Day 3 of my Newfoundland trip started at the crack of dawn, when I was awakened before 4am by the alarm of the logger in the room next to me at the Lakeview Inn in Millertown. I tossed and turned for the next hour and a half and then made my way downstairs, where I had a terrific breakfast with Antler Gold’s exploration team. After breakfast, we headed to the team’s exploration home base, a rented cabin a few blocks away from the Inn.

Millertown located on the Shores of Red Indian Lake

For the exploration team, each day starts here with a safety review and a delegation of assignments by Exploration Manager, Dave Evans. By about 7 am, we were on the road headed south of Millertown, down a set of logging roads, to Antler’s Wilding Lake Gold Project.

Yours Truly standing in Antler’s Elm Zone Trench

Before getting any further into my site visit report, I’m going to share some interesting facts about the history of Millertown.

Millertown

Just south of Buchans junction, which sits at the north end of Red Indian Lake in central Newfoundland, is Millertown. Millertown was established in about 1900 by Lewis Miller, a timber baron and merchant from Crieff, Scotland.

Having exhausted his timber lands in Sweden, Miller brought a team of Scots and 100 Swedish lumberman to the Red Indian Lake area, in an effort to establish a logging operation that could supply the British Empire with pine timber.

What is left of the old saw mill in Millertown

The town was created to house this team of lumbermen as they built 80 Swedish style, two-room cottages along the shores of the lake. Additionally, they constructed a school and a church on the hill overlooking the lake, which still stands today.

Millertown Church and homes along the shores of Red Indian Lake

During my visit, I asked about the logging industry in the area, and was told that since the closure of the pulp and paper mill in Grand Falls, logging in the area has really declined with only a small number of companies still in operation. Unfortunately, the industry’s decline has had a major effect on the town and many younger families have left.

Shores of Red Indian Lake

With the area’s great geology and the access provided by the logging roads, however, a mining renaissance could be coming to Millertown and the surrounding area. Companies such as Antler Gold, Marathon Gold and Torq Resources are exploring heavily in this general region. A large discovery and the development of a mine could bring much needed cash and jobs to this beautiful area in central Newfoundland.

The Wilding Lake Gold Project

After driving for about an hour on the rough logging roads, we arrived at the point of the original Wilding Lake gold mineralization discovery, which occurred just a few years ago. The gold was found in 2015 by prospectors, Brian Jones and Gary Rowsell, in quartz boulders alongside a new logging road. Grab samples from these boulders assayed up to 74.8 g/ton gold.

Approximate location of the first boulders discovered by Jones and Rowsell

Jones and Rowsell eventually sold the property to Altius Minerals, which is a large mining royalty company based in St. John’s, Newfoundland and Labrador. Altius then carried out further exploration activities in the fall of 2016, such as soil and basal till sampling, airborne and ground geophysics.

Fast-forwarding to today, Altius has since optioned the property to Antler Gold, who is currently conducting a systematic exploration program of the property with soil sampling, trenching and, most recently, a 2,500m drill program of some highly prospective targets.

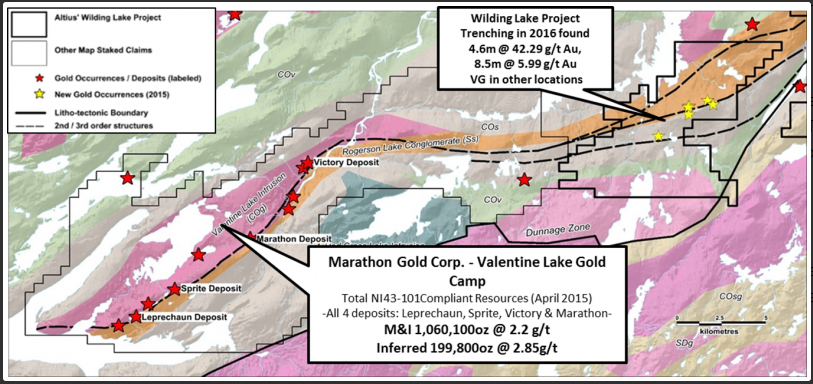

To note, Antler’s Wilding Lake Project covers 215 sq. km and more than 50 km of strike length of the projected structural trend that is believed to control the regional gold mineralization. This trend is the same as Marathon Gold’s Valentine Lake Gold Camp, which currently boasts a total over 2 million ounces of 43-101 compliant gold resources in the Measured and Indicated, and Inferred Resource categories.

Wilding Lake Gold Project Geology Map

Text Book Example of Rogerson Lake Conglomerate

Gold Mineralization Zones

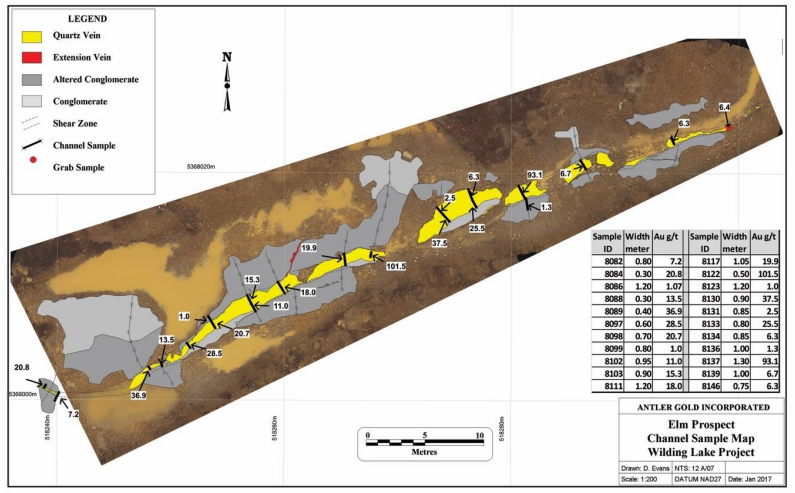

In 2016, 5 gold mineralization zones – Alder, Taz, Elm, Cedar and Dogberry – were found by Atlius’ exploration team. The gold showings mainly consist of quartz-tourmaline veins containing clots of coarse-grained chalcopyrite, hematite, malachite and visible gold is hosted by the Rogerson Lake Conglomerate.

Taz Zone Trench located in Close Proximity to Original Boulder Discovery

In the picture below, the purplish coloured rock is the Rogerson Lake Conglomerate. As the conglomerate nears the quartz veining, its colour changes to brownish. The Elm Zone was the most developed trench I saw, and the focus of drilling at the time of my visit.

Elm Zone Trench – Rogerson Lake Conglomerate, bottom left purplish colour

Elm Zone Trench – Site of drilling on the day of my visit

Taz Trench Rock

Systematic Exploration

The drive down the logging roads to Wilding Lake gave Exploration Manager Dave Evans and I a chance to talk about the project, and the systematic approach they are using to find gold mineralization on the property. In the mining industry, a systematic approach is paramount to conserving capital and making every dollar count.

Beginning in the summer, Evans and his team set out to explore as much of the property as possible, taking soil samples and mapping the property, in hopes of identifying further targets for this fall’s 2,500m drill program.

This systematic approach is particularly important for exploration in Central Newfoundland and Labrador because of the amount of overburden which masks most outcroppings. This overburden layer can vary in depth from 0.5m to 15m throughout Newfoundland and Labrador.

The layering of the soil can be seen when standing in the dug trenches, as the top thin layer of organics clearly sticks out on top, followed by an overburden blanket of varying thickness, which is followed by basal till along the top of the rock.

Evans pointed out that the key to proper soil sampling is to get a sample below the organics in the A horizon, down to the brownish soil, where there is the possibility for gold to be present. When high potential soil samples or boulders are found, the geologists identify the path of the glaciers, which would have worn the mineralized outcrops as they moved across, many years ago. The exploration team then moves up ice of the high gold in soil or boulder samples to (hopefully) find the buried quartz vein outcrops.

By overlaying soil and till sampling data with the geophysical data, followed by trenching and channel sampling along the quartz veins in each zone, the team has identified high potential targets which, at the time of my visit, were the focus of the drilling.

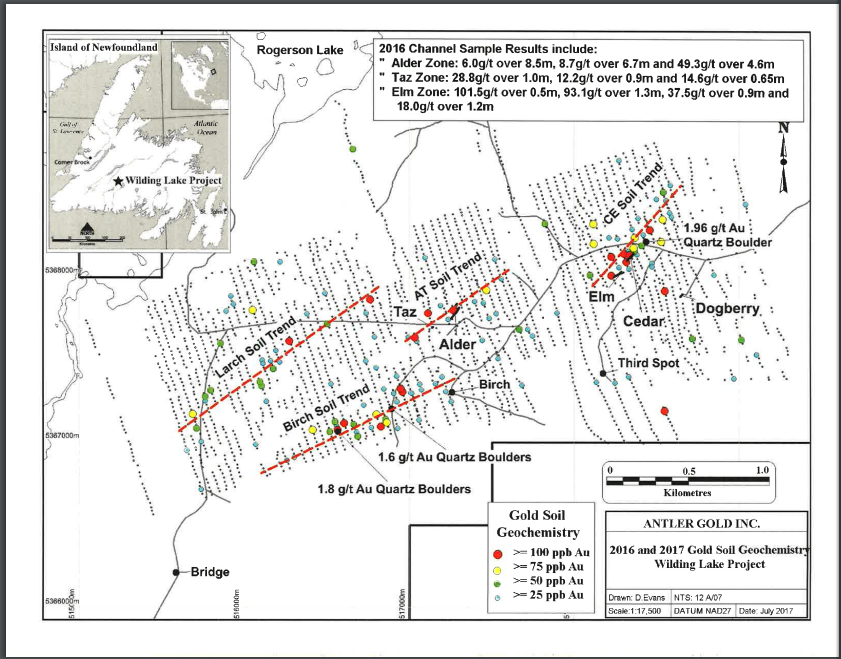

Evans told me that, to date, they have collected over 6000 samples across the property. In the July 26th, 2017 news release, Antler released the gold soil geochemistry diagram seen below.

2016 and 2017 Soil Geochemistry Wilding Lake Project – News Release July 26th, 2017

Further in the August 30th, 2017 news release, Antler announced the discovery of new mineralized zones, Red Ochre and Raven. The Red Ochre Zone is located roughly 900 meters to the southwest of the Alder Zone, while the Raven Zone is located 400m to the northeast of the Red Ochre Zone.

Antler’s systematic approach to exploration is clearly working and makes me confident that if there is more gold mineralization within their claim boundaries, they will find it!

Pointing out a Fleck of Gold at the Taz Trench Outcrop

Trenching Work

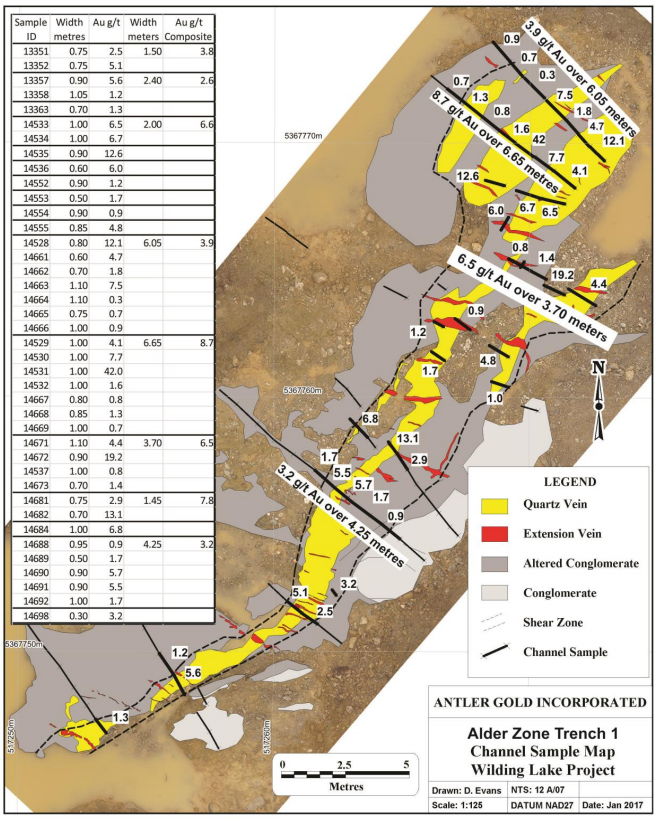

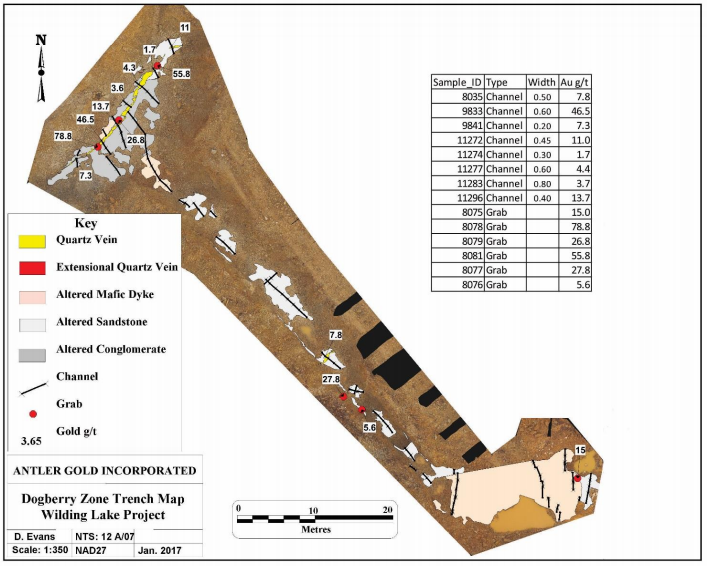

I have included a few pictures from my visit and a few images produced by Antler depicting the Elm Zone, Alder Zone and Dogberry Zone trenches, which have channel sampling data included from the quartz veins. These were a part of a January 24, 2017 news release.

Elm Zone Trench – Quartz Vein Outcrop

Elm Zone Trench – Exploration Manager, Dave Evans

News Release Jan.24, 2017 – Alder Zone Trench

News Release Jan.24, 2017 – Elm Zone Trench

News Release Jan.24, 2017 – Dogberry Zone Trench

Newfoundland and Labrador – A New Frontier for Gold Exploration

Finally, for those who haven’t read my article on Newfoundland and Labrador as a mining jurisdiction, and/or don’t know much about this great province on Canada’s East Coast, you can find it here.

Concluding Remarks

Touring the property with Exploration Manager, Dave Evans, was an exciting and very insightful experience. In any mineral exploration endeavour, a systematic approach that ensures dollars are spent wisely is vital to the success of the operation. In the case of Antler, I had the chance to see, first hand, the dividends that are paid when you have a defined process that’s performed by an experienced team.

Secondly, having met Antler CEO, Dan Whittaker, this past summer in Toronto, I’m confident Antler shareholders, including myself, are in good hands moving forward. I am a buyer of Antler Gold and look forward to the first round of drill results in the coming weeks.

Don’t want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now – it’s FREE!

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company(s) and sector that is best suited for your personal investment criteria. Junior Stock Review does not guarantee the accuracy of any of the analytics used in this report. I do own Antler Gold shares. I have NOT been compensated to write this article and have No business relationship with Antler Gold.

Velocity Minerals (TSX-V: VLC) is a gold (“Au“) exploration and development junior focused on eastern Europe. Others in the region include Eldorado Gold, Nevsun, Freeport McMoran, Rio Tinto, First Quantum, Teck and Lundin Mining. In July, the TSX Venture exchange approved a transformational deal in which the Company acquired options on 2 highly prospective properties in southeastern Bulgaria. In conjunction with these new assets, a talented new management team and Board is in place.

Velocity is aligned with private Bulgarian gold miner Gorubso Kardzhali (owner of the optioned projects and the only company in Bulgaria with a permit for cyanide-related processing of gold ores). Gorubso has been producing from its high-grade underground Chala gold mine for over 10 years and owns / operates a newly built (2011) Carbon-In-Leach (“CIL“) processing plant that has excess capacity. Close ties with Gorubso is helps in interactions with local communities and governmental bodies. (See Corporate Presentation)

Rozino Gold Project – 70% Earn-in Option

Velocity holds an option, exercisable for 6 years, to acquire an undivided 70% Interest in the Tintyava property, granted by Gorubso Kardzhali A.D. (“Gorubso”). The Rozino project, the subject of a recently filed Technical Report, is located within the Tintyava property, which has an area of 163 sq. km. To exercise the option, the Company must deliver a NI 43-101 compliant PEA.

The Rozino project is located 20 kilometres east of the Ada Tepe gold deposit being developed by Dundee Precious Metals, 50 km southeast of Kardzhali, host to tailings and gold processing facilities operated by Gorubso, and 350 km east-southeast of the capital of Sofia.

On August 21st, results of the first 2 drill holes at the Company’s Rozino gold project were released. Additional drill results are expected in the first half of September. Regarding the first 2 holes, Keith Henderson, Velocity’s President and CEO commented…

“These results are among the best grades ever returned from the project and the drill holes clearly demonstrate the potential for thick, high-grade gold mineralization between historical drill fences.”

Notice that I added boldface in the above quote, “between historical drill fences.” To a large degree, the success of Velocity Minerals’ main project revolves around that sentence. In the 1980s, a Bulgarian State-run company explored Rozino under the erroneous assumption of a flat-lying exploration target (which called for routine vertical drilling). However, as Gwen Preston editor of, “Resource Maven” explained in her recent report on Velocity,

“….the gold was not in a flat lying body but in steeply dipping structures that the vertical holes missed completely. In most cases, each vertical hole cut between two steep structures and therefore only cut through the disseminated mineralization in between. The next round of exploration from 2001 to 2005 involved angled holes, but the geologic concept was still flawed – this group drilled angled holes, but to the northwest. As a result, they too drilled parallel to and between the mineralized structures at Rozino, which run northwest and dip very steeply.” — Gwen Preston, editor of Resource Maven, a weekly newsletter on investing in the metals space

Therefore, the news of the first 2 drill holes, including a near-surface interval of 39 m of 4.11 g/t Au goes a long way towards supporting the thesis that decades worth of historical drilling provided some useful information, but was largely ineffective. These results come on top of the only other angled drill hole, drilled in the right direction…. #R-245 in 2006 by Asia Gold, returned 68 m @ 3.15 g/t Au, including 11.39 m @ 8.09 g/t Au. If management is on to reasonably thick, near-surface intervals of 2-4+ g/t gold, (the Company will be drilling for several more months) then other key aspects of the Rozino project will take on new meaning.

By that I mean, for example, there are very promising historical trench samples including,

17 m @ 3.39 g/t Au, 4.53 g/t Ag and 14 m @ 4.29 g/t Au, 2.58 g/t Ag

But these samples were never followed up on, perhaps because ongoing drill results (drilled in the wrong orientation) were not as exciting as what Velocity might find. Still, according to the technical report, the potential for additional sub-parallel vein zones to the main deposit is thought to be good and the targets there are essentially untested by drilling.

And that’s not all, in addition to strong trench samples, note what the technical report had to say about preliminary metallurgical test work (– page 20),

“Preliminary metallurgical test work carried out by Geoengineering, Lakefields, Caracal and Wardell Armstrong suggests that recoveries by cyanide leaching are above 90%, with no deleterious elements and the deposit should be amenable to simple low cost processing. This is consistent with LSE deposits elsewhere in the world, where similar grade mineralisation is mined.”

There has been a substantial amount of work done on the property by at least 4 groups. According to the technical report, work included; 1:2,000 scale geological mapping (8 sq. km), soil sampling (2,079 stations), trenching (clearing of existing state trenches and new trenches) for 3,978 m, channel sampling from trenches (2,411 samples), 55 diamond drilling core holes for 7,409 m, assay results of drill core (4,918 samples), 12.2 line km of ground magnetic surveying and 1.5 line km of Induced Polarization geophysical profiling.

Key Management Team and Board Members

The newly assembled management / technical team and Board really stands out for a company with a market cap of just ~C$ 18 M. In addition to Bulgaria, team members have worked in eastern and southern Africa-Eurasia, central Asia, central-south America, Australia, Peru, Canada, Mexico, the U.S., Namibia, Burkina Faso, Turkey, Yemen, Argentina, Chile, Iran, Ireland, China, Siberia, DRC, Russia, Serbia and India.

Team members have worked at major miners including Anglo American, Rio Tinto, Kinross, Lundin Mining, Teck Resources and Glencore. Director Mark Cruise has Founded 2 highly successful juniors; zinc miner Trevali Mining and gold explorer International Tower Hill Mines. CEO/Director Keith Henderson has decades of deal making/deal structuring and capital raising expertise.

Velocity Minerals scores very high in terms of boots on the ground. In addition to the close working relationship with Gorubso, 2 of Velocity’s top 5 executives are Bulgarian Nationals and VP of Exploration Stuart Mills is working full-time in Bulgaria.

Chala Gold Mine Option Agreement

Management has signed an exclusive 12-month option agreement with Gorubso to contemplate a joint venture to enhance/expand Gorubso’s Chala gold mine and, if warranted, the CIL plant. That arrangement could possibly include feeding the plant with ore from one or both of Velocity’s projects. If a win-win agreement can be reached, Velocity could effectively be in production (in partnership with Gorubso) as soon as next year.

Velocity is organizing and digitizing Gorubso’s 10+ years of mining data at the Chala gold mine to understand the likelihood of significantly more (tonnage and/or higher grade) gold mineralization being identified. Although I hesitate to enlist the overused phrase, “huge blue-sky potential,” a JV with Gorubso could be a really big deal. If structured right, it would greatly de-risk the development of Velocity’s 2 projects, slash upfront cap-ex requirements, facilitate / reduce permitting costs & time lines and simplify operational flow sheet design (especially if Gorubso’s CIL plant were to be utilized).

Near-term Catalysts – Drill Results

Management is laser focused on resource drilling to produce an open-pittable resource estimate. Importantly, since previous resource estimates were limited by mistakes in the orientation of drilling, the final resource reported to the Bulgarian government was severely restricted, it had no resource blocks between drill fences. Management believes that substantial infill potential around the main deposit exists between drill fences, and mineralization remains open to the southeast and northwest.

A total of 9 diamond drill holes (approximately 2,000 m) are planned for Phase I, of which the first 2 holes have been reported. The program is part of a larger campaign of up to 65 drill holes (~12,000 m), planned to be ongoing through the remainder of 2017 and into early 2018. Additional drill results are expected in the first half of September.

Ekuzyata Gold Project, Southeastern Bulgaria

I only briefly mention Velocity’s 2nd project, Ekuzyata, a 50% Earn-in opportunity, (or revert to 5% GSR) because the main focus is Rozino.

Any discovery could be within reach of existing Chala mine infrastructure, so there would be limited need for additional capital if Gorubso and Velocity were partnered. Ekuzyata is located within Gorubso’s mine concession, no additional permitting would be required.

CONCLUSION

Drill results in September/October will carry a lot of weight, if they continue to be as good or better than the first 2 assays, the Rozino project will have (both) less risk of there being no meaningful resource, and more upside potential from near-surface, high-grade zone(s) of Au mineralization.

Success at Rozino should increase the likelihood of a JV with Gorubso, which would be a win-win for both companies and a win for local communities.

To recap, Velocity Minerals (TSX-V: VLC) is funded to explore an overlooked property that could be fast-tracked into development (if warranted by further drilling), potentially in partnership with existing producer Gorubso. A prospective JV could save Velocity Minerals a tremendous amount of development capital, allowing the Company to minimize equity dilution. Currently there are 57 M shares outstanding, (66 M fully-diluted), no debt or preferred shares. The market cap is ~C$ 18 M. (See Corp. Presentation)

To the extent that permitting and other key development & construction activities could be facilitated by Gorubso’s experience and connections, that too could expedite Rozino’s and/or Ekuzata’s path to potential production. Combined, Gorubso with its operating mine and CIL plant and Velocity with Rozino, Ekuzata and its strong geological, exploration & technical team, could become a regional powerhouse capable of accretive acquisitions of nearby mining assets.

–

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Velocity Minerals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Velocity Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Velocity Minerals and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Kermode Resources Ltd. Kermode Resources Ltd. |

KLM.V | +100.00% |

|

ADD.V | +50.00% |

|

ADD.AX | +50.00% |

|

SXL.V | +33.33% |

|

GGL.V | +33.33% |

|

CASA.V | +30.00% |

|

RUG.V | +25.00% |

|

RKR.V | +25.00% |

|

NOW.V | +20.43% |

|

TAS.AX | +20.00% |

Articles

FOUND POSTS

Chile’s Year-End Copper Windfall Signals Mining Recovery

January 10, 2025

Oman Resumes Copper Exports After Historic 30-Year Gap

January 7, 2025

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan