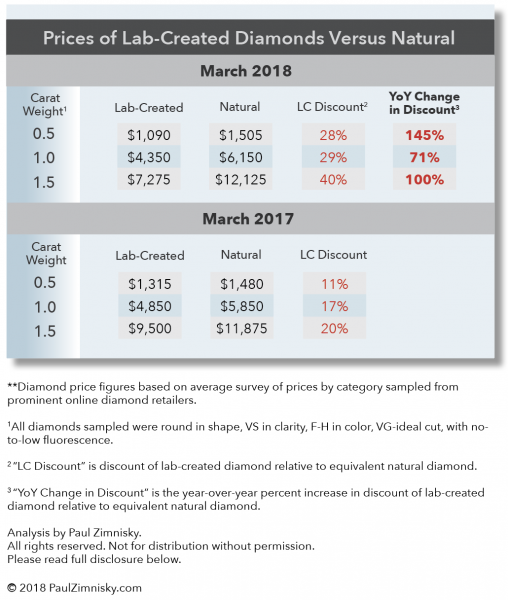

The discount of gem-quality lab-created diamonds, manufactured for use in jewelry, relative to natural diamonds has doubled from 11-20% a year ago to 28-40% today, according to a survey of prices.

For example, a white, 1-carat round diamond that is VS (very-slightly included) in clarity, F-H (near-colorless to colorless) in color, VG-ideal cut, with no-to-low florescence was selling for approximately $4,850 in March 2017 but is now $4,350 in March 2018, a 10% decline.

However, over the same period of time the price of an equivalent natural diamond went from $5,850 to $6,150, representing about a 5% increase. Thus, the discount of the lab-created diamond relative to the natural equivalent was approximately a 17% in March 2017, but is now about 29%, a 71% year-over-year increase.

See table below for more examples:

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in just the last few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufacturers.

Lab-created diamonds are becoming less expensive relative to natural equivalents as investment in lab-diamond production technology has rapidly improved production economics in just the last few years. This has led to rapid relative supply growth and an environment that is more price competitive for lab-diamond manufacturers.

However, actually gauging lab-diamond supply growth is difficult. The global proliferation of lab-diamond production facilities in recent years, from China to Russia to the U.S., has made tracking production figures challenging, especially given that the companies involved are private and proprietary in nature. Further complicating the process is the range in quality and scale at which lab-diamonds are being produced.

Natural diamond production quality can be segmented as approximately 40% gem-quality, 20% near-gem-quality, and 40% industrial-grade. Gem-diamonds are used in jewelry, industrial-grade diamonds are used for abrasive and other industrial application, and near-gem diamonds are used for both jewelry and more-specialized industrial application, with the split of use dependent on market prices and demand.

It is important to note that natural industrial-grade diamonds are simply seen as a by-product, as the presence of gem-quality diamonds in a deposit are what drive the economics behind natural diamond production decisions.

In the case of lab-diamonds, the ability to create higher-quality gem-diamond product economically is a relatively recent development –within the last decade. Even with the recent developments in technology, current lab-created production of true gem-diamonds only represents <10% of global output, estimated at <5M carats, which compares to natural gem-quality output of ~60M carats (based on 40% of an estimated total natural production of 147M carats in 2018).

The business of manufacturing lab-created diamonds for industrial application (typically referred to as synthetic diamond) has been around for decades, and the industry currently supplies >99% of global industrial diamond supply for use as abrasives (production is in the billions-of-carats for context).

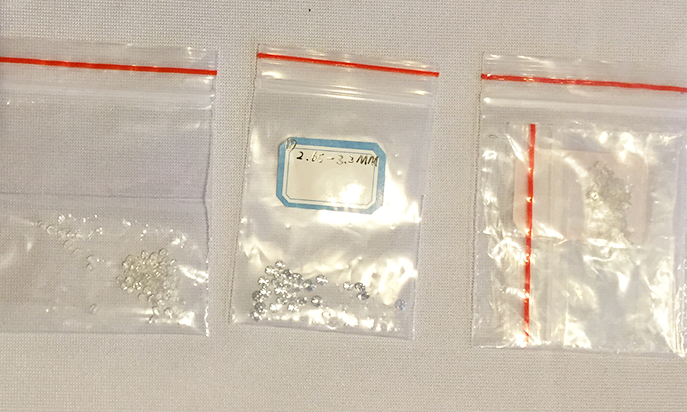

Lab-production of near-gem-quality diamonds is where supply analysis gets especially challenging. Producers of synthetic industrial-quality diamonds have been advancing their production capability through improved technology which has enabled them to increase the quality of their product from industrial to near-gem quality. Given that billions-of-carats of industrial-quality diamonds are produced each year, it becomes apparent that lab-created near-gem production could be in the hundreds-of-millions of carats; and some of this product is being passed off for use in jewelry –which is primarily used to embellish larger-stones and for use in pavé settings.

The natural diamond industry has been proactively developing affordable screening technology so that lab-created diamonds of all quality and sizes used in jewelry can be properly disclosed and sold as such.

As lab-diamond production continues to accelerate, it seems inevitable that the price spread between lab-created and natural diamonds across all sizes and qualities will continue to widen, especially in the case of generic lab-diamonds, those that are not supported by a manufacturer or retailer’s brand.

Medium-to-longer-term expect the dialog surrounding lab-created diamonds to shift from jewelry to application in high-tech developments such as processing chips, optics, laser devices, and thermal conductivity equipment. The unique properties of diamond make the application potential exciting and wide, and the scientific and tech community has just begun to scratch the surface of its potential.

The high-tech industry enthusiastically awaits economically available mass-produced high-quality diamond, the lab-diamond manufacturers know this and most are just using jewelry as a stepping stone.

—

For more on lab-created diamonds see: Lab-created Diamonds: Where to Go from Here?

Paul Zimnisky is an independent diamond industry analyst, author of the Zimnisky Global Rough Diamond Price Index and publisher of the subscription-based State of The Diamond Market monthly industry report. On May 9th, 2018 he will be speaking at the Mines and Money investor conference in New York City. Paul can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky.

by: Paul Zimnisky

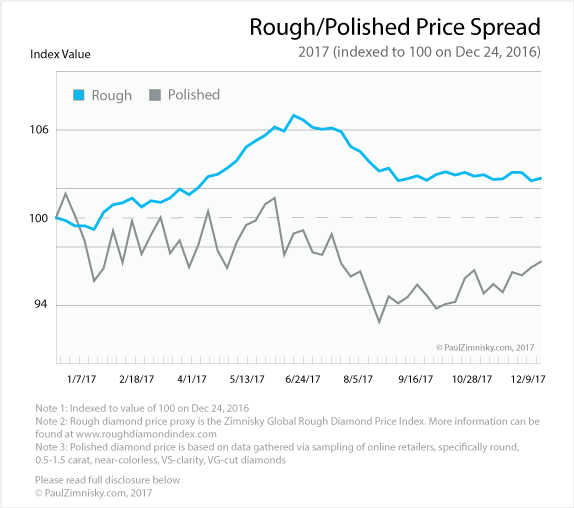

Through mid-December 2017, rough diamond prices are up 2.7%* year-to-date, while polished prices are down 3.5%**. However, despite shrinking manufacturer margins, the midstream segment of the industry still bought $5.3B worth of diamonds from De Beers this year, including $450M at the final sight which was 7% over the comparable sight last year and 81% over 2015.

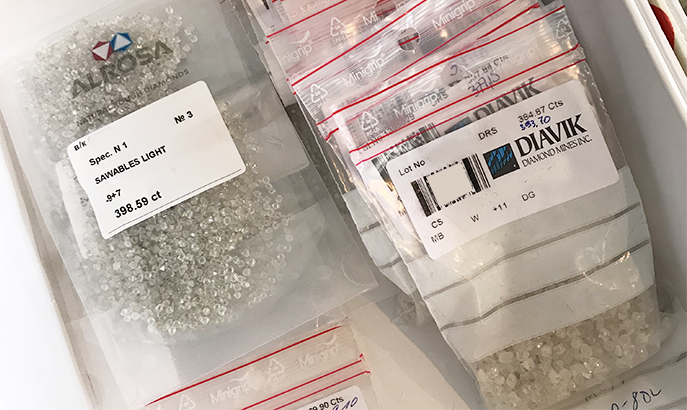

De Beers’ full-year sales were -5% relative to last year and +53% over 2015. Russian-major, ALROSA (MICEX: ALRS), is on pace to sell $4.4B of diamonds in 2017, which would be in line with 2016 and 27% over 2015.

2017 has been a year of excess inventory shifting from the upstream segment of the diamond industry to the mid-stream segment. For instance, industry leaders De Beers and ALROSA have both see their inventories decrease by an estimated 1.6M and 2.3M carats, respectively, through Q3 2017, this despite both producers also increasing production this year.

World-wide natural diamond production is estimated to rise to approximately 148M carats in 2017 which would be a 7% increase in volume over last year. The increase mostly due to the commencement of production at three new mines, the ramping-up of production at previously curtailed operations and expansion projects at legacy mines.

Despite various operating setbacks and political challenges that have disrupted production at multiple mines this year, including an accident that has since halted production at ALROSA’s Mir mine, most major miners are still on pace to produce towards the higher end of guidance ranges.

Most industry participants would agree that the first half of 2017 was strong, however, the second half relatively disappointing. Demand for rough returned aggressively in early-2017 as manufacturers in India recovered from the late-2016 liquidity crisis caused by the government’s demonetization of high denomination bank notes.

However, by mid-year, new polished entering the market compounded an already overstocked global polished inventory and manufacturers noticeably pulled back operating activity punctuated with longer-than usual Diwali factory closures in the fall.

In recent weeks manufacturer activity has begun ramping up again, as the industry prepares to replenish Christmas and Indian wedding season stock and deliver for Chinese New Year demand.

The U.S. consumer market is currently supported by a relatively strong economy. With the stock market regularly making new all-time highs and with most employment figures at favorable levels, consumer sentiment is positive. Pending tax reform and the recent appointment of a new Fed chairman that favors continued dovish policy has supported this trend.

America’s largest jeweler, Signet Jewelers (NYSE: SIG), had a challenging 2017, however most of underperformance can be attributed side effects associated with the company restructuring, and not necessarily the appetite of the U.S. consumer. In fact, globally-diversified Tiffany & Co. (NYSE: TIF) recently noted the U.S. market as one of its strongest.

Tiffany also noted particular strength in the company’s Mainland Chinese market. Recent results from leading Greater China jeweler, Chow Tai Fook (HK: 1929), supports this as the company has seen same-store-sales growth for four consecutive quarters in its Mainland market and three consecutive quarters in Hong Kong/Maccu.

Luk Fook (HK: 0590), which has a greater exposure to Hong Kong than Chow Tai Fook (which is more Mainland focused), had same-store-sales growth of over 11% in the six-months ending September 30, which stands out against three prior comparable years of decline.

On November 21, Chow Tai Fook described the current market as a “turning point…given the nascent jewelry market recovery” and Luk Fook has recently described the climate as “improved.”

The U.S. is still by far the largest end-consumer market for diamonds at about 50%. Greater China, which includes Mainland China, Hong Kong, Macau and Taiwan, and India represent the industry’s fastest growing large markets.

Global diamond supply is estimated to marginally decrease about 1.5% in 2018 to 146M carats and global polished diamond wholesale demand is estimated to hit $26.6B next year, which would be a 3.8% increase over 2017.

Heading into 2018, here are some possible diamond industry catalysts to watch for:

- Indian billionaire Anil Agarwal who has a fond interest in diamonds and is now the largest shareholder of De Beers’ parent Anglo American (LSE: AAL) after accumulating shares throughout 2017, could make a move to gain control of the company in 2018

- Next year ALROSA will decide whether to rebuild or close the Mir mine after it sustained a flooding accident in August 2017; a decision to permanently close the mine would be supportive of global supply/demand dynamics, e.g. the loss of Mir production would offset the combined new supply from Renard and Liqhobong (two of the three mines that commenced production this year)

- In December Tiffany & Co. stock rallied to just shy of an all-time high in part due to takeover speculation, an event that could possibly play out in 2018 as favor for international luxury returns

- Lucara Diamond Corp (TSX: LUC) is back to mining fresh South Lobe ore, the portion of the Karowe ore body that produced the Lesedi La Rona and Constellation diamonds; with a new advanced large-stone recovery system in place, Lucara has the potential to produce more newsworthy diamonds in 2018

- Signet Jewelers could recover after a disappointing 2017 as company-wide restricting plays out, including selling its customer credit portfolio, closing underperforming mall-based stores, expanding at off-mall locations, integrating web and digital into sales strategies, and executive level change

- Zimbabwe’s government-run ZMDC (private) has commenced conglomerate mining at the Marange fields with $30M of new equipment which could increase production in 2018 to an estimated 3.5M carats from just over 2.0M carats in 2017

- De Beers’ Voorspoed mine in South Africa, Gem Diamond’s (LSE: GEMD) Ghaghoo mine in Botswana, and previous-Rio Tinto (LSE: RIO) diamond project, Bunder, are all up for sale and could have new owners in 2018

- As production at De Beers’ and Mountain Province Diamonds’ (TSX: MPVD) Gahcho Kué mine approaches deeper depths in 2018, more production could come from center-lobe ore which is expected to be of lower grade but host higher-quality diamonds

- Kennady Diamonds (TSX-V: KDI) and Peregrine Diamonds (TSX: PGD) both disclosed that they had been in discussions with potential strategic partners in 2017, an indication of possible deals in 2018

- Stornoway Diamonds’ (TSX: SWY) waste sorting circuit which is being installed to alleviate diamond breakage during processing could prove effective when it goes live in Q2 2018, the likely result being a higher average diamond price achieved for Stornoway’s Renard goods

- Following a disappointing 2017, mining of lower grade areas at Firestone Diamonds’ (LSE: FDI) Liqhobong mine nears completion and production is expected to move to areas of the open pit that host higher quality diamonds in 2018

- A review of the proposed South African Mining Charter will take place in mid-February 2018, which could have implications on ownership and operations of diamond companies in the country including De Beers and Petra Diamonds (LSE: PDL)

- Further work at Luaxe in 2018, arguably the most important undeveloped diamond project in the world, could provide further clarity on resource and production details and a production start date, which is now anticipated for some time after 2020

- A continued weaker U.S. dollar in 2018 could support momentum in global consumer luxury demand, while a shift in trajectory could have an adverse effect

- An updated feasibility study on Shore Gold’s (TSX: SGF) Star-Orion South project in Saskatchewan Canada, is anticipated in 2018, which could change the economics of the project by reducing an almost $2B pre-production capex

- North Arrow Minerals (TSX-V: NAR) is expected to set up an exploration camp and drill its Mel property in 2018, the site of Canada’s newest diamond discovery, which could further indicate the significance of the discovery

- Lab-created diamond production expected to continue to increase in 2018, however wider-consumer appetite for the product is still unclear and production of larger gem-quality stones is still just a fraction of the natural equivalent production

- Dunnedin Ventures (TSX-V: DVI) has plans to conduct the company’s first drill program in 2018 at its Kahuna project in Canada’s Nunavut territory which could result in a new discovery near Agnico Eagle’s (TSX: AEM) Meliadine gold mine currently in development

- Lucapa Diamond (ASX: LOM) expects to commence production at Mothae in Lesotho in the second half of 2018, a mine with the potential to produce diamonds worth in excess of $1,000/ct on average

- The Diamond Producers Association, established by the diamond industry to return generic marketing to diamonds, could impact consumer demand following the launch of a second U.S. campaign and first Indian campaign in November 2017 and first Chinese campaign in April 2018

- Five Star Diamonds (TSX-V: STAR) plans to continue progressing exploration and development on over 20 kimberlite projects in Brazil in 2018, which could lead to Brazil eventually becoming a more important contributor to global diamond supply

- U.S.-based lab-created diamond producer, Diamond Foundry (private), plans to build a “MegaCarat foundry” in Washington state, with first reactors expected to be deployed by Q2 2018, which would add to the company’s current annual production estimated at approximately 100k carats

—

*Rough diamond price based on the Zimnisky Global Rough Diamond Price Index. More information can be found at www.roughdiamondindex.com. **Polished diamond price based on data gathered via sampling of online retailers, specifically round, 0.5-1.5 carat, near-colorless, VS-clarity, VG-cut diamonds.

All figures in U.S. dollars unless otherwise noted.

De Beers is 85% owned by Anglo American plc and 15% owned by the Government of the Republic of Botswana.

At the time of writing the author held a long position in Lucara Diamond Corp, Stornoway Diamond Corp, Mountain Province Diamonds Inc, Kennady Diamonds Inc, Tsodilo Resources Ltd, North Arrow Minerals Inc, Signet Jewelers Ltd and Peregrine Diamonds Ltd. Please read full disclosure below.

Paul Zimnisky is an independent diamond industry analyst, author of the Zimnisky Global Rough Diamond Price Index and publisher of the subscription-based State of The Diamond Market monthly industry newsletter. In 2018, he will be speaking at Mining Indaba in Cape Town, South Africa on February 6, and Mines and Money in New York on May 9. Paul can be reached at paul@paulzimnisky.com and followed on Twitter @paulzimnisky.

On November 1st, De Beers said that it will be closing its nearly depleted Victor diamond mine in northern Ontario in early 2019. Victor is the first in a line of legacy diamond mines world-wide that will be closing over the next 5-years.

Most notably, Rio Tinto’s illustrious Argyle mine in Australia is expected to shut operations in 2021. At peak production, in the mid-90’s, Argyle produced over 40M carats annually. To put that into perspective, total 2017 global diamond output is estimated at less than 150M carats.

De Beers Voorspoed mine in Botswana is on pace to reach end-of-life by the end of the decade, and a slew of the company’s alluvial mines in Namibia are planned to be phased out by 2022.

With global diamond demand forecast to grow at approximately 3.5% annually over the next five years, driven by middle class consumers in Mainland China and India, the industry’s fastest growing large markets, a supply gap down the line seems inevitable if forecasts hold.

Globally there only two new diamond projects in the works with annual production potential of in excess of 1M carats, one in Angola, the other in Russia. Further, new diamond project exploration has been limited by challenges in the upstream diamond industry’s primary jurisdictions.

Greenfields diamond exploration in South Africa is at multi-decade lows due to delays in granting of prospecting licenses and perceived risks of a new Mining Charter, and this year there was a production disruption at the Williamson diamond mine in Tanzania related to government changes in mining legislation.

In Botswana, home to De Beers’ primary asset base, the country has been heavily explored and most major diamond discoveries are assumed to already have been made. In Russia, most major diamond production in is controlled by government entities.

This makes Canada, already the third largest diamond producing nation in the world by value (see chart above), arguably the most prospective diamond exploration jurisdiction in the world. In May of this year, Canada’s leading diamond producer, Dominion Diamond (private), pledged to spend C$50M on exploration over next 5 years, the company’s first major greenfields exploration since 2007.

After being acquired for US$1.2B in July by private-held the Washington Companies (at a 44% premium to where the stock was trading the day before initial indication of interest was made), on November 1st Dominion reiterated plans of “reinvigorating” exploration programs in Canada.

Dominion is partnered with North Arrow Minerals (TSX-V: NAR) on the prospective “Lac de Gras” property, which is located within a diamondiferous kimberlite field in the Northwest Territories that is the source to some of the richest diamond deposits in the world, including Dominion’s two world-class mines, Ekati and Diavik.

Dominion’s partner is known for making 2 of the only 5 kimberlite discoveries made in Canada over the last 5 years, and both of North Arrow’s discoveries were diamond bearing. Just last month North Arrow announced a discovery at the company’s 100%-owned Mel project in in the Nunavut territory of Canada. The company has plans to set up an exploration camp and drill the property next year.

Mel is approximately 200km northeast of the North Arrow’s 100%-owned Naujaat property which already has an inferred resource of over 26M carats and contains fancy yellow and orangey-yellow diamonds. In September, the company completed a C$2M drilling and mini-bulk sampling program at the property with results expected in the coming months. North Arrow also has pending results from a till sampling program at its Pikoo project, a 100%-owned diamond bearing kimberlite project in Saskatchewan that was discovered by North Arrow in 2013.

This coming March, Dominion will lead a drill program at the aforementioned Lac de Gras joint-venture (69% Dominion/31% North Arrow) in hopes of discovering new diamondiferous kimberlites. At around the same time North Arrow will also be drilling at its 100% owned Loki project, also in the Northwest Territories, and approximately only 30-40km away from both Ekati and Diavik.

With active programs across multiple worthy projects in Canada’s premier diamond territories, North Arrow appears well positioned to add to previous success and maintain its status as Canada’s leading publicly-traded stand-alone diamond explorer.

Disclosure: Paul Zimnisky has been compensated by North Arrow Minerals to produce the above content. The content includes views that are based on observations and opinions. The author has made every effort to ensure the accuracy of information provided, however, accuracy cannot be guaranteed. The above content is strictly for informational purposes and should not be considered investment advice. Consult your investment professional before making any investment decisions. None of the parties involved accept culpability for losses and/or damages arising from the use of content above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Adex Mining Inc. Adex Mining Inc. |

ADE.V | +100.00% |

|

CCD.V | +50.00% |

|

WGF.V | +33.33% |

|

RUG.V | +33.33% |

|

ROX.V | +33.33% |

|

DMI.V | +33.33% |

|

IZN.V | +33.33% |

|

CASA.V | +30.00% |

|

SMN.V | +27.27% |

|

PEX.V | +25.00% |

Articles

FOUND POSTS

Orosur Mining (TSXV:AIM) Provides Update on Exploration at Anzá Project

December 31, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan