New Pacific Metals Corp (TSX:NUAG) has reported the assay results from the initial 21 boreholes of their Q1 2023 drilling project at the Carangas Silver-Gold Project in Bolivia. The first quarter of 2023 saw the successful completion of the drilling project, a follow-up to the previous year’s initiative at the Carangas site. Initially expected to involve 15,000 meters of diamond core drilling, the project was expanded to fill in and reach beyond areas drilled from 2021 to 2022. The operation kicked off as planned in January 2023, concluding with an impressive total of 17,623 meters drilled across 39 boreholes by the end of April. Each borehole intersected mineralization, with assay results from 21 holes available so far, and results from the remaining holes on the way.

For its premier mineral resource estimate, New Pacific teamed up with RPMGlobal Canada Limited, a consultancy providing technical services related to National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A qualified expert from RPMGlobal visited the site in March 2023, and with assay results from all boreholes soon to be available, the resource estimation is set to begin. The completed resource estimate is projected for release in Q3 2023.

The technical team is currently conducting in-depth surface geological mapping and sampling to sharpen drill targets beyond the previously drilled areas, focusing on the induced polarization (“IP”) chargeability anomalies. This interim mapping project is a strategic move in anticipation of the drilling project’s next phase, slated for H2 2023. The IP chargeability anomalies have shown a geophysical signature that aligns with the central valley’s drilled-off area, which is known to be rich in silver-gold mineralization—further solidifying the potential of the Carangas Project.

Highlights from the results are as follows:

DCAr0171 intersected a wide interval of silver mineralization measuring 205.6 m (76.8 m to 282.4 m) grading 123 g/t Ag, 0.44% Pb and 0.84% Zn, including 77.6 m (126.1 m to 203.7 m) grading 242 g/t Ag, 0.71% Pb and 1.30% Zn. This step-out hole was drilled through fluvial sediment cover to the southwest of the South Dome and implies that shallow silver mineralization remains open to the southwest, beyond the previously drilled West Dome-Central Valley-East Dome corridor.

DCAr0170 was drilled at the western limit of the Central Valley near the West Dome and intersected a wide interval of silver mineralization measuring 292.8 m starting near surface (9.2 m to 302 m) grading 58 g/t Ag, 0.39% Pb and 0.84% Zn, including 80.39 m (9.2 m to 89.59 m) grading 173 g/t Ag, 0.77% Pb and 1.08% Zn.

DCAr0154 intersected an interval of silver mineralization measuring 93.7 m (69.5 m to 163.2 m) grading 50 g/t Ag, 0.20% Pb and 0.53% Zn, including 13.05 m (72.4 m to 84.45 m) grading 280 g/t Ag, 0.36% Pb and 0.83% Zn. To depth, multiple intervals of gold mineralization were intersected, represented by 233.66 m (500.24 m to 733.9 m) grading 0.65 g/t Au and 107.1 m (774.24 m to 881.34 m) grading 0.84 g/t Au. This hole was drilled to test the eastern extension of gold mineralization at depth and the gold intervals in this hole indicate that gold mineralization remains open to the east.

DCAr0151 intersected an interval of silver mineralization measuring 66.76 m starting near surface (6.14 m to 72.9 m) grading 55 g/t Ag and 0.31% Pb, and a second silver interval of 3.63 m (266.13 m to 269.76 m) grading 215 g/t Ag, 0.45% Pb and 0.54% Zn. This hole was drilled in the upper portion of the East Dome.

|

Table 1 Summary of Drill Intercepts |

||||||||||

|

Hole_ID |

Depth_from |

Depth_to |

Interval_m |

Ag_g/t |

Au_g/t |

Pb_% |

Zn_% |

Cu_% |

AgEq_g/t |

|

|

DCAr0151 |

6.14 |

72.90 |

66.76 |

55 |

0.31 |

0.04 |

0.01 |

67 |

||

|

233.25 |

234.49 |

1.24 |

130 |

0.03 |

0.03 |

0.02 |

134 |

|||

|

266.13 |

269.76 |

3.63 |

217 |

0.45 |

0.54 |

0.06 |

254 |

|||

|

DCAr0152 |

6.00 |

47.78 |

41.78 |

42 |

0.40 |

0.25 |

0.01 |

63 |

||

|

69.25 |

125.28 |

56.03 |

21 |

0.38 |

0.94 |

63 |

||||

|

140.14 |

148.35 |

8.21 |

11 |

0.37 |

0.92 |

53 |

||||

|

177.30 |

213.11 |

35.81 |

9 |

0.03 |

0.44 |

0.82 |

0.03 |

54 |

||

|

242.70 |

302.00 |

59.30 |

16 |

0.18 |

0.21 |

0.58 |

0.03 |

57 |

||

|

311.78 |

315.92 |

4.14 |

1 |

0.97 |

0.01 |

0.07 |

73 |

|||

|

325.27 |

365.29 |

40.02 |

6 |

0.51 |

0.08 |

0.27 |

0.03 |

56 |

||

|

378.20 |

422.32 |

44.12 |

5 |

0.59 |

0.01 |

0.04 |

0.04 |

53 |

||

|

436.71 |

483.92 |

47.21 |

2 |

0.61 |

0.01 |

0.04 |

0.02 |

49 |

||

|

510.00 |

517.50 |

7.50 |

0 |

0.78 |

0.03 |

58 |

||||

|

523.50 |

531.90 |

8.40 |

6 |

1.15 |

0.01 |

0.04 |

0.09 |

99 |

||

|

576.10 |

597.17 |

21.07 |

1 |

0.01 |

0.03 |

0.82 |

31 |

|||

|

650.00 |

682.82 |

32.82 |

25 |

0.22 |

0.05 |

0.02 |

0.08 |

51 |

||

|

697.84 |

748.00 |

50.16 |

3 |

0.89 |

0.01 |

0.03 |

0.13 |

81 |

||

|

787.50 |

802.42 |

14.92 |

10 |

0.87 |

0.01 |

0.41 |

115 |

|||

|

DCAr0153 |

2.14 |

138.37 |

136.23 |

26 |

0.22 |

0.56 |

0.01 |

53 |

||

|

150.80 |

165.36 |

14.56 |

7 |

0.62 |

1.19 |

0.02 |

67 |

|||

|

191.45 |

356.50 |

165.05 |

6 |

0.27 |

0.34 |

0.80 |

0.01 |

63 |

||

|

380.74 |

386.00 |

5.26 |

6 |

0.61 |

0.01 |

0.07 |

0.06 |

59 |

||

|

409.00 |

422.00 |

13.00 |

19 |

0.14 |

0.15 |

0.28 |

0.15 |

58 |

||

|

440.70 |

464.00 |

23.30 |

8 |

0.40 |

0.02 |

0.04 |

0.16 |

55 |

||

|

482.22 |

610.15 |

127.93 |

5 |

0.59 |

0.02 |

0.03 |

0.04 |

53 |

||

|

659.52 |

720.90 |

61.38 |

6 |

0.30 |

0.04 |

0.21 |

0.17 |

53 |

||

|

755.70 |

833.67 |

77.97 |

4 |

0.08 |

0.07 |

0.51 |

0.02 |

31 |

||

|

DCAr0154 |

16.30 |

43.16 |

26.86 |

14 |

0.37 |

0.09 |

28 |

|||

|

69.50 |

163.20 |

93.70 |

50 |

0.20 |

0.53 |

0.02 |

75 |

|||

|

incl. |

72.40 |

85.45 |

13.05 |

280 |

0.36 |

0.83 |

0.01 |

319 |

||

|

209.50 |

219.25 |

9.75 |

6 |

0.09 |

0.97 |

0.60 |

61 |

|||

|

289.95 |

368.36 |

78.41 |

4 |

0.17 |

0.22 |

0.40 |

36 |

|||

|

378.10 |

408.00 |

29.90 |

5 |

0.16 |

0.17 |

0.33 |

32 |

|||

|

452.00 |

460.12 |

8.12 |

5 |

0.10 |

0.13 |

0.36 |

28 |

|||

|

500.24 |

733.90 |

233.66 |

8 |

0.65 |

0.01 |

0.13 |

59 |

|||

|

747.00 |

756.50 |

9.50 |

2 |

0.41 |

0.00 |

0.01 |

32 |

|||

|

774.24 |

881.34 |

107.10 |

5 |

0.84 |

0.01 |

0.01 |

65 |

|||

|

DCAr0155 |

1.84 |

137.25 |

135.41 |

11 |

0.37 |

0.37 |

0.01 |

35 |

||

|

DCAr0156 |

24.00 |

28.28 |

4.28 |

22 |

0.82 |

0.07 |

0.07 |

56 |

||

|

44.58 |

48.60 |

4.02 |

38 |

1.87 |

0.07 |

0.01 |

97 |

|||

|

65.00 |

74.00 |

9.00 |

45 |

0.47 |

0.02 |

59 |

||||

|

81.37 |

88.10 |

6.73 |

25 |

0.61 |

0.02 |

0.01 |

44 |

|||

|

102.50 |

105.00 |

2.50 |

26 |

0.19 |

0.05 |

0.01 |

34 |

|||

|

150.85 |

173.50 |

22.65 |

4 |

0.48 |

0.12 |

0.01 |

23 |

|||

|

270.45 |

278.80 |

8.35 |

56 |

0.39 |

0.04 |

0.01 |

70 |

|||

|

DCAr0157 |

3.23 |

15.42 |

12.19 |

18 |

0.29 |

0.02 |

0.01 |

29 |

||

|

41.97 |

139.12 |

97.15 |

16 |

0.56 |

0.03 |

34 |

||||

|

159.50 |

172.32 |

12.82 |

1.01 |

1.34 |

0.01 |

76 |

||||

|

DCAr0158 |

125.00 |

129.50 |

4.50 |

31 |

0.14 |

0.50 |

0.01 |

52 |

||

|

172.45 |

187.38 |

14.93 |

27 |

0.21 |

0.30 |

0.01 |

44 |

|||

|

240.38 |

241.84 |

1.46 |

62 |

0.07 |

0.12 |

68 |

||||

|

273.50 |

275.00 |

1.50 |

57 |

0.15 |

0.15 |

0.06 |

72 |

|||

|

299.00 |

303.00 |

4.00 |

67 |

0.10 |

0.11 |

0.06 |

79 |

|||

|

DCAr0159 |

5.00 |

39.10 |

34.10 |

35 |

0.57 |

0.03 |

53 |

|||

|

DCAr0160 |

6.70 |

28.20 |

21.50 |

31 |

0.26 |

0.02 |

0.01 |

39 |

||

|

75.50 |

109.89 |

34.39 |

23 |

0.27 |

0.04 |

0.01 |

33 |

|||

|

125.00 |

152.00 |

27.00 |

19 |

0.36 |

1.32 |

0.02 |

77 |

|||

|

DCAr0161 |

6.90 |

57.90 |

51.00 |

59 |

0.16 |

0.05 |

0.01 |

67 |

||

|

153.50 |

155.00 |

1.50 |

116 |

0.09 |

0.06 |

0.04 |

125 |

|||

|

225.50 |

252.50 |

27.00 |

18 |

0.05 |

0.11 |

0.01 |

24 |

|||

|

DCAr0162 |

75.47 |

79.39 |

3.92 |

31 |

0.76 |

1.27 |

97 |

|||

|

97.20 |

125.35 |

28.15 |

31 |

0.21 |

0.65 |

0.02 |

61 |

|||

|

136.27 |

154.20 |

17.93 |

9 |

0.31 |

0.78 |

0.05 |

50 |

|||

|

207.50 |

225.00 |

17.50 |

5 |

0.04 |

0.47 |

0.54 |

39 |

|||

|

287.10 |

304.31 |

17.21 |

7 |

0.18 |

0.53 |

0.72 |

0.02 |

62 |

||

|

321.22 |

329.88 |

8.66 |

3 |

0.08 |

0.40 |

0.96 |

53 |

|||

|

392.87 |

399.50 |

6.63 |

18 |

0.56 |

0.13 |

0.19 |

0.08 |

77 |

||

|

427.45 |

600.35 |

172.90 |

14 |

0.97 |

0.06 |

0.02 |

0.09 |

94 |

||

|

631.12 |

645.17 |

14.05 |

6 |

0.81 |

0.01 |

0.02 |

0.06 |

70 |

||

|

658.20 |

663.95 |

5.75 |

0 |

1.29 |

0.01 |

93 |

||||

|

673.67 |

717.87 |

44.20 |

2 |

1.08 |

0.00 |

0.01 |

0.05 |

85 |

||

|

734.00 |

754.50 |

20.50 |

2 |

0.71 |

0.01 |

0.01 |

0.03 |

57 |

||

|

796.40 |

819.70 |

23.30 |

1 |

0.84 |

0.03 |

0.02 |

63 |

|||

|

DCAr0163 |

5.60 |

59.50 |

53.90 |

22 |

0.46 |

0.05 |

0.01 |

38 |

||

|

70.00 |

197.25 |

127.25 |

37 |

0.63 |

0.12 |

0.01 |

60 |

|||

|

incl. |

137.40 |

149.30 |

11.90 |

123 |

0.82 |

0.24 |

0.01 |

156 |

||

|

incl. |

179.90 |

195.90 |

16.00 |

198 |

0.55 |

0.23 |

0.01 |

222 |

||

|

DCAr0164 |

7.50 |

19.50 |

12.00 |

14 |

0.13 |

0.22 |

25 |

|||

|

77.65 |

164.60 |

86.95 |

12 |

0.14 |

0.48 |

0.02 |

34 |

|||

|

187.00 |

252.97 |

65.97 |

4 |

0.03 |

0.31 |

0.48 |

31 |

|||

|

271.90 |

308.60 |

36.70 |

5 |

0.15 |

0.44 |

0.74 |

0.01 |

54 |

||

|

373.80 |

406.63 |

32.83 |

6 |

0.07 |

0.12 |

0.48 |

0.02 |

33 |

||

|

423.40 |

628.10 |

204.70 |

8 |

0.64 |

0.03 |

0.08 |

0.04 |

61 |

||

|

683.50 |

713.75 |

30.25 |

2 |

0.61 |

0.01 |

0.02 |

0.05 |

52 |

||

|

767.00 |

821.24 |

54.24 |

6 |

1.61 |

0.00 |

0.01 |

0.14 |

135 |

||

|

DCAr0165 |

72.27 |

144.80 |

72.53 |

21 |

0.21 |

0.76 |

53 |

|||

|

170.20 |

180.70 |

10.50 |

7 |

0.05 |

0.45 |

0.01 |

24 |

|||

|

235.56 |

263.40 |

27.84 |

6 |

0.30 |

0.81 |

42 |

||||

|

DCAr0166 |

1.00 |

53.10 |

52.10 |

13 |

0.25 |

0.27 |

30 |

|||

|

65.00 |

69.00 |

4.00 |

56 |

0.18 |

0.55 |

80 |

||||

|

88.00 |

146.90 |

58.90 |

19 |

0.26 |

0.75 |

53 |

||||

|

162.01 |

236.80 |

74.79 |

10 |

0.03 |

0.29 |

0.50 |

0.01 |

38 |

||

|

251.50 |

314.87 |

63.37 |

6 |

0.16 |

0.53 |

0.96 |

0.01 |

67 |

||

|

330.78 |

347.08 |

16.30 |

4 |

0.02 |

0.22 |

0.48 |

0.05 |

33 |

||

|

390.77 |

414.50 |

23.73 |

3 |

0.22 |

0.08 |

0.18 |

0.04 |

31 |

||

|

419.00 |

428.00 |

9.00 |

1 |

0.61 |

0.00 |

0.03 |

0.01 |

47 |

||

|

451.90 |

466.57 |

14.67 |

2 |

1.05 |

0.09 |

0.27 |

0.03 |

92 |

||

|

476.70 |

485.65 |

8.95 |

10 |

2.54 |

0.05 |

0.07 |

0.04 |

199 |

||

|

511.70 |

515.56 |

3.86 |

14 |

1.49 |

0.03 |

0.03 |

0.14 |

136 |

||

|

611.50 |

620.90 |

9.40 |

7 |

0.15 |

0.03 |

0.76 |

0.06 |

50 |

||

|

700.70 |

709.15 |

8.45 |

1 |

0.10 |

0.01 |

1.01 |

0.01 |

43 |

||

|

774.75 |

785.80 |

11.05 |

4 |

0.72 |

0.00 |

0.03 |

0.18 |

75 |

||

|

791.20 |

798.10 |

6.90 |

2 |

0.32 |

0.00 |

0.02 |

0.24 |

51 |

||

|

DCAr0167 |

5.00 |

73.30 |

68.30 |

25 |

0.56 |

0.06 |

44 |

|||

|

98.30 |

119.00 |

20.70 |

10 |

0.66 |

0.11 |

33 |

||||

|

140.00 |

143.91 |

3.91 |

9 |

1.16 |

0.09 |

0.01 |

46 |

|||

|

DCAr0168 |

62.75 |

104.80 |

42.05 |

18 |

0.30 |

0.58 |

47 |

|||

|

120.80 |

138.60 |

17.80 |

33 |

0.16 |

0.61 |

59 |

||||

|

175.87 |

186.00 |

10.13 |

19 |

0.12 |

0.35 |

34 |

||||

|

197.30 |

219.44 |

22.14 |

8 |

0.36 |

0.71 |

0.01 |

44 |

|||

|

237.70 |

269.80 |

32.10 |

28 |

0.97 |

1.37 |

0.08 |

109 |

|||

|

DCAr0169 |

14.80 |

74.67 |

59.87 |

31 |

0.82 |

0.06 |

57 |

|||

|

DCAr0170 |

9.20 |

302.00 |

292.80 |

58 |

0.39 |

0.84 |

0.02 |

99 |

||

|

incl. |

9.20 |

89.59 |

80.39 |

173 |

0.77 |

1.08 |

0.05 |

236 |

||

|

DCAr0171 |

76.80 |

282.40 |

205.60 |

123 |

0.02 |

0.44 |

0.84 |

0.02 |

167 |

|

|

incl. |

126.10 |

203.70 |

77.60 |

242 |

0.01 |

0.71 |

1.30 |

0.03 |

310 |

|

|

311.35 |

406.35 |

95.00 |

9 |

0.36 |

0.92 |

0.02 |

57 |

|||

|

Notes: |

|

|

1. |

Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2 |

|

2. |

Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data. |

|

3. |

Calculation of silver equivalent (“AgEq”) is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for Ag, US$0.95/lb for Pb, US$1.10/lb for Zn, US$3.40/lb for Cu, and US$1,600/oz for Au. The formula used for the AgEq calculation is as follows: AgEq = Ag g/t + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036 + Au g/t * 71.1111. This calculation assumes 100% recovery. |

|

4. |

A cut-off of 20 g/t AgEq is applied to calculate the length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. |

|

Table 2 Summary of Drill Holes of Discovery Drill Program of Carangas Project |

|||||||

|

Hole_id |

Easting |

Northing |

Altitude |

Depth_m |

Azimuth (°) |

Dip (°) |

Target |

|

DCAr0151 |

539617.75 |

7905215.10 |

4013.81 |

300.00 |

20 |

-45 |

ED |

|

DCAr0152 |

539311.30 |

7905343.30 |

3911.21 |

821.00 |

252 |

-75 |

CV |

|

DCAr0153 |

539324.98 |

7905302.65 |

3917.54 |

836.00 |

252 |

-67 |

CV |

|

DCAr0154 |

539487.76 |

7905479.04 |

3921.69 |

900.00 |

249 |

-66 |

CV |

|

DCAr0155 |

538797.69 |

7905700.86 |

4063.33 |

140.00 |

120 |

-40 |

WD |

|

DCAr0156 |

539684.64 |

7905129.41 |

4036.00 |

302.00 |

20 |

-45 |

ED |

|

DCAr0157 |

538799.21 |

7905701.13 |

4063.35 |

206.00 |

60 |

-40 |

WD |

|

DCAr0158 |

539517.04 |

7905105.86 |

3969.15 |

323.00 |

20 |

-45 |

ED |

|

DCAr0159 |

538841.19 |

7905736.01 |

4068.83 |

152.00 |

7 |

-40 |

WD |

|

DCAr0160 |

538841.30 |

7905734.87 |

4068.79 |

152.00 |

156 |

-40 |

WD |

|

DCAr0161 |

539663.65 |

7905221.91 |

4023.46 |

293.00 |

20 |

-45 |

ED |

|

DCAr0162 |

539403.94 |

7905455.30 |

3924.08 |

848.00 |

252 |

-67 |

CV |

|

DCAr0163 |

538842.50 |

7905735.25 |

4068.85 |

200.00 |

110 |

-40 |

WD |

|

DCAr0164 |

539412.79 |

7905417.33 |

3930.76 |

821.00 |

252 |

-70 |

CV |

|

DCAr0165 |

539247.76 |

7905094.61 |

3908.82 |

302.00 |

20 |

-45 |

ED |

|

DCAr0166 |

539400.87 |

7905371.39 |

3935.30 |

848.00 |

247 |

-75 |

CV |

|

DCAr0167 |

538843.04 |

7905735.85 |

4068.79 |

152.00 |

81 |

-40 |

WD |

|

DCAr0168 |

539276.07 |

7905026.84 |

3910.53 |

302.00 |

20 |

-45 |

ED |

|

DCAr0169 |

538841.68 |

7905740.16 |

4068.79 |

152.00 |

50 |

-40 |

WD |

|

DCAr0170 |

538946.49 |

7905288.56 |

3905.72 |

302.00 |

20 |

-45 |

WD |

|

DCAr0171 |

538631.00 |

7905028.49 |

3905.09 |

420.00 |

48 |

-59 |

SD |

|

Note: |

1. Drill collar coordinate system is WGS1984 UTM Zone 19S |

||||||

|

2. Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS except hole DCAr0036 which is by handheld GPS |

|||||||

|

3. CV – Central Valley; WD – West Dome; ED – East Dome; SD – South Dome |

|||||||

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

New Pacific Metals (TSX:NUAG) has announced the latest assay results of the 2022 drill program at its Carangas Silver-Gold Project, located in the Oruro Department of Bolivia. The company, along with its Bolivian partner, reported that assay results of all 115 drill holes drilled in 2022 have been received and released.

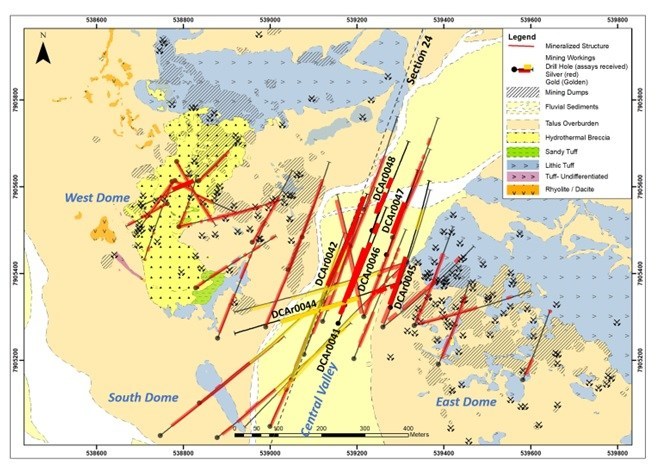

According to the detailed results and drill hole specifications listed in Tables 1 and 2, as well as in Figure 1, of the 29 holes, ten were deep holes drilled in different directions towards the Central Valley to define the limit of the gold mineralization system at depth. The drill results show that the gold system is open to the north and north-east directions with these targets currently being drill tested as part of the Company’s Q1 2023 drill program.

The remaining 19 holes were shallow and were drilled to define the near-surface silver mineralization. All nineteen holes intersected silver mineralization. These results demonstrate the significant potential of the Carangas Project for silver and gold mineralization.

In addition to the drilling activities, the results of an expanded 3D Bipole-Dipole IP-MT survey program completed in January 2023 have been received. The survey showed multiple chargeability anomalies outside the current area of drilling (seen in Figure 2). These new chargeability anomalies display a similar geophysical signature to those of the known silver-gold system and will be drill tested in future drilling campaigns.

The Carangas Project is a key project for New Pacific Metals Corp. and the latest assay results are an important milestone in the exploration and development of the project. With these positive results, the company is looking forward to future drilling campaigns and advancing the Carangas Project towards production.

Highlights from the results are as follows:

DCAr0112 intersected a gold mineralization interval of 306.95 m at depth from 359.55 m to 666.5 m, grading 1.2 g/t Au and 26 g/t Ag, including 31.78 m (411.65 m to 443.43 m) grading 122 g/t Ag, 4.11 g/t Au and 0.15% Cu, and near surface silver mineralization intervals of 41.03 m (55.97 m to 97 m) grading 54 g/t Ag, 0.25% Pb and 0.57% Zn, and 75.1 m (108.7 m to 183.8 m) grading 27 g/t Ag, 0.24%Pb and 0.65% Zn.

DCAr0104 intersected a gold mineralization interval of 328.3 m (233.75 m to 562.05 m) grading, 1.07 g/t Au, 20 g/t Ag ,0.14% Pb, 0.25% Zn and 0.14% copper (“Cu”), and a near surface silver-lead-zinc mineralization interval of 228.25 m (5.5 m to 233.75 m) grading 21 g/t silver (“Ag”), 0.54% lead (“Pb”) and 1.23% zinc (“Zn”), immediately followed by. Two more gold mineralization intervals intersected at further depth, 15.77 m (652.17 m to 667.94 m) grading 0.44 g/t Au and 0.12% Cu, and 252 m (693 m to 945 m) grading 0.45 g/t Au and 0.13% Cu.

DCAr0105 intersected a gold mineralization interval of 476.3 m (324.7 m to 801 m) grading 0.75g/t Au including 43.62 m (510.38 m to 554 m) grading 3.19 g/t Au, and a near surface silver-lead-zinc mineralization interval of 293.94 m (5.16 m to 299.1 m) grading 37 g/t Ag, 0.57% lead (“Pb”) and 1.3% zinc (“Zn”), including 38.99 m (5.16 m to 44.15 m) grading 134 g/t Ag, 1.48% Pb and 2.51% Zn.

Highlights of drill results for shallow holes

DCAr0141 intersected a near surface silver-lead-zinc mineralization interval of 110.15 m (5.85 m to 116 m) grading 136 g/t Ag and 0.96% Pb, including 6.92 m (30.73 m to 37.65 m) grading 693 g/t Ag and 1.71% Pb, and 24.63 m (59.87 m to 84.5 m) grading 197 g/t Ag and 2.14% Pb. Multiple historical underground mining voids for a total length of 16.39 m were intersected in this hole.

DCAr0128 intersected a near surface silver-lead-zinc mineralization interval of 78.3 m (7.7 m to 86 m) grading 104 g/t Ag, 0.74% Pb and 0.59% Zn including 33 m (30.5 m to 60.5 m) grading 226 g/t Ag, 1.47% Pb and 0.93% Zn. In addition, further down the hole to the end of hole, multiple shorter silver-lead-zinc mineralization intervals were intercepted.

DCAr0134 intersected 111.85 m (114.4 m to 226.25 m) grading 52 g/t Ag, 0.25% Pb and 0.59% Zn including 17.94 m (198.96 m to 216.9 m) grading 197 g/t Ag, 0.49% Pb and 0.91% Zn.

Update on Q1 2023 Resource Drill Program

The Company’s 2023 15,000 m drill program at Carangas is close to being completed. The results from this drill program, together with the results from 2021 and 2022 drilling, will be used to estimate an inaugural mineral resource to be completed in the second quarter of 2023.

Expanded IP survey program

A pilot 3D Bipole-Dipole IP-MT survey program was completed in the drilled area of West Dome-Central Valley-East Dome in September 2022 (refer to the Company’s news release dated on November 14, 2022), revealing that the blind gold mineralization system at the Central Valley overlays the strongest chargeability anomaly under the young sediments of the Central Valley.

Encouraged by the success of the pilot 3D Bipole-Dipole IP-MT survey program, an expanded 3D Bipole-Dipole IP-MT survey program was carried out at Carangas by Southern Rock Geophysics S.A. of Chile from November 2022 to January 2023. This expanded IP program covers the entire Carangas Basin of 29 square kilometers, which is mostly covered by young sediments.

Multiple high chargeability anomalies with a similar signature to that of the Central Velley were identified in the expanded area outside of the drilled area (Figure 2). These new anomalies generally have weak or no chargeability response near surface, but high chargeability starts to show from 200 m depth to more than 800 m depth from surface. These deep high chargeability anomalies may be related to sulfide mineralization at depth, which may be related to rhyolite intrusive bodies, like those seen in the Central Valley. These anomalies, such as those to the north of the Central Valley (Figure 2), will be drill targets in future exploration programs.

| Table 1 Summary of Drill Intercepts | ||||||||||

| Hole_ID | Form | To | Length_m | Ag_g/t | Au_g/t | Pb_% | Zn_% | Cu_% | AgEq_g/t | |

| DCAr0071 | 33.22 | 44.35 | 11.13 | 16 | 0.01 | 0.10 | 0.36 | 0.01 | 32 | |

| 70.58 | 82.79 | 12.21 | 22 | 0.10 | 0.27 | 0.01 | 34 | |||

| 94.23 | 164.40 | 70.17 | 29 | 0.01 | 0.24 | 0.54 | 0.01 | 55 | ||

| 175.70 | 191.33 | 15.63 | 18 | 0.03 | 0.18 | 0.35 | 37 | |||

| 211.83 | 220.36 | 8.53 | 61 | 0.58 | 0.36 | 0.62 | 0.01 | 135 | ||

| 263.98 | 278.90 | 14.92 | 5 | 0.02 | 0.32 | 0.52 | 0.01 | 34 | ||

| 286.64 | 290.00 | 3.36 | 11 | 0.62 | 0.84 | 1.55 | 0.01 | 132 | ||

| 306.30 | 310.17 | 3.87 | 10 | 0.12 | 0.93 | 1.85 | 107 | |||

| 316.71 | 326.80 | 10.09 | 6 | 0.08 | 0.50 | 0.83 | 54 | |||

| 338.35 | 345.70 | 7.35 | 7 | 0.06 | 0.48 | 0.84 | 0.01 | 55 | ||

| 374.70 | 391.10 | 16.40 | 5 | 0.09 | 0.24 | 0.43 | 0.04 | 37 | ||

| 405.80 | 409.64 | 3.84 | 4 | 0.04 | 0.38 | 0.86 | 0.02 | 49 | ||

| 415.85 | 422.97 | 7.12 | 5 | 0.08 | 0.47 | 0.87 | 0.01 | 55 | ||

| 439.62 | 449.24 | 9.62 | 3 | 0.08 | 0.35 | 0.53 | 37 | |||

| 485.10 | 529.44 | 44.34 | 2 | 0.16 | 0.08 | 0.77 | 42 | |||

| 548.00 | 614.43 | 66.43 | 3 | 0.03 | 0.12 | 0.65 | 0.01 | 31 | ||

| 634.80 | 650.24 | 15.44 | 3 | 0.11 | 0.09 | 0.44 | 0.03 | 31 | ||

| 671.40 | 684.60 | 13.20 | 6 | 0.19 | 0.01 | 0.07 | 0.15 | 38 | ||

| 709.76 | 735.78 | 26.02 | 5 | 0.01 | 0.05 | 1.13 | 0.07 | 52 | ||

| 825.75 | 843.70 | 17.95 | 13 | 0.18 | 0.49 | 0.02 | 0.36 | 78 | ||

| 861.50 | 870.40 | 8.90 | 6 | 0.41 | 0.01 | 0.01 | 36 | |||

| 892.21 | 915.80 | 23.59 | 7 | 0.52 | 0.01 | 0.01 | 0.08 | 53 | ||

| 983.18 | 996.57 | 13.39 | 7 | 0.15 | 0.01 | 0.33 | 52 | |||

| 1047.82 | 1055.00 | 7.18 | 4 | 0.18 | 0.01 | 0.14 | 32 | |||

| 1067.00 | 1079.85 | 12.85 | 6 | 0.10 | 0.01 | 0.01 | 0.20 | 35 | ||

| 1090.48 | 1100.00 | 9.52 | 3 | 0.04 | 0.01 | 0.19 | 25 | |||

| DCAr0104 | 5.50 | 233.75 | 228.25 | 21 | 0.05 | 0.54 | 1.23 | 0.02 | 83 | |

| 233.75 | 562.05 | 328.30 | 20 | 1.07 | 0.14 | 0.25 | 0.14 | 123 | ||

| 652.17 | 667.94 | 15.77 | 3 | 0.44 | 0.01 | 0.03 | 0.12 | 48 | ||

| 693.00 | 945.00 | 252.00 | 3 | 0.45 | 0.01 | 0.13 | 49 | |||

| 957.30 | 1018.96 | 61.66 | 5 | 0.07 | 0.01 | 0.20 | 31 | |||

| DCAr0105 | 5.16 | 299.10 | 293.94 | 37 | 0.08 | 0.57 | 1.30 | 0.03 | 106 | |

| incl. | 5.16 | 44.15 | 38.99 | 134 | 0.01 | 1.48 | 2.51 | 0.01 | 262 | |

| 324.70 | 801.00 | 476.30 | 4 | 0.75 | 0.02 | 0.08 | 0.07 | 68 | ||

| incl. | 510.38 | 554.00 | 43.62 | 6 | 3.19 | 0.02 | 0.04 | 0.10 | 245 | |

| DCAr0112 | 55.97 | 97.00 | 41.03 | 54 | 0.01 | 0.25 | 0.57 | 0.01 | 81 | |

| 108.70 | 183.80 | 75.10 | 27 | 0.01 | 0.24 | 0.65 | 0.02 | 58 | ||

| 195.40 | 215.44 | 20.04 | 6 | 0.11 | 0.60 | 0.58 | 51 | |||

| 247.66 | 309.78 | 62.12 | 4 | 0.12 | 0.10 | 0.28 | 0.03 | 28 | ||

| 359.55 | 666.50 | 306.95 | 26 | 1.19 | 0.03 | 0.07 | 0.06 | 120 | ||

| incl. | 411.65 | 443.43 | 31.78 | 122 | 4.11 | 0.09 | 0.14 | 0.15 | 437 | |

| 694.98 | 722.50 | 27.52 | 2 | 0.18 | 0.00 | 0.25 | 24 | |||

| 750.00 | 775.00 | 25.00 | 5 | 0.17 | 0.06 | 0.78 | 0.04 | 49 | ||

| DCAr0114 | 0.00 | 119.70 | 119.70 | 42 | 0.60 | 1.22 | 0.01 | 101 | ||

| 135.50 | 141.35 | 5.85 | 22 | 0.07 | 0.23 | 32 | ||||

| 148.45 | 173.80 | 25.35 | 30 | 0.14 | 0.33 | 0.01 | 46 | |||

| 188.29 | 195.30 | 7.01 | 36 | 0.08 | 0.17 | 44 | ||||

| 206.90 | 212.20 | 5.30 | 49 | 0.02 | 0.12 | 0.26 | 0.01 | 63 | ||

| 230.90 | 262.34 | 31.44 | 8 | 0.03 | 0.32 | 0.73 | 0.01 | 45 | ||

| 313.00 | 350.18 | 37.18 | 2 | 0.02 | 0.16 | 0.47 | 0.01 | 25 | ||

| 358.65 | 382.64 | 23.99 | 5 | 0.30 | 0.12 | 0.64 | 0.07 | 59 | ||

| 395.48 | 458.67 | 63.19 | 4 | 0.07 | 0.20 | 0.63 | 0.03 | 38 | ||

| 468.70 | 528.43 | 59.73 | 10 | 0.31 | 0.08 | 0.20 | 0.06 | 47 | ||

| 539.91 | 548.60 | 8.69 | 5 | 0.39 | 0.05 | 0.24 | 0.08 | 50 | ||

| 558.40 | 562.65 | 4.25 | 4 | 0.68 | 0.02 | 0.11 | 0.05 | 61 | ||

| 571.18 | 576.90 | 5.72 | 4 | 0.02 | 0.35 | 0.88 | 0.01 | 45 | ||

| 591.30 | 623.70 | 32.40 | 3 | 0.12 | 0.13 | 0.72 | 0.01 | 41 | ||

| 646.09 | 648.94 | 2.85 | 0 | 2.47 | 0.00 | 0.03 | 177 | |||

| 666.50 | 678.43 | 11.93 | 2 | 0.34 | 0.00 | 0.01 | 0.11 | 38 | ||

| 684.20 | 706.85 | 22.65 | 2 | 0.49 | 0.01 | 0.01 | 0.03 | 41 | ||

| 713.92 | 824.20 | 110.28 | 4 | 0.98 | 0.01 | 0.01 | 0.17 | 92 | ||

| 840.00 | 854.00 | 14.00 | 10 | 0.67 | 0.01 | 0.01 | 0.45 | 105 | ||

| DCAr0117 | 45.18 | 137.96 | 92.78 | 23 | 0.03 | 0.31 | 0.64 | 0.04 | 60 | |

| 147.62 | 169.35 | 21.73 | 6 | 0.11 | 0.12 | 0.50 | 0.07 | 42 | ||

| 188.86 | 347.22 | 158.36 | 11 | 0.51 | 0.19 | 0.18 | 0.06 | 64 | ||

| 382.78 | 426.00 | 43.22 | 17 | 0.95 | 0.03 | 0.07 | 0.10 | 97 | ||

| 457.70 | 480.63 | 22.93 | 11 | 0.49 | 0.03 | 0.12 | 0.08 | 59 | ||

| 496.48 | 507.00 | 10.52 | 8 | 0.28 | 0.02 | 0.08 | 0.05 | 36 | ||

| 529.75 | 649.81 | 120.06 | 8 | 0.68 | 0.01 | 0.08 | 0.06 | 66 | ||

| 714.69 | 732.50 | 17.81 | 7 | 0.06 | 0.25 | 0.87 | 0.23 | 71 | ||

| DCAr0123 | 54.76 | 115.90 | 61.14 | 31 | 0.04 | 0.28 | 0.99 | 0.05 | 81 | |

| 124.50 | 284.32 | 159.82 | 11 | 0.11 | 0.42 | 0.97 | 0.05 | 68 | ||

| 330.13 | 393.67 | 63.54 | 14 | 0.60 | 0.03 | 0.12 | 0.02 | 63 | ||

| 417.59 | 434.12 | 16.53 | 12 | 0.20 | 0.06 | 0.17 | 0.22 | 56 | ||

| 487.45 | 502.30 | 14.85 | 2 | 0.11 | 0.05 | 0.35 | 0.03 | 27 | ||

| 513.42 | 517.55 | 4.13 | 9 | 2.58 | 0.12 | 1.23 | 0.01 | 237 | ||

| 544.75 | 548.91 | 4.16 | 5 | 0.22 | 0.85 | 1.19 | 0.00 | 85 | ||

| 574.77 | 577.43 | 2.66 | 4 | 0.29 | 0.37 | 0.99 | 0.02 | 71 | ||

| 590.38 | 597.14 | 6.76 | 3 | 0.11 | 0.36 | 0.90 | 0.01 | 53 | ||

| DCAr0126 | 19.10 | 188.06 | 168.96 | 40 | 0.37 | 1.19 | 0.01 | 92 | ||

| incl. | 31.20 | 58.07 | 26.87 | 120 | 0.99 | 4.03 | 0.04 | 288 | ||

| 196.70 | 201.05 | 4.35 | 14 | 0.04 | 0.26 | 0.57 | 0.00 | 43 | ||

| 223.30 | 229.18 | 5.88 | 3 | 0.05 | 0.37 | 0.76 | 0.00 | 43 | ||

| 238.00 | 296.43 | 58.43 | 5 | 0.02 | 0.34 | 0.71 | 0.00 | 40 | ||

| 395.95 | 491.00 | 95.05 | 3 | 0.09 | 0.14 | 0.52 | 0.03 | 34 | ||

| 522.97 | 545.15 | 22.18 | 9 | 0.22 | 0.05 | 0.30 | 0.12 | 48 | ||

| 568.00 | 579.17 | 11.17 | 8 | 0.68 | 0.07 | 0.35 | 0.01 | 71 | ||

| 589.15 | 601.00 | 11.85 | 13 | 0.81 | 0.00 | 0.04 | 0.08 | 80 | ||

| 627.03 | 629.95 | 2.92 | 2 | 1.02 | 0.00 | 0.03 | 0.03 | 78 | ||

| 638.41 | 646.85 | 8.44 | 11 | 1.06 | 0.00 | 0.01 | 0.09 | 97 | ||

| 699.00 | 848.00 | 149.00 | 3 | 0.80 | 0.00 | 0.02 | 0.09 | 70 | ||

| DCAr0128 | 7.70 | 86.00 | 78.30 | 104 | 0.74 | 0.59 | 0.01 | 146 | ||

| incl. | 30.50 | 63.50 | 33.00 | 226 | 1.47 | 0.93 | 0.01 | 301 | ||

| 100.80 | 103.80 | 3.00 | 9 | 0.13 | 1.59 | 0.01 | 66 | |||

| 120.00 | 148.80 | 28.80 | 17 | 0.17 | 0.62 | 43 | ||||

| 179.87 | 209.93 | 30.06 | 7 | 0.17 | 0.51 | 0.02 | 32 | |||

| 220.31 | 228.40 | 8.09 | 114 | 0.87 | 0.58 | 0.01 | 159 | |||

| 236.86 | 243.30 | 6.44 | 31 | 0.50 | 0.68 | 0.01 | 69 | |||

| 263.80 | 278.05 | 14.25 | 31 | 0.20 | 0.33 | 48 | ||||

| 282.55 | 288.55 | 6.00 | 3 | 0.57 | 0.41 | 34 | ||||

| DCAr0131 | 70.18 | 75.89 | 5.71 | 66 | 0.04 | 0.19 | 68 | |||

| 96.79 | 133.20 | 36.41 | 51 | 0.86 | 0.59 | 0.03 | 81 | |||

| 146.13 | 159.74 | 13.61 | 45 | 0.13 | 0.17 | 0.01 | 50 | |||

| 212.00 | 239.80 | 27.80 | 32 | 0.36 | 0.65 | 0.01 | 47 | |||

| 257.20 | 262.50 | 5.30 | 38 | 0.77 | 0.82 | 63 | ||||

| DCAr0132 | 35.50 | 128.56 | 93.06 | 28 | 0.11 | 0.40 | 0.93 | 0.05 | 83 | |

| 140.57 | 148.80 | 8.23 | 5 | 0.03 | 0.19 | 0.70 | 0.03 | 39 | ||

| 176.15 | 265.52 | 89.37 | 10 | 0.41 | 0.29 | 0.39 | 0.06 | 67 | ||

| 288.29 | 293.80 | 5.51 | 4 | 0.52 | 0.04 | 0.04 | 0.03 | 47 | ||

| 314.60 | 401.48 | 86.88 | 7 | 0.41 | 0.04 | 0.30 | 0.04 | 51 | ||

| 420.23 | 435.80 | 15.57 | 12 | 0.24 | 0.07 | 0.53 | 0.07 | 56 | ||

| 448.15 | 474.77 | 26.62 | 4 | 0.37 | 0.04 | 0.08 | 0.01 | 35 | ||

| 500.50 | 504.50 | 4.00 | 4 | 0.86 | 0.05 | 0.08 | 0.04 | 74 | ||

| 518.70 | 552.80 | 34.10 | 3 | 1.32 | 0.02 | 0.07 | 0.02 | 102 | ||

| 566.18 | 587.45 | 21.27 | 9 | 0.30 | 0.03 | 0.26 | 0.03 | 42 | ||

| 617.62 | 647.80 | 30.18 | 2 | 0.36 | 0.11 | 0.29 | 0.00 | 41 | ||

| 689.95 | 740.00 | 50.05 | 2 | 0.21 | 0.04 | 0.34 | 0.01 | 30 | ||

| DCAr0133 | 13.50 | 20.50 | 7.00 | 64 | 0.31 | 0.13 | 77 | |||

| 77.00 | 79.60 | 2.60 | 29 | 0.61 | 1.04 | 82 | ||||

| 104.95 | 112.21 | 7.26 | 16 | 0.43 | 1.20 | 0.01 | 70 | |||

| 122.22 | 185.26 | 63.04 | 26 | 0.13 | 0.47 | 0.01 | 47 | |||

| 196.78 | 225.40 | 28.62 | 15 | 0.22 | 0.51 | 0.04 | 42 | |||

| 259.70 | 261.00 | 1.30 | 174 | 0.13 | 0.38 | 0.05 | 195 | |||

| 273.38 | 277.26 | 3.88 | 39 | 0.10 | 0.29 | 51 | ||||

| 310.00 | 311.30 | 1.30 | 1200 | 3.64 | 2.94 | 0.04 | 1408 | |||

| DCAr0134 | 3.03 | 40.60 | 37.57 | 11 | 0.43 | 0.14 | 28 | |||

| 114.40 | 226.25 | 111.85 | 52 | 0.25 | 0.59 | 0.01 | 80 | |||

| incl. | 198.96 | 216.90 | 17.94 | 197 | 0.49 | 0.91 | 0.04 | 245 | ||

| DCAr0135 | 32.20 | 35.79 | 3.59 | 35 | 0.15 | 0.01 | 40 | |||

| 47.00 | 54.00 | 7.00 | 21 | 0.36 | 0.01 | 0.01 | 32 | |||

| 70.27 | 89.00 | 18.73 | 13 | 0.40 | 0.01 | 0.01 | 27 | |||

| 169.00 | 187.72 | 18.72 | 4 | 0.09 | 0.71 | 0.01 | 31 | |||

| DCAr0136 | 1.15 | 28.00 | 26.85 | 115 | 0.36 | 0.16 | 0.01 | 132 | ||

| 59.50 | 63.99 | 4.49 | 92 | 0.10 | 0.13 | 0.01 | 100 | |||

| 130.43 | 133.16 | 2.73 | 78 | 0.13 | 0.20 | 88 | ||||

| DCAr0137 | 1.28 | 11.50 | 10.22 | 14 | 0.48 | 0.04 | 0.01 | 30 | ||

| 25.33 | 35.80 | 10.47 | 19 | 0.21 | 0.02 | 26 | ||||

| 70.86 | 113.30 | 42.44 | 5 | 0.19 | 1.52 | 0.01 | 63 | |||

| 144.58 | 145.90 | 1.32 | 117 | 0.39 | 0.75 | 0.02 | 155 | |||

| DCAr0138 | 36.50 | 99.00 | 62.50 | 33 | 0.02 | 0.37 | 1.33 | 0.02 | 92 | |

| 125.00 | 403.28 | 278.28 | 6 | 0.13 | 0.30 | 0.80 | 0.02 | 52 | ||

| 450.40 | 530.49 | 80.09 | 4 | 0.81 | 0.06 | 0.23 | 0.04 | 74 | ||

| 546.47 | 571.00 | 24.53 | 2 | 0.61 | 0.02 | 0.03 | 0.05 | 52 | ||

| 648.05 | 902.00 | 253.95 | 11 | 1.00 | 0.01 | 0.07 | 0.03 | 87 | ||

| DCAr0139 | 6.20 | 7.40 | 1.20 | 89 | 0.14 | 0.08 | 96 | |||

| 14.10 | 35.92 | 21.82 | 12 | 0.28 | 0.23 | 28 | ||||

| 44.20 | 81.80 | 37.60 | 31 | 0.22 | 0.71 | 0.01 | 62 | |||

| 143.25 | 149.00 | 5.75 | 12 | 0.26 | 0.47 | 35 | ||||

| 158.67 | 208.09 | 49.42 | 17 | 0.24 | 0.72 | 0.01 | 49 | |||

| 231.50 | 253.20 | 21.70 | 34 | 0.26 | 0.28 | 0.02 | 52 | |||

| 292.60 | 298.72 | 6.12 | 30 | 0.07 | 0.11 | 36 | ||||

| DCAr0140 | 2.79 | 5.66 | 2.87 | 64 | 0.06 | 0.20 | 73 | |||

| 12.96 | 24.00 | 11.04 | 41 | 0.53 | 0.18 | 0.01 | 63 | |||

| 107.79 | 189.00 | 81.21 | 54 | 0.23 | 0.43 | 0.01 | 75 | |||

| 211.32 | 239.30 | 27.98 | 65 | 0.43 | 0.66 | 0.01 | 101 | |||

| 298.92 | 302.45 | 3.53 | 222 | 0.85 | 1.79 | 0.01 | 307 | |||

| DCAr0141 | 5.85 | 116.00 | 110.15 | 136 | 0.96 | 0.02 | 165 | |||

| incl. | 30.73 | 37.65 | 6.92 | 693 | 1.71 | 0.02 | 0.01 | 744 | ||

| incl. | 59.87 | 84.5 | 24.63 | 197 | 2.14 | 0.01 | 0.01 | 260 | ||

| DCAr0142 | 2.75 | 57.65 | 54.90 | 37 | 0.23 | 0.14 | 49 | |||

| 68.64 | 72.05 | 3.41 | 61 | 0.24 | 0.13 | 73 | ||||

| 122.00 | 218.70 | 96.70 | 36 | 0.15 | 0.25 | 49 | ||||

| incl. | 126.48 | 131.40 | 4.92 | 280 | 0.27 | 0.28 | 0.01 | 299 | ||

| 233.00 | 268.20 | 35.20 | 128 | 0.22 | 0.10 | 0.01 | 139 | |||

| incl. | 252.00 | 260.70 | 8.70 | 458 | 0.65 | 0.09 | 0.04 | 484 | ||

| DCAr0143 | 2.00 | 53.40 | 51.40 | 32 | 0.30 | 0.13 | 46 | |||

| 160.01 | 209.62 | 49.61 | 70 | 0.16 | 0.34 | 86 | ||||

| 252.52 | 270.60 | 18.08 | 67 | 0.20 | 0.33 | 0.01 | 85 | |||

| 278.00 | 279.33 | 1.33 | 420 | 0.74 | 0.09 | 0.04 | 449 | |||

| 291.00 | 299.62 | 8.62 | 59 | 0.11 | 0.15 | 68 | ||||

| DCAr0144 | 17.10 | 45.92 | 28.82 | 98 | 0.31 | 0.26 | 0.01 | 117 | ||

| 174.00 | 204.25 | 30.25 | 83 | 0.42 | 0.46 | 0.01 | 111 | |||

| 221.70 | 242.35 | 20.65 | 21 | 0.33 | 0.29 | 0.01 | 41 | |||

| 250.78 | 281.00 | 30.22 | 54 | 0.08 | 0.10 | 0.01 | 60 | |||

| DCAr0145 | 2.24 | 86.70 | 84.46 | 25 | 0.51 | 0.43 | 0.01 | 55 | ||

| 107.30 | 203.40 | 96.10 | 35 | 0.24 | 0.40 | 0.01 | 57 | |||

| incl. | 147.93 | 157.20 | 9.27 | 173 | 0.80 | 0.77 | 0.07 | 230 | ||

| DCAr0146 | 5.00 | 7.30 | 2.30 | 91 | 0.14 | 0.06 | 0.01 | 98 | ||

| 14.99 | 56.18 | 41.19 | 15 | 0.66 | 0.16 | 40 | ||||

| 111.57 | 122.15 | 10.58 | 25 | 0.20 | 0.37 | 0.01 | 44 | |||

| 130.54 | 143.00 | 12.46 | 12 | 0.19 | 0.41 | 0.01 | 32 | |||

| 154.70 | 169.64 | 14.94 | 102 | 0.14 | 0.11 | 0.01 | 110 | |||

| 190.75 | 245.95 | 55.20 | 20 | 0.20 | 0.39 | 0.01 | 39 | |||

| 263.20 | 304.60 | 41.40 | 7 | 0.27 | 0.40 | 29 | ||||

| DCAr0147 | 2.60 | 29.43 | 26.83 | 26 | 0.56 | 0.17 | 35 | |||

| 157.72 | 172.27 | 14.55 | 32 | 0.32 | 0.30 | 0.01 | 52 | |||

| 189.71 | 190.90 | 1.19 | 156 | 0.98 | 0.23 | 0.03 | 195 | |||

| 198.39 | 221.00 | 22.61 | 16 | 0.39 | 0.16 | 0.01 | 34 | |||

| 227.00 | 239.95 | 12.95 | 10 | 0.78 | 0.20 | 0.01 | 40 | |||

| 248.80 | 253.90 | 5.10 | 43 | 0.15 | 0.16 | 0.01 | 54 | |||

| 264.00 | 274.50 | 10.50 | 83 | 0.11 | 0.19 | 0.02 | 94 | |||

| DCAr0148 | 1.54 | 45.50 | 43.96 | 99 | 0.44 | 0.12 | 116 | |||

| 128.57 | 130.00 | 1.43 | 148 | 0.07 | 0.12 | 154 | ||||

| 140.50 | 161.00 | 20.50 | 56 | 0.16 | 0.46 | 0.01 | 77 | |||

| 201.74 | 210.50 | 8.76 | 26 | 0.39 | 0.59 | 0.05 | 62 | |||

| 222.50 | 235.57 | 13.07 | 104 | 0.44 | 0.13 | 0.02 | 123 | |||

| 241.65 | 247.43 | 5.78 | 31 | 0.28 | 0.15 | 0.01 | 46 | |||

| DCAr0149 | 52.91 | 108.56 | 55.65 | 5 | 1.07 | 0.47 | 0.02 | 54 | ||

| DCAr0150 | 14.45 | 25.90 | 11.45 | 14 | 0.45 | 0.07 | 0.01 | 30 | ||

| 34.52 | 40.90 | 6.38 | 10 | 0.33 | 0.10 | 0.01 | 24 | |||

| 53.53 | 56.15 | 2.62 | 29 | 0.65 | 0.23 | 0.01 | 56 | |||

| 127.49 | 155.00 | 27.51 | 5 | 0.30 | 0.97 | 47 | ||||

| Notes: |

| 1. Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2 |

| 2. Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data. |

| 3. Calculation of silver equivalent (“AgEq”) is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for Ag, US$0.95/lb for Pb, US$1.10/lb for Zn, US$3.40/lb for Cu, and US$1,600/oz for Au. The formula used for the AgEq calculation is as follows: AgEq = Ag g/t + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036 + Au g/t * 71.1111. This calculation assumes 100% recovery. |

| 4. A cut-off of 20 g/t AgEq is applied to calculate the length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. |

| Table 2 Summary of Drill Holes of Carangas Project | |||||||

| Hole_id | Easting | Northing | Altitude | Depth_m | Azimuth (°) | Dip (°) | Target |

| DCAr0071 | 538895.96 | 7905008.03 | 3906.95 | 1100.00 | 20 | -70 | |

| DCAr0104 | 539029.50 | 7905086.20 | 3904.89 | 1026.00 | 20 | -70 | CV |

| DCAr0105 | 538960.67 | 7905391.94 | 3916.03 | 902.00 | 130 | -72 | CV |

| DCAr0112 | 539352.10 | 7905487.62 | 3909.28 | 908.00 | 252 | -67 | CV |

| DCAr0114 | 538973.57 | 7905514.92 | 3947.33 | 854.00 | 140 | -75 | CV |

| DCAr0117 | 539043.40 | 7905263.38 | 3905.53 | 800.00 | 20 | -70 | CV |

| DCAr0123 | 539053.90 | 7905297.60 | 3905.74 | 668.00 | 20 | -64 | CV |

| DCAr0126 | 539033.23 | 7905528.51 | 3933.07 | 848.00 | 132 | -79 | CV |

| DCAr0128 | 539369.89 | 7905286.72 | 3930.55 | 301.00 | 20 | -45 | ED |

| DCAr0131 | 539364.20 | 7905116.80 | 3923.63 | 300.00 | 20 | -45 | ED |

| DCAr0132 | 538979.50 | 7905241.33 | 3905.14 | 740.00 | 27 | -70 | CV |

| DCAr0133 | 539386.84 | 7905335.33 | 3927.33 | 320.00 | 20 | -45 | ED |

| DCAr0134 | 539400.26 | 7905373.68 | 3934.41 | 296.00 | 20 | -45 | ED |

| DCAr0135 | 538799.93 | 7905467.20 | 4003.26 | 250.00 | 200 | -45 | WD |

| DCAr0136 | 539436.46 | 7905470.89 | 3926.88 | 206.00 | 20 | -45 | ED |

| DCAr0137 | 538834.77 | 7905615.12 | 4036.77 | 200.00 | 54 | -40 | WD |

| DCAr0138 | 539133.86 | 7905074.84 | 3906.25 | 920.00 | 20 | -66 | CV |

| DCAr0139 | 539436.36 | 7905310.09 | 3950.19 | 300.00 | 20 | -45 | ED |

| DCAr0140 | 539441.10 | 7905194.65 | 3947.27 | 325.00 | 20 | -45 | ED |

| DCAr0141 | 538780.93 | 7905611.80 | 4040.87 | 242.00 | 165 | -40 | WD |

| DCAr0142 | 539462.93 | 7905395.94 | 3944.99 | 302.00 | 20 | -45 | ED |

| DCAr0143 | 539492.94 | 7905329.81 | 3956.96 | 314.00 | 20 | -45 | ED |

| DCAr0144 | 539497.70 | 7905209.54 | 3964.78 | 311.00 | 20 | -45 | ED |

| DCAr0145 | 538780.49 | 7905615.05 | 4041.22 | 218.00 | 42 | -40 | WD |

| DCAr0146 | 539403.97 | 7905093.67 | 3933.66 | 320.00 | 20 | -45 | ED |

| DCAr0147 | 539478.82 | 7905140.94 | 3961.05 | 300.00 | 20 | -45 | ED |

| DCAr0148 | 539491.60 | 7905329.30 | 3956.95 | 250.00 | 74 | -45 | ED |

| DCAr0149 | 538785.39 | 7905659.65 | 4053.76 | 161.00 | 62 | -40 | WD |

| DCAr0150 | 539561.94 | 7905082.60 | 3984.52 | 299.00 | 20 | -45 | ED |

| Note: | 1. Drill collar coordinate system is WGS1984 UTM Zone 19S | ||||||

| 2. Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS | |||||||

| 3. CV – Central Valley; WD – West Dome; ED – East Dome | |||||||

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

New Pacific Metals (TSX:NUAG) has announced new assay results for another seven drill holes from its 2022 drill program at the Carangas Silver-Gold Project in Bolivia in conjunction with its local Bolivian partner. The results continue to expand silver and gold mineralization at the project. Near surface silver horizons are stacked over a broad bulk gold mineralization, presenting multiple opportunities for the company.

21,980 metres across 43 drill holes have been completed to-date, with assay results for the twelve drill holes as part of the 2022 drill program being received and released. The results from the first five drill holes were released on July 13, 2022, with 7 more added on August 8. There are 31 drill holes with results still pending, with five drill rigs turning as part of the program.

Most importantly, the company intersected 514m grading 1.1 grams per tonne gold from the 6th drilled in the emerging Gold Zone (Deep Hole DCAr0044). There are six holes remaining for this zone, all of them being relatively shallow that targeted near-surface mineralization in the northern portion of the Central Valley of the zone.

Highlights from the results are as follows:

- Gold Hole DCAr0044: 514.85 m interval (from 266.35 m to 781.2 m) grading 1.10 g/t Au and 6 g/t silver (“Ag”), including higher grade intervals of 14.15 m (from 436.2 m to 450.35 m) grading 3.8 g/t Au, 11g/t Ag and 0.12% copper (“Cu”); 87.51 m interval (from 472.4 m to 559.91 m) grading 2.57 g/t Au, 9 g/t Ag and 0.12% Cu.

- Silver Hole DCAr0041: 78.68 m interval (from 37.8 m to 116.48 m) grading 75 g/t Ag, 0.71% Pb and 0.69% Zn.

- Silver Hole DCAr0042: 79.2 m interval (from 53 m to 132.2 m) grading 77 g/t Ag, 0.73% Pb and 1.43% Zn.

- Silver Hole DCAr0045: 170.64 m interval (from 8.36 m to 179 m) grading 88 g/t Ag, 0.38% Pb and 0.61% Zn, including 72.17 m interval grading 150 g/t Ag.

- Silver Hole DCAr0046: 74.67 m interval (from 7.68 m to 82.35 m) grading 102 g/t Ag, 0.9% Pb and 0.36% Zn.

- Silver Hole DCAr0047: 19.95 m interval (from 77.5 m to 97.45 m) grading 163 g/t Ag, 0.41% Pb and 1.31% Zn.

- Silver Hole DCAr0048: 33.96 m interval (from 142.5 m to 176.46 m) grading 104 g/t Ag, 0.42% Pb and 0.68% Zn.

Hole DCAr0044 intersected a silver interval of 25.12 m (from 33.88 m to 59.0 m) grading 64 g/t Ag, 0.22% Pb, 0.11% Zn and a silver interval of 61.66 m (from 84.83 m to 146.49 m) grading 24 g/t Ag, 0.32% Pb and 0.89% Zn. From 266.35 m to 781.2 m, a broad gold interval of 514.85 m interval grading 1.10 g/t Au and 6 g/t Ag was intersected, including higher grade subintervals of 14.15 m grading 3.8 g/t Au, 11g/t Ag and 0.12% copper (“Cu”) from 436.2 m to 450.35 m, 87.51 m grading 2.57 g/t Au, 9 g/t Ag and 0.12% Cu from 472.4 m to 559.91 m. These two higher grade intervals are hosted in strongly argillic-sericite altered ignimbrite with dissemination and crosscutting veins of pyrite and chalcopyrite. A third higher grade interval of 29.89 m grading 2.46 g/t Au. 5 g/t Ag and 0.14% Cu intersected from 717.07 m to 746.96 m, is hosted in mineralized flow-banded rhyodacite intrusive with dissemination and crosscutting veins of pyrite and chalcopyrite.

This hole was drilled across the Central Valley about 50 m to the south of and parallel to the hole DCAr0039 which intersected a 535 m interval grading 1 g/t gold (please refer to the Company’s news release on July 13, 2022).

Hole DCAr0041 intersected a 266.99 m (from 30.06 m to 297.05 m) silver zone grading 31 g/t Ag, 0.52% Pb and 0.95% Zn, including a 78.68 m interval grading 75 g/t Ag, 0.71% Pb and 0.69% Zn. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0042 intersected 332.7 m interval (from 53.0 m to 385.7 m) grading 25 g/t Ag, 0.45% Pb and 0.95% Zn, including 79.2 m interval grading 77 g/t Ag, 0.73% Pb and 1.43% Zn. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0045 intercepted 170.64 m grading 88 g/t Ag, 0.38% Pb and 0.61% Zn (from depth 8.36 m to 179 m), including a 72.17 m interval grading 150 g/t Ag. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0046 intersected 195.65 m (from 7.68 m to 203.33 m) grading 48 g/t Ag, 0.57% Pb and 0.82% Zn, including 74.67 m interval (from 7.68 m to 82.35 m) grading 102 g/t Ag, 0.9% Pb and 0.36% Zn. This hole was drilled on grid at a dip angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0047 intersected 109.02 m (from 72.05 m to 181.07 m) grading 57 g/t Ag, 0.24% Pb and 0.68% Zn. This hole was drilled on grid at an angle of -45 to test the continuity of silver mineralization at a shallow level.

Hole DCAr0048 intersected a silver interval of 62.31 m (from 65.0 m to 127.31 m) grading 55 g/t Ag, 0.36% Pb and 0.73% Zn, and a silver interval of 33.96 m (from 142.5 m to 176.46 m) grading 104 g/t Ag, 0.42% Pb and 0.68% Zn. This hole was drilled on grid at a dip angle of -45 to test the continuity of silver mineralization at a shallow level.

| Table 1 Summary of Drill Intercepts | ||||||||||

| Hole_ID | Depth_from | Depth_to | Interval_m | Ag_g/t | Au_g/t | Pb_% | Zn_% | Cu_% | AgEq_g/t | |

| DCAr0041 | 30.06 | 297.05 | 266.99 | 31 | 0.06 | 0.52 | 0.95 | 0.03 | 85 | |

| incl. | 37.80 | 116.48 | 78.68 | 75 | 0.00 | 0.71 | 0.69 | 0.02 | 120 | |

| 333.38 | 371.45 | 38.07 | 6 | 0.37 | 0.41 | 0.71 | 0.02 | 71 | ||

| DCAr0042 | 53.00 | 385.70 | 332.70 | 25 | 0.03 | 0.45 | 0.95 | 0.02 | 71 | |

| incl. | 53.00 | 132.20 | 79.20 | 77 | 0.00 | 0.73 | 1.43 | 0.01 | 148 | |

| DCAr0044 | 33.88 | 59.00 | 25.12 | 64 | 0.00 | 0.22 | 0.11 | 0.00 | 75 | |

| 84.83 | 146.49 | 61.66 | 24 | 0.01 | 0.32 | 0.89 | 0.00 | 64 | ||

| 156.80 | 174.10 | 17.30 | 3 | 0.02 | 0.35 | 1.08 | 0.01 | 52 | ||

| 266.35 | 781.20 | 514.85 | 6 | 1.10 | 0.02 | 0.04 | 0.07 | 94 | ||

| incl. | 436.20 | 450.35 | 14.15 | 11 | 3.80 | 0.05 | 0.02 | 0.12 | 296 | |

| incl. | 472.40 | 559.91 | 87.51 | 9 | 2.57 | 0.04 | 0.03 | 0.12 | 207 | |

| incl. | 717.07 | 746.96 | 29.89 | 5 | 2.46 | 0.01 | 0.01 | 0.14 | 195 | |

| DCAr0045 | 8.36 | 179.00 | 170.64 | 88 | 0.0 | 0.38 | 0.61 | 0.02 | 121 | |

| incl. | 8.36 | 80.53 | 72.17 | 150 | 0.0 | 0.39 | 0.21 | 0.02 | 170 | |

| DCAr0046 | 7.68 | 203.33 | 195.65 | 48 | n/a | 0.57 | 0.82 | 0.01 | 93 | |

| incl. | 7.68 | 82.35 | 74.67 | 102 | n/a | 0.90 | 0.36 | 0.01 | 141 | |

| 327.78 | 365.17 | 37.39 | 4 | n/a | 0.49 | 0.75 | 0.00 | 44 | ||

| DCAr0047 | 72.05 | 181.07 | 109.02 | 57 | n/a | 0.24 | 0.68 | 0.01 | 88 | |

| Incl. | 77.50 | 97.45 | 19.95 | 163 | n/a | 0.41 | 1.31 | 0.02 | 220 | |

| DCAr0048 | 65.00 | 127.31 | 62.31 | 55 | n/a | 0.36 | 0.73 | 0.01 | 92 | |

| 142.50 | 176.46 | 33.96 | 104 | n/a | 0.42 | 0.68 | 0.03 | 142 | ||

| Notes: | |

| 1. | Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2 |

| 2. | Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data. |

| 3. | Calculation of silver equivalent (“AgEq”) is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for Ag, US$0.95/lb for Pb, US$1.10/lb for Zn, US$3.40/lb for Cu, and US$1,600/oz for Au. The formula used for the AgEq calculation is as follows: AgEq = Ag g/t + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036 + Au g/t * 71.1111. This calculation assumes 100% recovery. Due to the early stage of the Project, the Company has not yet completed metallurgical test work on the mineralization encountered to date. |

| 4. | A cut-off of 20 g/t AgEq is applied to calculate the length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. |

| 5. | n/a stands for no fire assay of gold was carried out. |

| Table 2 Summary of Drill Holes of Discovery Drill Program of the Carangas Project | |||||||||

| Hole_id | Easting | Northing | Altitude | Depth_m | Azimuth (°) | Dip (°) | Date_start | Date_complete | Target |

| DCAr0041 | 539155.52 | 7905285.54 | 3906.91 | 437.00 | 20 | -45 | 3/8/2022 | 3/13/2022 | C. Valley |

| DCAr0042 | 539121.24 | 7905335.45 | 3907.65 | 400.00 | 20 | -45 | 3/15/2022 | 3/21/2022 | C. Valley |

| DCAr0044 | 539297.60 | 7905378.46 | 3909.11 | 1083.30 | 254 | -66 | 3/23/2022 | 4/19/2022 | C. Valley |

| DCAr0045 | 539273.97 | 7905323.23 | 3908.27 | 450.00 | 20 | -45 | 3/24/2022 | 4/2/2022 | C. Valley |

| DCAr0046 | 539171.12 | 7905329.49 | 3907.10 | 400.00 | 20 | -45 | 4/2/2022 | 4/9/2022 | C. Valley |

| DCAr0047 | 539267.05 | 7905445.11 | 3908.45 | 300.00 | 20 | -45 | 4/9/2022 | 4/15/2022 | C. Valley |

| DCAr0048 | 539231.41 | 7905496.81 | 3908.35 | 300.00 | 20 | -45 | 4/16/2022 | 4/22/2022 | C. Valley |

| Notes: | |

| 1. | Drill collar coordinate system is WGS1984 UTM Zone 19S. |

| 2. | Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS except for hole DCAr0036 which is by handheld GPS. |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Silver prices have swung to new highs as investors weigh risks and equity sell-offs. Prices have swung from trading over US$25 in March to hit a YTD high of US$26.38, and after a pullback at the end of that month, another price spike in April brought it back to those highs. From an April high of US$25.91, prices have hit a low of US$22.52.

However, despite the pullback, silver has begun to trade more like its safe-haven sibling gold. But while gold is often held as a hedge against risk and inflation, silver has applications beyond that. It’s used in solar panels, water filtration, and a variety of other industrial applications. So, while it may not be as popular as gold, it certainly has its place in a portfolio.

For investors looking for silver stocks, the current sell-off has provided opportunities to value plays with massive upside as silver prices rise again.

Honey Badger Silver (TSXV:TUF)

Honey Badger Silver, a junior mining company based in Canada, has had a string of announcements during silver’s turnaround. Most recently, the company announced on March 29 that it had acquired a 100% interest in the Clear Lake deposit in the Whitehorse Mining District of the Yukon.

The transaction is subject to a 1% net smelter return royalty on all metals except silver. The Clear Lake deposit is known to be an important source of zinc and lead but holds mostly silver. With the acquisition, Honey Badger Silver Inc. is becoming the owner of a historic resource of 5.5 million ounces of silver.

This acquisition was an important addition to Honey Badger Silver’s portfolio, as it works to enter more silver properties at different stages of production in order to allow it to offer investors high exposure to silver prices. The company continues to conduct asset evaluations.

The historical resources were reported in a NI-43-101 technical report dated February 23, 2010, and were 43-101 compliant at the time the agreement was signed.

Americas Gold and Silver (TSX:USA)

Americas Gold and Silver is based in North America and owns several producing sites, including the San Rafael mine in the Cosalá operations in Sinaloa, Mexico, which includes the Galena Complex from Idaho, US

During its quarterly earnings call on March 17, the firm revealed its complete 2021 results and addressed the disappointment seen at its Relief Canyon Mine, which failed to go into commercial operation in 2021 owing to metallurgical difficulties. The company is confident, however, due to the reopening of Cosalá and the rising silver price. Its most recent Q1 production results also showed an output of 300,000 silver ounces and 1,274,000 silver equivalent ounces.

New Pacific Metals (TSX:NUAG)

New Pacific Metals is a precious metals explorer and builder. Its main business at the moment is its Bolivian Silver Sand project, which it developed. The firm has two additional silver properties in Bolivia: Silverstrike and Carangas. New Pacific is exploring Silver Sand and Carangas for 2022.

New Pacific Metals released two news stories about exploration at Carangas in February: one announcing a grade of 78 grams per metric ton (g/t) silver and the other sharing the discovery of gold mineralization. However, until silver’s price surge in March, the company’s share price did not experience significant gains. In April, the company also announced intersections of 229 g/t silver at the Silver Sand project, and guidance that it expected to complete 15,000 meters of drilling by the end of April.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CMB.V | +900.00% |

|

CCD.V | +100.00% |

|

CASA.V | +30.00% |

|

AAZ.V | +25.00% |

|

RMI.AX | +25.00% |

|

POS.AX | +25.00% |

|

KGC.V | +20.00% |

|

GDX.V | +20.00% |

|

LPK.V | +16.67% |

|

CCE.V | +16.67% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan