Magna Mining (TSXV: NICU) has announced further assay results from its 2023 diamond drilling program. The company continues to find high-grade nickel mineralization in the 105 Footwall (“FW”) Zone. Specifically, drillhole MCR-23-040 intersected a segment with 4.2% nickel, 0.9% copper, and 1.4 grams per ton of platinum, palladium, and gold across a 7.0-metre length.

Dave King, SVP Technical Services commented in a press release: “The 105 FW Zone is similar to the 101 FW Zone, and consists of high nickel tenor, semi-massive to massive sulphide veins hosted within a breccia structure extending into the footwall from the Sudbury Igneous Complex (“SIC”). Additional diamond drilling within the 105 FW zone continues to intersect high-grade mineralization with increasing precious metals (Pt, Pd, Au) as this structure approaches the Main Zone. We are encouraged to see high-grade PGE mineralization at the 1500 ft level, down-plunge of the defined 109 FW zone, where these two structures are interpreted to intersect, indicating this style of mineralization may continue to depth” (see Figure 1).

The focus of the 105 FW diamond drilling to this point has aimed to expand the existing Indicated Mineral Resource. The goal is to better understand the geological factors that influence mineralization and the consistency of the grades. Drillhole MCR-23-040 also showed two high-grade intersections rich in precious metals, registering 0.3% nickel, 0.8% copper, and 38.6 grams per ton of platinum, palladium, and gold over 0.3 metres and 0.2% nickel, 0.5% copper, and 35.2 grams per ton of platinum, palladium, and gold over 0.5 metres. These findings are connected to the 109 FW zone and lie outside of its current Mineral Resource, suggesting the potential for adding near-surface resources that may be suitable for more selective mining techniques.

The update also includes additional assay results from the G1 and G2 contact exploration targets, along with remaining assays for near-surface drilling in the 109 FW zone. These results were presented along with a location map and summarized data tables.

Magna Mining is continuing its diamond drilling operations at Crean Hill. Currently, one diamond drill is focused on exploring deeper sections of the footwall.

Highlights from the results are as follows:

- 105 FW Zone

MCR-23-040: 4.2% Ni, 0.9 % Cu, 1.4 g/t Pt + Pd + Au over 7.0 metres

MCR-23-046: 0.2% Ni, 1.2 % Cu, 6.3 g/t Pt + Pd + Au over 5.2 metres

And 2.7% Ni, 1.5 % Cu, 18.1 g/t Pt + Pd + Au over 0.9 metres

MCR-23-050: 1.1% Ni, 0.6 % Cu, 4.3 g/t Pt + Pd + Au over 8.8 metres

And 0.6% Ni, 3.5 % Cu, 10.1 g/t Pt + Pd + Au over 1.1 metres

Table 1: Summary of Assay Results

| Drillhole | Zone | From (m) |

To (m) |

Length (m) |

Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | TPM g/t | NiEq | |

| MCR-23-026 | G1 | 240.51 | 244.73 | 4.22 | 0.47 | 0.42 | 0.03 | 0.07 | 0.03 | 0.04 | 0.13 | 0.70 | |

| MCR-23-027 | G2 | 28.08 | 37.11 | 9.03 | 0.75 | 0.33 | 0.04 | 0.03 | 0.02 | 0.04 | 0.09 | 0.96 | |

| Including | 34.19 | 37.11 | 2.92 | 1.59 | 0.17 | 0.07 | 0.02 | 0.01 | 0.01 | 0.04 | 1.77 | ||

| MCR-23-028 | G2 | 38.83 | 46.23 | 7.40 | 0.42 | 0.42 | 0.03 | 0.01 | 0.01 | 0.01 | 0.03 | 0.65 | |

| MCR-23-033 | Intermediate | 35.81 | 43.84 | 8.03 | 0.12 | 0.66 | 0.01 | 0.02 | 0.04 | 0.19 | 0.24 | 0.47 | |

| MCR-23-039 | 105 FW | 471.00 | 471.66 | 0.66 | 0.33 | 0.20 | 0.01 | 2.39 | 1.07 | 1.13 | 4.59 | 1.20 | |

| and | 530.61 | 534.75 | 4.14 | 0.20 | 0.09 | 0.01 | 1.25 | 0.61 | 0.45 | 2.30 | 0.63 | ||

| MCR-23-040 | 109 FW | 21.30 | 21.60 | 0.30 | 0.31 | 0.81 | 0.09 | 9.38 | 26.71 | 2.52 | 38.61 | 8.65 | |

| 109 FW | 65.45 | 65.91 | 0.46 | 0.18 | 0.45 | 0.01 | 26.50 | 5.00 | 3.68 | 35.18 | 5.44 | ||

| 105 FW | 261.00 | 267.98 | 6.98 | 4.19 | 0.87 | 0.11 | 0.42 | 0.80 | 0.15 | 1.37 | 4.98 | ||

| MCR-23-43 | G2 | No Significant Values | |||||||||||

| MCR-23-44 | G2 | 50.57 | 52.51 | 1.94 | 0.45 | 0.27 | 0.03 | 0.11 | 0.02 | 0.01 | 0.14 | 0.62 | |

| MCR-23-45 | G2 | No Significant Values | |||||||||||

| MCR-23-46 | 105 FW/109 FW | 453.09 | 458.24 | 5.15 | 0.24 | 1.15 | 0.02 | 1.32 | 4.20 | 0.74 | 6.26 | 2.04 | |

| and | 466.02 | 466.89 | 0.87 | 2.70 | 1.53 | 0.07 | 17.16 | 0.67 | 0.22 | 18.05 | 5.68 | ||

| Intermediate | 639.69 | 645.20 | 5.51 | 1.16 | 0.72 | 0.05 | 0.36 | 1.42 | 0.03 | 1.80 | 1.91 | ||

| MCR-23-47 | G2 | No Significant Values | |||||||||||

| MCR-23-48 | Exploration | No Significant Values | |||||||||||

| MCR-23-50 | 105 FW/109 FW | 448.36 | 453.12 | 4.76 | 1.06 | 0.64 | 0.03 | 2.92 | 0.84 | 0.58 | 4.34 | 2.04 | |

| and | 461.28 | 462.40 | 1.12 | 0.62 | 3.52 | 0.05 | 0.64 | 4.60 | 4.89 | 10.14 | 4.32 | ||

| and | 469.58 | 470.34 | 0.76 | 0.23 | 1.01 | 0.01 | 0.31 | 6.00 | 2.24 | 8.55 | 2.57 | ||

| and | 488.77 | 489.10 | 0.33 | 1.97 | 6.25 | 0.04 | 5.10 | 0.29 | 0.09 | 5.48 | 5.35 | ||

| and | 513.10 | 513.36 | 0.26 | 1.54 | 0.37 | 0.25 | 0.01 | 24.50 | 0.03 | 24.54 | 7.78 | ||

| MCB-23-023 | 109 FW | 29.12 | 35.99 | 6.87 | 0.08 | 0.11 | 0.01 | 2.04 | 0.90 | 0.61 | 3.55 | 0.71 | |

| MCB-23-024 | 109 FW | 10.00 | 12.02 | 2.02 | 0.03 | 0.07 | 0.02 | 2.63 | 0.75 | 0.57 | 3.95 | 0.69 | |

| MCB-23-025 | 109 FW | 27.22 | 36.00 | 8.78 | 0.05 | 0.03 | 0.01 | 2.65 | 1.16 | 0.68 | 4.49 | 0.80 | |

| MCB-23-026 | 109 FW | No Significant Values | |||||||||||

All lengths are downhole length.

NiEq % = ( (Ni% x 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Ni $/lb

Metal prices in US$: $8.50/lb Ni, $3.75/lb Cu, $22.00/lb Co, $1000/oz Pt, $2000/oz Pd and $1,750/oz Au

Table 2: Drillhole Collar Coordinates

| BHID | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| MCR-23-026 | 474330 | 5142140 | 296 | 192 | 52 | 350 |

| MCR-23-027 | 474511 | 5141877 | 294 | 175 | 44 | 325 |

| MCR-23-028 | 474510 | 5141876 | 294 | 100 | 45 | 80 |

| MCR-23-033 | 473426 | 5141934 | 299 | 130 | 59 | 147 |

| MCR-23-039 | 473099 | 5141551 | 301 | 353 | 49 | 575 |

| MCR-23-040 | 473033 | 5141813 | 288 | 1 | 72 | 402 |

| MCR-23-043 | 474510 | 5141879 | 294 | 229 | 45 | 50 |

| MCR-23-044 | 474511 | 5141881 | 294 | 129 | 45 | 65 |

| MCR-23-045 | 474510 | 5141882 | 294 | 143 | 75 | 51 |

| MCR-23-046 | 473269 | 5141611 | 301 | 331 | 67 | 692 |

| MCR-23-047 | 474508 | 5141880 | 294 | 74 | 65 | 69 |

| MCR-23-048 | 473942 | 5141740 | 299 | 130 | 45 | 248 |

| MCR-23-050 | 473269 | 5141611 | 301 | 331 | 64 | 581 |

| MCB-23-023 | 473070 | 5141754 | 294 | 310 | 38 | 36 |

| MCB-23-024 | 473061 | 5141726 | 293 | 252 | 42 | 80 |

| MCB-23-025 | 473061 | 5141726 | 293 | 305 | 38 | 51 |

| MCB-23-026 | 473048 | 5141780 | 292 | 265 | 38 | 30 |

*Drillhole Coordinates are in coordinate system NAD 83 Zone 17

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Magna Mining (TSXV:NICU) has announced that ongoing drilling confirmed a new zone of near surface sulphide mineralization located roughly 1000 metres east of Crean Hill Main Zone. The company has completed four holes, intersected disseminated to local semi-massive sulphides within a narrow embayment structure at the Sudbury Igneous Complex.

The most recent drilling targeted near the historical drill hole LM01800, which intersected 0.58% Cu, 0.72% Ni over 33.2 metres and 0.39% Cu, 0.67% Ni over 20.2 metres starting at 10.3 metres downhole.

The historical drill hole was drilled beneath a mineralized outcrop at surface. Before this, it had not followed up with drilling. Magna Mining also intersected between 25 and 60 metres of disseminated sulphides, including narrow semi-massive intervals of less than 1 metre at drill holes MCR-23-014 to MCR-22-17.

Dave King, SVP of Magna, commented in a press release: “We are encouraged to intersect near surface mineralization along strike of the known Crean Hill mine ore zones. The widths of mineralization intersected are significant, and if the copper and nickel grades are consistent with the historical drill hole, LM01800, with further definition drilling this zone may potentially be amenable to open pit mining. We expect to have assay results for this initial drilling within four weeks and will report results soon after they are received.”

Mynyr Hoxha, Vice President Exploration, commented: “We are very pleased to report that this diamond drill program was successful in identifying a wide zone of mineralization between the existing resource and surface in the West Zone, in an area previously interpreted as waste in the 2022 feasibility study. Results from the additional 2022 exploration drilling have also demonstrated that the West Zone remains open for expansion along strike to the west and down-dip to the south, where the dip of the mineralization is shallower than previously interpreted. Having intersected this zone of shallow-dipping mineralization cutting through the gabbros in multiple holes now, we believe this could be the feeder system for the entire mineralized Shakespeare deposit.”

Highlights from the results are as follows:

SHAKESPEARE ASSAY RESULTS

Magna Mining is also pleased to report that assay results from the second phase of 2022 drilling at the Shakespeare deposit have now been received. A total of 1,902 metres of drilling across nine drill holes was completed in this phase of the 2022 drill program, the results of which are summarized below. Drill hole locations are shown in Figures 3 and 4, and assay results are summarized in Table 1. A summary of the pertinent conclusions from these results is as follows:

- Drilling has successfully expanded the West Zone mineralization both down-plunge, and closer to the surface in areas which were previously undrilled. The West Zone remains open along the strike and down-dip to the south. The results confirm the potential to add near surface resources around the West Zone.

- Further successful drilling in the area between the East and West zones (MMC-22-47) supports the hypothesis that the Shakespeare open pit could be optimized in the future through incorporating East and West Zone mineralization into a single open pit design.

- Mineralized intercepts are consistent with grades and tenors that are reported in the existing NI 43-101 compliant mineral resource and reserve estimates for Shakespeare.

Highlights of the Shakespeare 2022 Phase 2 drilling include:

- MJU-22-01 intersected 0.25% Ni, 0.32% Cu, 0.81 g/t Pt + Pd + Au over 36.1m. This hole was targeting a near surface area of the West Zone, which was within the feasibility study pit shell, but previously undrilled and interpreted as waste rock.

- MMC-22-45 intersected 0.30% Ni, 0.58% Cu, 1.04 g/t Pt + Pd + Au over 16.6m, extending known mineralization in the West Zone near the “S-13 Zone”, and extends the newly identified shallow dip of mineralization further to the south.

- MMC-22-47 intersected 0.34% Ni, 0.40% Cu, 1.01 g/t Pt + Pd + Au over 11.2m in an area below historical drilling and demonstrates continuity of the mineralization in this brecciated area. This area of mineralisation remains open to west.

- MMC-22-48, intersected 0.23% Ni, 0.28% Cu, 0.80 g/t Pt + Pd + Au over 34.0m down-plunge of the current West Zone resource, further extending the known depth extent of mineralization in the West Zone.

A total of 4,020m of drilling across 15 drill holes was completed at Shakespeare in 2022. The 2022 exploration program has been successful in testing and expanding the West Zone mineralization, refining the geological model, and identifying new exploration targets that could represent areas for further expansion of the Shakespeare Deposit. The 2023 exploration and drilling program at Shakespeare is scheduled to commence in Q2 2023.

Table 1: Selected 2022 Shakespeare Drilling Assay Results

| DDH | From (m) | To (m) | Length (m) | Ni (%) | Cu (%) | Co (%) | Pt (g/t) | Pd (g/t) | Au (g/t) | |

| MMC-22-45 | 220.14 | 236.74 | 16.60 | 0.30 | 0.58 | 0.02 | 0.35 | 0.42 | 0.27 | |

| including | 226.49 | 233.91 | 7.42 | 0.41 | 0.56 | 0.02 | 0.47 | 0.57 | 0.37 | |

| MMC-22-46 | 241.25 | 244.73 | 3.48 | 0.28 | 0.42 | 0.02 | 0.26 | 0.35 | 0.23 | |

| MMC-22-47 | 14.65 | 15.34 | 0.69 | 0.04 | 1.83 | 0.01 | 0.00 | 0.01 | 0.12 | |

| and | 141.00 | 144.99 | 3.99 | 0.24 | 0.36 | 0.01 | 0.26 | 0.36 | 0.16 | |

| and | 151.81 | 163.01 | 11.20 | 0.34 | 0.40 | 0.02 | 0.35 | 0.46 | 0.20 | |

| including | 157.94 | 163.01 | 5.07 | 0.51 | 0.54 | 0.03 | 0.54 | 0.66 | 0.28 | |

| MMC-22-48 | 214.82 | 248.83 | 34.01 | 0.23 | 0.28 | 0.02 | 0.25 | 0.32 | 0.23 | |

| including | 214.82 | 222.71 | 7.89 | 0.48 | 0.50 | 0.03 | 0.51 | 0.67 | 0.45 | |

| MMC-22-49 | 112.04 | 116.65 | 4.61 | 0.18 | 0.00 | 0.02 | 0.78 | 0.74 | 0.01 | |

| and | 123.24 | 123.62 | 0.38 | 0.19 | 0.79 | 0.01 | 0.40 | 0.41 | 0.10 | |

| MMC-22-50 | 85.00 | 93.00 | 8.00 | 0.26 | 0.25 | 0.02 | 0.23 | 0.27 | 0.19 | |

| and | 99.22 | 110.13 | 10.91 | 0.21 | 0.23 | 0.02 | 0.17 | 0.23 | 0.12 | |

| including | 99.22 | 106.59 | 7.37 | 0.28 | 0.29 | 0.02 | 0.22 | 0.30 | 0.15 | |

| MMC-22-51 | 115.07 | 150.00 | 34.93 | 0.41 | 0.40 | 0.03 | 0.39 | 0.44 | 0.23 | |

| including | 117.88 | 125.11 | 7.23 | 0.50 | 0.55 | 0.03 | 0.49 | 0.62 | 0.31 | |

| and | 160.25 | 182.63 | 22.38 | 0.20 | 0.20 | 0.01 | 0.20 | 0.24 | 0.08 | |

| MJU-22-01 | 23.89 | 60.00 | 36.11 | 0.25 | 0.32 | 0.02 | 0.28 | 0.37 | 0.16 | |

| including | 23.89 | 35.71 | 11.82 | 0.35 | 0.40 | 0.02 | 0.38 | 0.48 | 0.24 | |

| MJU-22-02 | 78.74 | 80.68 | 1.94 | 0.27 | 0.23 | 0.01 | 0.30 | 0.34 | 0.13 | |

| and | 95.93 | 99.10 | 3.17 | 0.27 | 0.25 | 0.01 | 0.30 | 0.34 | 0.05 |

- Drill hole intersection lengths are downhole length.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Magna Mining (TSXV:NICU) has announced it has received new assays from its November 2022 drill program a the Crean Hill Mine in Sudbury. Drillhole MCR-22-005 followed up on high grade nickel mineralization intersected in the 101 Footwall Zone from drillhole MCR-22-003. The resulting assay was as follows: Hole MCR-22-005 intersected mineralization grading 4.0 % Ni, 0.7 % Cu, 0.7 g/t Pt+Pd+Au over 31.1 metres, including two massive sulphide intervals grading 6.5 % Ni, 1.0 % Cu, 0.5 g/t Pt+Pd+Au over 5.0 metres, and 5.7 % Ni, 0.7 % Cu, 0.8 g/t Pt+Pd+Au over 16.1 metres.

The company plans to resume scheduled drilling at Crean hill or the 2023 drill program on January 9th. Magna has budgeted 15,000 metres of drilling for the year.

2022 saw four drillholes target the 101 FW zone below historical mining. Previously, Lonmin Canada did not focus on this area because it isn’t considered a low-sulphide, high PGE system. The zone consists of disseminated to locally massive sulphide, which is hosted in a footwall breccia system that extends southwest into the footwall of the intermediate Zone.

The footwall orebodies in Sudbury are normally hosted within breccia systems, and are known to be elevated in Ni, Cu, and PGE mineralization.

David King, Senior Vice President for Magna, commented in a press release: “We are excited to announce additional assay results from our current drilling at Crean Hill. These assay results from drillhole MCR-22-005 are the second set of assay results received from the 101 FW Zone, and they demonstrate the continuity of high grade, massive sulphide mineralization within the footwall breccia zone. The 2022 drilling has improved our geological understanding of the 101 FW Zone mineralization and these results will enable Magna to effectively explore along strike and down-dip of the known mineralization, as well as explore for additional, similar mineralization within the footwall environment at Crean Hill. Additional assay results are expected over the coming weeks and will be announced shortly thereafter.”

Highlights from the results are as follows:

- Drillhole MCR-22-005, intersected 4.0 % Ni, 0.7 % Cu, 0.7 g/t Pt+Pd+Au over 31.1 metres, Including 6.5 % Ni, 1.0 % Cu, 0.5 g/t Pt+Pd+Au over 5.0 metres, and 5.7 % Ni, 0.7 % Cu, 0.8 g/t Pt+Pd+Au over 16.1 metres in the 101 FW Zone

- The 101 FW Zone represents an area of high grade, massive sulphide mineralization over significant widths that was un-mined by prior operators

- 101 FW Zone mineralization is hosted within an approximately 70 metre wide footwall breccia package which remains open for exploration down-dip and along strike

Table 1 Summary of Assay Results Received to Date

| Drillhole | Zone | From (m) | To

(m) |

Length (m) | Ni % | Cu % | Co % | Pt g/t | Pd g/t | Au g/t | TPM g/t | NiEq | |

| MCR-22-001 | Assays Pending | ||||||||||||

| MCR-22-002 | Assays Pending | ||||||||||||

| MCR-22-003 | Intermediate | 75.83 | 105.06 | 30.23 | 0.68 | 0.43 | 0.02 | 0.36 | 0.13 | 0.11 | 0.60 | 0.99 | |

| including | 95.55 | 105.06 | 10.51 | 1.11 | 0.61 | 0.03 | 0.86 | 0.31 | 0.20 | 1.37 | 1.63 | ||

| 101 FW | 154.53 | 157.20 | 2.67 | 2.57 | 0.40 | 0.07 | 0.94 | 0.67 | 0.17 | 1.78 | 3.15 | ||

| 101 FW | 168.12 | 178.90 | 10.78 | 3.75 | 1.74 | 0.09 | 0.20 | 0.22 | 0.04 | 0.46 | 4.69 | ||

| including | 168.12 | 169.78 | 1.66 | 3.24 | 8.30 | 0.08 | 0.07 | 0.24 | 0.21 | 0.52 | 7.65 | ||

| and | 173.10 | 178.90 | 5.80 | 6.01 | 0.33 | 0.14 | 0.35 | 0.33 | 0.02 | 0.70 | 6.47 | ||

| 101 FW | 192.27 | 195.47 | 3.20 | 0.80 | 3.76 | 0.06 | 1.00 | 2.52 | 0.67 | 4.19 | 3.31 | ||

| 101 FW | 215.75 | 222.00 | 6.25 | 0.19 | 0.71 | 0.01 | 0.02 | 0.02 | 0.08 | 0.13 | 0.52 | ||

| MCR-22-004 | Assays Pending | ||||||||||||

| MCR-22-005 | Intermediate | 75.27 | 98.09 | 22.82 | 0.50 | 0.48 | 0.01 | 0.18 | 0.06 | 0.07 | 0.31 | 0.77 | |

| including | 88.17 | 92.23 | 4.06 | 0.88 | 0.97 | 0.02 | 0.45 | 0.16 | 0.14 | 0.75 | 1.44 | ||

| 101 FW | 138.39 | 169.44 | 31.06 | 4.04 | 0.69 | 0.10 | 0.36 | 0.25 | 0.07 | 0.67 | 4.58 | ||

| including | 138.39 | 143.42 | 5.03 | 6.50 | 1.03 | 0.17 | 0.28 | 0.17 | 0.03 | 0.48 | 7.26 | ||

| and | 153.08 | 169.44 | 16.07 | 5.68 | 0.69 | 0.13 | 0.43 | 0.29 | 0.05 | 0.78 | 6.29 | ||

| 101 FW | 178.70 | 184.74 | 6.04 | 0.19 | 0.22 | 0.01 | 0.38 | 0.54 | 0.42 | 1.33 | 0.55 | ||

| MCR-22-006 | Assays Pending | ||||||||||||

| MCR-22-007 | Assays Pending | ||||||||||||

| MCR-22-008 | Assays Pending | ||||||||||||

| MCR-22-009 | Assays Pending | ||||||||||||

| MCR-22-010 | Assays Pending | ||||||||||||

All lengths are downhole length. True width is estimated at 60-80% of downhole length.

NiEq % = ( (Ni% x 2204 x Ni Price $/lb) + (Cu% x Cu Recovery% x 2204 x Cu Price $/lb) + (Co% x Co Recovery % x 2204 x Co Price $/lb) + (Pt gpt x Pt Recovery % / 31.1035 x Pt $/oz) +(dt gpt x Pd Recovery % / 31.1035 x Pd $/oz) + (Au gpt x Au Recovery % / 31.1035 x Au $/oz))/2204 x Ni $/lb

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

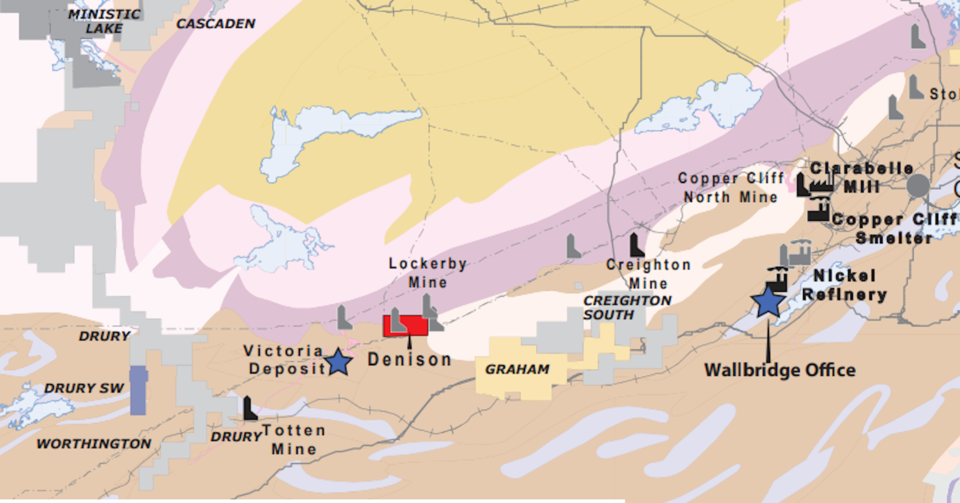

Magna Mining (TSXV: NICU) has agreed to buy 100% of Lonmin Canada Inc.’s (Loncan) assets, which include the Denison project and the inactive Crean Hill nickel-copper-PGM mine, both located in Ontario’s Sudbury basin.

Magna’s CEO Jason Jessup stated to investors: “We believe that this is, in every sense of the word, a transformational acquisition, and it is a key milestone in our vision to become the next mid-tier nickel producer in Canada.”

The Denison project, which includes the old Crean Hill mine, is 37 kilometers east of the company’s advanced-stage Shakespeare operation. From 1906 to 2002, Crean Hill was dug over three periods and yielded 20.3 million tonnes of ore containing 1.3% nickel, 1.1% copper, and 1.6 g/t platinum-palladium-gold. Loncan announced an agreement with Vale Canada regarding the transfer and development of the Denison project in 2018 after the mine closed.

After the operations were halted, several PGM-rich regions were investigated. Recent drilling has revealed 1.69% nickel, 2.28% copper, and 2.37 g/t platinum-palladium-gold over 8.23 meters in the 99 Shaft zone, and 1.87% nickel, 0.95% copper, and 3.14 g/t platinum-palladium-gold over 6.16 meters in the 109 West zone.

According to the share purchase agreement between Magna, Loncan and current Loncan shareholders – which consists of Sibanye UK (formerly known as Lonmin Ltd., a subsidiary of Sibayne Stillwater), Wallbridge Mining (with 16.5% ownership) and other minority shareholders – the total cost for all outstanding shares of Loncan will be C$16 million. This includes a closing payment of C$13 million in cash as well as a deferred payment amounting to $3 million.

Magna has proposed to issue approximately 74 million subscription receipts of the firm at a price of C$0.27 each in a private placement, raising aggregate gross proceeds of up to C$20 million, in order to finance the purchase of Loncan and exploration and development of the Denison project.

Jessup commented further in a press release: “The Crean Hill mine was a significant producer in the Sudbury basin for more than 80 years, and we believe the Denison project has potential to add tremendous value through development of the remaining historical mineral resources and additional exploration on the property. The successful closing of this transaction will be transformative for Magna and has several potential synergies with Magna’s fully permitted, advanced-stage Shakespeare project.”

The Shakespeare property is a past-producing nickel-copper-PGM mine located 70 km southwest of Sudbury. The project has an existing NI 43-101 resource (20.3 million tonnes in the indicated category grading 0.33% nickel, 0.36% copper, 0.32 g/t platinum, 0.35 g/t palladium and 0), permits for both the construction of a 4,500 t/d mill and recommencement of open pit mining activities recommend this surrounding 180 km² land package as being highly prospective for additional discoveries of nickel, copper and PGM deposits.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

CTN.V | +50.00% |

|

DMI.V | +33.33% |

|

MTB.V | +33.33% |

|

AAZ.V | +33.33% |

|

CASA.V | +30.00% |

|

SRZ.AX | +28.57% |

|

EXN.TO | +27.27% |

|

CRI.V | +25.00% |

|

RMD.V | +25.00% |

|

RG.V | +25.00% |

Articles

FOUND POSTS

Uzbek Gold Miner NMMC Moves Closer to Potential London IPO

March 11, 2025

SQM Reduces Spending as Lithium Market Weakness Persists

March 7, 2025

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan