I wrote last week about ongoing concerns around the management of the Marampa mine, a massive iron-ore deposit in East Sierra Leone. After Gerald Metals failed to restart production since taking ownership of the mine in 2016 through their ‘SL Mining’ subsidiary, fears that the company’s creditors would cut their losses began to circulate. Now, it seems the situation is far worse than first thought. Troubling lawsuits, fleeing investors and some deep-seated concerns around the corporate social responsibility obligations may leave Gerald Metals’ top team of Craig Dean, Brendan Lynch, Pat Crepeault and Gary Lerner exposed as we head towards the new year.

Last week the Government of Sierra Leone, which had been dissolved for the Christmas break since early December, rushed through the ratification of legislation that renewed Gerald Metals’ mining licence at Marampa [1]. After weeks of scrutiny and claims that Gerald Metals were days from having their licence revoked, the news will have come as a great relief to the company’s management team. However, this has proven to be something of a false dawn.

Since my last article for Mining Feeds, reports have now reached me that the Revolving Credit Facility, on which Gerald Metals relies to run its Marampa project, is undersubscribed.

In 2014, the last time the Revolving Credit Facility was renewed, appetite from investors was such that the facility had to be upsized by $50m to account for interest [2]. That confidence is now in short supply. Earlier this year, Gerald’s equity partners, Pengxin International Mining Co., jumped ship, which was worrying enough [3]. But now that several lead investors in the RCF, two Lloyds of London syndicates and a pair of Israeli and French banks, have completely pulled out of renewing their credit lines, serious questions must not only be asked over Gerald Metals’ continuing ability to guide Marampa through care and maintenance; they must be asked of their credit worthiness full stop.

So, what has gone so wrong for Gerald Metals, a veteran commodities house with 50 uneventful and profitable years of business, in their dealings in Sierra Leone?

For a start, investors know more than anyone that when it comes to a faltering business, the fish rots from the head. It is easy to point the finger at the disastrous iron ore price crash that shook the global industry in 2014; but whilst plenty of firms were rattled by the drop, very few are still yet to recover. Allegations of inexperience have been levelled at Craig Dean, the CEO of Gerald Metals, since he unexpectedly took the top job, joining the firm from Deloitte in 2013. Since then, it hasn’t been the easiest of tenures for Craig Dean: between fighting allegations of sexual harassment from his former General Counsel, Roxanne Khazarian [4], and being sued by Australian commodities giant, Cape Lambert Resources, for breach of contract [5], it’s hardly surprising the embattled CEO hasn’t kept his eye on the ball.

But in truth, the issues go far beyond management. Anger on the ground in Lunsar has grown since Gerald Metals has failed to make good on pledges to support local community projects around the Marampa site. Tensions were also raised last month when Ibrahim Alusine Kamara, an investigative journalist with the Sierra Express who had been routinely reporting on management issues at Marampa, ended up in hospital after a brutal assault.

With a Presidential election around the corner in Sierra Leone, foreign investors will be keeping a very close eye on things, paying particular attention to the current business environment. Sierra Leone relies on a vibrant mining sector both as its economic base and golden ticket to the global marketplace. So, the Bai Koroma administration must make sure that the sorts of issues we are seeing at Marampa are identified and addressed before investor confidence is damaged. After all, the fish rots from the head in government too.

[1] http://www.miningglobal.com/

by Linus Booker

It is said that the most valuable commodity in Sierra Leone is diamonds. But in my experience, one commodity is priceless: trust. Contracts move, governments are ousted and money changes hands all the time, but the one thing you cannot buy in Sierra Leone is trust.

I’ve been based in Geneva from most of this year, but have been on a project in Freetown for the last 10 weeks. The talk of the town is all about how the creditors attached to one of the biggest foreign-owned mining investors here may be about to discover the value of trust the hard way. But if this blows up, knowing where to place the blame may raise as many questions about creative accounting as it does about management.

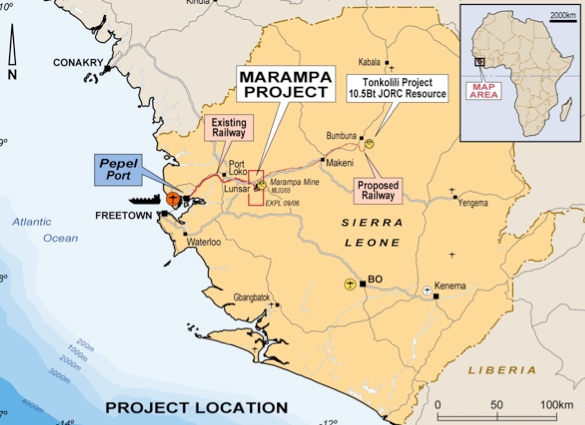

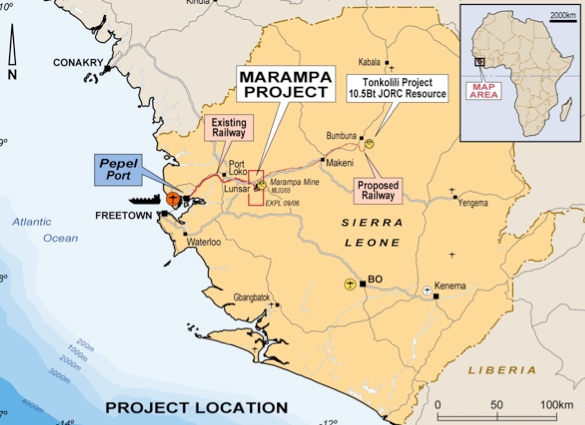

First, some context: there is a vast iron ore mine in the east of Sierra Leone that has the potential for 40 years of mining. The Marampa mine was first developed by London Mining, the erstwhile giant of African mining, before being snapped up and developed by one of Frank Timis’s companies when London Mining went bust. After the iron-ore price crashed in 2014, things went very quiet at Marampa before ownership quietly transferred to company called ‘SL Mining’ owned by Connecticut-based Gerald Metals. The iron ore price has since recovered, but production is yet to resume at Marampa. What’s more, lingering concerns over how Gerald secured the Marampa licence in the first place has meant that scrutiny on the ground is mounting by the day.

Since mid-November there have been concerns voiced in the local newspapers in Sierra Leone about Gerald Metals. Articles have variously claimed that Gerald Metals is under serious pressure from the government over its dismal performance, or claimed that Gerald Metals is about to lose its mining licence. Wednesday’s news from Freetown tells us Gerald Metals has some support of the government, but for many observers this too will raise more questions than it answers.

Since Gerald Metals first acquired the licence at Marampa, rumours of foul-play have surrounded the company. Their near-overnight acquisition of the mine in March this year did not go unnoticed by newspapers here in Sierra Leone, with the kindest criticism being raised over inexperience of the new management. Given the problems restarting production at Marampa, it does seem fair to ask what faith should be placed in Gerald’s CEO, Craig Dean, who trained as a forensic accountant at Deloitte, not in metals trading, not even in mining.

For creditors, keeping an eye on the Deloitte connection may be sensible. Deloitte currently represents Gerald Metals. The accountancy firm has enough trouble on the African continent already, and by all accounts, the scandal surrounding the Steinhoff empire is yet to run its full course. Newspapers are already suggesting that an investigation into Deloitte’s compliance with international audit standards is around the corner.

And those checks may come sooner rather than later. Why? Well, according to reports online, Gerald’s credit lines for Marampa are up for review.[1] Banks like BNP Paribas, Credit Suisse, Deutsche Bank and Credit Agricole will be weighing the merits of renewing the $225m float currently attached to Marampa. Presumably in response to mismanagement of Marampa, the creditors have already decreased their exposure following an initial float of $300m for Gerald in 2014. So, any news of accounting irregularities, added to the fact that production at Marampa remains dormant, could spell real trouble for Gerald’s credit lines. With BNP Paribas still smarting from the $8.9 billion fine it received for its ties with Cuba, Iran and Sudan, this is no time for their compliance teams to risk another scandal on the books.

So, Gerald may have been given a stay of execution from the Government of Sierra Leone, but it remains to be seen if their creditors will be so merciful.

[1] http://www.tfreview.com/news/

Linus Booker is principal consultant with Chavenage Mining Consultants, an independent practice he established in 2005. Previously a contractor with a number of blue-chip extractive firms, Linus has worked in Zambia, Russia and Sierra Leone, and is currently based between London and Zurich. He is married with three children.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ironbark Zinc Ltd. Ironbark Zinc Ltd. |

IBG.AX | +8,566.69% |

|

MTB.V | +100.00% |

|

WGF.V | +100.00% |

|

BKM.V | +72.73% |

|

AAZ.V | +50.00% |

|

ADD.V | +50.00% |

|

RMI.AX | +50.00% |

|

MTB.AX | +50.00% |

|

CASA.V | +30.00% |

|

PGZ.V | +27.27% |

Articles

FOUND POSTS

Orosur Mining (TSXV:AIM) Provides Update on Exploration at Anzá Project

December 31, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan