to execute a 5000m drill program in the heart of the Yukon.

Let’s take a look!

Klondike Gold Corp. (KG: TSXV)

MCap – $24 million (at the time of writing)

Shares – 95 million

Fully Diluted – 120 million

Cash – $7 million

Ownership:

Frank Giustra – 14%

Eric Sprott – 13%

Key Investors – 10%

Insiders – 11%

NOTE: As you can see from the ownership breakdown, Klondike is tightly held by a small number of hands. Specifically, Canadian billionaires, Frank Giustra and Eric Sprott, who collectively control almost a third of the company’s outstanding shares and, I think, speaks to the upside potential that is seen in Klondike Gold and its district sized land package in the heart of the Yukon.

Klondike Gold’s Leadership

Klondike Gold Corp. is led by CEO, Peter Tallman, who is a geologist by trade and has over 35 years of experience in the mining industry.

During a conversation with Tallman, he related his start in the mining sector back to when he was in his early teens and helped build a log cabin just south of Algonquin Park, located in central Ontario. The key to this experience didn’t have anything to do with building or geology, but was important because Tallman became an avid and skilled canoeist, which would later be a key component in him attaining his first geology job outside of university.

After completing his geology degree at the University of Western Ontario, Tallman’s first job was with Selco (later BP-Selco), where he was hired to prospect for diamonds in northern Ontario. A key prerequisite for this job was proficient canoeing skills, which Tallman had in spades, and so he got his start in the mining business. Additionally, with Selco, he moved to Newfoundland where, while working in a remote corner of the province, chipped the discovery outcrop of what later became the Hope Brook gold mine.

Tallman has worked for a number of different companies in senior roles, over the course of his career, including Noranda Exploration, Prime Equities International (Murray Pezim), and Messina Minerals, just to name a few. Each of these experiences over the course of the last 35+ years has prepared Tallman well for leading Klondike Gold in their mission to discover an economic gold deposit in the Klondike.

The Klondike team is rounded out by CFO, Jessica Van Den Akker, and Board of Director members, Gordon Keep (CEO of Fiore Management & Advisory Corp.), John Pallot, Steve Brunelle and Tara Christie. The team has recently expanded the team with the addition of Ian Perry, VP Exploration who has extensive experience managing advanced exploration projects towards development stage.

Yukon

As the company name suggests, Klondike Gold is focused on gold exploration in Canada’s Yukon Territory. For those who may not be familiar with Canada’s geography, the Yukon is located north of British Columbia and it shares its western border with Alaska.

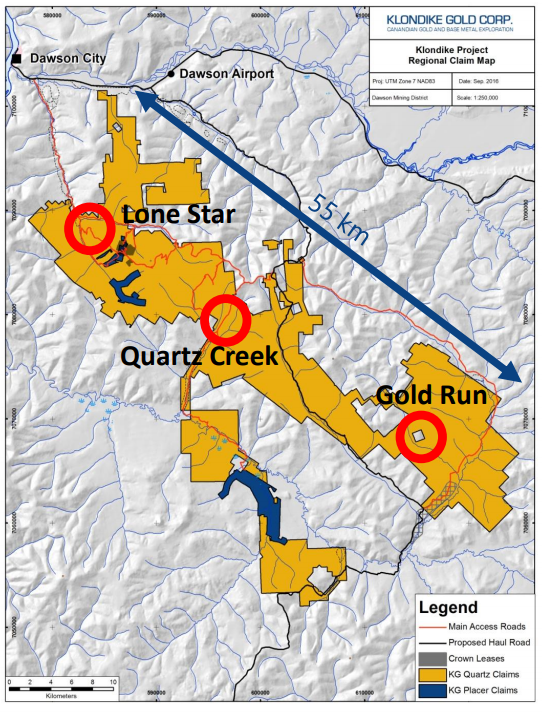

Klondike Gold Regional Claim Map

Klondike Gold owns 100% of its 2,942 contiguous claims, totaling 557 square kilometers, which sit in close proximity to Dawson City. Dawson City was built to support gold miners during the Klondike Gold Rush of the 1890s and hosts the major infrastructure needed for the exploration and development of mining projects, such as an airport, access to supplies and electrical infrastructure.

13th in the World for Mining Investment Attractiveness – Fraser Institute Ranking

The Yukon is a premier jurisdiction for mining and attained a score of 79.67, or 13th in the world, for mining investment attractiveness, according to the Fraser Institute’s 2018 rankings. The Fraser Institute uses a number of criteria in evaluating a jurisdiction, such as political stability, mining law, taxation and, arguably the most important, mineral potential.

The Yukon has well developed infrastructure, including more than 4,800km of all-weather roads, airports, power, Internet and cell phone service. Additionally, for companies that require international export of their concentrates, deep sea ocean ports are accessible across the Yukon’s western border in Alaska.

Yukon Mining Alliance

Uniquely, to my knowledge, many of the junior and major mining companies with projects in the Yukon have formed the Yukon Mining Alliance (YMA) with the Yukon Provincial Government and the Canadian Northern Economic Development Agency.

The YMA’s mandate is to,

“promote Yukon’s competitive advantages as a top mineral investment jurisdiction and its member companies and their Yukon-based project.” ~ YMA

In my opinion, this is a huge advantage of investing in companies with projects in the Yukon, as clearly, the marketing and promotion of mining within the Territory’s borders is a major priority. Bottom line, narrative plays a big role in the success of junior mining companies, and with the added help of the YMA, Yukon-based companies have a distinct advantage working together to promote the Yukon mining jurisdiction narrative.

Personally, I have seen the YMA presence at a couple of the top mining conferences in Canada, such as PDAC and Cambridge’s Vancouver Resource Investment Conference (VRIC). The YMA is putting the Yukon on the map for interested resource investors which, I believe, will pay off in spades as we move into the next leg of the bull market.

Klondike Gold Rush

The Klondike Gold Rush began in August of 1896, as three prospectors, George Carmack, Jim Mason and Dawson Charlie, discovered gold in what they referred to as “Rabbit” Creek, or what is now referred to as Bonanza Creek. With the discovery and the rush to stake their claim, word quickly spread of their discovery, and so spurred a historic gold rush in Canada’s Yukon Territory and the United States’ Alaska.

Source: Yukon Government Archive

It’s estimated that the Klondike Gold Rush attracted 100,000 people from all walks of life, testing their luck against the odds to find their fortune. Many of the new American prospectors found their way north via ships boarded in Seattle. Former ports, such as Dyea, Alaska, were accessible at high tide and allowed prospectors to begin the lengthy trip north toward the center of the Gold Rush, Dawson City, which is roughly 700km north.

Source: Yukon Government Archive

Unfortunately, for the vast majority of newly minted prospectors, their aspiration of discovering a fortune never happened; if it wasn’t the weather and the long trip to the prospective gold claims, it was the exorbitant costs that came with exploring and living in the north. In many of the articles I read while researching the Klondike Gold Rush, many estimated costs being 10 times higher than what many of the people would have experienced in their former lives, living in Toronto, New York or Chicago.

Source: Yukon Government Archive

The Klondike Gold Rush is estimated to have produced $29 million in gold over its 3 year span. Additionally, the Yukon Geological Survey estimates that a total of 20 million ounces of gold has been extracted from the Klondike goldfields since 1896. Gold mining can be credited with spurring the development of much of Canada’s and America’s northern most territories and states. In my opinion, the Yukon holds tremendous mineral potential and will only increase its prestige within the mining community.

Tr’ondëk Hwëch’in First Nation

Klondike Gold’s claims lie within the Tr’ondëk Hwëch’in First Nation lands, which are in the Dawson City area. To note, Goldcorp’s Coffee Gold Project, which was acquired from Kaminak Gold Corp, and sits 130km south of Dawson City, is also within the Tr’ondëk Hwëch’in First Nation lands.

Tr’ondëk Hwëch’in First Nation is based in Dawson City and consists of roughly 1,100 Hän-speaking people. The First Nation is governed by an elected Chief and four councillors, who take direction from the Elder’s Council, a group of Tr’ondëk Hwëch’in people, aged 55 and over. The governing body oversees all agreements affecting the First Nation, including finance, health, social programs, housing and natural resources.

In recent news, the Tr’ondëk Hwëch’in First Nation signed a collaboration agreement with Goldcorp over the development of their Coffee Gold Project. In my opinion, the success of this negotiation was imperative to any of the mining companies exploring or developing within the Tr’ondëk Hwëch’in lands, giving each company a glimpse of what a future deal with them might look like, if they are able to discover an economic deposit or move forward with the development of what they already have.

Klondike Gold Project

As stated earlier, the Klondike has a rich history in gold mining, as 20 million ounces of placer gold have been mined there. The question that Tallman and his team at Klondike Gold are trying to answer is, where did the placer gold come from? When this question is finally answered, there’s a good possibility that the discovery of an economic gold deposit will follow soon thereafter.

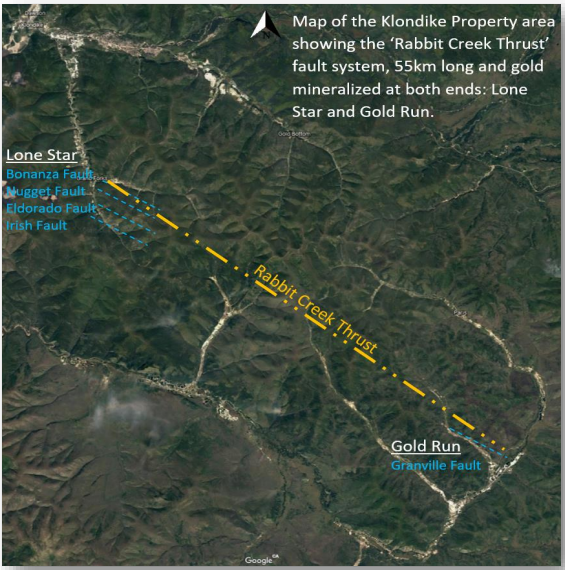

Thus, since taking the helm of Klondike Gold, Tallman has set out to determine if the fault system, which he identified in his original desktop review of the company, plays a role in controlling gold mineralization. Specifically, in our discussion of the property, Tallman refers to the Rabbit Creek Thrust Fault, which stretches roughly 55 km from the Lone Star target to the Gold Run target.

Tallman believes that this is a very important fault and, ultimately, is the key driver in the gold mineralizing event. As you can see in the image above, secondary fault systems, which Tallman refers to as horse tail faults, have been identified around the outer limits of the Rabbit Creek Thrust Fault, and are the areas of focus for Klondike’s upcoming drill program.

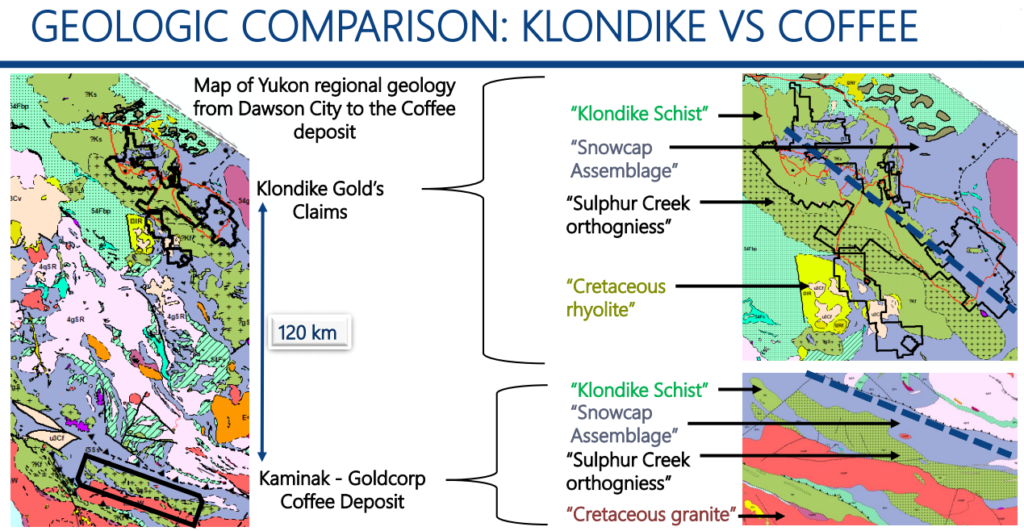

What I found most interesting about our conversation regarding the geology of the targets is how they resemble Goldcorp’s, formerly Kaminak Gold’s, Coffee Gold Project geology. Examining a few of Klondike’s slides from their latest Corporate Presentation, they outline the similarities in geological structures.

Klondike Gold Corporation Presentation – Slide 16

In my opinion, the identification of these similarities is a HUGE plus for Tallman and his team, as they are using the knowledge and processes laid out by Kaminak to influence their plans for exploration on their Lone Star and Gold Run targets. Not only does this make the exploration more efficient, but also speaks to the potential of what Klondike may have in terms of gold mineralization.

While it’s important to understand downside risk before investing in a junior mining company, it’s also very important to understand the upside potential. Therefore, I think it’s safe to say that the upside potential for Klondike can be found in a comparison to the Coffee Gold Project, which has 2.16 million ounces of gold reserves (Proven and Probable) and an additional 2 million ounces of gold resources (Indicated and Inferred). To note, Goldcorp paid Kaminak roughly $100/oz in ground for Coffee. Given Klondike’s current MCAP, the upside potential looks very good.

2018 Exploration

Klondike’s plan for its 2018 exploration program has three main components:

- Airborne Mapping – Complete 2500 to 3000 line kilometers of airborne surveys across the entire 557 square kilometer property. In my discussion with Tallman, he stated a few times how inadequate the old government geological maps of the property are. Accurate maps of the property are integral for efficient drill target gathering.

- Soil Sampling – Groundtruth Exploration has been hired to complete 5000 soil samples and complete the ortho-photographic modelling footage via drone. Airborne mapping overlain with soil sampling data will help the Klondike team narrow down their focus for the diamond drill program.

- Drill Program – 50 to 70 holes will be drilled for an estimated total of 5000 meters. This is a preliminary drilling budget, which Tallman suggests could be expanded, depending on results. Drilling on Klondike’s Lone Star target should begin very soon, with drilling on the Nugget and Gold Run targets to follow.

PUSH: Watch for drill results in the weeks ahead, as Klondike should have steady news flow of drill results over the next couple of months.

Metallurgical Work

Additionally, Tallman mentioned that they will be drilling a few holes of HQ core, which has a diameter of 96mm, which is almost 20mm larger than that standard NQ or CHD 76 core which is typically used in exploration drilling. Why the larger core size? Klondike will be using the larger core sample for the beginnings of a metallurgical study, which should shed some light onto economic viability of the Klondike mineralization.

Concluding Remarks

In my opinion, Klondike Gold has the basis for success when it comes to gold exploration:

- Experienced management team which is supported by smart money, via billionaire investors, Frank Giustra and Eric Sprott.

- District scale land package of 557 square kilometers with the premier mining jurisdiction that is the Yukon. NOTE: The Yukon ranks 13th in the world in mining investment attractiveness as per the Fraser Institute’s 2018 Survey.

- The Klondike Goldfields have produced 20 million ounces of placer gold over their history.

- Extensive 2018 exploration program, which includes airborne mapping, soil samplings and a 5000m drill program. High news flow throughout the summer.

- Exploration program is supported by a robust plan which is rooted in the geological similarities between Klondike’s target geology and Goldcorp’s 4 Moz Coffee Gold Project, which is just south of Dawson City.

- CASH – $7 million

Gold exploration is a risky endeavour, one that is fraught with more failure than success. In Klondike Gold’s case, failure is a very real possibility, however, I believe with the strengths outlined above, Klondike has positioned themselves to have the best possible probability of success in discovering economic gold as we as investors could hope. Therefore, I’m a buyer of Klondike Gold and am looking forward to a summer of what I think will be good news flow and share price appreciation!

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own shares in Klondike Gold Corp. All Klondike Gold Corp. analytics were taken from their website and press release. Klondike Gold Corp. is a Sponsor of Junior Stock Review.

MiningFeeds previously wrote about Bonterra Resources (TSX-V: BTR) and its Gladiator Gold Project in Quebec. The company has steadily advanced through an extensive resource development program expand and define its geological resource model for an updated 43-101 Mineral Resource technical report that will likely prove to be significantly larger than its dated 2012 resource estimate.

In 2012, using a 4 g/t Au cut-off grade and comprised of approximately 15,600 meters of drilling, the Gladiator Gold Deposit contained an inferred resource of 905,000 tonnes, grading 9.37 g/t Au for 273,000 ounces of gold. On average, 90% of operating mines have a grade of less than 8 g/t gold. This ranks Gladiator in the top 10% of the world, when discussing the grade nature of the mineralization. The company has invested significantly since 2015 to expand this resource in the Abitibi Gold Belt, known as one of the world’s most prolific gold belts.

Bonterra has continued to drive shareholder value over the past three years by focusing on putting shareholder dollars in the ground and completing over 100,000 meters since 2016, most recently by continuing drilling through an infill/definition winter camp drill program. Bonterra’s share performance has beat Gold, TSX Venture Index, TSX Index and even the GDXJ Index, which tracks all miners:

Drilling has delivered recent headlines such as:

- Bonterra Continues to Demonstrate Continuity of the Gladiator Gold Deposit Intersecting 16.9 g/t Gold over 6.5 m

- Bonterra Extends Gladiator Gold Deposit Further Westward 17.8 g/t Au Intersected over 3.0 Meters

- Bonterra’s Winter Drill Program Discovers 6th Parallel Gold Zone at the Gladiator Gold Deposit.

- Bonterra Extends Multiple Zones at Gladiator Gold Deposit

This work is part of the company’s 70,000-metre drill program planned for 2018 and has consistently intersected gold mineralization in every hole, and is clearly proving up the company’s deposit in Quebec. There will be more results for an updated resource

Dale Ginn, VP Exploration for Bonterra Resources, stated:

“Initial results from the winter drilling campaign continue to highlight the predictability of the mineralized zones and the validity of the geological model. The positive results from the large diameter drilling will contribute to the success of the preliminary metallurgical work at the deposit. Bonterra continues to successfully execute its aggressive resource development program with seven active drills on site, and five drills at work on the Gladiator Gold Deposit.”

The company is clearly improving its confidence in the resource, and highlighting to the market how predictable the zones have become for targeting drilling to intersect gold mineralization. Another important milestone was to demonstrate that the resource they are drilling has the potential to be economic, which they have done with a recent press release that states the mineralization found at Gladiator is 99% recoverable. By industry standards, their rock is as clean as it gets, and indicates the quality of the deposit in regards to extraction of the gold, and how they stand well above their peers in regards to metallurgical extraction.

Peter Ball, the vice president of operations for Bonterra recently gave an interview to outline these results.

The market is slowly realizing the robust nature of the project, and potential economic nature of the rock when highlighting the high grade resource and metallurgical recovery.

Bonterra is likely pushing towards to a significant re-rate upwards to align with other more advanced peers, and thus the current valuation of the share price represents an opportunity for investors.

——–

Bonterra Resources Inc. (TSX-V: BTR, OTCQX: BONXF, FSE: 9BR1)

Telephone: 1-(844)-233-2034

Email: ir@bonterraresources.com

Website: www.bonterraresources.com

‘In order to produce half a million cars a year…we would basically need to absorb the entire world’s lithium-ion production.’ – Elon Musk

“The skillsets that young people should learn about mining should apply to everything. We just need to do a better job of explaining to people in urban environments that the human activity of mining is absolutely fundamental to the way this planet is going to evolve. Completely and totally fundamental.” – Robert Friedland, Ivanhoe Capital

The future envisioned by industry leaders hinges heavily on the production of new materials to power and build the future. Leaders such as Elon Musk have been developing the blueprint for the future with electric cars, battery grids and renewable energy solutions. While, other leaders such as Robert Friedland are looking to supply the materials to build this future. Mr. Friedland makes the case and understands the story that is unrolling in real time. Mining is the critical component to meet the world’s demands for a sustainable future. The prerequisite for this future is mining and with every mineral discovery and development project, this future is coming closer.

Mr. Friedland is not the only miner that realizes the economy of tomorrow will require the development of new mining assets. Azincourt Energy Corp. (TSX-V: AAZ) is a Canadian junior exploration company that has been actively building their mining asset portfolio in anticipation of the future demand for minerals that will provide clean energy; from lithium to uranium to cobalt.

Azincourt Energy Chairman, Ian Stalker is an experienced mining executive that sees the writing on the wall when it comes to the materials and fuel that future technology will require. Mr. Stalker is a senior international mining executive with over 45 years of hands-on experience in resource development. Over his career Mr. Stalker has directed over twelve major mining projects, from exploration drilling to start-up, including gold, base metal, uranium and industrial minerals. He is currently CEO of LSC Lithium (TSX.V: LSC), and Chairman of Plateau Uranium (TSX.V: PLU), and is the former CEO of UraMin Inc., the London and Toronto listed public uranium company that was acquired by Areva for US$2.5 billion in August 2007. In a recent press release, Mr. Stalker outlined the current strategy for Azincourt.

“The lithium market is obviously very strong right now, and the near-term future for lithium demand remains extremely positive. Our decision to expand Azincourt’s focus to include lithium and other materials is something we feel strongly about. To get a foothold and exposure in this environment, at this time, is an important and strategic step for us.”

Azincourt recently acquired five lithiums projects in located in the Winnipeg River Pegmatite Field, Manitoba, Canada. Two of the projects, the Lithium One and Two projects, are adjacent to Quantum Minerals Corp.’s Cat Lake lithium project which includes a historical estimate from drilling in 1947 that defined 545,000 tonnes of 1.4 percent lithium oxide (Li2O). Drilling could prove up this ground.

Two other of the acquired lithium projects, the Lithman West and East projects are adjacent to the Tanco Mine lease property. These projects are part of the Winnipeg River pegmatite field which hosts numerous lithium-rich pegmatites or “hard-rock” lithium such as the Tanco pegmatite that has been mined at the Tanco mine since 1969 for spodumene, a major component for hosting lithium (Li), and other rare earth ores.

Azincourt has scheduled exploration work to begin in the spring of 2018, with a field program that includes detailed mapping of the known pegmatite outcroppings on the Lithium One and Lithium Two projects. This will be followed immediately by a comprehensive chip sampling program designed to generate targets for the drill programs anticipated at both properties during the summer of 2018.

Previous work in 2016 produced twelve samples between a range of 0.02 per cent to 3.04 per cent Li2O from the Eagle pegmatite, and up to 2.08 per cent Li2O. Select sampling will concentrate on the Eagle and FD5 pegmatites at Lithium Two, and on the Silverleaf pegmatite at Lithium One, which returned values as high as 4.33 per cent Li2O in the 2016 exploration program (see press release dated Feb. 1, 2018).

On Feb. 8, 2017, the company signed a non-binding letter of intent to acquire the BullRun erythrite project, a prospective cobalt property located six kilometres northwest of the town of Cobalt, Ont. (see press release date Feb. 8, 2018). Alex. Klenman, President and CEO of Azincourt Energy commented on the company’s strategy with this acquisition.

“We’ve been looking into adding a potential cobalt property as we grow our project portfolio, so we’re pleased to move to LOI on this. We are going to immediately begin a comprehensive due diligence process to gain as much understanding as we can on the potential of the project, and we hope to progress to the definitive stage in due course. In addition, we are actively reviewing other potential projects that will continue to strengthen the company in the growing clean energy space. We haven’t filled our want list yet, so we remain very active on the acquisition front.”

True to the company strategy, Azincourt announced a new project that is adjacent to the western edge of Plateau Uranium’s (TSX-V: PLU) Macusani Project in Peru. This project contains the high-grade Falchani discovery that includes consistent 3,000-3,500 ppm Li over 100m intercepts at depth, and U3O8 grades up to 500 ppm over 50m intercepts at surface. The plateau features areas of uranium-rich surface mineralization as well as lithium mineralization at depth.

Initial leach test results conducted by Plateau Uranium in December showed that 77-80% of contained lithium can be extracted from Falchani. Plateau’s Macusani Project is fast becoming one of the world’s largest undeveloped uranium-lithium districts. Although Macusani started life as a pure uranium story, exploration and metallurgical work has unearthed the lithium resource at depth.

The company has been developing two projects in the Athabasca basin, in Northern Saskatchewan, home to the largest and highest grade deposits in the world, the Preston Project and the Patterson North Lake Property.

The Preston project comprises a large land position (approx. 121,249 hectares) strategically located to the south of NexGen Energy’s (TSX-V: NXE) Rook 1 project hosts the high grade Arrow deposit, as well as proximal to Fission Uranium’s (TSX: FCU) Patterson Lake South project host to the high grade Triple R deposit. The company has 15 drill target areas associated with eight prospective exploration corridors that have been successfully delineated through extensive geophysics.

The second project, The Patterson Lake North property “PLN” lies next to the northern edge of the Patterson Lake South property, owned by Fission Uranium Corp. (TSX-V: FCU) where uranium mineralization has discovered over 2.24 kilometres (east-west strike length) in four separate mineralized “zones.”

To date Azincourt has spent $3 million earning into PLN. Prior to Azincourt’s involvement, Fission spent approximately $4.7 million on exploration on PLN. There are three separate target areas that are drill-ready.

Azincourt Energy Corp. recently completed a private placement for gross proceeds of $1,655,000. In addition, the company has received an additional $1,215,009.48 in gross proceeds from the exercise of warrants over the past several weeks.

“We have more than enough funds to meet existing work requirements on our lithium and uranium projects for the next year or so, and further, the additional funding means we have upward flexibility in how we approach our work programs and portfolio expansion. Simply put, we can put more dollars into the ground, and into acquisitions,” said Mr. Klenman.

With ~69 million shares outstanding, cash in the bank, the company trading at 19 cents, the company has plenty of exploration news on the way, shares in Azincourt present a current opportunity.

While inventions and ideas grab the headlines, little attention is given to the fundamentals of building a clean energy future. Azincourt Energy Corp. (TSX-V: AAZ) has put together an impressive portfolio of mineral projects from lithium, uranium to cobalt; the minerals that will fuel the future. Azincourt Energy is in the early stages and with news on the way, investors should pay attention.

Clicker Here to Visit the Company’s Web Page: http://azincourtenergy.com/

*** The mineral reserve estimate cited above as part of the Lithium Two project is presented as a historical estimate which does not conform to current National Instrument 43-101 standards. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although the historical estimates are believed to be based on reasonable assumptions, they were calculated prior to the implementation of National Instrument 43-101 standards. These historical estimates therefore do not meet current standards as defined under sections 1.2 and 1.3 of NI 43-101; consequently, the issuer is not treating the historical estimate as current mineral resources or mineral reserves.

***MiningFeeds.com was compensated for the creation and publication of this article. This does not constitute investment advice.

by Andrew Topf

50M+ ounce Walker Lane Trend

While most gold investors are familiar with the Carlin Trend – the largest gold-producing region in the United States – there are other, less explored parts of Nevada starting to attract a lot of attention. Specifically, the Walker Lane Gold Belt where company-making discoveries are being drilled.

Located in southern Nevada, Walker Lane has some of the most important mining districts in North America including Comstock, Tonopah, Goldfield, Bullfrog and Aurora. Estimated to host over 50 million gold ounces, the region is being actively explored by Kinross and Barrick at the producing Round Mountain Mine, Gryphon Gold at the Borealis Mine, and Newcrest Mining at the Redlich project.

Unlike the Carlin Trend, where most gold projects are mining ore less than a gram per tonne, Walker Lane is starting to stand out on its own merits with exceptional high-grade assays.

High-grade gold mine open for expansion

Northern Empire Resources (TSXV: NM; USOTC: PSPGF) is a well-financed gold exploration and development company focused on an emerging gold district in the Walker Lane Trend. The Sterling Gold Project hosts four distinct deposits, including a fully permitted, open-pit mine. The Sterling Mine is one of the highest-grade heap leach mines in the western United States.

Situated 185 kilometres (two-hour drive) northwest of Las Vegas, on the eastern flank of the Bare Mountains, Sterling features five past-producing open pit and two underground gold mines. Drilling, surface mapping and sampling on the project suggests that the historic deposits are open for expansion and there is potential for new discoveries. The property still has infrastructure in place from 2015 when the Sterling Mine was last in production.

A history of success: $3B in takeout value

Along with having an outstanding property with exploration upside, Northern Empire also features a management team with an exceptional record of creating value for shareholders. Led by Executive Chairman Douglas Hurst and Michael Allen, President and CEO, the Northern Empire board has created over $3 billion in takeout value, including Newmarket Gold, acquired for $1 billion by Kirkland Lake, Kaminak Gold, acquired by Goldcorp for $520 million, International Royalty Corp, bought by Royal Gold for $700 million, Rainy River Resources, bought by Newgold for $310M, and Underworld Resources, purchased by Kinross Gold for $138 million.

Currently sitting at a $80-million market capitalization, Northern Empire has a cash balance of $18 million, having recently completed a $15 million bought deal financing that included no warrants. In fact, the company raised $35 million in 2017 with no warrants.

The gold junior is coming off a successful 2017 drill campaign and will aggressively drill known mineralized zones in 2018 to expand resources and explore for new deposits on its 125-kilometre land package.

709,000 ounces inferred, plus newly staked ground

The story of Northern Empire began in May 2017 when it acquired the Sterling Gold Project in Nye Country from Imperial Metals for $10M. The $20 million acquisition financing included an investment by global precious metals producer Coeur Mining, which earned an 11.6% stake in the company.

Northern Empire is backstopped by the low risk, permitted heap leach Sterling Mine; majors have an appetite for high margin, high grade assets. The main event, however is the blue-sky potential north of Sterling, where more ounces are ripe for exploration. In particular the focus is on the SNA deposit, which has Carlin-type mineralization adjacent to the Mother Lode deposit owned by Corvus Gold.

Between 1980 and 2000, nearly 200,000 ounces were pulled from Sterling’s three open pits and two underground mines. The run of mine ore was placed on heap leach pads, where gold recoveries averaged 88%.

Total inferred resources at the project are 709,000 ounces with an average grade of 2.23 grams per tonne gold – which is high for a deposit in Nevada where most deposits are lower-grade.

Northern Empire has all the permits required to operate the Sterling Mine. In May 2016 the mine was permitted to restart operations, with the Bureau of Land Management finding that the mine would not have significant environmental impacts.

Over the last six months the company has been aggressively expanding the property, having staked an additional 489 claims in June, thereby increasing its original land position by 50%. Another 261 claims were staked in October, which further solidified Northern Empire as the dominant landholder in the Bare Mountains, a district which includes the past-producing Sterling, 144, Daisy, Secret Pass, Gold Ace, Mother Lode deposits, and Bullfrog Mine.

Four jewels in The Crown

Exploration is focused on the Crown Block of deposits just 7 kilometres north of the Sterling Mine. For the first time the Crown Block has been consolidated in a contiguous land package under one ownership. The Crown Block hosts four primary targets: Daisy deposit, Secret Pass deposit, SNA deposit and the Shear Zone target. The mineralization follows the same East-West detachment fault structure that hosted Barrick’s Bullfrog Mine, which produced 2.3 million ounces of gold at an average grade of 3.2 grams per tonne (“g/t”).

Glamis and Rayrock previously operated the Daisy Mine, which included Daisy, Secret Pass, and Mother Lode pits, and produced 104,000 ounces of gold between 1997 and 2001. When gold dipped below $300, the mine was closed down.

A total of 160 holes were drilled at Secret Pass which was previously mined in the 1990’s. Significant drill intercepts beyond the existing pit indicate potential resource expansion. Drill hole D-320 on the eastern edge of the historical pit intercepted 1.02 g/t gold over 77.7 metres.

SNA lies on a north-south structure that hosts Carlin-type mineralization which is open for expansion. Historically 149 holes were drilled at SNA. The Shear Zone is on the upper level of an epithermal vein and indicates potential for bonanza grades at depth. Past discoveries of mineralization were not followed up on.

2017 drilling confirms resource model, opens up new opportunities

In August 2017 Northern Empire initiated the first phase of an exploration program designed to confirm and expand the inferred resources at the Sterling Gold Project. Historic drill holes from the Daisy deposit include 68.58 g/t Au over 2.02 m, 7.37 g/t Au over 19.81 m, 80.77 g/t Au over 2.10 m, and 4.63 g/t Au over 35.05 m.

Of the planned 5,200 metres of drilling, over half was focused on the Sterling Mine, where Northern Empire outlined a pit-constrained inferred resource of 231,000 gold ounces grading 3.67 g/t. The work provided confidence in the resource, tested for extensions along strike and provided metallurgical samples prior to Northern Empire beginning economic studies.

The 52-hole drill program, 25 of which were reverse circulation holes and 27 that were diamond-drilled, started with the Daisy and Secret Pass deposits within the Crown Gold Project. The company also performed an evaluation of the entire project and flew a geophysical survey to identify new targets.

The Daisy deposit hosts an inferred mineral resource of 174,000 gold ounces at an average grade of 2.12 g/t gold, while the Secret Pass inferred resource is 188,000 ounces of gold at an average grade of 1.65 g/t.

The drills then moved to the Sterling Mine to complete infill, resource expansion, and exploration drilling.

The first 24 results of the drill program were released in November. According to Northern Empire’s CEO Michael Allen:

“This round of drill results supports our resource model of the Sterling deposit, as well as the location of the underground workings. Sterling was known to be a narrow, high grade deposit with excellent metallurgy. Of note, are the occasional broader zones of mineralization, such as 12.19 metres of 8.37 g/t gold, as well as previously unacknowledged lower grade mineralization being identified by Northern Empire’s drilling; both of which may represent real opportunities within the Sterling deposit. Also, our early exploration of the area to the west and south of the Sterling deposit has yielded interesting results.”

Assay results from another seven holes reported in early December highlighted shallow, high-grade oxide gold at the Sterling Mine, with several holes hitting significant mineralization at the edges of the resource model, indicating the deposit remains open for expansion. Notable drill intercepts included 10.0 metres of 14.59 grams per tonne, 9.05 metres of 8.66 g/t, and 7.59 metres of 8.25 g/t.

2018 drilling year-round: in progress

As the calendar turns to a new year, Northern Empire is making plans for a 15,000-metre drill program it announced mid-December; the drills have already begun turning. In this new phase, drilling will be focused on infill and expansion of the Sterling Mine, Daisy, Secret Pass and SNA deposits, as well as testing high-priority exploration targets. Drilling will be completed with both core (diamond drilling) and reverse circulation rigs.

This area of Southern Nevada is accessible 12 months a year and Northern Empire will be aggressively working all year round. In early 2018 the company will turn its attention to the Crown Block, where drilling will begin on the SNA deposit where Northern Empire has identified the potential for a large Carlin-type deposit. This work will be targeting north-south structures exiting the Mother Lode pit, adjacent to the north and owned by Corvus Gold, and where historic drill holes such as ML088, drilled on the company’s property, returned 10.67 metres grading 4.13 g/t starting at 60.96 metres, and 28.96 metres grading 1.76 g/t starting at 100.58 metres.

Indeed an exciting aspect of this round of drilling is the close proximity of Corvus Gold’s drills on that company’s Mother Lode project, just metres away from Northern Empire’s holdings. Mother Lode produced 34,000 ounces at an average grade of 1.8 g/t in the late 1980s but closed due to low gold prices. In December Corvus announced it has expanded the sediment-hosted Mother Lode gold system to at least 450 metres along strike.

Corvus Gold’s exploration program at Mother Lode has received a major response from the market, with the stock more than doubling over the past year (+126%); most of the gain has been in the last three months and can likely be attributed to its success at the Mother Lode.

Since Northern Empire is the dominant land holder, and owns all the land surrounding Mother Lode, any extension of Mother Lode beyond Corvus Gold’s tight boundaries is likely to add ounces to Northern Empire’s Sterling Gold Project.

Drilling will also be completed at the Daisy and Secret Pass deposits with the goals of upgrading and expanding the resources, collecting metallurgical samples, and testing exploration concepts. On September 18 and October 4, 2017, the company announced drill results for Daisy and Secret Pass, highlighted by 47.24 metres of 1.47 g/t gold at Daisy and 82.30 metres grading 1.25 g/t at Secret Pass.

Conclusion

Northern Empire has an impressive assemblage of both past-producing gold mines and enticing exploration targets at its Sterling Gold Project in one of Nevada’s most promising gold mining regions: The Walker Lane Trend.

With the gold price powering above $1,330 per ounce, mineral-rich gold companies are rising in valuation once again, so what better time to get in on an exciting gold play that appears to offer investors ample upside? Northern Empire has the property, the treasury and the team to make it happen.

About the Author:

With over a decade of journalistic experience working in newspapers, trade publications and as a mining reporter, Andrew Topf is a seasoned business writer. He holds degrees in journalism and political science, and earned a Masters from the London School of Economics.

Typically, main stream banks are late to the party when it comes to coverage of early stage companies because these companies still present risk to conservative investors. However, since we are in the early innings of the new blockchain/cryptocurrency economy that is here to stay, firms are starting to look at companies that have adopted the new model early.

One such company is HIVE Technologies Ltd. (TSX-V: HIVE) which listed preceding the huge upswing in bitcoin prices that has attracted analysts’ attention and which presents a compelling opportunity to invest in the new sector.

On Monday, GMP Richardson Securities analyst Deepak Kaushal, P.Eng., CFA initiated coverage of HIVE with a “spec buy” recommendation.

Mr. Kaushal notes that HIVE offers investors a unique exposure to the emerging blockchain sector with a competitive advantage, high growth, free cash flow, attractive return on capital and exposure to diversification in the cryptocurrency space.

The investment thesis presented by Kaushal is that blockchain technology enables new decentralized economic systems that will profoundly change the nature of monetary transactions and will become critical to the global economy.

“For investors, we see a new, high-risk high-reward sector that has low correlation to other investment classes. We see miners as essential infrastructure providers for blockchain networks that can build diversified portfolios of cryptocurrencies at attractive returns on-investment. Today miners are accelerating investment to capture cryptocurrencies as early as possible, to maximize the potential for value appreciation. Over the long term, we believe miners will become utility-like in their risk-return profile, as blockchain networks mature and cryptocurrency spot price volatility stabilizes. We think miners are a good option for new investors to the sector given the potential for diversification to mitigate company and application-specific risk.”

He set a price target of $5.35.

Secondly, PI Financial analyst David Kwan also initiated coverage noting that HIVE is well positioned to outperform its peers. Mr. Kwan recommended the Vancouver-based firm with a “buy” rating.

The analyst cited Hive’s low-cost operations in stable jurisdictions and its partnership with cryptocurrency miner Genesis Mining Ltd. which brings a “key competitive advantage.”

“HIVE is leveraging Genesis’ extensive cryptocurrency mining experience and expertise as well as benefiting from cheap power costs, access to leading edge technologies, and lower operating and equipment costs amongst other things… Genesis owns over 25 percent of HIVE and has two representatives on the Board. We believe Genesis has a strong financial incentive to make HIVE a success.”

However, he warned that investing in the cryptocurrency and blockchain sector remains a risky proposition because of the volatility seen in cryptocurrencies and share prices of companies in the sector. He expects regulatory uncertainty and creep to be a problem in the near term.

However, Mr. Kwan is optimistic because Hive stands out in the space. “Some of the key attributes of a successful miner are cheap power, a cool climate…With operations in Iceland and Sweden and its partnership with Genesis, we believe HIVE checks all of these boxes and will be one of the lower cost miners, enabling them to generate stronger margins and cash flow in the good times and better weather the down times.”

The analyst set a price target of $5.25.

As of the close on Tuesday Jan. 30, 2017, shares in HIVE could be purchased for $2.60.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CMB.V | +900.00% |

|

RLC.AX | +100.00% |

|

NSE.V | +76.19% |

|

FEX.V | +50.00% |

|

CRB.AX | +50.00% |

|

MRQ.AX | +33.33% |

|

CRD.V | +33.33% |

|

KGD.AX | +33.33% |

|

UCU.V | +32.41% |

|

AGD.AX | +30.00% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan