The following interview of Lawrence Roulston, newly appointed non-executive Chairman of Metalla Royalty & Streaming was conducted by phone and email in the week ended November 5th. Lawrence has 35 years’ of diverse hands-on experience. He recently founded WestBay Capital Advisors, providing business advisory & capital markets expertise to the junior & mid-tier sectors of the mining industry.

From 2014 to 2016, he was President of Quintana Resources Capital, which provided resource advisory services for U.S. private investors, focused primarily on streaming transactions. Before Quintana, he was a mining analyst and consultant, as well as the editor of “Resource Opportunities”, an independent investment publication focused on the mining industry. He has graduate-level training in business and holds a B.Sc. in geology.

Regarding the appointment, detailed in a press release dated October 6, 2017, CEO Brett Heath commented as follows,

“Lawrence’s extensive knowledge of the resources industry, finance, and listed company governance makes him exceptionally well qualified to lead the Metalla Board in helping to deliver long-term, sustainable returns for the Company’s shareholders”

Metalla has a lot going on, without further ado, here’s a timely update on the Company.

Can you please give readers a high-level overview of what Metalla Royalty & Streaming does, and what assets it owns?

Metalla acquires royalties and streams on gold and silver deposits. A royalty is a fixed percent of the revenue produced from a mine; a stream is the right to purchase a portion of the metal output from a mine at a fixed price. Royalties and streams both offer upside exposure to increases in the metal prices, and to exploration success (they are typically for the life of the mine).

Importantly, because royalties and streams are based on revenues, they do no expose investors to operating costs and to capital costs.

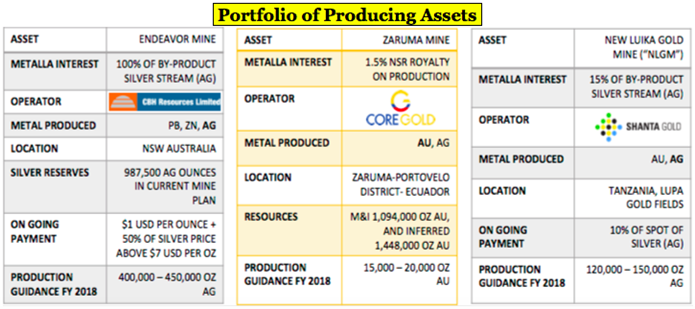

Metalla currently owns three cash-flowing assets, including a royalty on a gold mine in Ecuador; we have part of a stream that involves all the silver produced at a gold mine in Tanzania, for a fixed price of 10% of the silver spot price. We also have the right to buy all the silver byproduct from a big zinc mine in Australia, for a price of about $6 an ounce. We also hold gold-silver royalties on three development-stage projects, two of which are in Canada.

We expect those development projects to generate cash in the next 1-5 years: Two involve extensions of existing mines and one development asset that will have ore trucked to a nearby processing plant. All of them are operated by large producers. We own another dozen royalties on earlier stage projects, mostly in Canada.

How did you find Metalla Royalty & Streaming, or did MTA find you?

I had known 2 of the directors for several years. In addition to being very familiar with the mining industry, I had particular experience in royalties and streaming, most recently as President of Quintana Resources Capital. In that role, I helped a Texas oil family and another big private investment group to set up an investment vehicle that was aimed at streaming. So, it was a good fit.

Please tell readers about other key members of your team, including Brett Heath, E.B. Tucker & Charles Beaudry?

E.B. is Editor of the Casey Report. He has 15 years’ experience in fund management and security analysis. Charles is a Canadian P.Geo. with over 30 years’ experience in project generation, business development, exploration and project management.

Brett, the CEO, has many years of experience in putting deals together in the mining industry. He did an outstanding job to buy the royalty package from Coeur Mining, which made the major our largest shareholder. He is now working with other large mining companies on similar deals.

The latest FY quarterly earnings (as of August 31st) were released on October 26th, can you hit upon the highlights? When will Metalla be cash flow positive?

Metalla is now cash flow positive. When including all production (and inventory) for June, July & August, the Company produced 115,667 ounces of silver with an average cash margin of over US$10. We expect next quarter to be even better as the Endeavor operation ramps up.

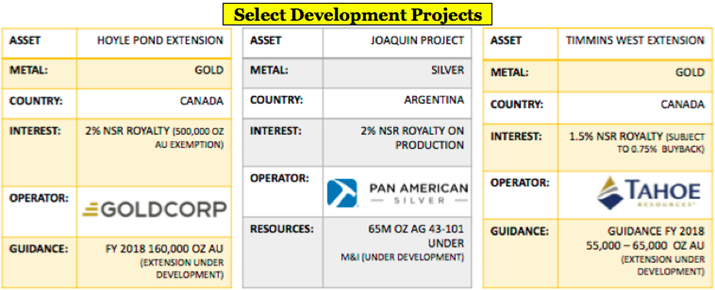

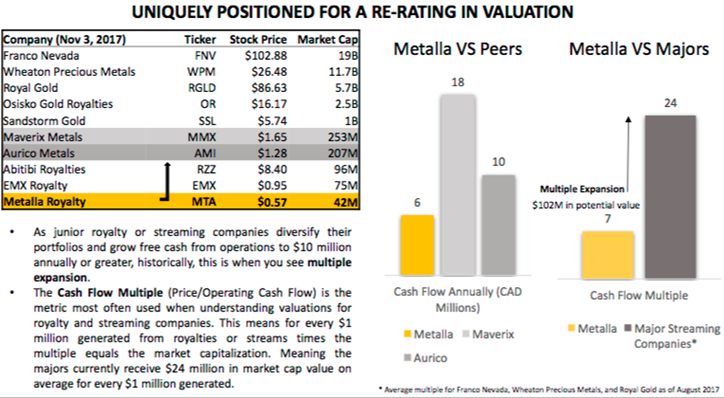

How can a company with a market cap of only [~C$ 42 M = ~US$ 33 M] operate in the Royalty & Streaming business alongside billion dollar companies like Franco-Nevada, Wheaton Precious Metals & Royal Gold?

Those larger companies, with values from U$5 to U$15 billion, are focused on larger deals. Wheaton’s last deal, for example, was a year ago and involved the acquisition of additional 25% gold stream on the Salobo mine in Brazil for total upfront consideration of $800 million. There aren’t a lot of deals around of that size, and so the deals that do come along are intensely competitive.

We are looking at deals that are under the radar of the larger companies. The purchase price on the Coeur deal, for example, was US$13 million. That size of deal is of no interest to the larger players, but by putting a few of them together, we are well on our way to building a company.

As a highly experienced investor & research analyst in natural resource companies, how does Metalla stack up against other precious metals juniors?

It is one of the very few juniors that is cash flow positive. Metalla is diversified, with 18 separate precious metals royalties or streams, most of which already have a resource outlined. With the deals now in hand, Metalla has a solid base of cash flow from 3 mines, and a very strong organic growth pipeline, with 3 other projects already in the development stage. Those assets put the company in a very strong position to make further acquisitions and continue to grow.

Can you comment on your Company’s acquisition pipeline? What kinds of deals, in what metals, in what jurisdictions, are you looking at?

We have great relationships with majors, mid-tiers, and juniors regarding their non-core royalties. The majors specifically grew over the past decade through mergers and acquisitions. Along the way, they picked up a lot of assets that are now non-core.

With Coeur, for example, they looked at the value of what to them were small assets, and compared that to the value of owning a piece of Metalla. They elected to convert the steady cash flow to a stake in a company that they saw as having potential to greatly appreciate in value. We expect to be able to repeat that success.

Do you care to comment on precious metals prices, where they might be headed? Does Metalla need the gold & silver price to move higher for its share price to perform well?

Deep down, we believe in higher precious metal prices. But, we are very pragmatic. Anything we do has to make good sense at the current metal prices. Our plan is to create substantial shareholder value based on current prices. We are continuing to add to our inventory of gold and silver ounces that we have access to via royalties and streams.

We are committed to enhancing the cash flow that we generate. In that way, we will increase shareholder value, aside from whatever happens to the metal prices. Any gain in the gold or silver price will add to what should already be an attractive investment.

Do you have a view on the cryptocurrency craze (bitcoin / ethereum, etc), a view on if that market is pulling investors away from junior metals & mining stocks?

A lot of investors in precious metals are attracted by the tangible nature of gold and silver; hard assets, if you will. Those folks aren’t likely to give that up for the abstraction of block chains. There are some junior mining speculators who may take an interest, but those are not the people we are targeting to invest in a cash-flowing company based on gold and silver.

When your team acquired the assets from Coeur Mining this summer, there was talk about extending the mine life of the Endeavor mine. Can you update readers on the status of that initiative?

The Endeavor zinc mine is a small unit of a big Japanese metals smelting and refining group, so there is little news about the mine itself. As part of the due diligence process, I visited Endeavor and toured the underground mine and the processing facility. I had meetings with the onsite management, the geological, engineering and processing teams, as well as senior corporate management of the mining division.

They are very committed to extending the mine life. Management is presently evaluating a target zone just below the current mining area. There is clearly a lot of metal down there and they are conducting a Feasibility Study aimed at developing that zone. When I was there, they were quite positive on the potential. At that time, the zinc price was $1.10/lb.

Today, the zinc price is nearly $1.50/lb. One would have to believe that if it was attractive at $1.10, it would be even more so at nearly $1.50. That zone could add several years to the mine life. And, they are continuing to explore the property for additional deposits.

We valued this deal on the basis of a 2-yr mine life. Anything beyond 2 years is a bonus, and it is now looking highly likely that the mine life will extend well into the future. That would be huge, as investors are giving us no value for anything beyond the initial mine life.

There have been indications by CEO Brett Heath that a cash dividend could be in the works. Does it make sense for a high-growth company to distribute cash to shareholders?

Given that the majority of our counter-parties prefer to hold Metalla shares instead of receiving cash, it allows the Company to grow exponentially with much less financing risk compared to peers. We feel linking a portion of cash flow to dividends is necessary to give shareholders true exposure to gold and silver prices. There are plenty of small cap resource companies that will never return any capital to shareholders.

We want to stand out among this group. We also plan to reinvest a portion of the cash into more accretive transactions. An announcement will be coming before year-end.

To sum things up, why should readers take the time to do further due diligence on Metalla Royalty & Streaming? Is there a reason to consider buying shares sooner, rather than later?

Metalla offers shareholders exposure to gold & silver, without operating cost and capital cost risk. We are cash flowing, with excellent prospects for further acquisitions, which would add substantial value in the near term. We are now working hard to put together that next deal.

This story is not well known, and is not well understood. (For example, we get no credit for an extended mine life in Australia.)

So far, we have only had a single quarter of cash flow. The next quarter will confirm that we are generating cash flow, and that the cash flow from the existing deals is growing. Enhanced investor awareness and the potential for another deal should see the share price begin to move in the near term.

Thank you Lawrence, this was very interesting. I look forward to following events unfold over the next few months.

Disclosures: The content of this interview is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Metalla Royalty are speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Metalla Royalty and the Company was an advertiser on [ER]. By virtue of ownership of the Company’s shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

CZN.AX | +50.00% |

|

AFR.V | +33.33% |

|

RUG.V | +33.33% |

|

GCX.V | +33.33% |

|

CASA.V | +30.00% |

|

SRI.AX | +28.57% |

|

BSK.V | +25.00% |

|

GZD.V | +25.00% |

|

GQ.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan