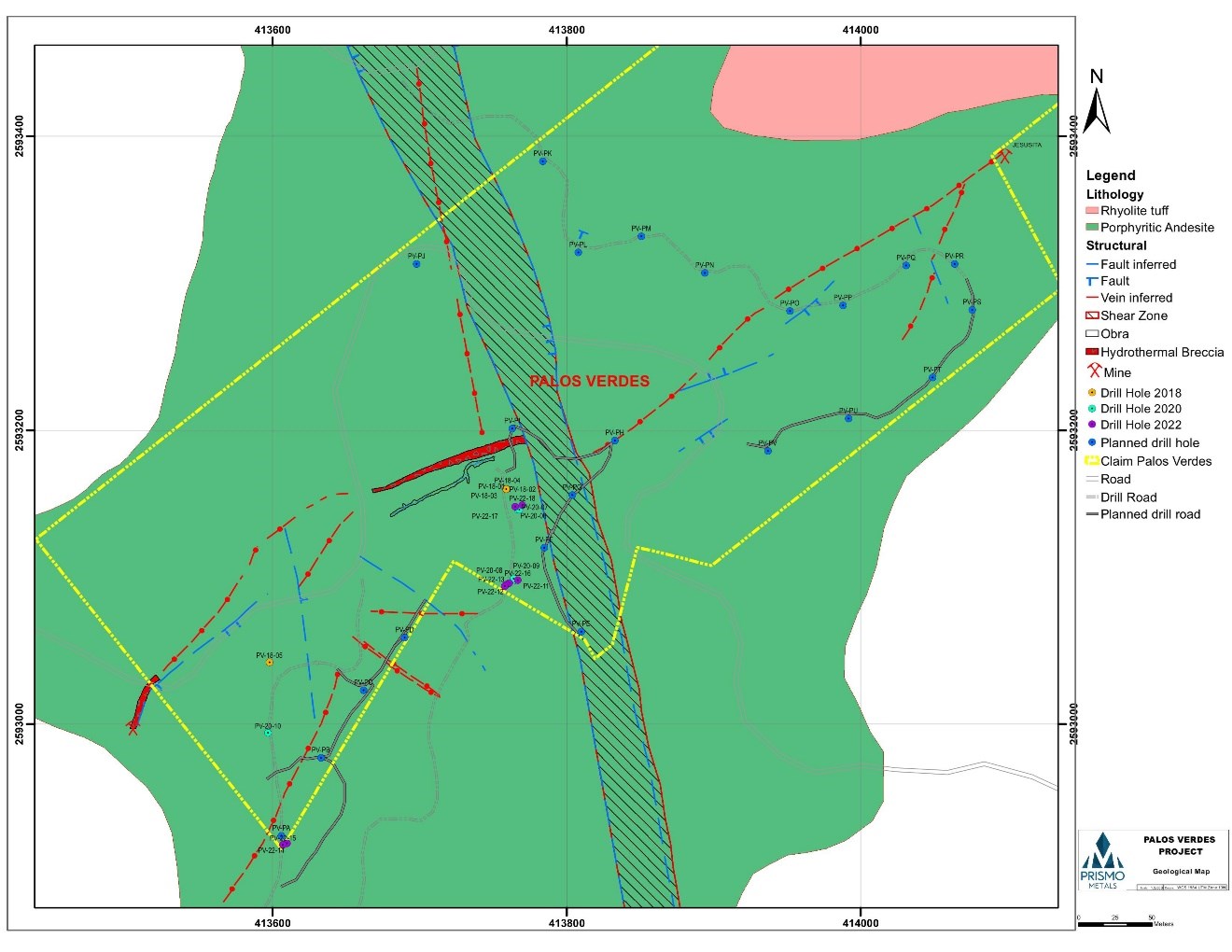

In a recent update from Prismo Metals (CSE: PRIZ), the company announced the commencement of their eagerly anticipated 2023 drilling expedition at the Palos Verdes Project, situated in the Panuco mining district, Sinaloa State, Mexico.

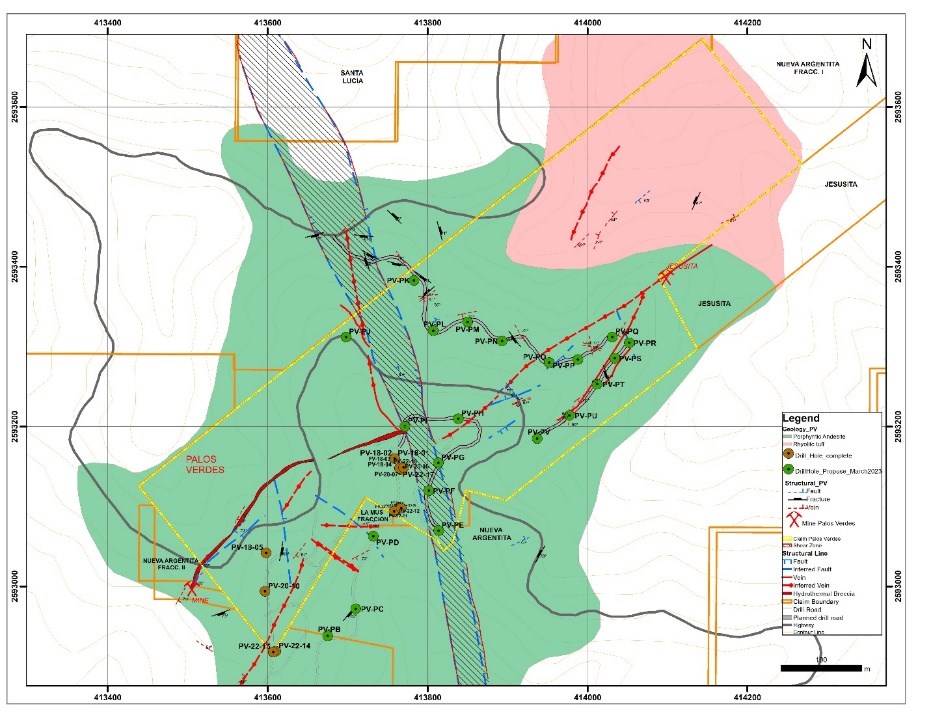

The company’s focus is on a comprehensive drill operation, spanning a minimum of 2,500 meters, aimed at exploring 65% of the undrilled strike length of the Palos Verdes vein, as well as other veins identified on the surface. Prismo’s exploration territory is believed to house a sizeable ore shoot, bearing resemblances to the ones unearthed by Vizsla Silver Corp. (TSXV: VZLA) on neighboring plots.

Dr. Craig Gibson, President and CEO of Prismo Metals, commented in a press release: “We are excited to begin drilling along the Palos Verdes vein in areas that were not previously accessible for drilling. The upcoming drill program will begin by testing the Palos Verdes vein to the northeast of the previous intercepts, initially with shallow drilling to confirm the orientation of the vein to be followed by deeper holes. A ten to fifteen-hole program that will take two months to complete is currently underway,” he stated.

The Palos Verdes Project shares borders with Vizsla Silver Corp.’s Panuco silver-gold endeavor. The Palos Verdes vein, with a strike length of 750 meters on Prismo’s turf, originates from Vizsla’s concession located south-west of Palos Verdes (refer to Fig. 1 for details).

Historical drilling operations have revealed high-grade mineralization, with the most promising intercept recorded at 2,336 g/t Ag and 8.42 g.t Au across an actual width estimated at 0.8 meters. This is part of a larger mineralized span boasting 1,098 g/t Ag and 3.75 g/t Au over a true width of 2.3 meters.

The Palos Verdes project finds its home in the renowned Pánuco-Copala silver-gold district in the southern part of Sinaloa, Mexico. Positioned roughly 65 kilometers NE of Mazatlán, Sinaloa, within the Municipality of Concordia, the Palos Verdes concession encompasses 700 meters of the Palos Verdes vein’s strike length. This particular vein, a component of the north-easterly trending vein family, is located in the eastern section of the district, beyond the scope of modern exploration.

Initial shallow drilling (<100m) conducted in 2018 on the Palos Verdes Vein, aimed at regions 30 to 50 meters beneath mostly barren vein outcrops, resulted in a multistage vein discovery measuring two to seven meters in width. This vein carried thin intervals of high-grade precious metal values along with minor base metals. This mineralization remains open in all directions and the current drilling scheme is devised to trace it along its strike and depth.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

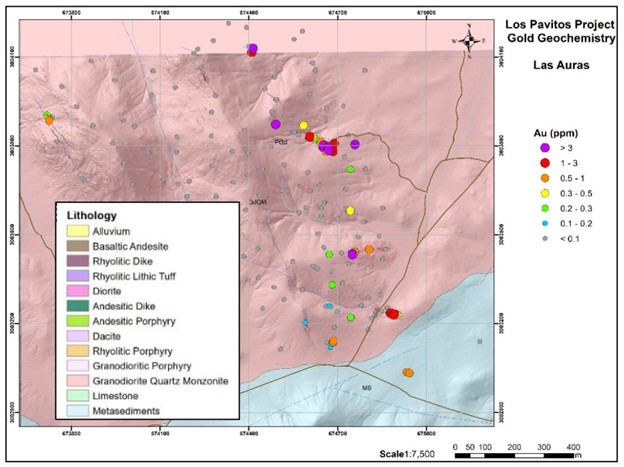

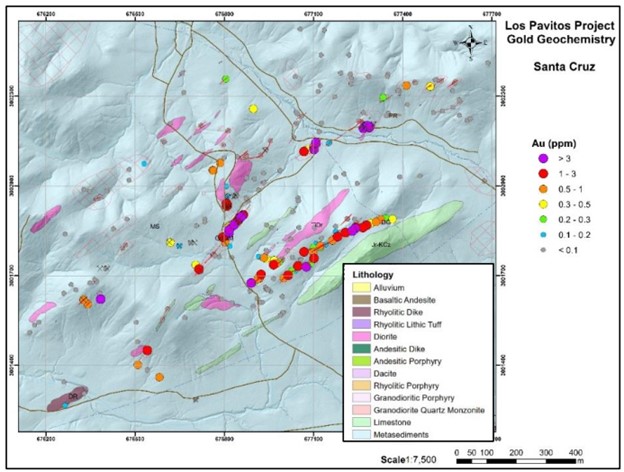

Prismo Metals (CSE: PRIZ) (OTCQB: PMOMF) has reported positive assay results from its extensive exploration of the 5,289-hectare (20 square miles) Los Pavitos project, situated in the mineral-rich Alamos region of southern Sonora State, Mexico. The most promising findings were observed at the Las Auras and Santa Cruz target areas, where numerous gold assays exceeded 3 grams per ton (g/t) over widths ranging from 0.15 to 1.5 meters.

The Las Auras target area delivered particularly impressive results, with the highest gold concentration reaching 14.35 g/t over 0.5 meters, and 12.25 g/t over a 1-meter width in two distinct locations. At the Santa Cruz target, ongoing sampling also revealed notable gold and silver values. The best results featured 5.48 g/t gold and 269 g/t silver over a 0.5-meter width, while another sample displayed 543 g/t silver and 1 g/t gold over 1.5 meters.

The most recent phase of systematic mapping and sampling focused on the Las Auras target, where 199 samples were collected. Additionally, follow-up sampling at Santa Cruz saw the completion of 94 samples. Out of the 293 samples, forty-nine yielded gold concentrations of 0.5 g/t or higher, and eleven samples also contained over 100 g/t silver. The pathfinder elements arsenic (As) and bismuth (Bi) were generally found to be strongly anomalous.

Dr. Craig Gibson, President and CEO of Prismo Metals, commented in a press release: “We are very pleased to see high-grade gold results emerge from our detailed sampling program at Las Auras along with continued high gold and local silver from Santa Cruz. The two areas are different; Las Auras is characterized by northwest trending veins and shears hosted in intrusions, while Santa Cruz is dominated by northeast trending veins that follow sedimentary bedding. Both areas have significant soil cover and trenching will help trace the structures and determine the full width of the mineralized areas”.

Table 1. Highlight assays from the Las Auras area

| Sample | Type | Style | Width (m) | Easting | Northing | Au_g/t | Ag g/t | As_ppm | Bi_ppm | |||||||

| 12092 | Chip | Vein | 0.5 | 674653 | 3003803 | 9.4 | 17.75 | 1155 | 10.7 | |||||||

| 12093 | Chip | 0.65 | 674655 | 3003805 | 0.673 | 2.33 | 1040 | 12.55 | ||||||||

| 12094 | Chip | Vein | 0.2 | 674660 | 3003799 | 2.38 | 9.27 | 891 | 0.46 | |||||||

| 12095 | Chip | 0.6 | 674661 | 3003781 | 0.539 | 8.37 | 183 | 11.55 | ||||||||

| 12096 | Chip | 0.5 | 674667 | 3003797 | 5.83 | 14.65 | >10000 | 3.15 | ||||||||

| 12097 | Chip | 0.6 | 674670 | 3003796 | 1.06 | 2.86 | 1390 | 1.74 | ||||||||

| 12098 | Chip | Vein | 0.15 | 674669 | 3003796 | 3.84 | 4.26 | >10000 | 9.01 | |||||||

| 12115 | Chip | Vein | 0.15 | 674673 | 3003795 | 0.583 | 1.1 | 4070 | 4.92 | |||||||

| 12116 | Chip | Area | 0.6 | 674670 | 3003786 | 6.43 | 4.74 | >10000 | 8.53 | |||||||

| 12117 | Chip | Area | 0.6 | 674685 | 3003782 | 1.25 | 1.65 | 4550 | 1.48 | |||||||

| 12121 | Chip | Vetilla | 0.6 | 674643 | 3003815 | 0.599 | 1.92 | 1670 | 0.53 | |||||||

| 12124 | Chip | Vein | 0.15 | 674606 | 3003830 | 1.19 | 1.73 | 6200 | 4.32 | |||||||

| 12125 | Chip | Disseminated | 0.6 | 674606 | 3003831 | 1.85 | 3.29 | 887 | 1.16 | |||||||

| 12163 | Chip | Area | 1 | 674491 | 3003873 | 3.85 | 5.96 | 5270 | 8.5 | |||||||

| 12165 | Chip | Vetilla | 1.5×2.5×1 | 674414 | 3004129 | 12.25 | 47.3 | 2290 | 16.1 | |||||||

| 12196 | Chip | Area | 1 | 673725 | 3003886 | 0.563 | 1.72 | 493 | 5.02 | |||||||

| 12209 | Chip | Vetilla | 0.4 | 674807 | 3003451 | 0.74 | 42.7 | 6780 | 137 | |||||||

| 12210 | Chip | Vetilla | 0.5 | 674758 | 3003443 | 0.555 | 4.77 | 3880 | 7.69 | |||||||

| 12211 | Chip | Vetilla | 0.5 | 674750 | 3003433 | 14.35 | 52.7 | 5630 | 14.3 | |||||||

| 12217 | Chip | Skarn | 0.6 | 674684 | 3003137 | 0.551 | 89.7 | >10000 | 25.6 | |||||||

| 12218 | Chip | Skarn | 0.6 | 674685 | 3003137 | 0.739 | 8.18 | >10000 | 11.95 | |||||||

| 12219 | Chip | Skarn | 0.6 | 674686 | 3003142 | 0.716 | 224 | >10000 | 0.39 | |||||||

| 12251 | Chip | Vein | 0.25 | 674881 | 3003235 | 1.31 | 0.95 | 8190 | 3.22 | |||||||

| 12252 | Chip | Area | 1 | 674879 | 3003236 | 1.2 | 1.31 | 5510 | 2.19 | |||||||

| 12253 | Chip | Vein | 0.25 | 674877 | 3003235 | 0.771 | 1.32 | 6340 | 4.17 | |||||||

| 12255 | Chip | Vein | 0.4 | 674893 | 3003232 | 2.24 | 10.05 | >10000 | 7.22 | |||||||

| 12256 | Chip | Vein | 0.4 | 674887 | 3003234 | 0.829 | 9.26 | 3810 | 1.08 | |||||||

| 12257 | Chip | Area | 1 | 674889 | 3003230 | 1.47 | 4.8 | 8140 | 2.15

|

|||||||

Table 2. Highlight assays from the Santa Cruz area

| Sample | Type | Style | Width (m) | Easting | Northing | Au_g/t | Ag g/t | As_ppm | Bi_ppm |

| 12289 | Chip | Breccia | 0.5 | 677099 | 3001780 | 0.67 | 46.5 | >10000 | 0.67 |

| 12293 | Chip | Area | 1 | 677243 | 3001862 | 1.98 | 72.6 | >10000 | 0.54 |

| 12305 | Chip | Area | 2 | 676715 | 3001722 | 1.89 | 3.37 | 652 | 0.6 |

| 12314 | Chip | Vein | 1.5 | 676966 | 3001737 | 1.42 | 64.2 | >10000 | 3.37 |

| 12315 | Chip | Vein | 1.5 | 676977 | 3001741 | 0.876 | 329 | >10000 | 1.69 |

| 12323 | Chip | Vein | 1.5 | 676924 | 3001704 | 1.01 | 542 | >10000 | 0.97 |

| 12327 | Chip | Vein | 1.5 | 676891 | 3001676 | 5.14 | 88.1 | >10000 | 5.05 |

| 12330 | Chip | Vein | 1 | 676934 | 3001760 | 0.707 | 447 | 3030 | 4.5 |

| 12349 | Chip | Vein | 1.8 | 677015 | 3001702 | 1.07 | 37.1 | 5640 | 0.55 |

| 12359 | Chip | Vein | 0.5 | 677240 | 3001858 | 3.08 | 295 | >10000 | 0.73 |

| 12361 | Chip | Vein | 0.5 | 677231 | 3001850 | 5.48 | 269 | >10000 | 0.11 |

| 12384 | Chip | Vein | 0.5 | 677327 | 3001888 | 0.869 | 35.3 | 8860 | 0.06 |

| 12385 | Chip | Vein | 0.5 | 677311 | 3001880 | 0.872 | 7.58 | >10000 | 0.21 |

| 12387 | Chip | Vein | 0.5 | 677279 | 3001869 | 1.95 | 70.2 | 6360 | 0.2 |

| 12388 | Chip | Vein | 0.5 | 677266 | 3001861 | 2.24 | 181 | >10000 | 1.84 |

| 12389 | Chip | Vein | 0.5 | 677208 | 3001844 | 2.62 | 326 | >10000 | 0.72 |

| 12391 | Chip | Vein | 0.5 | 677181 | 3001831 | 1.5 | 54.5 | >10000 | 0.68 |

| 12393 | Chip | Vein | 0.5 | 677164 | 3001818 | 0.654 | 21.9 | 4010 | 0.23 |

| 12395 | Chip | Vein | 0.5 | 677123 | 3001800 | 0.533 | 184 | 9790 | 1.02 |

| 12397 | Chip | Vein | 0.5 | 677076 | 3001730 | 3.15 | 398 | >10000 | 5.48 |

| 12398 | Chip | Vein | 0.5 | 677000 | 3001692 | 0.645 | 8.81 | 4400 | 0.58 |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

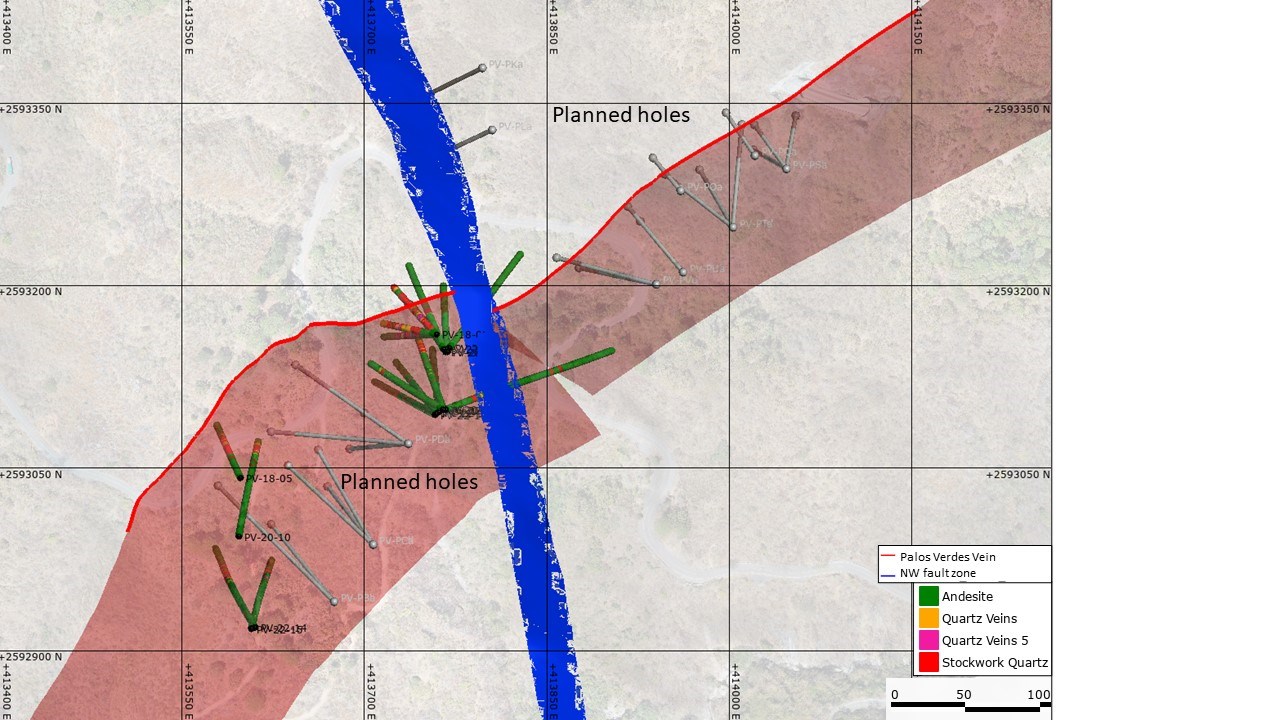

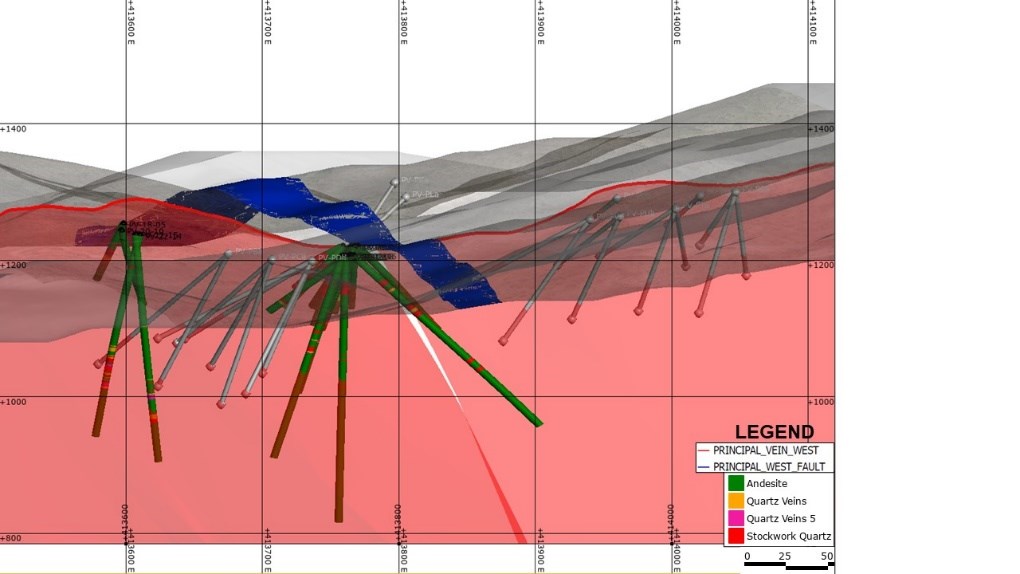

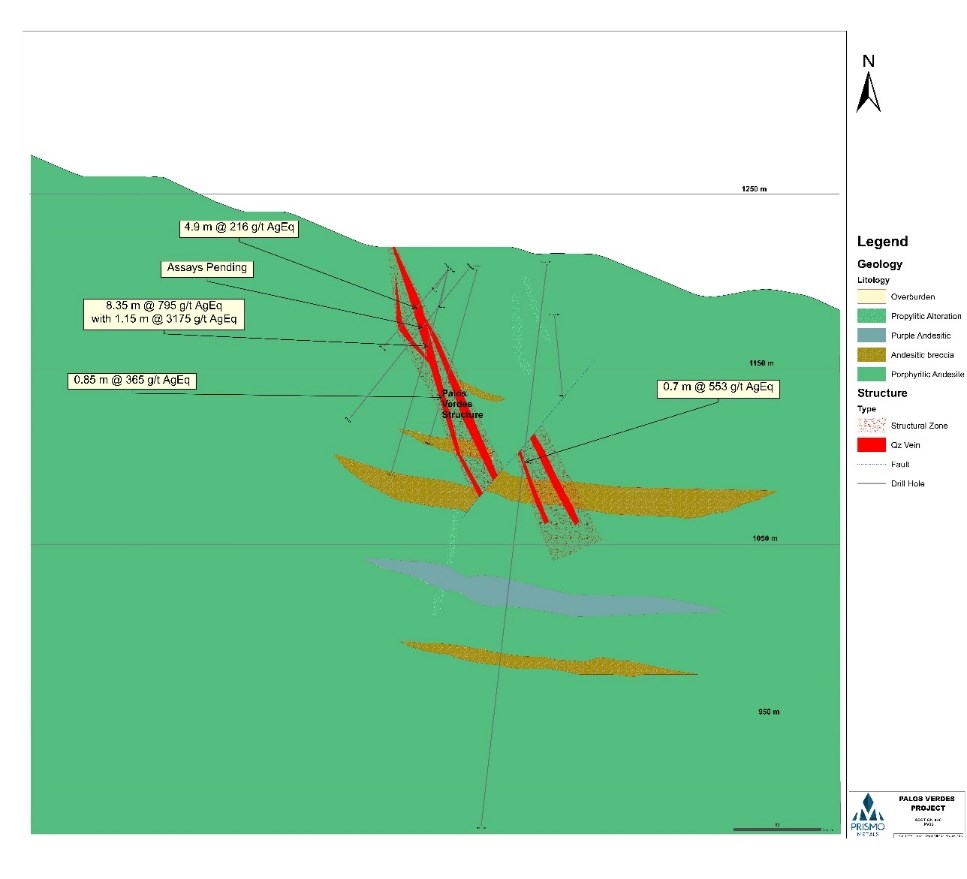

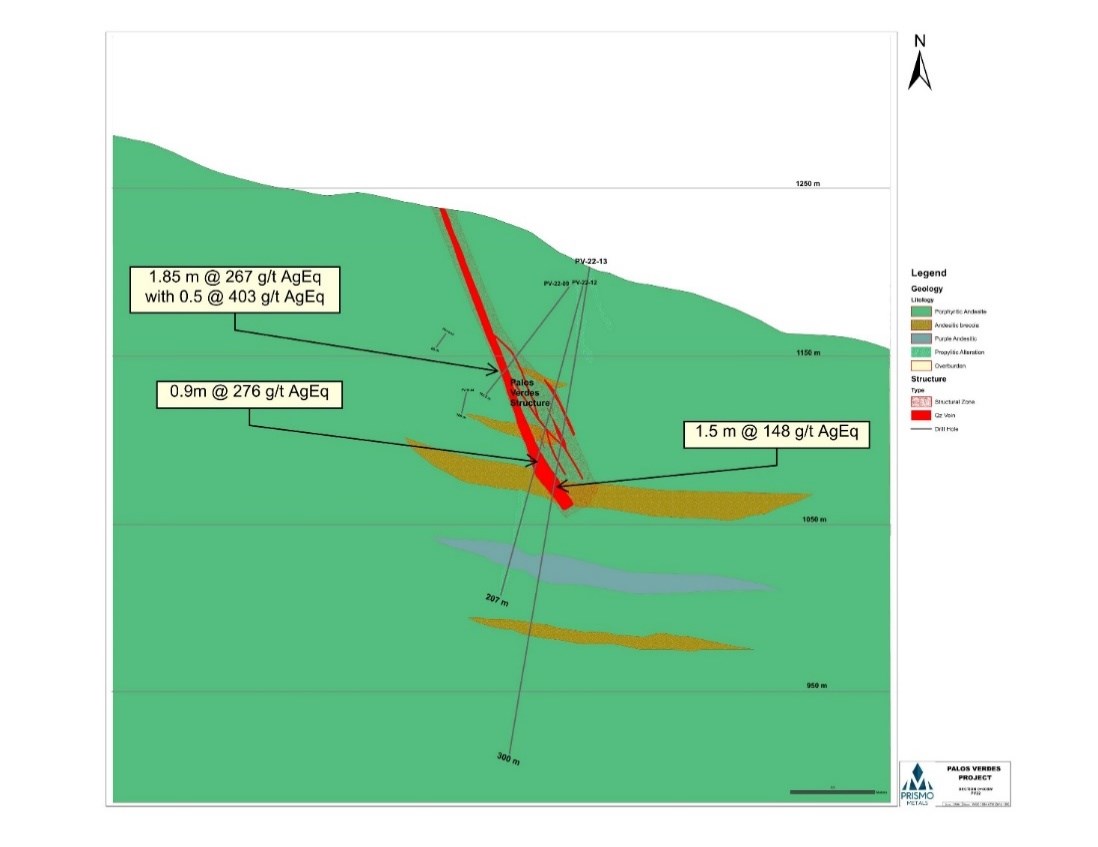

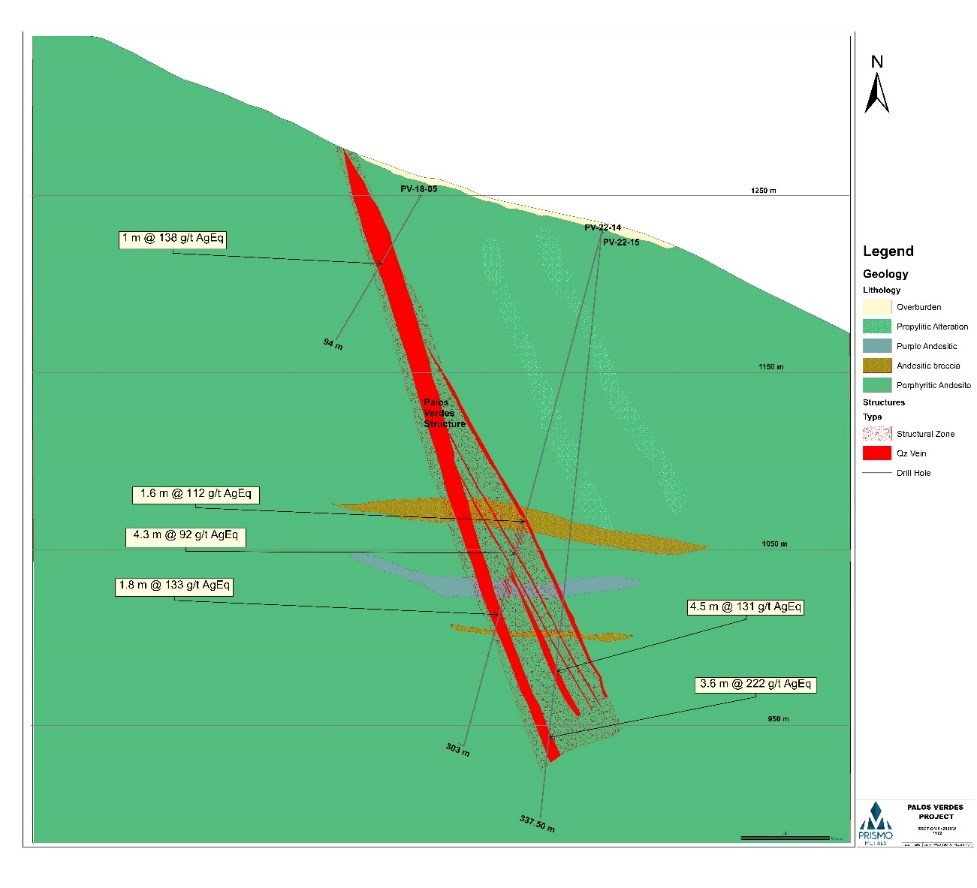

Prismo Metals (CSE:PRIZ) has announced new assay results for its first five holes from the drill program at the Palos Verdes project. The company still expects assays for the last three holes of the 2022 campaign to arrive before the end of December. Located in the Panuco-Copala district of the state of Sinaloa, Mexico, the Palos Verdes concession covers 700 metres of strike length in the Palos Verdes vein.

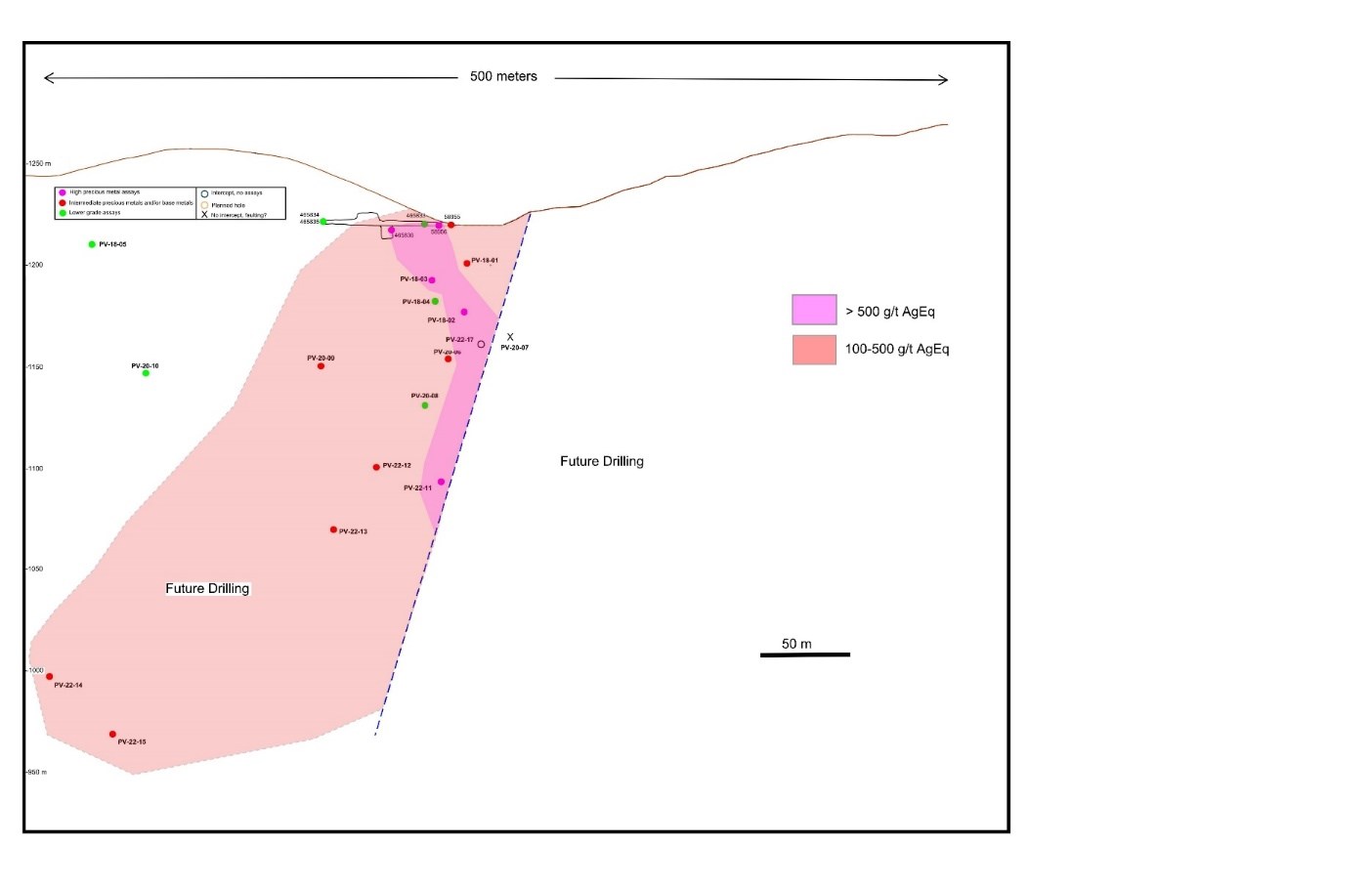

The first drill hole of the season, PV-22-11, cut 0.7 meters downhole length with 553g/t AgEq or 4.18 g/t gold and 207 g/t silver. All five holes reported here cut significant mineralization, and in general intercepts were relatively gold and base-metal rich (Table 1). The company has completed the current drill program with almost 2,100 meters drilled in eight holes as shown in Table 2.

Several holes cut wide zones of mineralization, including nine meters downhole in hole PV-22-15 that averaged 187 g/t AgEq or 1.02 g/t Au with 1.1 % Pb and 1.4 % Zn. These intercepts shown in table 3 range from 50 to 150 meters below previous shallow drilling that had several high-grade intercepts. Table 3 shows the intercepts from the historic drilling with silver equivalent values shown for comparison purposes, with the best being 3,175 g/t AgEq over a true width estimated at 0.8 meters within a larger mineralized interval with 795 g/t AgEq over a true width of 5.5 meters.

Craig Gibson, President and CEO of Prismo Metals, commented in a press release: “The drill program was successful in extending the mineralization to depth below the shallow drill holes completed previously and provided important information on the distribution of metal values. Under the current environmental permit, we had access to limited drill sites, which leaves ample room to significantly extend the higher-grade zones in the mineralized ore shoot along strike.

“Approximately 70% of the strike length of the Palos Verdes vein remains untested, including the central portion of the southwestern segment of the vein, and all of the northeastern extension. In April of this year, we applied for an expanded environmental permit which we anticipate obtaining before our next phase of drilling planned for January 2023. Upon receipt of the expanded environmental permit, we will immediately initiate further drilling to the northeast to be funded by the announced strategic investment from Vizsla Silver Corp. Also, once this agreement with Vizsla is finalized, we will be able access the central portion of the southern segment of the Palos Verdes vein from roads on their adjacent concession, thereby further expanding our ability to explore the Palos Verdes property.”

Further results and a corporate update as provided by Prismo Metals include:

Prismo also provided an update on its short-term corporate priorities.

Prismo is currently working on finalizing the announced strategic investment by Vizsla Silver Corp. The strategic investment will provide for a cash injection to Prismo of $500,000 and issuance to Prismo of $1.5 million in Vizsla shares which will provide Prismo shareholders further exposure to the district via equity ownership position in Vizsla Silver.

The companies will also form a joint technical committee to allow for the pursuit of district-scale exploration of Panuco silver-gold district. This transaction is expected to be finalized by December 16, 2022. The next phase of drilling at Palos Verdes, expected in January 2023, will be reviewed by the technical committee to be formed as part of the agreement with Vizsla Silver.

At the Los Pavitos project, the surface mapping and sampling program begun early in 2022 continues, with completion of the initial mapping and sampling program over the concession slated for December. Preparation of the environmental permit application is in progress, field work has been completed and the application will be submitted shortly, with drilling planned in the first quarter of 2023.

No drilling has been completed to the northeast of the fault. Source: Prismo Metals

Table 1. Assays for drill holes in the current program.

| Hole | From

(m) |

To

(m) |

Width

(m) |

Est True

Width (m) |

Au

(g/t) |

Ag

(g/t) |

Cu

(%) |

Pb

(%) |

Zn

(%) |

Ag eq

(g/t) |

| PV-11 | 114.85 | 115.55 | 0.7 | 0.42 | 4.18 | 207 | 0.02 | 0.02 | 0.02 | 553 |

| PV-12 | 117.9 | 118.8 | 0.9 | 0.54 | 3.18 | 13 | 0.01 | – | – | 276 |

| PV-13 | 118.5 | 120.0 | 1.5 | 0.9 | 0.66 | 93 | – | – | – | 148 |

| PV-14 | 165.0 | 172.2 | 7.2 | 4.3 | 0.06 | 21 | 0.08 | 0.49 | 0.85 | 77 |

| incl | 169.4 | 171.0 | 1.6 | 2.5 | 0.07 | 28 | 0.12 | 0.52 | 1.01 | 88 |

| 179.9 | 184.2 | 4.3 | 2.6 | 0.03 | 27 | 0.41 | 0.81 | 1.01 | 92 | |

| 193.0 | 195.9 | 2.9 | 1.7 | 0.05 | 12 | 0.27 | 0.14 | 1.88 | 93 | |

| incl | 194.1 | 195.9 | 1.8 | 1.1 | 0.07 | 14 | 0.36 | 0.13 | 2.80 | 133 |

| PV-15 | 238.5 | 243.0 | 4.5 | 2.7 | 0.18 | 43 | 0.29 | 0.36 | 1.60 | 131 |

| 263.5 | 272.5 | 9 | 5.4 | 1.02 | 16 | 0.23 | 1.10 | 1.41 | 187 | |

| incl | 266.45 | 272.5 | 6.05 | 3.6 | 0.91 | 22 | 0.33 | 1.61 | 2.04 | 222 |

Silver equivalent values are calculated using the following metals prices: Au, US$1,750/oz, Ag, $21.24/oz, Pb, $0.97/lb and Zn, $1.34/lb. Cu was not used in the calculation, and metallurgical recoveries were not considered as there is no data available.

Table 2. Drill hole data for holes from the current program.

| Hole | Easting | Northing | Elev | Azim | Incl | Depth (m) | |

| PV-22-11 | 413,761 | 2,593,096 | 1,209 | 355 | -82 | 393.00 | |

| PV-22-12 | 413,759 | 2,593,095 | 1,209 | 325 | -75 | 207.00 | |

| PV-22-13 | 413,758 | 2,593,094 | 1,209 | 300 | -80 | 300.00 | |

| PV-22-14 | 413,610 | 2,529,919 | 1,230 | 330 | -75 | 303.00 | |

| PV-22-15 | 413,607 | 2,529,918 | 1,230 | 15 | -80 | 337.50 | |

| PV-22-16 | 413,767 | 2,593,098 | 1,209 | 70 | -60 | 288.00 | |

| PV-22-17 | 413,765 | 2,593,148 | 1,205 | 340 | -50 | 115.00 | |

| PV-22-18 | 413,770 | 2,593,149 | 1,205 | 40 | -50 | 156.00 | |

Coordinates in UTM WGS84 using handheld Garmin GPS.

Table 3. Drill results for all previously released drill holes at the Palos Verdes Project

| Hole | From

(m) |

To

(m) |

width

(m) |

Est True

width (m) |

Au

(g/t) |

Ag (g/t) | Cu

(%) |

Pb

(%) |

Zn

(%) |

Ag eq

(g/t) |

| PV-01 | 23.90 | 28.80 | 4.90 | 4.2 | 0.89 | 31 | 0.21 | 0.30 | 2.63 | 216 |

| PV-02 | 40.35 | 48.70 | 8.35 | 5.5 | 1.69 | 474 | 0.54 | 1.09 | 3.84 | 795 |

| incl. | 45.25 | 48.70 | 3.45 | 2.3 | 3.75 | 1098 | 0.67 | 1.99 | 3.00 | 1581 |

| incl. | 46.55 | 47.70 | 1.15 | 0.8 | 8.42 | 2336 | 0.27 | 1.72 | 2.46 | 3175 |

| PV-03 | 31.30 | 40.65 | 9.35 | 7.0 | 1.45 | 15 | 0.05 | 0.11 | 1.04 | 178 |

| incl. | 39.55 | 40.65 | 1.10 | 0.8 | 12.15 | 50 | 0.26 | 0.53 | 5.01 | 1263 |

| PV-04 | 55.45 | 59.00 | 3.55 | 3.0 | 0.12 | 37 | 0.31 | 0.12 | 0.74 | 121 |

| PV-05 | 54.25 | 57.40 | 3.15 | 2.0 | 0.25 | 23 | 0.06 | 0.32 | 0.62 | 77 |

| incl. | 56.40 | 57.40 | 1 | 0.42 | 30 | 0.12 | 0.83 | 1.27 | 138 | |

| PV-06 | 70.55 | 75.85 | 5.3 | 3.2 | 0.13 | 69 | 0.14 | 0.12 | 0.29 | 220 |

| 75.00 | 75.85 | 0.85 | 0.5 | 0.46 | 317 | 0.12 | 0.09 | 0.21 | 365 | |

| PV-07 | 32.40 | 34.20 | 1.8 | ? | 0.01 | 9 | 0.35 | 0.24 | 0.47 | 36 |

| PV-08 | 92.70 | 96.05 | 3.35 | 2.5 | 0.24 | 17 | 0.09 | 0.19 | 0.58 | 65 |

| 92.70 | 93.65 | 0.95 | 0.7 | 0.55 | 37 | 0.24 | 0.61 | 1.21 | 147 | |

| PV-09 | 87.10 | 88.95 | 1.85 | 1.3 | 0.73 | 38 | 0.19 | 0.61 | 3.89 | 267 |

| incl. | 87.10 | 87.60 | 0.5 | 0.3 | 1.63 | 44 | 0.27 | 0.79 | 5.15 | 403 |

| PV-10 | 125.30 | 126.50 | 1.20 | 0.9 | 0.03 | 6 | 0.06 | 0.03 | 1.4 | 71 |

Partial data for holes PV-01 to PV-10 were included in previous news releases, of September 30, 2020 and December 20, 2020 True width of the intercept in hole PV-07 is unknown.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan