Major mining companies are looking to enter the potash business, or expand existing operations, as they look for increased demand from developing nations such as China, India and Brazil.

“This is a solid business and the big mining companies agree. If they can find a way to participate in it, they will.” Mark Connelly, New York brokerage Sterne Agee.

BHP Billiton – In the spring of 1869 a German Chemist named Charles Rasp immigrated to Australia for his health. Unable to find work in his chosen trade Charles learned to ride a horse and began wrangling sheep. One day, while out riding his horse at Broken Hill, he discovered mineralized rock. He took out a mining lease, punched holes in the ground and eventually found rich veins of silver. The Broken Hill Proprietary Company – BHP – was incorporated in 1885 while mining silver and lead at Broken Hill in western New South Wales.

Billiton was a mining company that got its start in September 1860 when the articles of association were approved by a meeting of shareholders in the Groot Keizerhof Hotel in The Hague, Netherlands. Shortly afterwards the company acquired the mineral rights to the tin-rich islands of Banka and Billiton off the eastern coast of Sumatra.

Nicknamed “the Big Australian”, BHP is the world’s largest mining company. It was created in 2001 by the merger of Australia’s Broken Hill Proprietary Company and Anglo-Dutch Billiton. Today BHP produces – oil, natural gas, bauxite, aluminum, copper, silver, lead, zinc, uranium, diamonds, coal, titanium, well, you get the idea, they’re miners, they pull “stuff” out of the ground and sell it.

BHP, seeking to benefit from surging demand for fertilizer, made a $40 billion hostile bid for Potash Corp. of Saskatchewan Inc. Yielding to political pressure, Canada’s Federal government nixed the deal. BHP paid $341 million, C$8.35/share, to acquire Saskatoon’s Athabasca Potash. The acquisition gave BHP Athabasca’s Burr Project, which is located next to BHP’s Jansen Project. BHP announced on 24th June 2011, a further investment of US$488 million to support development at its Jansen Potash Project. This piece of additional capital will fund site preparation and the procurement of long lead time items during the project’s feasibility study. This funding will also enable BHP to develop the first 350 meters of the production and service shafts. The announcement takes BHP Billiton’s investment in Jansen to, so far, $1.2 billion.

Vale S.A. – Formerly known as Companhia Vale do Rio Doce (CVRD) was founded by the Brazilian Federal Government in June 1942. The company was privatized in 1997 when the Brazil Consortium bought just over 40% of the Federal Government’s stock.

Even though Vale has operations in the energy and logistics sectors both sectors combined contribute less than ten percent to Vales total revenues. Vale is a miner and controls the Brazilian iron ore industry owning all Brazilian iron ore exporters. In recent years, in an attempt to diversify its operations, Vale has made a string of purchases getting into copper, kaolin, nickel and coal. In October 2006 Vale bought Canada’s second largest mining company, Inco, for $18.9 billion. Vale also produces manganese, ferroalloys, bauxite, potash (Sergipe mine in Brazil), alumina and aluminum.

Vale S.A. has moved into the fertilizer business in a big way. In January of 2009, Vale bought Rio Tinto’s potash assets in Argentina and Saskatchewan Canada for US$850. In January 2010, Vale announced it would acquire all the shares of Bunge Participacoes e Investimentos S.A. (BPI). Vale will pay $1.65 billion US for BPI – for its wholly owned phosphate mining operations in Brazil – and another $ 2.15 billion US for its 42.3 percent in Fertilizantes Fosfatados S.A. (Fosfertil) – a leading Brazilian fertilizer company. Engineering work has started at Vales Rio Colorado solution mining potash project in Mendoza, Argentina. Estimated start-up is for the second half of 2014 with a nominal capacity of 4.3 Mt per year of potash.

Vale said it’s planning to consolidate its position in the potash industry by taking its fertilizer unit private. The change would give the Brazilian-based miner more control over the business that now represents about 2 per cent of global potash production. Vale is planning to build a $3 billion potash project in Saskatchewan, and has other potash projects in its pipeline.

Rio Tinto – A site along the Rio Tinto river in the Andalusian Province of Huelva, Spain has been mined for copper, silver, gold, and other minerals since 3000 BC. After being lost for centuries the mines were rediscovered in 1556, the Spanish government began operating them in 1724 but sold them in 1873 to Matheson and Co. Hugh Matheson formed a syndicate consisting of Deutsche Bank (56% ownership), Matheson (24%), and railway firm Clark, Punchard and Company (20%). The syndicate registered the Rio Tinto Company on 29 March 1873. The Rothschild family had control by the end of the 1880s.

After selling its South American and Saskatchewan (Canada) potash assets in 2009 to cut debt Rio has re-entered the potash business. The company is teaming up with North Atlantic Potash Inc. – the Canadian subsidiary of Russia’s JSC Acron, a fertilizer producer – to hunt for potash in Saskatchewan. A joint venture between Aluminum Corp. of China (Chinalco) and Rio Tinto has received approval for exploration in China. The JV will initially focus on exploring for copper in China but has plans to expand into coal and potash.

K+S AG – Bought Canada’s Potash One, the previous owners of Legacy, in a 2010 deal worth $434 million. Potash prices at the time were 40% lower than today. After saying on March 8th 2011 that it expects global demand for potash to rise 3-5 percent per annum, Europe’s largest (and the worlds fourth largest) potash producer, Germany’s K+S AG said on November 29th 2011 that it will move forward with construction of its $3.2 billion Legacy project in Saskatchewan.

The reality is the potash story is just starting. Unlike other resource plays there is no cycle, demand is expected to rise year over year making potash an excellent play in what some expect will be a long term agricultural commodities bull market.

Future Demand – “Just when we need more soil to feed the 10 billion people of the future, we’ll actually have less—only a quarter of an acre of cropland per person in 2050, versus the half-acre we use today on the most efficient farms.” David Montgomery, author of the 2007 book Dirt: The Erosion of Civilizations

Fertilizers are becoming increasingly important for many reasons:

- There’s 220,000 people being born every day, that’s 220,000 more mouths to feed every day;

- An increasing disposable income in a growing middle class, more money in more pockets means more and more people climbing the protein ladder;

- Loss of arable land, topsoil degradation;

- Desertification and climate change;

- The Green Revolution’s impact on crop production is declining, in some cases reversing;

- Some older mines are going to become more inefficient or be lost;

- Underutilization of potash in many countries;

- Demand from the countries whose economies are starting to develop and have the ability to get into farming;

- Security of supply.

Higher crop yields are needed in order to feed today’s global population of seven billion so strong fertilizer prices are sustainable. Over the next fifty years, as we add another 4.5 billion people to the world’s population, global demand for food will increase almost 70% if population growth predictions are correct. The sheer amount of people being born every year, the loss of arable land and the change of diet among a newly prosperous, urban population in developing countries are the most important factors stoking the rise in global food demand.

As demand for food rises, so does the requirement for crop nutrients. Potash has unique characteristics:

- High-quality, economically viable deposits are rare;

- Major offshore markets have little or no indigenous production capability;

- Barriers to entering the business are significant;

- Potash has been historically under applied relative to nitrogen and phosphate; and,

- Limited new operational capability is expected.

A rising income means more money in the household budget. The new middle class consumers forgo plant based calories in favor of adding more protein from meat and dairy products to their diets. It takes up to eight kilograms of grain to produce one pound of beef – less for pork, chicken, milk or eggs – between 2kg and 6kg. As meat consumption soars, more grain is needed to feed more livestock. In 1995, the Chinese ate an average of 25kg of meat per person, by 2007, the Chinese were consuming 53kg of meat per person.

Enlarging and diversifying the meat supply is a first step for every developing country. In 1980, the world ate 133 million tonnes of meat and drank 342 million tonnes of milk. By 2002, consumption had increased to 239 million tonnes of meat and 487 million tonnes of milk. The United Nations Food and Agriculture Organization (FAO) estimates that by 2030 global annual consumption of meat will stand at 373 million tonnes and 736 million tonnes of milk.

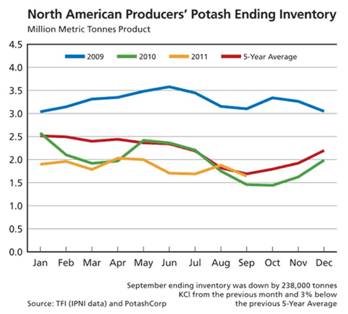

Potash Corporation of Saskatchewan Inc. (TSX:POT & NYSE:POT), the world’s largest fertilizer producer by market value, doubled its third quarter earnings, reporting 94 cents per share or $826 million compared to 38 cents per share or $343 million a year ago. During the first nine-months of 2011, the company’s earnings have doubled from $1.39 per share during the same period last year to $2.73 per share today. Net income of US$826 million was the second highest Q3 profit in the company’s history – gross margin reached US$1.1-billion. Potash production was 1.9 million tonnes, a third quarter record for Potash Corp.

The company said demand was strong from both North American and international customers. “Crop prices remained at historically high levels [in the third quarter] and farmers continued to strive for increased production to capitalize on the economic opportunity in agriculture. As a result, demand for our potash, phosphate and nitrogen products remained strong,” commented Bill Doyle chief executive of Potash Corp. Global grain stocks remain at extremely low levels. Potash Corp. said at the beginning of the year that it would take two years of record harvests to get inventories back to comfortable levels, 2011 has been referred to as a lost year.

According to figures compiled by Bloomberg potash prices averaged 27 percent higher in the third quarter compared with a year earlier. There may be room for more upside, the cost of fertilizer as a percentage of corn revenue is 13%, 18% is the norm.

“Global potash prices have surged in 2011, driven by a tight global supply/demand balance, and with producers heavily committed through year-end, we view current price levels as being sustainable.” Don Carson, analyst, Susquehanna Financial Group.

Here are your “Movers and Shakers” for the week ending September 16th, 2011 on the TSX and TSX-V Exchanges. In no particular order, these are the 10 mining companies that caught our eye this week.

Here are your “Movers and Shakers” for the week ending September 16th, 2011 on the TSX and TSX-V Exchanges. In no particular order, these are the 10 mining companies that caught our eye this week.

1. Dalradian Resources Inc. (TSX: DNA)

Dalradian Resources was this week’s top TSX-listed mining stock percentage gainer posting a gain of 27.8%. Dalradian will be added to the S&P/TSX SmallCap Index on Monday, September 19th. Earlier this month, the company announced intersecting 3.2m grading 5.34g/t Au at its Curraghinalt Deposit in Northern Ireland.

2. TerraX Minerals Inc. (TSX-V: TXR)

On the TSX Venture board, TerraX Minerals posted a weekly gain of 37.9% which made it the number one mover this week. On Wednesday, September 14th, the company announced it intersected a porphyry-style alteration with significant sulphides at its Stewart gold-copper property in Newfoundland.

3. Aura Minerals Inc. (TSX: ORA)

Aura Minerals chalked up an 11.6% loss this week which marked the largest decline for a TSX-listed mining stock. Aura closed down $0.20 on Friday to end the week at $1.53. The company has faced a host of operational problems and the loss of its chief executive officer. In July, Dundee Capital Research analyst Ron Stewart noted, “No question in our mind, Aura has had the proverbial stuffing knocked out of it in the market.” At the time, Aura was trading at $2.13 and Stewart issued a $3.00 target on the company’s stock.

4. Copper One Inc. (TSX-V: CUO)

Copper One was off 17.5% this week which marked the biggest drop for any widely traded TSX-V listed mining stock. Volume was up considerably on Friday with over 1.4 million shares traded. The company’s stock was off $0.07 on the day to close at $0.33 on no news. On July 8th, Copper One annouced that exploration work on the Rivière Doré project in Quebec was being put on hold. At the time, the company’s shares were trading at $0.70.

5. Avion Gold Corp. (TSX: AVR)

Avion Gold was the most actively traded issuer on the TSX Exchange on Friday with over 33 million shares trading hands. The company was up $0.08 on the week to close at $2.54. Avion Gold is being added to the TSX Global Gold and Global mining Indexes effective Monday, September 19th, 2011.

6. Silver Wheaton Corp. (TSX: SLW)

Silver Wheaton was the second most actively traded stock on Friday on the TSX Exchange with almost 24 million shares traded. On Monday, September 19, 2011 Silver Wheaton will be added to the TSX 60 Index. Also upcoming, third quarterly cash dividend payment for 2011 of US$0.03 per common share will be paid to holders of record of its common shares as of the close of business on September 20, 2011.

7. Allana Potash Corp. (TSX:AAA)

This week marked the first full week of trading on the TSX for Allana Potash. The company graduated to the TSX on Friday, September, 9th. On Thursday, September 15, Allana Potash announced drill results from the company’s potash project in Ethiopia which included 8 meters of 18.54% KCl. About the news, Company President & CEO Farhad Abasov stated, “Allana management believes that the potash in this region may be amenable to mining by open pit methods and future studies will focus on this potential.”

8. Silvercorp Metals Inc. (TSX: SVM)

Silvercorp Metals was in the headlines all week after the B.C. Securities Commission announced last Friday it was conducting a regulatory investigation into anonymous allegations against the company. A second set of allegations were published on the internet this week and the company’s Chairman Dr. Rui Feng invited the authors responsible for the accusations to “come out of the shadows and participate with the regulators in their investigations“. This week the company bought back over $31 million of its own shares through a normal course issuer bid.

9. Copper Fox Metals Inc. (TSX-V: CUU)

B.C. copper miner Copper Fox intends to raise an additional $2-million via a private placement bringing the total private placement proceeds of its recently announced financing to $5-million. The offering is expected to consist of 3,333,334 units at a purchase price of $1.50 per unit. Each unit consists of one common share of Copper Fox and one-half common share purchase warrant of Copper Fox. Each whole warrant entitles the holder to acquire one common share of Copper Fox at an exercise price of $1.75 for one year.

10. Passport Potash Inc. (TSX-V: PPI)

Passport Potash was also in the B.C. Securities Commission spotlight this week when, on Monday, the regulator expressed concern that the company may be in possession of the results of an economic analysis for the Holbrook project that had not been disclosed through a news release and material change report. The company’s shares are down $0.09 on the week closing at $0.47.

After buying your morning double-double at Tim Horton’s, do you ever wonder where the coins came from? Long before they were turned into the money that we all carry around with us in our pockets, they were raw metals hidden in the earth. How do mining companies know where to drill to find metal deposits? Once they find the deposits, how do these companies extract the minerals? The answers almost always lie in mining technologies.

In mining, technologies ranging from IT and computer software systems that provide 3D models of resource deposits to chemical process technologies used to separate minerals from ore have improved the efficiency of extraction by leaps and bounds; even over the past decade. Yet some mining technologies have been around for centuries. For the production of aluminum, the first part of the process was invented in 1887 by Russian scientist Karl Bayer. Bayer discovered that aluminium oxide (alumina) could be produced from bauxite when using sodium hydroxide. The second part of the process, the Hall-Héroult process, was developed one year earlier in 1886. It involves dissolving alumina in molten cryolite and electrolysing the molten salt bath to obtain pure aluminium metal. The process was discovered independently by American chemist Charles Martin Hall and French scientist Paul Héroult. In 1888, Hall opened the first large-scale aluminium production plant in Pittsburgh, which eventually evolved into the Alcoa corporation.

Today, we look at three mining companies listed in Canada that are developing innovative mining process technologies. We start with an aluminum miner in the province of Quebec that is going up against the 124 year old Bayer process.

Orbite V.S.P.A. Inc. (TSX-V: ORT.A)

It has long been known that alumina can be refined from aluminous clay deposits but this process is not widely exploited because, historically, the quality and cost of alumina from clay has not been competitive with alumina from bauxite using the Bayer process. Orbite has a patented process for extracting alumina from aluminous clay and in February, 2011 the company completed a pilot plant with a production rate of one tonne per day of alumina. The plant is reportedly capable of producing both smelter grade alumina and high-purity alumina in a cost-effective manner.

On July 7th, 2011, Orbite closed a $57.5 million bought deal financing through its lead underwriter Mackie Research Capital Corporation. Mackie Research analyst Matt Gowing calls Orbite a “game-changing alumina production company” and has a 1 year price target of $7.50 on the company’s stock. Mr. Gowing states, “According to Orbite’s engineering design and pilot plant work thus far, the company is targeting a cash cost of operating the metallurgical plants to be approximately less than half of the $280 cost per tonne or ($140/tonne) incurred by bauxite-based alumina producers”.

Not only does Orbite control their technological process, they also control their resource supply. Recently, the company updated its NI 43-101 compliant resource estimate at the Grand Vallee property from 75-300 million tonnes to 1 billion tonnes of aluminous clay grading, at an average, 23.13% alumina. Shares of the company have been on a tear in 2011. Starting the year at $0.90, Orbite’s shares are currently trading at $3.38 and has lately been one of the TSX’s most actively traded stocks.

Verde Potash PLC (TSX-V: NPK)

Verde Potash (formerly Amazon Mining) is developing the Verdete slate, or green slate, potash project in Brazil. On March 8, 2010 Verde Potash received an initial National Instrument 43-101 compliant inferred mineral resource estimation of 105 million tonnes at 10.3% K20 inferred resource for the project.

But this junior potash mining company also utilizes a little technology. On December 1st, 2010, the company filed a patent application in the U.K. for the production of conventional potash product, muriate of potash (KCl) and sulphate of potash (SOP) from Verdete slate. The company plans on utilizing a relatively new extraction process that heats Verdete slate to almost 1,100 degrees Celsius to extract the potash. This process results in a new fertilizer, ThermoPotash, that the company believes will be more suited to the needs of the Brazilian marketplace.

Brazilian soil is much more acidic than soil in other parts of the world, and the problem has been compounded by the agricultural use of potassium chloride. And potassium chloride, the fertilizer produced in Canadian potash mines, also washes away too easily in Brazil’s heavy tropical rains. Shares of Verde Potash currently trade in the $7.50 range valuing the company at over $240 million.

Alexander Mining PLC (TSX-V: AXD)

Alexander Mining is a relatively new issuer on the TSX Venture Exchange hitting the Canadian market in January earlier this year. The company is also listed on the AIM Exchange in the U.K. Alexander is a mining and mineral processing technology company. Through it’s wholly owned subsidiary MetalLeach Limited, Alexander controls two proprietary (patent pending) hydrometallurgical mineral processing technologies. These technologies are designed for the extraction processes of certain base metal deposits.

Of the aformentioned techniques, the copper process has been demonstrated at pilot plant scale for heap leaching and at bench scale for agitated leaching. The cobalt process has been bench scale tested for both heap and agitated leaching. While development of the zinc process has led to a new solvent extraction process for which patents are pending. Shares of Alexander mining last traded at $0.11 on the TSX-V Exchange valuing the company at $15 million.

The World Meteorological Organization predicts global food output may be impacted as climate change brings more extreme weather over the next decade. China, the organization says, is likely set for harsher droughts and North America will get heavier rain.

Extreme weather in the US, the world’s largest agricultural exporter, likely attributed to record highs of global food costs in February, 2011. The UN Food and Agriculture Organization’s World Food Price Index, which tracks 55 food-commodity items, rose nine times in the past ten months.

“Extreme events will become more intense in the future, especially the heat waves and extreme precipitations,” Omar Baddour, a division chief at the United Nations’ agency. “That, combined with less rainfall in some regions like the Mediterranean and China, will affect crop production and agriculture.” China’s Office of State Flood Control and Drought Relief Headquarters announced recently that drought there has affected 6.5 million hectares of farmland. Huang Xiangbing, a village committee official from China’s drought stricken Hubei Province pointed out, “An old saying goes ‘a bowl of water now will bring a bowl of grain in harvest’. Right now is the vital time for spring irrigation, but we have not seen a drop of rainfall.”

Global demand for major grains such as maize, rice, and wheat is projected to increase by nearly 48 percent from 2000-2025 according to research presented by Mark Rosegrant, Director of Environment and Production Technology at the International Food Policy Research Institute. Rosegrant, presenting at the AG Innovation Showcase held in St. Louis, Missouri this week, said “Climate change, high-and-volatile food and energy prices, population and income growth will put intense pressure on land and water and challenge global food security as never before.”

As for spinoff effects of this grim scenario, a report from the International Potash Institute says “Future demand for food is enormous and the limited availability of land and water, climate change and the need to adhere to environmentally-friendly practices – all present a huge challenge to the world’s agriculture in the coming years. Hence increased production will be achieved by both increased productivity and additional land under cultivation. In both scenarios, increased consumption of nutrients is inevitable.” The bottom line? Bad news is good news for potash stocks.

Shares of Potash Corporation of Saskatchewan (TSX:POT), the world’s largest potash supplier, are faring well. Rebounding from a mid-May low of $49, the company’s shares are currently trading at $53.66. On May 6th, Potash released their Q1 2011 results, which showed record gross margins and record earnings attributed to high sales prices for all nutrients and increased demand for potash.

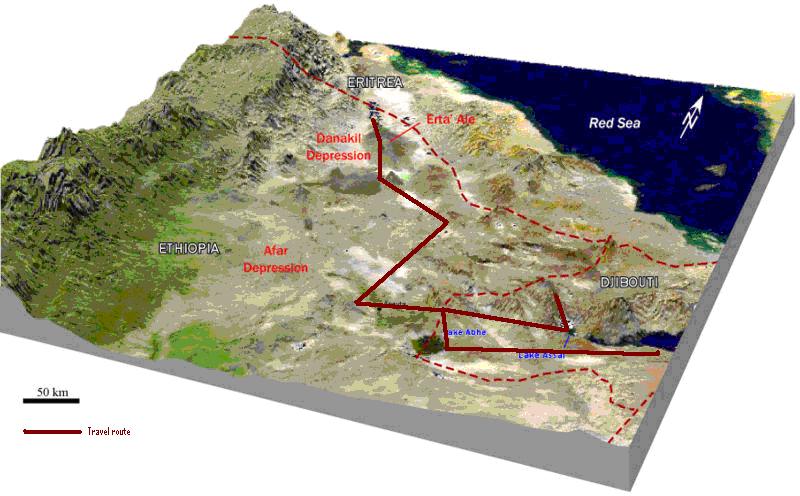

Junior potash miners are also feeling the love. Allana Potash (TSXV:AAA), a potash exploration company working on exploration and development of a potash resource in Ethiopia’s Danakil Depression has responded in kind. Shares of Allana Potash are currently trading at $1.88 up over $0.20 from last week. And shares of Western Potash (TSXV:WPX) are also on the move. The company’s stock is up eight cents today currently trading at $1.31 with over a million shares already trading hands. Western, as the name suggests, is developing a project in Saskatchewan, the home of the world’s largest supply of potash in Western Canada.

Lithium and Potash was the focus of MiningFeeds.com’s May Issue. In the issue, we connected with Allana’s President & CEO Farhad Abasov for an exclusive interview – CLICK HERE – to read more. We also discussed the future of Western Potash with Patricio Varas the company’s President & CEO – CLICK HERE – for the interview.

- Encanto President & CEO Jim Walchuck and Muskowekwan Chief Reg Bellerose in joint development of Saskatchewan potash.

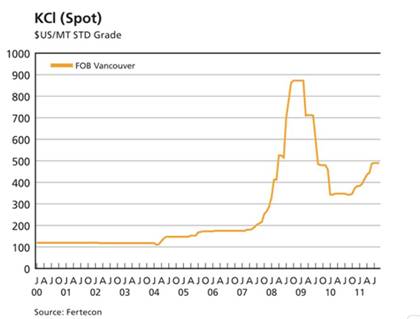

After a brief pause, the price of potash is on the rise once again. Demand is now expected to top fifty million tonnes in 2011. Just a few years ago Potash was once a seemingly minor commodity, worth less than $175 a tonne. But with agricultural demand surging, most analysts today expect it will find a price base between $400 and $500 per tonne this year. And Saskatchewan, once habitually depended upon federal transfer payments, is now a relative rock star on the international potash stage because it produces about a third of the world’s annual supply.

In Saskatchewan, the concentration of potash-power, properties and projects, are in the hands of just a few: Potash Corp. (TSX: POT), Agrium (TSX: AGU) and Mosaic (NYSE: MOS) dominate the landscape. But 2008 saw a new entrant on the scene when Encanto Potash (TSXV: EPO) signed its first Exploration Participation Agreements with the Muskowekwan First Nation of Saskatchewan. This was the first step in securing what is, according to Encanto’s President Jim Walchuck, “a collection of properties that offer great exploration and development potential that we simply could not have secured anywhere else in Saskatchewan.”

Many believe this type of arrangement is a modern day necessity in Saskatchewan as dozens of native lands claims are currently under review. Some bands, such as the Cote, Key and Keeseekoose First Nations, have received ground-breaking Federal settlements of up to $80 million.

In resource rich Western Canada, dialogues and partnerships between native groups, industry and government are becoming more common. And that mindset is spreading; the Yukon government recently noted that, “Native groups have demonstrated that they are willing to work with responsible exploration and mining companies and support their projects in exchange for the consideration of benefits to the local community.”

In March, 2011 the first Métis Economic Development Forum was held between business leaders in Saskatchewan and the Métis First Nation. Corporations including world Uranium giant Cameco, SaskEnergy and SaskPower were in attendance. Topics such as partnerships, procurement and community economic development were discussed. Métis National Council President Clément Chartier said, “If we are to begin making a difference in our communities, we need to host frank, open discussions between business and grassroots. It was encouraging to hear industry leaders say they are eager to do business with our people but need their expertise to open the way.”

It’s hard not to notice the tenor of business conversations in this part of the world has become more conciliatory and pro-business. One of Saskatchewan’s more proactive Native groups, for example, the Meadow Lake Tribal Council, owns multiple corporations including NorSask Forest Products. Newly elected Chief Eric Sylvestre recently said he is willing to “Sit down with industry and work out some arrangements”. Sylvestre pointed to oil and gas, and potash as possible areas for future business development and was quick to note when he identified BHP Billiton as a potential partner, “They have a good track record in dealing with First Nations.”

Since securing their arrangement, Encanto Potash has obtained INAC (Indian Northern Affairs Canada) permits on three of its development agreements and, on March 18th, 2011, the company announced its first NI 43-101 resource estimate of 79.1 million metric tonnes of indicated recoverable KCl and 60.5 million metric tonnes of inferred recoverable KCl with a proposed solution mining scenario similar to that of Potach Corp.’s Patience Lake project.

In a recent conversation with the MiningFeeds.com, Encanto head Jim Walchuk said the joint venture with Muskowekwan First Nations was more than just a milestone: “We see our partnership providing many opportunities such as possible tax benefits, a continuous land package and an efficient permitting path with just two stakeholders: Muskowekwan First Nation and Indian and Northern Affairs Canada. Following our recently announced resource estimate on the Home Reserve, we have definitely moved our partnership to a new level. We believe Encanto is in a very enviable position for developing this project.”

Walchuck feels good about his company’s partnership with the Muskowekwan First Nations, a sentiment that is echoed by Muskowekwan Chief Reg Bellerose who said the arrangement “…provides a framework for potash development in our territory, allows our nation to participate and benefit fully, and most importantly, ensures that these developments do not compromise our existing rights, assets, environment and culture. This is a formula our nation can accept and obviously so can industry.” And when describing the benefits to his people Chief Bellerose added, “It is good for a community, it is good for our First Nation, and it is is good for our future. For our children to have an opportunity where they normally wouldn’t.”

Unlike lithium, potash is not scarce. The resource, however, is concentrated in a few privileged places on the globe, such as Canada, Russia and Belarus.

This fact, in effect, turns the idea of abundance on its ear. Potash is extremely rare if you live in a “have not” country. The concentration of supply, combined with the prohibitive costs associated with establishing a producing mine, means there are a limited number potash suppliers. In fact, just a handful of producers account for 75% of potash production in the world. The two largest potash producers in North America are Potash Corporation of Saskatchewan (TSX:POT) and The Mosaic Company (NYSE: MOS); a Fortune 500 Company based in Minnesota. Silvinit, which is currently in merger talks with Russian counterpart Uralkali, and Belarusian government owned Belaruskali are the dominant players in Asia. Norway’s Yara and Germany’s K + S Kassell are the major producers out of Europe.

Much like lithium, the price of potash is established by direct negotiation between suppliers and buyers. When potash’s price per tonne reached nearly $1,000 in 2008, the inelasticity of supply became very apparent. This gave rise to the “potash bubble” and there was a temporary standoff between buyers and sellers – not many new supply agreements were announced from 2009 to 2010. Without the soil enrichment that potash provides, however, many crop producers run the risk of losing yield. Clearly, this standoff had a built in timer.

The entrance fee to join the exclusive club of potash producers is typically in the billions of dollars. In 2007, one of India’s largest mining companies Sainik Coal Mining was awarded a mining license to begin potash extraction in the Danakil Depression of Ethiopia. Sainik is planning to invest $1.1 billion in the project.

In the developed world that cost is even greater. Russell Carter, managing editor of World of Mining Professionals, recently reported, that “…a new Saskatchewan conventional mine would require an estimated upfront capital investment of C$2.8 billion, excluding roads, rail lines, utilities, port facilities and other infrastructure costs outside the plant gate. It would take a minimum seven years to generate positive cash flow from a newly built conventional mine”.

In April 2008, Mosaic announced that it would expand its three potash operations in Saskatchewan by five million tonnes over the next 12 years at a cost of US$3.15 billion but less than a year later was forced to lay-off 1,000 workers and reign in production as a result of the economic crisis.

Today, Aussie resource giant BHP Biliton, not one to be discouraged by the minor setback of a takeover gone awry has plans for a new potash mine. The Jansen Project is located 140 km east of Saskatoon, Saskatchewan. The mine is expected to be completed by 2015 and has been engineered to produce eight million tonnes of potash each year, or 12 % of the world’s current demand. This mega project is expected to cost $10 billion. With an estimated potash resource of 840 million tonnes and a mine life of perhaps a hundred years, the project provides BHP with a significant entry into the potash market.

Many believe that the rise of potash is not a bubble, but a genuine realignment of the supply demand equation. In their own second quarter analysis Potash Corporation said their research suggests that “…Chinese potash consumption could rise from less than 10m tonnes a year today to 30m by 2020. Indian consumption could jump from less than 6m tonnes to 15m in the same period.” Other proponents suggest that the BHP bid for Potash was not the frothy sign of a bubble at all, but rather, a sign of the bottom. Most reports suggest global demand will continue to rise by approximately 3% per year.

So with supply tightly concentrated in a few hands and demand steady, it appears potash will be news for some time to come. But where should investors in the sector be turning their attention to today? MiningFeeds.com breaks down five interesting candidates.

1. Potash Corporation of Saskatchewan (TSX:POT)

Location, location, location. Saskatchewan, the once sleepy little prairie province that is home to just over a million people, is home to half the world’s total supply of potash.

Half a decade ago, that fact was a footnote. Today, with the price of potash having risen from $190 to over $500 a metric tonne, it’s headline news. Potash Corp has done very well. Well enough, in fact, that the world came calling in the form of a hostile takeover attempt from BHP Bilington.

In mid-November 2010, after the Canadian government stone-walled the potential deal, BHP announced it had withdrawn its $38.6 billion unsolicited takeover offer for the Potash Corporation of Saskatchewan. Both Potash and the Saskatchewan government fiercely lobbied Canada’s Conservative government to block the deal, citing what amounted to national security concerns. Potash produces about 23% of the world’s supply of the newly important material and generates significant revenue for the Saskatchewan government.

The Canadian federal government, led by Industry Minister Tony Clement formally scuttled the Potash deal because it didn’t represent a “net benefit” to Canadians. The decision, which was made under the Investment Canada Act, was an assessment some felt was too subjective. Clement, obviously feeling the precarious nature of his position, gave the Australian mining giant a thirty day window to restate its case and make any additional representations to Ottawa. But BHP Biliton elected to terminate the offer and forgo the red tape.

Potash’s fiscal 2010 results, released on February 20th, punctuated the reasons BHP Biliton was so keenly interested in Saskatchewan’s largest company. Top line sales were a whopping $6.54 billion and the company was extremely profitable, reporting net income of $1.81 billion, or $1.98 per share.

With one thwarted hostile takeover under its belt, it is clear Potash Corporation of Saskatchewan now plays on an international stage. The company, to its credit, isn’t showing any signs of stage fright. By 2015, Potash expects its annual potash operational capability to reach 17.1 million tonnes, almost twice what it was in 2005 when construction was completed on its first expansion project. Management now says it expects to increase production by almost 70% over the next five years.

2. Allana Potash (TSXV: AAA)

Potash is hot. Allana’s potash might be just a little hotter.

That’s because Toronto based Allana Potash’s property is located in the Danakil Depression of Ethiopia one of the lowest places on earth not covered by water, and, with temperatures routinely soaring to over 60 Celcius, the hottest. When Potash was discovered in this basin near the Red Sea in 1918, most wouldn’t blame anyone for simply turning their back on it. But the quality and amount of potash available here, as Allana’s short experience is already proving, means the appeal is simply too lucrative, even in the excruciating heat of the Danakil Desert.

Potash production began in the Danakil in 1918 after a railway was completed from the port of Mersa Fatma in Eritrea to an area 28 km outside of Dallol. But when large-scale supplies from Germany, USA, and USSR came to market after the Second World War the region sat dormant for decades.

But just a few years ago, with Potash high in demand again, Etiopia and Eritrea governments granted a number of licenses. Allana’s property surrounds Sainik’s Crescent Potash Project and is adjacent to BHP Billiton’s holdings in the Depression. When Allana acquired its Ethiopian potash concessions in September, 2008 the transaction was supported by a NI-43-101 compliant technical report from ERCOSPLAN Ingenieurgesellschaft and North Rim Exploration. That report showed an inferred mineral resource of 105,200,000 tonnes of potash mineralization (Sylvite and Kainite) with a composite grade of 20.8% KCl and near surface mineralization was present.

Since acquiring the concessions Allana has been busy developing the project, attracting a $12.3 million strategic investment from Liberty Metal and Mining; 17% ownership stake, and a two million dollar investment from China Mineral United Management. Then, On March 1st, Allana completed a $38 million financing from a syndicate of brokers and an over-allotment option from Liberty Metals.

Recently The MiningFeeds.com talked to Farhad Abasov, President and CEO of Allana Potash about their experience in the Danakil and the 154,000 hectares land position the company holds in the Nequen province of Argentina. For the exclusive interview CLICK HERE.

For 5 Potash Stocks to Watch in 2011 – Part 2 – CLICK HERE.

3. IC Potash (TSXV:ICP)

All Potash is not created equal. The most common form, called Muriate of Potash, or MOP, accounts for about 95% of all potash fertilizers used worldwide.

Toronto’s IC Potash, however, is concerned with the more rare and expensive Sulphate of Potash, or SOP. SOP is slightly lower in potassium and is used in crops such as tobacco or pineapples, which are more inclined to fertilizer burn. SOP, which is sometimes referred to as “premium” potash, is aptly named because it trades at a premium; the price is normally 20-30% higher than regular potash.

With their Ochoa project in New Mexico, a land position that covers more than 100,000 acres, IC Potash is focused on becoming the world’s lowest cost producer of SOP. IC believes they are sitting on a resource of over a billion tonnes that is, as the company describes, “an average of 5.7 feet thick, and has an 83% grade, a remarkable grade for any resource.”

Shares of IC Potash raced from $.85 cents on December 20th of last year to over $1.70 as the potential of the Ochoa project became verified. The biggest one day leap happened January 5th after an updated preliminary economic assessment by Gustavson Associates of Lakewood, Colorado estimated the net present value of the Ochoa project at $1.4-billion. On March 17th, the company completed a $20 million financing at $1.60 per share. Going forward, IC Potash said their capital cost estimates to develop their mine are $662-million, and projected production cost of SOP will be $164 per tonne.

Investors bullish on IC Potash believe these profit margins will continue to positively affect the company’s share price. Compass Minerals (NYSE: CMP), through its wholly owned subsidiary Great Salt Lake Minerals, is the leading producer of sulphate of potash in North America. In March, that company reported it was selling SOP for roughly $900 per short tonne, up $50 from the company’s December 2010 price.

Equity analyst are paying attention to rising prices, but some perceive a shortage of potash juniors in a sector where properties are scarce and mines can take years to develop. Robert Winslow, an analyst with Wellington West, said IC Potash is “set to benefit from a resurgence in demand.” Because, prices for “premium” potash are still trending up and the acquisition of junior Potash One made remaining Potash juniors more valuable compelling him to “…re-rate all the junior potash stocks we cover with a positive bias.” Winslow recently raised his price target to $2.40 and “sees potential for the stock to trade above $8 by 2015.”

4. Western Potash (TSXV:WPX)

Western Potash, as its name suggests, is developing a potash project in Saskatchewan, the sparsely populated province in Western Canada that produces about a third of the world’s supply of the stuff. The company’s Milestone Potash Project is located in the central part of the province, about 35 kilometres southeast of Regina.

Saskatchewan potash deposits are deep, typically a kilometre or more underground. For deep deposits, a range of factors must be considered over and above the pure economics associated with building a processing facility. Historically, underground mining was not considered feasible if a deposit was deeper than 1100m below surface. Western Potash’s deposit is way underground; the potash rich ore is located at a depth of 1,700 meters.

So what’s the solution for Western Potash? Solution mining. Solution mining is a process used to extract minerals using an aqueous leaching solution. A liquid is pumped into a deposit and makes contact with the ore. The resulting solution is then pumped to the surface and processed. The process was discovered in the 1960’s and is only now being used to mine salts such as potash, copper and uranium. Australia’s Beverley Uranium Mine is the first operating solution, or in-situ mine in the world.

Solution mining can be tricky business. Certain temperature conditions, for example, need to be available in order for solution mining to work. A temperature greater than 50 degrees Celsius is generally required, implying a depth of at least 1,450 meters. Solution mining begins by undercutting the mineralized zone by dissolving an initial cavern below the seam of interest within the potash beds. This is followed by dissolving the salt and potash upward and through the mineralized beds while utilizing a “ceiling cap”. The oil or gas ceiling cap inhibits vertical cavern growth until a large area is undermined. Mining then progresses vertically by raising the cap and dissolving mineralized portions of the roof. The minerals are then recovered from the saturated fluid by recrystallization. After mining the empty caverns may be useful for underground storage, and are sometimes more valuable than the minerals produced during cavern development.

Western Potash management believes its potash properties are top notch candidates for solution-mining. A NI-43-101 resource estimate determined the Milestone Project had 41 million tonnes of Measured Resource, 133 million tonnes of Indicated Resource, and 560 million tonnes of Inferred Resource with an average grade of around 30% KCl. The resource estimate, prepared by Agapito Associates, suggests an annual potash production rate of 3 million tonnes for well over forty years.

But building a potash mine is not an inexpensive proposition, the price tag associated with Western’s project is estimated at $2.5 billion. To that end, the company recently completed a $20 unit financing at $1.10 and, with the proceeds, has initiated their feasibility study for Milestone Project, engaging engineering consultants AMEC Americas. The MiningFeeds.com connected with Western Potash President and CEO Patricio Varas for an exclusive interview – CLICK HERE.

5. Amazon Mining (TSXV: AMZ)

The name Amazon Mining will tell you a little about the only Canadian listed potash junior operating in Brazil, but don’t get too attached to it. In the second quarter of this year Amazon, which is currently developing the Cerrado Verde potash project in Brazil, plans to change its name to Verde Potash. And with the year the company has had, why not?

Shares of Amazon rocketed from just over a dollar midway through 2010 to a high of $8.60 on January 21st of this year. The company has other assets, but it’s potash, and the unique opportunity the company has carved out in Brazil, that has investors bidding up the shares of the company.

Amazon’s potash project involves a little technology. The company plans on utilizing a relatively new extraction process that heats Verdete, or green slate, to almost 1,100 degrees Celsius to extract the potash. This process results in a new fertilizer, ThermoPotash, that the company believes will be more suited to the needs of the Brazilian marketplace. Brazilian soil is much more acidic than soil in other parts of the world, and the problem has been compounded by the agricultural use of potassium chloride. And potassium chloride, the fertilizer produced in Canadian potash mines, also washes away too easily in Brazil’s heavy tropical rains.

Brazil, which is the largest coffee and sugar cane producer in the world, is the world’s fourth largest user of potash and and the second largest importer. The country produces less than ten per cent of its annual needs. The country is aiming to reduce its import needs to 60% over the next five years.

Things are moving ahead quickly at Cerrado Verde. On March 8, 2010 Amazon received an initial National Instrument NI 43-101 compliant inferred mineral resource estimation of 105 million tonnes at 10.3% K20 Inferred Resource for its Cerrado Verde potash project. The company is currently undertaking a drill program with the hopes of expanding their potash resource. The good news kept rolling for Amazon when a preliminary economic assessment showed the project may have an an estimated life of a hundred years, more than double previous estimates. The assessment also showed that project capital costs are estimated to be between $150 and $250 million which, by international standards, is considered quite modest.

For 5 Potash Stocks to Watch in 2011 – Part 1 – CLICK HERE.

Potash is hot. Allana’s potash might be just a little hotter.

That’s because Toronto based Allana Potash’s (TSXV:AAA) property is located in the Danakil Depression of Ethiopia, one of the lowest places on earth not covered by water, and, with temperatures routinely soaring to over 60 Celsius, the hottest.

When Potash was discovered in this basin near the Red Sea in 1918, most wouldn’t blame anyone for simply turning their back on it. But the quality and amount of potash available here, as Allana’s short experience in the region is already proving, means the appeal is simply too lucrative, even in the excruciating heat of the Danakil Desert.

Potash production began in the Danakil in 1918 after a railway was completed from the port of Mersa Fatma in Eritrea to an area 28 km outside of Dallol. But when large-scale supplies from Germany, USA, and USSR came to market the region sat dormant for decades.

But just a few years ago, with Potash high in demand again, Etiopia and Eritrea governments granted a number of licenses. Allana’s property surrounds Sainik’s Crescent Potash Project and is adjacent to BHP Billiton’s holdings in the Depression. When Allana acquired its Ethiopian potash concessions in September, 2008 the transaction was supported by a NI-43-101 compliant technical report from ERCOSPLAN Ingenieurgesellschaft and North Rim Exploration. That report showed an inferred mineral resource of 105,200,000 tonnes of potash mineralization (Sylvite and Kainite) with a composite grade of 20.8% KCl with near surface mineralization was presented.

Since acquiring the concessions Allana has been busy developing the project, attracting a $12.3 million strategic investment from Liberty Metal and Mining; 17% ownership stake, and a two million dollar investment from China Mineral United Management. Then, On March 1st, Allana completed $38 million in financings from a syndicate of brokers and an over-allotment option from Liberty Metals.

Recently The MiningFeeds.com talked to Farhad Abasov, President and CEO of Allana Potash about their experience in the Danakil and the 154,000 hectares land position the company holds in the Nequen province of Argentina.

The Danakil Depression in the Afar Region of Ethiopia is noted as the hottest place on earth and, based on the photos I’ve seen from the area, is one of the most visually stunning. Could you tell our readers a bit about the region and the people who inhabit the area.

The Danakhil Depression is truly one of the most interesting locations in Ethiopia. The Dallol area is very hot and is approximately 125 metres below sea level. In the centre of the Dallol area sits Dallol Mountain which contains active hot springs that spew smoke and sulphur and form terraces with unique geological features. Surrounding the Dallol Mountain, which is really just a small hill, is a very flat white salt plain similar to other salt plains around the world. The area is virtually uninhabited due to the hot climate where year round temperatures average 40°C and lack of rainfall. On the flanks of the depression Afari nomads come to the area in the cooler months with their goat herds and to mine salt and export it to market in camel caravans. Allana currently employs approximately 25 Afaris and we have found them to be reliable workers, keen to learn and very friendly.

From 1998 to 2000 Eritrea and Ethiopia were at war and in 2007 there was a hostage taking by Eritrean militia in the area along the Eritrea and Ethiopia boarder – what is the current political state concerning the disputed border region?

The border is very quiet now although Ethiopia does maintain a military presence near the small village of Hamadela. The border is approximately 20 km from our camp but for the past three years that Allana has been working in the area there have been no incidents whatsoever.

By way of background, could you explain the genesis of Allana Potash and talk about some of the early challenges and successes your company faced?

Allana Potash grew from Allana Resources which was a company formed in Canada. Allana entered into an agreement in 2008 to earn 100 % of the project and began field studies in 2008 and 2009 followed by camp construction and drilling in 2010. The main early challenges faced by the company were related to the poor infrastructure in the region and the climate. Early in the program it was recognized that a modular camp complete with air conditioning, kitchen, showers etc. would be necessary to conduct advanced exploration on the project. While the project had been drilled in the 1950s and 1960s, additional drilling by Allana would be necessary. To facilitate our exploration efforts the government of Ethiopia rehabilitated and modified about 60 km of road to provide good access to the area and allow heavy machinery to make it to site.

The company experienced many successes in 2010 including the completion of the first drill holes in the region in almost 40 years, completion of a seismic program in the evaporite basin and expanding our land position. To date Allana has completed 11 drill holes all of which intersected potash and some at fairly shallow depths, as shallow as 110 metres.

In March last year it was reported that that China Investment Corp and their $300 billion Sovereign Wealth Fund was looking at your Dallol potash project – where is the company at with these discussions?

Allana was actually not directly involved in these discussions. However, we have been actively discussing our project with other potential development partners. We are looking at partners who can contribute to the development of the project either financially or technically. And in the last 6 months, Allana has succeeded in bringing two strong partners to the table to support our project.

Would you mind telling us more about your partners and their value to Allana?

In November 2010 Liberty Metals and Mines, a private equity fund that is a part of Liberty Mutual Group based in Boston, invested over $12 million in Allana and showed a strong commitment to assist Allana at the construction stage financing. And recently, on March 24, Allana announced a strategic investment of $10 million by a very strong group, IFC – part of World Bank Group. IFC is one of the largest multilateral financing organizations contributing to the development of key mining, infrastructure and industrial projects worldwide. In fiscal 2010, IFC invested $18-billion internationally and our board believes the support that IFC can provide to us in Ethiopia is significant.

This interview appeared in 5 Potash Stocks to Watch in 2011 – Part 1 – CLICK HERE for the article.

Western Potash, as its name suggests, is developing a potash project in Saskatchewan, the sparsely populated province in Western Canada that produces about a third of the world’s supply of the stuff. The company’s Milestone Potash Project is located in the central part of the province, about 35 kilometres southeast of Regina.

Saskatchewan potash deposits are deep, typically a kilometre or more underground. For deep deposits, a range of factors must be considered over and above the pure economics associated with building a processing facility. Historically, underground mining was not considered feasible if a deposit was deeper than 1100m below surface. Western Potash’s deposit is way underground; the potash rich ore is located at a depth of 1,700 meters.

So what’s the solution for Western Potash? Solution mining. Solution mining is a process used to extract minerals using an aqueous leaching solution. The solution is pumped into a deposit and makes contact with the ore. The resulting solution is then pumped to the surface and processed. The process was discovered in the 1960’s and is only now being used to mine salts such as potash, copper and uranium. Australia’s Beverley Uranium Mine is the first operating solution, or in-situ mine in the world.

Solution mining can be tricky business. Certain temperature conditions, for example, need to be available in order for solution mining to work. Generally a temperature greater than 50 degrees Celsius is required, implying a depth of at least 1,450 meters. Solution mining begins by undercutting the mineralized zone by dissolving an initial cavern below the seam of interest within the potash beds. This is followed by dissolving the salt and potash upward and through the mineralized beds while utilizing a “ceiling cap”. The oil or gas ceiling cap inhibits vertical cavern growth until a large area is undermined. Mining then progresses vertically by raising the cap and dissolving mineralized portions of the roof. The minerals are then recovered from the saturated fluid by recrystallization. After mining the empty caverns may be useful for underground storage, and are sometimes more valuable than the minerals produced during cavern development.

Western Potash management believes its potash properties are top notch candidates for solution-mining. A NI-43-101 resource estimate determined the Milestone Project had 41 million tonnes of Measured Resource, 133 million tonnes of Indicated Resource, and 560 million tonnes of Inferred Resource with an average grade of around 30% KCl. The resource estimate, prepared by Agapito Associates, suggests an annual potash production rate of 3 million tonnes for well over forty years.

But building a potash mine is not an inexpensive proposition, the price tag associated with Western’s project is estimated at $2.5 billion. To that end, the company recently completed a $20 unit financing at $1.10 and, with the proceeds, has initiated their feasibility study for Milestone Project, engaging engineering consultants AMEC Americas. The MiningFeeds.com connected with Western Potash President and CEO Patricio Varas for an exclusive interview.

Western Potash went public in 2008 just before the financial crisis hit the markets – can you tell us a bit about that experience?

It certainly was an exciting period for Western Potash. We raised a significant amount of capital ($20 million) privately prior to our ($23 million) IPO in May 2008. With hindsight we had impeccable timing as the markets fell apart a few months after. So we were able to weather the financial storm and begin the exploration work that the project demanded. We were able to discover 3 new and distinct potash deposits. 2 in Manitoa and 1 in Sasaktchewan. We settled on the best potash address in the world- Saskatchewan Canada. We were offered a plethora of potash projects, from Alberta to Africa during this period. Our philosophy ws simple – if we found a beter project we would snap it up. We never found anything to match our Milestone Sk. project. We have a stable supportive government , a clearly defined potash industry, predictable and manageable environmental permitting and regulation, an independent and large Tier 1 NI 43-101 potash resource and a solid technical and financial team behind it all. So far it’s been a great experience.

At the depth of the crisis shares of Western Potash traded all the way down to $0.15 but it has been a slow and steady recovery since the beginning of 2009. Apart from the rebound in the overall markets – what do you attribute your success to during the period?

I certainly believe it’s due to the slow recoginition of the quality of our Milestone project and the steady progress we made developing it. Today, we have clearly established a significant and unique Tier 1 NI 43-101 compliant potash resource that is gaining attention from a variety of global fertilizer, mining and state owned enterprises.

Another key component is that Western Potash has a great depth of exploration and development experience that we have been able to drawn on. Each one of our top 4 mining executives has spent time with Rio Tinto and has been involved in the process of bringing a mine into development. Whether it be 0ur discovery of diamonds at Diavik, gold at Lahir or copper at Sto Domingo Del Sur our exploration team has proven it can deliver results. The Western team knows what needs to be done and, perhaps more importantly, we also understand what the majors are looking for. That’s why we parked our claim on top of a geothermal heat anomaly. This one factor should contribute enormously to lowering our cost of production as a viable solution mining operation; and, low cost production is major factor for Tier 1 companies looking for new project entry points. Our Scoping Study does a good job of encapsulating this fact.

Could you tell us about the current status your project?

We have begun the Feasibility Study Process. We have engaged AMEC Americas Ltd as the lead consultant for this process. Headquartered in Saskatoon they are completing expansion work at Potash Corp’s mines and understand the potash sector and know saskatchewan intimately. We are now in the process of updating our NI 43-101 resource calculation (41 M t of measured, 133 Mt Indicated and 560 Mt of Inferred) to plug into the study. In Februaray we completed a small 2 well program to gather geotechnical information and expand the resource. In addition we have brought considerable new land into the resource area which will definitely enhance our Measured and Indicated resource estimates. We are also conducting trade-off studies with regards to water, energy, process technology, etc. Considerable focus is on our water, we have just signed an MOU for delivery of the water with the city of Regina. Fresh water for solution mining is critical and this new option will lower our CAPEX and potentially our OPEX.

In December last year the company completed a $20 million financing – do you have sufficient money to complete your feasibility study?

We have raised enough money to complete the prefeasibility study portion of the Feasibility Study Process and, with the execution of outstanding warrants, will bring in the remainder required to take us to Feasibility.

Given your strong financial position, is the company considering partnering as a mechanism for fast-tracking the project? If so, what type of capabilities would an ideal partner have to compliment Western Potash?

We are definitely actively pursuing a partner to work with to capitalize the project. Unlocking the value is a major part of the process with a project of this size and scope. The attributes of the “ideal partner” would be a purchaser of potash as a consumer or trader, project development and engineering expertise, and have the financial ability to cooperatively finance a $2.5 billion project. However, it is more likely that each one of those components will be spun out of the project and developed in association with the other components. Regardless of the partnership structure, going forward there will be a debt and equity component, an enormous EPCM contract; and, a long term secure supply of potash. Our mangement tean has just returned from a 2 week trade mission with the Saskatchewan government in India and we are our continuing to build our strategic relationships in China with yet another road trip to Beijing and Hong Kong next week. There is plenty of global interest in the Milestone project and we hope to convert that into long term shareholder value.

This interview appeared in 5 Potash Stocks to Watch in 2011 – Part 2 – CLICK HERE for the article.

The Danakil Depression is a geological depression in the Horn of Africa that includes three areas: the Afar Triple Junction; part of the Great Rift Valley where it overlaps Eritrea; and, the Afar Region of Ethiopia and Djibouti. About 1200 km² (463 sq mi) of the Danakil is covered by salt, and salt mining is a major source of income for many of the area’s local tribes. But it is not salt that has attracted the attention of the international mining community – it is potash.

The Dallol Desert is the lowest point within the greater Danakil Depression and the hottest place in the entire world at 100 meters below sea level. Potash was discovered there many years ago and production began in 1918 after a railway was completed from the port of Mersa Fatma in Eritrea to an area 28 km outside of Dallol. Potash production ended after World War I when large-scale supplies from Germany, USA, and USSR came to market. Activity in the region sat dormant until just a few years ago when a number of licenses were granted by both Etiopia and Eritrea governments.

In 2007 one of India’s largest mining companies Sainik Coal Mining was awarded a mining license to begin potash extraction in the Danakil Depression – the largest project in the region (estimated at 160 million tonnes). Sainik plans to invest $1.1 billion in the project.

Then on July 18, 2008 Bloomberg reported that the Ethiopia government granted a 17,000 square kilometre permit to BHP Billiton. In the same report, the Mines Ministry also confirmed that three Canadian companies were granted potash exploration licenses in the area.

In neighbouring Eritrea, South Boulder Mines, a company listed on the Australian Stock Exchange (ASX: STB), announced in July, 2009 that it was granted the Colluli Potash Project exploration licence by the Eritrean Ministry of Energy and Mines. Then it became more interesting when it was reported in March, 2010 that China Investment Corp and their $300 billion Sovereign Wealth Fund was looking at Allana Potash (TSXV: AAA) and their Dallol potash project.

And it’s not cooling down yet, yesterday Ethiopian Potash (TSXV: FED) emerged as the latest entrant on the scene and staked its claim on the area with the reverse takeover of G & B Central African Resources. Shares of Ethiopian Potash hit the market with a fervour trading seven million shares closing at $0.75 up nearly $0.60 on the day.

It is clear that the Horn of Africa is open for business. Gebre Egziabher the director of mineral operations for Ethiopia’s Mines Ministry recently stated, “The sector has seen a dramatic change, seven years ago, the West didn’t know about our mineral resources.” Ethiopia’s government is aiming to license 50 mineral-exploration projects every year and more than double exports from the industry to $1 billion in five years.

Food, these days, is headline news. The 2007 Mexican tortilla riots, which came after a sudden and sharp rise in the price of corn, seemed an isolated incident at the time, but were actually the beginning of something much larger. From Algeria increasing wheat supplies after food riots in that country, to to the suicide of a Tunisian fruit seller sparking a revolution, what we eat and how much we pay for it has become political.

The prices we now pay for most any food item are, by most accounts, higher than they have ever been. The UN’s Food and Agriculture Organization reported that in February their Food Price Index rose for the eighth consecutive month.

So where is this heading? Last month, The Economist speculated that food production “will have to rise by 70% by 2050 to keep pace with population growth, the explosion of developing countries’ megacities and the changes in diet that wealth and urbanization bring.”

Canada has not experienced food riots, but one word puts us squarely into the center of any story concerning food worldwide: potash. Potash, a mined salt that is especially high in potassium, is used to improve the nutrient value, yield and water retention of most any crop. The price of potash has skyrocketed of late, from under $100 a ton in 2004 to near $500 a ton today. Much of the rise in the price of potash is because of China. China, the world’s largest consumer of potash, has twenty-two per cent of the world’s population but less than ten per cent of its arable land. Canada, as anyone who followed the BHP Billiton saga lay out on parliament Hill will know, is the world’s largest producer of potash.

Just months ago, Vancouver’s Passport Potash (TSXV:PPI), a company based in Vancouver but acquiring properties in the US, might have seemed an unlikely candidate to factor in the potash story. Passport, as late as three quarters ago, was almost comically under capitalized. The company’s financial statements for the quarter ended May 31st of last year showed a cash position of just $291. Still, Passport owned mineral property options in The Holbrook basin of Arizona, a shallow Potash deposit in Navajo County Arizona that was first identified in the 1960’s, but never developed due to low Potash prices at the time.

In late December Passport intercepted Potash on its first drill hole at Twin Buttes Ranch, an area that had never been drilled before. The success the company had in Arizona turned a proposed $5 million private placement in January into $7 million offering that was completed in February. Passport now controls over 70,000 acres of land in the Holbrook Basin, an area it estimates could contain 2.5 billion tons of potash. Shares of Passport, which could be had for $.06 on October 22nd of last year, hit a high of $.98 on February 25th.

Recently, BMO Capital Markets analyst Joel Jackson told the Financial Post that Passport is part of a larger phenomenon in which “the most speculative, early-stage (potash) companies are performing the best.” Jackson suspects some juniors will ultimately disappoint as more information becomes available about their properties while others will become takeover candidates.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

SDR.V | +66.67% |

|

BSX.TO | +66.67% |

|

GRI.V | +50.00% |

|

GGL.V | +42.86% |

|

SGU.V | +40.00% |

|

CTN.V | +33.33% |

|

RKR.V | +33.33% |

|

CASA.V | +30.00% |

|

CVB.V | +29.17% |

Comstock Mining, Inc. Comstock Mining, Inc. |

LODE | +27.22% |