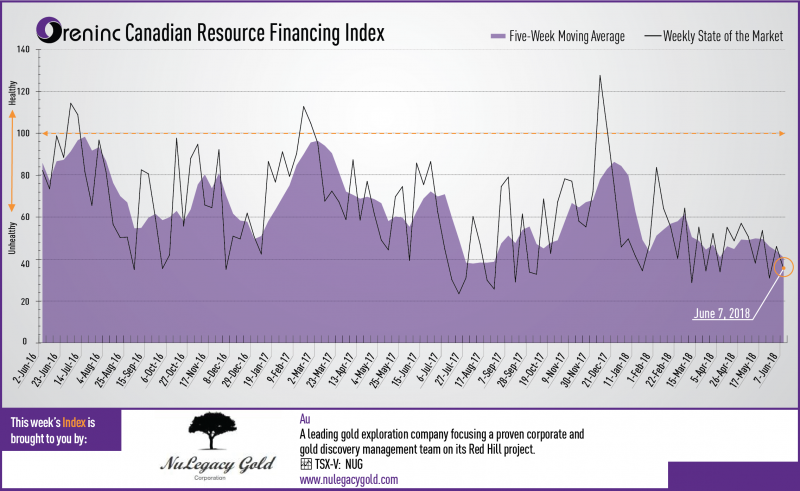

Last week index score: 45.96

This week: 35.42

Zinc One Resources (TSX-V: Z) reported the final drill results from the high-grade zinc discovery in the Mina Chica zone of its Bongará zinc project in north-central Peru.

The Oreninc Index fell in the week ending June 8th, 2018 to 35.42 from 45.96 a week ago as financings decreased, and broker action stayed away.

Gold spent the week flirting again with the US$1,300/oz level in the run up to the G7 summit in Canada, with US president Donald Trumplooking to pick a fight with anyone that would pay him attention as he also prepares for a summit meeting with North Korean leader Kim Jong-un. Despite the trade sabre-rattling, those watching the precious metals space are waiting for the outcome of the US Federal Reserve Market Committee (FOMC) meeting this coming week and any indications related to further interest rate increases.

Financings and broker activity continue to be sparse as Oreninc’s Kai Hoffmann showed at the 121 Mining Investment Conference in New York last week, as interest in the mining sector continues in a funk.

On to the money: total fund raises announced halved to C$50.8 million, a two-week low, which included no brokered financings and no bought deal financings. The average offer size fell to C$2.0 million, an eleven-week low whilst the number of financings fell to 25, a two-week low.

Gold closed up at US$1,298/oz from US$1,293/oz a week ago. Gold is now down 0.36% this year. The US dollar index closed down a tad at 93.53 from 94.15 a week ago. The van Eck managed GDXJ closed down a smidge at US$32.78 from US$32.80. The index is down 3.96% so far in 2018. The US Global Go Gold ETF increased to US$12.95 from US$12.71 a week ago. It is now down 0.46% so far in 2018. The HUI Arca Gold BUGS Index closed down at 178.83 from 179.15 last week. The SPDR GLD ETF continued to sell off and closed its inventory down at 828.76 tonnes from at 836.42 tonnes a week ago.

In other commodities, silver closed up at US$16.78/oz from US$16.41/oz a week ago. Copper’s gain accelerated as it closed up at US$3.30/lb from US$3.09/lb last week. Oil continued to lose ground as it closed down slightly at US$65.74 a barrel from US$65.81 a barrel a week ago.

The Dow Jones Industrial Average saw a strong rebound to close up at 25,316 from 24,635 last week. Canada’s S&P/TSX Composite Index also saw a winning week to close up at 16,202 from 16,043 the previous week. The S&P/TSX Venture Composite Index also closed up at 775.22 from 765.94 last week.

Summary:

- Number of financings decreased to 25, a two-week low.

- One brokered financing was announced this week for C$8.0m, a one-week high.

- No bought-deal financings were announced this week, a one-week low.

- Total dollars nearly halved to C$50.8, a two-week low.

- Average offer size dropped to C$2.0m, an eleven-week low.

Financing Highlights

Nouveau Monde Graphite (TSX-V: NOU) opened an C$8.0 million private placement @ C$0.30 with Eight Capital and Haywood Securities as co-lead agents.

- Syndicate including Canaccord Genuity and Desjardins Securities.

- Each unit comprised of one share and half a warrant exercisable @ C$0.40 for two years.

- Net proceeds for capital allocations related to Nouveau Monde’s graphite demonstration plant in Saint-Michel-des-Saints.

Major Financing Openings:

- Nouveau Monde Graphite (TSX-V: NOU) opened a C$ 8 million offering underwritten by a syndicate led by Eight Capital on a best effortsbasis. Each unit includes half a warrant that expires in 24 months.

- MGX Minerals (CSE: XMG) opened a C$ 7.01 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months. The deal is expected to close on or about June 18th.

- GoviEx Uranium (TSX-V: GXU) opened a C$ 6.06 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months.

- Golden Dawn Minerals (TSX-V: GOM) opened a C$ 5.4 million offering on a best efforts basis. Each unit includes a warrant that expires in 36 months.

Major Financing Closings:

- Troilus Gold (TSX-V: TLG) closed a C$ 10.01 million offering underwritten by a syndicate led by GMP Securities on a bought deal basis.

- Almaden Minerals (TSX: AMM) closed a C$ 9.44 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis. Each unit included half a warrant that expires in 48 months.

- GoviEx Uranium (CSE: GXU) closed a C$ 6.06 million offering on a best efforts basis. Each unit included a warrant that expires in 36 months.

- Troilus Gold (TSX-V: TLG) closed a C$ 5.75 million offering on a best efforts basis.

Company News

Zinc One Resources (TSX-V:Z) reported the final drill results from the high-grade zinc discovery in the Mina Chica zone of its Bongará zinc project in north-central Peru.

- High-grade zinc mineralization is about 200m long and 120m wide.

- Highlights included 21m @ 27.5% Zn in hole MCH-18-041.

Analysis

With a new high-grade zinc discovery, this phase of drilling has been very successful, adds to the potential of the project, even though the size potential of the Mina Chica zone will have to wait for a future drilling programme. And with only a small portion of the 6km mineralized trend tested, there is a lot more exploration (and results) to come in the future.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

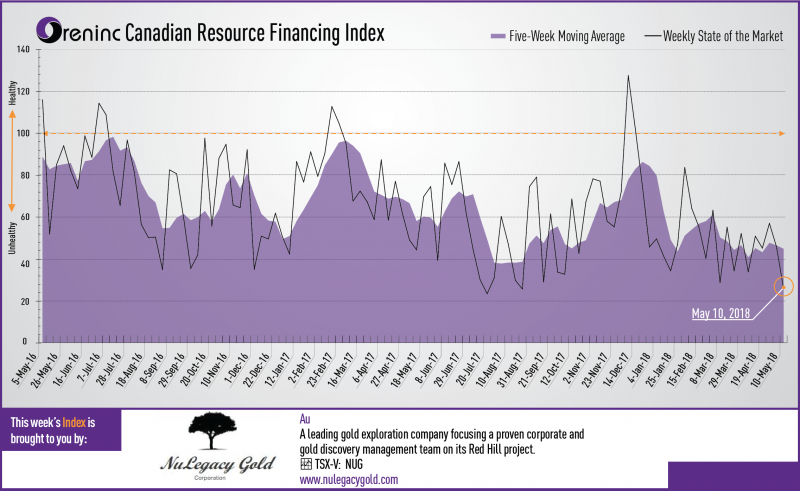

Last week index score: 36.21 (updated)

This week: 52.74

The Oreninc Index rose in the week ending May 18th, 2018 to 52.74 from an updated 36.21 a week ago despite good falling below US$1,300/oz.

Gold finally gave way and fell below the US$1,300/oz level to hit a year-to-date low as the US dollar continued to strengthen, the US ten-year treasury hit a 3% yield and economic data continued to show positive results.

US dollar strength is overpowering geopolitical risk concerns which continue to swirl around: the past week saw the US open its new embassy in Israel in Jerusalem. The ceremony was attended by president Trump’s daughter, Ivanka and provoked mass protests by Palestinians during which Israeli security forces killed dozens.

President Trump’s blunt, hard ball approach to issues also threatened to derail the possibility of talks with North Korean leader Kim Jong-Un after the US carried out extensive war air exercises with South Korea.

On to the money: total fund raises announced increased to C$81.7 million, a two-week low, which included five brokered financings for C$50.5 million, a nine-week high and two bought deal financings for C$20.0 million, a one-week high. The average offer size grew to C$3.5 million, a two-week low and the number of financings grew to 23, a two-week high.

Gold fell to US$1,293/oz from US$1,319/oz a week ago after hitting a low of US$1,285/oz. Gold is now down 0.75% this year. The US dollar index increased again and closed up at 93.63 from 92.54 a week ago. The van Eck managed GDXJ suffered as a result closing down at US$32.84 from US$33.85 last week. The index is down 3.78% so far in 2018. The US Global Go Gold ETF also fell to US$12.98 from US$13.35 a week ago. It is now down 0.23% so far in 2018. The HUI Arca Gold BUGS Index closed down at 177.75 from 182.24 last week. The SPDR GLD ETF again saw sales to close its inventory at 855.28 tonnes from 857.64 tonnes a week ago.

In other commodities, silver also gave up ground to close down at US$16.44/oz from US$16.66/oz a week ago. Likewise, copper closed down at US$3.06/lb from US$3.11/lb last week. Oil continued to post gains to close up at US$71.28 a barrel from US$70.51 a barrel a week ago.

The Dow Jones Industrial Average again saw losses to close down at 24,715 from 24,831 last week. Canada’s S&P/TSX Composite Index continued to see growth to close up at 16,162 from 15,983 the previous week. The S&P/TSX Venture Composite Index also closed up at 786.39 from 782.92 last week.

Summary:

- Number of financings grew to 23, a two-week high.

- Five brokered financings were announced this week for C$50.5m, a nine-week high.

- Two bought-deal financings were announced this week for C$20.0m, a one-week high.

- Total dollars decreased to C$81.7m, a two-week low.

- Average offer size tumbled to C$3.5m, a two-week low.

Financing Highlights

Canadian Zinc (TSX: CZN) entered into an equity financing agreement with RCF VI to purchase 100 million shares @ C$0.20 for gross proceeds of $20 million.

- RCF VI will be issued 50 million warrants exercisable @ C$0.25 until December 31st 2018.

- The proceeds will be used to repay a US$10 million bridge loan advanced by RCF VI and the ongoing development of the Prairie Creek Zn-Pb-Ag project in Northwest Territories, Canada.

Major Financing Openings:

- Canadian Zinc (TSX: CZN) opened a C$20 million offering underwritten by a syndicate led by Resource Capital Fund VI on a best efforts basis. Each unit includes half a warrant that expires in seven months.

- Troilus Gold (TSX-V: TLG) opened a C$10.01 million offering underwritten by a syndicate led by GMP Securities on a bought deal basis. The deal is expected to close on or about June 5th.

- Rio2 (TSX-V: RIO) opened a C$10 million offering underwritten by a syndicate led by Clarus Securities on a bought deal basis. The deal is expected to close on or about June 7th.

- Troilus Gold (TSX-V: TLG) opened a C$7.01 million offering on a best efforts basis. The deal is expected to close on or about June 5th.

Major Financing Closings:

- West African Resources (TSX-V: WAF) closed a C$34.3 million offering on a best efforts basis.

- Silvercrest Metals (TSX-V: SIL) closed a C$17.25 million offering underwritten by a syndicate led by PI Financial on a bought deal basis.

- South Star Mining (TSX-V: STS) closed a C$4.19 million offering underwritten by a syndicate led by Echelon Wealth Partners on a best efforts basis. Each unit included a warrant that expires in 24 months.

- Renaissance Gold (TSX-V: REN) closed a C$3.12 million offering on a best efforts basis.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Website: www.oreninc.com

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

CZN.AX | +50.00% |

|

GCX.V | +33.33% |

|

CRB.AX | +33.33% |

|

RUG.V | +33.33% |

|

AFR.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

GZD.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan