The U.S. stock markets are becoming more unstable, fueling mounting anxiety about what’s likely coming. After surging to new all-time-record highs in late July, stocks plunged in a sharp pullback as the US-China trade war escalated. Stock markets’ resiliency in the face of bearish news is partially determined by how companies are faring fundamentally. The big U.S. stocks’ just-reported Q2’19 results illuminate these key indicators.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the US Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

The deadline for filing 10-Qs for “large accelerated filers” is 40 days after fiscal quarter-ends. The SEC defines this as companies with market capitalizations over $700m. That easily includes every stock in the flagship S&P 500 stock index (SPX), which contains the biggest and best American companies. The middle of this week marked 38 days since the end of Q2, so almost all the big US stocks have reported.

The SPX is the world’s most-important stock index by far, with its components commanding a staggering collective market cap of $25.8t at the end of Q2! The vast majority of investors own the big US stocks of the SPX, as some combination of them are usually the top holdings of nearly every investment fund. That includes retirement capital, so the fortunes of the big U.S. stocks are crucial for Americans’ overall wealth.

The huge ETFs that track the S&P 500 dominate the increasingly-popular passive-investment strategies as well. The SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF are the 3 largest ETFs in the world. This week they reported colossal net assets running $258.5b, $179.3b, and $115.8b respectively! The big SPX companies overwhelmingly drive the entire stock markets.

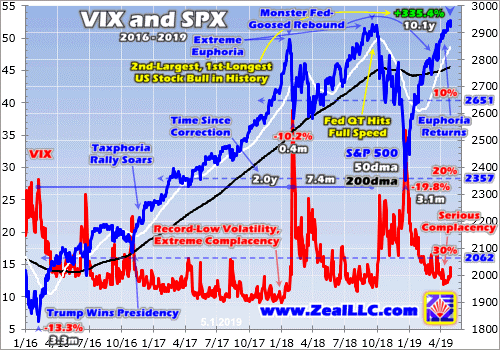

Q2’19 proved quite volatile in the U.S. stock markets, leading to increasing unease. The SPX surged 3.9% higher in April, hitting 4 new record closing highs. That capped an unbelievable 25.3% rocketing over just 4.2 months, a crazy move higher. That was driven by extreme Fed dovishness, as it panicked following the SPX’s severe 19.8% near-bear correction that bottomed in late December. Euphoria reigned supreme.

But the big US stocks couldn’t stay at such lofty heights, so the SPX fell on balance through May on the way to a 6.8% pullback by early June. China reneged on major trade commitments it made to the US over a year through 10 rounds of high-level trade talks. So Trump ramped tariffs on a $200b tranche of annual Chinese imports into the US from 10% to 25%. US-China trade-war news was a key market driver in Q2.

That considerable selloff was reversed by a hyper-dovish Fed riding to the rescue. First its chairman said the Fed was ready to start cutting rates again, and later top Fed officials’ collective outlook for future rates shifted from one hike to one cut. The SPX blasted 7.6% higher in a few weeks on that, achieving another new record high in late June. The US-China trade war and Fed jawboning and actions will keep fueling volatility.

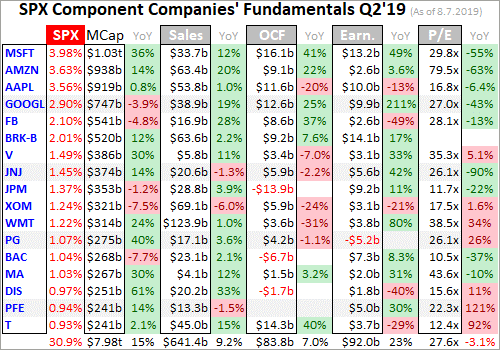

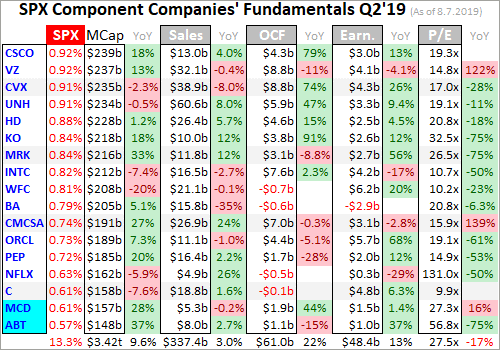

Every quarter I analyze the top 34 SPX/SPY component stocks ranked by market cap. This is just an arbitrary number that fits neatly into the tables below, but a dominant sample of the SPX. As Q2 waned, these American giants alone commanded fully 44.2% of the SPX’s total weighting! Their $11.4t collective market cap exceeded that of the bottom 439 SPX companies. Big US stocks’ importance cannot be overstated.

I wade through the 10-Q or 10-K SEC filings of these top SPX companies for a ton of fundamental data I feed into a spreadsheet for analysis. The highlights make it into these tables below. They start with each company’s symbol, weighting in the SPX and SPY, and market cap as of the final trading day of Q2’19. That’s followed by the year-over-year change in each company’s market capitalization, an important metric.

Major U.S. corporations have been engaged in a wildly-unprecedented stock-buyback binge ever since the Fed forced interest rates to the zero lower bound during 2008’s stock panic. Thus the appreciation in their share prices also reflects shrinking shares outstanding. Looking at market-cap changes instead of just underlying share-price changes effectively normalizes out stock buybacks, offering purer views of value.

That’s followed by quarterly sales along with their YoY change. Top-line revenues are one of the best indicators of businesses’ health. While profits can be easily manipulated quarter to quarter by playing with all kinds of accounting estimates, sales are tougher to artificially inflate. Ultimately sales growth is necessary for companies to expand, as bottom-line profits growth driven by cost-cutting is inherently limited.

Operating cash flows are also important, showing how much capital companies’ businesses are actually generating. Companies must be cash-flow-positive to survive and thrive, using their existing capital to make more cash. Unfortunately many companies now obscure quarterly OCFs by reporting them in year-to-date terms, lumping multiple quarters together. So if necessary to get Q2’s OCFs, I subtracted prior quarters’.

Next are the actual hard quarterly earnings that must be reported to the SEC under Generally Accepted Accounting Principles. Lamentably companies now tend to use fake pro-forma earnings to downplay real GAAP results. These are derided as EBS profits, Everything but the Bad Stuff! Certain expenses are simply ignored on a pro-forma basis to artificially inflate reported corporate profits, often misleading traders.

While I’m also collecting the earnings-per-share data Wall Street loves, it is more important to consider total profits. Stock buybacks are executed to manipulate EPS higher, because the shares-outstanding denominator of its calculation shrinks as shares are repurchased. Raw profits are a cleaner measure, again effectively neutralizing the impacts of stock buybacks. They better reflect underlying business performance.

Finally the trailing-twelve-month price-to-earnings ratios as of the end of Q2’19 are noted. TTM P/Es look at the last four reported quarters of actual GAAP profits compared to prevailing stock prices. They are the gold-standard valuation metric. Wall Street often intentionally conceals these real P/Es by using fictional forward P/Es instead, which are literally mere guesses about future profits that almost always prove too optimistic.

These are mostly calendar-Q2 results, but some big U.S. stocks use fiscal quarters offset from normal ones. Walmart, Cisco, and Home Depot have lagging quarters ending one month after calendar ones, so their results here are current to the end of April instead of June. Oracle uses quarters that end one month before calendar ones, so its results are as of the end of May. Such offset reporting ought to be banned.

Reporting on offset quarters renders companies’ results way less comparable with the vast majority that report on calendar quarters. We traders all naturally think in calendar-quarter terms too. Decades ago there were valid business reasons to run on offset fiscal quarters. But today’s sophisticated accounting systems that are largely automated running in real-time eliminate all excuses for not reporting normally.

Stocks with symbols highlighted in blue have newly climbed into the ranks of the SPX’s top 34 companies over the past year, as investors bid up their stock prices and thus market caps relative to their peers. Overall the big US stocks’ Q2’19 results looked decent, with modest sales and profits growth. But these growth rates are really slowing, and stock valuations remain near bubble levels relative to underlying earnings.

Over the past 19.3 years, I’ve written 873 of these weekly web essays. None are more challenging than these ones analyzing quarterly results. There’s so much data to collect and analyze, so much work to do. So it wasn’t until Q4’17 results that I took on this Herculean task. Understanding the fundamentals of big U.S. stocks is critical to gaming likely coming stock-market performance, so the hard work is well worth it.

Out of the 7 quarters so far in this essay series, the concentration of capital in the top 34 SPX companies has never been higher. A staggering 44.2% of the market capitalization of all 500 stocks is centralized in just 34 stocks! This compares to 41.7% in Q1’18. It is not healthy for a shrinking pool of market-darling stocks to dominate the entire US markets. That leaves market performance overly dependent on them.

Much of this ominous concentration risk comes from the beloved mega-cap technology companies. The SPX’s top 5 component stocks are Microsoft, Amazon, Apple, Alphabet, and Facebook. They commanded fully 16.2% of the SPX’s entire market cap at the end of Q2, nearly 1/6th! Thus if any one of them gets hit by bad company-specific news, it will help drag the entire stock markets lower intensifying any selling.

One of the cool perks of being a professional speculator and newsletter guy is I get to listen to financial television including CNBC and Bloomberg all day every day. That offers excellent reads on the prevailing sentiment that drives markets. Almost every professional money manager interviewed loves these elite mega-cap techs, including them in their top holdings. They are universally-held and incredibly-crowded trades.

When capital deployed in stocks becomes overly concentrated, that feeds on itself for awhile. Investors deploy capital with money managers based on their performance. If they don’t own these mega-cap techs that investment inflows have driven higher for years, they risk falling behind their peers and losing business. So money managers feel forced to buy the high-flying mega-cap techs even at lofty valuations.

Interestingly these guys try to justify their heavy mega-cap-tech holdings by claiming these stocks are less risky than the broader markets because their businesses are so strong. I can’t count the number of times I’ve heard that mega-cap techs are what to own in case of a recession. That’s total nonsense, as high-flying really-popular stocks have greater downside. The more capital invested, the more potential selling.

During that severe near-bear correction where the SPX plummeted 19.8% largely in Q4’18, these top 5 SPX stocks amplified that by 1.3x with a 24.8% average drop. When the SPX pulled back 6.8% mostly in May, MSFT, AMZN, AAPL, GOOGL, and FB averaged big 12.5% declines nearly doubling the SPX’s retreat! And during the sharp 6.0% SPX pullback since late July, their average fall of 7.8% again leveraged it 1.3x.

The serious risks of too much capital in too few stocks aside, the big U.S. stocks as a group enjoyed a solid Q2 fundamentally. Their collective revenues grew 2.7% year-over-year to $978.8b. Much of this was concentrated in those 5 mega-cap tech stocks, which averaged amazing 16.0% top-line growth compared to just 4.4% for the rest of the top 34 SPX stocks. Money managers use this to rationalize being overweight.

These elite tech market-darlings are certainly not recession-proof, despite the euphoria surrounding them. Recessions are often triggered by stock bear markets, which generate enough fear to scare both consumers and businesses into pulling in their horns and spending less. That is likely to lead to falling sales for all 5 of these mega-cap techs, which will hammer their prices sharply lower sucking in the SPX.

Businesses will cut back on their information-technology spending if they are worried about their own sales, hurting the fast-growing cloud-computing sides of Amazon, Microsoft, and Google. Companies will also cut back on their marketing spends if their own perceived prospects dim sufficiently, leading to lower revenues for Google, Facebook, and even Amazon. These high-flying stocks will really suffer in a bear market.

On the consumer side, the sales of Apple’s expensive products will plunge dramatically when consumers get worried about their own futures. They will keep their existing iPhones and iPads longer, extending the critical upgrade cycle. And most of the endless stuff Amazon sells is discretionary not essential, so those purchases will be cut back when people feel financially stressed. The top SPX stocks aren’t immune to a slowdown.

In Q2’19 these top 34 SPX and SPY stocks saw operating-cash-flow generation soar 17.0% YoY to $144.8b. Again those 5 mega-cap techs led the way, with 21.0% average growth compared to 12.9% for the rest. But these market-darling tech companies benefit heavily from the great optimism spawned by record-high stock markets. That convinces both companies and consumers to heavily buy their offerings.

The GAAP-earnings front was more interesting, with these big US stocks’ total profits up just 4.2% YoY to $140.5b in Q2’19. These were dragged down by a couple notable losses, including Procter & Gamble writing down $8.3b in a massive goodwill-impairment charge. That was an admission this company paid far too much for its Gillette shaving business, as men are shaving less and increasingly using cheaper razors.

Then Boeing suffered an ugly $3.4b loss from operations due to its ill-fated 737 MAX airplane. This is a 1960s-era airframe that was upgraded with engines far larger than ever intended in order to maximize fuel efficiency. But these wouldn’t fit under the wings, so they were mounted forward and higher. That screwed up this airplane’s center of gravity and aerodynamics, requiring computer assistance to keep flying.

Either this inherently-unstable flawed design or software bugs caused two horrific crashes killing 346 people. So the entire 737 MAX fleet was grounded, and that airplane was supposed to generate about a third of Boeing’s revenue over the next 5 years! So this company is in a world of hurt until well after this airplane is cleared to fly again. Overall SPX-top-34 profits would’ve been even higher without these losses.

While 4.2% profits growth sounds good, it is still slowing sharply. Overall SPX corporate-earnings growth rocketed 20.5% higher in 2018 largely thanks to the Tax Cuts and Jobs Act. Its centerpiece slashed the US corporate tax rate from 35% to 21%, which went effective as last year dawned. 2018’s four quarters were the only ones comparing pre- and post-TCJA earnings. This year the comparisons are all post-tax-cut.

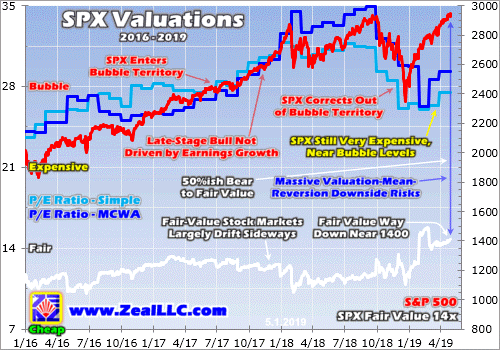

Thanks to the stock markets’ massive corporate-tax-cut rally in 2017 and 2018, and sharp rebound on the Fed’s radical shift to dovishness earlier this year, valuations remain dangerously high. They are still up near historical bubble levels heralding new bear markets. So low-single-digit earnings growth, with the threat of actual shrinkage in future quarters, isn’t likely to be enough to support these lofty stock prices for long.

Before we get to valuations though, there’s more to consider on the big US stocks’ earnings. One of the main reasons corporations engage in stock buybacks is to artificially boost their reported earnings per share. That masks what their underlying overall GAAP profits are doing, lulling traders into complacency. Some of the companies among these top 34 had yawning gulfs between earnings per share and total profits!

The main culprits were the top 4 mega-cap US banks, JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. Their financial reporting is mind-bogglingly complex, and full of estimates that allow them to actively manipulate their reported earnings per share. Wall Street loves the big financial stocks, which are often the most-important sector after mega-cap tech for coloring sentiment for the entire stock markets.

JPM’s EPS soared 22.5% YoY in Q2 despite total GAAP earnings only up 10.5%. BAC looked similar at 17.2% EPS growth versus 8.3% overall profits growth. WFC saw earnings per share soar 33.7% YoY despite overall earnings only rising 19.7%. And C’s 19.0% EPS surge literally tripled its 6.3% growth in hard GAAP profits! Something is really wrong here and highly misleading, eventually the truth will catch up.

Some big non-financial stocks also had magical earnings-per-share growth far outstripping underlying corporate-profits growth. Cisco’s EPS rocketed 25.0% higher despite mere 13.1% growth in the bottom-line profits on its income statement. Sooner or later there has to be a reckoning between earnings per share and actual profits, even if huge stock buybacks persist. These key profits measures have to converge.

Wall Street analysts have grown adept at using misdirection to blind investors to the adverse trends in earnings growth. Mighty Apple was a key case in point recently, reporting its Q2’19 results after the close on July 30th. This was heralded as a big beat, with EPS of $2.18 on revenues of $53.8b both exceeding expectations of $2.10 and $53.4b. By those metrics it looked like Apple was thriving, so its stock shot higher.

In after-hours trading it was up 4%+, and by the middle of the next day this monster-market-cap stock had rocketed 6.0% higher! The problem was comparing those Q2 results to estimates is totally deceptive. The analysts always lowball their guesses to ensure companies beat, stoking euphoria and complacency. But all that really matters is companies’ absolute profits and sales growth compared to their year-earlier quarters.

In hard year-over-year terms, Apple’s Q2’19 sales only eked out a 1.0% gain. That was pathetic relative to its other 4 mega-cap-tech peers, which averaged 19.7%. And Apple’s Q2’19 GAAP earnings actually plunged 12.8% YoY from Q2’18! So what Wall Street dishonestly spun into a great quarter was in reality a weaker one. Eventually stock prices have to reflect underlying fundamentals, not perma-bull propaganda.

Ominously stock prices remain dangerously high relative to their underlying corporate earnings. The big U.S. stocks averaged trailing-twelve-month price-to-earnings ratios way up at 27.5x as Q2’19 wrapped up. That is just shy of the historical bubble threshold above 28x! So the current earnings picture over the past 4 quarters certainly doesn’t justify such lofty stock prices. That greatly amplifies market downside risk.

These chronic overvaluations aren’t just concentrated in those top 5 mega-cap tech stocks, which sported 36.2x average P/Es. The rest of the top 34 were still near bubble territory averaging 25.9x. Trading at such high valuations, these stock markets are an accident waiting to happen. It’s only a matter of time until the next bear market arrives. It could be spawned by the mounting US-China trade war, or weaker profits.

Over the past several calendar years, earnings growth among all 500 SPX companies ran 9.3%, 16.2%, and 20.5%. This year even Wall Street analysts expect it to be flat at best. And if corporate revenues actually start shrinking due to mounting trade wars or rolling-over stock markets damaging confidence and spending, profits will amplify that downside. Declining SPX profits will proportionally boost valuations.

Excessive valuations after long bulls always eventually spawn proportional bear markets. And we are way overdue for the next one. At its latest all-time-record high in late July, this current monster SPX bull up 347.3% in 10.4 years ranked as the 2nd-largest and 1st-longest in all of US stock-market history! This powerful secular uptrend can’t persist near bubble valuations as corporate-earnings growth stalls or even reverses.

Bear markets are necessary to maul stock prices sideways to lower long enough for profits to catch up with lofty stock prices. These fearsome beasts are nothing to be trifled with, yet complacent traders mock them. The SPX’s last couple bears that awoke and ravaged due to high valuations pummeled the SPX 49.1% lower in 2.6 years leading into October 2002, and 56.8% lower over 1.4 years leading into March 2009!

Seeing big US stocks’ prices cut in half or worse is common and expected in major bear markets. And there’s a decent chance the current near-bubble valuations in US stock markets will soon look even more extreme. If the big US stocks’ fundamentals deteriorate, the overdue bear reckoning after this monster bull is even more certain. So big US stocks’ coming Q3’19 and Q4’19 results could prove pivotal if they’re weak.

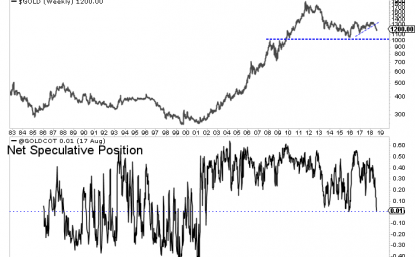

Cash is king in bear markets, since its buying power grows. Investors who hold cash during a 50% bear market can double their holdings at the bottom by buying back their stocks at half-price. But cash doesn’t appreciate in value like gold, which actually grows wealth during major stock-market bears. When stock markets weaken its investment demand surges, which happened in December as the SPX sold off hard.

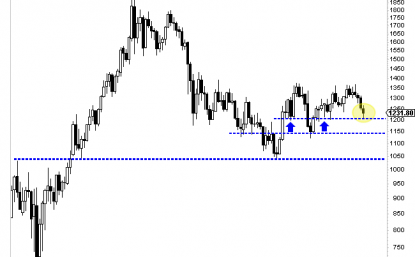

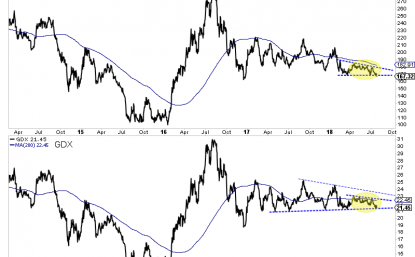

While the SPX plunged 9.2% that month, gold rallied 4.9% as investors flocked back. The gold miners’ stocks which leverage gold’s gains fared even better, with their leading index surging 10.7% higher. The last time a major SPX selloff awakened gold in the first half of 2016, it soared up 30% fueling a massive 182% gold-stock upleg! Gold’s awesome decisive bull breakout in late June is already attracting traders back.

Absolutely essential to weathering bears is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. Lately we’ve been doing this in gold stocks, buying them while out of favor earlier this year to enjoy massive gains in recent months.

This past week we realized absolute gains on gold-stock trades including 109.7%, 105.8%, and 92.0%! All our trades, analyses, and outlooks are detailed in our popular weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off summer-doldrums sale! Staying informed is essential for success.

The bottom line is big U.S. stocks’ latest fundamentals from Q2’19’s earnings season were decent. These elite companies enjoyed modest sales and earnings growth. But that masked serious and mounting risks. Investment capital is increasingly concentrating in the beloved mega-cap technology stocks, leaving stock markets overly dependent on their fortunes. Any slowing from them will drag the entire stock markets lower.

More ominously big U.S. stocks’ valuations remain way up near dangerous bubble territory. Their earnings aren’t justifying their lofty stock prices. The resulting downside risks are exacerbated with profits growth really slowing, and threatening to stall out entirely or even shrink in coming quarters. This is a potently-bearish situation, even before any bad news like further escalation in the US-China trade war hits stocks.

Adam Hamilton, CPA

August 13, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

The silver miners’ stocks have been pummeled in recent months, plunging near major secular lows in late May. Sentiment in this tiny sector is miserable, reflecting silver prices continuing to languish relative to gold. This has forced traditional silver miners to increasingly diversify into gold, which has far-superior economics. The major silver miners’ ongoing shift from silver is apparent in their recently-released Q1’19 results.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the U.S. Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

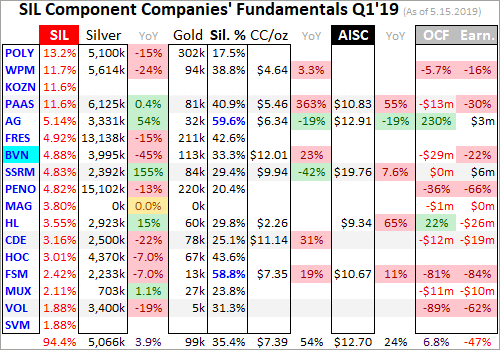

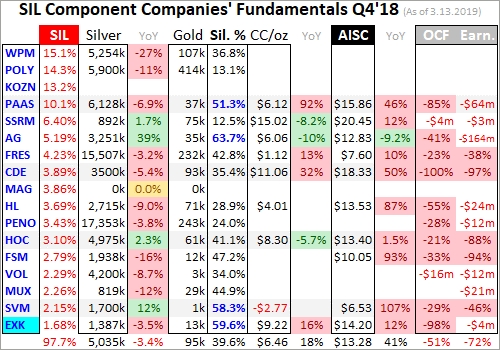

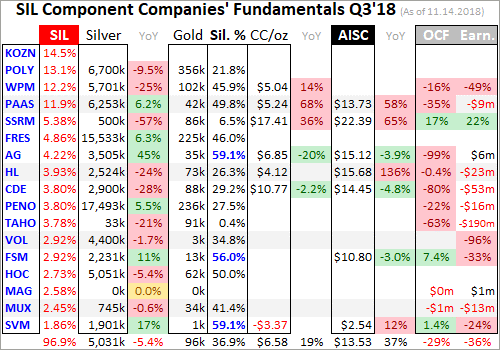

The definitive list of major silver-mining stocks to analyze comes from the world’s most-popular silver-stock investment vehicle, the SIL Global X Silver Miners ETF. Launched way back in April 2010, it has maintained a big first-mover advantage. SIL’s net assets were running $294m in mid-May near the end of Q1’s earnings season, 5.6x greater than its next-biggest competitor’s. SIL is the leading silver-stock benchmark.

In mid-May SIL included 24 component stocks, which are weighted somewhat proportionally to their market capitalizations. This list includes the world’s largest silver miners, including the biggest primary ones. Every quarter I dive into the latest operating and financial results from SIL’s top 17 companies. That’s simply an arbitrary number that fits neatly into the table below, but still a commanding sample.

As of mid-May these major silver miners accounted for fully 94.4% of SIL’s total weighting. In Q1’19 they collectively mined 70.9m ounces of silver. The latest comprehensive data available for global silver supply and demand came from the Silver Institute in April 2019. That covered 2018, when world silver mine production totaled 855.7m ounces. That equates to a run rate around 213.9m ounces per quarter.

Assuming that mining pace persisted in Q1’19, SIL’s top 17 silver miners were responsible for about 33% of world production. That’s relatively high considering just 26% of 2018’s global silver output was produced at primary silver mines! 38% came from lead/zinc mines, 23% from copper, and 12% from gold. Nearly 3/4ths of all silver produced worldwide is just a byproduct. Primary silver mines and miners are fairly rare.

Scarce silver-heavy deposits are required to support primary silver mines, where over half their revenue comes from silver. They are increasingly difficult to discover and ever-more expensive to develop. And silver’s challenging economics of recent years argue against miners even pursuing it. So even traditional major silver miners have shifted their investment focus into actively diversifying into far-more-profitable gold.

Silver price levels are best measured relative to prevailing gold prices, which overwhelmingly drive silver price action. In late May the Silver/Gold Ratio continued collapsing to its worst levels witnessed in 26.1 years, since April 1993! These secular extremes of the worst silver price levels in over a quarter century are multiplying the endless misery racking this once-proud sector. This silver environment is utterly wretched.

The largest silver miners dominating SIL’s ranks are scattered around the world. 10 of the top 17 mainly trade in U.S. stock markets, 3 in the United Kingdom, and 1 each in South Korea, Mexico, Peru, and Canada. SIL’s geopolitical diversity is good for investors, but makes it difficult to analyze and compare the biggest silver miners’ results. Financial-reporting requirements vary considerably from country to country.

In the U.K. companies report in half-year increments instead of quarterly. Some silver miners still publish quarterly updates, but their data is limited. In cases where half-year data is all that was made available, I split it in half for a Q1 approximation. Canada has quarterly reporting, but the deadlines are looser than in the States. Some Canadian miners really drag their feet, publishing their quarterlies close to legal limits.

The big silver companies in South Korea, Mexico, and Peru present other problems. Their reporting is naturally done in their own languages, which I can’t decipher. Some release limited information in English, but even those translations can be difficult to interpret due to differing accounting standards and focuses. It’s definitely challenging bringing all the quarterly data together for the diverse SIL-top-17 silver miners.

But analyzing them in the aggregate is essential to understand how they are faring. So each quarter I wade through all available operational and financial reports and dump the data into a big spreadsheet for analysis. Some highlights make it into this table. Blank fields mean a company hadn’t reported that data by mid-May, as Q1’s earnings season wound down. Some of SIL’s components report in gold-centric terms.

The first couple columns of this table show each SIL component’s symbol and weighting within this ETF as of mid-May. While most of these stocks trade on US exchanges, some symbols are listings from companies’ primary foreign stock exchanges. That’s followed by each miner’s Q1’19 silver production in ounces, along with its absolute year-over-year change. Next comes this same quarter’s gold production.

Nearly all the major silver miners in SIL also produce significant-to-large amounts of gold! That’s truly a double-edged sword. While gold really stabilizes and boosts silver miners’ cash flows, it also retards their stocks’ sensitivity to silver itself. So the next column reveals how pure these elite silver miners are, approximating their percentages of Q1’19 revenues actually derived from silver. This is calculated one of two ways.

The large majority of these top SIL silver miners reported total Q1 revenues. Quarterly silver production multiplied by silver’s average price in Q1 can be divided by these sales to yield an accurate relative-purity gauge. When Q1 sales weren’t reported, I estimated them by adding silver sales to gold sales based on their production and average quarterly prices. But that’s less optimal, as it ignores any base-metals byproducts.

Next comes the major silver miners’ most-important fundamental data for investors, cash costs and all-in sustaining costs per ounce mined. The latter directly drives profitability which ultimately determines stock prices. These key costs are also followed by YoY changes. Last but not least the annual changes are shown in operating cash flows generated and hard GAAP earnings, with a couple exceptions necessary.

Percentage changes aren’t relevant or meaningful if data shifted from positive to negative or vice versa, or if derived from two negative numbers. So in those cases I included raw underlying data rather than weird or misleading percentage changes. Companies with symbols highlighted in light-blue have newly climbed into the elite ranks of SIL’s top 17 over this past year. This entire dataset together is quite valuable.

It offers a fantastic high-level read on how the major silver miners are faring fundamentally as an industry and individually. The crazy-low silver prices really weighed on operating cash flows and earnings in Q1, and the silver miners’ years-old shift into gold continued. These companies are having no problem just surviving this silver-sentiment wasteland, but they probably won’t be thriving again before silver recovers.

SIL’s poor performance certainly reflects the challenges of profitably mining silver with its price so darned cheap. Year-to-date in late May, SIL had already lost 12.2%. Silver itself was down 7.2% YTD at worst, starting to threaten mid-November 2018’s 2.8-year secular low of $13.99. And that just extended last year’s losing trend, where SIL plunged 23.3% amplifying silver’s own 8.6% loss by 2.7x. This sector looks ugly.

Silver’s weakest prices relative to gold in over a quarter century have continued to devastate silver-mining sentiment. Investors understandably want nothing to do with the forsaken silver miners, so their stock prices languish near major lows. Even their own managements seem really bearish, increasingly betting their companies’ futures on gold rather than silver. Silver’s Q1 price action further supports this decision.

During Q1’19 silver ground another 2.3% lower despite a 0.8% gold rally, bucking its primary driver. Q1’s average silver price of $15.54 fell 7.1% YoY from Q1’18’s average. That was way worse than gold’s mere 1.9% YoY average-price decline. The silver-mining industry is laboring under a pall of despair. Although production decisions aren’t made quarter by quarter, the chronically-weak silver prices are choking off output.

Production is the lifeblood of silver miners, and it continued to slide. The SIL top 17 that had reported their Q1 results by mid-May again mined 70.9m ounces of silver. That was down 3.1% YoY from Q1’18’s silver production, excluding Silvercorp Metals. SVM’s fiscal years end after Q1s, and it doesn’t report its longer more-comprehensive annual results until well after Q1’s normal quarterly earnings season wraps up.

It’s not just these major silver miners producing less of the white metal, the entire industry is according to the Silver Institute’s latest World Silver Survey. 2018 was the third year in a row of waning global silver mine production. This shrinkage is accelerating too as silver continues to languish, running 0.0% in 2016, 1.8% in 2017, and 2.4% in 2018! Peak silver may have been seen with this metal so unrewarding to mine.

The traditional major silver miners aren’t taking silver’s vexing fading lying down. They’ve spent recent years increasingly diversifying into gold, which has way-superior economics with silver prices so bombed out. The SIL top 17’s total gold production surged 10.9% YoY to 1387k ounces in Q1! This producing-less-silver-and-more-gold trend will continue to grow as long as silver prices waste away in the gutter.

Silver mining is as capital-intensive as gold mining, requiring similar large expenses to plan, permit, and construct new mines, mills, and expansions. It needs similar fleets of heavy excavators and haul trucks to dig and move the silver-bearing ore. Similar levels of employees are necessary to run silver mines. But silver generates much-lower cash flows than gold due its lower price. Silver miners have been forced to adapt.

This is readily evident in the top SIL miners’ production in Q1’19. SIL’s largest component in mid-May as this latest earnings season ended was the Russian-founded but UK-listed Polymetal. Its silver production fell 15.0% YoY in Q1, but its gold output surged 41.1%! Just 17.5% of its Q1 revenues came from silver, making it overwhelmingly a primary gold miner. Its newest mine ramping up is another sizable gold one.

SIL’s second-largest component is Wheaton Precious Metals. It used to be a pure silver-streaming play known as Silver Wheaton. Silver streamers make big upfront payments to miners to pre-purchase some of their future silver production at far-below-market unit prices. This is beneficial to miners because they use the large initial capital infusions to help finance mine builds, which banks often charge usurious rates for.

Back in May 2017 Wheaton changed its name and symbol to reflect its increasing diversification into gold streaming. In Q1’19 WPM’s silver output collapsed 24.4% YoY, but its gold surged 17.4% higher! That pushed its silver-purity percentage in sales terms to just 38.8%, way below the 50%+ threshold defining primary silver miners. WPM’s 5-year guidance issued in February forecasts this gold-heavy ratio persisting.

Major silver miners are becoming so scarce that SIL’s third-largest component is Korea Zinc. Actually a base-metals smelter, this company has nothing to do with silver mining. It ought to be kicked out of SIL post-haste, as its presence and big 1/9th weighting really retards this ETF’s performance. Korea Zinc smelted about 64.0m ounces of silver in 2018, which approximates roughly 17% of its full-year revenue.

Global X was really scraping the bottom of the barrel to include a company like Korea Zinc in SIL. I’m sure there’s not a single SIL investor who wants base-metals-smelting exposure in what is advertised as a “Silver Miners ETF”. The weighting and capital allocated to Korea Zinc can be reallocated and spread proportionally across the other SIL stocks. The ranks of major silver miners are becoming more rarefied.

SIL’s fourth-largest component in mid-May is Pan American Silver, which has a proud heritage mining its namesake metal. In Q1’19 its silver production was flat with a negligible 0.4% YoY increase, yet its gold output soared 74.2%! Thus PAAS’s silver purity slumped to 40.9%, the lowest by far seen in the years I’ve been doing this quarterly research. And it’s going to get much more gold-centric in coming quarters.

PAAS acquired troubled silver miner Tahoe Resources back in mid-November. Tahoe had owned what was once the world’s largest silver mine, Escobal in Guatemala. It had produced 5.7m ounces in Q1’17 before that country’s government unjustly shut it down after a frivolous lawsuit on a trivial bureaucratic misstep by the regulator. PAAS hopes to work through the red tape to win approval for Escobal to restart.

But the real prize in that fire-sale buyout was Tahoe’s gold production from other mines. That deal closed in late February, so that new gold wasn’t fully reflected in PAAS’s Q1 results. Now this former silver giant is forecasting midpoint production of 27.1m ounces of silver and 595.0k ounces of gold in 2019! That is way into mid-tier-gold territory and a far cry from 2018’s output of 24.8m and 178.9k. PAAS has turned yellow.

Pan American will probably soon follow in Wheaton’s footsteps and change its name and symbol to reflect its new gold-dominated future. As miserable as silver has been faring, I’m starting to wonder if the word “silver” in a miner’s name is becoming a liability with investors. The major primary silver miners are going extinct, forced to adapt by diversifying out of silver and into gold as the former languishes deeply out of favor.

In Q1’19 the SIL-top-17 miners averaged only 35.4% of their revenues derived from silver. That’s also the lowest seen since I started this thread of research with Q2’16 results. Only two of these miners remained primary silver ones, and their silver-purity percentages over 50% are highlighted in blue. They are First Majestic Silver and Fortuna Silver Mines, which together accounted for just 7.6% of SIL’s total weighting.

With SIL-top-17 silver production sliding 3.1% YoY in Q1’19, the per-ounce mining costs should’ve risen proportionally. Silver-mining costs are largely fixed quarter after quarter, with actual mining requiring the same levels of infrastructure, equipment, and employees. So the lower production, the fewer ounces to spread mining’s big fixed costs across. SIL’s major silver miners indeed reported higher costs last quarter.

There are two major ways to measure silver-mining costs, classic cash costs per ounce and the superior all-in sustaining costs. Both are useful metrics. Cash costs are the acid test of silver-miner survivability in lower-silver-price environments, revealing the worst-case silver levels necessary to keep the mines running. All-in sustaining costs show where silver needs to trade to maintain current mining tempos indefinitely.

Cash costs naturally encompass all cash expenses necessary to produce each ounce of silver, including all direct production costs, mine-level administration, smelting, refining, transport, regulatory, royalty, and tax expenses. In Q1’19 these SIL-top-17 silver miners reported cash costs averaging $7.39 per ounce. While that surged 23.6% YoY, it still remains far below prevailing prices. Silver miners face no existential threat.

The major silver miners’ average cash costs vary considerably quarter-to-quarter, partially depending on whether or not Silvercorp Metals happens to have edged into the top 17. This Canadian company mining in China has negative cash costs due to massive byproduct credits from lead and zinc. So over the past couple years, SIL-top-17 average cash costs have swung wildly ranging all the way from $3.95 to $6.75.

Way more important than cash costs are the far-superior all-in sustaining costs. They were introduced by the World Gold Council in June 2013 to give investors a much-better understanding of what it really costs to maintain silver mines as ongoing concerns. AISCs include all direct cash costs, but then add on everything else that is necessary to maintain and replenish operations at current silver-production levels.

These additional expenses include exploration for new silver to mine to replace depleting deposits, mine-development and construction expenses, remediation, and mine reclamation. They also include the corporate-level administration expenses necessary to oversee silver mines. All-in sustaining costs are the most-important silver-mining cost metric by far for investors, revealing silver miners’ true operating profitability.

The SIL-top-17 silver miners reporting AISCs in Q1’19 averaged $12.70 per ounce, 7.2% higher YoY. That remained considerably below last quarter’s average silver price of $15.54, as well as late May’s ugly silver low of $14.34. So the silver-mining industry as a whole is still profitable even with silver drifting near quarter-century-plus lows relative to gold. And those AISCs are skewed higher by SSR Mining’s outlying read.

Another traditional silver miner that changed its name, this company used to be known as Silver Standard Resources. SSRM has shifted into gold too, gradually winding down its old Pirquitas silver mine resulting in abnormally-high AISCs of $19.76 per ounce. Excluding these, the SIL-top-17 average in Q1 falls to $10.94 which is a much-more-comfortable profits cushion between production costs and low silver prices.

Interestingly SSRM has been ramping up a new mine close to its old Pirquitas mill, and is starting to run that ore through. That makes SSR Mining one of the rare silver miners that’s going to see growing output this year. It is forecasting a midpoint of 4.9m ounces of silver production in 2019, a 74% jump from last year’s levels! Higher production should lead to lower AISCs going forward, pulling the average back down.

As hopeless as silver has looked in recent months, it won’t stay down forever. Sooner or later gold will catch a major bid, probably on surging investment demand as these dangerous stock markets roll over. Capital will start migrating back into silver like usual once gold rallies long enough and high enough to convince traders its uptrend is sustainable. Since the silver market is so small, that portends much-higher prices.

At Q1’19’s average silver price of $15.54 and average SIL-top-17 AISCs of $12.70, these miners were earning $2.84 per ounce. That’s not bad for a sector that investors have left for dead, convinced it must be doomed. Being so wildly undervalued relative to gold, silver has the potential to surge much higher in the next gold upleg. The average Silver/Gold Ratio since Q1’16 right after today’s gold bull was born was 77.1x.

At $1400 and $1500 gold which are modest upleg gains, silver mean reverting to recent years’ average SGR levels would yield silver targets of $18.16 and $19.46. That’s conservative, ignoring the high odds for a mean-reversion overshoot, and only 16.9% and 25.2% above Q1’s average price. Yet with flat AISCs that would boost the SIL top 17’s profits by 92.3% and 138.0%! Their upside leverage to silver is amazing.

The caveat is the degree to which silver miners’ earnings amplify this metal’s upside is dependent on how much of their sales are still derived from silver when it turns north. If the SIL top 17 are still getting 35% of their sales from silver, their stocks should surge with silver. But the more they diversify into gold, the more dependent they will be on gold-price moves. Those aren’t as big as silver’s since gold is a far-larger market.

On the accounting front the top 17 SIL silver miners’ Q1’19 results highlighted the challenges of super-low silver prices. These companies collectively sold $3.0b worth of metals in Q1, which actually clocked in at an impressive 10.8% YoY increase. That was totally the result of these companies mining 10.9% more gold in Q1. Though it dilutes their silver-price exposure, shifting into gold really strengthens them financially.

But operating-cash-flow generation looked much worse, collapsing 55.1% YoY to $237m across the SIL top 17 that reported them for Q1. There was no single-company disaster, but Q1’s average silver prices being 7.1% lower YoY eroded OCFs universally. That led to these miners’ collective treasuries shrinking 22.9% YoY to $2.3b. That’s plenty to operate on, but not that much to fund many mine builds or expansions.

Hard GAAP profits reported by the SIL top 17 silver miners were very weak too in Q1’19, plunging 54.9% YoY to $123m. But there were no major writedowns from these low silver prices impairing the value of silver mines and deposits. Investors don’t buy silver stocks for how they are doing today, but for what they are likely to do as silver mean reverts higher. Silver-mining earnings surge dramatically as silver recovers.

Silver’s last major upleg erupted in essentially the first half of 2016, when silver soared 50.2% higher on a parallel 29.9% gold upleg. SIL blasted 247.8% higher in just 6.9 months, a heck of a gain for major silver stocks. But the purer primary silver miners did far better. The purest major silver miner First Majestic’s stock was a moonshot, skyrocketing a staggering 633.9% higher in that same short span! SIL’s gains are muted.

The key takeaway here is avoid SIL. The world’s leading “Silver Miners ETF” is increasingly burdened with primary gold miners with waning silver exposure. And having over 1/9th of your capital allocated to silver miners squandered in Korea Zinc is sheer madness! If you want to leverage silver’s long-overdue next mean reversion higher relative to gold, it’s far better to deploy in smaller purer primary silver miners alone.

One of my core missions at Zeal is relentlessly studying the silver-stock world to uncover the stocks with superior fundamentals and upside potential. The trading books in both our popular weekly and monthly newsletters are currently full of these better gold and silver miners. Mostly added in recent months as these stocks recovered from deep lows, their prices remain relatively low with big upside potential as gold rallies!

If you want to multiply your capital in the markets, you have to stay informed. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q1 we’ve recommended and realized 1089 newsletter stock trades since 2001, averaging annualized realized gains of +15.8%! That’s nearly double the long-term stock-market average. Subscribe today for just $12 per issue!

The bottom line is the major silver miners are still struggling. With silver continuing to languish at quarter-century-plus lows relative to gold, the economics of extracting it remain challenging. That led to slowing silver production and higher costs in Q1. The traditional major silver miners continued their years-long trend of increasingly diversifying into gold. Their percentage of sales derived from silver is still shrinking.

There aren’t enough major primary silver miners left to flesh out their own ETF, which is probably why SIL is dominated by gold miners. While it will rally with silver amplifying its gains, SIL’s upside potential is just dwarfed by the remaining purer silver stocks. Investors will be far-better rewarded buying them instead of settling for a watered-down silver-miners ETF. Their stocks will really surge as silver mean reverts much higher.

Adam Hamilton, CPA

June 4, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

The U.S. stock markets sure feel inflectiony, at a major juncture. After achieving new all-time record highs, sentiment was euphoric heading into this week. But those latest heights could be a massive triple top that formed over 15 months. Then heavy selling erupted in recent days as the U.S.-China trade war suddenly went hostile. The big U.S. stocks just-reported Q1’19 fundamentals will help determine where markets go next.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the U.S. Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

The deadline for filing 10-Qs for “large accelerated filers” is 40 days after fiscal quarter-ends. The SEC defines this as companies with market capitalizations over $700m. That currently includes every stock in the flagship S&P 500 stock index (SPX), which contains the biggest and best American companies. The middle of this week marked 38 days since the end of Q1, so almost all the big U.S. stocks have reported.

The SPX is the world’s most-important stock index by far, with its components commanding a staggering collective market cap of $24.9t at the end of Q1! The vast majority of investors own the big U.S. stocks of the SPX, as some combination of them are usually the top holdings of nearly every investment fund. That includes retirement capital, so the fortunes of the big U.S. stocks are crucial for Americans’ overall wealth.

The major ETFs that track the S&P 500 dominate the increasingly-popular passive-investment strategies as well. The SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF are among the largest in the world. This week they reported colossal net assets running $271.9b, $175.1b, and $111.5b respectively! The big SPX companies overwhelmingly drive the entire stock markets.

Q1’19 proved extraordinary, the SPX soaring 13.1% higher in a massive rebound rally after suffering a severe correction largely in Q4. That pummeled this key benchmark stock index 19.8% lower in jU.S.t 3.1 months, right on the verge of entering a new bear market at -20%. By the end of Q1, fully 5/6ths of those deep losses had been reversed. Did the big U.S. stocks’ fundamental performances support such huge gains?

Corporate-earnings growth was expected to slow dramatically in Q1, stalling out after soaring 20.5% last year. 2018’s four quarters straddled the Tax Cuts and Jobs Act, which became law right when that year dawned. Its centerpiece was slashing the U.S. corporate tax rate from 35% to 21%, which naturally greatly boosted profits from pre-TCJA levels. Q1’19 would be the first quarter with post-TCJA year-over-year comparisons.

Big U.S. stocks’ valuations, where their stock prices are trading relative to their underlying earnings, offer critical clues on what is likely coming next. By late April the epic stock-market bull as measured by the SPX extended to huge 335.4% gains over 10.1 years! That clocked in as the second-largest and first-longest bull in U.S. stock-market history. With the inevitable subsequent bear overdue, valuations really matter.

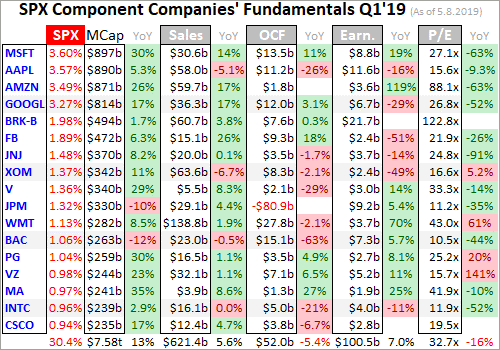

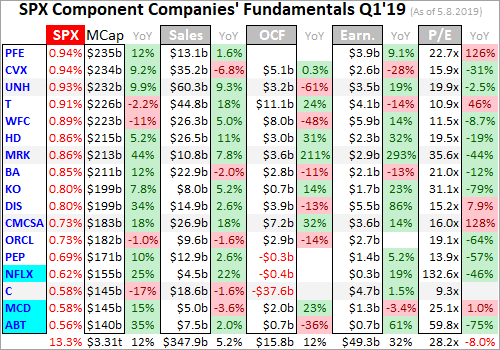

Every quarter I analyze the top 34 SPX/SPY component stocks ranked by market cap. This is just an arbitrary number that fits neatly into the tables below, but a dominant sample of the SPX. As Q1 waned, these American giants alone commanded fully 43.7% of the SPX’s total weighting! Their $10.9t collective market cap exceeded that of the bottom 437 SPX companies. Big U.S. stocks’ importance cannot be overstated.

I wade through the 10-Q or 10-K SEC filings of these top SPX companies for a ton of fundamental data I feed into a spreadsheet for analysis. The highlights make it into these tables below. They start with each company’s symbol, weighting in the SPX and SPY, and market cap as of the final trading day of Q1’19. That’s followed by the year-over-year change in each company’s market capitalization, an important metric.

Major U.S. corporations have been engaged in a wildly-unprecedented stock-buyback binge ever since the Fed forced interest rates to deep artificial lows during 2008’s stock panic. Thus, the appreciation in their share prices also reflects shrinking shares outstanding. Looking at market-cap changes instead of just underlying share-price changes effectively normalizes out stock buybacks, offering purer views of value.

That’s followed by quarterly sales along with their YoY change. Top-line revenues are one of the best indicators of businesses’ health. While profits can be easily manipulated quarter to quarter by playing with all kinds of accounting estimates, sales are tougher to artificially inflate. Ultimately sales growth is necessary for companies to expand, as bottom-line profits growth driven by cost-cutting is inherently limited.

Operating cash flows are also important, showing how much capital companies’ businesses are actually generating. Companies must be cash-flow-positive to survive and thrive, using their existing capital to make more cash. Unfortunately many companies now obscure quarterly OCFs by reporting them in year-to-date terms, lumping multiple quarters together. So if necessary to get Q1’s OCFs, I subtracted prior quarters’.

Next are the actual hard quarterly earnings that must be reported to the SEC under Generally Accepted Accounting Principles. Lamentably companies now tend to use fake pro-forma earnings to downplay real GAAP results. These are derided as EBS profits, Everything but the Bad Stuff! Certain expenses are simply ignored on a pro-forma basis to artificially inflate reported corporate profits, often misleading traders.

While we’re also collecting the earnings-per-share data Wall Street loves, it’s more important to consider total profits. Stock buybacks are executed to manipulate EPS higher, because the shares-outstanding denominator of its calculation shrinks as shares are repurchased. Raw profits are a cleaner measure, again effectively neutralizing the impacts of stock buybacks. They better reflect underlying business performance.

Finally the trailing-twelve-month price-to-earnings ratios as of the end of Q1’19 are noted. TTM P/Es look at the last four reported quarters of actual GAAP profits compared to prevailing stock prices. They are the gold-standard metric for valuations. Wall Street often intentionally conceals these real P/Es by using the fictional forward P/Es instead, which are literally mere guesses about future profits that often prove far too optimistic.

These are mostly calendar-Q1 results, but some big U.S. stocks use fiscal quarters offset from normal ones. Walmart, Home Depot, and Cisco have lagging quarters ending one month after calendar ones, so their results here are current to the end of January instead of March. Oracle uses quarters that end one month before calendar ones, so its results are as of the end of February. Offset reporting ought to be banned.

Reporting on offset quarters renders companies’ results way less comparable with the vast majority that report on calendar quarters. We traders all naturally think in calendar-quarter terms too. Decades ago there were valid business reasons to run on offset fiscal quarters. But today’s sophisticated accounting systems that are largely automated running in real-time eliminate all excuses for not reporting normally.

Stocks with symbols highlighted in blue have newly climbed into the ranks of the SPX’s top 34 companies over the past year, as investors bid up their stock prices and thU.S. market caps relative to their peers. Overall the big U.S. stocks’ Q1’19 results looked pretty mixed, with slight sales growth and strong earnings growth. But these growth rates are really slowing, and valuations remain extreme relative to underlying profits.

From the ends of Q1’18 to Q1’19, the S&P 500 rallied 7.3% higher. While solid, that’s not much relative to the extreme euphoria and complacency during this latest earnings season. These stock markets could really be in a massive-triple-top scenario after this record bull run, a menacing bearish omen. The SPX initially peaked at 2872.9 in late January 2018, mere weeks after those record corporate tax cuts went into effect.

Then it quickly plunged 10.2% in 0.4 months, a sharp-yet-shallow-and-short correction. But with overall SPX earnings growth exceeding 20% YoY comparing post-tax-cut quarters to pre-tax-cut ones, this key benchmark clawed back higher and hit 2930.8 in late September 2018. That was merely a 2.0% marginal gain over 7.8 months which saw some of the strongest corporate-profits surges ever from already-high levels.

From there the SPX plummeted 19.8% in 3.1 months in that severe near-bear correction largely in Q4. This trend of slightly-better record highs followed by far-worse selloffs is troubling. By late April 2019 the SPX had stretched to 2945.8, jU.S.t 2.5% above its initial peak 15.1 months earlier. Such paltry gains in a span with record corporate tax cuts and resulting torrid earnings growth should really give traders pause.

Technically these three major record highs look like a massive triple top. The big U.S. stocks’ Q1 results are critical to supporting or refuting this bearish technical picture. The SPX/SPY top 34 did enjoy superior market-cap appreciation from the ends of Q1’18 to Q1’19, averaging 12.8% gains which ran 1.7x those of the entire SPX. That exacerbated the concentration of capital in the largest SPX stocks, the mega-cap techs.

As Q1 ended, 5 of the 6 largest SPX stocks were Microsoft, Apple, Amazon, Alphabet, and Facebook. Together they accounted for a staggering 15.8% of this flagship index’s entire market cap, closing in on 1/6th! These companies are universally adored by investors, owned by the vast majority of all funds and constantly extolled in glowing terms in the financial media. Investors think mega-cap techs can do no wrong.

Last summer these incredible businesses were viewed as recession-proof, effectively impregnable. But even if there’s some truth to that, it doesn’t guarantee mega-cap-tech stock prices will weather a stock-market selloff. During that 19.8% SPX correction mostly in Q4, these 5 dominant SPX stocks and another SPX-top-34 tech darling Netflix averaged ugly 33.3% selloffs! They amplified the SPX’s decline by 1.7x.

No matter how amazing the sales growth among the mega-cap techs, they aren’t only not immune to SPX selloffs but their lofty stock prices make them more vulnerable. Overall the SPX/SPY top 34 companies reported Q1’19 revenues of $969.3b, which was 0.9% YoY higher than the top 34’s in Q1’18. That’s not great performance considering how universally-loved and -owned these companies are among nearly all funds.

Those 6 mega-cap tech stocks did far better, enjoying order-of-magnitude-better revenues growth of 9.9% YoY! Excluding them the rest of the SPX top 34 actually saw total sales slump 1.8% lower YoY, which sure doesn’t sound like a strong economy. If this trend of stalling or slowing revenue growth continues, profits growth will have to start falling sharply in future quarters. Earnings ultimately amplify sales trends.

Even more bearish, Wall Street analysts headed into Q1’19’s earnings season expecting all 500 SPX companies to enjoy 4.7% total revenues growth. But the top 34 that dominate the U.S. stock markets did much worse at 0.9% even with mega-cap techs included. That was definitely a sharp slowdown too, as the SPX top 34 saw 4.2% YoY sales growth in Q4’18. Slowing revenue growth is a real threat to the stock markets.

Remember the SPX surged dramatically in Q1, fueling quite-euphoric sentiment leading into quarter-end. At the same time traders mostly believed that a U.S.-China trade deal would soon be signed, removing the trade-war risks. High tariffs are a serious problem for the gigantic multinational companies leading the SPX, potentially heavily impacting sales. Yet revenue growth was already slowing even before this week!

Trump had twice delayed hiking U.S. tariffs on Chinese imports from 10% to 25%, a good-faith sign giving time for real trade-deal negotiations. But his patience ran out this past Sunday after China backtracked on key previoU.S. commitments. So Trump tweeted the current 10% U.S. tariffs on $200b of annual Chinese imports would surge to 25% today, and warned that 25% tariffs were coming “shortly” on another $325b!

China will retaliate as long as high U.S. tariffs remain in effect. That will really retard U.S. sales from top-34 SPX companies in that country. Beloved market-darling Apple is a great example. This second-biggest stock in the S&P 500 did $10.2b or 17.6% of its Q1’19 sales in China! The U.S.-China trade war heating up in a serious way portends even-weaker revenues going forward for the big U.S. stocks dominating the SPX.

The total operating cash flows generated by the top 34 SPX/SPY companies looked like a disaster in Q1, plummeting 64.4% YoY to $67.8b. Thankfully that is heavily skewed by a couple of the major U.S. banks. JPMorgan Chase and Citigroup reported staggering negative OCFs of $80.9b and $37.6b in Q1, due to colossal $123.1b and $30.4b negative changes in trading assets! This seems really confusing to me.

Mega-bank financials are fantastically-complex, and no one can hope to understand them unless deeply immersed in that world. I’ve been a certified public accountant for decades now, spending vast amounts of time buried in 10-Qs and 10-Ks to fuel my stock trading. Yet even with my background and experience I can’t interpret mega-bank results. It seems weird trading assets plummeted in Q1 as the SPX surged sharply.

But rather than getting bogged down in mega-bank arcania that may be impossible to comprehend by outsiders, we can just exclude the four SPX-top-34 mega-banks from our OCF analysis. They include JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. Without them, the rest of the SPX top 34 reported total OCFs of $163.2b in Q1’19. That was dead-flat ex-banks, up just 0.3% YoY from Q1’18’s OCFs.

So the big U.S. stocks’ operating-cash-flow generation really slowed too in Q1, stalling out compared to hefty 11.5% YoY growth in Q4’18. That’s another sign that the U.S. economy must be slowing despite the red-hot stock markets. That’s ominous and bearish considering the coming headwinds if the trade wars continue and if the stock markets roll over decisively. Future quarters’ business environments won’t be as good.

Earnings were a different story entirely last quarter, soaring dramatically among the SPX/SPY top 34. They totaled $149.8b, surging an enormous 36.1% YoY! But that was skewed way higher by Warren Buffett’s famous Berkshire Hathaway, the biggest SPX stock after the mega-cap techs. BRK reported a monster Q1 profit of $21.7b, compared to a $1.1b loss a year earlier. That accounted for 1/7th of the top 34’s total.

But Berkshire’s epic profits are due to the sharp stock-market rebound rally, not underlying operations. A new accounting rule that Warren Buffett hates and rails against at every opportunity requires unrealized capital gains and losses to be flushed through quarterly profits. Thus when the SPX plunged in Q4’18, BRK reported a colossal $25.4b GAAP loss. That was largely reversed in Q1’19 with its gigantic $21.7b gain.

Excluding the $16.1b of BRK’s Q1 profits that were mark-to-market stock-price gains, the SPX top 34’s total profits grew 21.5% YoY to $133.6b in Q1. That’s still impressive, but it masks some big problems on the corporate-earnings front. Those 6 elite mega-cap tech companies dominating the SPX actually saw their collective Q1 GAAP profits plunge 11.2% YoY! Apple, Alphabet, and Facebook suffered sharp declines.

Usually mega-cap tech stocks are the profits engine driving the entire SPX higher. If these market-darling companies that are universally-loved and -held struggled with earnings growth in Q1, what does that say about profits going forward? And again profits can be manipulated quarter-to-quarter by playing with all kinds of accounting estimates. So if anything corporate profits are overstated instead of understated.

One of Wall Street’s great farces is the game of comparing quarterly results to expectations instead of what they were in the comparable quarter a year earlier. Mighty Apple is a great example, reporting after the close on April 30th. Its Q1 earnings per share and sales of $2.47 and $58.0b came in ahead of Wall Street expectations of $2.37 and $57.5b. So Apple’s stock surged 4.9% the next day on those “great results”.

But that expectations bar had been lowered dramatically, which is the only reason Apple beat. On an absolute year-over-year basis compared to Q1’18, Q1’19 saw sales drop 5.1%, OCFs plummet 26.3%, and earnings plunge 16.4% YoY! That was quite weak, and couldn’t be considered good by any honest measure. In this recent Q1 earnings season, the fake expectations game obscured plenty of real weakness.

Yet overall SPX-top-34 profits growth still remained strong, with companies suffering drops offset by other companies seeing big jumps. But earnings can’t be considered in isolation, they are only relevant relative to underlying stock prices. Imagine you own a rental house and someone offers you $1000 a month to move in. The reasonableness of that earnings stream is totally dependent on the value of your property.

If your house is worth $100k, $1k a month looks great. But if it’s worth $1m, $1k a month is terrible. The profits anything generates are only measurable relative to the capital invested in that asset. The classic trailing-twelve-month price-to-earnings ratios show how expensive stock prices are relative to underlying corporate profits. Big SPX-top-34 earnings growth isn’t bullish if overall profits are low compared to stock prices.

At the end of Q1’19 proper before these Q1 results were reported, the SPX/SPY top 34 component stocks averaged TTM P/Es of 30.4x. That is definitely improving compared to the prior four quarters’ trend of 46.0x, 53.4x, 49.0x, and 39.7x. But 30.4x is still dangerously high absolutely. Over the past century-and-a-quarter or so, fair value for the U.S. stock markets was 14x. Double that at 28x is where bubble territory begins.

So the big U.S. stocks were literally trading at bubble valuations exiting Q1! Their stock prices were far too high relative to their underlying earnings production compared to almost all of U.S. stock-market history. And this wasn’t just a mega-cap-tech-stock thing, with these elite companies often being bid to really-high valuations compared to other sectors. The 6 mega-cap techs we’ve discussed indeed averaged a crazy 52.0x.

But the other 28 top-34-SPX companies remained very expensive near bubble territory even excluding the tech giants, averaging 25.8x! Even the strong Q1’19 earnings growth didn’t help much. At the end of April as those Q1 results started to work into TTM P/E calculations, the SPX top 34 averaged a slightly-higher P/E of 31.0x. Literal bubble valuations with stock markets trading near all-time record highs are ominous.

Just last Friday when the SPX closed right at its highest levels in history, I wrote a contrarian essay on these “Dangerous Stock Markets”. It explained how high valuations kill bull markets, summoning bears that are necessary to maul stock prices sideways to lower long enough for profits to catch up with lofty stock prices. These fearsome beasts are nothing to be trifled with, yet complacent traders mock them.

The SPX’s last couple bears that awoke and ravaged due to high valuations pummeled the SPX 49.1% lower in 2.6 years leading into October 2002, and 56.8% lower over 1.4 years leading into March 2009! Seeing big U.S. stocks’ prices cut in half or worse is common and expected in major bear markets. And there’s a decent chance the current bubble valuations in U.S. stock markets will soon look even more extreme.

Over the past several calendar years, earnings growth among all 500 SPX companies ran 9.3%, 16.2%, and 20.5%. This year even Wall Street analysts expect it to be flat at best. And if corporate revenues actually start shrinking due to mounting trade wars or rolling-over stock markets damaging confidence and spending, profits will amplify that downside. Declining SPX profits will proportionally boost valuations.

If the big U.S. stocks’ fundamentals deteriorate, the overdue bear reckoning after this monster bull is even more certain. Cash is king in bear markets, since its buying power grows. Investors who hold cash during a 50% bear market can double their holdings at the bottom by buying back their stocks at half-price. But cash doesn’t appreciate in value like gold, which actually grows wealth during major stock-market bears.

Gold investment demand surges as stock markets weaken, as we got a taste of in December. While the SPX plunged 9.2%, gold rallied 4.9% as investors flocked back. The gold miners’ stocks which leverage gold’s gains fared even better, with their leading index surging 10.7% higher. The last time a major SPX selloff awakened gold in the first half of 2016, it soared 30% higher fueling a massive 182% gold-stock upleg!

Absolutely essential in bear markets is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. While Wall Street will deny this coming stock-market bear all the way down, we will help you both understand it and prosper during it.

We’ve long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q1 we’ve recommended and realized 1089 newsletter stock trades since 2001, averaging annualized realized gains of +15.8%! That’s nearly double the long-term stock-market average. Subscribe today for just $12 per issue!

The bottom line is the big U.S. stocks’ Q1’19 results were pretty mixed despite the surging stock markets. Revenues and operating cash flows only grew slightly, which were sharp slowdowns from big surges in previous quarters. While earnings somehow defied sales to soar dramatically again, that disconnect can’t persist. A slowdown looked to be underway even before the U.S.-China trade war flared much hotter this week.

Even the surging corporate profits weren’t enough to rescue super-expensive stock markets from extreme bubble valuations. They are what spawn major bear markets, which are necessary to maul stock prices long enough for valuations to mean revert lower. Make no mistake, these overvalued stock markets are still an accident waiting to happen. Stock investors should diversify, adding substantial gold allocations.

Adam Hamilton, CPA

May 15, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

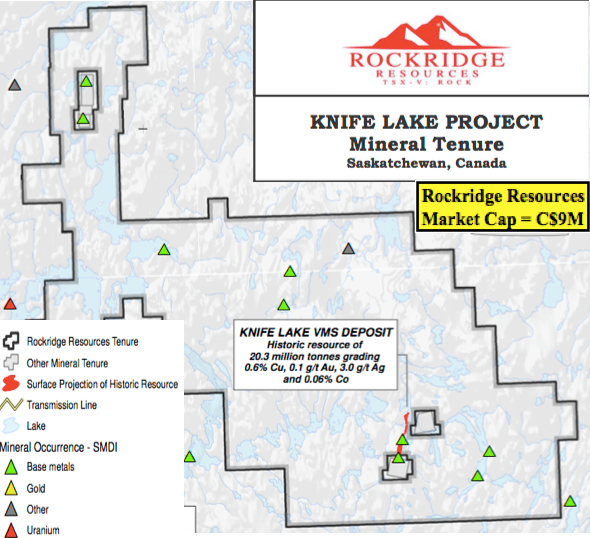

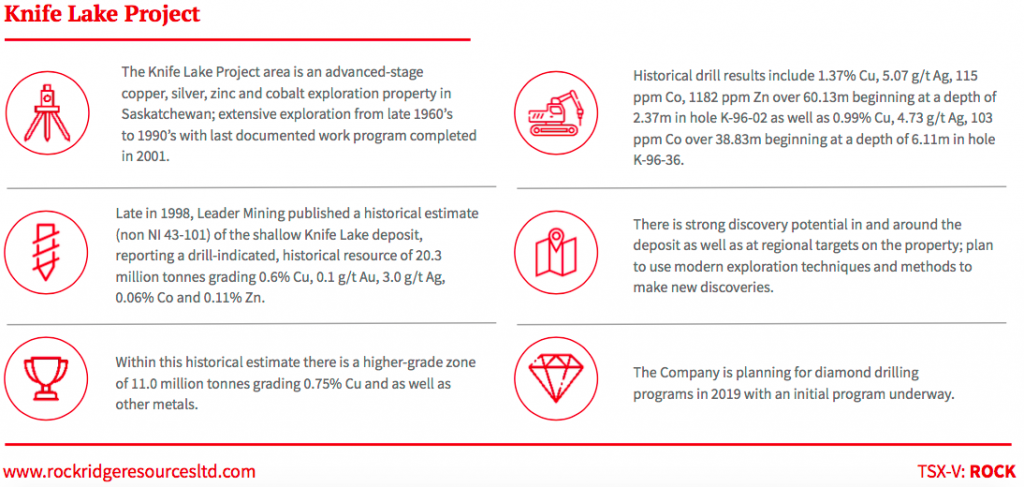

Rockridge Resources (TSX-V: ROCK) is a fairly new mineral exploration company focused on the acquisition, exploration & development of mineral resource properties in Canada. Its focus is copper & base metals. More specifically, base, green energy & battery metals, of which copper is all three! Not just any place in Canada, world-class mining jurisdictions such as Saskatchewan. And, not just good jurisdictions, but in mining camps with significant past exploration, development or production, in close proximity to key mining infrastructure.

The company’s flagship project Knife Lake is in Saskatchewan, Canada, (ranked 3rd best mining jurisdiction in the world) in the Fraser Institute Mining Company Survey. The Project hosts the Knife Lake deposit, a near-surface, (high-grade copper) VMS copper-cobalt-gold-silver-zinc deposit open along strike and at depth. Management believes there’s strong discovery potential in and around the deposit area, and at additional targets on ~85,000 hectares of contiguous claims.

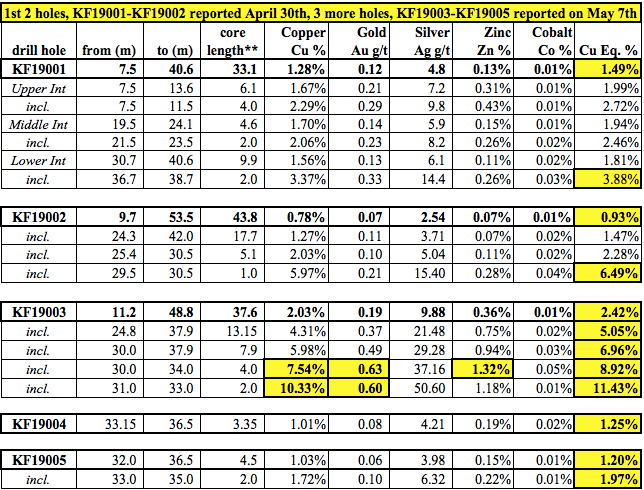

On May 7, Rockridge reported additional results from its Winter diamond drill program at its flagship Knife Lake project in Saskatchewan. Hot on the heels of last week’s press release (April 30th) of 2 holes, comes 3 more. I was planning on writing an article on those excellent results, but Equity.Guru beat me to the punch, putting out this well done piece. Readers following along may recall that the key takeaway was that holes KF19001 & KF19002 largely confirmed historical grades, intercept widths & geological conditions. Fast forward to May 7th, and management’s interpretation of drill holes KF19003, KF19004 & KF19005 was announced. Results on the remaining 7 holes will be released over the next 20-30 days. As a reminder, Rockridge has an option agreement with Eagle Plains Resources to acquire a 100% Interest in the majority of the Knife Lake Cu-Zn-Ag-Au-Co VMS deposit.

Earlier this year, Rockridge drilled 12 holes for a total of 1,053 meters. Importantly, this represents the first work on the property since 2001. Readers may recall from reading past articles & interviews on Epstein Research and Equity.Guru and viewing videos of CEO Trimble, that the company’s primary goal is to explore districts that have been under-explored, never explored, or not recently explored. Management’s highly skilled and experienced technical team & advisors deploy the latest exploration technologies & methods. A lot has changed in 18 years; a simple example would be the use of drones to fly various surveys.

Whatever management is doing seems to be working, as evidenced by 2 of the first 5 holes returning very strong results, and the third hole, KF19003 a true blockbuster.

Hole KF19003 was even better than the first 2 holes. In fact, significantly better, with a grade (Cu Eq.) x thickness (in meters) value of 91, compared to 41 & 49. Make no mistake, KF19001 / 19002 were great, they averaged 1.21 Cu Eq. over an average 38.5m. But, KF19003, WAS something to write home about…. [if under the age of 30, Google the idiom, “nothing to write home about“]. Near-surface like the first 2 holes, the 37.6m interval assayed 2% Cu, 0.2 g/t Au, 9.9 g/t Ag, 0.36% Zn & 0.01% Co, for an estimated 2.42% Cu Eq. grade. 2% Cu over 37.6 meters is a tremendous showing at under 41 meters downhole.

Holes KF19004 & KF19005 were mineralized, but had narrower intercept widths of interest. Still, there were attractive Cu Eq. grades (1.25% & 1.20%, respectively). Interestingly, Gallium (up to 25.6 ppm) & Indium (up to 15.2 ppm) values were found in the mineralized zones of all 3 holes. Those 2 Rare Earth Metals trade at an average of about US$300/kg. Each 10 ppm = 1kg/tonne. KF19004 & KF19005 confirmed mineralization up-dip of historically drilled high grade mineralization. So, those 2 holes were like KF19001 & KF19002, important in building the potential resource size. All activities are advancing the Project toward a NI 43-101 compliant mineral resource estimate later this year.

Perhaps best of all, drill hole KF19003 confirmed high-grade mineralization up-dip of KF19002 in an area where no historical drilling is known to have been done. Therefore, this assay, and perhaps nearby assays to follow, will increase the size & grade of the upcoming mineral resource estimate. There were also encouraging zinc values, incl. 4m (from the 37.6m) of 1.32% Zn, nearly C$50/tonne rock. Gold values up to 0.63 g/t are interesting, but like the zinc, I’m referring to only the best grades, from smaller intercepts. That 4m interval I mentioned also had 7.54% Cu. This is clearly a COPPER deposit, Knife Lake is a near-surface, high-grade Cu project. See drill hole results from KF19001 – KF19005 below. Holes KF19001 & KF19002 were released on April 30, and KF19003-KF19005 on May 7.

Rockridge’s President & CEO, Jordan Trimble commented: “The results from drill hole KF19003, specifically 2.42% Cu Eq. over 37.6m, far exceeded our expectations and represents one of the best holes ever drilled on the project. It is important to note that this drill hole was collared in an area where no historical drilling has been reported. As such these drill results are expected to have a positive impact on the historical resource. Final results from the remaining 7 drill holes are pending and will provide steady news flow over the near term.”

Drill indicated intercepts (core length) are reported as drilled widths and true thickness is undetermined. {details about calculation of Cu Eq. grade can be found in the press release}.{details about calculation of Cu Eq. grade can be found in the press release}.

From the press release, “The Knife Lake area saw extensive exploration from the late 1960s to the 1990s with the last documented work program completed in 2001. Between 1996 & 1998, Leader Mining completed 315 diamond drill holes, outlining a broad zone of mineralization occurring at a depth of less than 100 m. Late in 1998, Leader published an historical estimate, reporting a, “drill-indicated” resource of 20.3 M tonnes, grading 0.6% Cu, 0.1 g/t Au, 3 g/t Ag, 0.06% Co & 0.11% Zn. Within the historical estimate there is a higher grade zone containing 11.0 M tonnes of 0.75% Cu, plus other metals.”

NOTE: These mineral resource estimates are not supported by a compliant NI 43-101 technical report. A qualified person has not done the work to classify these estimates as current mineral resources in accordance with NI 43-101 standards. Furthermore, the categories used for these historical resource estimates are described as, “drill-indicated”. This is not a NI 43-101 resource category, but based on the methodologies & drill hole spacing, management believes it would likely be classified as Inferred.

The Project is within the word famous Flin Flon-Snow Lake mining district that contains a prolific VMS base metals belt. Management paid < half a penny/lb. of copper and they believe there’s tremendous exploration upside. The goal? High-grade discoveries in a mineralized belt that could host multiple deposits, as VMS-style zones often contain clusters of mineralized zones. Of course, the trick is finding them. No modern exploration, drilling or technology has been deployed at Knife Lake. It was discovered 50 years ago and last explored in the 1990s. Airborne geophysics, regional mapping & geochemistry was done. Management believes that modern geophysics; high resolution, deep penetrating EM & drone mag surveys to cover large areas in detail, could make a big difference.