By: Paul Farrugia

Gold and silver mining stocks face increased risks and uncertainty in 2018, not seen by investors and mining management teams for quite some time. Many of the top risks to gold stocks are related to geopolitical and financial, which will only compound the already high operational risks. Many of these top risks to gold stocks can be applied to silver stocks and any commodity stocks as well. What was most interesting, many of these risks are not seen as a concern to the management teams of Newmont Mining or Barrick Gold when going through their 10-Ks, versus the elevated risks the investment community sees in the macro landscape. Is the investment community concerned with many risks or is management thinking many of the risks won’t happen to them? These risks can heighten mining risk because of the elevated geopolitical and financial risks, potentially disrupting supply, and driving up gold prices even further without gold demand increasing. Are these the catalysts that will push up higher gold prices?

HISTORY REPEATS

Over a long-term enough time horizon, the sixteen biggest risk events repeat, but with a slight twist. The risks are the same, but the characters in the play are different. Capital controls, nationalization of assets, labor disputes, increased regulation on assets, and royalty changes. They all have occurred during different time periods, at some point or another. Most are tied to miners generating an incredible amount of profits, and individual countries wanting to get a bigger share of those revenues. It’s hard to move a mine, putting the mine at increased operational and political risk to earn more on those assets.

GEOPOLITICAL RISKS

- Geopolitical Escalations Disrupting the Supply-chain

- Government Election Uncertainty

- Tariffs (on Mine Supplies)

- Export Restrictions of Commodities

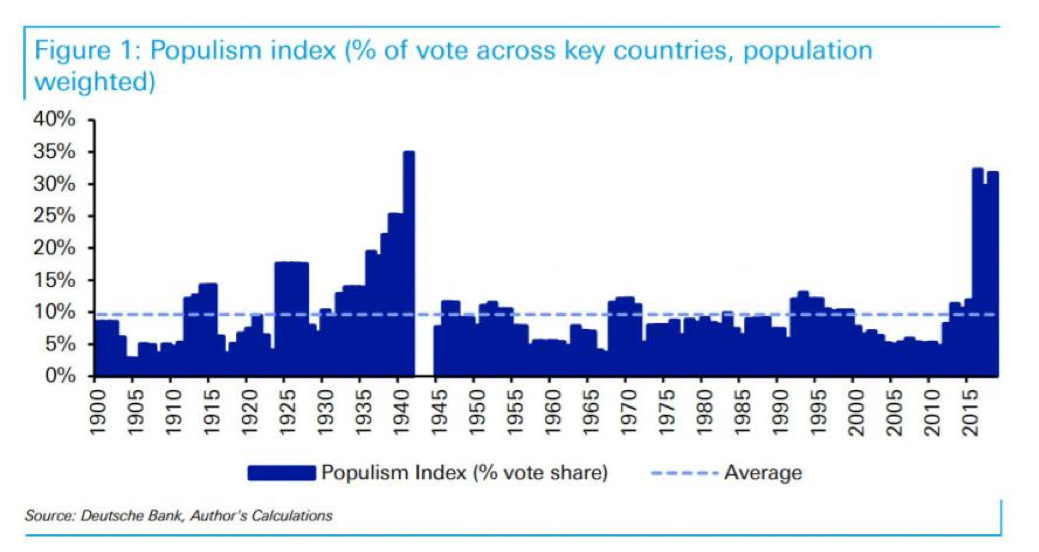

Supply disruptions from geopolitical are at heightened levels of risk not seen since the 1930’s and 1940’s, because of increased geopolitical risks. All of this political uncertainty increased demand for all private assets (not just gold).There is a shift from public assets to private assets.

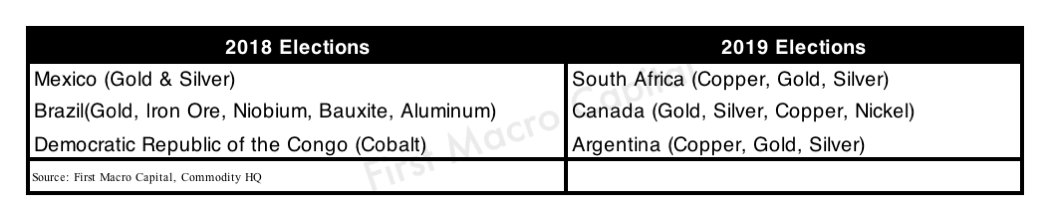

Geopolitical risks are always the hardest for management and investors to get a firm grip on. It requires so many “ifs or if that”, to really pinpoint which will do harm to the mine operations. The geopolitical risks can impact other items that impact funding of the operations like capital controls or the mine operations supplies. A simple solution for investors to mitigate geopolitical risk is to see if the miner has its operations across more than one country, to limit any country-specific risk. There are also several general elections in 2018 and 2019 in commodity-specific countries. Mexico is a significant gold and silver mining producer, and it is having elections in 2018. Brazil also has its general election in 2018, its second largest export commodity in dollar value is gold. Brazil also produces more than 90% of the worlds Niobium, third largest producer of iron ore, and sixth largest producer of aluminum [1]. Heightened political matters will only increase throughout 2018 and continue into 2019, adding to already heightened geopolitical issues.

FINANCIAL RISKS

- Economic Slowdown

- ETF margin requirements reducing liquidity in mining ETF impacting financing

- Financial Taxation Changes by Governments

- Bail-in Risk to cash balance

- Rising Interest Rates

- Cash held Government Bonds – Debt Jubilee

The world continues to work through the debt issues, that have not been resolved since 2008 financial crisis. The risks at banks continue to remain elevated, particularly the European banks. We expect there will be a debt jubilee in some form, with shorter duration government bonds being converted into longer-dated bonds. Companies that are holding shorter-term term government paper as “safe” allocation for their cash, will be caught off guard if their government paper is re-adjusted to a longer duration. Corporate bonds are a better alternative. For Canadian and Australian miners they also face the added bail-in risk of deposits. Federal governments have explicitly stated that they will consider bail-in options, issuing depositors a clear warning. However, “This will never happen to us” management teams always say. Well, they have before, and they will again. If governments are already warning you what they will do in the next crash, and you fail to heed their warning. The list of repeat offenders is quite long.

Even Goldman Sachs CEO, Lloyd Blankfein is warning about the sovereign crisis coming next.

“What is kind of a little bit off. A lot of the bank issues in the United States and around the world have been solved. But migrating the problem to the sovereign balance sheets. So the banks look pretty good, but the Fed has $4 trillion of debton its balance sheet. And it’s even more, we are not in a European audience. In Europe they would really know what they meant because all the European banking system is fixed but Europeans are all also buying up all the debt. The budget deficits haven’t contracted, they’ve widened. The banks buy the debt, then walk over to the European Central bank, finance it. Get new money, so they can buy the next round of debt.

So, you have countries with way bigger deficits, as a percentage of GDP than the U.S., that are borrowing money for ten years, at 3.0% or 2.5%. Really? And the banks look ok.

It is the sovereigns that look risky, like Greece. You wonder is the next crisis going to be a sovereign crisis? And if it is, it will just be a continuation. People will look back and say.. what we really did, we didn’t fix the outcome of the financial crisis. We left that open and as a result, its really been a thirty-year workout.”Lloyd Blankfein [Source: CNBC]

THIS COULD NEVER HAPPEN?

LATE IN THE CYCLE COMMODITY ISSUES

- Labor price issues

- Government Expropriation Risks

- Royalty Regime increases on mining assets

Investors, who say that any of the above risks can never happen, fail to learn the lessons of history to see that, yes, these events have happened and they impacted miners at one point or another. They have impacted many miners over the past 30 years. My experience has taught me, that most investors only really look back far enough to the last crash as to what could happen. Every one of these late in the cycles issues (labor price pressures, government expropriation, royalty regime increases) have always all occurred during the last mining boom. We don’t see these late in the cycle commodity risks evident in gold and silver stocks at this time. Look at cobalt and the skyrocketing price increases. This resulted in governments stepping in and raising cobalt taxes. Investors and management should not be surprised that this occurred, but human beings rarely learn from the past lessons.

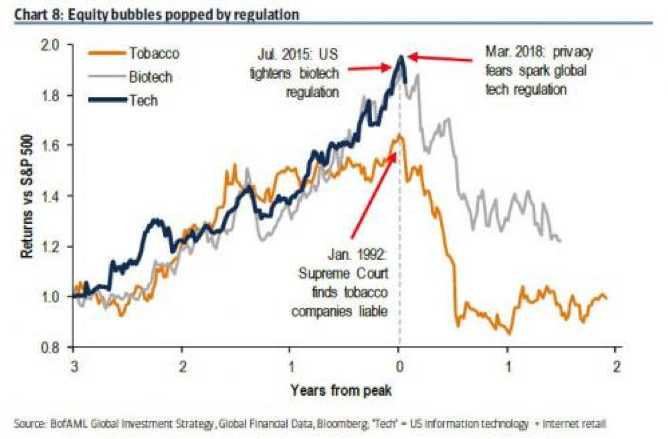

For the longer cycle-related events, the time period is much longer than the typical business cycle. By taking into account the business cycle and debt cycles in conjunction with the commodity cycle, you can see where the events will take place. One of my leading long-term bearish indicators in any industry is the regulation card because it has historically highlighted the top in the industry. The mining sector is not there yet.

RISK ALWAYS ON OPERATIONS

OPERATIONAL RISKS

- Mine start-up

- Cyber Espionage on Mines

- Regulatory changes on permitting

The risk to miners will always have the operational risks, particularly when the mine is starting up. Even the best construction engineers and site managers do their best to mitigate the mine risks. The financial and geopolitical poses an added layer of risk that could disrupt the supply chain.

MANAGEMENT TEAMS WILL RESPOND ONLY AFTER

History has shown that management teams from all industries will respond only to a situation or negative event after it has happened. “It couldn’t happen to me” or “That happened 30 years ago”. For the investor, it is better to assume that management will respond only after the event has happened. I am always concerned when the majority of new MBA’s choose a hot and trending industry to build a career in because the top is almost always nearby. We don’t see MBA’s flocking to the gold sector at issue at this time, which continues to make an unloved and unwanted, but excellent for the long-term investor.

FAILURE TO LEARN FROM PAST CYCLES

As this new commodity cycle takes fold, new management teams have entered the mining sector. Old management teams have either sold out, been fired or decided to call it quits after a number of mining cycles. Gone are the lessons from past cycles putting out fires, dealing with governments, capital raising, and operating expertise. This is why it is important to seek those management teams that have succeeded in the past and are still around. It will only increase the odds of success. For the new management teams, they have to earn investor’s trust. If investing in them, watch about putting all your money in from the start, because they will slip. That is certain.

OPPORTUNITIES FOR INVESTORS

Risk events can present opportunities for investors on assets because when investors indiscriminately sell stocks, they sell out the good ones. By thinking through risk events now, it allows investors and management CEO’s to better capitalize on opportunities that can present themselves because your weaker and ill-prepared peers won’t. The risks can also reduce overall gold supply and even with the heightened demand due to geopolitical and financial risks. The gold and silver sectors remain under-owned in relation to other sectors. Technology remains over owned particularly given it is at the beginning of incoming regulation.

“By failing to prepare, you are preparing to fail.” ― Benjamin Franklin

TAKE AWAY FOR THE PORTFOLIO MANAGER & GOLD STOCK ANALYST

Warren Buffett said it best, in managing risk in the investments one makes:

“The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.”

Better to focus on risk control

- Country Diversification- Reduce risks in the portfolio by diversifying across multiple countries.

- Financial Strength – Balance sheet counts at the end of the day. How management diversifies its cash will be critical reducing bank deposit risk and debt jubilee exposure.

- Margin of Safety – The greater the difference between commodity price and the mine’s All-In-Sustaining-Cost (AISC) reduces the chances of going bust should commodity prices fall.

- Investors can seek out less financially leveraged companies, and while ensuring the company is growth focused.

- Seeking companies with high management ownership with a significant portion of their wealth in the company.

We have outlined the key geopolitical, financial, and operational risks that investors should be aware of and at least think through in their own portfolios and CEO’s in operating their businesses. 2018 is a period of elevated geopolitical and financial markets related risks to gold stocks. This elevated risk may be the catalysts that wake up the investment community and shift from public assets to private assets, benefiting commodities like gold and silver. While risk is always present when investing, there are risks that one can control, and there are risks that one cannot control.

“If you are not worried, you should be. If you are worried, probably less to be worried about” – Paul Farrugia

Paul Farrugia, BCom. Paul is the President & CEO of First Macro Capital. He helps his readers identify mining stocks to hold for the long-term. He provides a checklist to find winning gold and silver mining producer stocks, including battery metals.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan