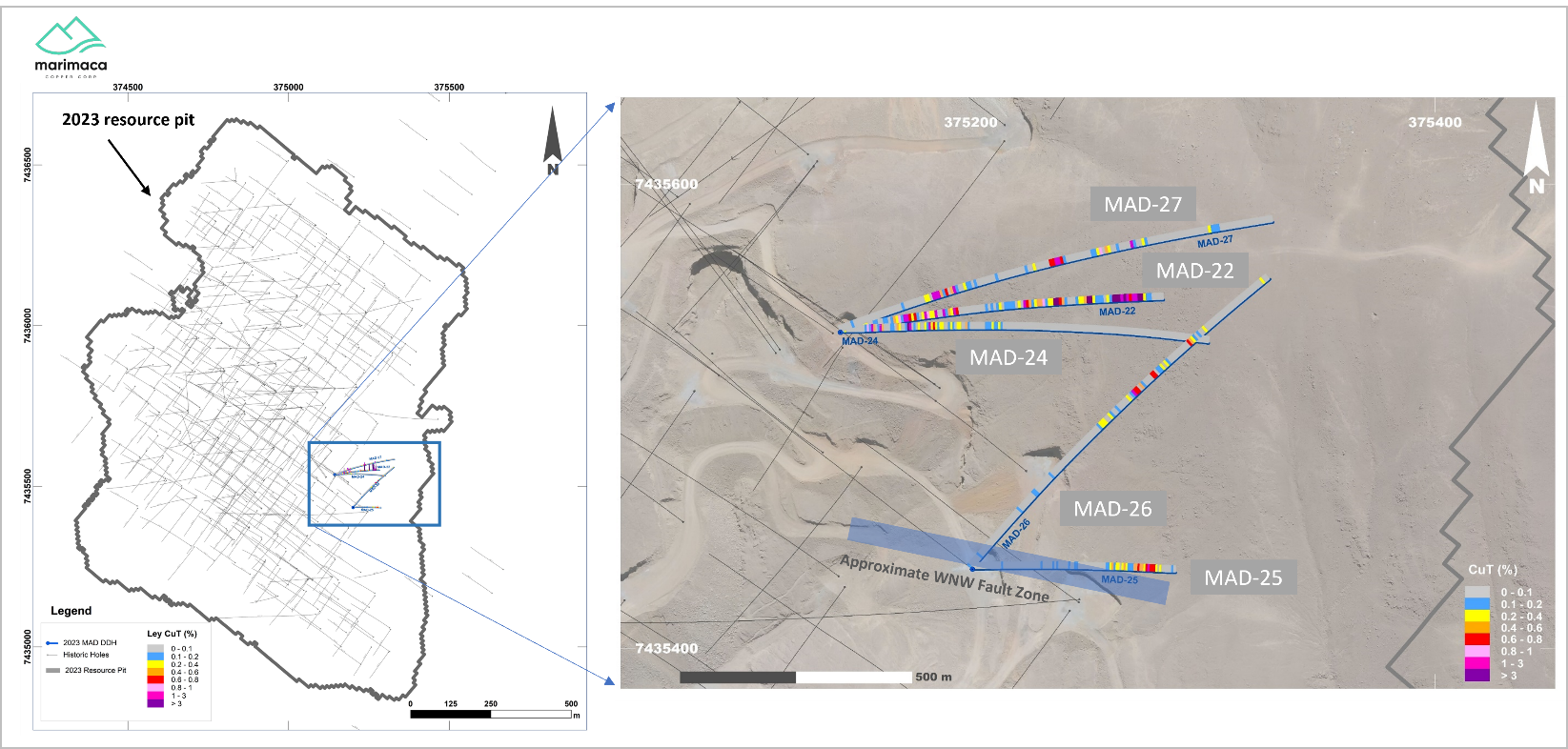

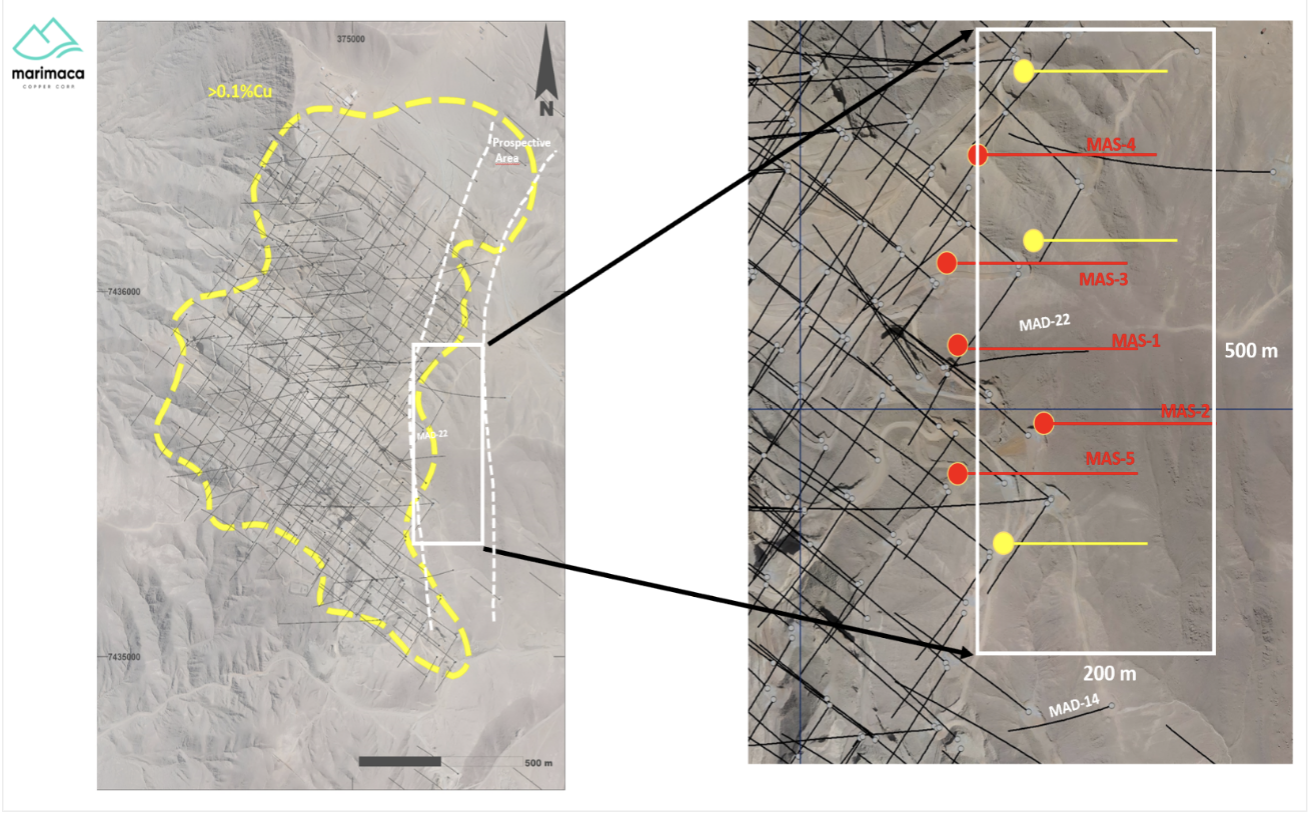

Marimaca Copper (TSX:MARI) has reported the latest findings of its recent five-hole diamond drilling exploration program at the eastern edge of the Marimaca Oxide Deposit (MOD). The program was initially carried out to follow up on the sulphide-bearing intersection of the formerly disclosed hole MAD-22, renowned for its higher concentration of primary copper mineralization located down-dip of the Marimaca oxides.

Sergio Rivera, VP Exploration at Marimaca Copper, commented in a press release: “Despite challenging drilling conditions we continue to improve our understanding of Marimaca’s genesis and target generation for the potential sulphide feeder zones. We are very encouraged to see the continuation of the alteration assemblages and rock types observed in MAD-22 in the follow-up program, which is the first time that consistent sulphide-associated alteration has been observed below the MOD. MAD-25, in particular, which stepped out 500m to the south of MAD-22, intersected the expected alteration mineral assemblages with strong mineralization at the targeted horizon, but was terminated before the expected higher-grade zone due to the intersection of a fault zone, which deviated the hole.

Planning for the next phase of sulphide exploration will incorporate learnings from this first phase campaign, including adjusting the approach to drilling from east to west to allow for easier orientation of the drilling to the deeper target horizons. Approaching from the west will take time to plan new drilling infrastructure rather than using existing eastern drill pads at the MOD, however we believe the sulphide potential warrants this. We continue to believe that the sulphide potential is high, particularly considering the scale of the oxidized mineralized body at the MOD and the indications, such as Hole MAD-22, that higher grade remnant feeder structures, remain intact in the shallower down-dip zones of the MOD.”

Drilling operations faced considerable difficulties, largely due to the direction of drilling from existing pads along the MOD’s primary known structures. The data generated from this effort, along with insights regarding future deeper drilling tactics, especially their origin and orientation, will inform the layout of ensuing exploration activities.

Expanding on individual drill hole observations, hole MAD-25 was a 500m step out to the south of MAD-22. It discovered strong mixed and primary sulphide mineralization from nearly the projected target horizon, which was roughly 136m downhole. However, operations were halted at 218m due to an encountered fault.

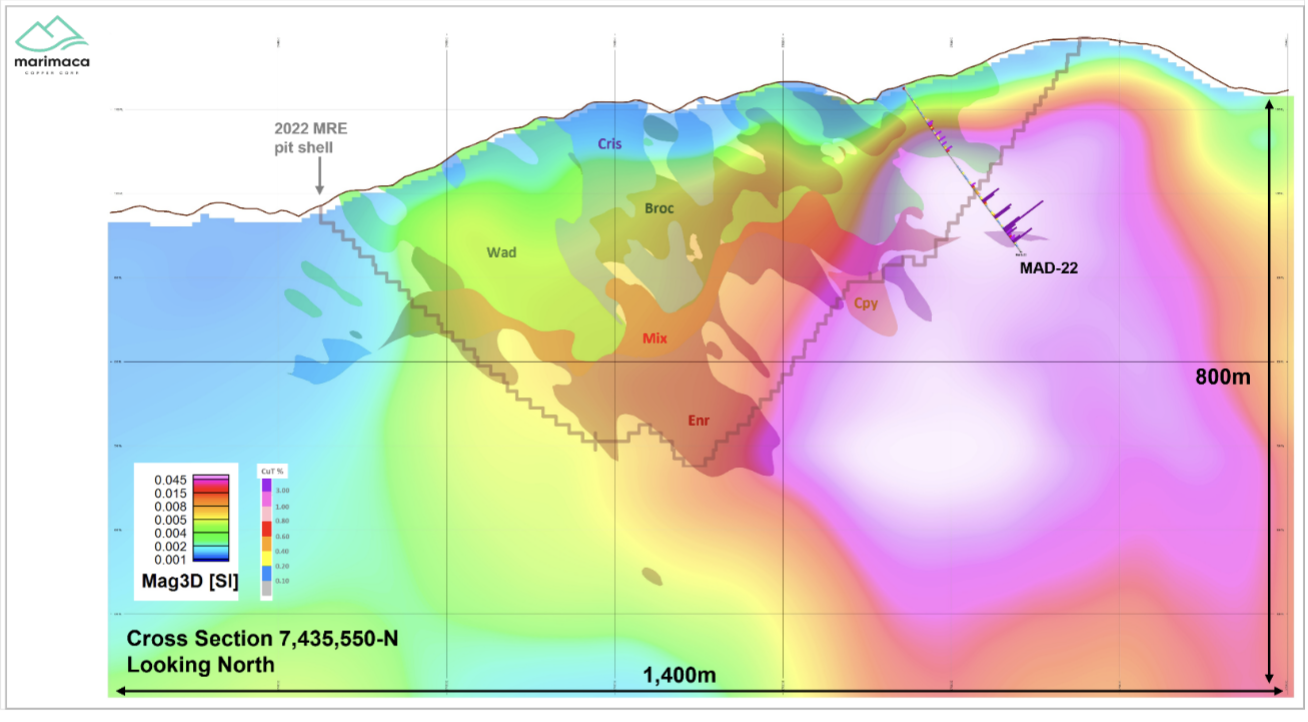

Holes MAD-25, 26, and 27 intersected extensions of alteration-mineralization assemblages similar to those found in MAD-22. These included sections displaying massive to stringer filling chalcopyrite and pyrite and pervasive hydrothermal magnetite replacement. The latter was partially linked to coarse actinolite veinlets associated with the porphyritic quartz-diorite intrusion host rock.

The drill holes were found immediately adjacent to the eastern wall of the whittle pit limits, in accordance with the Mineral Resource Estimate (MRE) from October 2022. This positioning indicates the possibility of high-grade, open-pit-able mineralization.

The sulphide copper mineralization observed in the deeper mineralized intercepts appeared less consistent than in MAD-22, which was attributed to variability in the pyrite/chalcopyrite ratio in the primary zones. Such variation is typical in Iron Oxide Copper Gold (IOCG) systems and requires further analysis to vector to the zones bearing a higher amount of chalcopyrite. This particular observation was corroborated in MAD-26, which intersected strong magnetite alteration from 186m. Nonetheless, it presented a higher pyrite/chalcopyrite ratio compared to MAD-22, which corresponds to lower grade copper intersections.

Highlights from the results are as follows:

- Four drill holes recovered to a maximum depth of 349m from surface, with three holes completed successfully to target depth

- The fourth hole, although recovered, MAD-25 was terminated above target depth due to poor rock quality caused by localized faulting

- Holes MAD-24, 25, 26 and 27 intersected the extension of the upper oxide and mixed/enriched copper mineralization

- This zone is interpreted as the near-surface, oxidized expressions of high-grade mineralized structures encountered in MAD-22

- MAD-25 intersected 56m at 0.40% CuT from 136m including 24m at 0.63% CuT of secondary and primary sulphides in-line with the projected horizon from MAD-22, however, could not progress further into the horizon due to rock quality in a fault zone and was terminated at 218m

- Hole MAD-24 intersected 74m of 0.52% CuT from 24m including 18m at 0.68% CuT from 24m and 28m at 0.79% CuT from 64m above the projected sulphide horizon

- Hole MAD-24 intersected a barren post-mineral dyke from 224.3m which occupied the projected extension of the sulphide horizon from MAD-22

- Hole MAD-27 intersected 40m at 0.50% CuT from 68m including 18m at 0.90% CuT of mixed and enriched mineralization from 74m, and a deeper intersection of 12m at 1.0% CuT of chalcopyrite mineralization from 162m

- Hole MAD-26 intersected strong magnetite alteration from 186m, however with a higher pyrite/chalcopyrite ratio relative to MAD-22 corresponding to lower grade copper intersections

- MAD-23 was terminated as a result of contractor operational performance leading to contractor replacement for subsequent holes (MAD-24, 25, 26, 27)

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

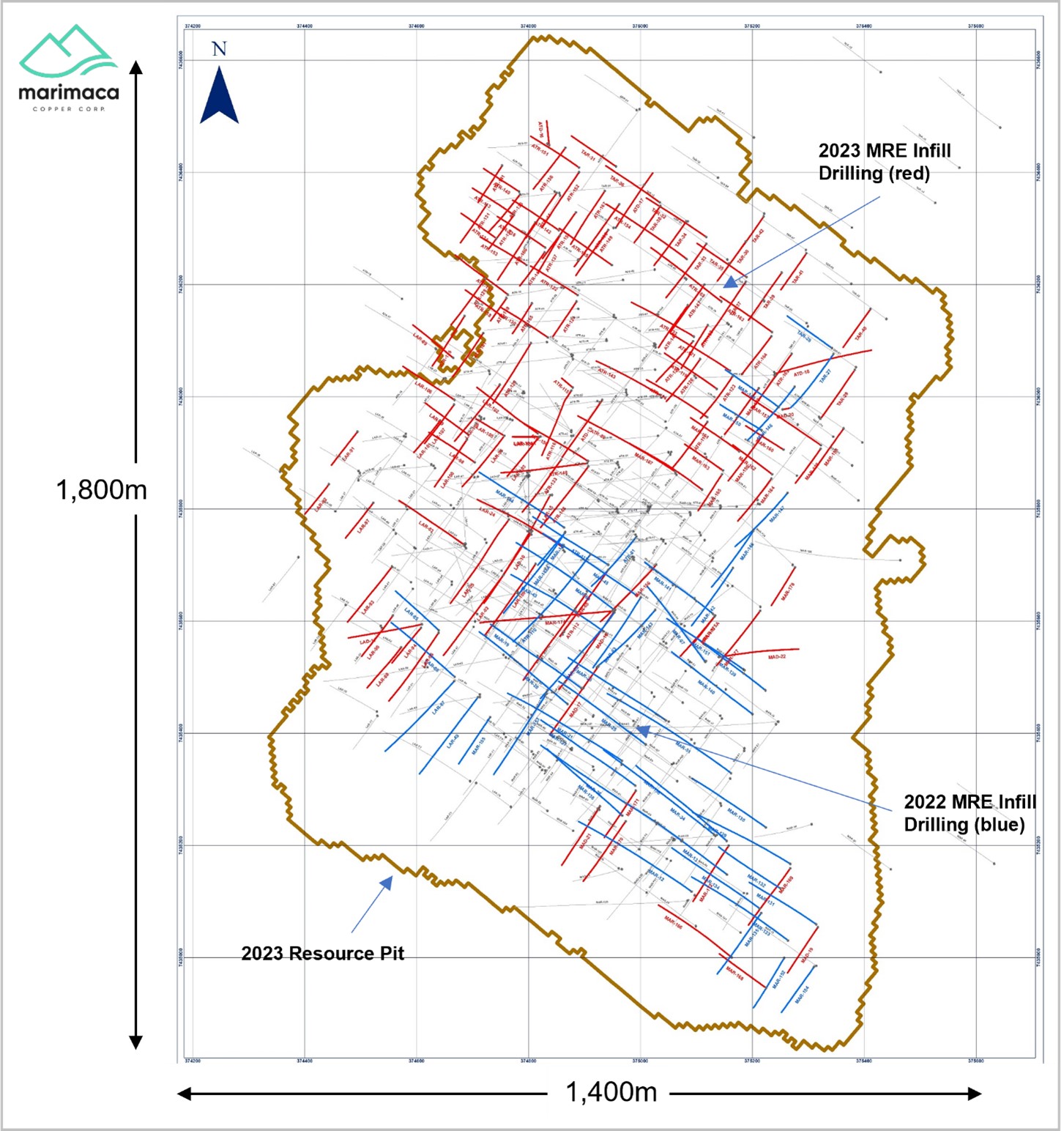

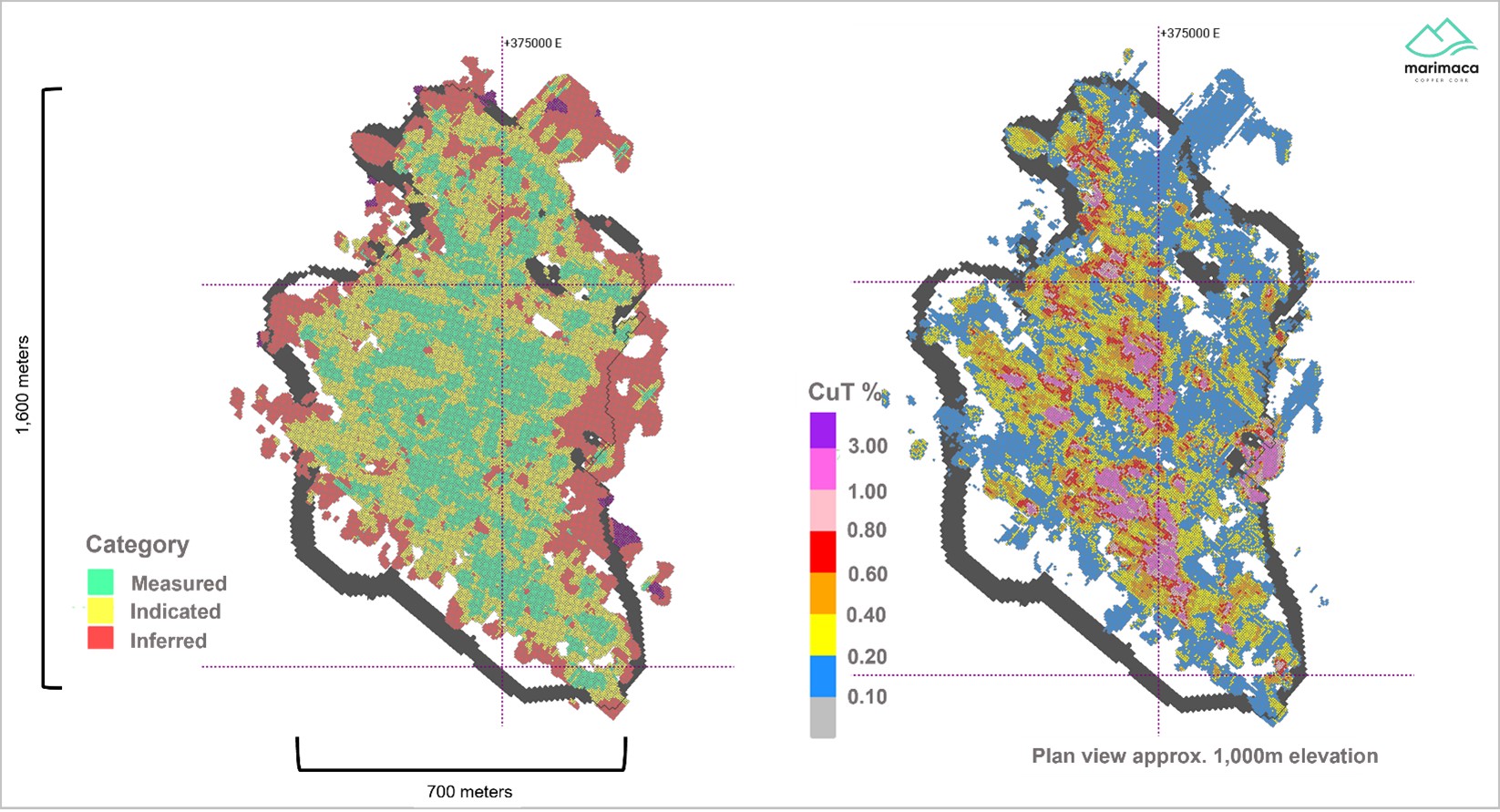

Marimaca Copper (TSX:MARI) has shared a revised Mineral Resource Estimate (MRE) for its flagship Marimaca Oxide Deposit (MOD) project located in the Antofagasta region of northern Chile.

The updated 2023 MRE integrates a substantial 28,374m of fresh drilling data that was collated subsequent to the unveiling of the 2022 MRE in October 2022. Since the MOD’s inception in 2016, a cumulative total of 139,164m of drilling has been completed. The recent drilling data, gathered following the release of the 2022 MRE, mainly focused on enhancing the conversion of Inferred Resources into the Measured and Indicated categories.

The updated MRE adheres strictly to the Definition Standards set by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) and the National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101).

The significant highlights from the MRE include:

- Measured and Indicated Resources totalling 200.3Mt at 0.45% CuT, encapsulating 900kt of contained copper

- Inferred Resources measuring 37.3Mt at 0.38% CuT, encompassing 141kt of contained copper

- A robust 86% of the total resource tonnes of the MOD now fall under the Measured and Indicated categories

- The updated MRE significantly lowers the risk associated with the Marimaca ore body in anticipation of the forthcoming Definitive Feasibility Study (DFS)

- The majority of the recent drilling operations were concentrated in the northern parts of the MOD, which had earlier been associated with lower drilling density

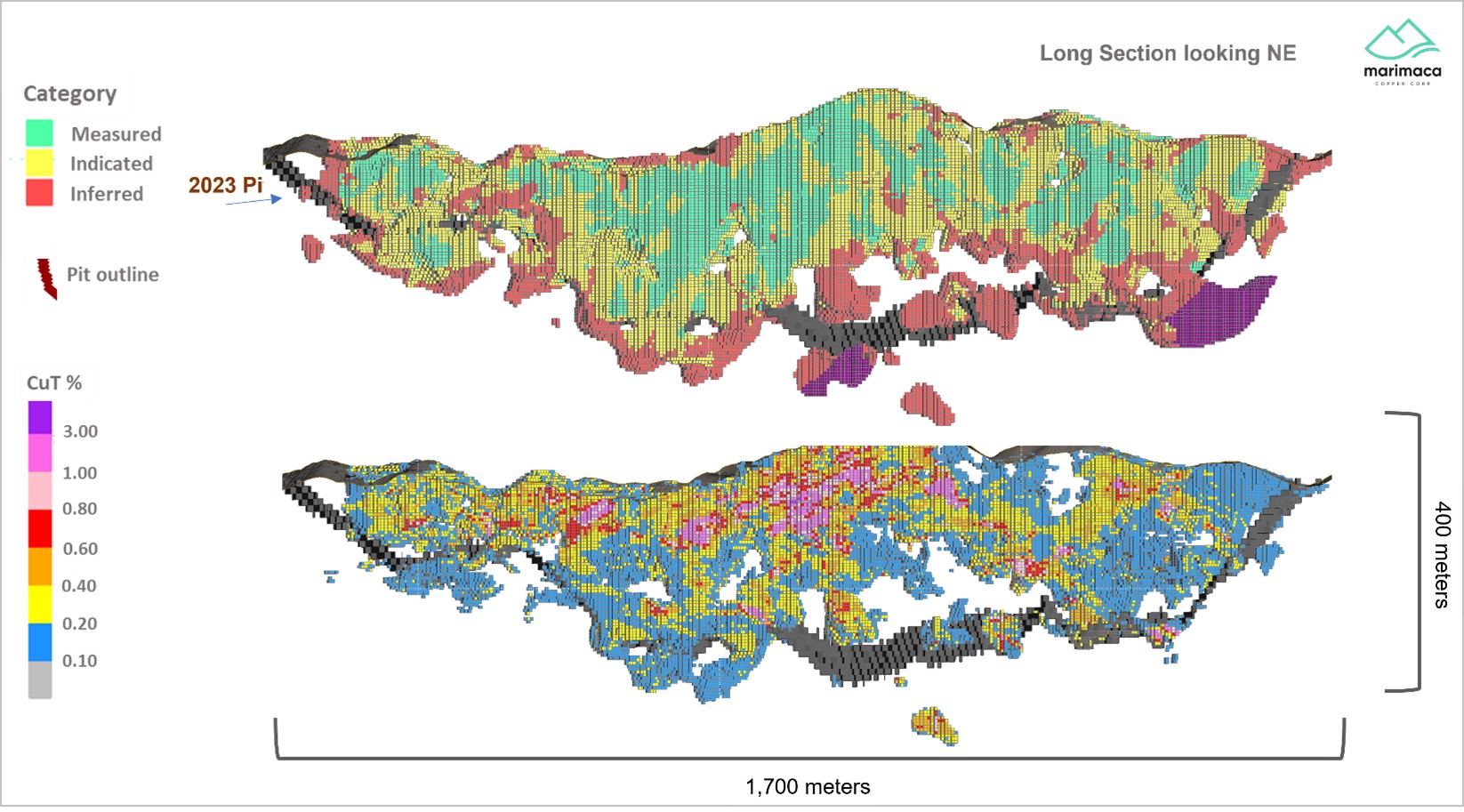

The MOD continues to demonstrate unique characteristics in the 2023 MRE, such as a low strip ratio maintained in the constraining pit shell and all mineral resources captured within a single continuous pit. It marks the final phase of oxide resource definition at the MOD before the planned DFS. The company’s exploration focus will now shift towards the Marimaca sulphide target and the definition of near-mine satellite oxide targets, including Mercedes, Cindy, and Mititus.

The 2023 MRE was compiled by independent consultants NCL Ingeniería y Construcción SpA (NCL) and authenticated by Luis Oviedo, a qualified person independent of Marimaca, as per the terms under NI 43-101. The updated MRE reflects 139,164m of drilling across 554 drill holes completed between 2016 and 2022, with an effective date of May 17, 2023. The same operating cost parameters as the 2022 MRE were used for the Whittle Optimisations, alongside a copper price assumption of US$4.00/lb.

Marimaca has also concluded five extensive phases of metallurgical testing at Marimaca. A sixth phase is currently in progress, which is expected to define the optimized process design flowsheet before the planned DFS. The results from the fifth phase, announced on June 15, 2022, indicate a promising larger proportion of total copper is expected to be recovered in industrial-scale operations.

The Marimaca Deposit showcases the continuity of the oxide mineralization across the north-south extent of the deposit, with the mineralization consistently hosted by east-dipping fracture sets. Higher grade zones of oxides, mixed and enriched mineralization, extend at depth beneath the green oxide zones.

Exploration for sulphide mineralization down-dip of the MOD to the east is ongoing, and further results will be made public in the coming months.

Hayden Locke, President & CEO of Marimaca Copper, commented in a press release: “The 2023 MRE represents the culmination of an exceptionally successful two years of infill drilling at the Marimaca Oxide Deposit led by Sergio Rivera and his team. We are very pleased with our conversion ratio of Inferred Resources to Measured and Indicated categories, and today’s result drives significantly improved confidence in the geological model and understanding of the Marimaca ore body.

“The M&I resource estimate at the MOD now stands at approximately 900,000 tonnes of contained metal, and this will support the assessment of a larger operation in terms of copper cathode production and mine life extension during the Definitive Feasibility Study. Despite the significant resource growth demonstrated at Marimaca since 2019, the ore body’s core, unique attributes have been preserved as the deposit has grown – very low strip ratio; a shallow higher-grade core expected to be accessible in the early mining years; and limited pre-stripping or significant cutbacks expected during operation.

“We continue to progress rapidly forward with development workstreams at the MOD including preparation for our permitting submissions and the Feasibility Study. Additionally, the first phase of the 2023 sulphide exploration program has been completed with assays pending and results expected in the near term.”

Results from the updated MRE are as follows:

| Mineral Resource Category and Type | Quantity | CuT | CuS | CuT | CuS |

| (kt) | (%) | (%) | (t) | (t) | |

| Total Measured | 96,954 | 0.49 | 0.28 | 473,912 | 268,628 |

| Total Indicated | 103,358 | 0.41 | 0.21 | 425,797 | 219,690 |

| Total Measured and Indicated | 200,312 | 0.45 | 0.24 | 899,709 | 488,319 |

| Total Inferred | 37,289 | 0.38 | 0.15 | 141,252 | 55,802 |

Table 1. 2023 Mineral Resource Estimate (reported at 0.15% CuT cutoff)

* Pit shell constrained resources with demonstrated reasonable prospects for eventual economic extraction (RPEEE) are generated using series of Lerchs-Grossmann pit shell optimizations completed by NCL

* CuT means total copper and CuS means acid soluble copper. Technical and economic parameters include: copper price US$4.00/lb; base mining cost of US$1.51/t with a mining cost adjustment factor of US$0.04/t-10m bench; Heap Leach “HL” processing cost US$5.94/t (incl. G&A); Run-of-Mine “ROM” processing cost US$1.65/t (incl. G&A); SX-EW processing cost and selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM recovery 40% of CuT; and 42°-52° pit slope angle

* Mineral resources which are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration

| Cut-off grade (% CuT) |

Measured | Indicated | Measured + Indicated | Inferred | |||||||||

| Quantity kt | CuT [%] | CuS [%] | Quantity kt | CuT [%] | CuS [%] | Quantity kt | CuT [%] | CuS [%] | Quantity kt | CuT [%] | CuS [%] | ||

| 0.40 | 44.0 | 0.77 | 0.44 | 37.5 | 0.69 | 0.38 | 81.6 | 0.73 | 0.41 | 12.1 | 0.64 | 0.24 | |

| 0.30 | 60.2 | 0.65 | 0.38 | 55.5 | 0.58 | 0.31 | 115.7 | 0.62 | 0.35 | 18.8 | 0.54 | 0.21 | |

| 0.22 | 77.8 | 0.56 | 0.32 | 77.0 | 0.49 | 0.26 | 154.9 | 0.53 | 0.29 | 27.2 | 0.45 | 0.18 | |

| 0.20 | 83.0 | 0.54 | 0.31 | 83.8 | 0.47 | 0.25 | 166.8 | 0.50 | 0.28 | 30.2 | 0.43 | 0.17 | |

| 0.18 | 88.3 | 0.52 | 0.30 | 91.3 | 0.44 | 0.23 | 179.6 | 0.48 | 0.26 | 33.0 | 0.41 | 0.16 | |

| 0.15 | 97.0 | 0.49 | 0.28 | 103.4 | 0.41 | 0.21 | 200.3 | 0.45 | 0.24 | 37.3 | 0.38 | 0.15 | |

| 0.10 | 113.3 | 0.44 | 0.24 | 127.6 | 0.36 | 0.18 | 241.0 | 0.39 | 0.21 | 46.6 | 0.33 | 0.13 | |

| 0.00 | 146.1 | 0.35 | 0.19 | 178.2 | 0.27 | 0.14 | 324.3 | 0.31 | 0.16 | 72.0 | 0.24 | 0.09 | |

Table 2. Mineral Resource Sensitivity

* Pit shell constrained resources with demonstrated reasonable prospects for eventual economic extraction (RPEEE) are generated using series of Lerchs-Grossmann pit shell optimizations completed by NCL

* CuT means total copper and CuS means acid soluble copper. Technical and economic parameters include: copper price US$4.00/lb; base mining cost of US$1.51/t with a mining cost adjustment factor of US$0.04/t-10m bench; Heap Leach “HL” processing cost US$5.94/t (incl. G&A); Run-of-Mine “ROM” processing cost US$1.65/t (incl. G&A); SX-EW processing cost and selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM recovery 40% of CuT; and 42°-52° pit slope angle

* Mineral resources which are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration

| Mineral Resource Category and Type | Quantity | CuT | CuS | CuT | CuS |

| (kt) | (%) | (%) | (t) | (t) | |

| Measured | |||||

| Brochantite | 31,293 | 0.62 | 0.45 | 194,890 | 141,442 |

| Chrysocolla | 24,252 | 0.44 | 0.33 | 105,594 | 79,863 |

| Wad/Black oxides | 10,727 | 0.29 | 0.15 | 30,599 | 16,116 |

| Mixed | 18,626 | 0.51 | 0.13 | 95,159 | 23,431 |

| Enriched | 12,056 | 0.40 | 0.06 | 47,669 | 7,776 |

| Total Measured | 96,954 | 0.49 | 0.28 | 473,912 | 268,628 |

| Indicated | |||||

| Brochantite | 29,084 | 0.56 | 0.41 | 162,753 | 117,847 |

| Chrysocolla | 13,591 | 0.38 | 0.28 | 51,332 | 37,674 |

| Wad/Black oxides | 19,880 | 0.28 | 0.15 | 56,382 | 29,649 |

| Mixed | 17,193 | 0.41 | 0.11 | 71,109 | 18,654 |

| Enriched | 23,611 | 0.36 | 0.07 | 84,221 | 15,867 |

| Total Indicated | 103,358 | 0.41 | 0.21 | 425,797 | 219,690 |

| Measured and Indicated | |||||

| Brochantite | 60,376 | 0.59 | 0.43 | 357,643 | 259,290 |

| Chrysocolla | 37,843 | 0.41 | 0.31 | 156,927 | 117,536 |

| Wad/Black oxides | 30,607 | 0.28 | 0.15 | 86,981 | 45,765 |

| Mixed | 35,819 | 0.46 | 0.12 | 166,268 | 42,085 |

| Enriched | 35,667 | 0.37 | 0.07 | 131,891 | 23,643 |

| Total Measured and Indicated | 200,312 | 0.45 | 0.24 | 899,709 | 488,319 |

| Inferred | |||||

| Brochantite | 4,950 | 0.46 | 0.32 | 22,892 | 15,710 |

| Chrysocolla | 4,488 | 0.36 | 0.26 | 16,250 | 11,695 |

| Wad/Black oxides | 8,727 | 0.29 | 0.15 | 25,180 | 12,799 |

| Mixed | 5,979 | 0.36 | 0.11 | 21,548 | 6,541 |

| Enriched | 13,145 | 0.42 | 0.07 | 55,381 | 9,057 |

| Total Inferred | 37,289 | 0.38 | 0.15 | 141,252 | 55,802 |

Table 3. 2023 MRE by Mineralization Type

* Pit shell constrained resources with demonstrated reasonable prospects for eventual economic extraction (RPEEE) are generated using series of Lerchs-Grossmann pit shell optimizations completed by NCL

* CuT means total copper and CuS means acid soluble copper. Technical and economic parameters include: copper price US$4.00/lb; base mining cost of US$1.51/t with a mining cost adjustment factor of US$0.04/t-10m bench; Heap Leach “HL” processing cost US$5.94/t (incl. G&A); Run-of-Mine “ROM” processing cost US$1.65/t (incl. G&A); SX-EW processing cost and selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM recovery 40% of CuT; and 42°-52° pit slope angle

* Mineral resources which are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration

| Parameter | 2022 MRE | 2023 MRE |

| Mining cost (US$/t mined) | $1.51 base ($1.76 avg.) | $1.51 base ($1.76 avg.) |

| Mining Cost Adjustment Factor (US$/t-10m bench) | $0.04 | $0.04 |

| Heap Leach Cost (including G&A and mining cost component from pit to Heap Leach) | US$5.94/t processed | US$5.94/t processed |

| Run-of-Mine Cost (including G&A and mining cost component from pit to ROM) | US$1.65/t processed | US$1.65/t processed |

| SX-EW processing cost and selling cost (US$/lb Cu) | $0.16 | $0.16 |

| Heap Leach Recovery (% CuT) | 76% | 76% |

| ROM Recovery (% CuT) | 40% | 40% |

| Pit Slope angle | 42 – 52° | 42 – 52° |

Table 4. Summary of Inputs – 2023 MRE (no changes from 2022 MRE)

The Company intends to file an updated technical report to support the updated 2023 MRE on SEDAR within 45 days of this news release or such earlier time in accordance with NI 43-101.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

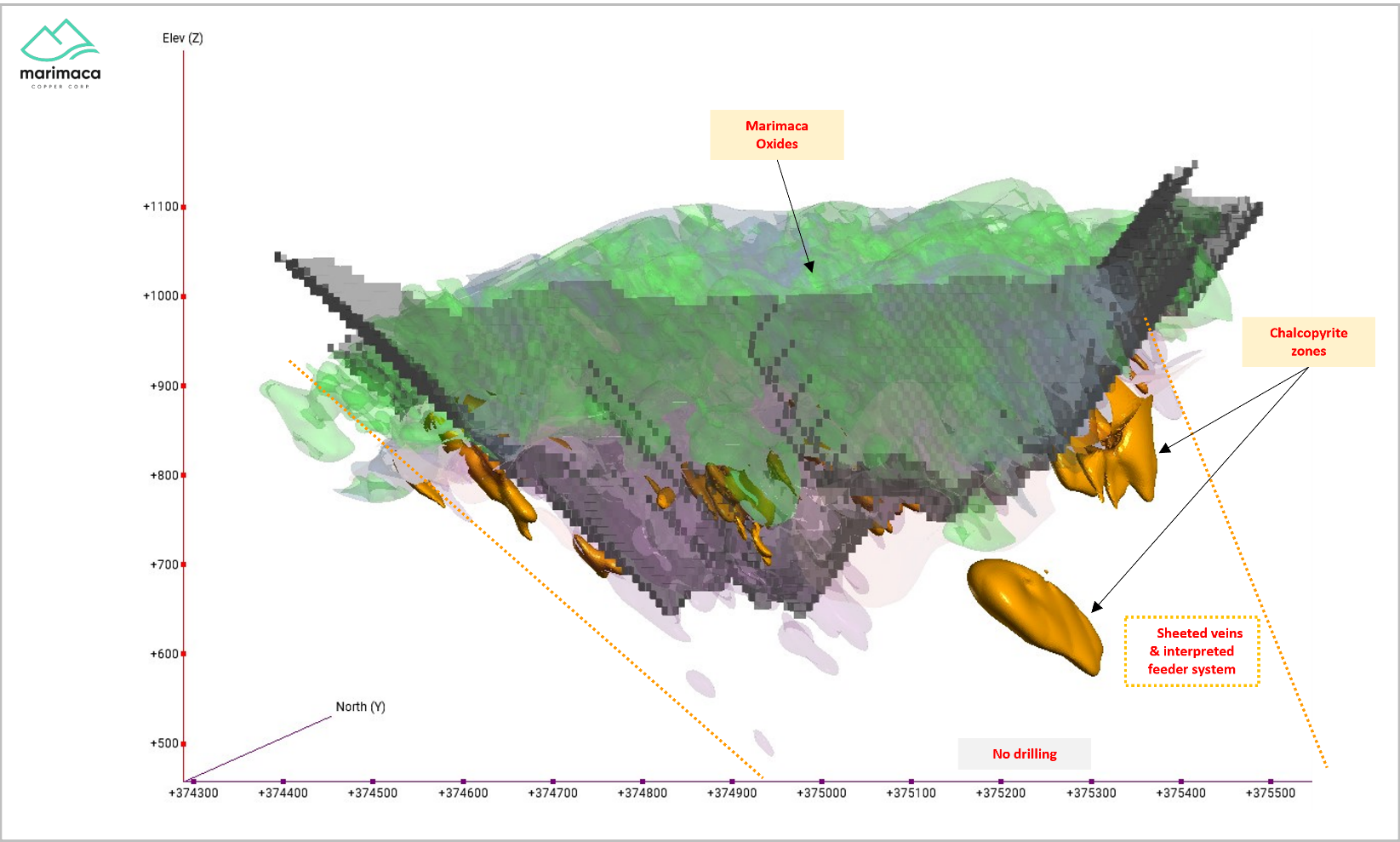

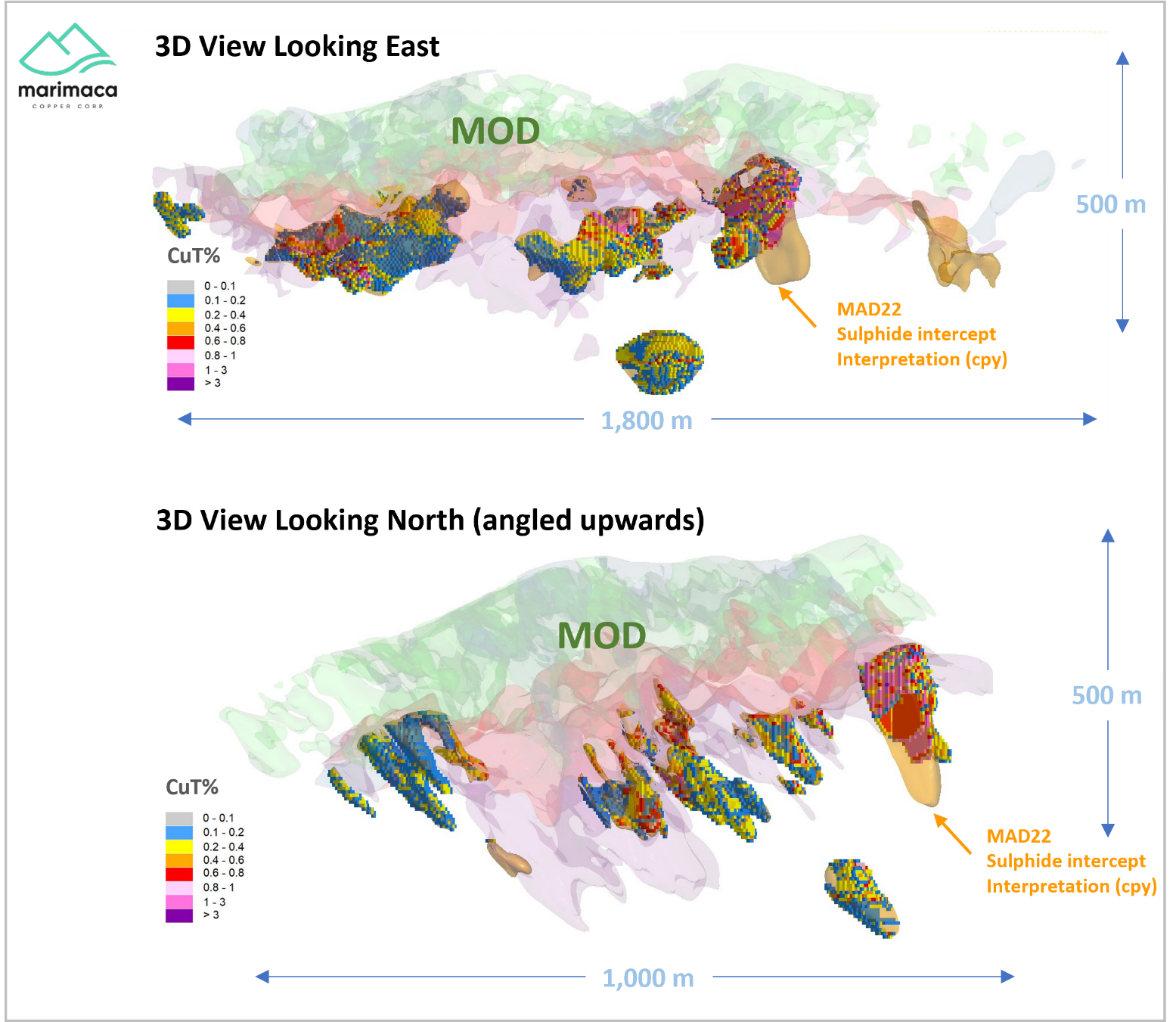

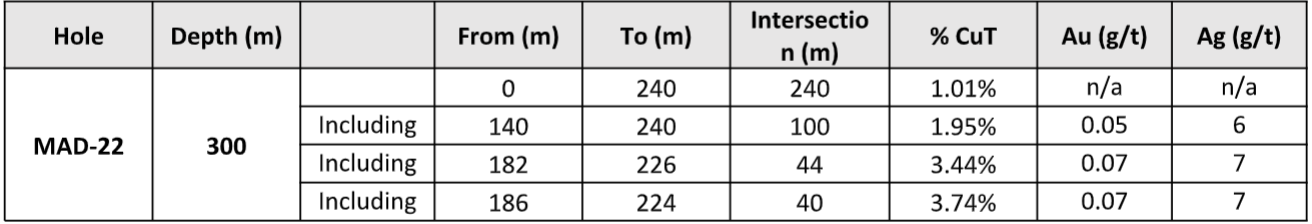

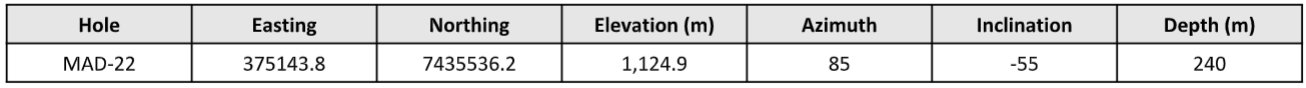

Marimaca Copper (TSX:MARI) has announced assay results for gold and silver from drill hole MAD-22 at the Marimaca Copper project. The results outlined the first phase of follow-up drilling of the exciting new sulphide target identified in drill hold MAD-22, originally intersecting 120m at 1.7% CuT including 92m at 2.11% CuT. These results are the first anomalous precious metal content encountered at the Marimaca Project.

The Marimaca project is located in the Antofagasta region of northern Chile, a well-known copper mining district. Marimaca Copper. holds a 100% interest in the project. The recent drilling at the Marimaca project has been focused on exploring the potential for new sulfide mineralization. Sulfide deposits are typically higher grade than oxide deposits and can be economically attractive for mining. The discovery of a new sulfide target in MAD-22 was a significant development, and the follow-up drilling was designed to better understand the nature of this mineralization.

The assays from MAD-22 have shown that the sulfide mineralization is associated with significant gold and silver mineralization. This is the first time that anomalous precious metal content has been encountered at the Marimaca project. The results from MAD-22 also show that the gold and silver mineralization is associated with the deeper sulfide mineralization, which is consistent with other sulfide deposits in the region.

The results from MAD-22 are encouraging for Marimaca Copper Corp. and demonstrate the potential for the discovery of additional high-grade sulfide mineralization at the Marimaca project. The company plans to continue drilling to further explore the sulfide target identified in MAD-22 and to test other targets in the project area.

In addition to the sulfide targets, Marimaca Copper Corp. is also continuing to explore the oxide mineralization at the Marimaca project.

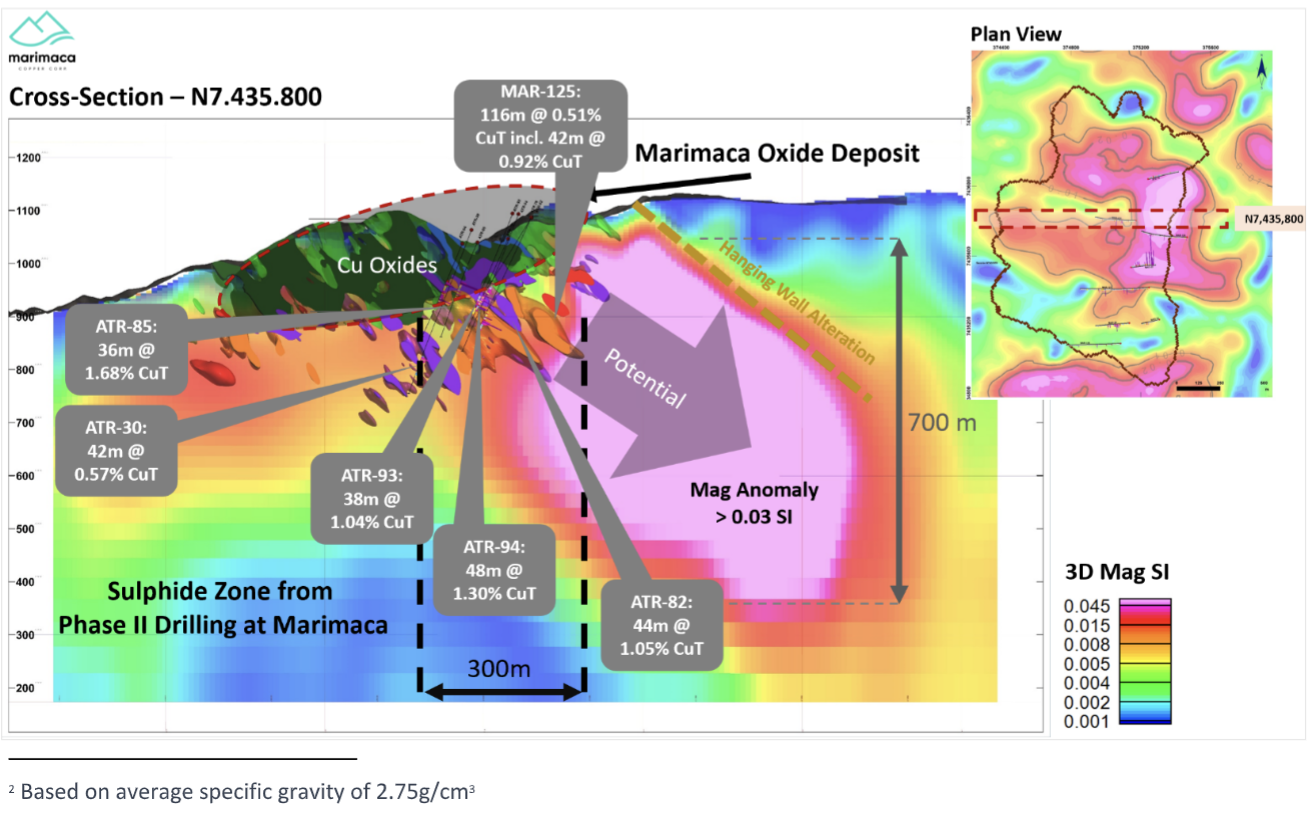

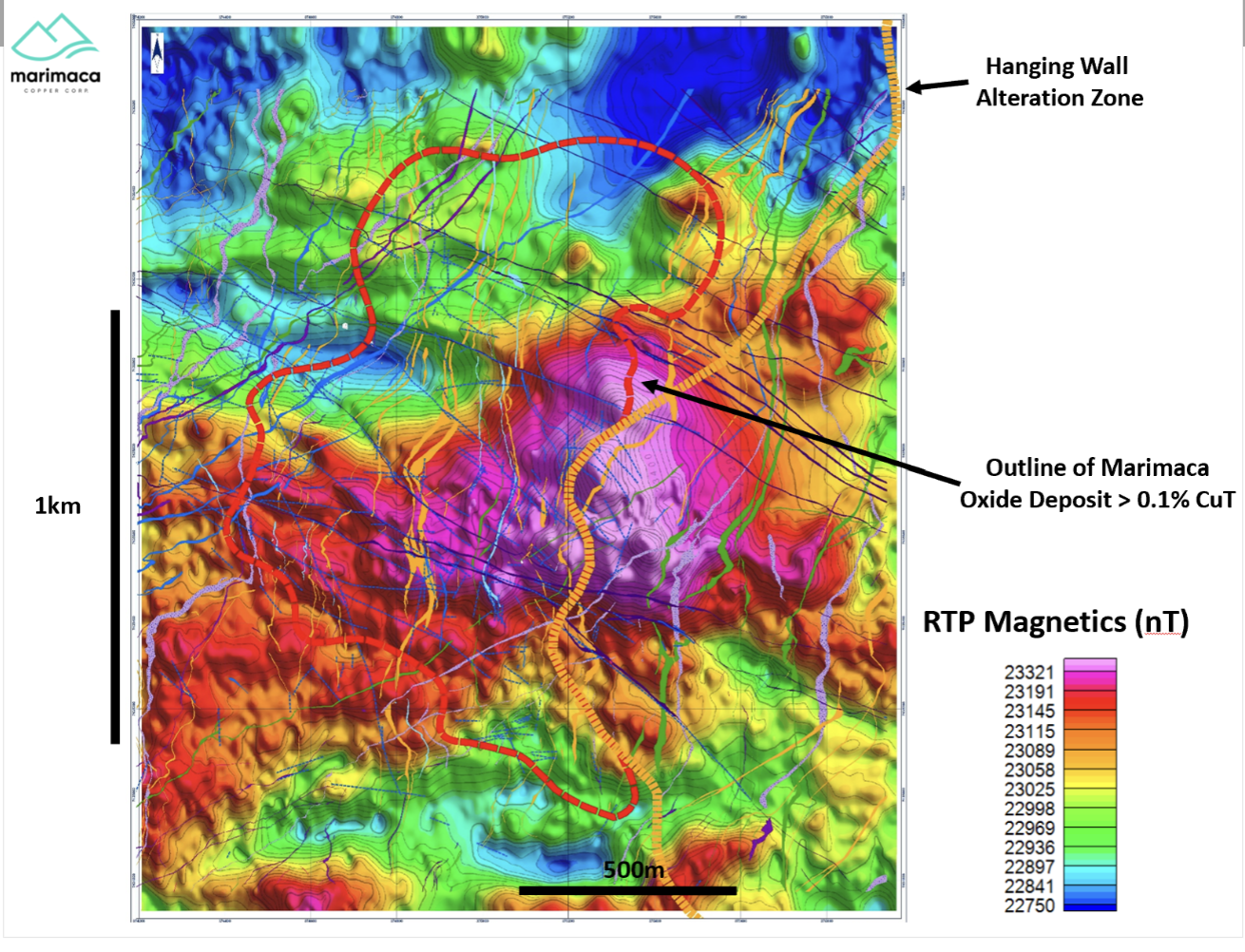

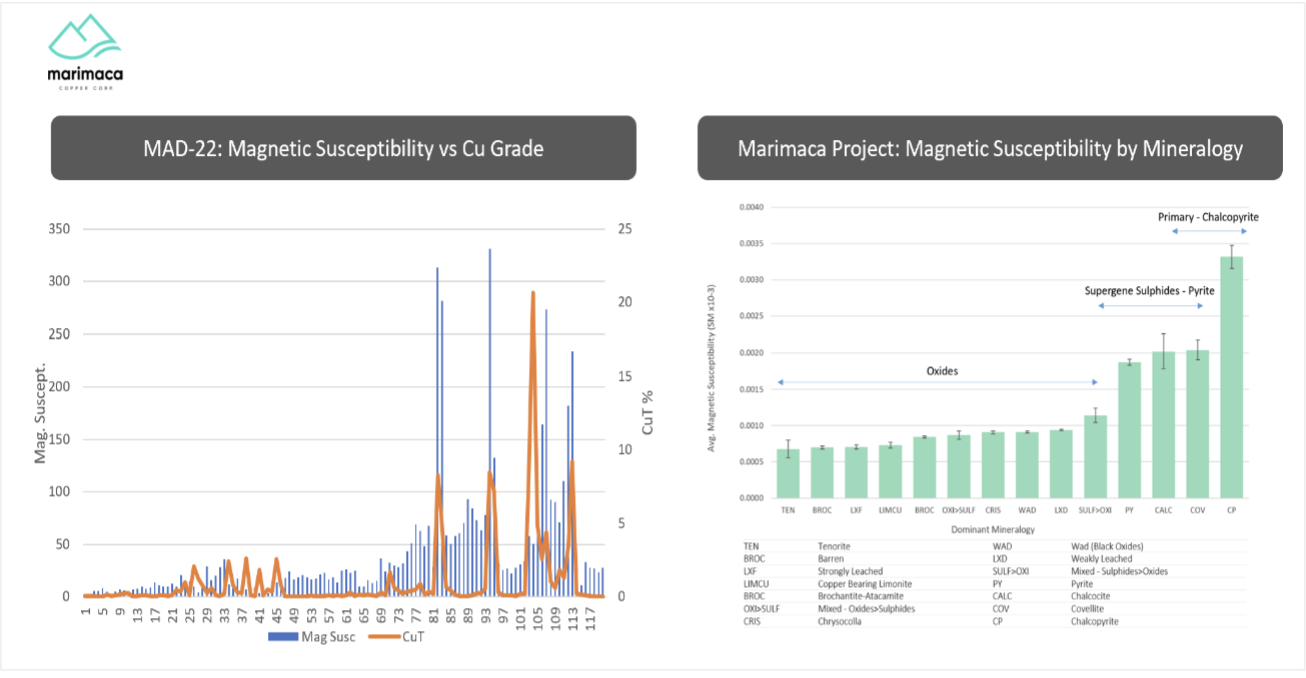

Sergio Rivera, VP Exploration of Marimaca Copper, commented in a press release: “MAD-22 was a spectacular drill hole in terms of grade, continuity and the shallow nature of mineralization, and provided us with valuable information with respect to potential sulphide feeder zones for the Project. As we have noted in previous releases, there is a strong correlation between magnetic anomalism and the presence of primary copper mineralization. MAD-22 once again strongly confirmed the relationship. It has also been noted that outcropping zones with higher prevalence of magnetite, in veins and stringers, could be a good surface vector for future exploration targeting Marimaca-style IOCG (Iron Oxide Copper Gold) deposits.

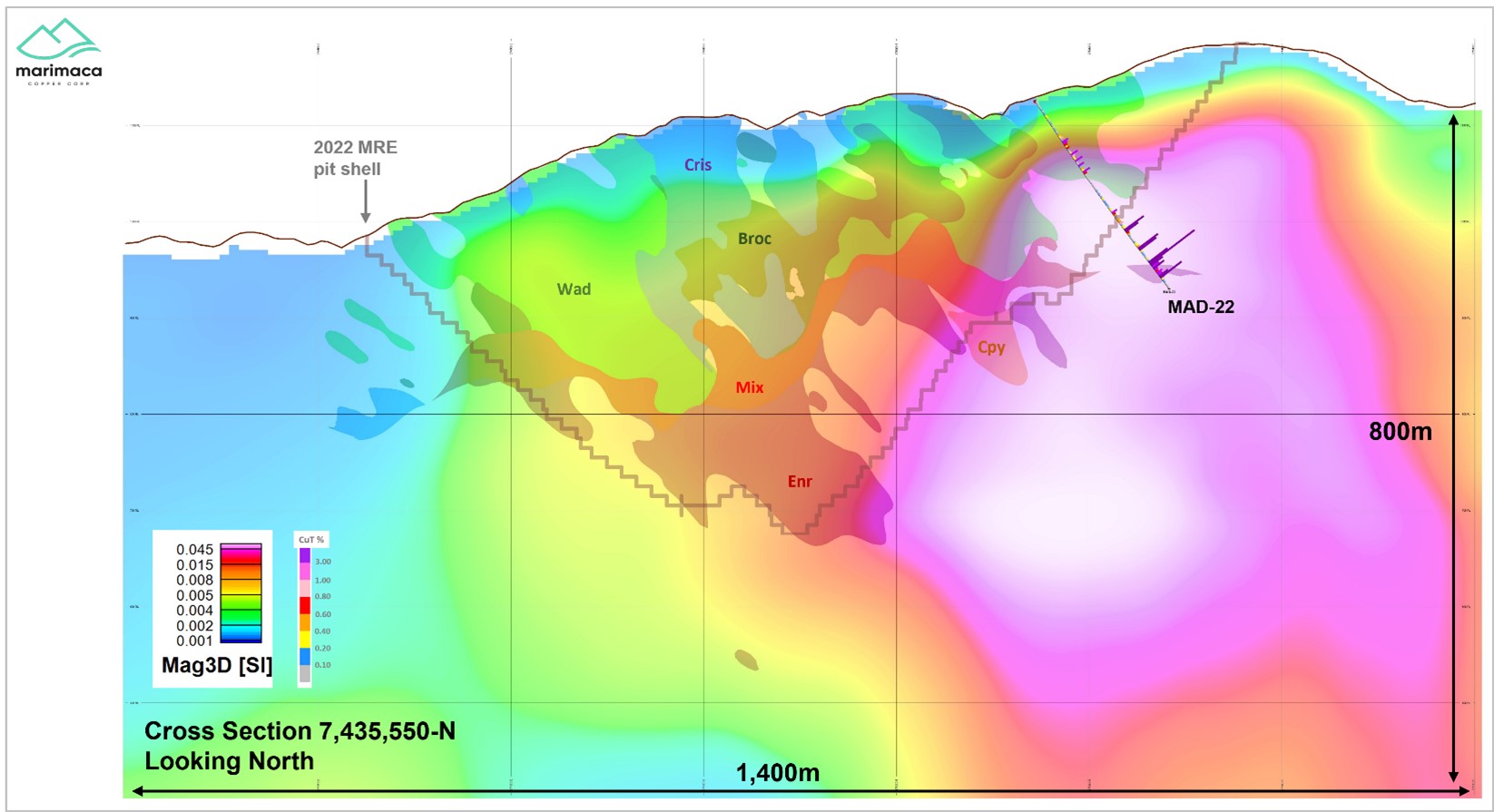

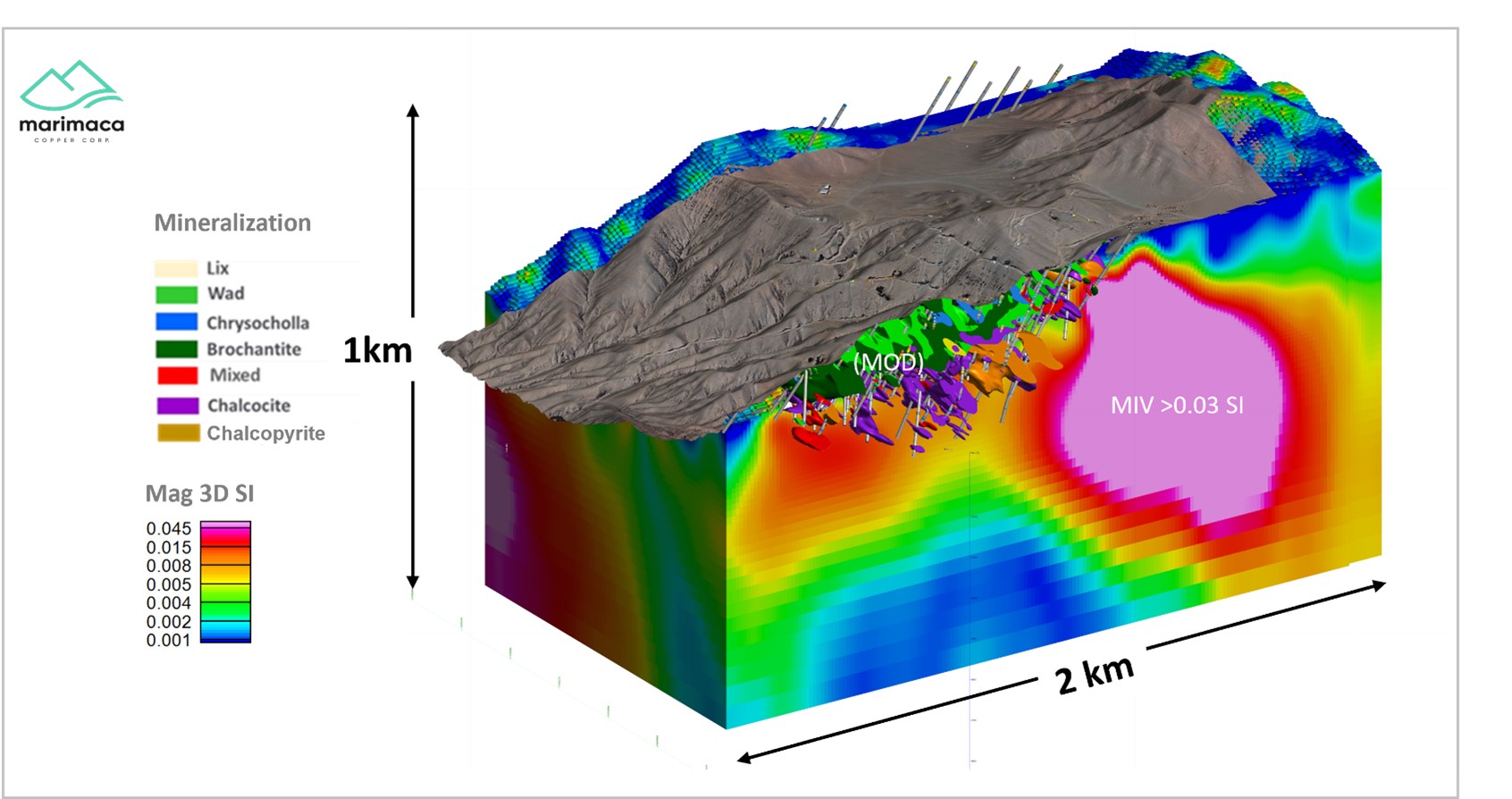

“In 2020, we completed high resolution magnetic work and developed a 3D model which highlights a large-scale magnetic anomaly, which we estimate to be over 175 million 3 meters in volume, or approximately 475 million 2 tonnes of high magnetic susceptibility rock mass. MAD-22 was drilled into the southern extent of this anomaly, which extends over strike of approximately 1.0km and to a depth of around 800m below surface.

“The result of MAD-22 is an exciting confirmation of our view that there is significant sulphide potential below the MOD. We have mobilized a rig to complete an initial follow up program to test the immediate 300m to 500m of strike around MAD-22. Based on the results we achieve we will then plan an expanded programme.”

Highlights from the results are as follows:

Table 1. Summary of Anomalous Precious Metal Intervals

Table 2. Drill Collars and Survey

- First anomalous gold and silver identified at Marimaca coincident with higher grades of primary copper mineralization in MAD-22

- 100m of anomalous gold (majority >0.02g/t) and silver (majority >1g/t) from 140m

- 40m with an average grade of 3.74% CuT and 0.07g/t Au and 7g/t Ag from 186m

- Represents 40m with an average grade of 3.84% CuEq 1 from 186m

- MAD-22 intersected over 240m of continuous mineralization from surface with a high grade primary mineral zone at depth including:

- Reconfirms strong association of high-grade chalcopyrite with high magnetic susceptibility

- Encountered massive chalcopyrite over an interval of 92m with an average copper grade of 2.11% CuT from 140m

- Located immediately adjacent to the eastern wall of the whittle pit limits for the October 2022 MRE, indicating potential for high grade, open pit-able mineralization

- Indications are that mineralization relates to a second, later stage, mineralizing event when compared to the broader

Marimaca Oxide Project

- Large scale magnetic anomaly previously identified believed to be prospective for mineralization similar to the primary

zone in MAD-22 - Five-hole diamond drilling program planned, and rig mobilised, to follow up results of MAD-22:

- 50m to 100m step outs from MAD-22

- First phase tests approximately 300m of strike potential around MAD-22 with a target width of up to 300m

- Drilling will test deeper extensions below the limit of drill hole MAD-22, which terminated in mineralization

- Second phase of up to five holes based on results of first phase increase tested strike length to 500m+

- Fully funded to test the exciting sulphide target

Figure 5: Relationship of Magnetic Susceptibility and Drilling Across the Project. Source: Marimaca Copper

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Marimaca Copper (TSX:MARI) has reported new results from diamond drill hole MAD-22 at the Marimaca Oxide deposit. The drill hole intersected high-grade primary sulphide mineralization down-dip of oxide mineralization. MAD-22 is a geological-geotechnical drill hole that the company has drilled from the easter MOD all the way through the 2022 Mineral Resource Estimate pit wall. The hole has intersected high-grade, most chalcopyrite mineralization.

MAD-22 has intersected the border of the magnetic susceptibility high identified during Marimaca’s 2020 geophysical campaign, and the magnetic anomaly under the current MOD dips to the east. It also has the same geometry as the interpreted extension of the structure hosting the copper oxide mineralization at the MOD. The drilling at MAD-22 was aimed at gathering geotechnical and geological information about the eastern pit wall area.

Sergio Rivera, VP of Exploration of Marimaca Copper, commented in a press release: “The sulphide potential at Marimaca has always presented a compelling exploration opportunity for the Company. The size of the oxide resource base at the MOD, as demonstrated in the 2022 Mineral Resource Estimate, is a testament to the scale of the mineralizing system and hole MAD-22 provides exciting evidence for potential extensions of sulphide feeder zones down-dip of Marimaca’s oxide blanket.

“While previous drilling into the down-dip geophysical targets identified in 2020 and 2021 intersected additional mixed and secondary sulphides at depth (MAMIX), MAD-22 represents the first significant primary sulphide intersection to date and could represent a primary high grade feeder structure as interpreted in our geological model for the deposit.

“With the 2022 drill program now completed, results from MAD-22 will be considered in our exploration planning going forward. We look forward to updating the market as our interpretation and plans for additional exploration work are finalized.

“In parallel and as discussed in previous releases, we will continue with our de-risking strategy at the MOD with the objective of delivering an updated MRE in early 2023, capturing the second half of the 2022 infill program. This will form the basis for the DFS on the Marimaca Oxide Deposit planned for the second half of 2023 or early 2024.”

Highlights from the results are as follows:

- Highlights from reported results are:

- Full drill hole intersection of 240m at 1.01% CuT from surface in two separate zones of oxide and primary sulphide

- Oxide highlights:

- 82m at 0.53% CuT from 10m including 50m at 0.80% CuT from 42m

- Sulphide highlights:

- 92m at 2.11% CuT from 140m, including

- 22m at 5.27% CuT from 204m

- Hole MAD-22 was drilled from inside the 2022 MRE pit area toward and through the eastern border of the MOD at depth

- Consistent with current MRE for the MOD, MAD-22 intersected oxide and mixed mineralization before transitioning into primary sulphide mineralization

- Primary mineralization is dominated by veins and stringers of massive and semi-massive chalcopyrite within dominantly magnetite-actinolite alteration consistent with magnetic highs

- The occurrence of primary sulphide mineralization down dip to the east of the MOD is consistent with the current geological model for Marimaca’s Iron-Oxide-Copper-Gold (“IOCG”)-style copper mineralization

- Mineralization at Marimaca is controlled by a regional scale system of sheeted fractures and dykes, created by a major extensional event with mineralization introduced along fractures and structural splays

- The MOD’s copper oxides were formed by the oxidation of a chalcocite enrichment blanket derived from original primary sulphides

- Results from MAD-22 will be reviewed and the Company will provide an update to the market on next steps to follow up the results in due course

- In parallel the Company will continue to progress permitting and engineering workstreams to support the planned Definitive Feasibility Study “DFS” on the Marimaca Oxide Project planned for the second half of 2023

Table 1. Summary of Drill Results

| Hole | Depth (m) | From (m) | To (m) | m | %CuT | ||

| MAD-22 | 240 | 0 | 240 | 240 | 1.01 | % | |

| including | 10 | 92 | 82 | 0.53 | % | ||

| Including | 42 | 92 | 50 | 0.80 | % | ||

| and | 112 | 232 | 120 | 1.65 | % | ||

| including | 140 | 232 | 92 | 2.11 | % | ||

| including | 178 | 232 | 54 | 2.80 | % | ||

| Including | 204 | 226 | 22 | 5.27 | % | ||

| Including | 214 | 224 | 10 | 8.10 | % | ||

Table 2. Drill Collar and Survey

| Hole | Easting | Northing | Elevation | Azimuth | Inclination | Depth |

| MAD-22 | 375143,8 | 7435536,2 | 1124,9 | 85 | -55 | 240 |

Sampling and Assay Protocol

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ratel Group Ltd. Ratel Group Ltd. |

RTG.TO | +60.00% |

|

ERL.AX | +50.00% |

|

MRQ.AX | +50.00% |

|

AFR.V | +33.33% |

|

CRB.AX | +33.33% |

|

GCX.V | +33.33% |

|

RUG.V | +33.33% |

|

CASA.V | +30.00% |

|

BSK.V | +25.00% |

|

PGC.V | +25.00% |

Articles

FOUND POSTS

Arras Minerals (TSXV:ARK) Updates on Elemes Drill Program in Kazakhstan

December 19, 2024

Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025

December 17, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan