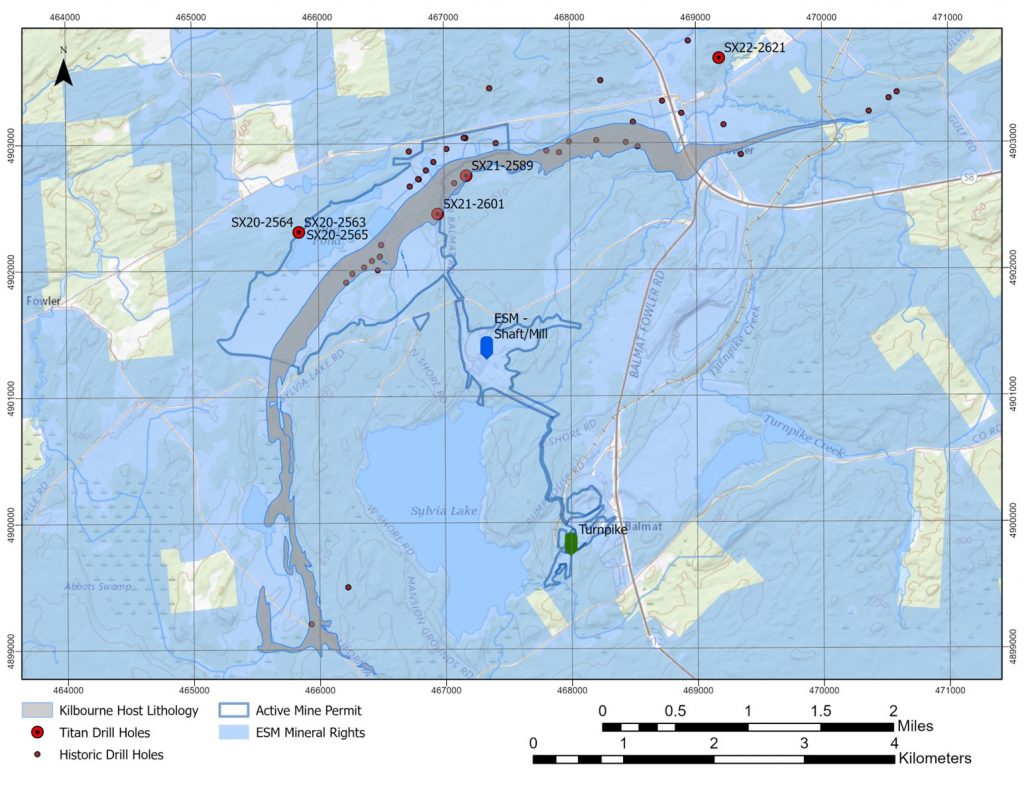

Titan Mining (TSX:TI) has announced the discovery of the Kilbourne graphite trend, situated on the lands where the Empire State Mine is currently operational in upstate New York. Preliminary assessments indicate that the Kilbourne target could potentially contain between 3.36 million tons and 26.25 million tons of graphite, grading 2.0% to 4.5%. However, these estimates are based on available drill data and are still conceptual, lacking enough exploration to define a current mineral resource. The company has emphasized that further exploration may not necessarily result in a confirmed mineral resource.

Donald Taylor, President and CEO of Titan Mining, commented in a press release: “Natural flake graphite is a critical material in the production of lithium-ion batteries with significant and increasing demand. The confirmation of a global scale flake graphite target on the Company’s land package is an especially significant development in the history of the Company.”

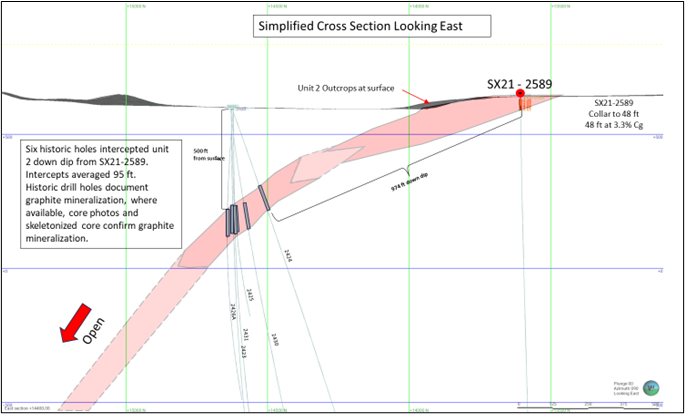

The Kilbourne target emerged from an analysis of historic geological data and recent drilling activities. The host rocks’ high metamorphic grade has increased the size and characteristics of the contained graphite to flake sizes. To date, 53 drill holes have been tested for the presence of graphite, all of which showed graphite content. However, only six of these have been assayed for graphite quality. The company has engaged an independent laboratory to conduct further testing and evaluation.

Graphite’s presence in this particular district is not new and has historical precedents dating back to the first half of the 20th century. Titan Mining currently holds over 80,000 acres of mineral rights in St. Lawrence County, NY and plans to continue evaluating data for additional graphite exploration targets.

Graphite is a naturally occurring form of pure carbon and is critical for a range of industrial and energy applications, including lithium-ion batteries. The United States currently lacks domestic sources for natural flake graphite, a situation that has raised concerns given the rising demand for this resource. The U.S. Department of Energy anticipates that by 2025, the demand for graphite will outstrip production by 79%. This gap is expected to widen substantially by 2035.

Currently, China dominates the global graphite supply, providing more than 60% of the world’s graphite. The scarcity of domestic resources has landed graphite on the U.S. Department of Energy’s critical materials list, especially in light of the burgeoning electric vehicle and battery manufacturing sectors in the United States. Given the environmental and financial costs of synthetic graphite, natural graphite is increasingly seen as a viable alternative, particularly as concerns about the sourcing of critical materials continue to grow.

At present, the United States has only two graphite deposits that have reached the pre-feasibility stage or beyond: the Graphite Creek Deposit in Alaska and the Coosa Graphite Project in Alabama.

Highlights from the results are as follows:

- At or near surface targets with geological potential totaling between 210 and 1,050 million tons (Mt) grading between 2.0% and 4.5% graphitic carbon (Cg)

- Flake graphite is a key input to the auto industry battery supply chain and designated as a Critical Material by the United States Department of Energy

- There is no domestic source of flake graphite production; China, which accounts for more than half of global production, has recently announced export restrictions that may threaten the market

- ESM lands hosting the Kilbourne graphite trend are fully permitted for drilling with some portions of these lands also currently permitted for mining

- Aggressive plan to fast-track exploration and development with goal of being first domestic supplier of materials to the auto industry battery market

Table 1: Kilbourne Drilling Intercepts

| 2020-2022 Kilbourne Drilling | |||||||

| Hole ID | From (ft) | To (ft) | Interval (ft) | From (m) | To (m) | Interval (m) | Cg% |

| SX20-2563 | 632.3 | 665.6 | 33.3 | 192.7 | 202.9 | 10.1 | 3.1 |

| 673.9 | 697.0 | 23.1 | 205.4 | 212.4 | 7.0 | 1.5 | |

| 723.1 | 760.8 | 37.7 | 220.4 | 231.9 | 11.5 | 2.3 | |

| SX20-2564 | 652.0 | 742.5 | 90.5 | 198.7 | 226.3 | 27.6 | 2.3 |

| SX20-2565 | 612.0 | 642.0 | 30.0 | 186.5 | 195.7 | 9.1 | 3.1 |

| 742.0 | 768.1 | 26.1 | 226.2 | 234.1 | 8.0 | 1.9 | |

| SX21-2589 | 0.0 | 47.9 | 47.9 | 0.0 | 14.6 | 14.6 | 3.3 |

| SX21-2601 | 70.0 | 101.2 | 31.2 | 21.3 | 30.8 | 9.5 | 2.1 |

| SX22-2621 | 1,031.9 | 1,140.0 | 108.1 | 314.5 | 347.5 | 32.9 | 2.6 |

| 1,243.9 | 1,255.0 | 11.1 | 379.1 | 382.5 | 3.4 | 1.9 | |

| 1,310.0 | 1,350.0 | 40.0 | 399.3 | 411.5 | 12.2 | 3.1 | |

| 1,375.0 | 1,400.0 | 25.0 | 419.1 | 426.7 | 7.6 | 2.1 | |

| 1,465.0 | 1,831.0 | 366.0 | 446.5 | 558.1 | 111.6 | 2.2 | |

| Including | 1,495.0 | 1,510.0 | 15.0 | 455.7 | 460.2 | 4.6 | 3.3 |

| and | 1,530.0 | 1,560.0 | 30.0 | 466.3 | 475.5 | 9.1 | 3.5 |

| and | 1,695.0 | 1,831.0 | 136.0 | 516.6 | 558.1 | 41.5 | 3.1 |

Table 2: Kilbourne Collar Information (NAD 1983 UTM Zone 18N)

| Collars | ||||||

| Hole ID | Length (ft) | Easting (m) | Northing (m) | Elevation (m) | Azimuth | Dip |

| SX20-2563 | 3153 | 465846 | 4902302 | 186.010 | 120 | -55 |

| SX20-2564 | 3487 | 465846 | 4902302 | 186.010 | 125 | -63 |

| SX20-2565 | 3407 | 465846 | 4902302 | 186.100 | 125 | -50 |

| SX21-2589 | 2287 | 467176 | 4902744 | 186.000 | 0 | -90 |

| SX21-2601 | 1877 | 466948 | 4902442 | 193.000 | 0 | -90 |

| SX22-2621 | 3487 | 469184 | 4903668 | 182.837 | 150 | -70 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

CZN.AX | +50.00% |

|

RUG.V | +33.33% |

|

AFR.V | +33.33% |

|

GCX.V | +33.33% |

|

CASA.V | +30.00% |

|

SRI.AX | +28.57% |

|

BSK.V | +25.00% |

|

GQ.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan