Thor Explorations (TSXV:THX), a Canadian mining company with operations in West Africa, has announced that its Douta project in Senegal could become its second gold mine in the region, following the discovery of more than twice the potential gold in the area. According to analysts, this new development provides the company with “greater confidence” in the project’s potential.

The Douta project currently holds an indicated resource of 20.2 million tonnes grading 1.3 grams of gold per tonne, with an inferred resource of 24.1 million tonnes grading 1.2 grams of gold per tonne. These figures translate to 874,900 oz. of contained metal for the indicated resource and 909,400 oz. of contained metal for the inferred resource.

The updated estimate now shows that the Douta project contains a total of 1.78 million oz. of contained gold, which is a significant increase of 144% compared to the initial resource estimate released in November 2021. At that time, the inferred resources totalled 730,000 oz. of gold in 15.3 million tonnes grading 1.5 grams gold.

Thor Explorations is now expected to focus on further exploration activities in the Douta project, with the aim of confirming the resource estimate and potentially expanding the size of the deposit. The company’s first gold mine in West Africa, the Segilola Gold Project in Nigeria, began production in 2021 and has since delivered strong operational results. With the promising results at Douta, Thor Explorations is well-positioned to continue its growth in the region.

Thor Explorations’ latest discovery of more gold in its Douta project in Senegal has been described as “impressive” by Echelon Capital Markets, indicating that it could become the company’s second gold mine in West Africa. The updated resource estimate shows a 144% increase in contained gold compared to the previous estimate released in November 2021. As a result, Thor is now planning further drilling activities to confirm the resource estimate and potentially expand the size of the deposit.

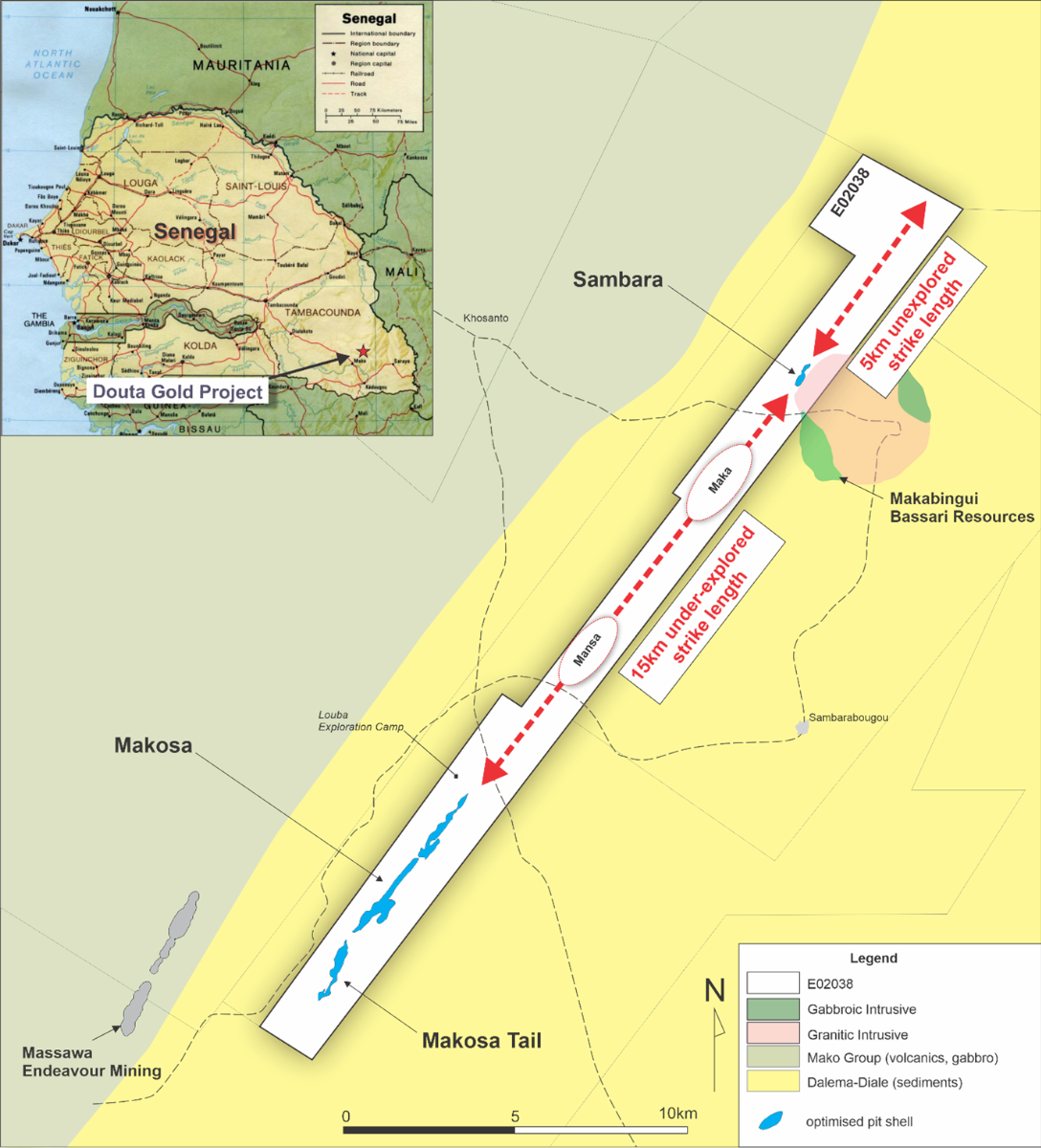

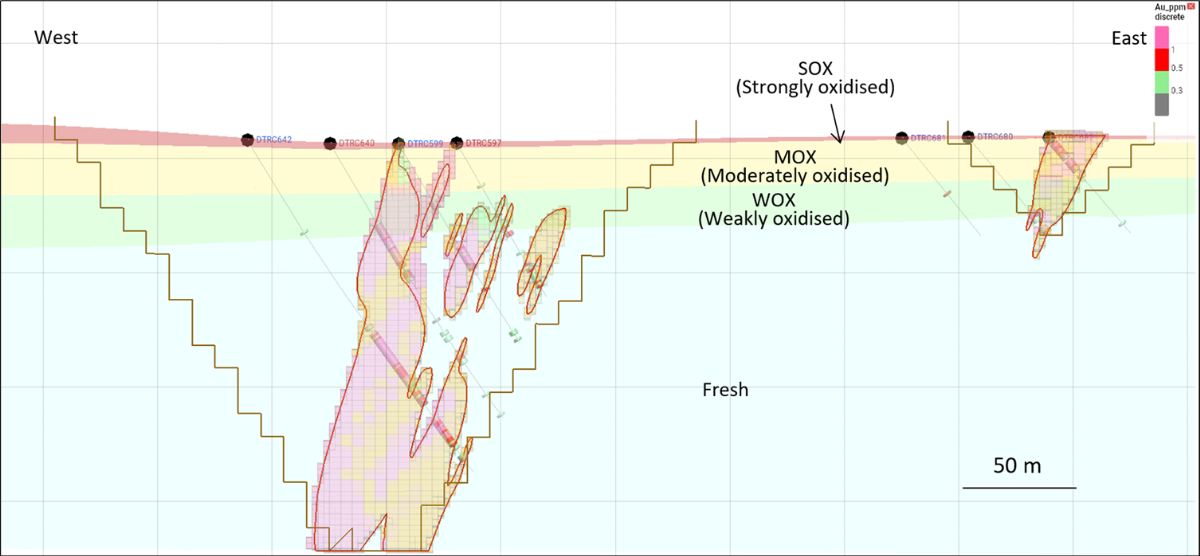

The Douta project, which lies in the far southeast of Senegal, is 70% owned by Thor, while the rest is held by local partner International Mining Co. The project includes the Makosa, Makosa Tail, and Sambara prospects, which remain open along strike and down-dip after 64,567 meters of drilling. The estimate used a cut-off grade of 0.5 gram gold per tonne within optimized open-pit shells, using a gold price of US$2,000 per ounce.

Thor Explorations is registered in Vancouver but does most of its business in London, where its shares trade at a discount to similar companies, according to Echelon. Despite this, Thor generally outperforms its peers regarding the growth of its cash flow and its all-in sustaining costs. The miner’s first gold mine in West Africa, the Segilola Gold Project in Nigeria, has already produced 98,000 oz. of gold, and the company is now poised to continue its growth in the region with the promising results at Douta.

Thor is now preparing a preliminary feasibility study for what could be an open-pit operation in Douta. Additionally, the company plans to undertake 40,000 meters of diamond and reverse circulation drilling this year. Mineralization remains open along strike between the prospects, with growth potential along 20 km of prospective strike length, the company said. Thor’s latest discovery of more gold in Douta is a promising development that could potentially lead to the opening of a new gold mine in West Africa.

Thor Explorations’ Douta project in Senegal has gained attention from mining analysts and investors after new figures showed a significant increase in the potential gold reserves. While Thor holds a 70% stake in Douta, its partner International Mining Co. holds a 30% free carried interest in the project until Thor declares a probable reserve. At that point, International Mining must either sell its interest to Thor or fund its pro-rata share of exploration and operating expenses. However, Thor has not yet provided clarification on the ownership of International Mining.

Located in the Kéniéba inlier, 4 km east of Endeavour Mining’s Sabadola-Massawa project, Douta covers an area of 58 sqkm. Bassari Resources is developing the Makabingui project immediately to the east. The updated resource estimate for Douta includes the Makosa, Makosa Tail, and Sambara prospects, all of which remain open along strike and down-dip. The company is planning to undertake further drilling activities to confirm the resource estimate and potentially expand the size of the deposit.

Echelon Capital Markets has noted that preliminary tests indicate that Douta’s oxide material may be recovered using gravity and carbon-in-leach methods, with biological oxidation and pressure oxidation methods also being assessed. The company aims to prepare a preliminary feasibility study for what could potentially be an open-pit operation in Douta. Endeavour’s Massawa achieved gold recoveries of 88% for similar rocks using biological oxidation processing, providing a positive outlook for Douta’s gold recovery potential.

Thor’s exploration efforts in West Africa have been promising so far, with the Segilola Gold Project in Nigeria already producing 98,000 oz. of gold. With the Douta project showing strong potential, the company is expected to continue its growth in the region.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Stelmine Canada Limited Stelmine Canada Limited |

STH.V | +100.00% |

|

MHC.AX | +100.00% |

|

ADE.V | +100.00% |

|

MTX.V | +100.00% |

|

MKA.V | +61.11% |

|

ERA.AX | +50.00% |

|

DOS.V | +33.33% |

|

MTB.V | +33.33% |

|

CASA.V | +30.00% |

|

RMD.V | +25.00% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan