Inomin Mines (TSXV:MINE) has carved a unique position in the critical minerals exploration sector. With a firm focus on identifying, acquiring, and exploring large deposits of essential minerals, the company is committed to discovering resources that fuel a cleaner energy future. In an exclusive conversation with MiningFeeds, Inomin Mines shares insights into its projects, strategy, and the role it hopes to play in the global supply chain for critical minerals.

MiningFeeds: Could you give us an overview of Inomin Mines and its key focus within the critical minerals exploration industry?

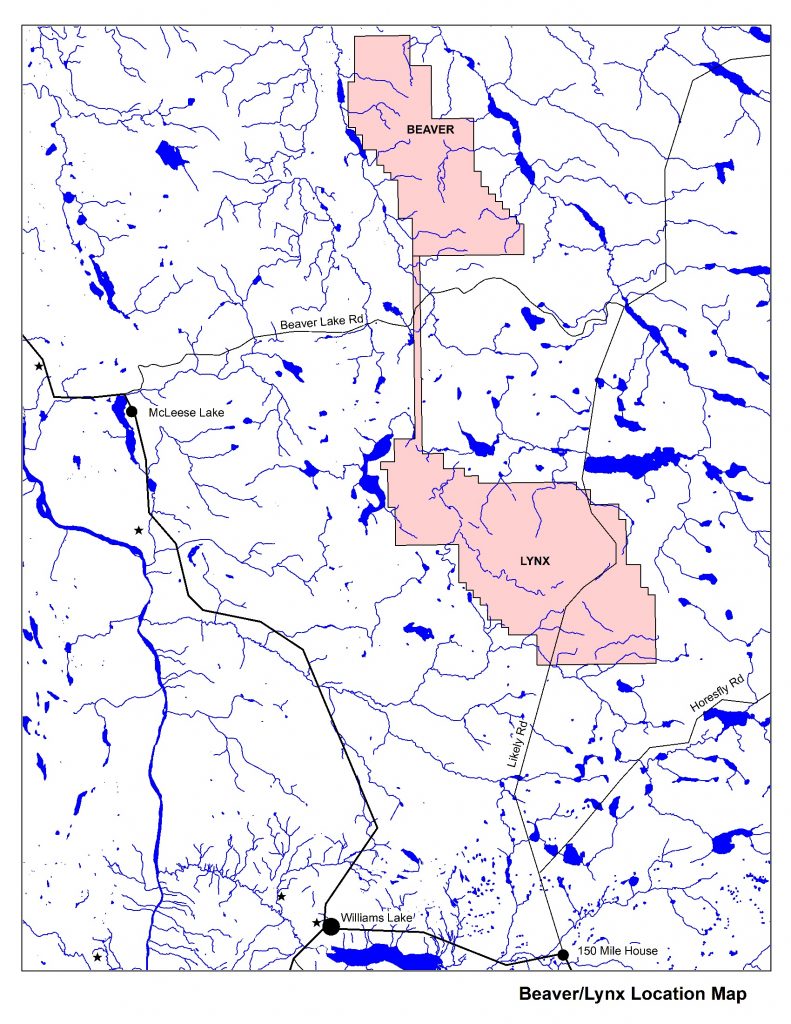

Inomin Mines: Inomin Mines (TSXV:MINE) is an exploration company focused on the identification, acquisition, and exploration of mineral properties prospective for hosting large deposits, especially critical minerals and precious metals. We acquired the Beaver-Lynx property to give the company exposure to discovery of significant nickel and magnesium resources. Such commodities are among the most critical materials for Western countries as they are largely produced in foreign countries, especially Asia and the Middle East, where supplies are subject to disruptions and trade restrictions.

With Inomin Mines’ strategic acquisition of the Beaver-Lynx property, the company is primed for the discovery of critical mineral deposits. Their focus on key resources like nickel and magnesium aims to address Western dependence on foreign mineral production, a goal that aligns with broader supply chain security efforts.

MiningFeeds: The Beaver-Lynx project is a significant part of Inomin’s portfolio. What makes this project stand out in terms of its potential for high-grade magnesium and sulphide nickel deposits?

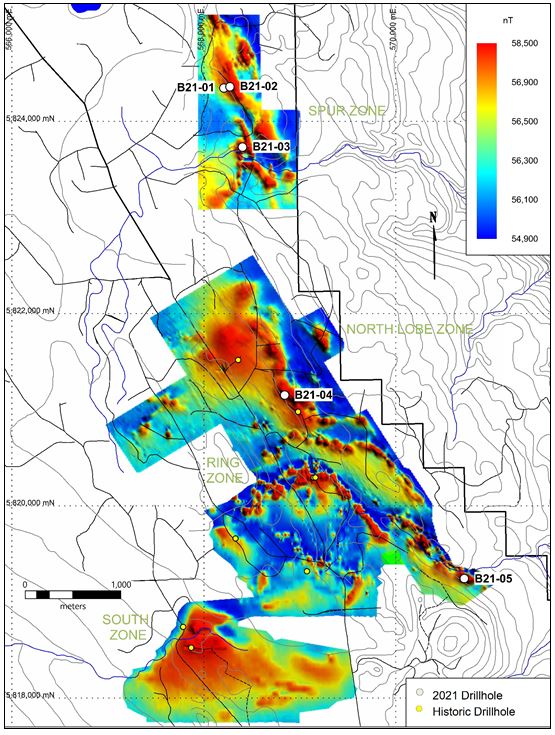

Inomin Mines: Among the project’s many stand-out factors is its large mineral size potential. In terms of size, exploration indicates the property could host over 2 billion tonnes of resources. If so, the project would be among the largest resources of nickel and magnesium in Canada.

Inomin’s Beaver-Lynx project represents an immense opportunity with its potentially vast mineral deposits. With over two billion tonnes of resource potential, Beaver-Lynx could secure a top position in Canada’s nickel and magnesium supply chain, offering significant strategic advantages.

MiningFeeds: Inomin has mentioned that the Beaver-Lynx project benefits from excellent infrastructure and a strong local workforce. How important are these factors for the success of a mining project, especially in south-central British Columbia?

Inomin Mines: As Beaver-Lynx is in an infrastructure-rich area, including hydroelectric power, all-season roads, and active railroad, it allows for significantly lower project costs for exploration, as well as development and mining. The existing infrastructure is worth billions, and if not in place, would take years to establish – obviously a tremendous advantage for projects in the region. The surrounding resource communities support mining as the industry is a leading economic sector providing well-paying jobs and related opportunities.

The project’s strategic location in British Columbia’s resource-rich infrastructure highlights how a supportive local workforce and established infrastructure can significantly lower costs and enhance project feasibility.

MiningFeeds: Recently, Inomin applied for hydrogen rights related to the Beaver-Lynx project. Can you explain how this expands the project’s potential and what role hydrogen could play in the future of mining and energy?

Inomin Mines: Beaver-Lynx is in a geologic setting prospective for natural hydrogen, also known as geologic hydrogen and white hydrogen. Hydrogen and/or other gases that may be found add to the project’s potential value. We haven’t yet tested the property’s potential for hydrogen but plan to going forward. In our last drilling program, one of the holes went through an empty area void of material which could represent a reservoir hosting gas.

Natural hydrogen, unlike green and other types of hydrogen, has been called the “holy grail of clean energy” as it doesn’t need to be processed, and used in fuel cells, only emits water vapor. Hydrogen will become a growing and important energy source to assist industries (including mining) and countries decarbonize, and create cleaner, more sustainable environments.

The potential discovery of natural hydrogen at Beaver-Lynx adds an exciting layer to the project. Hydrogen’s clean energy credentials make it a sought-after resource in the push for decarbonization, presenting Inomin with a unique opportunity to contribute to cleaner energy solutions.

MiningFeeds: Could you provide more details on how the proximity of Beaver-Lynx to two major mines adds to the strategic advantage of the project?

Inomin Mines: Beaver-Lynx is located between two of the province’s largest operating mines: Gibraltar and Mount Polley. Our property in fact borders Taseko’s Gibraltar mine, just eight kilometres from the open pit. Gibraltar has been in production for many years and is a significant economic contributor to nearby communities, employing over 700 persons. Exploration and mining in the region have a long, highly valued history that will enable new projects such as Beaver-Lynx to continue to be welcomed by residents and other stakeholders.

By situating itself near established mines, Inomin Mines stands to benefit from shared resources and a supportive mining community, setting the stage for Beaver-Lynx to become an integral part of British Columbia’s mining landscape.

MiningFeeds: Inomin is targeting critical minerals, which are essential for technologies like electric vehicles and renewable energy systems. How does the company see itself contributing to the global supply of these minerals?

Inomin Mines: If we confirm Beaver-Lynx holds a major source of critical minerals, then the project can contribute to global supplies, especially a clean supply source. It would be relatively cleaner because Canada has much higher environmental standards (compared to many countries in Asia and Africa), and preliminary testing indicates the project likely has the advantage of being able to sequester carbon dioxide mining emissions given the high amount of magnesium mineralization.

Inomin Mines aims to enhance global supplies of critical minerals, emphasizing cleaner extraction processes aligned with Canada’s rigorous environmental standards. This dedication to environmentally responsible mining could position Beaver-Lynx as a leading source for sustainable critical minerals.

MiningFeeds: You recently closed a private placement and provided a corporate update. How does this funding support your current exploration efforts and future expansion?

Inomin Mines: We raised a relatively small amount of capital earlier this year to advance our exploration and business activities. We plan to raise more capital near-term to continue to advance Beaver-Lynx and other opportunities.

The additional capital raised by Inomin fuels its exploration initiatives, enabling the company to push forward with its development goals at Beaver-Lynx and pursue further growth.

MiningFeeds: What challenges and opportunities do you foresee in the critical minerals sector, and how is Inomin positioning itself to navigate these dynamics?

Inomin Mines: One challenge in the sector, and mining in general, is gaining public interest and support. The mining industry is still viewed by many people as a dirty (polluting) business. The reality is without critical minerals there is no greener society. The mining sector needs to continue to make progress to be more sustainable and better communicate the industry’s contributions and importance to the world.

Inomin is keenly aware of the perception challenges facing the mining industry. By adopting sustainable practices and engaging in transparent communication, the company aims to redefine the role of mining in fostering a greener, cleaner society.

MiningFeeds: Sustainability is a growing concern in the mining industry. How does Inomin incorporate environmental and social governance (ESG) principles into its projects, particularly Beaver-Lynx?

Inomin Mines: We try to operate in a manner that’s beneficial to all stakeholders especially where we work. Communication is key and we contribute where we can, even on a small scale. For instance, for those few residents that reside where our property is located, we’ve pointed out that they should test their well water as it’s likely to contain high content of metals like nickel – not something you want to consume long-term.

Inomin Mines’ proactive approach to stakeholder engagement demonstrates its commitment to ESG principles, particularly through initiatives that promote community welfare, like advising local residents on potential water quality issues.

MiningFeeds: Looking ahead, what milestones should investors and stakeholders expect from Inomin in the near future, particularly with regard to the Beaver-Lynx project and your broader exploration goals?

Inomin Mines: A key near-term objective is to raise further capital to continue to advance Beaver-Lynx. We’d like to delineate a maiden mineral resource and test for hydrogen. As resource market conditions are still relatively soft, we hope to attract a project partner and strategic shareholders. Of course today’s market conditions provide opportunities for investors – that’s the nature of our highly cyclical sector.

Inomin is setting its sights on several key milestones, including additional fundraising, resource delineation, and hydrogen testing. The company’s adaptability in navigating the cyclical resource market presents investors with a timely opportunity in the critical minerals sector.

As Inomin Mines continues to explore and expand its portfolio, the company’s commitment to sustainability, innovation, and community engagement makes it an important part of the critical minerals exploration industry and for contributions to the future of clean energy technologies, both in Canada and on a global scale.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Romios Gold Resources Inc. Romios Gold Resources Inc. |

RG.V | +50.00% |

|

ADD.V | +50.00% |

|

HBK.V | +50.00% |

|

ERA.AX | +50.00% |

|

BCU.V | +40.00% |

|

PLY.V | +33.33% |

|

PLY.V | +33.33% |

|

ERL.AX | +33.33% |

|

MRQ.AX | +33.33% |

|

HLX.AX | +33.33% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan