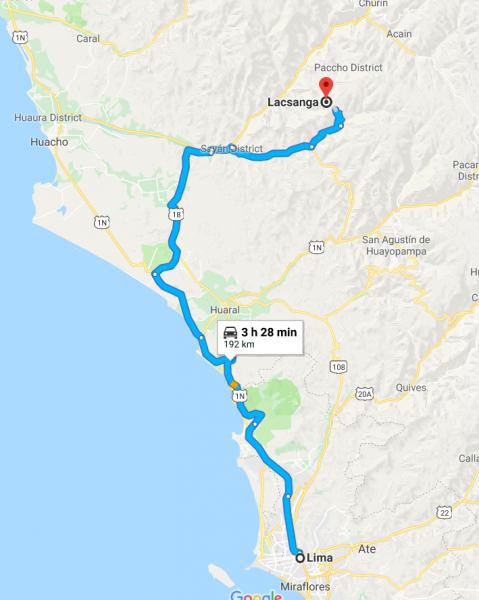

Lupaka Gold Inc. (TSX-V: LPK) has been completing the necessary steps to achieve commercial production at its wholly-owned Invicta Gold project in Peru, located 120 km north of Lima by road. Recently, I had the opportunity to re-visit the mine site to see how work is progressing towards production.

It is at this point in the life span of a mining company where institutional investors typically invest, and the stock price starts to move back up towards full value, which makes it a good time to invest. Lupaka Gold (TSX-V: LPK) is at this point.

With financing secured, the company has commenced construction and development work in order to commence production in the second half of 2018, resulting in potential full appreciation for its shares. The Company’s diligence and hard work is starting to bare fruit through the following recent developments:

- Fully funded to complete its 6 to 12-month goals, including the start of production at Invicta

- Produced a positive PEA on the project with an initial 6 year mine plan

- Community agreement in place

- Commencement of roadwork to mine site

- Building out the in-country team with the appointment of Dan Kivari, P.Eng., as Director of Operations

- Mine rehabilitation and construction

- Ongoing sampling and surveying

The financing secured in 2016 was through Pandion Finance for a total of $7 million (U.S.), available to the Company in three tranches, all of which have now been drawn. This forward gold sale agreement is repayable to Pandion by delivering a total of 22,680 ounces of gold over 45 months.

Pandion plays a partnership role in development by receiving payment in gold from the actual mine rather than by way of equity or traditional debt structures. It also does not dilute shareholders as would with a financing in the market.

With money in place, now begins the real work.

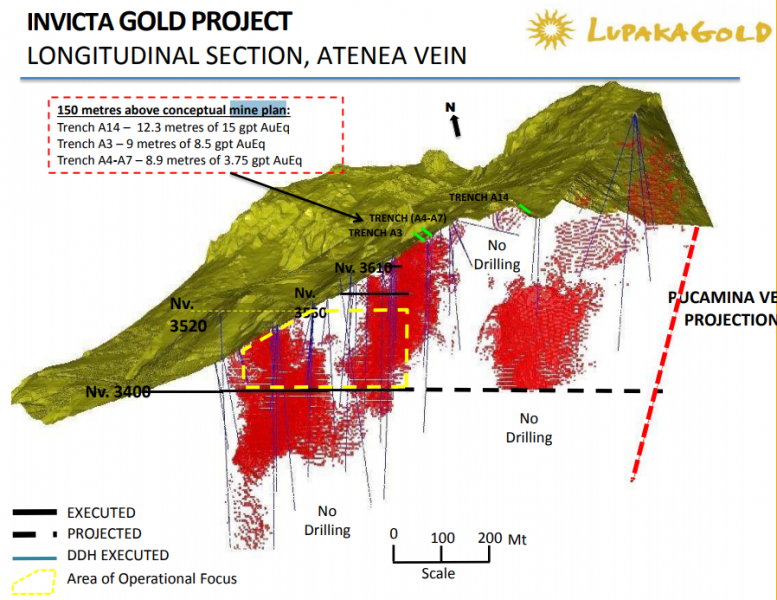

On March 1, 2018, Lupaka issued a preliminary economic assessment (PEA) which outlined low capital expenditures, an initial mining scenario of 350 tonnes per day (tpd), and a very quick payback and path to cash flow. The strategy is to commence mining in an area close to existing infrastructure and focus on a small portion of the resources within the Aetnea vein. While the current Environmental Impact Assessment allows for up to 1,000 tpd, Lupaka’s approach is to start small and gradually increase production over the next few years.

The PEA boasts all-in sustaining costs of $575 per gold ounce equivalent (“AuEq oz”) over an initial six-year mine life and an average annual pre-tax operating profit of $12.3-million ($1300 gold assumption), very attractive economics at current metal prices. There is no need to state the Internal Rate of Return (“IRR”) as it produces meaningful cash flows within the first year.

The updated mineral resource (part of the PEA) outlines 3.0 million tonnes (“Mt”) of Indicated Mineral resources at 5.78 grams per tonne (“gpt”) AuEq oz using a 3.5-gram-per-tonne cut-off, and 0.6 Mt of inferred mineral resources at 5.49 gpt AuEq oz. The initial six-year mine plan is designed on only a portion of the mineral resource (~0.6Mt at an average head grade of 8.58 gpt AuEq, incorporates existing infrastructure which minimizes capital start-up costs.

The company now has over 24 years of tonnage, in terms of Indicated Mineral resources, mining at the 350 tpd, however management’s goal would be to increase production towards the EIA level of 1,000 tpd, which would increase production from 33,700 AuEq oz/yr up to closer to 100,000 AuEq oz/yr.

At the main portal, the company recently announced sample assay values over the footwall vein averaged 9.86 gpt AuEq over a strike length of 130 metres, with an average width of 6.1 metres. The average sampled grades are in-line, or higher, than grades within the mine plan, based on the PEA. With a combined average width of over 12 metres, the sub-vertical Invicta deposit extends for over 130 metres in strike length on the 3400 level and will be immediately accessible for extraction when the Invicta mine becomes operational in the second half of 2018.

The start small approach also allows the Company to reinvest into exploration in surrounding areas, in order to gain confidence to increase the mine plan, and to prove up new resources to potentially extend production for years to come.

Lupaka has been granted a water use permit from the Peruvian Ministry of Agriculture. Surface rights have been attained, a well has been constructed, and testing studies have concluded it can supply water up to 60 liters per second during the dry season, which should be sufficient supply for an onsite mill in the future.

As part of the agreement that was completed with the community of Lacsanga in July/2017, Lupaka was to undertake and complete certain improvements to the roads, including widening and creation of bypasses around the communities. The company signed a contract with local operators to expand, enhance and modify 27 kilometres of road commencing from the paved Huacho-Churin-Oyon Highway, located at approximately 1,500 metres above sea level, up to the Invicta project located at approximately 3,500 metres above sea level.

Work is ongoing to ensure that 30-tonne trucks can operate safely and efficiently using North American standards. This involves proper safety berms, passing stations, water drainage, widening hard rock areas using explosives and community by-passes routes.

There is a camp to house workers on site that was built by previous operators. It currently can house about 60 to 70 people, but it is already looking like they will have to expand the camp to accommodate a growing team.

Lupaka announced that development would begin with rehabilitation, preparation at Invicta with three crews, a new adit and 3430 level to be constructed. The Invicta project has approximately of 1.2 kilometres of existing adits, cross-cuts and underground workings.

As you can see below, the cross cut at the 3430 level is in the process of rehabilitation and construction. Over the past few months, work has been advancing to the point the cross cut has approached the main vein wall. Two 4.2-yard PLH Scoops have arrived on site along with a single boom jumbo drill in preparation of accelerated development and stope preparation.

At the lead of operations on site is recently appointed Dan Kivari, P.Eng. (picture in the centre above). He has more than 30 years of international experience in metallurgy, engineering and management of mineral projects throughout various stages of development. Most recently, Mr. Kivari held the position of chief operating officer at Stellar Mining Corp., a privately held mining company in Peru.

Mr. Kivari’s previous work experience includes several senior operating roles such as regional manager for Agnico Eagle Ltd.’s Western and Nunavut operations, where he was responsible for the development of the Meadowbank gold project, and vice-president of operations with Yamana Gold (TSX: YRI) overseeing the development of the Chapada copper-gold project. Throughout this experience, he has picked up the skills necessary to build a team for the Invicta Project.

There is still plenty of work to be done to meet the company’s goal to de-risk and evaluate the suitability of a plant by the second half of 2018. New bulk samples need to be extracted and sent to toll milling facilities to test and optimize metallurgical recoveries and concentrate quality.

A previous run-of-mine bulk test in February 2016 achieved good recoveries in concentrate streams — returning 87.5% gold, 91.2% silver, 91.5% copper, 90.03% lead and 90.1% zinc. The sample was a blend of approximately 80% run-of-mine material and 20% from a low-grade stockpile derived from development.

Looking forward, the company and the geology suggests that there is plenty more to be mined and there is the potential for the construction of a mill which would further reduce the company’s costs and improve any future valuation of the Invicta mine.

From six months ago, the Invicta Gold project is now a completely different scene. Today the roads have and continue to be widened (making them safe), staff and operating equipment is on site and the newly created 3430 Level cross cut has hit the main zone of mineralization.

From an investors perspective, mines moving to production present the greatest investment opportunity because each advancement the company makes de-risks the project and it becomes a question of the operating team to achieve goals on budget and proving the business model works. Lupaka is at this stage and its shares present an opportunity right now.

The hard work is underway at Invicta and the team is already in place to bring it into production, just in time for improving metal prices and the renewed interest in gold. The company appears to be well positioned to bring the project online during the second half of 2018 and meet its objective of becoming cash flow positive in its inaugural year.

Investors can look forward to the following positive catalysts:

- Bulk sample results from prospective toll mill facilities

- Toll milling agreement

- Offtake agreement

- Exploration plans and results

- Obtaining commercial production at 350 tpd

- Engineering and trade-off studies for building a plant onsite

With an all-in-sustaining cost of $575 per AuEq oz over initial six-year mine life, and plenty of resources not yet announced with permits in place to increase production, Lupaka Gold (TSX-V: LPK) is a company to watch.

It is at this stage where investors could see the greatest share price appreciation as the company is on task and working towards becoming a producing gold mine.

Lupaka Gold Inc. (TSX-V: LPK)

On Nov. 8, 2017, Lupaka Gold Corp. (TSX-V: LPK) received $2 million to further advance its Invicta Gold Project in Peru. This funding was Tranche 2 of the forward gold purchase agreement with Pandion Mine Finance (PLI). This is an important step on the path to production for Lupaka and is an effective alternative to equity financing that links success to production not just share price appreciation.

The receipt of this money satisfied the company’s agreement with Pandion to register the Lacsanga Community Agreement in the Public Registry system in Peru, which was completed on Nov. 6, 2017. These funds will partially go towards the widening of the road up to the site which the company hopes to complete before the rainy season in Peru.

With the registration of the Lacsanga Community Agreement now complete, the only significant conditions remaining to be completed in order to receive Tranche 3 are the requirements to put a mineral offtake agreement in place and to raise an additional US $2 million from other sources.

To meet the conditions for third and final tranche, the company entered into an agreement to sell the Crucero Gold Project to GoldMining Inc. (TSX-V: GOLD) for total approximately $6 million ($750,000 in cash and 3,500,000 shares of GoldMining).

The prepaid forward gold purchase deal with Pandion was announced at the end of June and is an attractive way to finance Lupaka’s Peruvian development project because it is non-dilutive to shareholders and has a fixed end-date.

In an interview earlier this year in the Northern Miner, Chairman of Lupaka Gold Gold Ellis outlined the strategy and benefits of this agreement.

“This is not a royalty agreement that goes on forever…We don’t pay anything for the first 15 months and we only pay them a small percent of what we produce for the next 45 months, and we’re done. It’s gone, it’s clean, there is no residual.”

Furthermore the agreement allows for a 15-month payment holiday which is important as it allows Lupaka the ability to complete development of the mine and ramp up cash flow before having to make any gold repayments.

A prepaid commodity forward agreement is where a buyer agrees to purchase a certain quality and quantity of a commodity from a producer in exchange for an upfront payment. In short, the buyer is acting as a lender in the sense that it is providing money up-front in exchange for future production.

Getting up and running will not be as onerous as other development mining projects as the company plans on using contract miners, contract trucking, and using toll milling facilities.

Tying financing to certain conditions and goals is an excellent way to ensure capital is not wasted on “general corporate purposes” plus tying financing to production is a great way to avoid dilution for shareholders. Lupaka Gold is on the path to production with a clear vision of how to fund and become the next producing mine in Peru.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Ironbark Zinc Ltd. Ironbark Zinc Ltd. |

IBG.AX | +8,400.00% |

|

EDE.AX | +100.00% |

|

RG.V | +50.00% |

|

EOX.V | +50.00% |

|

RLC.AX | +50.00% |

|

MTB.AX | +50.00% |

|

PJX.V | +45.45% |

|

MEX.V | +42.86% |

|

PLY.V | +33.33% |

|

TMX.AX | +33.33% |

Articles

FOUND POSTS

Orosur Mining (TSXV:AIM) Provides Update on Exploration at Anzá Project

December 31, 2024

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan