OceanaGold (TSX:OGC) has announced results from ten drillholes completed as part of the ongoing exploration and resource conversion program at its Wharekirauponga (WKP) project in New Zealand. These holes, drilled after the cut-off date for the December 31, 2023 Mineral Resources estimate, continue to intersect high-grade mineralization in the East Graben (EG) Vein system.

The December 2023 Mineral Resources estimate outlined an Indicated resource of 1.0 million ounces at a grade of 15.9 g/t gold. The recent drilling has targeted both the southern and northern shoots of the EG Vein system, with opportunities remaining for up-plunge, down-plunge, and along-strike extensions of the vein. High-grade intercepts remain open, and step-out drilling in hole WKP100, the most southerly hole on the EG Vein, confirmed mineralization of comparable width occurring a further 200 metres along strike of the currently defined high-grade southern shoot. The company is awaiting final approvals for a new drill site to enable more effective drill testing of this strike extension.

The EG Vein system remains the primary, near-term target for drilling, with 11,300 metres planned in 2024, focusing on resource conversion and growth.

In related news, OceanaGold has welcomed the announcement by New Zealand’s recently elected Government to create a new one-stop-shop fast-track consenting (permitting) regime. This new bill aims to promote streamlined processes for regional and national projects of significance and accelerate the development of major projects. The Company believes that its Waihi North Project, which includes the development of Wharekirauponga, has the potential to meet the requirements for consideration under this new regime.

The Waihi North Project is expected to create significant socio-economic contributions for the communities in the Coromandel region and for New Zealand as a whole. This includes substantial in-country investments and a significant increase in direct and indirect employment opportunities. OceanaGold aims to develop a mine that aligns with its objective of reducing its carbon footprint and has a history of operating to the highest environmental and social standards, enabling it to run a successful and responsible mining business in New Zealand for over three decades.

The Company has lodged a resource consent application for its proposed Waihi North Project with Hauraki District Council and Waikato Regional Council.

Gerard Bond, President & CEO of OceanaGold, commented in a press release: “Today’s drill results align with our strategy of adding value through near-mine resource conversion and growth. Much of 2023’s drilling was focused on converting resources at Wharekirauponga and today’s results continue to demonstrate the excellent grade and continuity within the EG vein. Ongoing and planned drilling in 2024 will step out to the south on the EG vein to further define the extent of high-grade mineralization of this exceptional deposit. The recently announced introduction of the Fast Track Approvals Bill signals a new focus by the New Zealand government to facilitate the delivery of significant development projects, including mining. In its introduction into parliament, the Bill received strong support from the Minister for Regional Development and for Resources. We look forward to learning more about the Government’s criteria and process for fast-track approvals, given the potential for accelerated permitting of the Waihi North Project, which includes Wharekirauponga. Development of Wharekirauponga has the potential to contribute significantly to the New Zealand economy, while maintaining a strong focus on environmental and social stewardship.”

Highlights from the results are as follows:

- 61.9 g/t Au over 4.0 m from 534.4 m, EG Vein (WKP118C)

- 31.0 g/t Au over 5.2 m from 513.7 m, EG Vein (WKP124A)

- 58.5 g/t Au over 2.5 m from 474.7 m, EG HWS Vein (WKP118C)

- 19.0 g/t Au over 6.3 m from 471.9 m, EG Vein (WKP113A)

- 11.3 g/t Au over 6.7 m from 523.0 m, EG Vein (WKP111D)

Table 1: Wharekirauponga drill intersections subsequent to the December 31, 2023 resource update.

|

Drill Hole ID |

From (m) |

To (m) |

True width (m) |

Au (g/t) |

Ag (g/t) |

Vein |

|

|

WKP111D |

523.0 |

531.8 |

6.7 |

11.3 |

9.9 |

EG |

|

|

WKP118C |

474.7 |

478.3 |

2.5 |

58.5 |

96.6 |

EG HWS |

|

|

WKP118C |

534.4 |

540.7 |

4.0 |

61.9 |

80.0 |

EG |

|

|

WKP113A |

471.9 |

479.6 |

6.3 |

19.0 |

18.8 |

EG |

|

|

WKP113B |

478.4 |

487.5 |

7.5 |

7.4 |

5.7 |

EG |

|

|

WKP122 |

306.0 |

308.3 |

1.4 |

14.0 |

33.8 |

EG |

|

|

WKP123 |

307.3 |

310.4 |

2.0 |

8.9 |

27.2 |

EG |

|

|

WKP124A |

513.7 |

520.5 |

5.2 |

31.0 |

41.7 |

EG |

|

|

WKP125 |

320.9 |

322.2 |

1.0 |

16.5 |

28.5 |

EG |

|

|

WKP125 |

284.4 |

284.8 |

0.3 |

55.1 |

66.0 |

EG HW |

|

|

WKP126 |

298.3 |

299.6 |

0.8 |

2.3 |

7.0 |

EG |

|

|

WKP127 |

365.6 |

369.4 |

1.9 |

6.4 |

20.8 |

EG |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

While serious concerns linger in the markets about the strength of the swing up, gold mining stocks have continued their leg higher. The first quarter of 2021 was a positive period for gold miners, creating a new extended rally to bring most back to pre-pandemic levels. While most of the biggest miners have been doing well, a drop in the gold stock benchmark and trading vehicle GDX VanEck Vectors Gold Miners ETF of 9.8% in Q1 demonstrates a lack of equality in the gains.

Sentiment Uncertainty Turns to Directional Confidence

Gold itself lost 10% through the period, but has rebounded quickly in Q2. This has been a big boost to miners, particularly in the US. It has been the majors that propped up the GDX in Q1; these stocks often amplify gold’s material moves by two or three times. As spot gold continues to recover, so does sentiment for gold miners, and the majors are seeing this more than others. The GDX reverted 21.8% higher in May, and continued to climb this month. During the same time, gold prices climbed 6.6%, with all indicators pointing to a better sentiment around gold and gold mining stocks.

Q1 2021 reported results show that the majors in particular are outperforming all other gold miners, with strong results and a growing share of the dominant gold-stock ETF. The top 25 GDX gold miners now account for 88.1% of the market cap of the ETF. This dominance is also borne out in the results, with almost all of the top gold mines by production and expansion in the U.S. being owned and operated by those same companies.

The top 25 stocks in the GDX reported recovering and powerful production numbers for Q1. Although total production dropped 2.8% in the period, total revenues jumped 10.5% YoY to $13.7B. This is one of the best quarters ever for this group.

Higher Commodity Prices Boosting Everything

The lower output was offset by 13.4% higher gold prices in the same period, boosting their bottom lines and pushing their financials along healthily. This has been a recurring trend in the mining industry as commodity prices continue to push higher every month with reopenings driving demand along and a positive outlook for the industry expands with every new project and restart announced. Production is nearing pre-pandemic levels again and investment in the first quarter picked up rapidly as miners raced to get back on track for 2021.

The bottom lines of the major gold miners in the ETF was impressive, with 47.1% high YoY earnings. Those soaring earnings and profits seem to be in line with a recovering industry and one that is moving faster than many other parts of the global economy. While some have tried to attribute this to low comparison from 2020, looking at most of these companies shows that this performance comes on the back of normal performance and not any over-compensation from the slowdown of last year.

The List of Winners

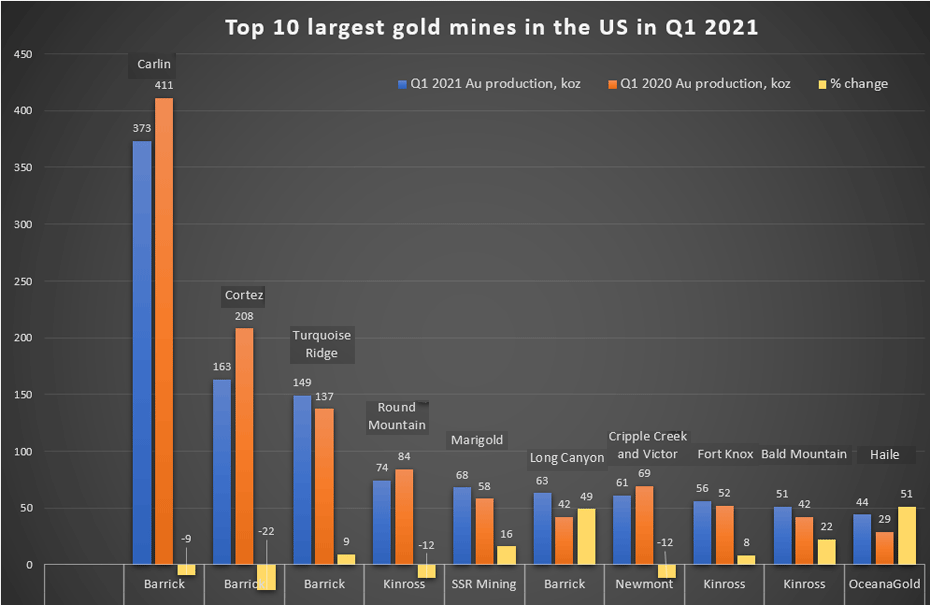

Kitco has put together a list of the top largest gold mines in the US based on gold production in Q1 2021, and it is clear that the biggest players continue to dominate not just the biggest gold stock ETF, but also production quantities.

Barrick takes four of the top ten spots, including the three top spots that seem to generally be reserved for the company across its Carlin, Cortez, and Turquoise Ridge mines. The biggest miners in the industry continue to dominate production and profits right now, but they are also lifting other stocks with them as gold prices rise and industry sentiment begins to reverse in Q2 2021.

| Operation | Major Owner/Operator | Q1 2021 Au production, koz | Q1 2020 Au production, koz | % Change | |

| 1 | Carlin | Barrick | 373 | 411 | -9 |

| 2 | Cortez | Barrick | 163 | 208 | -22 |

| 3 | Turquoise Ridge | Barick | 149 | 137 | 9 |

| 4 | Round Mountain | Kinross | 74 | 84 | -12 |

| 5 | Marigold | SSR Mining | 68 | 58 | 16 |

| 6 | Long Canyon | Barrick | 63 | 42 | 49 |

| 7 | Cripple Creek and Victor | Newmont | 61 | 69 | -12 |

| 8 | Fort Knox | Kinross | 56 | 52 | 8 |

| 9 | Bald Mountain | Kinross | 51 | 42 | 22 |

| 10 | Haile | OceanaGold | 44 | 29 | 51 |

Source: Kitco

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan