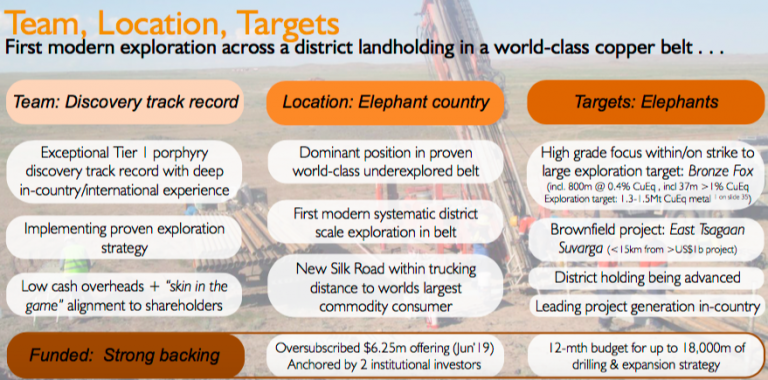

Kincora Copper [TSX-V: KCC] fell off investor’s radar screens due to an extended period of inactivity in 2018, but now the Company is cashed up, team in place, and ready for extensive drilling at 5 independent, large-scale porphyry targets with a 12-month funded budget for up to 18,000 m of drilling.

Kincora has been operating in Mongolia for > 8 years. In 2016, the Company secured unencumbered access to its promising Bronze Fox project and consolidated the dominant landholding in the Southern Gobi copper-gold belt, between and on strike with Rio Tinto’s Oyu Tolgoi (“OT“) copper-gold mine, and the Tsagaan Suvarga porphyry project, via the merger with IBEX, a private vehicle indirectly controlled by Robert Friedland.

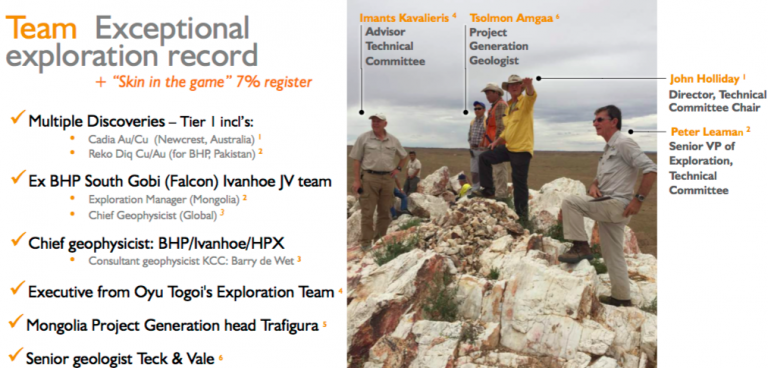

This attracted a world-class technical team, credited with multiple discoveries of Tier 1 copper deposits, looking to repeat such successes. Since then, the Company has been executing the first modern systematic exploration program across a district-scale landholding in a highly mineralized, but vastly under-explored copper-gold porphyry belt. Now, drilling is just days away.

These are exciting times for Kincora, the most exciting in the Company’s history. The Company is in a prime position in the copper sector where new discoveries are being well rewarded and successful juniors acquired at significant premiums. For example, just this week Australian-listed MOD Resources was taken out by a billion-dollar market cap Sandfire Resources.

A new cornerstone investor, HK-based New Prospect, now the 2nd largest shareholder with about 12% of the Company, is a natural resource specialist fund with an extensive global network. LIM Advisors remains the largest investor, one of the longest operating alternative investment managers in Asia, they invest across the capital structure in deep value & special situations.

Investors in small cap natural resource stocks know that the best time to be in a junior is right before a BIG discovery. That’s the time we could be at right now with Kincora. Management just raised $6.25M. Will there be a new discovery! More than one!! None!!! Yes, there could definitively be zero new discoveries…. This is a highly speculative situation, but backed by a team that has an excellent track record of large discoveries.

Even without blockbuster discoveries, the Company has planned a very detailed and well thought-out drill program that’s sure to cover a lot of bases and provide a pipeline of news flow over the next 12 months. Raising $6.25M in a very tough market at a $7M pre-money valuation was a BIG success in and of itself, demonstrating the strength of management, the projects / targets and the massive opportunity.

The de-risking capital raise is strong evidence of the belief by cornerstone investors & seasoned management that Mongolia is a great place to, potentially, make the newest globally significant copper discovery since 2014. To learn more, please continue reading this Interview of Sam Spring, President & CEO of Kincora Copper [TSX-V: KCC].

Can you talk about how we got to the point of a substantial drill program starting very soon?

After 2018 being a transitional year of setting the right corporate foundations for success, we are entering an exciting period where the drill bit will drive Kincora’s valuation once again. This month we will commence an aggressive, multiple rig, fully-funded drill program. The focus is discoveries on 5 large, independent copper porphyry targets on our 100%-owned Bronze Fox and East Tsagaan Suvarga (“East TS”) projects.

This will be the first drill program conducted by our industry-leading technical team, who have found multiple Tier 1 copper assets. For the last 3 years, we have undertaken the first modern, district-scale, exploration across this vastly mineralized, but significantly under-explored Southern Gobi copper-gold belt.

As readers may know, there are 2 large-scale porphyry projects in this region. Rio Tinto / Turquoise Hill Resources’ Oyu Tolgoi open pit mine and underground development project, and a privately-held open pit development project called Tsagaan Suvarga. We believe there are more globally significant copper discoveries to be found.

Limited drilling supports our Bronze Fox project potentially hosting an independently defined, conceptual exploration target of 1.3 to 1.5 M tonnes (midpoint = 3.086 billion Cu Eq. pounds). That would be an in-situ value of $11 billion (1.32 CAD/USD, US$2.70/lb. Cu).

The first hole of the program will, for the first time, correctly test a very large zone (previously drilled in the wrong direction). However, prior drilling still managed to intersect 37 m at > 1% Cu Eq., within 864 m of 0.38% Cu Eq.

Our East TS project sits in the shadows of a billion-dollar open pit construction project at Tsagaan Suvarga (“TS”). Within this brownfield setting, we’re drilling 3 separate targets that are the closet analogues to the high-grade ore bodies at OT…. since OT! While just targets, readers should understand that what we’re exploring for is large and in a very favorable location and geological setting. OT’s ongoing underground expansion is the largest hard rock mining project in the world. It could become the 3rd largest copper mine on the planet, with a 100-year+ mine life.

Kincora was formed in 2011, but we are in the strongest position today that the Company has ever been in. Yet, our current market cap of $12M, (with $6M cash!) is a fraction of our peak valuation of nearly $50M. At that time, we had attracted a buyout offer for the Company and had signed 14 NDA’s with interested parties.

While naturally I’m biased, I think it would be hard to find many juniors with similar risk/return profiles and multiple near-term catalysts, backed by a world-class management, Board, Technical team, Advisors and key shareholders, trading at such a low valuation.

With the Company shortly ramping up drilling of our existing exploration portfolio, and focused on ongoing expansion opportunities, Kincora is the most active foreign-listed junior seeking to make the next Tier 1 discovery in Mongolia.

You just closed on a $6.25M capital raise in a very difficult market. Who were the key investors in this very important round?

~60% was taken up by 2 large natural resource funds and associated groups, who will represent > 40% of Kincora’s shares going forward. These groups, LIM Advisors & New Prospect Capital are both Hong Kong based funds and have a track record investing in Mongolia.

In total, there were > 30 investors in the deal, with strong Board / management participation and good support from high-quality sophisticated investors. As you can imagine, given current market conditions, a lot of work went into this raise. We truly appreciate the vote of confidence from those who invested.

How much of that $6.25M will go towards exploration? Please describe the upcoming drill program.

The vast majority will support Kincora undertaking the most aggressive exploration & discovery drill program anywhere in Mongolia this year. ~$5M will cover up to 18,000 m of drilling at Bronze Fox & East TS, plus project generation activities and advancing earlier-stage exploration targets.

Mongolia has unique geological potential to host globally significant discoveries, and that is what we are focusing on. This raising, with the accompanying warrant package, aligns our capital markets strategy with our exploration & expansion plans and gives us a good shot (but no certainty) at making new discoveries.

We are on record stating that these drill targets are, ‘as good as you get within a global setting for their respective stages’. The key driver in the next 12 months is proof of high-grade & our geological concepts, to confirm our models & interpretations with positive drill results.

In addition to your management team & Board, please describe recent due diligence done by independent advisors, consultants & analysts. Didn’t your largest shareholder also commission a study?

Our drill strategy is the culmination of almost 30 years’ copper exploration experience in this belt by senior members of our team, 5 years of exploration work and model refinements by ourselves and previous owners (including Ivanhoe Mines and IBEX) that provide us with strong conviction to focus on the selected 5 targets.

Kincora has been through 5 technical reviews since mid-2017, including from 1) a leading natural resource private equity group, 2) the EBRD, 3/4) LIM Advisors (twice) and 5) New Prospect Capital, all of which have resulted in capital being invested.

As you have picked up on Peter, our largest shareholder commissioned an independent technical review of our targets, work programs and strategy before becoming a cornerstone investor in our latest offering. This review suggested a, ‘discovery’ had already been made at Bronze Fox within the under-explored target zone to the west of a key regional fault in an area we are calling West West Kasulu. This is where the first drill hole will go. In the independent consultant’s opinion, this target area has been significantly upgraded by recent exploration activities.

While we are optimistic, and management participated in the recent raising, and have undertaken detailed systematic exploration, there’s nothing left to do but drill these targets. Please let me reiterate that Kincora is a high-risk, exploration play. Hence, there are high rewards for success.

A risk is that it might cost tens of millions to delineate an attractive NI 43-101 compliant resource. What is your team’s goal for the upcoming drill program, can you articulate what success might look like?

Absolutely. We appreciate the fact that porphyries are capital intensive, and that exploration is very risky. More meters of drilling provide us a better chance of confirming our geological concepts and riding the value creation curve for shareholders.

The best recent example of a large-scale copper porphyry discovery is that of SolGold at its Alpala project in Ecuador. The deposit at Alpala is deep, so drilling costs there are significantly more than in Mongolia. In March 2016, SolGold raised A$5.7 million at 2.3p/share, having drilled 13 promising holes and seeking to confirm its discovery. An equivalent drill program to what Kincora is now looking to complete at our 2 projects. They had fantastic results…. Over the course of 31 months, SolGold drilled a further 54 holes, attracted both Newcrest and BHP as strategic investors, and re-rated 20x for shareholders.

That’s what success at the target-testing phase of drilling can result in, even in difficult capital markets and a flat/decreasing copper price environment, which we believe is temporary.

At Bronze Fox, our drill campaign is designed to advance the strike potential away from the fault to the west, demonstrate the interpreted, significant increase in tonnage & grade potential, and confirm a new discovery. Prior higher-grade intersections include 3 of 4 holes drilled by Kincora that returned > 1% Cu and/or Cu Eq., incl. the best hole, F62, which hosted 13 m of 1.15% Cu / 1.41% Cu Eq., within 37 m at 0.83% Cu / 1.04% Cu Eq. and 864 m at 0.38% Cu Eq.

At our East TS, the geological concept we are seeking to confirm is that OT-style mineralization is present. Each of the 3 targets at East TS have large-scale potential, with individual coincident geophysical anomalies equivalent in size to ore bodies at OT and SolGold’s Alpala project.

While more conceptual and risky than the 2 targets at Bronze Fox, such a setting and scale of targets is unique – if located in more established copper districts around the world — it’s likely the area around TS & East TS would have already seen extensive drilling.

A rule of thumb for porphyry discoveries is that ~50,000 m of drilling generally provides visibility for ~5M tonnes Cu Eq. metal. Exercise of the warrants that were part of the recent offering would bring in an additional $15M (2.5x the recent raising), and enable another 100,000 meters of drilling.

There are many Copper bulls, yet the price at US$2.70/pound is half of what some bulls think is coming. Do you have a view on the Copper price?

A good question, we get asked that a lot. I will leave the forecasting to the experts, but we’re noticing that most investors see the writing on the wall. Like us, they believe the supply side will at some point (perhaps soon?) struggle to meet even average-trend demand growth, let alone any acceleration from increasing global electrification. This theme is being picked up by generalist investors as well, who have noticed what an unexpected supply shock has done to the iron ore price this year.

Regarding the industry players (mid-tiers & Majors), there has been a notable, but quiet, shift towards looking at new growth projects again over the last 18 months. BHP & Rio Tinto are even talking about organic exploration success stories, focusing on copper as a preferred commodity for expansion. That said, we are just starting to see more of the traditional miners expand into earlier stage projects to rebuild their pipelines.

Time will tell, but I certainly think that even at current copper prices, if we find what we’re looking for, there will be significant interest in Kincora. A tailwind from rising copper prices would of course be welcomed, but given the lack of exploration success industry-wide, globally, for many years now, the project pipeline is in great need of new, sizable discoveries. That is what we believe Mongolia and our targets offer investors.

Please talk about Mongolia, some readers probably won’t invest there. What do you tell investors, shareholders, prospective investors — about Mongolia country risk?

At the time I joined Kincora in 2012, Mongolia was the fastest growing economy in the world. This was driven by the first phase emergence of delivering previously untapped resources to international markets.

This emergence meant that at the time it was almost mandatory for coal & copper Majors to be seeking entry into the southern Gobi regions, with product trucked to the world’s largest consumer of both commodities. We are 5 Prime Ministers, 2 governments, a number of high profile disputes and reversals to unfavorable investment laws later, but the rocks and big picture potential remain unchanged.

In a landscape of few significant greenfield projects recently being commissioned, OT is proof of concept that Mongolia is a mature mining jurisdiction. OT is the largest development project in Mongolia’s history. It’s expected to account for up to a third of Mongolia’s GDP by the mid 2020s. It paves the way for companies like ours by lowering barriers to entry and we and others greatly benefit from newly built regional infrastructure.

When one looks at other copper jurisdictions, it’s becoming harder and more expensive to operate. Chile’s 2018 copper output was greater than the 2nd, 3rd & 4th largest country producers combined. The multi-billion-dollar cap-ex profile for Chile’s Codelco, just to keep production flat, shows the increasing challenges regarding water, community relations & high altitude, not to mention a declining copper grade!

Many other large copper supply regions are also difficult and/or increasingly difficult to operate in; look at recent developments in the DRC, China, Panama, Russia, Zambia, Indonesia, PNG, etc.

Given the team and operational track record we have at Kincora Copper [TSX-V: KCC] we are eyes wide open to the risk/reward scenario in Mongolia, which we find compelling, exploring for the next globally significant copper discovery.

Your readers should stay tuned for drill results, which should start arriving in 5-6 weeks’ time. We expect results to be ongoing for the rest of the year.

Thank you Sam, I think we covered a lot of ground. Bottom line, drill results will define Kincora Copper going forward, and a lot of smart money is betting on good drill results between now and year end.

Peter Epstein

Epstein Research

June 27, 2019

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owns shares in Kincora Copper, and it was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Stelmine Canada Limited Stelmine Canada Limited |

STH.V | +100.00% |

|

MHC.AX | +100.00% |

|

ADE.V | +100.00% |

|

MTX.V | +100.00% |

|

MKA.V | +61.11% |

|

ERA.AX | +50.00% |

|

DOS.V | +33.33% |

|

MTB.V | +33.33% |

|

CASA.V | +30.00% |

|

RMD.V | +25.00% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan