As I have explained in my previous post on the world gold production, the share of major gold producing countries in the world gold production decreases. But what about the relative production from major gold miners?

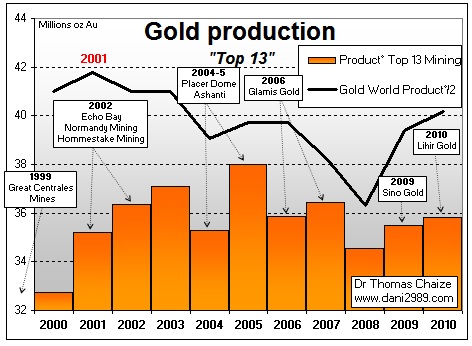

As shown in the chart below, world gold production has decreased since 2001 (black line). Similarly, the gold production of the thirteen largest gold miners in the world (orange line) has decreased since 2006. This time shift can be explained by the acquisitions that major gold producers have made on many smaller gold producers around the world. Through acquisition they were able to increase their production temporarly but this does not change the fact that, overall, their respective world gold production is decreasing.

Here are some of the main takeovers of gold producers since 1999: Great Central Mining, Echo Bay (Canada), Normandy (Australia), Hommestake (oldest gold mine in the United States which survived the great depression in 1929), Placer Dome (Canada, founded in the early 19th century), Ashanti (South Africa, producing gold since 1897), Glamis Gold (Canada), Sino Gold (Australia), and Lihir Gold (Australia).

Despite these major takeovers, accounting for tens of billions of dollars, the relative production from major gold producers around the world has declined since 2008. It decreased from 47% in 2007 to 44.5% in 2010. The increase in the world gold production observed since 2008 is the result of smaller gold mines going into production (gold miners producing less than 500,000 ounces of gold per year).

In summary, the growth of world gold production since 2008 arises from a mosaic of small producers. This “atomization” of world gold production into less rational small production requires a high gold price. Smaller producer countries and smaller gold miners have stabilized world gold production in the short term (1-3 years). However, this is not enough to revive global production which is still below its level of 2001 despite the rise in gold prices over the past 10 years.

The takeover of the largest gold mine in the world by a major copper producer in Zambia is symptomatic of the situation of the major gold miners. The large scale gold deposits are increasingly rare and large gold miners are “forced” to produce more and more copper, zinc, lead, silver, molybdenum or uranium.

From the article entitled, “Gold Production of Large Gold Miners” by Dr. Thomas Chaize author of the Mining and Energy Newsletter. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

In China, gold production has increased for the eleventh consecutive year. China is the world largest gold producer for the third time in history with 345 tonnes of gold produced this year. Among the top gold-producing countries, China, with its increasing gold production, seems to go against the general trend of decreasing gold production. China has already announced that its gold production is expected to increase to up to 400 tonnes within the next three years.

Of the other major gold producing nations, Australia is the world’s second largest gold producer with a gold production of 255 tonnes in 2010 (+15%). However, this remains 20% below its peak level of production of 1998. In the United States, production of gold has been declining since 1998 (-37%) but has stabilized at around 230 tonnes per year over the last 4 years.

Gold production in South Africa, on the other hand, continues to decline. Until 2006, this country was once the world’s top producer but after almost a century of hegemony its ranking declined to the second position in 2007 and now fourth in 2010. Gold production in South Africa has decreased by 80% within the last 40 years. It is interesting to point out that 2010 Chinese gold production represents only a third of South Africa’s peak production in the late 1960s.

In 2010, Russia maintained its gold production at the same level; about 190 tonnes. While gold production in Peru is still below its peak production of 2005 (208 tonnes of gold) now producing just 170 tonnes of gold in 2010. Although one can identify more than three hundred mines in Peru, more than half of Peru’s production comes from two major gold mines. Indonesia produced 120 tonnes of gold in 2010, down 27% since its peak production in 2006. Half of Indonesia’s production is produced by one single company where production declined by 7% in 2010. And Canada also remains well below its peak production levels (166 tonnes of gold in 1941; and 177 tonnes of gold in 1991) with just 90 tonnes of gold produced in 2010.

The share of small gold-producing countries (Argentina, Bolivia, Brazil, Chile, Colombia, Ghana, Kazakhstan, Mali, Mexico, Morocco, Uzbekistan, Papua, Philippines, Tanzania, etc.) now account for more than a third of world gold production in 2010. This figure was less than 10% in 1969. These days, to find new deposits of gold, mining companies must go deeper into challenging territories such as deserts, rainforests and polar regions.

As a result of lower production costs due to 2008 crisis effects there is a temporary increase in the world production of gold. Since the crisis, global production increased by 240 tonnes reaching 2,500 tonnes in 2010 but short of the peak gold production reached in 2001 of 2,600 tonnes. But going forward, in the next 10 or 20 years, gold production will almost certainly decrease because of the lack of quality gold reserves.

For the original article, CLICK HERE.

From the article entitled, “World Production of Gold, 2011” by Dr. Thomas Chaize author of the Mining and Energy Newsletter. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

World production of the gray precious metal rose again in 2010. Silver, unlike gold, has seen production levels increase since 2003. This difference in production between gold and silver is not a coincidence due to geology and the history of their production.

World production of silver in 2010 was 713 million ounces. Silver production increased by 1.8% since 2009, 59.7% since its low in 1994 and 161.9% since 1968. In comparison, gold production increased by 8.7% since 1994 and 70% since 1968. World production of silver in 2010 has naturally increased with the increase in the combined production of copper, zinc and gold. This increase has resulted, somewhat mechanically, from the increased production of other metals around the world. Over two thirds of the production of silver is not from primary silver mines but from mine bi-products that produce zinc, copper, lead and gold.

World production of silver by country.

In 2010 Peru remains the world’s number one producer of silver. Silver production in Peru was 123.7 million ounces this past year, down by 1.3% when compared to 2009. The main silver mine in Peru produced 14.9 million ounces (12% of silver production in Peru). The mine is a primary copper mine which also produces silver. The second largest silver mine in Peru produced 10 million ounces (8% of silver production in Peru) and the third 8.6 million ounces (7% of silver production in Peru). The first three mines produce a quarter of the country’s silver, the rest is supplied by more than 140 mines.

Mexico is the second largest producer of silver in 2010. Production declined slightly from 114.1 to 112.5 million ounces of silver. The first number one mine in Mexico produced 35.9 million ounces of silver in 2010, one third of the country’s production and 5% of world production of silver in 2010. This mine is the second biggest silver mine in the world and also produces gold, lead and zinc.

China, number one in zinc, lead and gold, is the third largest producer of silver. China’s silver production continues to grow in 2010, up from 93.2 to 96.4 million ounces of silver. The largest silver mine in China (limited information available so no assurances on this data) is also a wealth of zinc and lead and accounts for only 4-5% of national production and 0.6% of world production.

Australia, number two in lead and gold, is the fourth largest producer of silver with 54.6 million ounces produced in 2010. Australia has the largest silver mine in the world. The mine also produces zinc and lead but is primarily a silver mine. Australia’s largest silver mine produces two thirds of the silver the country and accounts for 5.2% of world production of silver.

Chile, number one in copper, is the fifth largest producer of silver with 48 million ounces of silver produced in 2010. The leading silver mine in the country is also the world’s largest producer of copper, it extracts a quarter of silver production in Chile.

Russia is the sixth largest producer of silver in the world with 45 million ounces of silver produced in 2010. One third comes from a single mine that also produces gold with silver.

Bolivia is the seventh largest producer of silver with 43.7 million ounces of silver in 2010. The main silver mine in Bolivia produced 6.7 million ounces of silver in 2010.

The USA ranks eighth in silver production with 41.1 million ounces of silver produced in 2010. The largest U.S. silver mine, located in Alaska, is also the eighth largest silver mine in the world. It represents 17% of the silver from the U.S. and also produces zinc and lead.

Poland is the 9th largest producer of silver with 38.5 million ounces of silver. 100 percent of Polish production comes from from one mine that also produces copper.

Of these nine countries, the only leading silver mine that produces exclusively silver is from Bolivia. For all the other top silver producing countries, the largest silver mine also produces either copper, zinc, lead, molybdenum or gold.

As noted above, two-thirds of silver production is not derived from primary silver mines, rather from mine bi-products that produce silver along with copper, zinc, gold, lead, molybdenum, or even uranium (in Australia).

It is for this reason that the future of silver production depends to a large degree, almost half, on the production of zinc and copper. While the price of silver is often put in parallel with that of gold, its production depends primarily on the production of base metals. Therefore, the peak production of silver will probably happen at the same time as copper and zinc.

From the article entitled, “World Production of Silver” by Dr. Thomas Chaize author of the Mining and Energy Newsletter. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan