View of the water from Baie Verte

The research I did on Newfoundland and Labrador as a destination for mineral exploration and production had me excited to see, in person, if the province would deliver. On October 23rd, I visited Rambler Metals and Mining, and specifically their Ming’s Mine site, which sits roughly 15 minutes from Baie Verte.

Before getting into my visit to Rambler, I want to give you a quick intro to the Baie Verte Peninsula’s mining history and, in particular, a story of how Canada’s smallest town came to be.

Tilt Cove

Tilt Cove is currently the smallest town in Canada; with a population of just 6 people, it sits just a few kilometers from Rambler’s Nugget Pond Mill. The story of how Tilt Cove came to be varies depending on who you speak to, but here’s a brief summary of what I was told.

The story begins with a man named Issac Winser. Winser was a fisherman, who frequently fished the waters surrounding the Baie Verte Peninsula. In a chance encounter on the water between Winser and another man, Smith McKay, McKay noticed Winser was in possession of a large metallic rock, which he was using as an anchor for his boat.

Curiously, McKay took a closer look at the bluish green coloured rock and asked Winser where he had found it. Winser said he’d found it on the shores of the Tilt Cove area, and that there was a great deal more sticking out of the cliffs.

McKay, having a mining background, recognized the rock to be copper ore and later made his way to the Tilt Cove area to set up a mining operation, where he and his team mined the copper ore by hand. The Tilt Cove town was quickly established and grew from a town of 3 families in 1863 to a town of over 700 inhabitants by 1869.

In the Nugget Pond Mill offices, there is a copy of a very old Tilt Cove grocery store flyer advertising sale items. Additionally, the town’s prosperity even brought a movie theatre to the area and many other unexpected perks for such a small community in northwestern Newfoundland and Labrador.

For those interested in reading more about the history of Tilt Cove, here are a couple of links to check out: CBC – Tilt Cove, Canada’s smallest town, a big draw for tourists and Newfoundland Heritage – Once Upon A Mine.

Rambler Metals and Mining (RAB: TSX-V)

MCAP – 82.4 million (at the time of writing)

Shares – 549 million

Fully Diluted – 627 million

Cash – $2 million

Institutional Shareholders – CE Mining 72%, Lombard Odier 6%, CI Global Investments 5%, Tinma International 4%

Ming’s Mine and Nugget Pond Mill

Rambler Metals and Mining owns 100% of its 1640 ha property, which is home to the Ming Mine and Nugget Pond Mill. Rambler’s operation is expanding its underground operation by blending ores from the Lower Footwall Zone with the current mining from the massive sulphide zones to produce roughly 16 million pounds of copper annually, at a cost that’s below $2 USD per pound, giving the operation good upside potential against a rising copper price.

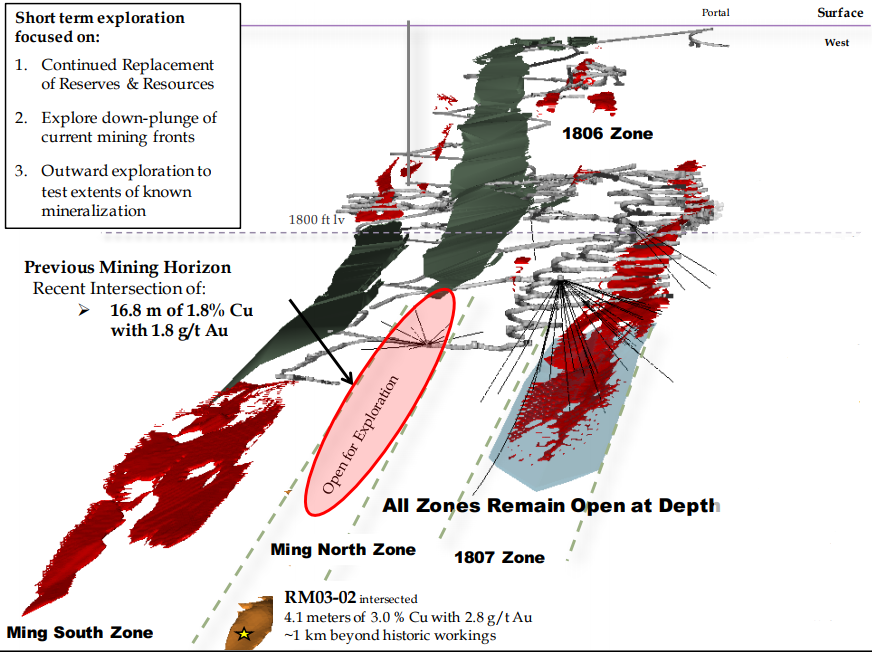

The Ming’s Mine has a total Proven and Probable Reserve of 8.7 million tonnes at 1.79% copper and 0.48 g/t gold, for a total of 341.2 million lbs of copper and 133.5 K oz of gold. All zones of the deposit remain open at depth.

Ming Mine – New portal cover installed as part of the ventilation upgrade project

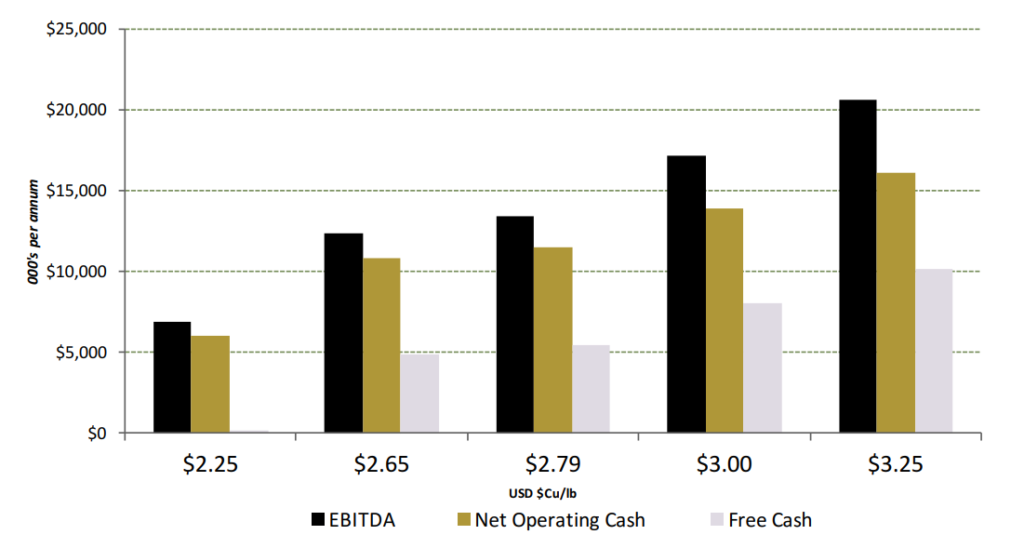

Currently, the mine is targeting 1250 mtpd, which will help drive down costs and allow Rambler to maximize their profits in what appears to be a strong future market for copper prices. Rambler’s corporate presentation gives us a glimpse of their sensitivity to a rising copper price – below is the graph.

Data Source NI43-101 2015 Technical Report – Financial KPIs @ 1,250 MTPD

Although the mine site is closer to Baie Verte, where I was staying, we started the site visit at the Nugget Pond Mill, which sits roughly 40km away from the mine site, near Canada’s smallest town, Tilt Cove.

The Nugget Pond Mill is located 10km off the 414, and is at about the 5km mark where the road breaks in two. On your left, you head to Snook’ Arm, and to your right, our destination, Nugget Pond.

Ming Mine – Truck being loaded with Copper Ore

Rambler purchased the Nugget Pond Mill in October of 2009 for $3.5 million CAD, which, at the time, was owned by Crew Gold Corporation. Crew was using the mill to process their gold ore, which was mined at their Nalunaq Gold Deposit in Greenland.

NOTE: The Nugget Pond Mill was originally built back in 1996 by Richmond Mines to mine the Nugget Pond deposit. When that ore body was depleted, Richmond movedto the Hammerdown mine, near Springdale, and mined, trucked and milled the ore at the Nugget Pond mill.

Nugget Pond Mill – Truck dumping a load of Copper Ore for Processing

The bulk of my site visit was spent at the Nugget Pond Mill, where I was given a detailed overview of the operation by the Mill Superintendent, Dwight Goudie. I then toured the facility, where I met with a couple of operators, Chester and Andrew, who took me through their respective operations and explained to me how the process works and the key parameters that they monitor.

Nugget Pond Mill – Operator Andrew, holding a piece of Dry Copper Concentrate

I was very impressed at the level of knowledge which both operators displayed. Clearly, they are both fully engaged in the whole process and take great pride in what they’re doing. Speaking from experience, getting and maintaining this sort of engagement isn’t always easy, but pays huge dividends to a company that can sustain it.

Future Growth

Rambler is steering towards a definitive engineering study with regards to an expansion of the mining process, in which their target is to achieve a production rate of 2,000 mtpd, Phase III. An increase to this level of production should lower costs, ergo giving even more potential protection against a falling copper price or upside potential in a rising copper price market.

Along with a longer term production goal of 2,000 mtpd, Rambler’s Chief Exploration Geologist, Larry Pilgrim, mentioned that they are targeting further exploration of the deposit, down plunge, as all zones remain open at depth. In particular, the Ming North Zone remains largely unexplored and will be the exploration focus of the future. A surface drill program is also underway targeting the down plunge extension of the Lower Footwall Zone.

This surface drilling has been successful in expanding the LFZ zone as well as expanding the massive sulphide zone (Ming South zone). A September news release highlighted some of the results from the first hole.

- Ming Massive Sulphide (MMS) – Upper lens 1.02 m of 1.63% Cu and 1.23 g/t Au and Lower lens 6.30 m of 2.85% Cu and 2.99 g/t Au

- Lower Footwall Zone (LFZ) – 40.0 m of 1.42% Cu, including 6.0 m of 2.51% Cu and 7.57 m of 2.27% Cu

Results from the second hole are expected in the next couple of weeks.

NOTE: Pilgrim is a native Newfoundlander with a lot of experience in the mining industry. He mentioned that western Newfoundland, right up the Baie Verte Peninsula, had enough prospective geological targets to last him 3 lifetimes. I mention this because it appears we have only hit the tip of the iceberg in Newfoundland and Labrador’s exploration potential, which is great for the future of mining within the province.

Ming Deposit – Slide from Rambler Corporate Presentation

In a news release on June 27 of this year, Rambler reported some great drill results from the Ming North Zone, which aren’t included in the current resource or reserve calculation. Some highlights were: R17-675-04: 4.00m of 3.17% Cu with 6.56 g/t Au, R17-675-05: 21.00m of 3.1% Cu with 1.13 g/t Au and R17-675-07: 17.97m of 2.79% Cu with 1.73 g/t Au. At the very least, the drill results show the potential to help replace the depleted reserves and, on the upside, show the potential to expand the resource and/or reserves in the future.

Concluding Remarks

I think it’s undeniable that the world is moving away from the use of fossil fuels as an energy source. In the coming years, alternative non-carbon emitting energy sources, such as solar and wind, appear as though they will have a larger footprint in energy generation. With this movement will come the need to store and transmit electricity on a far larger scale than we are today.

Thus, in my opinion, a major disruption in the primary battery metals and copper markets is destined to come. In saying this, positioning yourself in high quality companies such as Rambler Metals and Mining, could prove to be a good investment in the years ahead.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this newsletter.

Brian Leni is an online financial newsletter writer. He is focused on researching and marketing resource and other public companies. Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this newsletter. This article is intended for informational and entertainment purposes only!

Be advised, Brian Leni is not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Brian Leni’s online newsletter, especially if the investment involves a small, thinly-traded company that isn’t well known.

Brian Leni’s past performance is not indicative of future results and should not be used as a reason to purchase any stocks mentioned in his newsletters or on this website.

In many cases Brian Leni owns shares in the companies he features. For those reasons, please be aware that Brian Leni can be considered extremely biased in regards to the companies he writes about and features in his newsletters. You should conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. Brian Leni may buy or sell at any time without notice to anyone, including readers of this newsletter.

Brian Leni shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of this newsletter. You should independently investigate and fully understand all risks before investing. When investing in speculative stocks, it is possible to lose your entire investment.

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that they are accurate or complete. Our views and opinions in this newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Brian Leni does not undertake any obligation to publicly update or revise any statements made in this newsletter.

Brian Leni does not have a business relationship with Rambler Metals and Mining. Brian Leni does not own shares in Rambler Metals and Mining.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Taranis Resources Inc. Taranis Resources Inc. |

TRO.V | +52.17% |

|

RG.V | +50.00% |

|

AFR.V | +50.00% |

|

AAZ.V | +50.00% |

|

RDS.AX | +50.00% |

|

NTM.AX | +50.00% |

|

TAS.AX | +33.33% |

|

IZN.V | +33.33% |

|

CASA.V | +30.00% |

|

LPK.V | +27.27% |

Articles

FOUND POSTS

Filo (TSX:FIL) Expands Aurora Zone as Buyout Talks Progress

November 27, 2024

Rio Tinto-Backed Lithium Startup ElectraLith Pursues Major Funding

November 26, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan